|

Report from

Europe

EU tropical wood import quantity heading for an

historic low

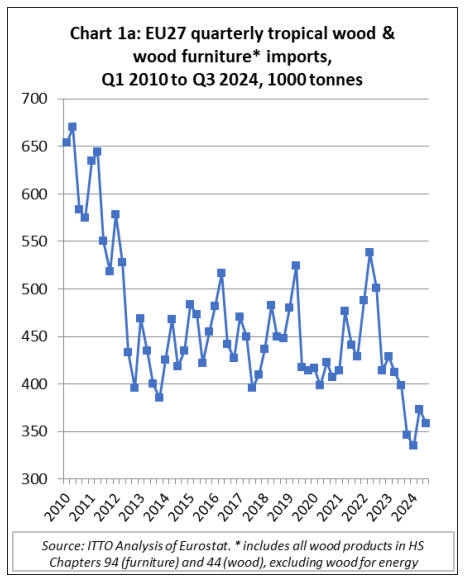

Total EU27 imports of tropical wood and wood furniture

of 358,100 tonnes in the third quarter of this year were

down 4% compared to the previous quarter and 10% less

than in the same quarter last year.

The latest figures mean that imports in the last four

quarters, averaging around 350,000 tonnes, have been well

below the long-term average of closer to 450,000 tonnes

(Chart 1a). In the first nine months of 2024, the EU27

imported 1,066,400 tonnes of tropical wood and wood

furniture, 14% less than the same period in 2023. In

quantity terms.

EU imports of tropical wood and wood furniture products

this year look set to be at the lowest annual level ever

recorded since the EU was first formed (as the EEC) in

1957.

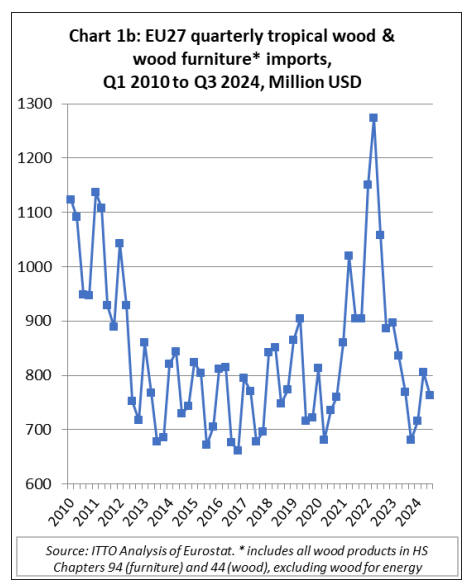

The trade figures look healthier when considered in value

terms. EU27 import value of tropical wood and wood

furniture in the third quarter this year was US$763 million,

5% less than the previous quarter and just 0.7% down on

the same quarter last year.

In value terms, EU27 tropical wood product imports are at

the same low, but broadly stable, level prevailing between

2013 and 2019 (Chart 1b). In the first nine months of

2024, the EU27 imported tropical wood and wood

furniture with total value of US$2284 million, 9% less

than the same period in 2023.

OECD forecasts slow growth in Europe

The latest edition of the OECD Economic Outlook

published on 4 December forecasts growth of 0.8% in the

eurozone in 2024, up from 0.5% last year and then rising

to 1.3% in 2026 and 1.6% in 2028. Although the forecast

recovery is some cause for optimism, both the current rate

of growth and the speed of recovery is slower than in all

other major economies except the UK and Japan. The

forecast was also prepared before recent political events in

France further dampened growth prospects in the

eurozone’s second largest economy.

OECD note that while consumer confidence has been

rising again in the EU and the housing market is beginning

to show signs of recovery in a few countries such as Spain

and France, industrial production and real business

investment are still largely stagnant across the region.

Amongst EU economies, Spain and the Netherlands are

highlighted as having experienced relatively robust

growth. In Germany, OECD note that while quarterly

output rose slightly in the three months to September

2024, weak sentiment continues to weigh on investment

activity. Germany's economy is projected to stagnate in

2024 and grow by 0.7% in 2025 and 1.2% in 2026.

On prospects for the eurozone economy, OECD suggest

that lower interest rates and ongoing spending of the

Recovery and Resilient Facility funds will support

investment, while private consumption growth will benefit

from tight labour markets and further disinflation.

