|

1.

CENTRAL AND WEST AFRICA

Importers adopting alternative sourcing strategies

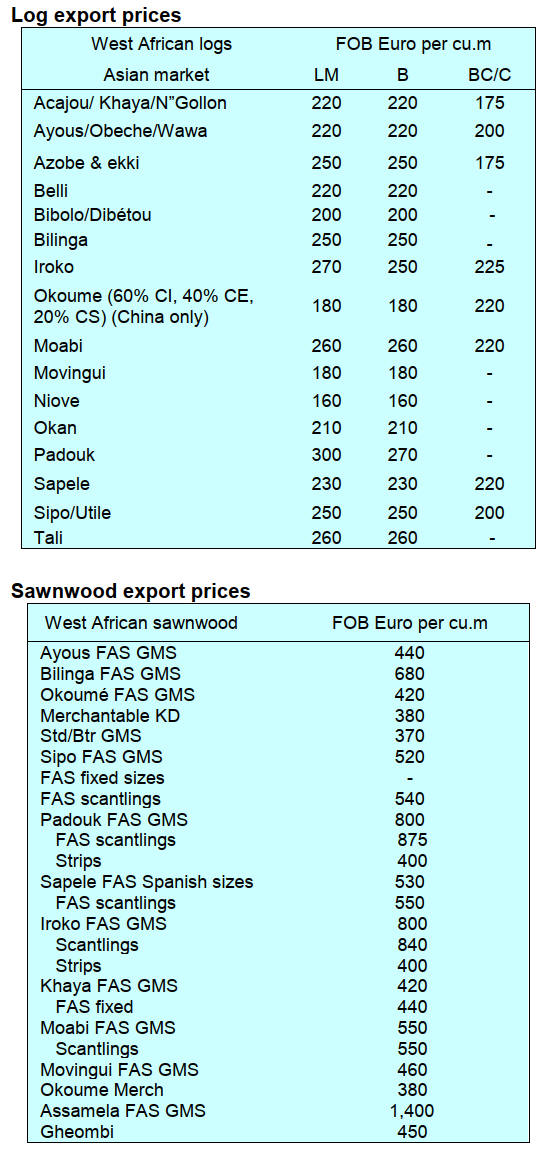

There have been no major shifts in timber prices since late

2024. European buyers, driven by compliance

requirements, continue to adapt sourcing strategies. A

growing number of European importers are turning to

sawnwood suppliers in the Democratic Republic of the

Congo, Liberia and Equatorial Guinea. This preference for

sourcing processed timber rather than logs benefits West

African mills that can demonstrate legal and sustainable

production.

Azobé (Ekki) remains in regular demand for infrastructure

projects in the EU and many European firms now opt to

buy sawn sizes directly from West Africa to meet strict

legality requirements.

Producers say any significant rebound in demand depends

heavily on an upturn in the Chinese market. China’s

timber demand remains notably sluggish, largely due to

decreased housing construction and an oversupply of

apartment units. As Chinese mills grapple with slow

domestic demand West African timber producers see

fewer orders.

Developments in Gabon, Cameroon and Congo

Gabon is in a seasonal dry period though intermittent rains

every few days still affect logging activities, particularly in

up-country areas. Road transport is slow through regions

like Lastourville, Lopé and Makokou where hauling

timber to Owendo port can take days. Ongoing work on

the Ndjolé-Bifoun route and other key arteries are

essential for connecting northern, eastern and southern

Gabon with Libreville but persistent rains and budget

constraints hamper progress.

Okoume remains the core species for local production

with peeler logs priced around 65,000 FCFA per cubic

metre delivered to the Nkok Special Economic Zone.

Premium CS-grade Okoume can reach 70,000 FCFA

while sawing-grade logs are now at 50,000 FCFA per

cubic metre delivered.

China’s reduced imports continue to dampen Gabon’s

timber exports. The Philippines remains a consistent buyer

of Okoume and Dabema, while Vietnam sustains interest

in Tali. Some improvement was noted in the Middle East

with modest inquiries for Andoung, Iroko, Padouk, Tali

and Okoume.

Controversy surrounds the government’s plan to label each

bundle of sawn timber with log origin GPS data. Millers

highlight practical challenges including how forestry

officers would verify felling deep in the bush.

Gabon is one of Africa’s largest timber exporters and a

major producer of veneer particularly for Chinese, Indian

and Vietnamese manufacturing.

Libreville continues to experience daily power outages.

The ongoing power cuts disrupt production and there are

reports of power surges causing damage electronics.

Gabonese sawmills are reported to be operating at around

40% capacity due to power outages.

The previous administration signed an agreement with a

Turkish company to bring in two power-generating

vessels. Authorities recently convened a group of

ministers, national power utility officials and petroleum

sector managers to review the contract conditions.

Harvesting activities have resumed across Cameroon,

coinciding with the beginning of the dry season that

typically lasts until June. However, production remains

subdued due to lackluster international demand. China’s

notably reduced timber imports have dampened output, the

overall market sentiment is low to stable.

Despite a return to normal trucking and railway

operations, production remains below potential as mills

choose to limit output in response to weak demand and

stringent government controls.

Strict enforcement of CFAD (Forestry Concession

Allocation Decree) regulations has significantly reduced

exports with some shipping company representatives

indicating a 50% drop in timber exports from Cameroon.

Government efforts to enforce strict regulations have

prompted some Asian operated mills to shut down, at least

temporarily. Estimates suggest roughly half of these mills

are currently closed. While this crackdown is part of a

broader push for responsible forestry practices, it also

reduces available production capacity.

Log inflows from northern Congo and the Central African

Republic remain low.

Looking ahead, the dry season may allow operators to

ramp up production but real growth hinges on improved

international demand, especially from China and

continued policy consistency. For now, Cameroon’s

timber sector navigates a climate of cautious activity,

hoping for more favorable conditions as the year

progresses.

Harvesting conditions in northern Congo have improved

with the cessation of rains, though production remains

below peak levels due to subdued demand in Asia and

Europe. Many operators continue to transport logs and

sawnwood to Douala in Cameroon which can be more

convenient than Pointe-Noire for northern producers

despite long stretches of unpaved roads. Transport to the

south, especially to Pointe-Noire, benefits from existing

tarmac roads and log parks in Maloukou.

However, the railway from Brazzaville to Pointe-Noire

remains in poor condition and it is reported the

government is seeking investment for its overhaul.

Meanwhile, direct trucking to Pointe-Noire remains a

viable option for producers near the coast, ensuring steady

port operations.

Producers report export order levels are stable to low. The

Philippines continues to purchase Okoume sawnwood,

while Tali exports to Vietnam provide a degree of

consistency. China’s demand, once a primary driver for

Congolese timber, has weakened with lower volumes and

prices. Some species preferred in Europe maintain some

niche appeal in Asia but local operators must navigate

strict regulations and competition from other West African

suppliers.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See:

https://www.itto-

ggsc.org/static/upload/file/20250116/1737011307133693.pdf

2.

