|

1.

CENTRAL AND WEST AFRICA

Crackdown on FCAD compliance

Operators in Cameroon report the authorities have

intensified enforcement of forestry regulations,

specifically the FCAD (Forestry Concession Allocation

Decree) and that this is impacting production for export

and local markets. Rigorous inspections and insistence on

strict legal compliance have compelled some Asian

operators to suspend production.

This clamp down, say millers, carries major implications

for the Dutch market where Azobé remains in high

demand. In the past Azobé was one of Cameroon’s

principal export species, shipped primarily in log form for

marine and outdoor enduses.

The Netherlands continues to be the main market for

Azobé using the hardwood for diverse infrastructure

projects such as dike reinforcement, oil pipeline supports

and increasingly for windmill mat installations. Demand is

particularly strong as the Ministry of Infrastructure and

Water Management increases dike heights in response to

the risk of coastal floods.

With Cameroonian mills facing reduced production buyers

of Azobé may turn to other West African suppliers,

potentially applying further pressure on Gabon’s Azobé

output. Despite these challenges Cameroon’s heightened

regulatory oversight aims to ensure sustainable and

transparent forestry operations.

ECTN application to benefit timber trade

On 1 January 2025 the Cameroon National Shippers'

Council (CNSC) launched its latest Electronic Cargo

Tracking Note (ECTN) issuance application bringing the

latest technology to the forefront of trade logistics. This

updated platform is particularly noteworthy for the timber

trade where efficient tracking and documentation of

shipments are essential to ensuring compliance with

international regulations and sustainable trade practices.

As timber remains one of Cameroon’s key export

commodities the ECTN system supports the industry's

growth by reducing administrative bottlenecks, improving

logistics and ensuring timely delivery of goods to

international markets.

See: https://www.cncc.cm/en/article/besc-3-0-new-version-

launched-856#myCarousel

New sawnwood marking requirement

The Ministry of Water and Forests, the Sea and the

Environment in Gabon plans to mandate that every bundle

of sawnwood for export carries an electronic readable

enabling tracking back to the log. In addition logs in the

CFAD/PAO system (Forest Concessions under

Sustainable Management (CFAD) and Operational Action

Plan) are GPS-marked. However, some millers question

the feasibility of tracing each board back to specific logs

through GPS codes especially given the ministry’s limited

capacity for field verification.

Industry syndicates such as UFIGA (Union des Forestiers

et Industriels du Gabon), UFIAQ (Chinese Association)

and local Gabonese trade groups are protesting the policy

warning of potential risks from arbitrary enforcement.

Government takes full control of Société Nationale des

Bois du Gabon

The government of Gabon has assumed full control of

Société Nationale des Bois du Gabon taking over from the

Gabon Special Economic Zone which was jointly

managed by Dubai-based Arise IIP and the Gabonese

government.

Brice Oligui Nguema, Transitional President of Gabon

stated the takeover demonstrates Gabon’s determination to

protect and sustainably manage its forest resources.

Marc Ona Essangui, Head of the non-governmental

organisation Brainforest and Vice-President of Gabon’s

Senate, stressed the importance of enhancing oversight

mechanisms within the timber sector. Essangui called for

the establishment of logging traceability systems, robust

monitoring framework and a forest code aligned with

international standards to ensure the sustainable

exploitation of Gabon’s forest resources.

See: https://commonwealthchamber.com/gabons-junta-gets-

direct-access-to-620-million-timber-industry/

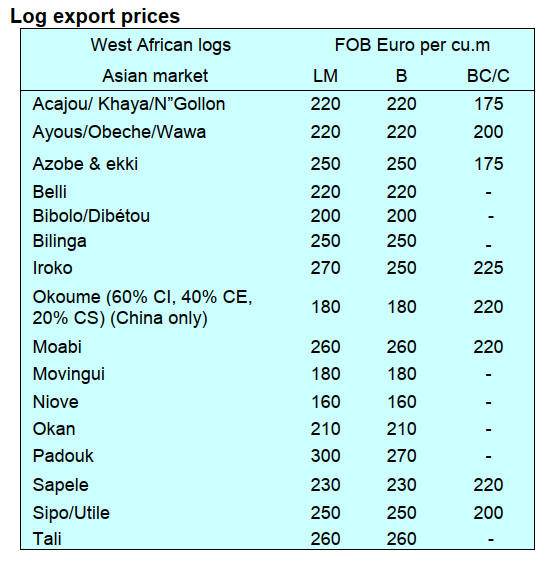

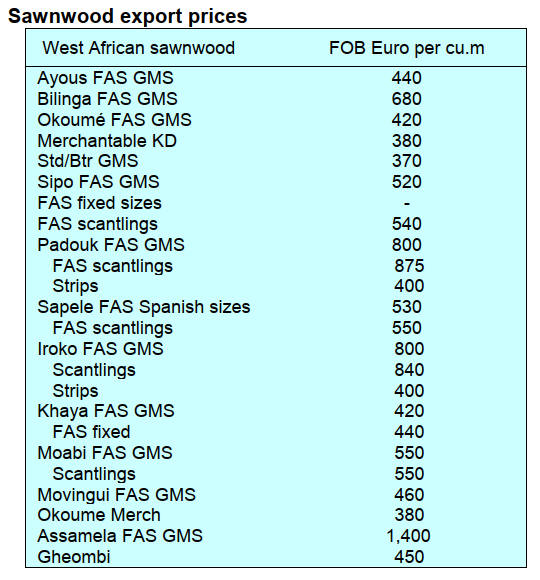

Adapting to regulation enforcement

Winter in Europe dampens export prospects but demand in

the Middle East and in the Philippines for construction and

furniture species provides some stability. Vietnam’s

consistent appetite for Tali and Padouk continues, while

demand in China remains subdued.

Operators say effective regulatory adaptation, especially in

Cameroon and Gabon, will be crucial for maintaining

market access and ensuring legal and traceable timber

supply.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See, https://www.itto-

ggsc.org/static/upload/file/20241217/1734418549204401.pdf

2.

GHANA

Business community assured of government

support

Ghana’s President, John Dramani Mahama, has reassured

the business community of his government’s support. He

said he would prioritise stability, predictability and an

investor-friendly environment for businesses in order to

drive economic growth.

In his inaugural address the President emphasised his

administration’s commitment to revitalising the economy

through reforms and policies designed to attract both local

and foreign investments.

President Mahama called on business leaders and

entrepreneurs to bring their investments to Ghana to

support the new economic model soon to be rolled out to

reshape the business environment to foster growth and

prosperity and to position the country as a key player in

the global economy. He pledged to look at the current tax

system and rationalise it to make it more transparent and

fairer.

The Association of Ghana Industries (AGI) has described

Ghana’s tax system as unfair and counterproductive,

particularly to the growth of local businesses. Chief

Executive Officer of the Association, Seth Twum-

Akwaboah, said Ghana’s current tax regime is a

disincentive to the private sector, a situation contributing

to low revenue generation for the State.

In a related development, an Associate Professor of

Finance at Andrews University, Michigan, USA, Professor

Williams Peprah, has suggested a property tax regime that

could significantly boost the country’s tax revenue-to-

Gross Domestic Produce ratio.

