|

1.

CENTRAL AND WEST AFRICA

Regional round-up

Central African Republic

Over the past few weeks the timber industry in the Central

African Republic has faced significant challenges due to

widespread heavy rain that has interrupted harvesting and

transportation. For an extended period almost no logs have

been delivered to the Port of Douala primarily because the

washed out roads.

After a surge of interest the market for Sapelli has

weakened leading mills to reduce production.

Cameroon

Cameroon's timber sector is facing challenges brought on

as a result of new regulations from the government and by

continuous heavy rain that has delayed harvesting,

production and transport.

Some mills are shifting their focus to Azobé, moving away

from redwoods previously exported to China and Europe.

While demand for Azobé remains stable, issues with

recent shipments of low-quality timber are causing

problems in some European markets.

Gabon

Gabon is also experiencing the effects of heavy rain. For a

period of three dry days mid-month sawmills in up-

country regions rushed to transport their sawnwood stocks.

However, key routes, such as the roads from Okondja and

Makokou through Lastourville were still in poor condition

with trucks taking up to three days to cover the 650 km

distance to the Port of Owendo in Libreville.

The proposed increase in land tax has not been

implemented following strong opposition from syndicates

and operators who lobbied the Ministry of Forestry. The

negative market situation has led to reduced production

and worker layoffs at a time when the new government is

encouraging investors and operators.

December is traditionally a half-production month and

with China currently out of the market, some mills are

closing or cutting back operations.

Power outages have returned after a period of stability and

now are almost daily and lasting several hours. These

disruptions are affecting the veneer industry in the special

economic zone. The Turkish electricity power supply ship

has arrived at the Port of Owendo and connections to the

power grid are still in progress.

Republic of Congo

The ongoing shortage of petrol and diesel continues to

create complex challenges for both private individuals and

industries, especially those not connected to the national

grid.

Production of sawnwood and veneer remains slow

exacerbated by heavy rain and difficulties in log supply.

In regions around Pointe-Noire road conditions are better

when dry as most main roads are paved though travel on

forest roads remains a challenge. It is estimated that

Okoume mills are operating at approximately 50%

capacity due to diminished demand from China.

Producer observations on market developments

The Chinese market remains very quiet. Buyers in the

Philippines continue to purchase Okoume, redwoods and

Dabema maintaining a steady demand. In Vietnam the

market remains strong for Tali with robust purchasing

activity while in India there has been a noticeable

slowdown in purchases of veneer and Padouk sawnwood.

It's significant that there has been a substantial reduction in

Padouk exports to Belgium and India. This decline is

attributed to increased domestic market consumption and

the need for exporters to satisfy CITES regulations.

PEFC announcement

In a step towards ensuring the raw materials coming out of

a PEFC-certified forest comply with EUDR requirements,

the revised PEFC Sustainable Forest Management

benchmark standard was approved by the PEFC General

Assembly on Wednesday 13 November 2024.

This revised standard, PEFC ST 1003:2024, comprises

several new and amended requirements that will enable

EUDR alignment for PEFC-certified material coming

directly from a PEFC-certified forest. This marks an

important step in our PEFC roadmap to EUDR alignment.

See: https://pefc.org/news/revised-pefc-sustainable-forest-

management-benchmark-standard-approved

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20241120/1732064596197451.pdf

2.

GHANA

Tax policies can drive industrialisation - AGI

General elections will be held in Ghana on 7 December

2024 and the Association of Ghana Industries (AGI) has

signaled its desire to see the new government to use its

first budget and economic policy to introduce tax reforms

and other interventions geared towards growing industries

and generally improve the country’s business

environment.

Speaking at the Association’s 64th Annual General

Meeting (AGM, the AGI President, Dr. Humphrey Kwesi

Ayim Darke, expressed the Association’s hope to see more

innovation from the incoming government regarding

macroeconomic management and fiscal rationalisation to

consolidate gains made under the International Monetary

Fund (IMF) structured programme.

Specifically, the AGI is seeking a review of the value-

added tax (VAT), imposition of the flat tax rate and action

on exchange rate stability interventions and other business

supportive policies that would improve company

competitiveness and promote industrialisation.

See: https://www.graphic.com.gh/business/business-news/agi-

awaits-tax-reforms-next-year.html

and

https://gipc.gov.gh/wp-content/uploads/2024/11/Q2-2024-

Investment-Report-Final.pdf

and

https://agighana.org/agi-tema-branch-organizes-annual-general-

meeting-and-seminar-on-taxation/

Other speakers at the plenary session including the Chief

Executive Officer of Ghana Exports Promotion Authority

(GEPA), Commissioner in charge of the Domestic Tax

Revenue and the CEO of AGI, all spoke on key measures

that could impact industrial growth.

