US Dollar Exchange Rates of

25th

Jan

2025

China Yuan 7.243

Report from China

EU preliminary anti-dumping ruling on multilayer wood

flooring

It has been reported that the European Commission has, in

an announcement on 15 January 2025, made a preliminary

anti-dumping ruling on Chinese multilayer wood flooring

and imposed provisional anti-dumping duties.

Provisional anti-dumping duty for one company is 45.9%,

for 5 companies 42.3%, two companies is 42.7%, for other

enterprises the rate is 46.7% or 49.2%.

The product involved has the EU CN (Combined

Nomenclature) code HS4418 7500 but does not include

bamboo panels or panels with at least a top layer of

bamboo (wear resistant layer) and flooring with Mosaic

panels.

See:

https://cacs.mofcom.gov.cn/cacscms/article/ckys?articleId=1831

21&type=1

and

https://news.futunn.com/en/flash/18328363/the-eu-has-made-a-

preliminary-anti-dumping-ruling-

on?level=1&data_ticket=1737859139113318

Tariff rates on imported wood products adjusted

China’s Tariff adjustment Plan for 2025 has been

announced and China will adjust the import tariff rates on

certain goods as of 1 January 2025 in an effort to expand

domestic demand and advance high-standard production.

Provisional import tariffs lower than the most-favored-

nation rates will be applied to 935 commodities as part of

the annual tariff adjustment plan. This plan will help

increase the imports of quality products.

The tariff rates for imported wood products, including

wood or bamboo charcoal, veneer, wood floor, fibreboard,

plywood, wooden doors, wood formwork, wooden pallets,

barrels and wooden tools, cork and cork products, bamboo

and rattan products have been adjusted.

Under 24 free trade and preferential trade arrangements,

conventional tariff rates will be applied to certain products

from 34 countries or regions in 2025 as part of China's

efforts to expand its globally-oriented free trade areas.

Among these, lower tariffs under the China-Maldives free

trade agreement, effective 1 January 2025, will eventually

lead to zero tariffs on nearly 96% of tariff lines.

China will also continue to offer zero-tariff treatment on

100% of tariff lines in 2025 to the 43 least developed

countries with which it has diplomatic relations in a bid to

support their development and foster mutual benefits.

See::http://gss.mof.gov.cn/gzdt/zhengcejiedu/202412/t20241227

_3950705.htm

and

http://gss.mof.gov.cn/gzdt/zhengcefabu/202412/t20241227_3950

708.htm

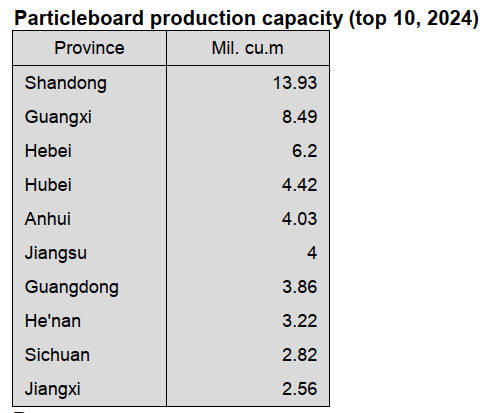

Particleboard production capacity to exceed 70 million

It is forecast that total production capacity of particleboard

in China could exceed 70 million cubic metres per year by

the end of 2025.

48 particleboard production lines have been built and put

into operation in 2024 in China with a new production

capacity of 15.41 million cubic metres per year, the largest

annual total production in the history of China's

particleboard industry.

305 particleboard production enterprises in China had 329

production lines at the end of 2024 and these are

distributed in 22 provinces and municipalities with a total

production capacity of 64.15 million cubic metres per year

and a net increase of 11.46 million cubic metres per year,

an increase of 22% on the basis of the end of 2023.

China's particleboard industry showed a decline in the

number of enterprises but the number of production lines,

production capacity and average single-line production

capacity continues to rise.

There are 30 particleboard production lines under

construction in China with a total production capacity of

10.15 million cubic metres per year. 7 regions in the

country (East China, South China, Central China, North

China, Southwest, Northwest and Northeast) have

particleboard production lines under construction

including 23 continuous flat pressing production lines with

a total production capacity of 9.3 million cubic metres per

year. These account for 92% of the production capacity

under construction.

Among the particleboard production lines under

construction, there are 4 OSB (including multi-functional

production line) production lines with a total production

capacity of 1.5 million cubic metres per year which will be

completed and put into operation from 2025 to 2026. At

that time the national OSB production capacity will further

grow breaking through 19 million cubic metres per year.

China's particleboard industry has grown such that there

is

a risk of imbalance between supply and demand.

Production to come on line in 2025/26 will lift total

production capacity of China’s particleboard to70 million

cubic metres.

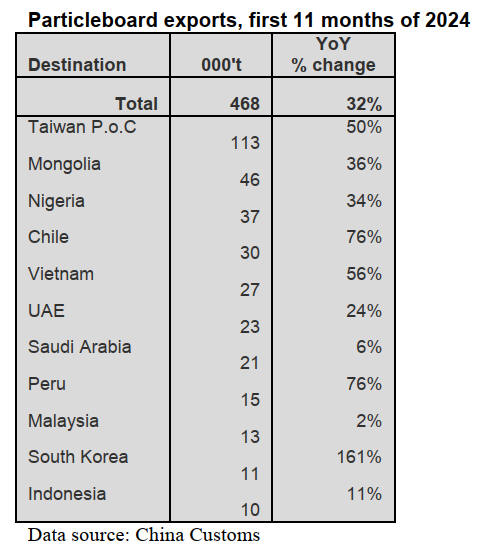

Growth in particleboard exports

According to data from China Customs in the first 11

months of 2024 China’s particleboard exports rose over

30% to 468,000 cubic metres valued at US$262 million,

up 7% over the same period of 2023.China’s particleboard

exports to all of the destinations grew.