See: https://citinewsroom.com/2025/01/ghana-is-open-for-

business-again-mahama-tells-business-community/

and

https://www.myjoyonline.com/rationalize-ghanas-tax-system-

agi-tells-government/

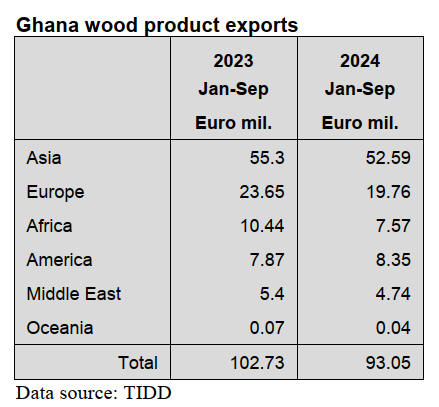

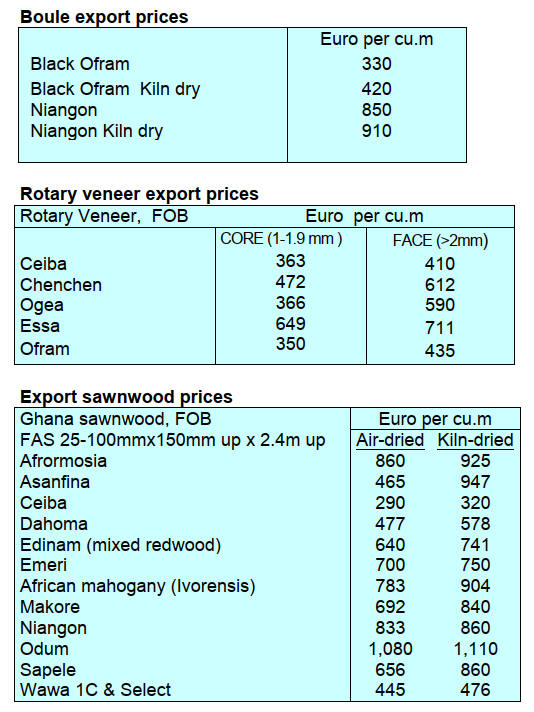

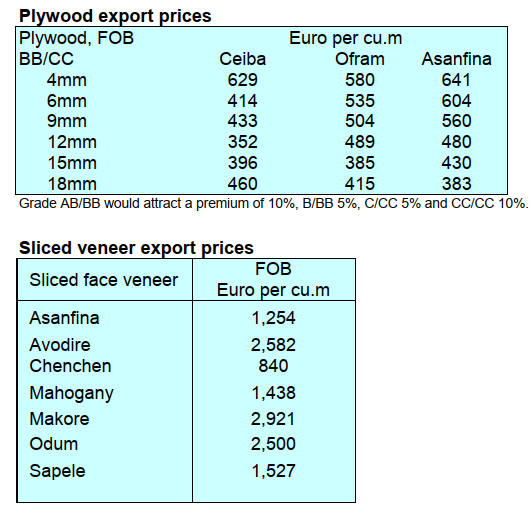

Three top markets: Asia, EU and Africa

Three of Ghana’s wood export markets accounted for 86%

of total receipts in the third quarter 2024. Ghana earned a

total of Eur93.05 million from the export of 208,102 cu.m

of wood products during the period January to September

2024.

This value represented a 9.4% decline when compared to

Eur102,738 million recorded from 226,016 cu.m for the

same period in 2023 according to Timber Industry

Development Division (TIDD) data sources.

Of the country’s six market destinations for wood

products, Asia (57%), Europe (21%) and Africa (8%)

alone accounted for most of the total export receipt for

first nine months in 2024.

However, export volumes to America, the Middle East and

Oceania markets accounted for less than 15% of the total

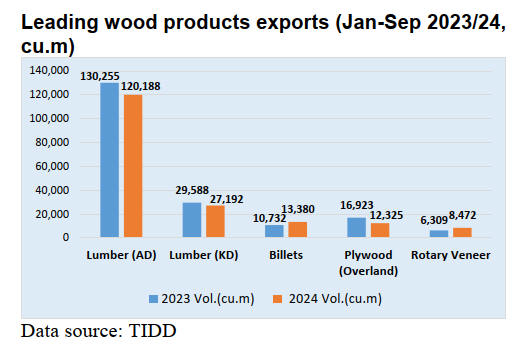

export revenue in both 2023 and 2024.

The leading wood products exported included air and kiln-

dried sawnwood, rotary veneer, billets and plywood

(Overland) which together contributed 181,557cu.m

(Eur77.45million) and 193,807cu.m (Eur84.06million) in

2024 and 2023 respectively.

Billets and plywood exports to regional markets recorded

higher volumes in 2024 as against that of 2023. However,

the performance of sawnwood and plywood in 2024 fell

11% when compared to the corresponding volumes in

2023.

For the African markets the major destinations included

Egypt, Morocco and South Africa with the ECOWAS sub-

region importing Eur5.25 million from 13,886 cu.m of

total African wood products exported from Ghana from

between January and September 2024.

Final review of Forest Landscape Restoration Strategy

The Forest Services Division (FSD) of the Forestry

Commission (FC) held a consultative and validation

workshop with members of the Parliamentary Committees

on Environment, Science and Technology, Lands and

Forestry and the Ghana Timber Millers Organisation

(GTMO).

The stakeholder consultation was to finalise the review of

the ‘Ghana Forest Landscape Restoration Strategy’

(GFLRS). A similar meeting held earlier at the Forestry

Commission Training Centre (FCTC) was attended by

other stakeholder groups.

The consultation review focused on aligning the GFLRS

with Sustainable Development Goals (SDGs) related to

climate action, forest restoration and plantation

development. The GFLRS is a 25-year strategic plan

launched in 2016 to be reviewed every five years.

In his opening address, the Chief Executive of the FC,

John Allotey, declared that since the launch of the Strategy

close to a decade ago a lot has changed in the global forest

landscape in relation to climate change, illegal mining,

wildfires, agricultural impact and expectations from

international communities. He therefore urged participants

to be fully committed in their deliberations and contribute

to producing to a working document that represented the

aspirations and interests of the country.

In his closing remarks Mr. Allotey assured participants all

relevant suggestions made would be duly incorporated into

the final document.

See: //fcghana.org/fc-engages-stakeholders-on-revised-forest-

landscape-restoration-strategy/

Ministerial appointments

President Mahama has nominated Dr. Cassiel Ato Forson

as Finance Minister designate. The President has also

named John Abdulai Jinapor and Dominic Akuritinga

Ayine as Ministers designate for Energy and Attorney-

General respectively according to a statement issued by

the Acting Spokesperson to the President, Felix Kwakye

Ofosu.

Dr. Forson is a lawmaker in parliament, he is an economist

with deep insights particularly on the economy of Ghana,

a Chartered Accountant and a Tax Practitioner with over

20 years’ experience in the public and private sectors.

According to Deloitte’s “A Sneak Preview of 2025: What

Lies Ahead?” report, Ghana’s economy is on track to

regain macroeconomic stability by 2025. The audit and

advisory firm attributed this outlook to the government’s

fiscal consolidation measures and debt restructuring

efforts, which are beginning to yield results.

The Bank of Ghana Governor, Dr. Ernest Addison, has

also maintained that the Ghana cedi’s stability in 2025 will

largely depend on the economy and some monetary policy

measures under implementation by the Central Bank.

See: https://www.cnbcafrica.com/2025/ghanas-president-names-

cassiel-ato-forson-as-finance-minister/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See, https://www.itto-

ggsc.org/static/upload/file/20241217/1734418549204401.pdf

3. MALAYSIA

Economy to remain resilient in 2025

Malaysia’s growth is set to reach around 5% in 2025 as

foreign direct investments and support from local funds

shield the economy from global risk according to the

Minister of Finance II, Amir Hamzah Azizan.

An executive of the Federation of Malaysian

Manufacturers (FMM) has said Malaysia’s economy is

poised for steady growth this year driven by strong

domestic demand, robust investment activities and growth

in exports and tourism despite potential global

uncertainties.

FMM President, Soh Thian Lai, noted that in the second

and third quarters of 2024 Malaysia’s gross domestic

product grew at 5.9% and 5.3%, respectively. The nation’s

GDP growth is forecast to be between 4.5% and 5% this

year.

He added “inflation is forecast to rise to 3% in 2025

influenced by domestic factors such as an increase in the

minimum wage, changes in the Employees Provident Fund

contributions for foreign workers, the extension of the

sales and service tax and subsidy rationalisation efforts.”

EUDR trial run

In a statement on its website the MTIB provides an up-

date on preparations for the EUDR. The MTIB says the

Malaysian timber legality assurance system (MTLAS),

implemented in 2013, is a system to verify the legality of

timber commodities in Peninsular Malaysia.

MyTLAS aims to assist exporters in fulfilling the due

diligence requirements, which involve all companies in the

timber product supply chain, including exporters,

suppliers, traders, processors and exporters.

The European Union has announced implementation of

the European Union Deforestation-free Regulation

(EUDR) will come into force in December 2025. To

ensure the efficient implementation of MyTLAS-

EUDR, MTIB conducted a trial run. As part of the

additional documentation requirements for the declaration

of MyTLAS-EUDR certificate details, exporters are

required to submit the following additional information:

Timber harvesting license information

Transport permit information

The scientific name of the timber species

Certification documents such

as PEFC/MTCS/COC or others

Due diligence and risk reduction assessments for

exporters, importers, suppliers and traders in the timber

commodities sector will be carried out in phases in 2025.

Implementing the new policy for MyTLAS certificates is

expected to begin on June 1, 2025.