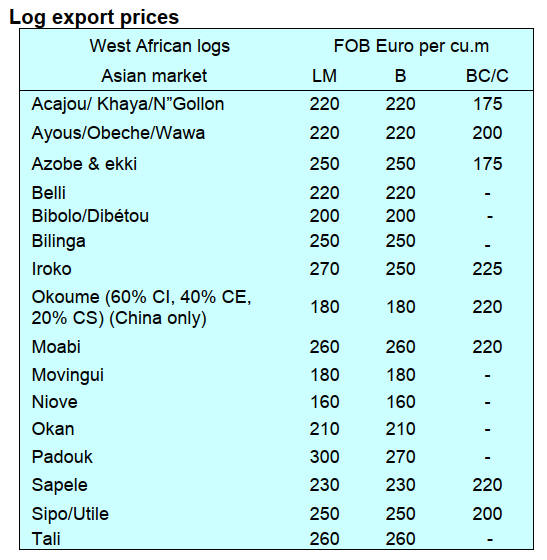

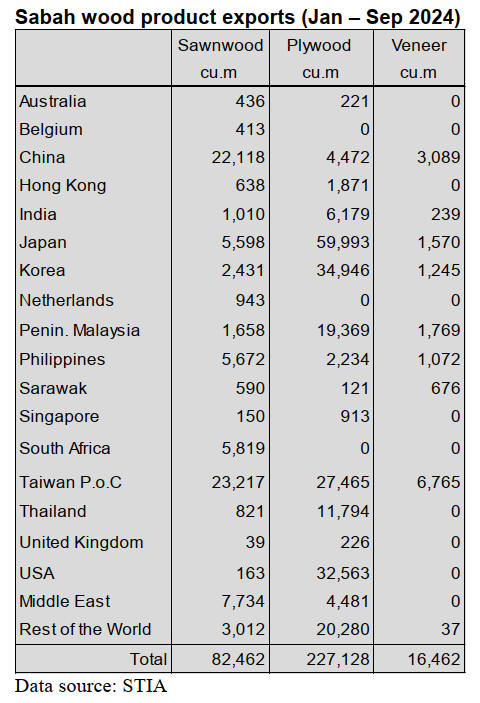

Wood product exports in first three quarters of 2024

According to data from the Timber Industry Development

Division (TIDD) of the Forestry Commission (FC)

revenue from wood product exports the first three quarters

of 2024 was US$93.03 million from a total export volume

of 208,108 cu.m.

The highest wood product export volume of 25,561 cu.m

was recorded in September and the lowest was in February

at 19,841cu.m.

The period also witnessed an increasing quarterly wood

export volume from 64,160 cu.m in the first quarter to

68,966 cu.m in the second quarter then to 74,976 cu.m in

the third quarter.

Major export markets

Countries in Asia were the major importers accounting for

between 63-65% of total export volumes for 2023

(226,000 cu.m) and 2024 (208,000 cu.m) respectively. In

terms of volume Europe was Ghana’s second largest

export market (-1% Jan-Sep) and the Africa the third ( -

3%).

The leading wood products were air and kiln dry

awnwood, rotary veneer, billets and plywood for the

regional market. The top species included Teak, Wawa,

Essa / Celtis, Ceiba and Denya.

CITES workshop to help protect natural resources

The Forest Services Division (FSD), the Timber Industry

Development Division (TIDD) and Wildlife Division of

the Forestry Commission (FC) participated in a 3-day

training workshop on Convention on International Trade

in Endangered Species (CITES), Non-Detriment Findings

(NDF) for Ghana.

This was to build capacity for the country to develop its

own NDFs for timber harvesting to protect the country’s

natural resources. The workshop also attracted local and

international industry stakeholders.

The event was organised by the CITES Scientific

Authority of Ghana, in collaboration with the German

Federal Agency for Nature Conservation (BfN) and

TRAFFIC.

The Faculty of Renewable Natural Resources, Kwame

Nkrumah University of Science (KNUST), hosted the

workshop with funding from BfN.

The event centred on the newly revised 9-Step Guidance

on Non-Detriment Findings (NDFs) for timber species.

Participants were taken through Non-Detriment Findings

procedures designed to scientifically evaluate parameters

such as species distribution and habitats, population status

and trends, harvest practices as well as volumes and

impact of trade in target species.

Professor Samuel Kingsley Oppong, a lecturer at the

KNUST, explained that the CITES Convention makes sure

that species sent out of Ghana do not negatively impact the

country’s forest cover and the environment. Hence the

formulation of the NDFs, which guides that process and

ensure sustainability of species, helping to ensure that

timber trade benefits species, ecosystems and local

communities alike.

The NDFs is a necessary precondition for issuing a CITES

permit, for natural resources that face extinction. During a

demonstration, participants were engaged in practical

exercises where they analyzed data gaps and applied the 9-

Step Guidance to the African mahogany (Khaya) three key

species namely Khaya ivorensis, K. anthotheca, and K.

grandifoliola, which are native to West and Central Africa.

See: https://fcghana.org/fc-participates-in-3-day-workshop-on-

cites-ndfs-for-ghana/

Ministry launches tree crop diversification project

The Ministry of Food and Agriculture has secured a

US$227 million credit from the World Bank to undertake

the ‘Ghana Tree Crop Diversification Project’ (GTCDP).

The Minister of Food and Agriculture, Bryan

Acheampong, said the project will raise the capacity of

stakeholders in the tree crop sector and improve their

competitiveness.

The GTCDP seeks to support sector-wide activities,

reforms and investments in the tree crop sector to enhance

production of cocoa, coconut, cashew and rubber. As part

of the project, commercial nursery operators will be

supported to supply quality planting materials to farmers

and government will also facilitate the acquisition of

planting materials and other agricultural inputs for 52,000

farmers.

According to the Minister, Bryan Acheampong, the

initiative has the potential to transform the agriculture

value chains by connecting downstream and upstream

actors. It will also address the risk of child labor in tree

crops through an integrated prevention, identification, and

remediation system.

The project aims to achieve significant outcomes, such as

increased yields and value addition for target tree crops,

improved climate adaptation strategies and substantial

reductions in greenhouse gas emissions.