However, moves towards a more restrictive fiscal stance -

necessary to reduce historically high budget deficits - will

dampen growth in some member states. OECD project that

core inflation in the eurozone will fall from 2.9% in 2024

to 2.4% in 2025 and 2.0% in 2026. This will provide space

for the European Central Bank to reduce interest rates to

boost growth.

The OECD forecast of eurozone growth takes account of

political uncertainty in Germany after the failure to

conclude negotiations on the 2025 budget and the fall of

the coalition government in November. However, the

forecast came before the collapse of the French

government on 4 December after Prime Minister Michel

Barnier was ousted in a no-confidence vote.

As things stand therefore, neither France nor Germany, the

EU's two largest economies which together account for

over 40% of the bloc's GDP, has a sitting government.

Germany is expected to hold a Federal election on 23

February 2025, but in France there can be no new

assembly elections until at least twelve months after the

snap election held in July this year.

This political vacuum at the heart of the EU may hamper

efforts to address Europe's burgeoning deficits and falling

competitiveness. The recent collapse of governments in

both countries was driven by deep political divisions over

fiscal policy. With the political landscape increasingly

polarised, whoever forms the new government in each

country will likely face difficulties pushing necessary tax

and spending proposals through.

Even before the ink was dry on the OECD's forecast of

0.9% GDP growth in France next year, and 1% in 2026,

forecasters were revising down their numbers in response

to the political crisis. According to an article in the Times

of London, "the French economy is unlikely to collapse

but will have to pull out the stops to grow by 0.5% next

year".

Steep decrease in new construction orders in the

eurozone

The weakness of the EU construction sector remains a

significant concern for the EU’s timber industry. Forward-

looking indices show that EU construction activity

continues to decline. The HCOB Eurozone Construction

PMI Total Activity Index — a seasonally adjusted index

tracking monthly changes in total industry activity —

posted 42.7 in November, down slightly from 43.0 in

October. The latest data was indicative of a steep decrease

in total output in the penultimate month of 2024.

According to HCOB, the rate of decrease in eurozone

construction activity quickened in November amid a

contraction in new orders, which fell at the strongest rate

since September 2023. The decline in activity was driven

by broad-based contractions across the three monitored

economies, led by the strongest fall in Germany since

April. French firms recorded a strong decrease that was

nonetheless the softest for a year, while firms in Italy saw

the least pronounced decline since May.

The housing sector continued to weigh heavily on total

output and was the worst-performing sector, though the

robust decline was nonetheless the softest for 14 months.

Civil engineering activity saw the softest fall since August.

However, commercial building firms recorded the

strongest contraction for three months.

Continuing slow recovery in EU27 tropical wood

furniture imports in Q3

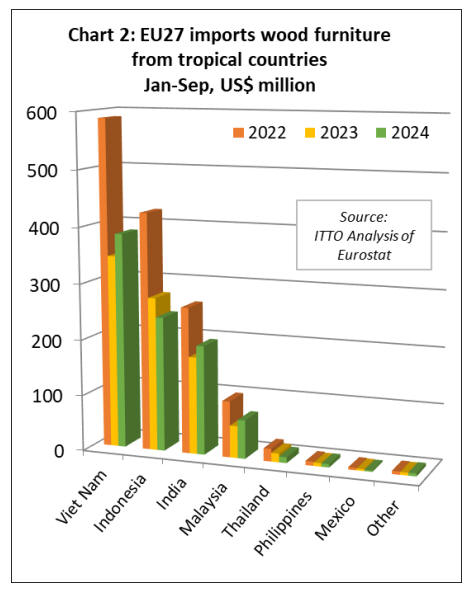

After a very slow start to the year, EU wood furniture

imports from tropical countries continued to make up lost

ground in the third quarter. In the first nine months of the

year, the EU27 imported 217,300 tonnes of wood furniture

from tropical countries with a total value of US$914

million.

Import quantity and import value were up 7% and 4%

respectively compared to the same period in 2023. In the

first nine months of this year compared to the same period

in 2023, EU27 import value of wood furniture increased

from Vietnam (+12% to US$385.1 million), India (+12%

to US$195.0 million), Malaysia (+20% to US$68.9

million), and the Philippines (+2% to US$6.2 million).