See:

https://www.mtib.gov.my/index.php/en/announcement/pemaklu

man-pelaksanaan-mytlas-%E2%80%93-eudr-trial-run

Forestry professionals with technical and practical

knowledge

The vision of the Sabah Forestry Department (SFD) is

towards realisation of Sustainable Forest Management

(SFM) issues essential for preserving biodiversity,

regulating the climate and supporting the socio-economic

well-being of communities.

The Chief Conservator of Forests, Frederick Kugan,

emphasises that SFD is committed in protecting a

minimum 50% of the State’s land for sustainable forest

use, prioritising the need for a highly skilled workforce to

manage these resources.

The Sabah Forestry Institute (Institut Perhutanan Sabah)

(IPS) plays a vital role in achieving this goal by producing

forestry experts equipped with technical and practical

knowledge, aligning with Sabah Forest Policy 2018 and

the Sabah Maju Jaya Development Plan. To date, IPS has

trained 322 Forest Rangers and 1,324 Forest Guards, while

awarding over 5,722 certificates for short courses.

See:

http://theborneopost.pressreader.com/article/281625310912957

Sarawak forestry roadmap 2025

The Sarawak Forest Department (SFD) has drawn up a

2025 strategic roadmap with four key pillars. SFD

Director, Hamden Mohammad, said this initiative aims to

align Department actions with evolving challenges and

opportunities.

The roadmap says the Depatment will assist in

diversifying Sarawak’s economy by exploring forest

carbon initiatives as a new revenue source, enhancing both

the State’s economy and sustainability commitments.

Secondly, digital transformation will continue to improve

operational efficiency and sustainable forest management.

Hamden added the Department has pledged to plant 50

million trees by 2025 ensuring the preservation of

Sarawak’s forest ecosystems for future generations. Social

equity will also remain a focus by the Department through

community development programmes, including social

forestry and non-timber forest products, benefitting local

communities directly.

See: https://www.theborneopost.com/2024/12/18/forest-

department-sarawak-draws-up-four-key-pillars-for-2025-

strategic-roadmap/

Timber certification

Malaysian Timber Certification Council confirmed there

are 6.47 million hectares of MTCS – PEFC Certified

Forests in Malaysia as of November 2024. These forests

comprise 30 Certified Natural Forest (FMUs) and nine

Certified Forest Plantations (FPMUs). There are 370

companies holding MTCS – PEFC Certified Chain of

Custody (as at October 2024).

See:

https://www.freemalaysiatoday.com/category/nation/2025/01/09/

malaysias-growth-set-to-surpass-5-this-year-says-minister/

Mangrove restoration

Efforts to plant and replenish mangrove forests have

attracted corporate and non-governmental organisations.

However, some question how successful and how

significant scattered actions contribute to the reforesting of

mangroves in the country and there have been calls for a

roadmap for mangrove restoration.

It has been proposed that such a roadmap could include

information on potentially restorable coupled with

suggestions of interventions by government agencies, non-

governmental organisations, local communities and public

and private organisations.

See:

https://www.nst.com.my/opinion/columnists/2024/12/1152582/c

oordinate-mangrove-conservation

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See, https://www.itto-

ggsc.org/static/upload/file/20241217/1734418549204401.pdf

4.

INDONESIA

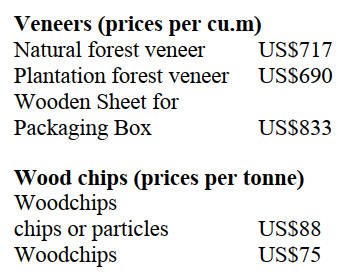

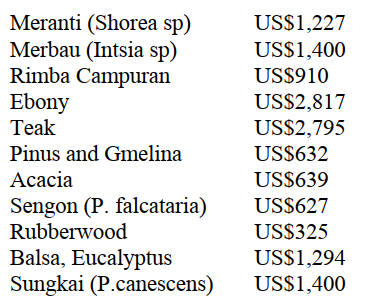

Export Benchmark Price (HPE) of Wood for

January

2025

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90), US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-nomor-1684-tahun-2024-tentang-harga-patokan-

ekspor-dan-harga-referensi-atas-produk-pertanian-dan-

kehutanan-yang-dikenakan-bea-keluar

Launch of SVLK Plus

The Ministry of Forestry has launched the Legality and

Sustainability Verification System (SVLK) Plus which has

added traceability features. The SVLK Plus ensures that

every exported wood product can be traced to its origin

thus improving verification of legality and ensuring the

sustainability of forest management. Forestry Minister,

Raja Juli Antoni, said "With SVLK Plus we ensure that

every exported forest product has verifiable origin of the

raw materials.” The Director of Forest Product Processing

and Marketing Development, Ristianto Pribadi, explained

that SVLK Plus emphasises traceability features with

geolocation.

See: https://validnews.id/nasional/kemenhut-perkuat-pasar-

kayu-ber-svlk-di-dalam-negeri

Boosting domestic wood product consumption

The Ministry of Forestry will strengthen domestic

marketing along side promotion in the global market to

boost sales of wood products certified by the Legality and

Sustainability Verification System (SVLK) Plus.

Director General of Sustainable Forest Management at the

Ministry of Forestry, Dida Migfar Rida, emphasised the

importance of securing the domestic wood product market

and targeting the export market.

Director of Forest Product Processing and Marketing

Development of the Ministry of Forestry, Ristianto

Pribadi, revealed that to strengthen the domestic market

SiHutanku.id has been launched, an information system

that compiles all information systems on sustainable forest

management.

On the SiHutanku.id site there is a market place service for

SVLK-certified wood products. In addition, an E-Catalog

for the forestry sector is also available making it easier for

businesses, the forest industry and MSMEs to access the

market for government procurement of goods.

See: https://forestinsights.id/genjot-penjualan-produk-kayu-

kemenhut-perkuat-pemasaran-di-dalam-negeri/

Furniture producers optimistic for 2025 despite

challenges

Domestic furniture and craft manufacturers are relying on

exports to sustain growth in 2025 as the domestic market

is expected to remain bleak due to declining purchasing

power.

Chairman of the Indonesian Furniture and Craft Industry

Association (Asmindo), Dedy Rochimat, acknowledged

that the furniture industry sees positive prospects in 2025

driven by export demand.

Dedy explained that the optimistic outlook is also

influenced by the trend in Indonesia's furniture export

performance which reached US$1.61 billion as of the third

quarter of 2024. This marks an increase of 3.3% compared

to the same period the previous year. He added, Asmindo

will continue to participate in events such as the

International Furniture and Craft Fair Indonesia (IFFINA)

to promote Indonesian furniture products in the global

market.

Asmindo faces challenges in the domestic market

particularly due to a decline in the middle class and a

general weakening of purchasing power among

consumers. This situation has led to sluggish demand for

furniture and handicrafts.

Additionally, challenges arise from potential employment-

related pressures due to minimum wage increases. The

furniture industry is a labour intensive sector that

employed more than 962,000 workers in 2023 and

includes small, medium and large enterprises.

Asmindo has proposed the government provide incentives

to enhance industrial competitiveness, including export

incentives, strengthened raw materials sector, improved

supply chain and advanced manufacturing technology.

See: https://www.msn.com/id-id/ekonomi/ekonomi/pengusaha-

furnitur-optimistis-soal-kinerja-ekspor-2025-saat-daya-beli-

domestik-kian-suram/ar-AA1wwNls?ocid=BingNewsVerp

Indonesia plans massive reforestation targeting 6.5

million hectares

The Indonesian Government is planning a massive

reforestation programme in across Indonesia mainly

targeting 6.5 million hectares of land within forest areas,

according to Presidential Special Envoy for Energy and

Environment, Hashim Djojohadikusumo.

The Minister of Forestry, Raja Juli Antoni, will lead

reforestation in degraded forest areas and confirmed that

reforestation will be conducted on the targeted 6.5 million

hectares. The reforestation process will be conducted

through an intercropping system, including planting

several crops plants that can benefit the surrounding

community.

See: https://en.antaranews.com/news/337564/indonesia-plans-

massive-reforestation-targeting-65-million-ha-of-land

In related news, the Ministry is preparing forest areas for

bioethanol development in support of President Prabowo

Subianto's goal to improve people's welfare and promote

food and energy self-sufficiency.