The Chief Executive of the Tree Crops Development

Authority, William Agyapong Quaittoo said the project

will address some of the challenges hindering the growth

of the Tree Crop sector established in 2019. It will benefit

about 53,000 farmers and create around 20,000 jobs and

rolled out in eleven districts across six regions of Ghana.

See:

https://allafrica.com/stories/202411180344.html#:~:text=The%2

0%24227.5%20million%20five%2Dyear,youth%20within%20th

e%20agricultural%20sector.

and

https://www.myjoyonline.com/agric-ministry-launches-227m-

tree-crop-diversification-project/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20241120/1732064596197451.pdf

3. MALAYSIA

Carbon offset guidelines

A Technical Working Group (TWG) for Forest Carbon

Offset Guidelines has been established by the Ministry of

Natural Resources and Environmental Sustainability

(NRES).

The TWG, working through the Malaysia Forest Fund

(MFF), is developing a national crediting system designed

to align with Malaysia’s unique environmental context

while actively supporting the country’s commitment to

maintaining over 50% forest cover. The crediting system

also fulfills the objectives of the National Policy on

Biological Diversity and Malaysia’s Nationally

Determined Contributions.

Known as the Forest Carbon Offset (FCO) the initiative

will facilitate the transfer of forest-based emissions

reduction or removals to buyers in the form of carbon

credits, enabling organisations to offset their carbon

emissions.

Following a feasibility study, a Technical Working Group

(TWG) was established, comprising experts from

government agencies, private sector, civil societies, non-

governmental organisations and academia to provide

insights and recommendations on the development of FCO

guidelines.

During the session, TWG members received an overview

of the draft guidelines prepared by MFF and were invited

to review and contribute feedback to refine the guidelines

further in preparation for the next meeting.

See: https://www.nres.gov.my/ms-

my/pustakamedia/Penerbitan/National%20Guidance%20on%20F

orest%20Carbon%20Market.pdf

and

https://mfc20.my/wp-content/uploads/2024/10/PAPER-9-

PROMOTING-SARAWAKS-FOREST-CARBON-

INITIATIVES.pdf

Environment and emission laws

Sarawak will implement two new regulations next year

aimed at enhancing environmental sustainability according

to Premier Abang Johari Tun Openg. The regulations are

the Certified External Auditors Eligibility and Registration

Regulations 2024 and the Burning and Emission

Regulations 2024.

These are designed to ensure compliance with ethical

standards and the responsibility to verify accurate reports,

thereby supporting Sarawak’s commitment to reducing

greenhouse gas emissions.

The Burning and Emission Regulations 2024 will govern

burning and gas emission activities in Sarawak by

enforcing strict controls, requiring prior approval from the

Controller of the Natural Resources and Environment

Board (NREB).

See: https://www.theborneopost.com/2024/10/23/sarawak-to-

implement-new-regulations-next-year-for-environmental-

sustainability-emissions-control-says-premier/

Restoring degraded forests

Sabah aims to convert around 400,000 ha of degraded

forest to industrial timber plantations. The Chief Minister,

Hajiji Noor, said this effort was being carried out through

the state's Action Plan on Forest Plantation Development

(2022–2036). As of October this year, he said, a total of

180,901 ha have been successfully restored and converted.

He added that rubberwood, acacia, batai, laran and red

mahogany (Eucalyptus pellita) are among the main species

in the forest plantations.

See: https://www.thestar.com.my/news/nation/2024/11/22/sabah-

to-restore-400000ha-of-degraded-forest-as-timber-plantations

Sarawak Sustainability Blueprint

The Sarawak Sustainability Blueprint, a roadmap to guide

all sectors towards harmonising economic growth and

environmental preservation was unveiled at the Sarawak

Sustainability Insights 2024 event in Kuching.

Sarawak, Abang Johari Tun Openg, said the blueprint

focuses on two critical dimensions, Green Transition and

Economic Equity with the aim of establishing a robust

framework that integrates sustainable practices.

There are 10 strategic thrusts under the Blueprint, namely

Energy Transition, Sustainable Agriculture and Food

Security, Green Mobility, Circular Economy, Sustainable

Manufacturing, Sustainable and Responsible Mining,

Protection and Enhancement of Natural Assets,

Sustainable Cities, Community Development and Eco-

Tourism.

Under the Energy Transition strategy the Premier said

Sarawak is dedicated to continue harnessing clean energy

sources to meet domestic energy demand and for power

exports.

See: https://dayakdaily.com/premier-unveils-sarawak-

sustainability-blueprint-to-guide-all-sectors-on-balancing-

economy-environmental-preservation/

Blue Carbon project to restore mangroves

The Sarawak Timber Industry Development Corporation

(STIDC) and Worldview Climate Solutions (WCS)

Malaysia have signed a Memorandum of Agreement to

launch the inaugural blue carbon project in the Tanjung

Manis area. The project aims to restore and preserve

10,000 hectares of mangrove forest.

The project aims to establish and develop a blue carbon

ecosystem, capturing and marketing carbon from restored

mangroves while supporting local biodiversity and eco-

tourism. The project is viewed not only as a significant

step in environmental conservation but also a major

opportunity to attract foreign investment that could

stimulate economic growth in Sarawak’s green energy and

eco-tourism sectors.

See: https://www.theborneopost.com/2024/11/14/stidc-wcs-sign-

moa-for-landmark-blue-project-initiative-in-tg-manis/

https://theborneopost.pressreader.com/article/281745569916284

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20241120/1732064596197451.pdf

4.