GHANA

Sawnwood dominated export trade but volume

dipped

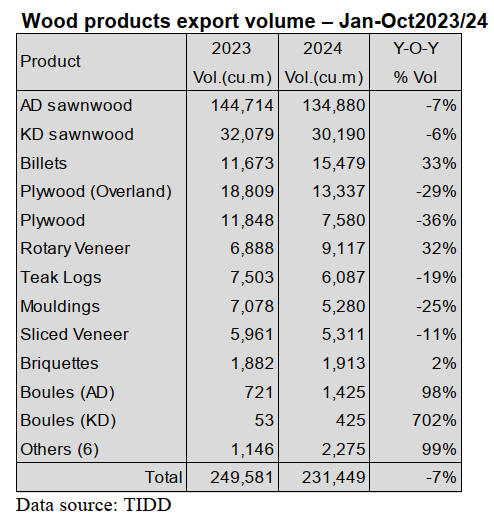

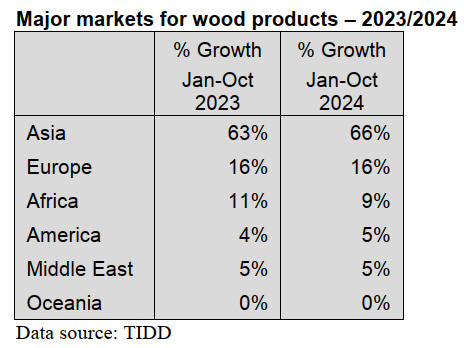

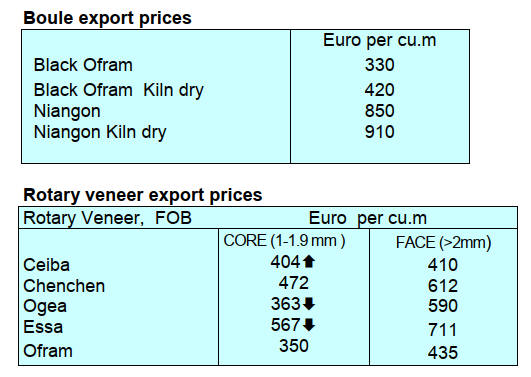

Ghana’s 10-months wood products exports for 2024

earned the country Eur103.94 million from a total volume

of 231,491 cu.m. This compared to the same period the

previous year showed a decline of 7% and almost 9% by

volume and value respectively according to Timber

Industry Development Division (TIDD) data.

Billets, rotary veneer, briquettes, air-dried boules and kiln-

dried boules recorded significant export volume growth in

the 10 months of 2024 against 2023 for the same period.

However, the overall 2024 performance was low due to

poor demand for some products in Europe, Africa and the

Middle East .

During the first ten months of 2024, tertiary product

exports earned Eur5.03 million compared to Eur6.23

million in the same period of 2023.

Secondary products generated a total of Eur37.86 million

(January to October 2024) against Eur42.77 million for the

same period in 2023. Asia accounted for 153.137 cu.m,

representing 66% of the total export volume in 2024,

(Eur59.00 million).

Average unit prices in 2024 for gmelina, avodire, black

ofram, ogea, niangon essa/celtis and tetekon decreased

year on year. The average unit price for wood product

exports saw a slight decrease of around 2% from

Eur457/cu.m in January to October 2023 to Eur449/cu.m

in the same period of 2024.

Former Minister of Energy to head the Ministry of

Lands and Natural Resources

The President, John Mahama, has nominated Emmanuel

Armah-Kofi Buah as Minister-designate for the Ministry

of Lands and Natural Resources (MLNR). Mr. Buah was

the Minister of Energy and Petroleum in the 2013 to 2016

administration.

According to the newly appointed Minister, the healing of

the country’s water bodies and legal and safe mining will

be his top priorities. He has therefore pledged to work

tirelessly to protect and manage the country’s lands and

natural resources effectively.

At a Parliamentary Ministerial vetting he also vowed that

when directed, he will revoke Legislative Instrument (LI)

2462 (Mining in Forest Reserves) to save the country’s

water bodies, tracks of farms from environmental

degradation.

The Chief Executive of the Forestry Commission (FC),

John Allotey, bade farewell to the staff of the Commission

marked by heartfelt speeches and reflections on the

journey he had during his tenure with the organisation.

At a durbar in his honour, he acknowledged the frontline

staff of the forest guards and rangers, whose unwavering

dedication had been the backbone of the achievements

chalked by the Commission. He emphasised that the

foundation they have all built together will continue to

support the mission of the Forestry Commission.

See:

https://www.ghanaweb.com/GhanaHomePage/business/Healing-

our-water-bodies-legal-mining-safe-mining-my-top-priorities-

Armah-Kofi-Buah-1969146

and

https://fcghana.org/c-e-bids-fc-farewell/

Survey reveals businesses optimistic on economic

prospects

A survey report by the UK-Ghana Chamber of Commerce

(UKGCC) has revealed businesses are optimistic about the

potential growth opportunities in the country but have

called for urgent reforms to address challenges hindering

economic progress.The 2024 UKGCC Business

Environment and Competitiveness Survey report revealed

that, while businesses are cautiously optimistic about

future growth particularly in technology adoption and

market expansion significant challenges remain

unresolved.

The study surveyed 725 businesses, comprising UKGCC

member and non-member companies from 22 industries.

The findings identified taxation policy, the cost of

telecommunications, government bureaucracy and the

regulatory framework as the top concerns for businesses in

2024.

The report also identified that the manufacturing sector is

embracing digital tools to enhance productivity and reduce

operational inefficiencies. However, the timber

manufacturing sector, which is a cornerstone of the

country’s economy, continues to face high production

costs, including raw material costs and access to financing.

In a related development, the latest Stanbic Bank Africa

Trade Barometer (SB ATB) rankings highlighted growing

trade challenges in the country. These included

deteriorating perceptions of trade-related factors such as

border efficiency in relation to Customs efficiency and

high taxes, infrastructure quality (telecom, road, power),

access to finance and governance.

Meanwhile, a Bank of Ghana (BoG) survey in December

2024 also showed an improvement in both consumer and

business confidence as economic growth remains strong.

See: https://thebftonline.com/2025/01/23/businesses-optimistic-

about-growth-call-for-urgent-reforms-report/

and

https://thebftonline.com/2024/11/13/trade-competitiveness-slips-

amid-challenges-report/

and

https://www.myjoyonline.com/business-consumer-confidence-

improves-economic-growth-remains-strong-bog/

Central Bank steady on interest rates

The Monetary Policy Committee of the Bank of Ghana

(BoG) has kept its key lending rate to commercial banks

unchanged at 27% after meeting to review developments

in the economy over the past two months. The Governor

of the Bank of Ghana Dr. Ernest Addison attributed this to

a steady decline and return to the path of dis-inflation.

See: https://www.bog.gov.gh/wp-

content/uploads/2025/01/Summary-of-Economic-and-Financial-

Data-January-2025.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250116/1737011307133693.pdf

3. MALAYSIA

Low interest may boost domestic houing demand

Bank Negara Malaysia has announced that it is keeping

interest rates unchanged at 3% as this is deemed to be

supportive of the economy and consistent with the current

assessment of inflation and growth prospects.

Analysts are of the opinion that maintaining the rate at 3%

(where it has been since May 2023) may encourage more

people to consider purchasing their own homes, especially

as the minimum wage will be increased from 1 February

along with the recent 13% plus raise for civil servants.

The real estate sector may see expansion due to growth in

the construction sector and increased foreign direct

investments (FDIs).Malaysia's total property transaction

value surpassed RM105 billion in the first half of 2024

with 198,906 transactions recorded, marking the highest

growth in value and volume over the past five years

according to the 2024 First Half Property Market Report

by the National Property Information Centre (Napic).

See:

https://www.nst.com.my/property/2025/01/1164644/property-

sector-poised-further-growth-led-higher-fdis-construction-

activity

Malaysia-EU FTAnegotiations to resume

It has been reported that long stalled negotiations for the

Malaysia-EU Free Trade Agreement (MEUFTA) will

resume. In 2023 the EU was Malaysia’s fourth largest

trading partner with trade reaching RM206.79bil.