The President has promised to allocate two million

hectares for bioethanol production as part of his efforts to

achieve energy security. The Minister said “it is now our

responsibility to prepare these forest areas, particularly for

bioethanol derived from Arenga pinnata (sugar palm/

areng palm).”

He added, this initiative is significant because palm offers

immense potential for the energy sector. The sap from

palm trees can be fermented into bioethanol, a renewable

energy source.

See: https://www.viva.co.id/english/1781572-minister-antoni-

indonesia-prepares-forests-for-bioethanol?page=2

Indonesia and Norway launch RBC-4 to reduce

emissions from deforestation

The Indonesian and Norwegian governments have

launched the fourth phase of contribution-based funding

(RBC-4) to advance efforts to reduce emissions from

deforestation and forest degradation (REDD+).

The launch of RBC-4 was made by the President's Special

Envoy for Climate Change and Energy, Hashim

Djojohadikusumo, Environment Minister, Hanif Faisol

Nurofiq, Forestry Minister, Raja Juli Antoni, and

Norwegian Ambassador to Indonesia and Timor-Leste Rut

Kruger Giverin.

Environment Minister, Hanif Faisol Nurofiq, explained

that RBC-4 includes funding of US$60 million for

Indonesia for the achievement of reducing greenhouse gas

emissions in the 2019-2020 period.

See: https://en.antaranews.com/news/337927/indonesia-norway-

launch-rbc-4-to-reduce-emissions-from-deforestation

Carbon market potential yet to be secured

Bambang Soesatyo, Chairman of the Board of Trustees of

the Indonesia Digital Carbon Association (IDCTA), said

that Indonesia has substantial potential in managing

carbon emissions and can play a crucial role in the global

carbon market. However, according to data from the

Financial Services Authority (OJK), carbon trading in the

country reached only Rp29.21 billion (US$1.82 million) as

of September 2023 with a volume of 460,000 tonnes of

CO2 equivalent.

He added,. "Indonesia aims to reduce greenhouse gas

emissions by 31.89% without international assistance and

43.2% with international support by 2030.

See: https://jakartaglobe.id/news/indonesias-carbon-trading-

market-shows-potential-but-falls-short-of-full-value

Developing non-timber products in mangrove areas

The Ministry of Forestry is actively promoting

community-managed businesses to utilise Non-Timber

Forest Products (NTFPs) found in the mangrove

ecosystem which includes 385.000 hectares designated

under the Social Forestry Programme.

Catur Endah Prasetiani, the Director of Social Forestry

Business Development at the Ministry of Forestry, stated

during a national dialogue held by CIFOR, approximately

385,064 hectares of mangrove areas are managed by 375

Social Forestry Groups (KPS).

She stated that the KPS, which operates near the mangrove

ecosystem, plays a vital role in protecting the area. In

addition to its ecological functions, such as acting as a

wave breaker and absorbing greenhouse gas emissions,

this ecosystem can also provide economic benefits without

the need to cut down or clear any land.

KPS primarily utilises mangrove the ecosystems for

ecotourism and silvo-fishery activities that support the

community's economy without harming the mangrove

forest.

See: https://www.antaranews.com/berita/4532938/kemenhut-

terus-kembangkan-hasil-hutan-bukan-kayu-di-kawasan-

mangrove?utm_source=antaranews&utm_medium=desktop&ut

m_campaign=popular_right

Credit plan for labour intensive industries

Chief Economic Affairs Minister, Airlangga Hartarto,

announced a series of programmes and incentives aimed at

sustaining economic growth, including a Rp20 trillion

(US$1.3 billion) credit facility for labour intensive

industries.

Industries eligible for the credit programme include

textiles, garments, footwear, furniture, food and beverages

and children’s toys. Companies must employ a minimum

of 50 workers to qualify for the programme.

The government has also introduced an economic package

for labour intensive sectors offering microloans ranging

from Rp500 million to Rp10 billion.

See: https://jakartaglobe.id/business/government-unveils-13-

billion-credit-plan-for-laborintensive-industries

Government-university synergy for forest protection

The Ministry of Forestry was recently visited by

representatives from the Forestry Faculty of the

Agriculture Institute of Bogor (IPB) to explore

opportunities for cooperation in environmental and

forestry preservation.

Forestry Minister Raja Juli Antoni stated "Good public

policies are essential so it is crucial for the government to

forge cooperation with various parties, including

universities.

According to the ministry's statement the meeting

addressed various potential areas for cooperation such as

adopting a smart forestry approach to monitor forest fire

risks and developing systems supportive of food security

and environmental protection. The Forestry Ministry and

IPB also assessed the possibility of cooperating in the

management of Forest Area with Special Purpose and the

conservation of biodiversity.

See: https://en.antaranews.com/news/340442/indonesia-seeks-

government-university-synergy-for-forest-protection

5.

MYANMAR

New Landscape for the natural resources trade

The ITTO correspondent writes: the landscape of the

natural resources trade has been reshaped in recent years,

shifting focus from timber to rare earth elements. Timber

had consistently been among Myanmar's top five export

commodities since 1990. Between 2012 and 2014, timber

export figures peaked at approximately US$700 million

annually just before the log export ban was enforced at the

end of March 2014.

Since then, export figures have gradually declined,

dropping below US$100 million for the first time in 2024.

Historically, Myanmar’s forestry sector has benefited from

effective forest management practices guided by skilled

forestry professionals.

The primary factor behind this decline is growing market

denial from key markets driven by concerns over the

legality of products and economic sanctions imposed

following the 2021 military takeover.

If market access continues to be denied alternative markets

will become a priority. However, this approach faces

significant obstacles, including restrictions on banking

services with Myanmar, which are under scrutiny by the

Office of Foreign Assets Control (OFAC).

In 2019–20 just before the State Administration Council

took the power, approximately 35–40 companies

purchased around 15,000 tons of logs from the Myanma

Timber Enterprise. The government kept the logging

pause from 2021 to 2023 and by 2024–25 the annual

harvested quantity has fallen to around 5,000–6,000 tons.

Last month, a workshop focusing on the development of

private forests, sustainable timber production, plantations

and wood-based industries was held at the Forest

Department in Nay Pyi Taw. Observations suggest that

prioritising alternative markets would be more pragmatic

than reactive advocacy efforts aimed at regaining access to

traditional markets.

The future of Myanmar’s timber and forestry sector

largely hinges on political stability, international relations

and the country’s ability to control illegal logging.

If Myanmar can establish more stringent enforcement

mechanisms and build stronger ties with countries open to

trade its forestry sector may continue to function, albeit

within a more limited market. However, without

substantial regulatory reform and investment in

sustainable practices the sector risks further degradation

which could threaten long-term viability and global market

acceptance.

Myanmar’s timber trade and forestry sectors are at a

crossroads, contending with international sanctions,

shifting markets, and domestic challenges.

Looking ahead, strengthening domestic regulations,

promoting local value-added processing and seeking

alternative forms of certification may offer pathways to

sustain the industry while addressing conservation and

sustainability goals. However, significant political and

economic challenges remain that must be addressed for

meaningful progress.

Source: Personal comments by the ITTO correspondent

World Bank: Myanmar faces overlapping crises

Myanmar's development trajectory has reversed sharply

due to overlapping crises. The 2021 military takeover

disrupted a decade of economic growth and reforms

leading to widespread conflict and displacement.

The UN estimates 18.6 million people, including six

million children need humanitarian aid with recent

cyclones exacerbating the crisis. Economic growth

remains stagnant, projected at just 1% for 2025. Inflation,

unemployment and poverty are rising, while disruptions in

trade, manufacturing and public services have hit

households hard.

Food security is worsening, with 42% of farming

households fearing food shortages. Public spending on

health and education has halved since 2020, limiting

human capital development. Skilled worker migration and

declining foreign investment further constrain long-term

prospects, signaling a prolonged recovery ahead for

Myanmar.

See: https://www.worldbank.org/en/country/myanmar/overview )

Electricity power cutsextended

The domestic media in Myanmar has reported the country

is grappling with worsening power outages. Admiral, Tin

Aung San, blamed the crisis on multiple factors including

“terrorist’ destruction” of the national grid, declining

natural gas production, delayed maintenance and natural

disasters. He announced that major cities are now divided

into blocks receiving limited electricity on a rotating

schedule due to supply shortages.

Yangon households are grouped into three blocks

receiving eight hours of electricity daily, while Mandalay

Region residents receive just six hours. Even the residents

of Capital experienced a power cut for the first time at the

beginning of 2025.

