Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jan

2025

Japan Yen 156.00

Reports From Japan

Interest rates moved to to

the highest level since 2008

The Bank of Japan (BoJ) has raised interest rates to the

highest level since 2008 and successfully avoided market

turmoil by carefully signaling this plan to the financial

market. The 25-basis-point move marks the first rate

increase since July and takes rates to their highest level in

17 years.

BoJ Deputy Govenor, Ryozo Himino, is reported as saying

the Bank’s decisions are determined by analysing the

overall economic situation and the need for confidence in

wage-rise momentum going into annual spring-wage

negotiations.

Recent price data show inflation at about the BoJ’s 2%

target. Government data released hours before the rate

increase decision showed consumer prices, excluding

volatile food prices, rose last year at an average rate of

2.5%, marking the third straight year of increase.

The consumer price index (CPI), excluding food, for

December alone showed a 3% rise. Another long-term

concern was wage growth. The annual spring wage

negotiations began in late January with the Japanese

Trade Union Confederation (Rengo) tabling wage-increase

targets of more than 6% for smaller enterprises and more

than 5% for large companies.

The 6% increases for smaller companies in Japan will be

tough and some analysts and business leaders argue not

achieving this target would leave many workers

falling further behind as inflation eats away the value of

earnings.

See: https://www.nippon.com/en/news/yjj2025012700771/japan-

labor-leader-seeks-strong-wage-hikes-at-smaller-biz.html

Companies brace for negative effect of US tariffs

Japanese businesses are trying to assess the possible

consequences from the policy changes the new US

administration has pledged to implement, especially with

regard to tariffs. More than 70% of nearly 700 US based

Japanese companies surveyed by the Japan External Trade

Organisation said that they expect a negative impact from

any additional tariffs imposed by the new administration.

Japanese economists, legal experts and business leaders

concur that additional tariffs, whether directly aimed at

Japan or not, could hurt Japan’s export-reliant machinery

and automobile sectors and undermine the global

economy.

See:

https://www.jetro.go.jp/news/releases/2025/70085ec732820931.h

tml

and

https://www.japantimes.co.jp/business/2025/01/20/economy/tru

mp-tariffs-impact/

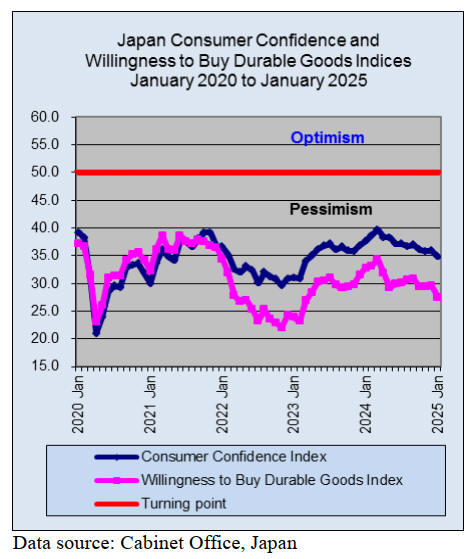

Bankruptcies up 22% in the first half of 2024

In its monthly report for January the Cabinet Office said

the economy is "recovering at a moderate pace, although

there has been a pause in some sectors”. This was the

same language used for the sixth consecutive month.

On the downside the Cabinet Office revised upward its

evaluation for corporate bankruptcies for the first time

since September 2024 saying the number of business

failures has been "almost flat," replacing the description

the wording that the pace of failures was "slowing."

The number of bankruptcies in the first half of 2024 was

4,887, up 22%, marking the second consecutive year in

which the number of bankruptcies rose. The service sector

saw 2,547 businesses fail, an increase of 21%.

Retailers followed with a rise of 17% and construction saw

an increase of 13%. The main problem was businesses

found it hard to pass on rising material and labour costs in

their prices. Severe worker shortages were also a problem.

Another cause of business failures is the problem

companies have in repaying interest-free loans provided

by the government as part of Covid relief measures.