However, import value fell from Indonesia (-12% to

US$240.5 million), Thailand (-32% to US$10.6 million),

and Mexico (-20% to US$2.6 million). EU27 wood

furniture imports from all other tropical countries were

negligible during the period (Chart 2).

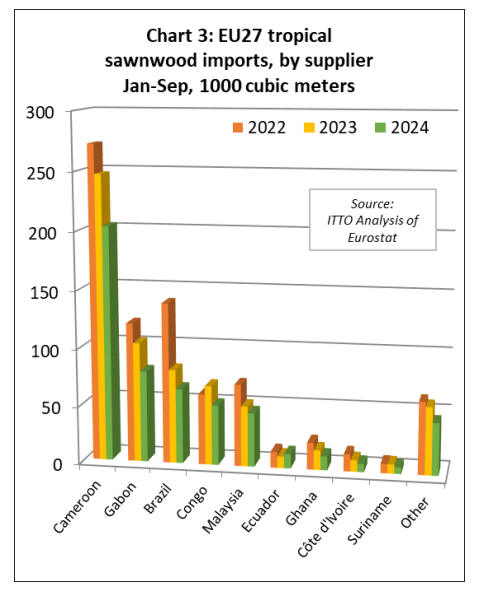

EU27 imports of tropical sawnwood down 20% in the

first nine months of 2024

The EU27 imported 527,600 cu.m of tropical sawnwood

in the first nine months of this year, 20% less than the

same period in 2023. Import value of this commodity was

US$487.1 million in the January to September period this

year, also 20% less than the same period in 2023.

Imports declined from nearly all leading supply countries

during the period including Cameroon (-18% to 203,100

cu.m), Gabon (-23% to 79,000 cu.m), Brazil (-20% to

64,900 cu.m), Republic of Congo (-24% to 51,900 cu.m),

Malaysia (-11% to 46,500 cu.m), Ghana (-30% to 11,900

cu.m), Côte d’Ivoire (-30% to 7,000 cu.m), Suriname (-8%

to 5,600 cu.m), the Democratic Republic of Congo (-54%

to 4,800 cu.m), and the Central African Republic (-57% to

4,400 cu.m).

Sawnwood imports from Ecuador bucked the overall

downward trend in the first nine months of this year, at

12,500 cu.m, up 25% compared to the same period in

2023. Imports from Vietnam also increased, by 46% to

4,800 cu.m (Chart 3).

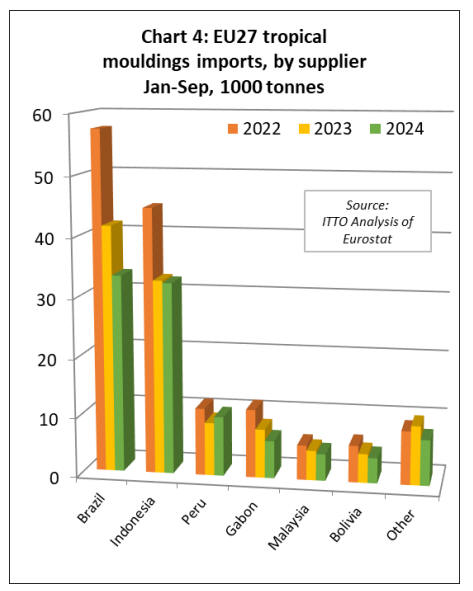

The EU27 imported 98,200 tonnes of tropical

mouldings/decking in the first nine months of this year,

12% less than in the same period in 2023. Import value of

this commodity was down 19% to US$172.4 million in the

same period.

During the first nine months, imports increased year-on-

year from Peru (+12% to 10,000 tonnes) but fell from all

other leading supply countries including Brazil (-20% to

33,300 tonnes), Indonesia (-1% to 32,200 tonnes), Gabon

(-23% to 6,300 tonnes), Malaysia (-10% to 4,500 tonnes),

and Bolivia (-13% to 4,200 tonnes) (Chart 4 left).

