US Dollar Exchange Rates of

25th

Nov

2024

China Yuan 7.25

Report from China

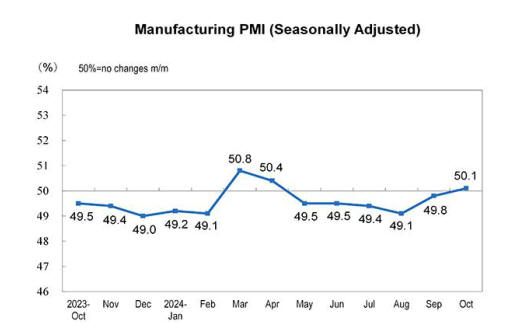

Manufacturing Purchasing Managers' Index

A press release from the National Bureau of Statistics

provides details of the October Manufacturing Purchasing

Managers' Index.

In October, the purchasing managers' index (PMI) for the

manufacturing sector was 50.1%, an increase of 0.3

percentage points from the previous month indicating a

modest rebound in the sector.

The PMI for large and medium-sized enterprises was

51.5% and 49.4% respectively, up by 0.9 and 0.2

percentage points from the previous month. The PMI for

small enterprises stood at 47.5%, a decrease of 1.0

percentage point from the previous month.

See;

https://www.stats.gov.cn/english/PressRelease/202411/t2024111

5_1957434.html

First log "insurance + futures" project in Guangxi

It has been reported that the first log ‘insurance + futures’

project has been established in Guangxi Zhuang

Autonomous Region.

The production of logs in Guangxi Zhuang Autonomous

region ranks first in China, accounting for nearly 40% of

the national total. The launch of the futures project is an

active attempt to support the services of "agriculture, rural

areas and farmers" and provides a new tool for risk

management for log producers, helps them lock log prices,

transfers market price risks, boosts confidence, ensures the

stability of income and helps improve the resilience of the

industry and promote the overall development of the

industry in the region.

Urban homes transformation

The Ministry of Housing and Urban-Rural Development

and the Ministry of Finance recently deployed resources to

accelerate the implementation of policy measures for the

transformation of urban areas and promote the

implementation of projects as soon as possible.

The scope of policy support for the renovation of homes

and infrastructure in urban areas has been expanded from

the initial 35 megacities and large cities with a permanent

urban population of more than 3 million to nearly 300

cities at the prefecture level and above.

The policy requires that all localities should implement

fiscal, tax, land and financial supporting policies for the

transformation of poor urban areas and formulate

compensation plans. Work will be undertaken to safeguard

the legitimate rights and interests of the population and

promote the implementation of various supporting

policies.

The aim is to release the huge potential of China's new-

type urbanisation and form new economic growth points.

It has been reported that the expansion of the urban area

transformation will also drive the increase in the demand

for wood-based panels.

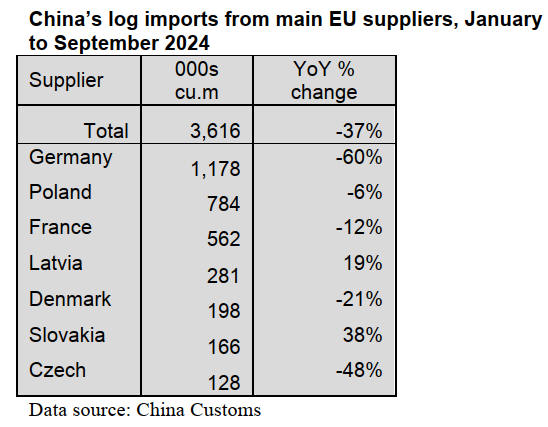

Decline in log and sawnwood imports from EU

According to China Customs log and sawnwood imports

declined sharply between January to September 2024.

China’s log imports from EU declined 37% to 3.616

million cubic metres between January to September 2024.

Log imports from Germany, Poland, France, Denmark and

the Czech Rep. fell fastest.

In contrast, China’s log imports from Lativia and Slovakia

rose 19% and 38% respectively.

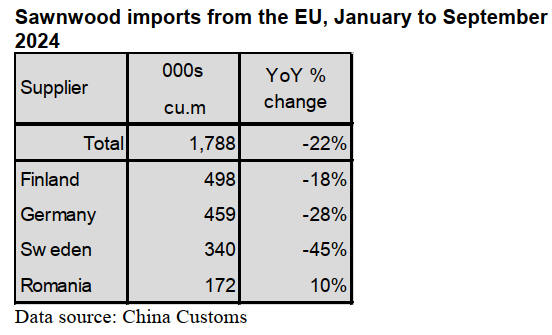

China’s sawnwood imports from EU member states

declined 22% to 1.788 million cubic metres between

January and September 2024.