See: https://www.tdb-

en.jp/news_reports/backnumber/brr24kami.html

and

See:

https://mainichi.jp/english/articles/20250123/p2g/00m/0bu/0530

00c

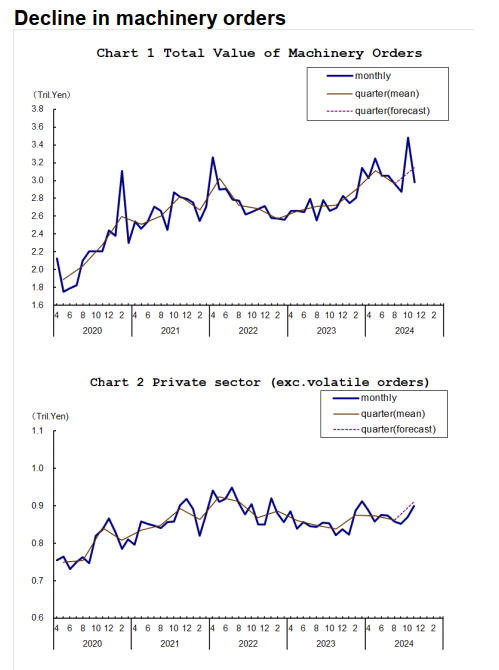

The total value of machinery orders received by 280

manufacturers operating in Japan decreased by 14% in

November from the previous month. Private-sector

machinery orders, excluding volatile ones for ships and

those from electric power companies, increased a

seasonally adjusted by 3.4% in November.

One of the largest wooden structures on earth

For the first time members of the media had the

opportunity to view the Japanese government pavilion

ahead of the 2025 World Exposition in Osaka, western

Japan,. The two-story Japan Pavilion covers 13,000 square

meters of floor space making it the largest pavilion at the

EXPO.

The EXPO is scheduled to run for six months from 13

April to 13October. The Grand Ring, a symbol of Expo

2025, is said to be one of the largest wooden structures on

earth. Much of the material comes from timber harvested

in Fukushima Prefecture which was, hit hard by the March

2011 earthquake, tsunami and nuclear disaster.

About 160 countries and territories are due to take part in

the event, based on the theme of "Designing Future

Society for Our Lives."

See: https://www.nippon.com/en/japan-topics/c12207/osaka-

expo%E2%80%99s-iconic-wooden-ring-features-fukushima-

timber.html

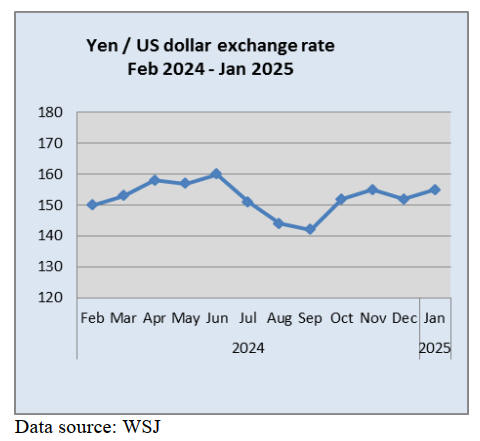

Weak yen unattractive to foreign workers

In late January the yen to regained ground against the US

dollar driven mainly by economic uncertainty in the US

and the positive outlook maintained by the Bank of Japan.

However, the weak yen, while boosting exports has a

downside. A depopulating Japan increasingly looks

overseas for the labour industries need. However, it is

becoming increasingly difficult to attract foreign workers

as their payment in yen, which has weakened

considerably, does not compared favourably with what

they can earn at home.