See: https://www.irrawaddy.com/news/burma/worsening-power-

cuts-plunge-myanmars-cities-into-

darkness.html#google_vignette

6.

INDIA

Modest inflation in

November

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 1.89% in November 2024. The

positive rate of inflation in November 2024 was primarily

due to increases in prices of food products, other

manufacturing, textiles and machinery and equipment.

Out of the 22 NIC two-digit groups for manufactured

products in November, 10 saw an increase in prices, 10

groups saw a decrease in prices and 2 groups witnessed no

change. Some of the important groups that showed month

on month price increases were manufacture of food

products; furniture; non-metallic mineral products;

pharmaceuticals, medicinal chemical and botanical

products and electrical equipment.

Some of the groups that witnessed a decrease in prices

compared to October 2024 were basic metals, rubber and

plastics products, chemicals and chemical products,

computer, electronic and optical products, motor vehicles

and trailers and semi-trailers.

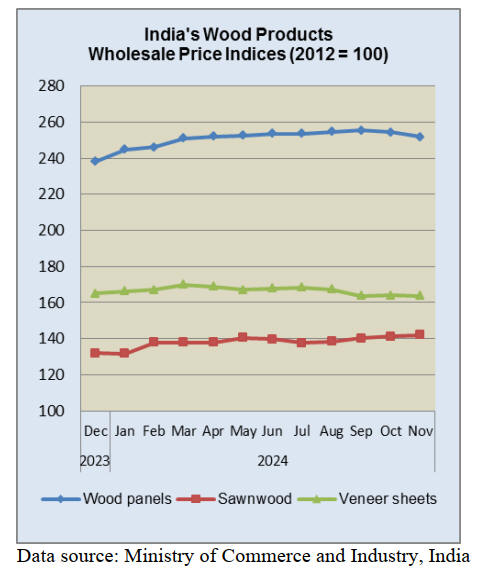

The WPI for woodbased panels declined in November but

the index for sawnwood rose. The price index for veneer

sheets in November was at around the same level as in

October.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Roll-out dates for new Standards

The deadline for implementation of the new Standards has

been confirmed. The implementation dates for the timber

sector are understood as follows:

Date: 14 January 2025

IS 3513 Resin Treated Compressed Wood

Date: 11 February 2025

IS 1659 Block Board

IS 12823 Prelam Particleboard

IS 3087 Particleboard

IS 124406 MDF

IS 3097 Veneered Particleboard

Date: 28 February 2025

IS 303 Plywood

IS 20202 Flush Doors

IS 710 Marine ply

IS 5509 Fire Retardant ply

IS 1328 Decorative ply

IS 4990 Shuttering ply

It is understood the authorities in India are not in favour of

any further extension which has caused panic in some

sectors and many industrialists have approached the

government. The domestic plywood, MDF and

particleboard manufacturers have, through their

federations, conveyed that they are okay with the new

standards and implementation, the date of should not be

further extended.

In contrast, some major furniture manufacturers in India

and some raw material suppliers for the furniture industry

have approached the government through their

associations and have explained the likely negative impact

of the implementation and that it should be postponed.

It is understood that as of 10 January 2025 no foreign

wood panel manufacturer has been issued with a BIS

License. Countries such as Thailand and Indonesia have

raised their concerns at the WTO citing non-transparency

issues. The Indian government has said that bilateral

meetings with Thai and Indonesian officials will be

conducted to resolve this issue.

In addition to the list of wood based panels covered by the

new Standard there are several specialty board products

categorised as plywood category that are very difficult to

manufacture in India so are imported but it is not yet clear

how these imports will be handled under the BIS/QCO.

The correspondent writes “another important thing is that

still, out of roughly 2400 plywood factories in India, only

about 800/1,000 factories have a QCO license. The big

question is what happens to rest?” He continues “there will

be a meeting in New Delhi in mid-January with all

stakeholders and any developments will be reported at the

end of January.

Forest and tree cover increase

The Minister for Environment, Forest and Climate

Change, Shri Bhupender Yadav, recently released the

‘India, State of Forest Report 2023 (ISFR 2023). The ISFR

has been published by the Forest Survey of India (FSI) on

a biennial basis since 1987. The report says India's total

forest and tree cover has increased by 1,445 sq km since

2021, reaching 25.17 per cent of the total geographical

area in 2023, according to the latest government data.

The India State of Forest Report (ISFR) 2023, released

recently also said that India has achieved an additional

carbon sink of 2.29 billion tonnes compared to 2005

levels.

As part of its climate plans and Nationally Determined

Contributions (NDCs) to meet the Paris Agreement goals,

the country has committed to creating an additional carbon

sink of 2.5 to 3 billion tonnes through additional forest and

tree cover by 2030.

See: https://pib.gov.in/PressReleasePage.aspx?PRID=2086742

7.

VIETNAM

Wood and wood product (W&WP)

trade highlights

According to Vietnam Customs, December 2024 exports

of W&WP reached US$1.55 billion, up 6% compared to

November 2024 and up 16% compared to December 2023.

WP exports alone, fetched US$1.1 billion, up 7.5%

compared to November 2024 and up 15.5% compared to

December 2023. In 2024, W&WP exports amounted to

US$16.25 billion, up 21% compared to 2023 of which WP

exports accounted for US$11.2 billion, up 22% compared

to 2023.

Vietnam’s imports of wood raw material in November

2024 was 469,800 cu.m, worth US$149.9 million, down

8% in volume and down 5% in value compared to October

2024. Compared to November 2023 imports increased by

12% in volume and 8% in value. In the first 11 months of

2024 imports of wood raw material reached 5.08 million

cu.m, worth US$1.64 billion, up 25% in volume and 19%

in value over the same period in 2023.

Vietnam’s NTFP exports in November 2024 continued to

increase reaching US$67.50 million, up 11% compared to

October 2024 and up 3% over the same period in 2023.

The W&WP exports to Australia in November 2024

earned US$11.8 million, down 0.1% compared to

November 2023. In the first 11 months of 2024 W&WP

exports to the Australian market totalled US$146.2

million, up 11% over the same period in 2023.

Office furniture exports in November 2024 earned US$35

million, up 47% compared to November 2023. In the first

11 months of 2024 exports of office furniture reached

US$289 million, up 18% over the same period in 2023.

In November 2024, W&WP imports to Vietnam stood at

US$231 million, down 2% compared to October 2024, but

up 14% compared to November 2023. In the first 11

months of 2024 W&WP import values totalled at US$2.5

billion, up 26% over the same period in 2023.

Vietnam's poplar imports in November 2024 were

estimated at 30,600 cu.m worth US$12.2 million, up 1% in

volume and 2% in value compared to October 2024.

Compared to November 2023, imports increased by 2% in

volume and 7% in value. In the first 11 months of 2024

Vietnam spent US$137.5 million on importing 348,700

cu.m, up 19% in volume and 14% in value over the same

period in 2023.

Imports of wood raw material from the US in November

2024 decreased slightly to 57,000 cu.m with a value of

US$26 million, down 3% in volume and down 1% in

value compared to October 2024, However, imports

increased by 16% in volume and 22% in value over the

same period in 2023. In the first 11 months of 2024

imports of wood raw material from the US reached

632,134 cu.m, with a value of US$275.4 million, up 32%

in volume and 33% in value over the same period in 2023.

Record exports of wood and non-timber forest

products (NTFP)

According to Vietnam’s Forestry Department, in 2024

W&WP and NTFP exports has reached a historic high of

US$17.3 billion. Among this total, W&WP exports

accounted for approximately US$16.3 billion while the

remaining portion was non-timber forest products. The

2024 trade surplus from forest product exports is projected

to be around US$14.4 billion.

This record-breaking export performance represents a 19%

increase compared to 2023 and surpasses the previous

record set in 2022 by more than 2%. In 2022, the total

export value of forest products reached US$16.9 billion,

with US$15.8 billion attributed to W&WP and the

remaining US$1.1 billion from NTFP.

Most W&WP categories recorded positive growth rates in

2024. Leading exports for the year was the wooden frame

seat category. By the end of November 2024 this product

earned US$3.1 billion, a 24% increase compared to the

same period in 2023.

Following this were living room and dining room

furniture, woodchips, bedroom furniture, wood-based

panels, floorings and kitchen furniture. All of these

product groups surpassed US$1 billion each in exports.