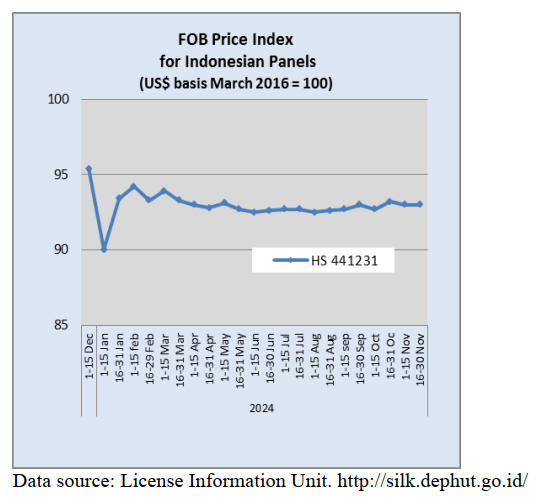

INDONESIA

Forestry investments to create 400,000

new jobs

During a meeting with Commission IV of the Indonesian

House of Representatives the Minister of Environment and

Forestry, Raja Juli Antoni, stated that the management of

the forestry sector in 2025 will prioritise increasing

production and the downstream processing of forest

products to support regional economic development.

He said "the forestry sector is expected to see an

investment value of IDR19.9 trillion in 2025 with planned

workforce absorption of 400,000 people".

Non-tax State revenues from the forestry sector are

projected to reach IDR7.72 trillion in 2025. This estimate

is based on calculations of revenue generated from

roundwood production to meet export demand, nature

tourism visits, utilisation of forest areas and administrative

fines in the forestry sector.

The Ministry aims to achieve specific performance targets

by 2025 which include a 55% reduction in greenhouse gas

emissions from the forestry sector. Additionally, the

ministry seeks to reduce the rate of deforestation to 0.2

million hectares per year and attain a national red list

index value for species under threat.

See: https://www.msn.com/id-id/berita/other/target-investasi-

rp199-triliun-pada-2025-sektor-kehutanan-bisa-serap-400000-

pekerja/ar-AA1uusAK?ocid=BingNewsVerp

and

https://www.msn.com/id-id/ekonomi/ekonomi/pemerintah-

targetkan-investasi-di-bidang-kehutanan-capai-rp-19-9-t-pada-

2025/ar-AA1uqO8S

and

https://www.antaranews.com/video/4481113/kemenhut-

targetkan-investasi-kehutanan-capai-rp199-triliun-pada-2025

In related news, the Minister of Environment and Forestry

indicated a roadmap and strategic plan for the reforestation

of 12 million ha. of damaged forests will be prepared. This

is a follow-up to President Prabowo Subianto's directive at

the UN COP29 in Azerbaijan.

Also the Minister confirmed that he will not hesitate to

revoke the Forest Area Borrow-Use Permit (IPPKH) from

corporations that fail to meet the land rehabilitation

obligations required by the permit.

See: https://www.tempo.co/lingkungan/menteri-kehutanan-siap-

cabut-ippkh-perusahaan-yang-tidak-merehabilitasi-lahan-

1171191

and

See: https://jakartaglobe.id/news/indonesia-plans-to-reforest-12-

million-hectares-of-damaged-land

Furniture sector - FurneCraft Expo

The Ministry of Industry hosted the 2024 FurneCraft Expo

in Semarang City, Central Java aimed at enhancing the

quality of human resources in the furniture sector and

boosting export sales. The exhibition was organised by the

Furniture and Wood Processing Industry Polytechnic

(Polifurneka), a vocational education unit of the Ministry

of Industry. It featured a variety of events aimed at helping

businesses expand and widen their knowledge.

Masrokhan, the Head of the Industrial Human Resources

Development Agency of the Ministry of Industry, stated

that the exhibition themed "Bring Back Culture with

Innovative Furniture" attracted thousands of visitors from

within the country and abroad. This event opened up new

export market opportunities for small and medium-sized

enterprises allowing them to boost sales through business

matching.

See: https://www.antaranews.com/berita/4457613/kemenperin-

gelar-furnecraft-expo-dorong-kualitas-sdm-sektor-furnitur

Area allocated for Social Forestry around 8 million ha

The Ministry of Forestry and Environment has reported, as

of October 2024, the area of Social Forestry has surpassed

8 million hectares involving over 1.3 million households.

For customary forests, the achievement is recorded at

more than 250,000 hectares for 138 customary law

communities.

During a discussion at the Indonesian Pavilion at COP29

the Director General of Social Forestry and Environmental

Partnerships (PSKL) at the Ministry stated, “We are

providing access to social forestry areas spanning 8.3

million hectares which includes the recognition of

customary forests.”

Mahfudz said that social forestry has became a national

priority programme within the 2015-2019 National

Medium-Term Development Plan (RPJMN) and continued

into the 2020-2024 plan.

See: https://www.antaranews.com/berita/4479849/kemenhut-

perhutanan-sosial-capai-lebih-dari-8-juta-ha-hingga-oktober

Indonesia, Japan Agreement on carbon credit trading

The Indonesian press has reported the governments of

Indonesia and Japan have reached an agreement to initiate

Mutual Recognition Arrangement (MRA) for bilateral

carbon credit trading cooperation. This MRA is reportedly

the first bilateral cooperation model between countries

under the framework of the Paris Agreement, specifically

Article 6.2.