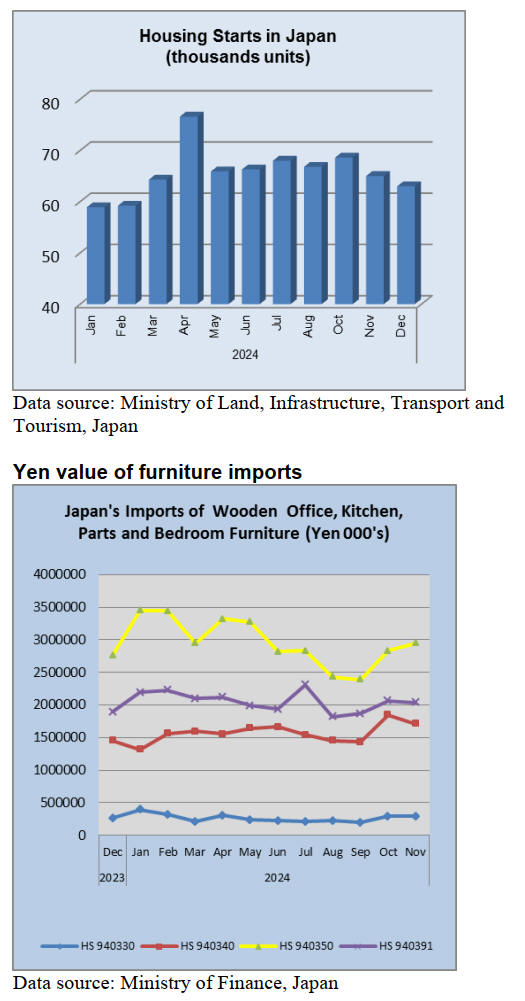

Mortgage rates set to rise

The significant jump in the interest rate to 0.5% will

impact the housing market and has raised concerns among

homeowners about how to prepare for increases in

mortgage payments.

According to a Nikkei-TV Tokyo opinion a majority of the

Japanese public supports the BoJ’s decision to raise the

policy rate to 0.5%. The latest rise lifted the rate to levels

not seen since 2008.

The Bank of Japan's two most recent interest rate

hikes

add roughly 8,000 yen to the average monthly mortgage

payment according to Nikkei calculations.

The impact of the BoJ rate adjustment is likely to be just

the first with some analysts expecting rates to reach as

high as 0.75% by the end of 2025. This potential upward

trend raises serious concerns for homeowners who are

already feeling the strain of increasing housing prices

across Japan, particularly in urban areas.

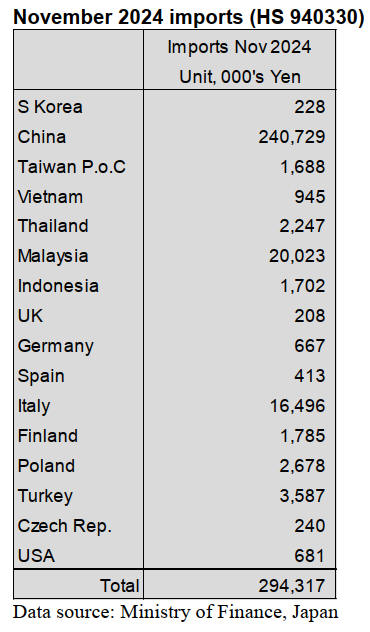

November 2024 wooden office furniture imports (HS

940330)

Year on year, the value of Japan’s imports of wooden

office furniture in November 2024 rose around 2% and

month on month there was a slight gain building on the

rise in the value of imports seen in October.

China accounted for most of wooden office furniture

(HS940330) imported to Japan in November at around

82%, maintaining the expanded share of the value of

imports recorded in October.

The other main shippers in November were Malaysia (9%)

and Italy (5%). In November 2024 the value of shipments

from Turkey and Poland captured a small share of the

value of wooden office furniture imports.