China’s sawnwood imports from the top shippers in the

EU, Finland, Germany and Sweden fell sharply resulting

in the overall decrease in total sawnwood imports from the

EU.

In contrast, China’s log imports from Romania rose 10%

between January and September 2024.

It is worth noting that China’s log imports from the US

and Canada rose 4% and 24% respectively between

January and September 2024 which offset the decline in

log imports from EU member states.

Since the outbreak of the conflict between Russia and

Ukraine timber exports from many European member

states have been affected.

Declining demand for timber in China is another factor

that has led to the decline in imports. There has also been a

reduction of domestic timber production in the EU,

notably Germany.

Surge in sawn softwood imports from US

China Customs data shows sawn softwood imports from

the US surged 43% to 162,400 cubic metres between

January to September 2024.

China imports a lot of pine sawnwood from the United

States. China’s pine, douglas fir, hemlock and spruce

sawnwood imports surged between January and

September 2024. However, China’s sawn hardwood

imports from the US fell 15% to 737,300 cubic metres

between January to September 2024. The total volume of

China’s sawnwood imports from the US dropped 8% to

899,700 cubic metres over the same period of 2023.

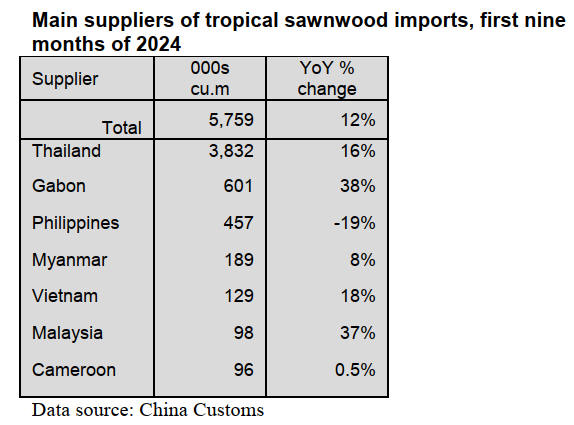

Rise in tropical sawnwood imports

Between January and September 2024 China’s tropical

sawnwood imports were 5.759 million cubic metres

valued at US$1.669 million, up 12% in volume and 15%

in value and accounted for about 28% of the national total.

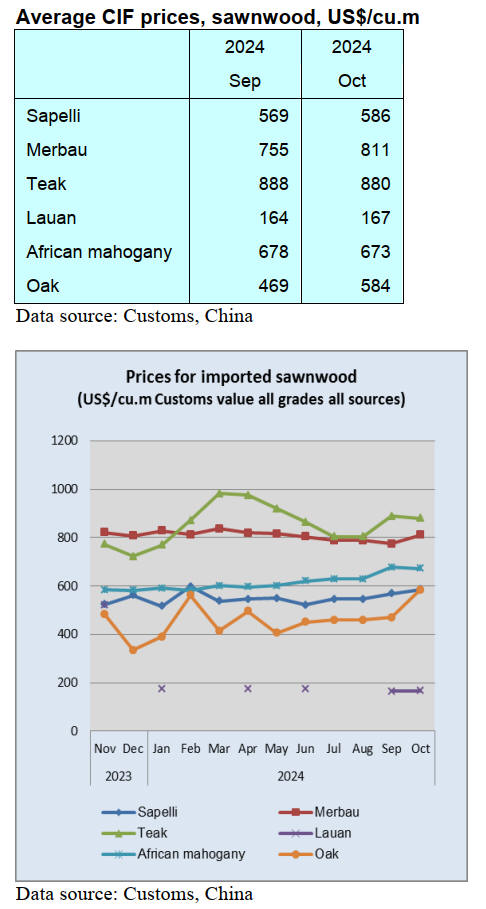

The average CIF prices for tropical sawnwood grew 3% to

US$290 per cubic metre over the same period of 2023.

Thailand was the largest tropical sawnwood supplier to

China in the nine months to September 2024. 67% of

China’s tropical sawnwood imports are shipped from

Thailand. China’s tropical sawnwood imports from

Thailand between January to September rose 16% to 3.832

million cubic metres valued at US$968 million, up 21% in

value over the same period of 2023. The average CIF price

for tropical sawnwood imports from Thailand rose 5% to

US$253 per cubic metre over the same period of 2023.