For the period of January to November last year trade with

the EU grew by 5% to RM200bil. compared to the same

period in 2023. As of 2023 the domestic press reports EU

investments in Malaysia have generated over 153,000 jobs

through 1,323 projects valued at RM227.9bil.

See:

https://www.thestar.com.my/news/nation/2025/01/20/malaysia-

eu-resume-negotiations-for-landmark-free-trade-deal

Potential of bamboo sector to be assessed

The Sarawak Timber Industry Development Corporation

(STIDC) has welcomed the opportunity to collaborate with

the Universiti Malaysia Sarawak (Unimas) bamboo

research in the State. A delegation from Unimas visited

STIDC’s bamboo pilot project in Sabal, Simunjan recently

to see the STIDC bamboo-planting project.

Unimas Deputy Vice Chancellor, Professor Dr. Siti Noor

Linda Taib, said “we see great potential in the bamboo

industry and want to continue to help STIDC develop this

sector so that it can have a positive impact on the economy

of the state of Sarawak.

See:

http://theborneopost.pressreader.com/article/281633900909147

Foreign Workers Transformation Approach

The Sarawak State Government’s Foreign Workers

Transformation Approach (FWTA) system came into

effect in mid-January. The FWTA is an online digital

application designed for processing work permit

applications for non-resident workers. However, many

industrialists have raised concern regarding the fees

involved.

The Sarawak Timber Association (STA) called for FWTA

charges to be deferred until further consultations with all

stakeholders have been conducted. STA CEO, Annie Ting,

pointed out that the sudden implementation has sparked

widespread concerns across various industries.

In a statement Deputy Minister in the Premier’s

Department (Labour, Immigration, and Project

Monitoring) Datuk Gerawat Gala assured stakeholders that

the government remains attentive to their grievances and is

committed to addressing them through further

engagement.

See: https://www.theborneopost.com/2025/01/17/gerawat-

sarawak-govt-open-to-revisiting-fwta-fee-structure-in-response-

to-industry-concerns/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See:

https://www.itto-

ggsc.org/static/upload/file/20250116/1737011307133693.pdf

4.

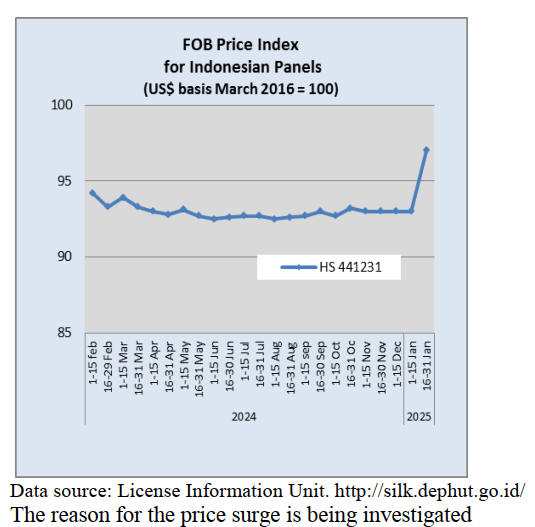

INDONESIA

Imported furniture is overwhelming the

domestic

market

Dedy Rochimat, the General Chairman of the Indonesian

Furniture and Craft Industry Association (ASMINDO, has

said the inflow of imported furniture into Indonesia

remains a pressing concern for local furniture

manufacturers who fear this may undermine the domestic

furniture industry. According to data from Statistics

Indonesia, furniture imports in the first 10 months of 2024

increased by 16% year on year.

ASMINDO stated “as an organisation representing 90% of

the SME sector ASMINDO is seeking support from the

government to protect domestic manufacturers.

ASMINDO has called for stronger regulatory measures to

control the inflow of furniture imports and an emphasis on

local products in government procurement”.

See: https://www.detik.com/properti/berita/d-7746050/furniture-

impor-banjiri-ri-asosiasi-mebel-minta-pemerintah-lindungi-

pasar-lokal.

Indonesian furniture exports at IDR 36 trillion

The Minister of Trade, Budi Santoso, stated that exports of

Indonesian furniture and craft products earned US$2.22

billion, equivalent to IDR36.07 trillion, between January

and November 2024. Budi noted that Indonesia is

currently ranked 19th in the world as a supplier of

furniture and crafts.

During the launch of IFFINA 2025 Budi said it is

encouraging to see that global demand for furniture and

crafts remains firm and expressed optimism that

Indonesian furniture exports will continue to rise to

achieve the 7% growth target. To achieve this, the

Minister of Trade emphasised the importance of

collaboration among the government, business

stakeholders and associations to boost exports.

See: https://www.antaranews.com/berita/4603254/mendag-sebut-

ekspor-furnitur-indonesia-capai-rp36-triliun

Pellets for South Korea

Indonesia has significant potential in the wood pellet

industry which is experiencing high demand in the

international market. Eko Prilianto Sudradjat, Indonesian

Trade Attaché in Seoul, noted that in S. Korea this trend is

driven by the policy to eliminate the use of coal in power

plants by 2030.

Indonesia currently ranks third in the global wood pellet

market. Vietnam leads the market with a nearly 40%. "The

growing use of bioenergy in S. Korea aligns with the green

energy policy aimed at reducing dependence on fossil

fuels" said Eko.

See: https://www.msn.com/id-id/berita/other/potensi-ekspor-

pelet-kayu-indonesia-untuk-korea-selatan-yang-lebih-hijau/ar-

BB1rmzbM?ocid=BingNewsVerp

Forests to remain intact

Forestry Minister, Raja Juli Antoni, clarified that the

government has no plans to convert 20.6 million hectares

of forest into food and energy plantations. He explained

that the government intends to adopt intercropping

patterns that preserve forests while optimising their

functions.

The approach envisaged, according to Raja Juli, involves

agroforestry which ensures forests are preserved,

ecosystem functions are maintained and food production is

increased. Raja Juli said this initiative aims to achieve

food self-sufficiency.

In related news, forestry sector members of the Indonesian

Forestry Entrepreneurs Association (APHI) welcomed the

plan of Forestry Minister, Raja Juli Antoni, to implement

the Food, Energy and Water Reserve Forest (HCPE)

programme.

APHI Deputy Chairperson, Erwansyah, said in a statement

this programme can also be implemented in the Forest

Utilisation Business Permit (PBPH) areas through a multi-

forestry business model.

He explained that forestry sector businesses have evolved

from the original business licensing based on commodities

(timber for example) to PBPH, namely business licensing

based on site/land potential. As a result businesses can

implement the multi-forestry business model through

utilising the full potential of forests.

See: https://forestinsights.id/implementasikan-multi-usaha-

kehutanan-aphi-sambut-program-hutan-cadangan-pangan-dan-

energi/

and

https://jakartaglobe.id/news/forestry-minister-forests-to-stay-

intact-in-food-and-energy-security-program

and

https://en.antaranews.com/news/341722/govt-pushes-

intercropping-in-forests-for-food-sufficiency

Revoking permits from irresponsible concession

holders

President Prabowo Subianto announced that he will revoke

the permits of non-compliant land and forest companies,

particularly those that have not fulfilled their obligations.

"The government will revoke permits for those who have

had multiple opportunities to fulfill their obligations but

have failed to do so" said Prabowo during a plenary

cabinet meeting in January 2025.

Prabowo emphasised the responsibilities of companies

operating in the forest. He stated that the government

would take control if these companies fail to adhere to the

regulations. The president also directed law enforcement

officials to strictly enforce the rules. He stressed that there

should be no preferential treatment for companies that

violate these regulations.