The United States continues to be the largest export

market for Vietnam’s W&WP exports accounting for over

55% of the total exports. According to Vietnam’s Forestry

Department W&WP exports to the US market have

experienced positive growth driven by increasing demand

and decreasing inventory levels in 2024.

Moreover, the shift in global supply chains, particularly

due to the US trade protection measures against Chinese

goods has opened up significant opportunities for

Vietnam’s wood products.

Other key markets such as China, Japan, South Korea and

EU remain crucial for Vietnam’s W&WP exports. These

markets, not only have high demand for wood products,

but also require goods that adhere to strict standards

regarding quality, design and sustainability.

Following the US was China, with exports reaching

US$1.9 billion, a 21% increase; Japan, with US$1.6

billion, up by 3%; South Korea, with US$722.4 million,

up by 0.6%; and the EU, with US$503 million marking a

27% growth.

At the end of 2024 W&WP exports continued to show

strong growth. In the week from December 10 to

December 17 exports reached over US$390 million,

reflecting a 5% increase compared to the previous week.

Among this exports of wooden furniture alone reached

US$250 million marking an increase of over 2% compared

to the previous week.

Wooden furniture exports in this period were directed to

several key markets. The US remained the leading market,

with exports reaching US$200 million, up by 4%

compared to the previous week. Following the US, Japan

imported nearly US$9 million worth of wooden furniture,

though this was a 5% decrease compared to the previous

week. South Korea showed a positive growth of 3%, with

exports amounting to US$5.5 million, while the UK saw a

decline of 11%. Canada, on the other hand, experienced a

significant drop of nearly 30%.

See: https://vietnamagriculture.nongnghiep.vn/wood-exports-set-

a-record-surpassing-17-billion-usd-d414834.html

Challenges in the wood supply chain

The legal origin of wood products is one of the most

essential requirements for Vietnam's two main export

markets, the US and the EU. This is considered a vital

factor for export enterprises.

According to a survey by a Forest Trends led research

group, wood materials in Vietnam come from: domestic

planted forests (acacia, eucalyptus and rubberwood), wood

from domestic small farms, imported plantation timber

(pine, ash, eucalyptus and acacia) and imported natural

forest timbers.

Many wood products in the group of bedroom furniture,

office furniture, kitchen and wooden furniture parts

exported to the EU are processed from areas that were

previously forests converted to rubber plantations. When

using this wood source, businesses face challenges in

traceability, transparency and accountability especially the

requirement to clearly state the names of all types of wood

used in exported products.

Another factor is related to the legality of imported wood

raw material sources including wood names and

commercial invoices.

Some countries also require other evidence, such as

packing lists, wood raw material purchase invoices or

logging licenses. Through assessment, the expert team

found that the ability of businesses in Vietnam to present

relevant evidence remains a challenge.

Dr. Hoang Lien Son, Director of the Center for Forestry

Economics Research (Vietnamese Academy of Forest

Sciences - VAFS) said that for a long time the wood

industry has been struggling with the distinction between

"legality" and "legal" wood raw material sources.

Decree 120/2024/ND-CP amending Decree 102 has

removed confiscated processed wood from the list of legal

wood. Son said that this has significantly reduced risks

related to the origin of wood, especially wood raw

material, when participating in the supply chain and

exporting.

According to Son, legality is an attribute of wood,

meaning that all must comply with regulations from the

preparation of input materials (seeds, planting soil,

forestry measures, etc.). It is also necessary to provide

relevant evidence to ensure transparency, accountability

and traceability back to the planting area.

The QR code technology of the iTwood system solves

these problems. Each stage in the supply chain, including

production, harvesting, processing, commercialisation,

etc., has a QR code so that consumers and management

agencies can clearly understand the information. In other

words, when the wood is guaranteed to be “legal” or

“legality” is an attribute of the wood, the risks will be

automatically resolved.

Up to now, Decree 102 (or currently Decree 120) has been

the legal basis for Vietnamese enterprises to fulfill their

accountability responsibilities. This is considered a

"passport" for Vietnamese wood to enter the US and EU

markets. However, when purchasing wood raw material,

many supply countries still use hard copy records and

documents instead of digital transformation in wood

traceability management.

Implementing the direction of Deputy Minister of

Agriculture and Rural Development Nguyen Quoc Tri,

aiming for a sustainable forestry industry and becoming a

high-value-added technical, economic sector, the

Department of Forestry has guided localities and

enterprises to remove bottlenecks related to the legality of

wood raw material, including the issuance of forest

planting area code.

See: https://vietnamagriculture.nongnghiep.vn/remove-the-

bottlenecks-in-the-wood-industry-supply-chain-d406028.html

Vietnam has first forest production unit code

Professor Vo Dai Hai considers the digitisation of forest

plantation areas associated with database construction a

significant step forward, helping the wood industry adapt

to increasingly high international standards.

The Vietnamese Academy of Forest Science (VAFS) has

just coordinated with the Department of Agriculture and

Rural Development of Tuyen Quang Province to grant a

forest production unit code certificate for raw materials to

Yen Son Forestry Company Limited at the 3-year review

conference of the 2021-2025 Cooperation Programme

between the two units.

The code granted covers an area of 1ha, planted with pure

hybrid acacia since 2022, in the raw material forest

planting area of Team 821, Dao Vien commune, Yen Son

district. Information on the planting area coordinates is

accurately determined by the iTwood System and certified

by the Tuyen Quang Provincial Forest Protection

Department.

It is the first forest production unit code granted to forest

owners in Vietnam, within the programme piloted by the

Ministry of Agriculture and Rural Development in 5

provinces: Bac Giang, Lang Son, Phu Tho, Tuyen Quang

and Yen Bai.

"The issuance of forest production unit codes contributes

to information transparency, promoting the export of wood

and forest products," said Mai Thi Hoan, Deputy Director

of the Department of Agriculture and Rural Development

of Tuyen Quang, hoping that, combined with the project to

build Tuyen Quang into a high-tech forestry area, the

locality will become a forestry development pole in the

North of the country.

Analysing this issue further, Prof. Dr. Vo Dai Hai,

Director of VAFS, said that when forest production unit

codes are assigned to wood lots entering the supply chain

the organisation and development of a legal wood supply

chain and traceability will be more convenient, cost less,

creating a digital platform for production and business

database of planted forests, digital transformation, strong

connection with the market and improving production and

business efficiency.

Granting planting area codes is an important requirement

to make transparent information about the origin of

products and the technology used to create those products.

This is one of the mandatory requirements in the context

of international integration and participation in the global

supply chain.

In Vietnam, the granting of planting area codes for

agricultural crops has been implemented according to the

Law on Cultivation 2018 and Decision 3156/QD-BNN-TT

dated August 19, 2022 of the Minister of Agriculture and

Rural Development. Thanks to this legal corridor, many

agricultural products, especially fruits, have increased in

export in recent years. For forestry, the issue of wood

traceability was raised quite early, according to the

provisions of the Agreement between the Government of

Vietnam and the Government of the United States on

Illegal logging and timber trafficking.

For the EU, Vietnam also participates in the Voluntary

Partnership Agreement (VPA) and is implementing the

construction of the VNTLAS timber legality assurance

system. Most recently, the European Commission adopted

the EU Deforestation Regulation (EUDR) on December 6,

2022. Accordingly, enterprises producing and using wood

raw material for processing must build and develop a legal

timber supply chain that does not cause deforestation. This

is a mandatory requirement for exporting goods to the EU.

In addition, other export markets for wood and wood

products from Vietnam, such as Japan, Korea, China, etc.,

also require strict control and traceability of wood origin.

“From these facts, it can be seen that the issuance of forest

production unit codes in the current context in Vietnam is

extremely necessary and urgent,” said Prof. Dr.Vo Dai

Hai.

Deputy Minister of Agriculture and Rural Development

Nguyen Quoc Tri has promptly directed the Forestry

Department and VAFS to study the experience of issuing

codes for agricultural crop growing areas to digitise the

process of issuing codes for forest growing areas, moving

towards building a database to manage all forest resources

in Vietnam.

Based on Decision No. 2260/QD-BNN-LN dated July 9,

2024, the Forestry Department and VAFS will implement

the task in 2 phases: The pilot phase, within 24 months,

will issue temporary guidance documents on the issuance

and management of forest production unit codes for raw

materials to draw experience and perfecting the system of

legal documents, before expanding nationwide.

Phase two, from 2026 onwards, the process of issuing and

managing forest production unit codes will be

implemented nationwide.