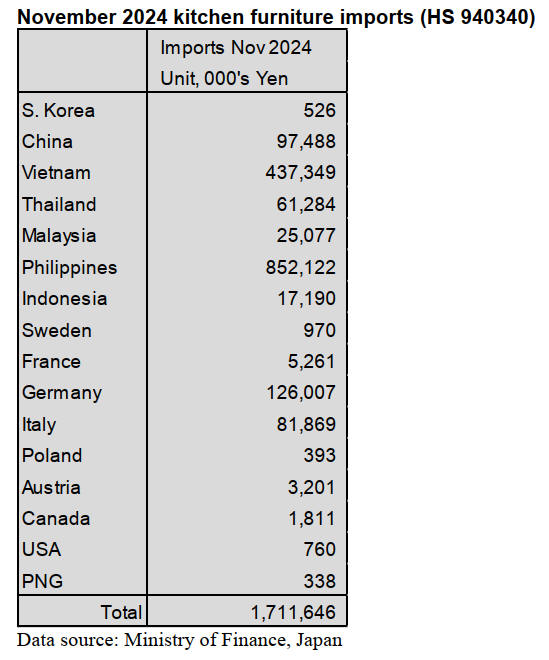

As was the case in October 2024 the value of shipments

from the Philippines accounted for 50% of the total value

of HS940340 imports with imports from Vietnam

accounted for 26%, a drop from the over 30% of the value

of November import. The third ranked supplier in

November was Germany, taking a 7% share of the value

of November imports. November arrivals from China

accounted for 6% of imports, around the same level as in

October.

The year on year value of Japan’s wooden kitchen

furniture imports rose in November, however, compared to

a month earlier the value of November imports fell slightly

after the almost 30% surge seen in October.

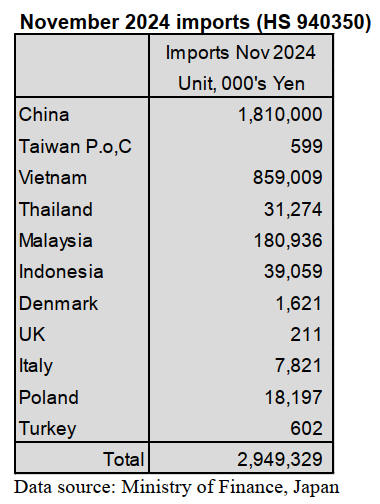

November 2024 wooden bedroom furniture imports

(HS 940350)

The value of wooden bedroom furniture (HS940350) in

November 2024 built on the gains seen in the unexpected

rise in the value of October imports, lifting the value of

imports back to levels seen in mid-year. November 2024

import values were up around 9% compared to November

2023 and also up (around 4%) compared to levels in

October.

The top shippers of wooden bedroom furniture to Japan in

November were China (61% share of November import

values), Vietnam (29%) and Malaysia (6%, a rise on a

month earlier).

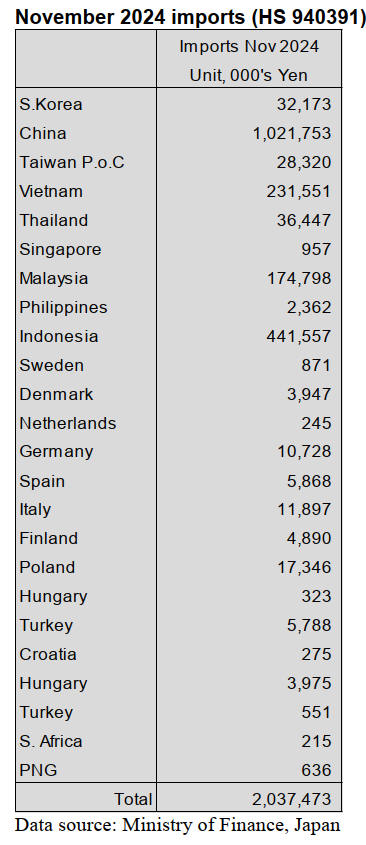

November 2024 wooden furniture parts imports (HS

940391)

The value of shipments of wooden furniture parts

(HS940391) from just four countries, China, Indonesia,

Vietnam and Malaysia accounted for over 90% of the

value of November imports to Japan. The value of

shipments from China in November accounted for 50% of

the total for the month (up from the previous month)

followed by Indonesia 22% (up from the previous month)

Vietnam (10%) and Malaysia (9%).