See:

https://nasional.kompas.com/read/2025/01/22/17092491/prabow

o-bakal-cabut-izin-perusahaan-nakal-pelanggar-aturan

and

https://www.inews.id/news/nasional/tegas-prabowo-akan-cabut-

izin-perusahaan-yang-langgar-ketentuan-tanah-dan-hutan

Task Force to combat forest violations

The Indonesian government, through Presidential

Regulatio Number 5 of 2025, has established a Task Force

to control and protect forest areas. President Prabowo

Subianto formed this task force with a mission: to

eradicate illegal activities within forest areas, improve

land management practices and maximise state revenue

from these resources.

The Forest Area Order Task Force operates directly under

the President's authority. Its organisational structure

includes a Director, led by Defense Minister, Sjafrie

Sjamsoeddin and an Executive body chaired by the

Deputy Attorney General for Special Crimes from the

Attorney General's Office.

The Task Force has the authority to investigate and take

action against illegal activities within forest areas, such as

unauthorised mining and plantation operations. To support

its duties the Task Force can collaborate with academics,

community groups and the private sector.

See: https://en.tempo.co/read/1967220/prabowo-establishes-task-

force-to-combat-forest-area-violations

Indonesia launches international carbon trading

platform

The Indonesian Carbon Exchange (IDXCarbon) officially

launched its first international carbon trading session on

20 January 2025. The launch was overseen by IDXCarbon

President Director, Iman Rahman and Indonesia's Minister

for Environment, Hanif Faisol Nurofiq. The Ministry

hopes the launch will serve as the first step toward

accelerating Indonesia’s Second Nationally Determined

Contributions which will be submitted to the secretariat of

the United Nations Framework Convention on Climate

Change (UNFCCC) in February 2025.

Carbon credits opened at a price of Rp96,000

(approximately US$5.86) per tonne for units under the

Indonesia Technology-Based Solution (IDTBS) category

and Rp144,000 (approximately US$8.80) per tonne for

units under the IDTBS Renewable Energy (IDTBS-RE)

category.

At the launch the Minister of forestry announced the

ministry is preparing a mechanism to facilitate the trading

of carbon from the forestry and other land use (FOLU)

sector.

He noted that this development is an important step in

establishing carbon pricing, including enhancing its

potential in the FOLU sector.

According to the Minister the Ministry of Forestry is

currently preparing a scheme that will hopefully boost

interest in the carbon market," he remarked. The ministry

has consulted with the Financial Services Authority (OJK)

to explore the possibilities for carbon trading based on

emissions reductions in the FOLU sector.

See:https://www.metrotvnews.com/read/NxGCGlxa-pemerintah-

godok-skema-perdagangan-karbon-sektor-pemanfaatan-hutan

and

https://en.tempo.co/read/1966011/indonesia-launches-

international-carbon-trading-platform

BRICS membership could boost exports

Trade Minister, Budi Santoso, said he is optimistic that

Indonesia's inclusion as a full member of BRICS could

increase exports. According to the Center of Economic

and Law Studies (CELIOS) Indonesia's full membership

of the BRICS grouping will provide new benefits,

especially in expanding its export markets.

Indonesia's exports have been focused on traditional

markets such as the US and Europe said CELIOS'

Economic Director, Nailul Huda and joining BRICS will

provide benefits for Indonesia to diversify export markets.

See: https://en.antaranews.com/news/340938/expect-brics-

membership-to-boost-exports-trade-minister

5.

MYANMAR

Myanmar’s timber industry - challenges and strategies

for revival

Recent updates from the Forest Department's official

Facebook page indicate that meetings have been held with

wood-based industries across various regions to discuss

recent regulatory changes.

These efforts aim to revive Myanmar's timber export

sector which has been significantly impacted by denied

access to major international markets.

These activities follow a December 2024 workshop

focusing on forest development, sustainable timber

production, plantations and strengthening wood-based

industries. Manufacturers often cite overly strict regulation

as one of the barriers for the development of timber trade

and exports.

Myanmar's wood-processing sector relies predominantly

on primary processing. This approach yields a diverse

range of sawn products catering to both domestic and

export markets. However, limited specialisation in value-

added or secondary processing has resulted in a

fragmented supply chain.

Until 2015, the Myanma Timber Enterprise (MTE) and

Forest Management Units (FMUs) managed log supplies

from multiple locations across the country. The reduced

active of FMU managers post-2015 reflects a structural

shifts which may result in reduced harvesting quotas,

resource depletion along with governance challenges.

This decentralised approach complicates documentation

and traceability compared to other countries where more

centralised, plantation-based systems dominate.

International assessments of management in Myanmar

often fail to account for Myanmar's unique forestry

context.

Such oversimplified evaluations overlook the complexities

of Myanmar's natural forest dynamics and socio-economic

factors. This underscores the need for tailored frameworks

that recognise the country's decentralised and multifaceted

supply chain.

Myanmar’s timber industry is undergoing significant

transition influenced by resource availability, international

market pressures and evolving policies. The sector is

adapting to global standards such as enhanced traceability.

Achieving this under Myanmar's current socio-political

and economic constraints is challenging.

By focusing on transparency, traceability and sustainable

practices Myanmar could begin to rebuild trust in its

timber industry and navigate its path toward a resilient and

internationally accepted forestry sector.

See - https://forestdepartment.gov.mm/news/28798

Promoting rattan, bamboo and NFTPs

The Union Minister for Natural Resources and

Environmental Conservation has taken steps to advance

the promotion of rattan, bamboo and Non-Timber Forest

Products (NFTP). During his recent visit to a Rattan

Finishing Factory in Yangon Region the Minister

inspected production processes and discussed raw material

use, exports and revenue.

At a meeting with entrepreneurs and officials from wood-

based, rattan and bamboo industries at the Forest Products

Joint Venture Corporation office the Minister emphasised

the importance of supporting small, medium and large-

scale businesses.

He highlighted Myanmar's annual production potential of

318 million bamboo poles and 77 million rattan rods and

mentioned ongoing approvals for private bamboo

plantations. The Minister stressed the need for sustainable

resource use while working to expand exports.

Entrepreneurs were encouraged to explore regional

markets, adopt new technologies and produce export-ready

finished products to drive job creation and economic

growth. The Minister called for strategic planning, private

sector collaboration and improvements in technology,

human resources and raw material access.

A key focus of the initiative is the development of

Myanmar’s first rattan certification system. The Myanmar

Rattan Association and Bamboo Entrepreneurs

Association (MRBEA) in collaboration with the newly

formed National Rattan Certification Board (NRCB) is

working on a certification framework to promote

sustainable harvesting practices, prevent over-extraction,

conserve biodiversity and support local communities.

It is reported that the certification will align with a

Participatory Guarantee Systems similar to that

implemented in Indonesia.

ASEAN - Prioritise ceasefire over elections

At a meeting of Southeast Asian foreign ministers

Myanmar was urged to focus on a ceasefire in its ongoing

conflict war rather than pursuing elections.

After the ASEAN meeting Malaysian Foreign Minister,

,Mohamad Hasan, said "election is not a priority at the

moment, the priority now is a ceasefire and for everyone

to stand down."

See: https://asean.org/secretary-general-of-asean-and-special-

envoy-of-the-un-secretary-general-on-myanmar-hold-a-bilateral-

discussion/

and

https://www.tbsnews.net/world/asean-tells-myanmar-prioritise-

ceasefire-over-elections-1047176

6.