The Vice Minister for Global Environmental Affairs,

Ministry of Environment Japan, Yutaka Matsuzawa, stated

that through the MRA the Indonesian and Japanese

governments can develop collaboration and cooperation

towards net zero emission between the two countries.

See: https://en.tempo.co/read/1940459/indonesia-japan-reach-

agreement-on-mra-for-carbon-credit-trading-at-cop29

5.

MYANMAR

No timber trade data available

As the Ministry of Commerce suspended the publication

of trade data and the Myanma Timber Enterprise (MTE)

stopped uploading the results of monthly tenders reliable

statistics are hard to come by.

According to wood product manufacturers in some months

there are no bids at MTE tender sales particularly for teak

logs. Manufacturers also have to contend with inconsistent

power supplies which have forced them to rely on

generators which has pushed up production costs. The

situation for workers in the sector is dire. The cost of

living continues to climb as the effect of sanctions bite but

manufacturers are not in a position to raise wages instead

turning to a variety of in-kind support for workers.

Yacht maker fined for importing Myanmar teak

UK based Yachting Monthly magazine has reported a

luxury yacht manufacturer based in the UK has been fined

for importing teak from Myanmar, marking the first

prosecution under the UK Timber Regulation (UKTR).

See: https://www.yachtingmonthly.com/news/sunseeker-handed-

240k-fine-for-using-illegal-blood-teak-from-myanmar-on-

vessels-99901

ILO moves on possible sanctions

The International Labor Organization (ILO) is considering

taking action against the authorities in Myanmar for rights

violations.

It has been reported the ILO Governing Body will discuss

a draft resolution on measures that will be taken. This

decision was welcomed by labour advocates who have

called for international action. Maung Maung, president of

the Confederation of Trade Unions Myanmar, which has

some 65,000 members, welcomed the ILO decision.

See: https://www.ilo.org/sites/default/files/2024-10/GB352-INS-

11-%5BNORMES-240911-003%5D-Web-EN.pdf

Formal banking system in Rakhine State virtually

collapsed

The Myanmar newspaper ‘Irrawaddy’ has reported the

banking system in Rakhine State has virtually collapsed.

Banks in Sittwe, Maungdaw, Thandwe and Minbya have

ceased operations.

In mid-November the last remaining private banks shut

down in Kyaukphyu, including KBZ, CB, AGD,

Ayeyarwady, Yoma and Global Treasure Banks says the

newspaper.

With the closure of banks, residents now have to pay

higher fees to withdraw and transfer money through

mobile banking services.

See: https://www.irrawaddy.com/news/burma/rakhines-banking-

system-collapses-as-myanmar-state-teeters-on-precipice.html

6.