As was seen in October, the rise in the value of November

imports was largely due to higher arrivals from China and

Vietnam, the top shippers of HS940391. Twelve shippers

in Europe accounted for just 3% of the value of November

arrivals. For the first time in 2024 the value of shipments

from Papua New Guinea appeared in the list of significant

suppliers of wooden furniture parts.

3D forest surveys

Japan’s Forestry Agency is calling on local governments

to conduct employing aircraft laser to get terrain

information a data obtained can be used for disaster

responses by analysing terrain changes after earthquakes

or heavy rain, in addition to being a tool for forest and

road management. The agency worked with the Geospatial

Information Authority of Japan to conduct a laser survey

for a terrain analysis of the Noto Peninsula in Ishikawa

Prefecture after a powerful earthquake caused landslides in

a wide swath of the area in January last year.

See: https://www.japantimes.co.jp/news/2025/01/06/japan/laser-

forest-terrain-surveys/

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Price hike of cedar crating

Tachikawa Rinsan Co., Ltd. in Hiroshima Prefecture will

raise the price of cedar crating by 3,000 yen, delivered per

cbm, as of February, 2025 because the production cost,

including the distribution cost and the purchasing price, is

20 – 30 % higher than last year.

The company manufactures domestic cedar and NZ radiata

pine crating or pallets. The logistics cost has been rising

since last spring and the purchasing price for a cedar log is

around 16,000 - 17,000 yen, delivered per cbm.

The price of cut cedar lumber is 47,000 – 53,000 yen,

delivered per cbm. 3 or 4 m cedar lumber is around 45,000

– 47,0000 yen, delivered per cbm.

Also, the cost of energy has skyrocketed last year and so is

the labor cost. The company has been struggling with

unprofitability and this is the reason for the price hike. The

company has already explained about the price increase to

the clients.

In Hiroshima Prefecture, Orvis Corporation, which is a

major cedar and NZ crating company, has been working

on raising the price gradually.

North American logs

The North American logs and lumber markets are still

sluggish. Also, the movement of North American logs and

lumber is slow after the winter break. Demand for North

American logs and lumber are firm in some areas but not

in the metropolitan areas. It is hard to say that demand is

recovering.

Precutting companies struggle with lessorders. Usually,

demand in every January through March is low but

demand is especially low this year.

The price of Douglas fir small sized lumber is bullish tone.

Since demand for Douglas fir small sized lumber was low

and consumers changed to purchase domestic lumber last

year, the price of Douglas fir small sized lumber was low.

However, inventories of Douglas fir small sized lumber at

manufacturers and distributors decreased and the arrival

volume of imported Douglas fir lumber decreased. As a

result, the price stopped falling. A Doulgas fir lumber

manufacturer in Japan needs to raise the price because the

selling price in North America was high and the yen was

weak.

There is a possibility that this manufacturer would raise

the price of other kinds Douglas fir lumber. Also, the price

of European and domestic lumber would rise. According

to the precutting companies, if the price of European

laminated redwood beam rose, the price of KD Douglas fir

beam also would rise.

Plywood

At the end of December, 2024, major plywood

manufacturers announced to raise the price of 12 mm 3 x 6

domestic softwood structural plywood by over 1,000 yen,

delivered per sheet in January, 2025. The price was around

950 yen, delivered per sheet in the middle of December,

2024.

However, the price is different in areas because it depends

on the negotiation between plywood manufacturers and

consumers. Inquiries to softwood plywood have been firm

in the middle of January, 2025. There had been a shortage

of trucks in December, 2024 so there might have been an

influence of a shortage of trucks.

There has been an increase in purchasing imported

plywood in December, 2024. It had been the weak yen

since the middle of October, 2024 and the yen depreciated

over 150 yen against the US dollar and also the price of

imported plywood in Japan was about stop decreasing.