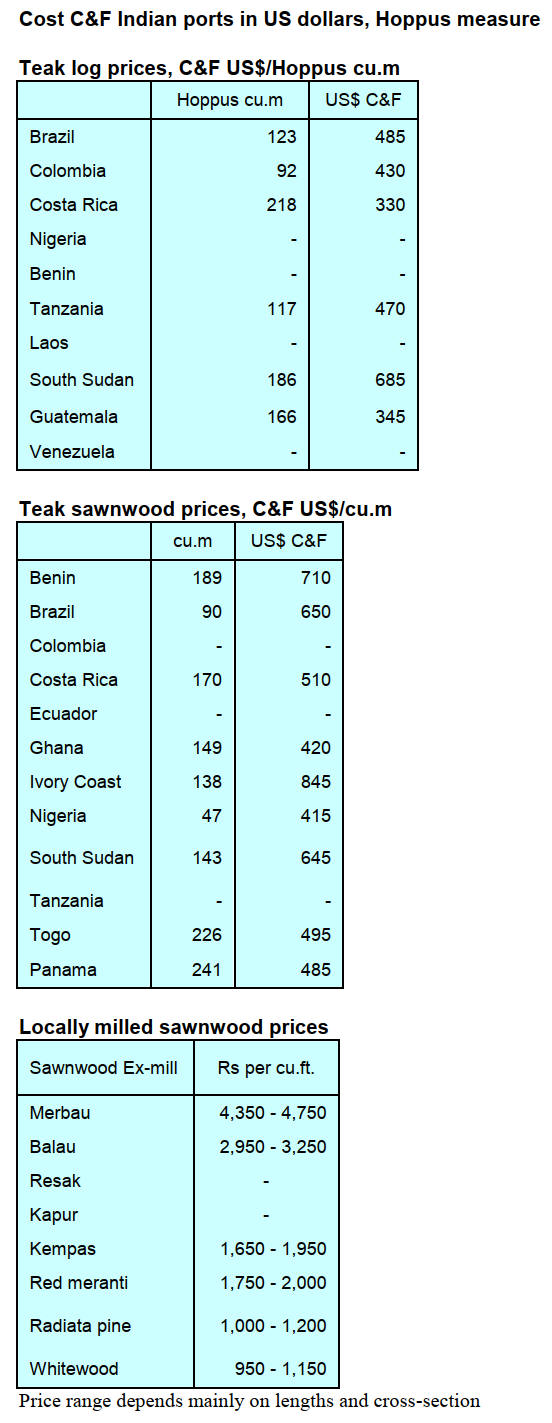

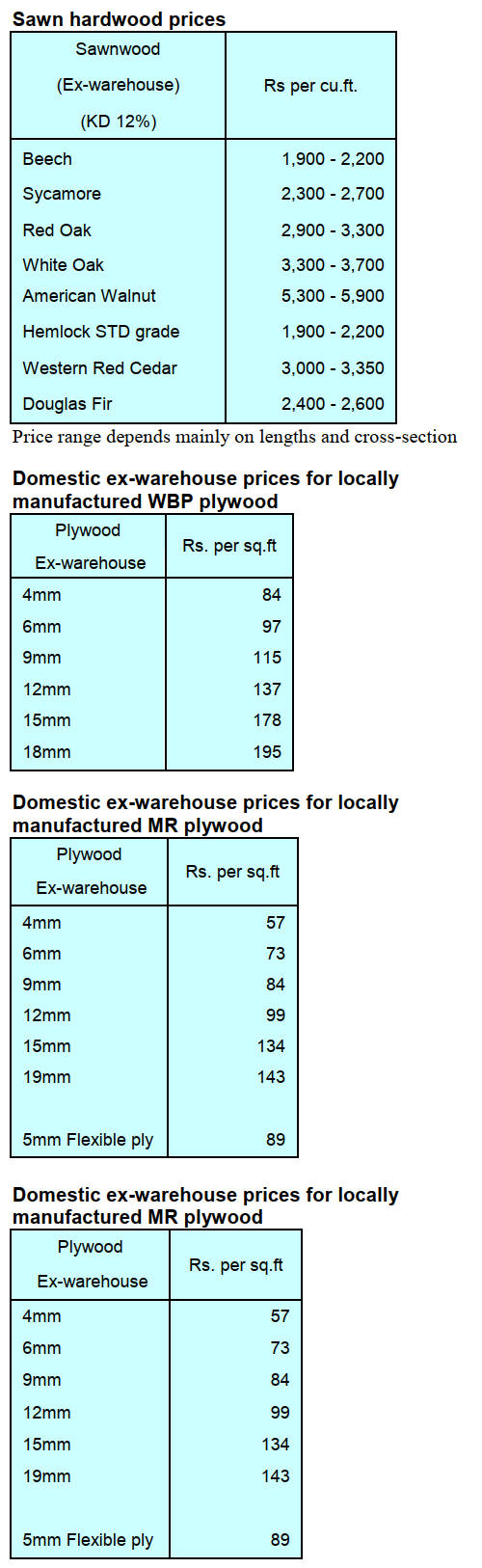

INDIA

Proposed tax could have

negative impact on housing

sector - CREDAI

The Confederation of Real Estate Developers’

Associations of India (CREDAI) has sent a letter to the

Union Finance Minister urging the Central Government to

reconsider the proposal to charge 18% GST (Goods and

Services Tax) on FSI/Additional FSI charges paid to local

authorities for real estate projects. FSI = Total Built-up Area

/ Plot Area. This ratio determines how much total floor area can

be constructed on a given plot of land.

According to CREDAI this tax would have a negative

impact on project costs pushing housing prices up by

approximately 10% .

The CREDAI press release says “The industry is already

burdened by rising raw material costs and such additional

charges will make affordable housing projects

economically unviable, potentially pushing the prices

upwards by 7-10% and directly impacting the purchasing

power of the middle-class segment – which constitutes

70% of total homebuyers. Additionally, Developers are

also excluded from claiming ITC on GST and this move

will further accrue costs and lead to double taxation,

increasing prices as a direct consequence.”

See: https://www.credai.org/media/view-details/522

In related news, the domestic media reports, because of

rising prices in some states, home sales fell in the final

quarter of 2024. The latest report by PropTiger.com states

that housing sales in India’s 8 prime residential markets

dipped 26% in the October-December period of 2024

compared to the same quarter last year.

See: https://www.proptiger.com/guide/post/homes-sales-drop-26-

in-q4-2024-launches-dip-33-proptiger-com-report

Kerala becoming a particleboard manufacturing hub

The Indian panel sector magazine, Ply Reporter, has said

the South Indian state of Kerala is emerging as another

Particle Boards manufacturing hub in India. Recently three

new manufacturing units have started production the

capacity addition has reached to 2,500 cubic metres per

day.

Reports say that most of the PB manufacturing lines have

approximately 150 to 250 cubic meters per day production

capacity of 8x4 ft size.

See: https://www.plyreporter.com/article/153997/kerala-

emerging-particle-boards-manufacturing-hub-with-timber-

upward

Economic prospects looking good

The Press Information Bureau of the Government of India

has highlighted elements from the January 2025 edition of

the World Bank’s Global Economic Prospects (GEP)

report that projects India's economy to grow at a steady

rate of 6.7% in both FY26 and FY27.

The governrment statement says at a time when global

growth is expected to remain at 2.7% in 2025-26 this

remarkable performance underscores India’s resilience and

its growing significance in shaping the world’s economic

trajectory.

The GEP report credits this momentum to a thriving

services sector and a revitalised manufacturing base,

driven by transformative government initiatives. From

modernising infrastructure to simplifying taxes, these

measures are fuelling domestic growth and positioning

India as a cornerstone of global economic stability.

The Global Economic Prospects (GEP) report is a flagship

publication of the World Bank Group that examines trends

and projections in the global economy.