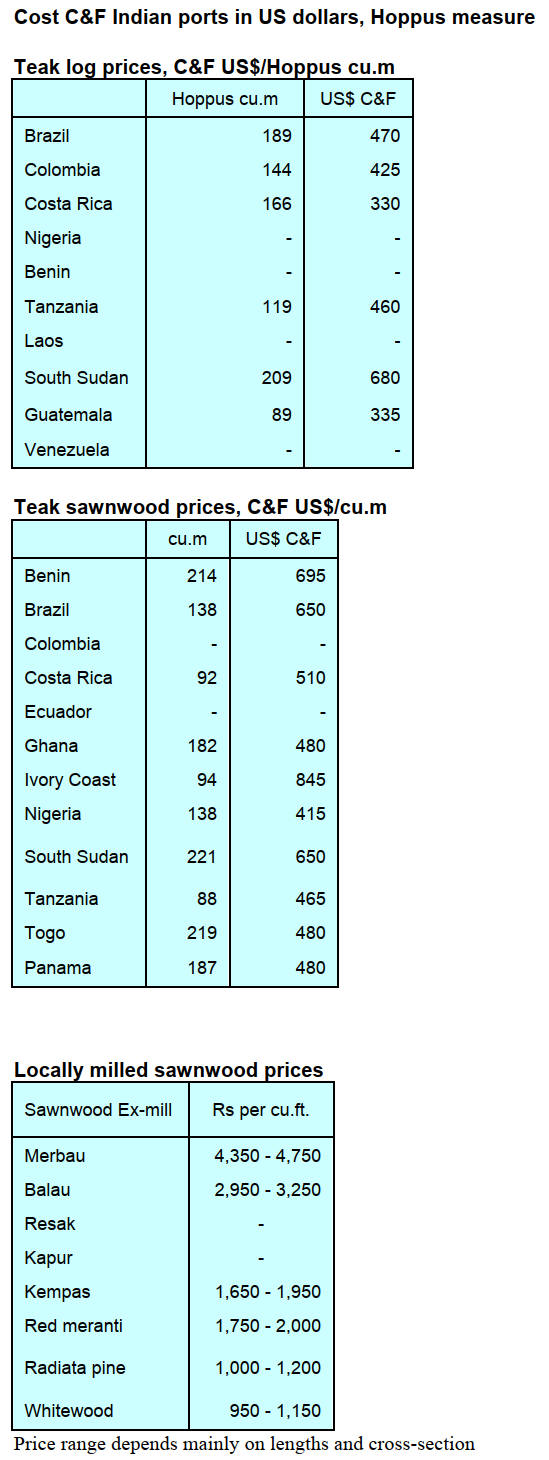

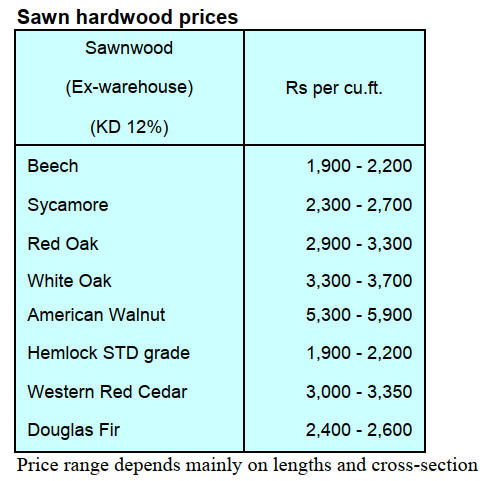

INDIA

Growth in pallet market

Expanding trade increases demand for pallets and wood is

the main raw material for pallet manufacturing followed

by plastic. The Indian market for wooden pallets has seen

significant growth over the years and will continue to

grow as trade volumes rise. Wooden pallets have

maintained market share as they can be reused multiple

times, aligns well with the rising awareness of sustainable

business practices and can be recycled.

The Economic Times of India points out in a recent article

that manufacturers in India have moved to ensuring

manufacturing processes use responsibly sourced raw

material. The major producers have adopted up-to-date

technologies designed to reduce waste and minimise

energy consumption.

See: https://economictimes.indiatimes.com/small-biz/sme-

sector/there-is-a-growing-market-for-recycled-and-upcycled-

pallets-jay-wood-industrys-

shah/articleshow/113756472.cms?from=mdr

Expanded agricultral output and government spending

to lift growth

A forecast from Morgan Stanley Research in its ‘2025

India Economics Outlook’ has projected India’s GDP

growth for the current fiscal year at 6.7% from 7% in an

earlier forecast. This change is mainly due to slower

growth in July-September 2024 quarter. The report

suggests GDP is likely to have rebounded to around 6.7-

6.8% in second half driven by a rise in agricultural

production and government spending.

High frequency data for July-September 2024 were weak

as indicated by revenue from the Goods and Services Tax

dipping to a 40-month low in September. Core

manufacturing sector output declined in August (after 41

months of expansion), the manufacturing PMI slipped to

an 8-month low in September and passenger and two-

wheeler vehicle sales were moderating.

This slowdown was driven by short term factors, says

Morgan Stanley, such as excessive rainfall in August

impacting production activity and a slowdown in

government spending. However October data showed a

rebound is likely. The high frequency growth data for

October does show signs of a pickup after slowing down

in the previous two months, helped by festive season

related sales.

According to Madhavi Bokil, Senior Vice-President at

Moody’s Ratings and author of their latest Economic

Forecast there are potential risks to inflation from

heightened geopolitical tensions and extreme weather

events and these underscore the Reserve Bank of India‘s

(RBI) cautious policy. The policy of the RBI, at present,

appears to be to keep the repo rate steady at 6.5% in

October and it is expected to retain its tight monetary

policy into next year.

See: https://www.morganstanley.com/asiaresearch/country-and-

region/india.html

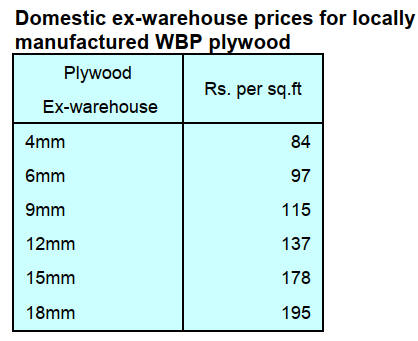

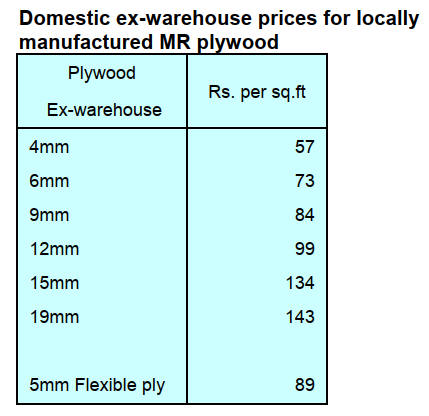

Plywood

Importers concerned on progress in proceedures for

new Ply Standard

The entry into force of the new Standards for imported

wood panel products is drawing close and the

correspondent says “there is a panic amongst Indian

importers because, so far, the Quality Control Office of the

Standards Bureau has not completed the required

international visits to checking the quality controls at

export producers necessary to complete the formalities for

issuing import licences”.

Plywood nand veneer from Nepal

While not known as a major wood product exporter the

Nepalese newspaper, Rising Nepal, has reported plywood

and veneers worth Rs3 bil. were exported to India in the

previous financial year. In Nepal logs for plywood

production are sourced from plantatiosn and farm plots of

mainly Alnus nepalensis, uttis (Alder tree) found in the

eastern hills of Nepal. During the same period, 21,994

tonnes of veneer worth Rs241 million were repoeredly

exported to India.

See: https://risingnepaldaily.com/news/46460

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

Statistics from Vietnam Customs show that in October

2024 the W&WP exports were valued at US$1.54

billion, up 23% compared to September 2024 and up

19% compared to October 2023. Of this, WP exports

alone reached US$1.05 billion, up 17% compared to

September 2024 and up 20% compared to October

2023.

In the first 10 months of 2024 W&WP exports earned

US$13.2 billion, up 21% over the same period in 2023

of which WP exports contributed US$9.1 billion, up

23% over the same period in 2023.

W&WP exports to the US market in October 2024

amounted to US$849.8 million, up 15% compared to

September 2024 and up 21% compared to October

2023.

