Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jan

2024

Japan Yen 158.00

Reports From Japan

Continued wage increases

are key

In 2024, the Japanese economy began a shift to becoming

‘more normal’ with three interest rate increases, the third

year of price increases and a second year of wage

increases.

In 2025 Japan is expected to experience a continuation of

wage and interest rate increases which should see the

economy growing more than 1 percent in inflation-

adjusted terms in fiscal 2025. It is anticipated that wage

increases will give a boost to consumer spending. Whether

Japanese employers will raise wages in 2025 faster than

the previous year holds the key to the economy's ability to

put itself on a domestic demand-led sustainable growth

path this year.

Wages need to grow faster than inflation to boost personal

consumption, a key engine of economic growth that has

been weak because of high prices. The forecast is for wage

growth outpacing prices, helping a recovery in personal

consumption. The consumer price index excluding fresh

food is expected to rise slightly more than 2 percent, a

slower pace than in fiscal 2024.

The Japan Center for Economic Research compiled

forecasts by 37 private-sector economists for the fiscal

year that starts in April. They predict average real growth

of 1.1%, a more optimistic projection than for the current

fiscal year (0.4%).

However, the projections also note downsides including

potential tariff increases by the incoming US

administration which could impact growth around the

world. A prolonged downturn in China's economy would

also have negative repercussions in Japan.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20250106_B01/#:~:te

xt=Economists%20predict%20that%20Japan's%20economy,a%2

0boost%20to%20consumer%20spending.

No steady economc trend opening way for rate hike

At its December policy board meeting the Bank of Japan

(BoJ) decided to keep its benchmark interest rate

unchanged, saying it will continue to target the short-term

rate at around 0.25%. This sent the yen to a one-month

low in December. Prior to the BoJ decision the US dollar

was already firmer above 154.50 yen after the Federal

Reserve hinted at a slower pace of interest rate.

The judgement appears to be that over the next few

months the BoJ will monitor wage trends, inflation and the

effects of policy changes in the US. The BoJ last raised

rates in July but the latest decision marks the third-straight

time for it to hold policy steady. Some officials have

observed that Japan's economy and prices are trending as

predicted and this could provide the opportunity for future

rate increases.

See: https://www3.nhk.or.jp/nhkworld/en/news/20241219_B02/

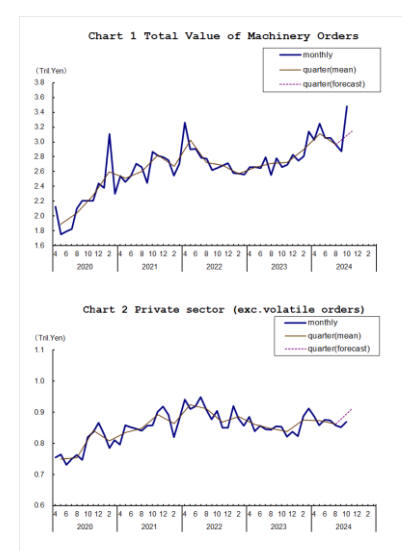

Private sector machinery orders stall

The total value of machinery orders received by 280

manufacturers operating in Japan increased by 21% in

October compared to the previous month on a seasonally

adjusted basis. Private-sector machinery orders, excluding

volatile ones for ships and those from electric power

companies, increased a seasonally adjusted by 2% in

October.

Cabinet Office data showed, on a year-on-year basis, core

orders (a highly volatile data series) regarded as a leading

indicator of capital spending in the coming six to nine

months, grew 5.6%, (forecast at 0.7%).

By sector, core orders from manufacturers jumped 12.5%

month-on-month in October while those from non-

manufacturers dropped. The Cabinet Office left its

assessment of machinery orders for October unchanged,

saying the recovery was pausing.

See: https://www.esri.cao.go.jp/en/stat/juchu/2023/2310juchu-

e.html

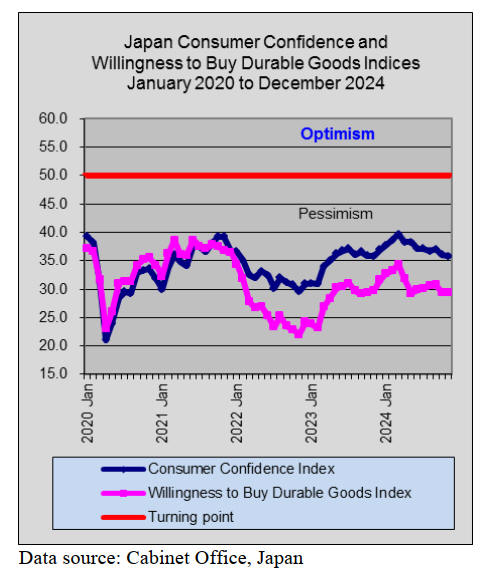

Consumer spending – no clear signs of strength

Japanese households continue to cut spending as inflation

is driving up prices which suggests the Bank of Japan is

likely to take a cautious approach to interest rate increases.