See: https://www.worldbank.org/en/publication/global-

economic-prospects

7.

VIETNAM

Wood and wood product (W&WP)

trade highlights

According to Vietnam Customs in 2024 Vietnam’s

W&WP exports earned US$16.25 billion and NTFP

exports brought about US$1.024 billion, a year-on-year

growth of over 20%.

Vietnam’s W&WP exports to Canada in December 2024

has reached US$25.8 million, up 17% compared to

December 2023. In 2024 W&WP exports to Canada

generated US$253 million, up 23% compared to 2023.

In December 2024 exports of kitchen furniture were

valued at US$126 million, up 15% compared to December

2023. In 2024 exports of kitchen furniture earned US$1.4

billion, up 19% compared to 2023.

Vietnam's W&WP imports in December 2024 were

estimated at US$250 million, up 8% compared to

November 2024 and up 35% compared to December 2023.

In 2024 W&WP imports totalled US$2.75 billion, up 27%

compared to 2023.

Vietnam's oak imports in December 2024 were 31,500

cu.m worth US$19.2 million, up 9% in volume and 10% in

value compared to November 2024. Compared to

December 2023 imports increased by 53% in volume and

65% in value.

In 2024 oak imports were recorded at 371,300 cu.m,

worth

US$217.3 million, up 36% in volume and 44% in value

compared to 2023.

Wood product exports to reach US$18 bil. in 2025

Vietnam’s Department of Forestry under the Ministry of

Agriculture and Rural Development has projected a

positive outlook for wood and wood product exports in

2025, with a target of US$18 billion.

According to the General Department of Customs,

Vietnam's wood and wood product exports in 2024 were

estimated at US$16.25 billion, up 20% year-on-year. The

2024 result represents a significant milestone as it

surpassed the previous record of US$15.8 billion set in

2022.

These successes can be attributed to the proactive efforts

of businesses to seek new markets, participating in trade

fairs and exhibitions, transition from simply processing to

designing innovative products and enhancing product

quality, according to the General Department of Customs.

The recovery of consumer demand in major markets,

particularly the US and Europe, provided a significant

boost to exports. The Vietnamese wood industry also

made inroads into key markets and expanded its presence

in emerging markets such as the UAE and India.

Despite these positive outcomes the industry still faces

notable challenges.

Key issues include the need for stricter control over the

legal origin of wood, the risk of trade fraud, competition

from regional players and global economic fluctuations.

The US and the EU have imposed strict regulations on the

legal origin of wood requiring Vietnamese businesses to

improve supply chain oversight. Regional competitors

such as Indonesia, Thailand and Malaysia also pose

significant challenges, while potential economic

slowdowns in major markets could impact demand.

To address these issues, according to the General

Department of Customs, the industry must adapt to market

regulations, enhance product value and strengthen market

penetration strategies.

Ngo Sy Hoai, Vice Chairman and General Secretary of the

Vietnam Timber and Forest Products Association

(VIFOREST) has said that, with strong growth momentum

and collaborative efforts between businesses and

regulatory agencies, the industry is well-positioned to

achieve new milestones and strengthen its international

presence.

Prospects for 2025

The Department of Forestry has forecast that Vietnam’s

wood exports could reach US$18 billion in 2025.

However, success will depend on factors such as global

economic recovery, consumer demand in major markets,

evolving trade policies and the competitiveness of

Vietnamese enterprises.

The US remains the leading market for Vietnamese

wood

products but competition from suppliers like China,

Malaysia and Indonesia underscores the need for

Vietnamese businesses to focus on value-added products.

The EU market, supported by the Vietnam-EU Free Trade

Agreement (EVFTA), offers additional opportunities

through tariff advantages. Demand in China, driven by

urbanisation presents another avenue for expansion though

stricter origin requirements remain a challenge.

To meet the US$18 billion target Ngo Sy Hoai emphasised

the importance of trade promotion. He suggested that

businesses should leverage e-commerce platforms,

although bulky wooden products pose logistical challenges

for online sales. He urged the Trade Promotion

Department to prioritise e-commerce initiatives tailored

for the wood industry.

In addition, the industry is embracing digital and green

transformations to comply with the regulatory

requirements of key markets like the US and EU. At the

national level, Hoai called for the Ministry of Industry and

Trade to actively promote Vietnam’s commitment to

sustainable practices with the message “Vietnam’s wood

industry says no to illegal wood”.

Restoration of degraded forests

Vietnam is seeking solutions for the restoration of

degraded forests. Deputy Prime Minister, Tran Luu

Quang, signed Decision No. 993/QD-TTg approving the

national plan to implement the “Glasgow Declaration on

forests and land”.

The overall objective of the Plan is to contribute directly

to the goal of sustainable development which embraces

agriculture, rural area develpoment, greenhouse gas

emission reduction and climate change adaptation,

biodiversity conservation, sustainable forest management,

transition to green economy, circular economy, promotion

of sustainable livelihood development for local people and

communities, ensuring food security and environmental

protection.

Specific goals in Vietnam’s plan include the strict

management of the existing natural forest area, minimising

the conversion of natural forest and limit forest and land

degradation.

By 2030, the country aims to reverse deforestation, forest

and land degradation, ensure harmonisation of sustainable

development of agricultural and forestry production in

association with agricultural and rural development

effectively contributing to the implementation of the

commitment to reduce greenhouse gas emissions under the

national self-determination (NDC).

At the same time the country will strive for the area of

poor natural forests to be restored and upgraded by 10%

by 2025 and 20% by 2030 thus contributing to reducing

the proportion of poor natural forests.

See: https://www.vietnam.vn/en/phan-dau-dien-tich-rung-

tu-nhien-ngheo-duoc-phuc-hoi-dat-10-nam-2

Exhibitions in Vietnam 2025 - must-visit events

Vietnam’s wood industry is witnessing strong

development and 2025 promises to be a boom year with a

series of international wood exhibition events. Below are

some notable fairs and exhibitions that promise to attract a

lot of attention taking place in 2025 in Vietnam, opening

up many business opportunities for the domestic and

international industries.

HAWA EXPO 2025

5 – 7 March, 2025

Location: Ho Chi Minh

VIFA EXPO 2025

5 March, 2025

Location: Ho Chi Minh

Q.FAIR 2025

March 6 – 9, 2025

Location: Binh Dinh

VietnamWood 2025

19-22 November, 2025

Location: Ho Chi Minh

See: https://vietnamwood.com.vn/top-wood-exhibition-in-

vietnam-2025/

8. BRAZIL

Advances in Brazilian Forest

Management

The State of Mato Grosso plays a crucial role in mitigating

global warming through sustainable forest management,

contributing significantly to national timber production.

Pará and Mato Grosso States account for most of the

timber harvested in Brazil, representing about 80% of the

national timber production value and a production of 3.95

million cubic metres in 2023, according to the Brazilian

Institute of Geography and Statistics (IBGE). Forestry and

timber processing is the main driver of the economy in 66

municipalities in the State of Mato Grosso generating over

13,000 formal jobs.

The State's forest-based sector adopts strict traceability

processes through the Sisflora 2.0 system ensuring

environmental compliance and transparency in the

commercialiation of timber from natural forests.

In 2024, the Mato Grosso State exported approximately

201,900 tonnes of forestry products to 69 countries

generating a trade surplus of US$85.3 million. The key

markets included the G7 (US$29.3 million), European

Union (US$25.7 million), Asia (US$22.2 million) and

BRICS (US$20.4 million) according to the Ministry of

Agriculture, Livestock and Food Supply.