Woodchip exports in October 2024 brought in about

US$240 million, up 10% compared to October 2023.

In the first 10 months of 2024,wood chip exports

earned US$2.2 billion, up 19% over the same period in

2023.

Vietnam’s W&WP imports in October stood at

US$235.9 million, up 0.6% compared to September

2024 and up 33% compared to October 2023.

In the first 10 months of 2024 W&WP imports to

Vietnam reached US$2.27 billion, up 27% over the

same period in 2023.

In September 2024, Vietnam imported 78,400 cu.m of

raw wood (logs and sawnwood) from Southeast Asia

worth US$18.56 million, down 31% in volume and

down 18% in value compared to August 2024.

Compared to the same period last year the import

volume increased by 5% and the value increased by

11%.

Vietnam’s W&WP exports to China in October 2024

amounted to US$173 million, up 20% compared to

September 2024 but down 5.5% compared to October

2023.

In the first 10 months of 2024 Vietnam’s W&WP

exports to the Chinese market totalled at US$1.7

billion, up 21% over the same period in 2023.

Exports of living and dining-room furniture in October

2024 reached US$267.6 million, up 21% compared to

October 2023.

In the first 10 months of 2024 exports of these

commodities earned US$2.2 billion, up 22% over the

same period in 2023.

Vietnam's padouk wood imports in October 2024 were

12,400 cu.m, worth US$4.1 million, up 6% in volume

and 7% in value compared to September 2024.

Compared to October 2023 imports increased in

volume but decreased by 23% in value.

In the first 10 months of 2024 imports of this wood

variety reached 106,200 cu.m, worth US$38.9 million,

down 2% in volume and down 5% in value over the

same period in 2023.

The imports of raw wood from Africa in September

2024 reached 56,460 cu.m, with a value of US$21.18

million, down 28% in volume and down 20% in value

compared to August 2024.

In the first 9 months of 2024 imports of raw wood from

Africa amounted to 522,340 cu.m, with a value of

US$193 million, down 6% in volume and down 12% in

value over the same period in 2023.

Imports of padouk

Vietnam's imports of padouk wood from all African

sources in the first 9 months of 2024 reached 77,500

cu.m, worth US$23.3 million, down 4% in volume and

down 4% in value over the same period in 2023.

The average CIF price for padouk in the first 9 months

of 2024 remained quite stable compared to the same

period in 2023 standing at US$370.8/cu.m. Prices for

African increased slightly.

Imports of padouk wood from the largest African

source accounted for 82% of the total import volume in

the first 9 months of 2024, reaching 77,500 cu.m worth

US$23.3 million, down 4% in volume and down 4% in

value over the same period in 2023.

Imports from Angola decreased by 81%; Cameroon

decreased by 31% and imports from Equatorial Guinea

fell 95% compared to the same period in 2023.

Similarly, imports from Laos decreased by 15% in

volume and decreased by 20% in value over the same

period in 2023 reaching 6,800 cu.m, worth US$6.9

million.

In addition, imports of padouk from Hong Kong

decreased by 25% in volume and decreased by 21% in

value over the same period in 2023, reaching 1,940

cu.m worth US$537,000.

In contrast, imports of padouk wood from Thailand

increased by 54% in volume and 106% in value over

the same period in 2023 reaching 5,400cu.m

Imports from Africa set to rise

Most of the wood imported from African sources is for

the production of wood products targeted at the

domestic market. In general, the demand for furniture

and interior products is rising each year so imports of

raw material from Africa will increase,

Imports from Cameroon, the largest supplier, fell

sharply by 44% in volume, equivalent to a decline of

20,120 cu.m. Imports from South Africa decreased by

14% in volume and 13% in value, Nigeria decreased by

9% in volume, Ghana decreased by 23% in volume and

15% in value. In contrast, imports from the DR Congo

increased by 14% in volume and 28% in value

compared to August 2023, Imports from Gabon

increased by 66% in volume and 44% in value.

In the first 9 months of 2024 wood imports from Africa

decreased year-on-year mainly due to a sharp decline in

imports from the 2 main suppliers, Cameroon and

Angola. Specifically, wood imports from Cameroon

decreased by 13% in volume, equivalent to 43,000

cu.m

Imports from Angola decreased sharply by 75% in

volume, equivalent to a decrease of 32,500 cu.m. In

contrast imports from selected African suppliers increased

sharply, such Nigeria by 73%, Democratic Republic of

Congo by 23% and Ghana by 37%.

Vietnam’s imports of raw wood from Southeast Asia

According to statistics from Vietnam’s Office of

Customs, in September 2024 Vietnam imported 78,400

cu.m of raw wood from Southeast Asia worth

US$18.56 million, down 31% in volume and down

18% in value compared to August 2024.

But compared to the same period last year, imports

increased by 5% in volume and 11% in value. This

growth shows that the demand for wood imports from

this region has remained, although there have been

fluctuations in volume and value.

It is forecast that in the coming months imports of raw

wood from Southeast Asia will continue to increase

due to the demand for production and consumption of

household wood furniture in the domestic and

international markets. Sawnwood will continue to be

the main import product.

Amongst Southeast Asian countries Thailand remains

the top wood material supplier for Vietnam with the

supply of 4,250 cu.m worth US$8.47 million, down

37% in volume and down 30% in value compared to

the previous month.

However, over the first 9 months of 2024 imports from

Thailand reached 474,560 cu.m, with a value of

US$87.18 million, up 31% in volume and 27% in value

over the same period in 2023.