After nearly 4 months of active participation, with high

determination towards sustainable forestry development,

as well as completing the goals and tasks of the industry in

2024, the Forestry Department, Department of Agriculture

and Rural Development, Forest Protection Sub-

Department, local authorities, businesses and people in 5

pilot provinces have had the first forest production unit

codes.

Based on the iTwood system, wood enterprises collect and

store legal records of wood from upstream suppliers

(forest owners, wood exporters, etc.) to the production

process of finished products. All information about the

origin and legality of wood will be shown through the

plantation area code.

In the long term, the plantation area code will be an

important input for activities such as granting sustainable

forest management certificates, paying for forest

environmental services or adapting to strict international

regulations such as EUDR (EU Deforestation-free

Regulation).

Dr. Ha Cong Tuan, Chairman of the Association of

Agricultural Economics and Rural Development and

former Permanent Deputy Minister of Agriculture and

Rural Development, commented that Vietnam still has

about 1 million hectares of forestry land for forest

regeneration. The potential for new planting in our country

is not much, because in this 1 million hectares, more than

300,000 hectares are rocky mountains and many wetlands.

"According to the recently issued national forestry plan,

Vietnam's forest area is stable, ensuring a 42-43%

coverage rate. Therefore, digitising management work is a

necessary and feasible task at this time," Tuan emphasised.

See: https://vietnamagriculture.nongnghiep.vn/vietnam-has-first-

forest-production-unit-code-d405680.html

Certified forests boost farmer incomes

Due to the increasing demand for wooden products, many

farmers in Thanh Hoa province have switched from

traditional forestry to FSC-certified forestry. This shift has

enhanced sustainable forest management and harvesting

according to FSC standards, creating a traceable, secure

supply of materials while ending deforestation-based

timber exploitation.

According to the Thanh Hoa Department of Agriculture

and Rural Development, the province has over 641,000

hectares of forest, including 56,000 hectares of large

timber forest and 260,000 hectares of planted forest.

Partnerships with enterprises are proving effective, helping

many households escape poverty through forestry.

Mr. Nguyen Dinh Thai, Head of the Forest Use and

Development Department (Thanh Hoa Forest Protection

Sub-Department), stated: "To increase farmers’ income

from forestry, the Department of Agriculture and Rural

Development will implement policies to support seedlings

and tissue culture, develop high-quality timber plantations,

and aim for sustainable certification. The support policy

for certification will provide VND300,000 per hectare for

areas over 300 hectares.

Additionally, we will focus on accumulating concentrated

forestland to produce timber, linking the entire value chain

from planting, caring, harvesting, processing and product

consumption."

The department is also working with local authorities to

promote participation in large timber forest plantations

with FSC certification, encouraging cooperative and group

formation to manage, protect and certify forests. This will

establish concentrated raw material areas with FSC

certification.

According to Mr. Thai, after several years of

implementation, Thanh Hoa province now has over 28,400

hectares of forest certified under FSC, involving 4,670

households. There are also seven value chains linking

forest owners (households and groups) with processing

factories.

Thanks to certification and livelihood models many

households in mountainous areas have risen out of poverty

through forestry.

By the end of 2025 Thanh Hoa aims to expand its planted

timber forest area to 125,000 hectares, with an additional

25,000 hectares of planted timber forest and 10 hectares of

bamboo and rattan certified under FSC. According to Mr.

Thai developing FSC forest certification has opened the

door for Thanh Hoa’s timber products to export to

European and U.S. markets thereby improving the income

of forest owners in mountainous areas. With each

harvesting cycle farmers can earn between VND 160-170

million per hectare.

See: https://vietnamagriculture.nongnghiep.vn/fsc-forest-no-

more-worries-about-price-pressure-d405863.html

8. BRAZIL

Advances in Brazilian Forest Management

The Brazilian Forest Service (SFB) says significant

progress has been achieved in the country's forest

management in 2024. In partnership with the National

Bank for Economic and Social Development (BNDES) the

first Brazilian restoration concession with carbon credits

was established in the Bom Futuro National Forest in the

State of Rondônia in the Amazon Region.

This project involves the restoration of 17,000 hectares

and an investment exceeding BRL600 million for

restoration and maintenance of the areas as well as the

sequestration of 6.5 million tons of carbon equivalent.

Additionally, the first Federal forest concession contract in

the Atlantic Forest was signed for the Irati National Forest,

in the State of Paraná covering 3,018 hectares and

incorporating the potential for carbon credits. Community

forest management and the bioeconomy benefited over

2,000 families involved in 10 community enterprises

within conservation units, settlements, quilombola

territories and indigenous lands.

In 2024, the SFB launched an Environmental

Regularisation Panel an online platform that provides an

overview of environmental regulations focusing on

requests to join the Environmental Regularisation

Programme (PRA) and analysis of data declared in the

Rural Environmental Registry (CAR).

This platform enhances transparency regarding

environmental regulations, facilitates coordination with

other public policies and encourages social participation.

Other initiatives included the compilation of over 1,000

wood samples as a tool combat illegal trade and the

inauguration of the new SFB headquarters in Santarém,

Pará State in the Amazon Region funded through a

bilateral partnership between Brazil and Germany.

SFB also supported the strengthening of knowledge in

forestry through the "Forest Knowledge (Saberes da

Floresta)" platform, offering 18 courses. These efforts

reflect the commitment to conservation, sustainable

management and socioeconomic development in Brazil's

forest regions.

See: https://www.gov.br/florestal/pt-

br/assuntos/noticias/2024/dezembro/retrospectiva-2024-confira-

os-principais-avancos-da-gestao-florestal-brasileira

Encouragings States and Municipalities through forest

concessions

In 2024 the SFB disbursed over R$27 million from the

Federal Forest Concessions Fund. The funds were

distributed among states and municipalities where the

concessions areas are located with the majority allocated

to Pará and Rondônia States.

These funds, regulated under the Public Forest

Management Law (Law no. 11.284/2006) and Decree

12.046/2024 came from the sustainable exploitation of

forests and were divided among the Chico Mendes

Institute for Biodiversity Conservation (ICMBio) (40%),

States (20%), municipalities (20%) and the National

Forest Development Fund (FNDF) (20%).

The funds allocated to states and municipalities must be

used for promoting the sustainable use of forest resources.

To receive these funds municipal environmental

secretariats and state environmental agencies need to

develop a Resource Application Plan detailing projects

and activities to be undertaken.

These disbursements encourage economic and social

development by promoting sustainable forest

management. Pará State plans to use the funds for

initiatives such as Community and Family Forest

Management in 2025, environmental improvements and

training.

Municipalities like Itaituba, Faro and Terra Santa will

invest in environmental infrastructure, restoration of

degraded areas and sustainable income projects such as

agroforestry systems and the creation of meliponaries (bee

farms) with native species.

See: https://www.gov.br/florestal/pt-

br/assuntos/noticias/2024/dezembro/concessoes-florestais-

repassam-r-27-milhoes-para-estados-e-municipios-em-2024

Exporters face challenging logistics

The Brazilian Association of Mechanically Processed

Timber Industry (ABIMCI) is intensifying efforts to

address logistical issues faced by the timber sector,

particularly concerning shipment delays as a result of

action by shipping companies.

These include issues such as shipment postponements,

rollover booking and unjust detention charges, among

other complications.

In meetings held with shipowners in São Paulo State

several proposals were presented to addresse these issues

including extending the free time period to 45 days,

avoiding undue charges against exporting companies,

improving the accuracy and predictability of ship

ETA/ETD with direct communication with exporters,

maintaining the contracted freight rate even in cases of

shipment delays as freight rates often change at the end of

the month and better negotiation of detention charges

directly with export companies.

Additionally, discussions were held on the main reasons

behind the failed port calls and the need for joint action

between the productive sector and service providers to

minimise the financial losses. ABIMCI will continue to

seek further meetings with shipping lines to advance

negotiations and find solutions.