In 2024, France imported US$13.7 million worth of forest

products, purchasing 7,192 tonnes from the Mato Grosso

State. This marked significant growth over the past

decade.

Sales to France increased by over 70% over ten years and

by almost 4% year on year. India also expanded its

imports by 8%, purchasing 24,947 tonnes worth US$13.9

million.

Other significant markets in 2024 included the United

States (US$12.9 million), Belgium (US$6.5 million) and

China (US$5.2 million).

See: https://forestnews.com.br/mato-grosso-contribui-para-

mitigar-aquecimento-global-por-meio-do-manejo-florestal/

Plantations sector achieved highest contribution to

GDP in 11 years

According to the Food and Agriculture Organization

(FAO) processed wood consumption is projected to

increase by 37% between 2020 and 2050.

Timber resources from forest plantations help reduce

pressure on native forests and promote carbon dioxide

sequestration throughout the growth cycle of trees.

Industry leaders emphasise that forestry offers economic

and environmental benefits. In 2022, the Brazilian forest

plantations sector achieved its highest contribution to GDP

over the past 11 years.

The Brazilian Tree Industry (IBÁ) reports that 9 million

hectares of planted forests in Brazil have the capacity to

absorb 88 billion tonnes of CO2eq from the atmosphere.

In 2023, the area dedicated to tree planting exceeded 10

million hectares for the first time, with eucalyptus

accounting for 76% of this area followed by pine. As the

climate crisis intensifies the Brazilian timber industry has

adopted sustainable practices to meet global standards.

See: https://www.portaldoagronegocio.com.br/florestal/mercado-

florestal/noticias/mercado-madeireiro-no-brasil-espera-

crescimento-sustentavel-ate-2050

Export update, November and December 2024

November

In November 2024 Brazilian exports of wood-based

products (except pulp and paper) increased 40% in value

compared to November 2023, from US$258.2 million to

US$360.5 million.

Pine sawnwood exports increased 39% in value between

November 2023 (US$45.8 million) and November 2024

(US$63.6 million). In volume, exports increased 31% over

the same period, from 199,700 cu.m to 262,500 cu.m.

Tropical sawnwood exports increased 69% in volume,

from 18,400 cu.m in November 2023 to 31,100 cu.m in

November 2024. In value, exports increased 58% from

US$8.3 million to US$13.1 million over the same period.

Pine plywood exports increased 44% in value in

November 2024 compared to November 2023, from

US$50.3 million to US$72.3 million. In volume, exports

increased 39% over the same period, from 160,900 cu.m

to 223,300 cu.m.

As for tropical plywood, exports increased in volume by

13% and in value by 7%, from 2,400 cu.m and US$1.4

million in November 2023 to 2,700 cu.m and US$1.5

million in November 2024.

As for wooden furniture, the exported value increased

from US$49.3 million in November 2023 to US$58.9

million in November 2024, an increase of almost 20%.

December

In December 2024 Brazilian exports of wood-based

products (except pulp and paper) increased 14% in value

compared to December 2023, from US$276.4 million to

US$315.2 million.

Pine sawnwood exports increased 15% in value between

December 2023 (US$52.3 million) and December 2024

(US$60.0 million). In volume, exports increased 3% over

the same period, from 237,800 cu.m to 245,100 cu.m.

Tropical sawnwood exports increased 9% in volume, from

22,100 cu.m in December 2023 to 24,000 cu.m in

December 2024. In value, exports increased from US$9.1

million to US$9.4 million over the same period.

Pine plywood exports increased 37% in value in

December 2024 compared to December 2023, from

US$50.5 million to US$69.1 million. In volume, exports

increased 33% over the same period, from 165,700 cu.m

to 219,900 cu.m.

As for tropical plywood, exports increased in volume by

83% and in value by 73%, from 1,800 cu.m and US$1.1

million in December 2023 to 3,300 cu.m and US$1.9

million in December 2024, respectively.

As for wooden furniture, the exported value increased

from US$45.6 million in December 2023 to US$54.2

million in December 2024, an increase of 19%.

2024 export performance

The consolidated data from Brazil´s 2024 trade balance

indicate that, from January to December, compared to the

same period in 2023, total exports decreased by -0.8%,

amounting to US$337.0 billion, while imports grew by

9.0%, reaching US$262.48 billion, resulting in a trade

surplus of US$74.55 billion according to the Ministry of

Development, Industry and Foreign Trade (MDIC).

The mechanically processed timber sector maintained

relative stability with the United States and the European

Union as the main markets. The sector faced significant

challenges in 2024, including logistical and port-related

bottlenecks, strikes by officials involved in export

processes and the threat of dockworker strikes in the US.

According to the Brazilian Association of Mechanically

Processed Timber Industry (ABIMCI), inadequate

infrastructure and high operational costs hindered the

efficient transportation of wood products.

The complex logistical scenario directly affected export

volumes with numerous variables requiring immediate

solutions. Infrastructure improvements to make services

more efficient require medium- and long-term planning

and investment.

ABIMCI highlighted that, while a slight recovery in export

volumes occurred in the last few months of 2024, this was

primarily due to the clearance of backlogged shipments

rather than real growth.

Variations in exported volumes across segments reflected

factors such as seasonality, interest rates and the

performance of construction sector in key destination

markets like the United States and the European Union.

The sector remains vigilant regarding global market

fluctuations and is planning strategies for 2025 based on

consolidated data to address structural challenges and

sustain its competitiveness.

See: https://abimci.com.br/exportacoes-brasileiras-de-madeira-

em-2024-mostram-estabilidade-usa-e-europa-sao-os-principais-

mercados/

Pará State - largest exporter of tropical timber

The State of Pará continues to be Brazil's largest exporter

of native tropical timber despite the challenges faced by

the sector. After the COVID-19 the sector showed signs of

recovery in 2022 driven by markets such as the United

States and the European Union.

However, in 2023, Pará experienced 40% decline in

timber exports compared to the previous year totalling

US$212.8 million and 242,000 tonnes exported. In 2024,

overall exports decreased but exports of profiled wood

products grew with the US accounting for 54% of demand.

The Association of Timber Industries Exporters of Pará

State (AIMEX) highlighted key issues affecting the sector

including bureaucratic delays in issuance of permits and

licenses, as well as the 2024 IBAMA (Brazilian Institute

for Environment and Renewable Natural Resources) strike

which disrupted operations.

Another challenge has been the inclusion of Ipę and

Cumaru timber species in CITES Appendix II

complicating their export.

Despite these difficulties, the State of Pará leads the

national log production, logging 4.9 million cubic metres

or 44% of national production and an increase of 5%

compared to the previous year.