Spending by households dropped 1.1% from a year earlier

in September compared with the consensus estimate of a

1.8% decrease, after sliding 1.9% in the previous month

according to a report by the Ministryof Internal Affairs.

Spending only rose twice in the 12 months to September

2024.

Outlays on housing, transportation and communications,

durable goods and health care dropped.

Consumer spending in Japan has consistently failed to

show clear signs of strength as shoppers have been forced

to cope with prices increasing at or above the BoJ’s

inflation target over the past 30 months.

The yen’s weakness is a key factor weighing on the

purchasing power of Japanese households. Consumer

confidence slid for the first time in five months in October

after Japan’s currency fell to the weakest level in almost

three months. Consumer spending, which accounts for

more than half the economy, is still below pre-pandemic

levels.

See: co.jp/business/2024/11/08/economy/september-household-

spending/

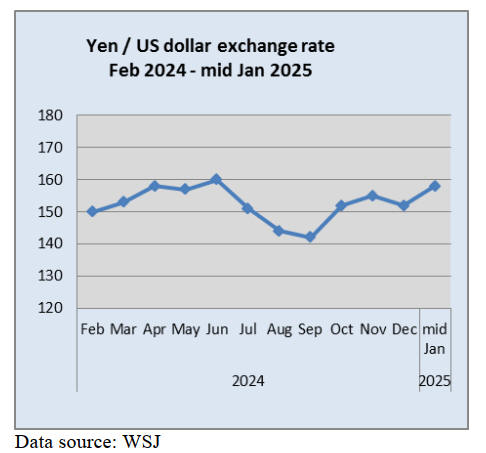

Strong US economy lifts dollar against the yen

As of the 10 January the yen stood at 158 to the US dollar

and has progressively depreciated since September last

year.

The yen exchange rate tends to be affected by the

difference in interest rates between Japan and the US.

Currently, interest rates in the US are much higher than in

Japan.

Even though the yen did show signs of strengthening the

current rate against the dollar is a reflection of a stronger

than expected US jobs report, falling unemployment and

wage growth in the US.

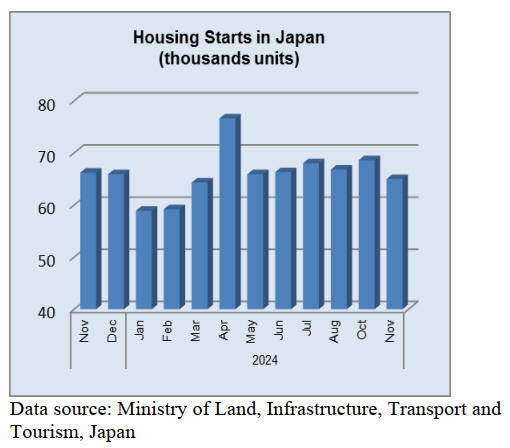

Homes getting smaller

According to the latest government survey houses in Japan

are getting smaller with the average floor space falling to a

30-year low. The average area per house is now about 92

square metres, a decline of 3 sq. metres from the peak in

2003. One of the main reasons is rising construction costs.

Builders are designing smaller homes to hold prices

stable

while at the same time maintaining their profit margins

which could be viewed as a ‘stealth price hike.’ Analysts

There are concerns that young couples living in small

homes may be deterred from having children. The

declining birth rate is a serious problem in Japan.

See: https://asia.nikkei.com/Economy/Japan-homes-shrink-to-

their-smallest-in-30-years

New homes to be fitted with solar panels

The Tokyo government adopted an ordinance on 15

December 2024 requiring new homes and buildings to be

fitted with solar panels making Tokyo the first place in

Japan to require solar panels on new detached houses. The

ordinance will come into force in April 2025. Under the

new rules the obligation to install solar panels for large

structures, such as office or apartment buildings, falls on

anyone who commissions their construction.