See:

https://abilink.abimci.com.br/ev/PTKDP/BM6/546e/w8KE9Kx7

yk/BQyw/

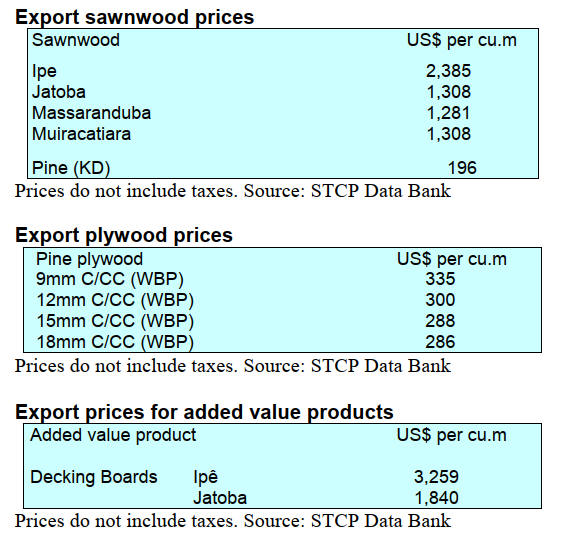

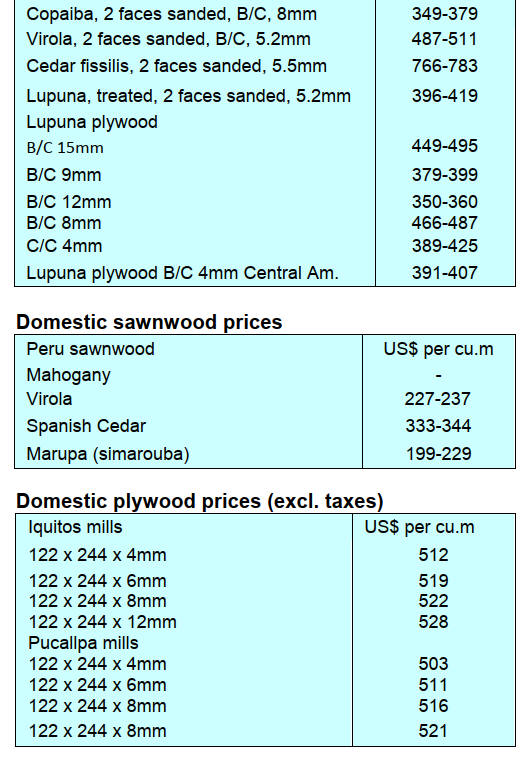

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See, https://www.itto-

ggsc.org/static/upload/file/20241217/1734418549204401.pdf

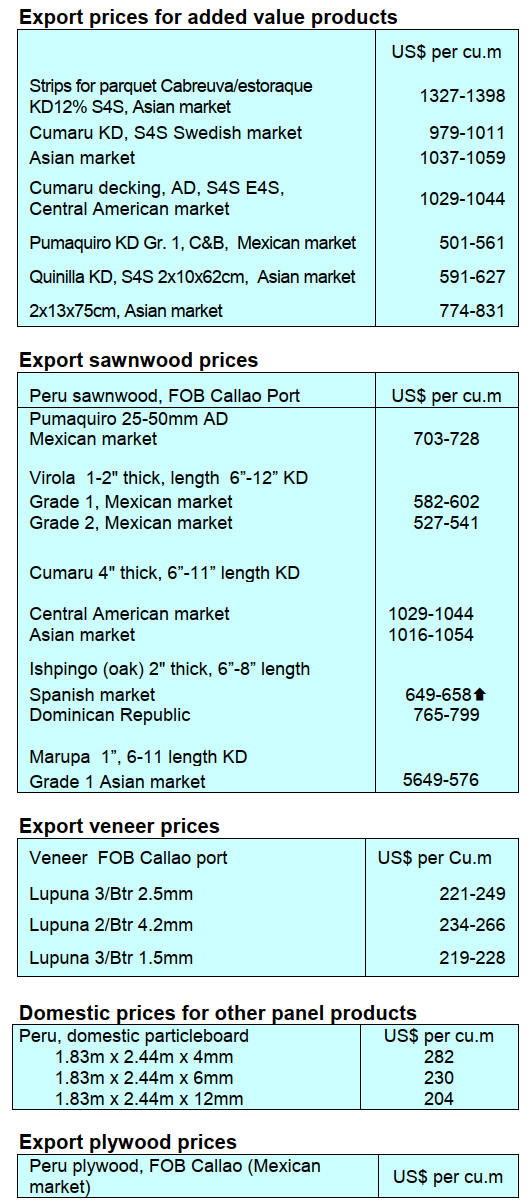

9. PERU

Strengthening forest

management capacty in native

communities

In a joint effort to promote sustainability and legality in

the management of forest resources the Forest and

Wildlife Resources Oversight Agency (OSINFOR), in

collaboration with the Basel Institute on Governance

(BASEL) and the Regional Forest and Wildlife

Development Management (GERFOR) of Loreto, trained

communities and promoters in Regional Conservation

Areas (ACR).

In November, at the decentralised OSINFOR office in

Iquitos, the first phase of a training workshop was held on

the topics of forest crimes and negotiation and agreements.

The event was aimed at promoters of the Maijuna Kichwa,

Ampiyacu Apayacu, Alto Nanay Pintuyacu Chambira and

Communal Tamshiyacu Tahuayo ACRs.

The second phase, held in the Boras Native Community of

Pucaurquillo, expanded on the topics addressed in the first

stage, including institutional requirements, action against

corruption, wood traceability and good practices for forest

sustainability.

See: https://www.gob.pe/institucion/osinfor/noticias/1074563-el-

osinfor-y-aliados-fortalecen-capacidades-en-comunidades-

nativas-para-la-gestion-de-los-bosques-con-la-mochila-forestal

Incentives for verified good forestry practices

As part of the promotion of sustainable forestry practices

the Yamino Native Community in Ucayal was offered a

discount on the payment for the right to use forest due to

good management certified by OSINFOR, The community

obtained a 15% discount on the payment for the right to

use forests.

Incentives strengthen the fight against deforestation, said

the Head of OSINFOR, adding “we are convinced that the

enabling titles allow for managed and guarded forests.

Granting incentives such as the one obtained by the

Yamino community shows that legality generates benefits

for the country and producers.”

See:https://www.gob.pe/institucion/osinfor/noticias/1070673-

ucayali-comunidad-nativa-yamino-recibe-incentivo-economico-

por-buenas-practicas-forestales-certificadas-por-el-osinfor

SERFOR defines the yield of sawnwood and flooring

slats

In order to regulate the processing of wood resources in

the industry the National Forest and Wildlife Service

(SERFOR) established that the reference yield coefficient

for sawnwood from round logs shall be 56% while, in the

case of processing non-profiled flooring slats, the yield

shall be 41%. This rule is made in compliance with the

provisions of the Regulation for Forest Management. In

addition, if the miller declares that he can achieve a

transformation yield higher than that established, this must

be submitted to SERFOR.

Along with the approval of the reference yields the

“Methodological Guide for the determination of the Yield

Coefficient of logs to sawnwood and Non-Profiled Boards

was approved. The yield of wood products is reported in

Summary Table 3: Balance of Primary Transformation of

the Operations Book for primary transformation

operations, a document that must be sent monthly to the

Regional Forestry and Wildlife Authority (ARFFS).

This is the first time that the Peruvian national forestry

authority has established a performance coefficient for

sawing logs as a result of a performance study which

included field evaluations in the four regions with the

highest sawn wood production, such as Ucayali, Junín,

Madre de Dios and Loreto.

See: https://www.gob.pe/institucion/serfor/noticias/1075046-

serfor-fija-porcentaje-de-rendimiento-de-la-madera-aserrada-y-

en-tablillas-para-piso

Regional governments and SERFOR continue with

zoning

The National Forest and Wildlife Service (SERFOR

)through its Sustainable Productive Forests (BPS)

programme is providing technical assistance to nine

regional governments for the sustainable management of

forests.

The forest management units establish categories of

forests that are registered in the national forest registry,

such as: Permanent Production Forests, Local Forests,

Reserve Forests, Protection Forests, Forest on lands of

peasant and native communities and Forests on Private

Properties. Based on this, the exploitation rights (enabling

titles) are granted.

Through this system SERFOR provides technical advice

on the forest management of the regions of San Martín and

Ucayali. It also supports the regions of Áncash,

Cajamarca, Junín, Huánuco, Loreto, Madre de Dios and

Pasco with the forest zoning process. According to the

national survey in 2019 all Peruvian forest territory lacked

completed forest management plans.

See: https://www.gob.pe/institucion/serfor/noticias/1082612-

serfor-brinda-asistencia-tecnica-a-nueve-gobiernos-regionales-

para-el-process-de-zonificacion-y-ordenamiento-forestal

|