China’s particleboard exports to Taiwan P.o.C were the

highest and rose 50% to 113,000 cubic metres in the first

11 months of 2024. China’s particleboard exports to South

Korea more than doubled I 2024.

Surge in plywood imports from Russia

According to data from China Customs in the first 11

months of 2024 plywood imports totalled 764,000 cubic

metres valued at US$205 million, jumping over 180% in

volume and up 7% in value over the same period of 2023.

Russia was the largest supplier of plywood to China in the

first 11 months of 2024. Plywood imports from Russia

surged over 230% to 716,000 cubic metres, accounting for

94% of the national total import volume.

Chinese enterprises have built factories in Russia to

manufacture plywood and export to China via the China-

Europe railway and these enterprises account for most of

the increased exports. Indonesia and Malaysia were the

second and third largest suppliers of plywood to China in

the first 11 months of 2024. China’s plywood imports

from Indonesia and Malaysia were 18,000 cubic metres

and 6,000 cubic metres, respectively.

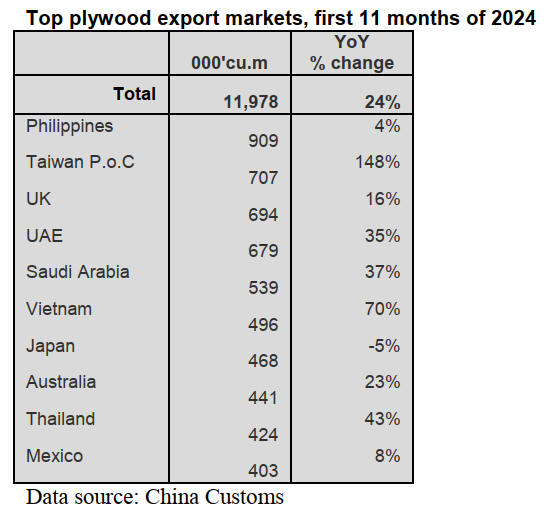

Substantial growth in plywood exports

According to data from China Customs in the first 11

months of 2024 China’s plywood exports grew

substantially and totalled 11.98 million cubic metres, up

24% over the same period of 2023.

China's plywood exports to all destination countries,

except Japan, expanded in the first 11 months of 2024.

China’s plywood exports to the Philippines were largest at

909,000 cubic metres, up 4% over the same period of

2023. China’s plywood exports toTaiwan P.o.C surged

over 140% to 707,000 cubic metres. In contrast, China’s

plywood exports to Japan alone fell 5% in the first 11

months of 2024.

Sales of consumer goods

The National Bureau of Statistics has reported retail sales

of consumer goods in November 2024 reached 4,376.3

billion yuan, up by 3%. Of the total retail sales of

consumer goods other than automobiles reached 3,899.8

billion yuan, up by 2.5%.

Between January and November retail sales of consumer

goods reached 44,272.3 billion yuan, up by 3.5% year on

year of which the retail sales of consumer goods other than

automobiles expanded 3.7%.

.

See:

https://www.stats.gov.cn/english/PressRelease/202412/t2024122

3_1957835.html

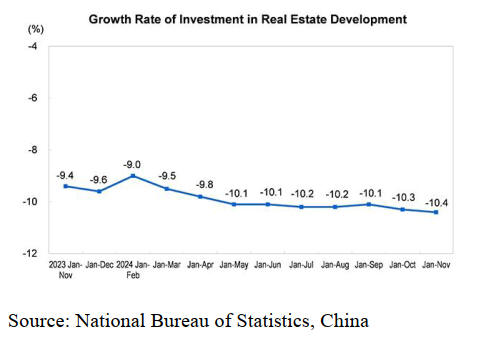

Investment in real estate, January to November 2024

Between January and November investment in real estate

development nationwide declined 10.4%, of which

investment in residential buildings was down by 10.5%.

See:

https://www.stats.gov.cn/english/PressRelease/202412/t2024122

4_1957843.htm

GGSC report December

Beginning December 2024 the Chinese government

extended zero-tariff treatment on all tariff lines for

products originating from all the Least Developed

Countries that maintain diplomatic relations with the

country.

Currently, China sees strong growth in large-scale

equipment renewals and trade-in programmes for

consumer goods. In November retail sales of furniture

increased by 36% year-on-year.

In December the GTI-China index registered 49.8%, an

increase of 0.1 percentage point from the previous month

and was below the critical value (50%) where it has been

for 2 consecutive months indicating that the business

prosperity of the timber enterprises represented by the

GTI-China index declined from the previous month.

In December the production volume in China's timber

sector was relatively stable. On the demand side, the

volume of export orders continued to grow, however,

domestic orders declined compared to the previous month.

As for the twelve sub-indices, four, export orders,

inventory of finished products, inventory of main raw

materials and delivery time were above the critical value

of 50%, one index (production) was at the critical value,

while the remaining seven indices, new orders, existing

orders, purchase quantity, purchase price, import,

employees and market expectation were all below the

critical value.

Compared to the previous month, the indices for

production, export orders, inventory of finished products,

purchase quantity, inventory of main raw materials and

delivery time increased by 0.1-7.4 percentage point(s) and

the indices for new orders, existing orders, import,

purchase price and employees declined.

The Global Timber Index (GTI) has launched a new sub-

index, the Market Expectation Index, which tracks and

monitors the confidence levels of leading timber

enterprises in GTI pilot countries regarding the trends of

their countries’ timber and wooden products markets over

the next six months.

|