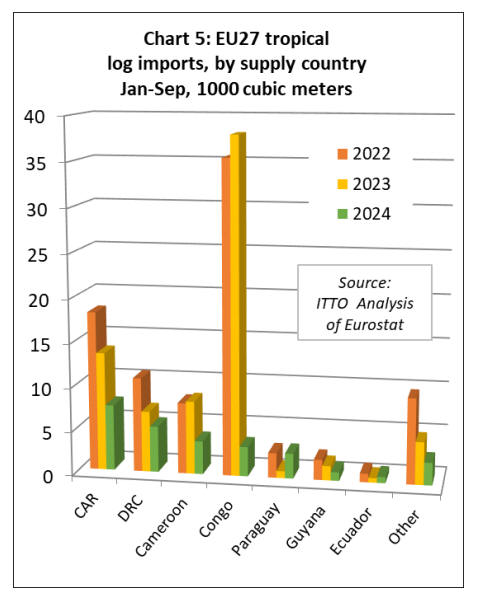

The EU27 imported 26,900 cu.m of tropical logs with a

total value of US$16.6 million in the first nine months of

this year, respectively 64% and 65% less than in the same

period last year. The decline was driven mainly by an 91%

decline in imports from the Republic of Congo to 3,400

cu.m.

This follows the ban on exports of most logs from the

country since 1st January 2023. EU27 imports of logs in

the first nine months of this year were also down

compared to the same period last year from the Central

African Republic (-44% to 7,500 cu.m), the Democratic

Republic of Congo (-24% to 5,200 cu.m), Cameroon (-

54% to 3,800 cu.m), and Guyana (-41% to 1,000 cu.m).

However, EU27 log imports increased from Paraguay

(+263% to 2,800 cu.m), and Ecuador (+37% to 700 cu.m)

during the nine-month period (Chart 5).

EU27 imports of tropical hardwood veneer, plywood

and joinery sliding this year

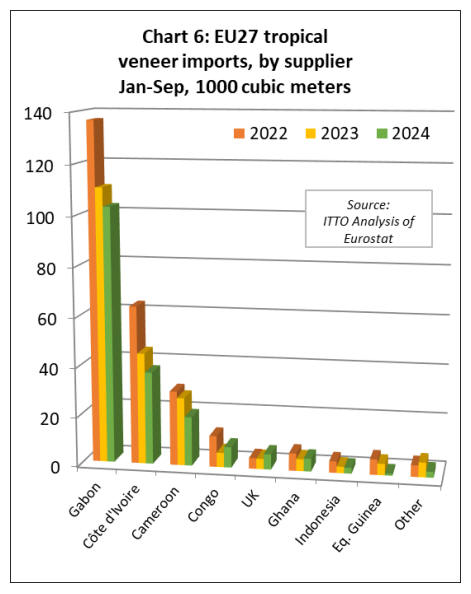

The EU27 imported 185,200 cu.m of tropical veneer with

a total value of US$125.6 million in the first nine months

of this year, down 12% and 13% respectively compared to

the same period last year.

Imports of tropical veneer from Gabon, by far the largest

supplier to the EU27, were 103,000 cu.m in the first nine

months of this year, 7% less than the same period in 2023.

EU27 imports of this commodity also decreased during the

period from Côte d'Ivoire (-17% to 37,300 cu.m),

Cameroon (-28% to 19,800 cu.m), Indonesia (-11% to

2,300 cu.m), and Equatorial Guinea (-84% to 800 cu.m).

Veneer imports into the EU27 increased during the nine-

month period from the Republic of Congo (+43% to 8,300

cu.m), the UK (+49% to 6,200 cu.m), and Ghana (+8% to

5,200 cu.m). (Chart 6).

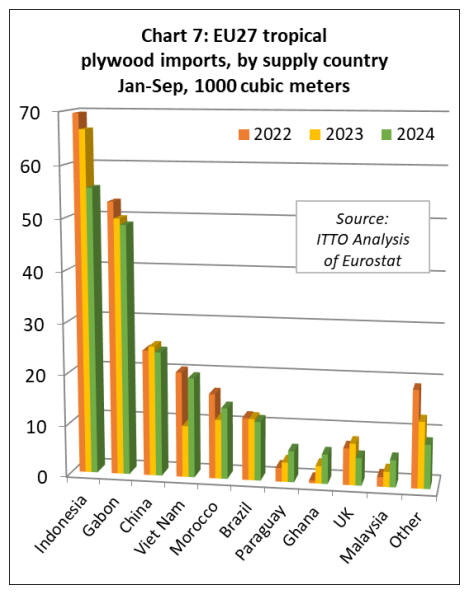

The EU27 imported 204,700 cu.m of tropical plywood

with a total value of US$149.0 million in the first nine-

months of this year, respectively 1% and 2% less than the

same period last year.