See: https://www.asahi.com/ajw/articles/14794249

Import update

Assembled wooden flooring imports

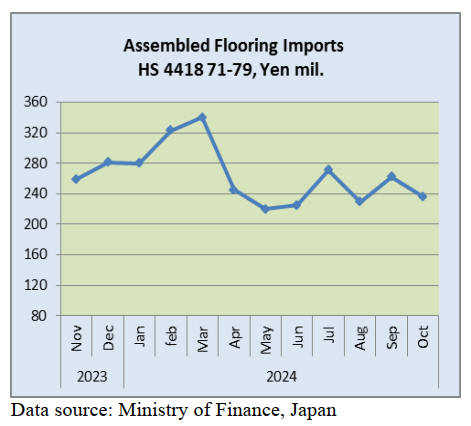

After the peak in the value of assembled wooden flooring

in March 2024 there was a sharp decline until June but

despite the change in direction the value of imports in the

period July to October did not recover. Year on year the

value of assembled wooden flooring (HS441871-79) in

October was down around 14% and compared to a month

earlier the value of October imports dropped 10%.

.

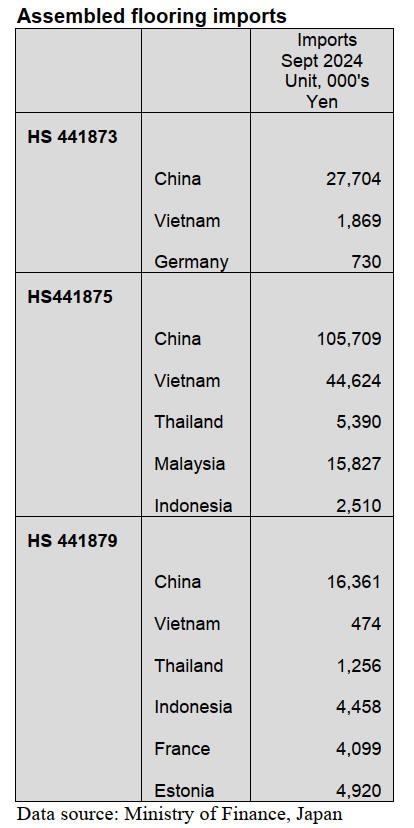

As in previous months the main category of assembled

flooring imports was HS441875, accounting for 74% of

the total value of assembled flooring imports. The second

largest category in terms of value was HS441879 (13%), a

decline compared to September. The third category of

import was HS441873 (13%) with the balance being

HS441974.

Of HS441875 imports 61% was provided by shippers in

China up sharply from a month earlier, 26% by shippers in

Vietnam. The three other sources of assembled flooring

(HS441875) in October were Malaysia, Thailand and

Indonesia.