See: https://www.oliberal.com/economia/para-e-o-maior-

exportador-de-madeira-tropical-nativa-do-brasil-apesar-dos-

reveses-aponta-a-aimex-1.908555

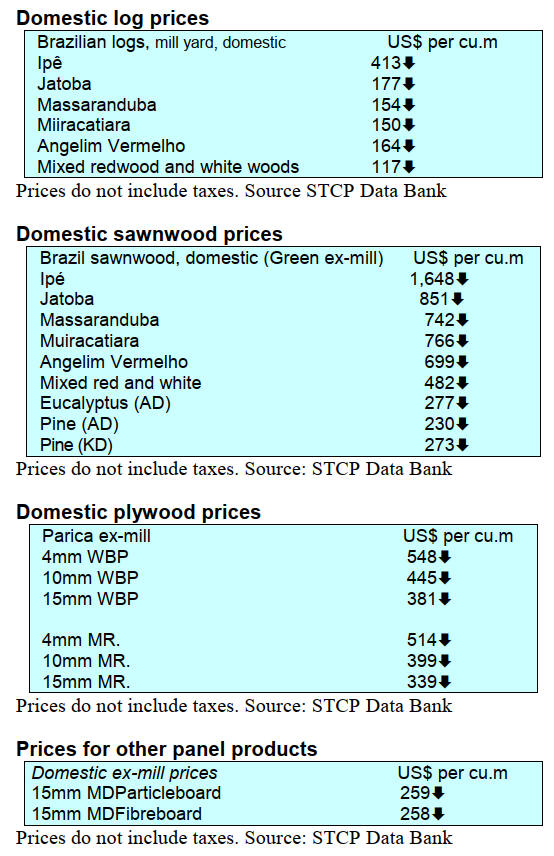

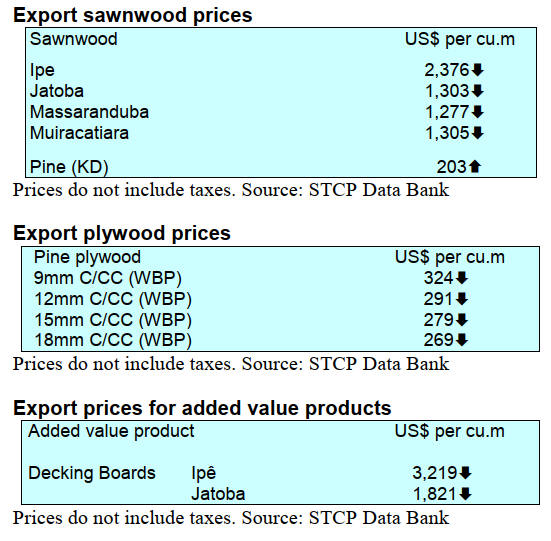

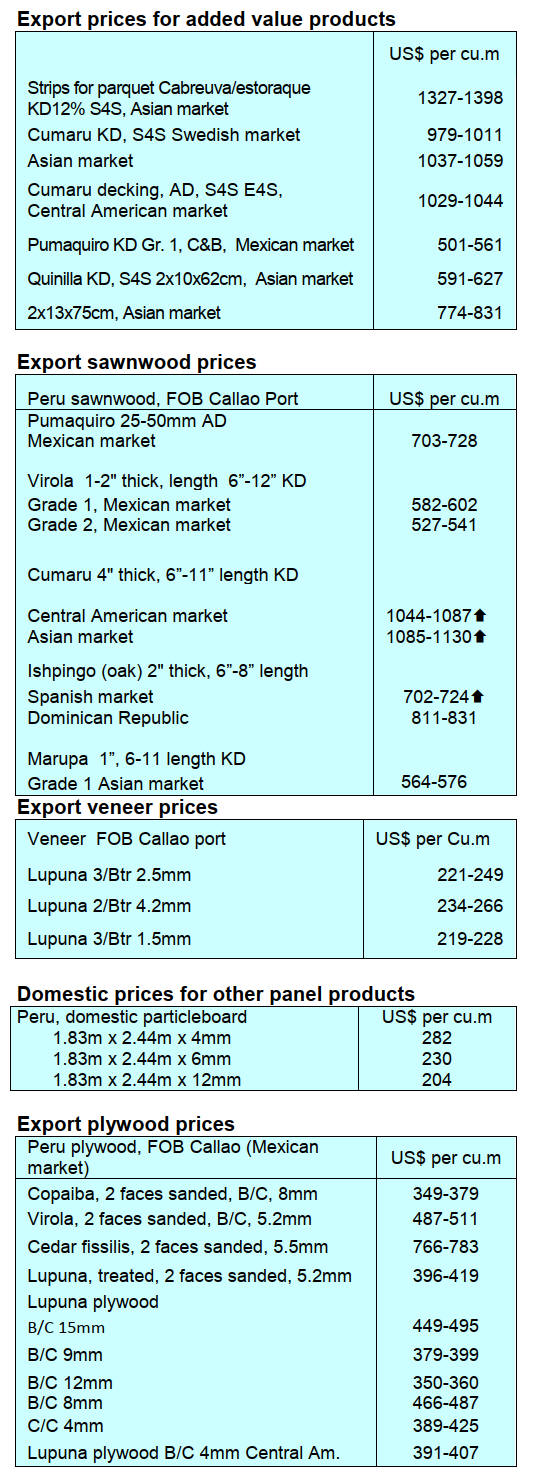

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250116/1737011307133693.pdf

9. PERU

Decline in export

earnings

Between January and November 2024 Peru's wood

product exports earned US$80.6 million, a drop of 13%

compared to the US$92.6 registered in the same period of

the previous year, reported the Association of Exporters

(ADEX).

ADEX detailed in its report that, in the first eleven months

of this year, the most important items exported were semi-

manufactured products at US$31 million with a share of

around 39% followed by sawnwood at US$25.9 million

and a share of 32%. Other products included firewood and

charcoal (US$ 6.8 million and an 8% share), construction

products (US$4.9 million and furniture and parts (US$4.5

million).

The main destinations were France (US$13.8 million), the

United States (US$14.4 million), China (US$10.8

million), the Dominican Republic (US$9.9 million) and

Mexico (US$9.7 million). Vietnam, Denmark, Belgium,

Chile and Germany completed the top ten market

destinations.

SERFOR approves stock declarations required in

advance of shihuahuaco and tahuarí exports

After verifying the information presented the National

Forestry and Wildlife Service (SERFOR) approved the

stock declarations submitted by the first group of

companies that will be permitted to export Dipteryx spp.

and Handroanthus spp. products.

SERFOR specialists conducted on site verification of the

stock declarations, the traceability of the wood product

from source, the accuracy of the data and the Forest

Transport Guide declarations. This process will continue

with the other companies that presented their stockdata

last year before the entry into force of CITES.

See: https://www.gob.pe/institucion/serfor/noticias/1090739-

serfor-aprueba-declaracion-de-stocks-para-exportar-shihuahuaco-

y-tahuari

Multi-sectoral Plan against forest fires

The President of the Council of Ministers highlighted that

the Multisectoral Plan against Forest Fires 2025-2027

ratifies the commitment to prioritise preventive measures.

This plan will strengthen protection of the environment

and the safety of citizens in the face of forest fire risks in

764 districts of the high Andean and Amazonian areas.

These measures are framed in three areas of action:

meteorological surveillance and investigation of the causes

of forest fires; risk reduction techniques and response

capacity to these fires.

The Disaster Risk Management Secretariat of the

Presidency of the Council of Ministers will be responsible

for monitoring compliance with the plan. Also, as part of

the Executive's commitment to transparency, these reports

will be published on the Peruvian State's Single Digital

Platform for Citizen Guidance.

Recovering degraded land

Representatives of Bosques Amazónicos held a workshop

with regional authorities and representatives of civil

society in Ucayali where they presented details of their

large-scale reforestation and restoration project with native

species.

The purpose of the meeting was to communicate the scope

of the initiative and to open the exchange of experiences

and knowledge as part of the process of involvement and

socialisation. The restoration project aims to recover more

than 10,000 hectares of degraded land through

reforestation with native species.

The meeting was attended by representatives of the Padre

Cote Cooperative, the Aidesep Ucayali Regional

Organization (ORAU), the Ucayali Agrarian Chamber, the

Peruvian Amazon Research Institute (IIAP), the National

Institute for Agrarian Innovation (INIA) and other

technical specialists from the region.

See: https://www.bosques-amazonicos.com/blog/en/large-scale-

reforestation-restoration-meeting-with-authorities-and-civil-

society-to-promote-sustainable-development-in-ucayali/

|