Imports fell from the three leading supply countries during

the period including Indonesia (-16% to 55,600 cu.m),

Gabon (-2% to 48,700 cu.m), and China (-4% to 24,300

cu.m). Imports from Brazil were also down, by 4% to

11,500 cu.m, while indirect imports via the UK fell 34% to

5,400 cu.m.

However, these losses during the nine-month period were

partly offset by rising imports from Vietnam (+94% to

19,500 cu.m), Morocco (+20% to 13,900 cu.m), Paraguay

(+59% to 6,100 cu.m), and Malaysia (+78% to 5,300

cu.m) (Chart 7).

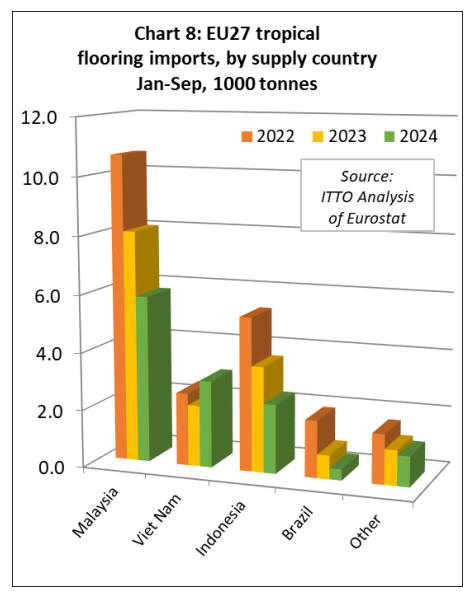

The EU27 imported 12,700 tonnes of tropical wood

flooring with a total value of US$33.1 million in the first

nine months of this year, down 20% and 28% respectively

compared to the same period in 2023.

Imports of 5,800 tonnes from Malaysia in the nine-month

period this year were 28% less than the same period in

2023. Flooring imports also fell from Indonesia (-35% to

2,400 tonnes) and Brazil (-53% to 400 tonnes). However,

imports increased from Vietnam (+42% to 3,000 tonnes)

(Chart 8).

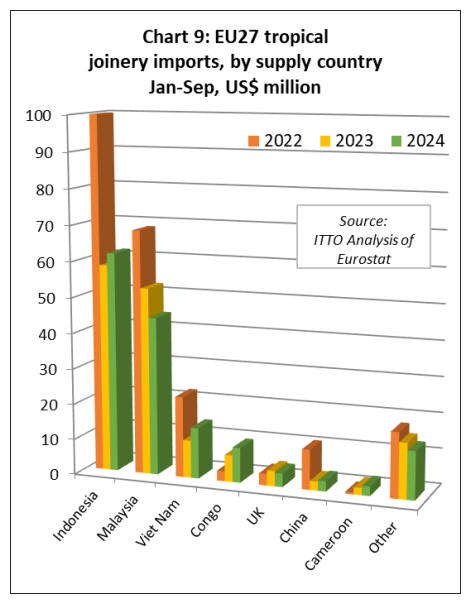

The value of EU27 imports of other joinery products from

tropical countries, which mainly comprise laminated

window scantlings, kitchen tops and wood doors, was

US$152.9 million in the first nine months of this year.

Tere was little change compared to the same period in

2023. Import quantity was up 7% to 66,000 tonnes during

the same period.

Between January and September this year, EU27 import

value of other tropical joinery products was down 15% to

US$44.4 million from Malaysia.

Indirect imports from the UK also fell, by 12% to US$3.8

million. However, import value increased 6% to US$61.8

million from Indonesia and was up 35% to US$14.3

million from Vietnam.

In a potentially significant longer-term development, given

efforts in central Africa to shift up the value chain as log

exports are banned, EU import value of laminated joinery

products in the first nine months of 2024 was up 31% to

US$9.8 million from the Republic of Congo and up 30%

to US$2.6 million from Cameroon (Chart 9).

|