The price of 12 mm 3 x 6 painted plywood for concrete

form is around 1,850 yen, delivered per sheet. Form

plywood is around 1,550 yen, delivered per sheet.

Structural plywood is around 1,550 yen, delivered per

sheet. 2.5 mm plywood is around 750 yen, delivered per

sheet. 4 mm plywood is around 930 yen, delivered per

sheet. 5.5 mm plywood is around 1,100 yen, delivered per

sheet.

In Southern Asia, the price of 12 mm 3 x 6 painted

plywood for concrete form is US$580 – 600, C&F per

cbm. Plywood form is US$490 – 510, C&F per cbm.

Structural plywood is US$500 – 520, C&F per cbm. 2.4

mm 3 x 6 plywood is around US$970, C&F per cbm. 3.7

mm plywood is around US$880, C&F per cbm. 5.2 mm

plywood is around US$850, C&F per cbm.

Domestic logs and lumber

Supply of domestic lumber has been declining due to

sluggish movement in Japan. The production of domestic

lumber in Kyushu region, Tohoku region and the northern

part of Kanto region is also declining.

In Kanto region, the price of cedar / cypress square,

cypress sill, 3 m cedar stud, 90 mm cedar/ cypress square,

and cypress taruki was raised since the end of November,

2024. KD 105 mm cedar post is 55,000 -58,000 yen,

delivered per cbm.

The price of cypress log keeps increasing and the price of

cedar log is also increasing. 4 m cypress log for sill is

24,000 yen in the northern part of Kanto region and

Kyushu region.

This is 2,000 yen higher than last month in the northern

part of Kanto region. It is 500 yen more than last month in

Kyushu region. It is 22,000 yen in Chugoku region, is

20,000 yen in Kansai area and is 19,000 yen in Chubu

region. It is 1,000 yen more than last month. 3 m cedar log

for post is 18,500 yen in the northern part of Kanto region

and this is 500 yen more than the previous time. Medium

sized cedar log is 14,000 yen in Pacific Ocean of Tohoku

region and this is 2,000 yen more than last time.

South Sea logs and products

Movement of South Sea and Chinese lumber are dull. The

yen had been 157 – 158 yen against the US dollar since

the second half of the last year and it was difficult to

predict the future of demand. There are less new orders

after the winter break.

Demand for decking is firm but consumers do not

purchase a lot of lumber due to the weak yen and low

demand period.

There will be the Chinese New Year holiday at the end of

January, 2025. Some lumber manufacturers in China will

take a holiday longer than last year because orders have

been not a lot since last year. Japanese distributors do not

purchase lumber due to low demand in Japan. Chinese

lumber manufacturers won’t lower the price of high

quality lumber.

Also, Indonesian lumber manufacturers will keep the price

same. South Sea logs had arrived to Japan in December,

2024 and the South Sea logs will be arrive to Japan in

January, 2025 as it was scheduled.

Strengthening exports of wood products to the US

Japan will strengthen in exporting cedar and cypress

structural lumber for 2 x 4 houses in the US.This is a

project to expand exports of domestic structural lumber by

using a subsidy from the Ministry of Agriculture, Forestry

and Fisheries. Japan has already got permission for the

strength of cypress structural lumber.

Cedar structural lumber will be authorized at the first half

of this year. Japan aims to see 71.8 billion yen in exports

in 2025, 16 % more than 2023’s exports and to see 166

billion yen in exports in 2030, 16.7 % more than 2023’s

exports.

Japan Wood Products Export Association had been in

charge of testing the strength of cypress structural lumber.

Structural lumber produced in the US has to be authorized

by ALSC (American Lumber Standards Committee

Incorporated) and NGR (National Grading Rule).

In the future, Japan Wood Products Export Association

will consider exports of 4 x 8 cypress structural plywood,

domestic laminated lumber, CLT, LVL and square timber.

|