Plywood imports

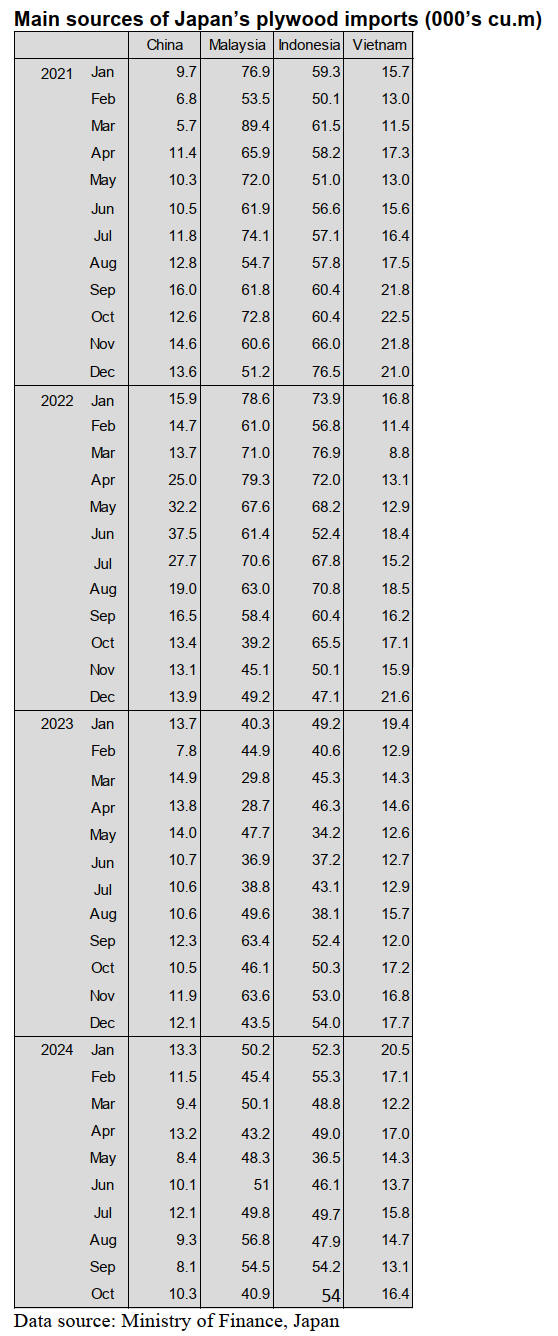

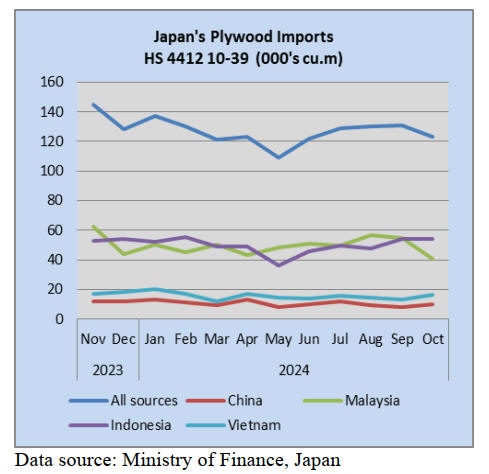

The volume of October plywood imports (441210-39) was

122,810 cu.m (130,998 cu.m in September) representing a

decline (8%) on levels a year earlier and the first decline in

total plywood imports since May 2024.

In October the volume of arrivals from producers in China

was around the same level as a year earlier and up slightly

from September .The volume of arrivals from both

Malaysia and Vietnam came in below levels seen a year

earlier while the volume of imports from Indonesia was up

year on year.

As in previous months, of the various categories of

plywood imported in October HS441231 was the largest

accounting for about 90% of the total volume of plywood

imports with the balance fairly evenly distributed across

the other HS codes. Malaysia and Indonesia accounted for

most of the HS441231 arrivals. Shipments from Vietnam

and China were spread across the categories tracked. Other

shippers appearing in Japan’s plywood import statistics in

October included Latvia and New Zealand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

October plywood supply

Total plywood supply in October, 2024 was 403,000

cbms, 3.8 % more than September, 2024. This is the

highest plywood supply per month in this year. One of the

reasons is that production and shipment of domestic

plywood are this year’s best volume. Imported plywood is

almost leveled off from last month and this is three

straight months decreasing.

Production of structural softwood plywood is 6.7 % more

than the previous month and shipment is 10.3 % more than

last month. Production of plywood in August and

September 2024 exceeded shipment. As a result, inventory

at the end of month kept rising for two months in a row.

However, shipment in October, 2024 was more than

production and the inventory at the end of October is

160,000 cbms, 3.3 % less than September 2024.

Shipment of plywood rose at several domestic plywood

manufacturers, trading companies and wholesalers in

October, 2024. However, it is hard to say that the plywood

market is lively because the new starts and floor areas are

still low.

The price of softwood plywood had been declining until

October 2024 and there were a lot of spot purchases from

consumers so it could say that the actual demand had

increased. The imported plywood was 0.3 % less than the

previous month. Malaysian plywood was 25.0 % less than

last month and this was the lowest volume for the first

time since August last year. Indonesian plywood was 0.3

% less than last month. Since the yen appreciated rapidly

after the middle of July 2024 consumers limited

purchasing 12 mm Malaysian plywood.

North American logs

North American logs and lumber markets are still

sluggish. Orders to precutting companies recovered

slightly. A precutting company says that the price of

European lumber reaches the bottom so if the price of

European lumber rise, the price of Doulgas fir lumber in

Japan would also rise. On the other hand, the price of

domestic small sized lumber has been low and house

builders keep demanding precutting companies to lower

the selling price. The consumers would keep purchasing

the domestic small sized lumber.

A major Doulgas fir lumber manufacturer in Japan

lowered the price of KD Doulgas fir beam in September

and October 2024. Therefore, there is a prediction of a

price drop in not only North American lumber but also the

imported lumber. However, the price has been leveled off

since then.

South Sea logs and wood products

Supply and demand for South Sea logs are balanced.

South Sea logs for from Malaysia and Papua New Guinea

arrived in Japan in December- January 2025 and the logs

will be delivered to Japanese lumber and plywood

manufacturers. If the logs arrive as scheduled, it would be

enough volume for the first half of 2025.

Demand for South Sea logs for pallets or blocks for steel

manufacturers has been low but for blocks for

shipbuilding is firm. The price of South Sea log in South

Asia is high due to the increasing labor cost. However, the

yen is stronger than before so the import cost would be

low.

Movement of South Sea and Chinese lumber is sluggish

due to the weak yen. Japanese distributors are not in rush

to purchase a lot of lumber because they have minimum

volume of lumber for their job.

|