China’s tropical sawnwood imports from Gabon rose 38%.

In addition, China’s tropical sawnwood imports from

Myanmar, Vietnam, Malaysia and Cameroon rose.

In contrast, China’s tropical sawnwood imports from the

Philippines, alone among the top suppliers, fell 19% over

the same period of 2023.

October Global Timber Index (GTI) China Report

The Global Timber Index (GTI) Report for October 2024

from the Global Green Supply Chain initiative (GGSC)

revealed the Chinese timber market was showing signs of

a recovery as the GTI index for the country registered

50.9%, above the critical value (50%) for the second

consecutive month.

With the start of the traditional peak season for China's

wood products sector an uptick in both production and

new orders has been observed. In contrast, demand signals

reported by some other countries were still in decline. The

GTI indices for the Republic of the Congo (48.1%), Ghana

(48.0%), Thailand (44.2%), Brazil (43.2%), Gabon

(35.4%), Mexico (33.9%) and Malaysia (22.8%) were all

well below the critical value of 50% indicating that in

these countries the overall business prosperity of GTI

participating enterprises shrank from the previous month.

However, in the African countries (Gabon, Ghana, and the

Republic of the Congo) the previous contraction in the

timber sector eased in October and it's worth noting that in

the Republic of the Congo the timber market was showing

signs of stabilisation on both supply and demand sides.

GTI China

On 25 October, the China Securities Regulatory

Commission approved the registration of log futures and

options on the Dalian Commodity Exchange. Many

industry insiders said that the launch of log futures is of

great significance as it can provide the market with

authentic, effective, continuous and authoritative prices

serving as an important reference for import and

processing enterprises.

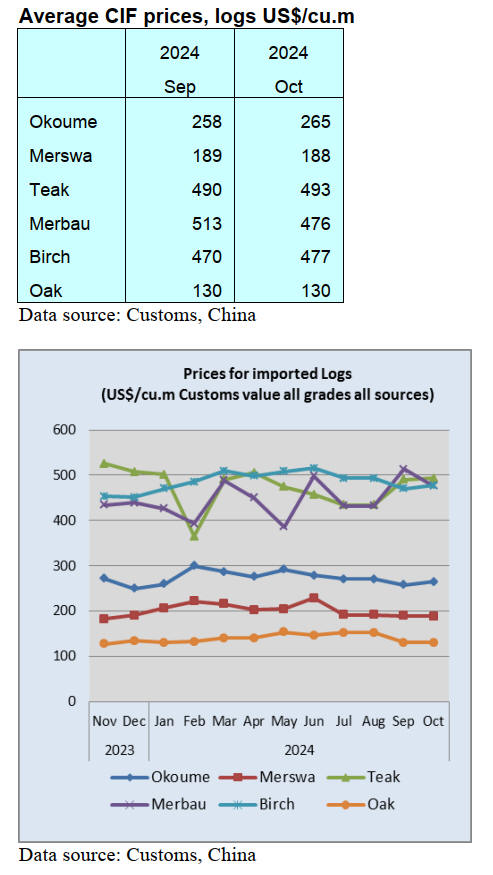

It is worth noting that since July the unit price of imported

logs declined for three consecutive months.

On 11 October, the European Commission announced that

it decided to initiate an anti-dumping proceeding

concerning hardwood plywood originating in China.

In October the GTI-China index registered 50.9%, a

decrease of 3.3 percentage points from the previous month

and was above the critical value (50%) for 2 consecutive

months indicating that the business prosperity of the

timber enterprises represented by the GTI-China index

expanded from the previous month.

In October China's timber sector maintained an upward

momentum and an uptick in both production and new

orders were observed. As for the eleven sub-indexes, five

indexes (production, new orders, purchase quantity,

inventory of main raw materials and delivery time) were

above the critical value of 50%, the export orders index

was at the critical value, while the remaining five indices

(existing orders, inventory of finished products, import,

purchase price, and employees) were all below the critical

value.

Compared to the previous month, the indices for existing

orders, purchase price, inventory of main raw materials,

and employees increased by 2.5-9.5 percentage points and

the indices for production, new orders, export orders,

inventory of finished products, purchase quantity, import,

and delivery time declined by 1.6-8.1 percentage points.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

See: https://www.itto-

ggsc.org/static/upload/file/20241120/1732064596197451.pdf

|