The main commodities imported from Thailand were

chipboard and sawnwood. A large volume was shipped

to Vietnam.Laos ranks second as a source of imports

and in September 2024 imports were 15.450 cu.m,

worth US$6.15 million, up 6% in volume and 2.5% in

value compared to the previous month and up by 34%

in volume and 226% in value over the same period in

2023.

In the first 9 months of 2024 imports of raw wood from

Laos reached 160,560 cu.m with a value of US$70.69

million, up 4.5% in volume but down 2% in value over

the same period last year. Sawnwood was the main

commodity imported from Laos.

In the first 9 months of 2024 imports of raw wood from

Malaysia reached 64,110 cu.m, at a value of US$16.43

million, up 13% in volume and 0.5% in value over the

same period in 2023. Malaysia is an important supplier

of particleboard and sawnwood for Vietnam.

\Major W&WPs imported from Southeast Asia

Wood materials imported from Southeast Asea to

Vietnam are diversified with sawn wood, log,

particleboard, fiberboard etc. Of these, particlepboard

and sawnwood are the two main commodities

imported.

In the first 9 months of 2024, sawnwood imports from

Southeast Asia totalled 219,680 cu.m, with a value of

US$90.56 million, down 4% in value over the same

period in 2023. Sawn rubberwood topped imports

followed by acacia, lagerstromia (Queen Crepe Myrtle)

and sindora (Sepetir).

In the first 9 months of 2024 log imports from

Southeast Asia reached 24,010 cu.m worth US$6.57

million, down 14% in volume and down 0.1% in value

over the same period in 2023. Logs of teak, acacia,

rubberwood and iron-wood dominated the imports.

Particleboard imports from Southeast Asia reached

35,790 cu.m, at a value of US$4.66 million in

September 2024, down 48% in volume and down 48%

in value compared to August 2024.

In the first 9 months of 2024 the volume of imported

particleboard reached 307,530 cu.m, with a value of

US$40.58 million, up 50% in volume and 51% in value

over the same period in 2023. This product is imported

mainly from Thailand and Malaysia with Thailand

being the largest supplier.

8. BRAZIL

Bioeconomy and biodiversity mapping in the

Amazon

An expert panel on “Amazon Biodiversity and

Archaeology Mapping: Promoting Territory Protection

and Bioeconomy” organised bythe Alana Foundation,

Mapbiomas and the Ministry of Development, Industry

and Foreign Trade (MDIC) was held during the G20

meeting.

The panel discussed ways to promote a sustainable

bioeconomy in the Amazon, balancing territorial

protection, biodiversity conservation and local community

engagement. Experts discussed combining advanced

technologies and traditional knowledge to accelerate

biodiversity mapping, a crucial step for national

sustainability.

The Amazon is home to around 1.5 million species that

have already been mapped but it is estimated to be home

to million of species of fauna and flora yet to be

discovered. Initiatives such as the XPRIZE Rainforest,

funded by the Alana Foundation, encourage the

development of technological solutions aligned with

traditional knowledge to map tropical forest biodiversity.

In September 2024 the G20 approved a declaration

establishing principles for developing the bioeconomy in

the world. For the first time, this topic was addressed in a

multilateral agreement, integrating the bioeconomy into

macroeconomic decision-making and discussions among

nations. This milestone is seen as a strategic step forward

in integrating sustainability and global development.

See: https://www.g20.org/pt-br/noticias/painel-discute-

bioeconomia-e-mapeamento-da-biodiversidade-para-a-protecao-

da-amazonia-a-maior-floresta-tropical-do-mundo

Brazil advances in new forest fund

During the 29th UN Climate Conference held in

Azerbaijan, representatives from countries with large areas

of tropical forests met during the event to advance a joint

conservation agenda which they plan to present to the

world by 2025.

The strengthening of a new funding mechanism for

conservation is important for Brazil which sees the

initiative as a key strategy for fulfilling its pledge to

eliminate deforestation by 2030.Currently, a coalition

‘United for Our Forests’ includes 18 countries out of 53

nations with significant tropical forest areas.

Among the main members are Brazil and other Amazon

countries, Mexico, Guatemala along with the Democratic

Republic of Congo which is the second largest forested

country in the world and Indonesia, the third largest

forested country in the world.

The new financial mechanism, called the ‘Tropical Forests

Forever Fund’ made significant progress in 2024 gaining

support from countries, including Germany, the United

Arab Emirates, Malaysia, Colombia and Indonesia. The

fund aims to raise US$125 billion from wealthy countries

and financial institutions, offering payments per preserved

hectare, penalising deforestation and providing additional

benefits for biodiversity protection and traditional

communities.

For Brazil, strengthening this new financing fund for

preservation is fundamental as it sees the initiative as a

practical alternative to achieve its zero-deforestation target

by 2030. However, the details of the TFFF will only be

presented at COP30, scheduled to take place in Belém, in

the State of Pará, Brazil.

See: https://oeco.org.br/reportagens/mirando-o-desmatamento-

zero-brasil-avanca-em-novo-fundo-de-preservacao/

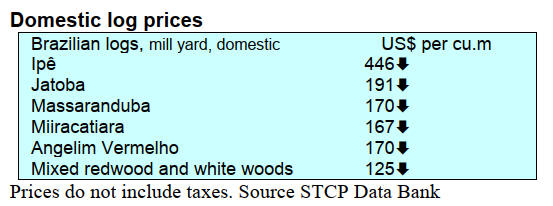

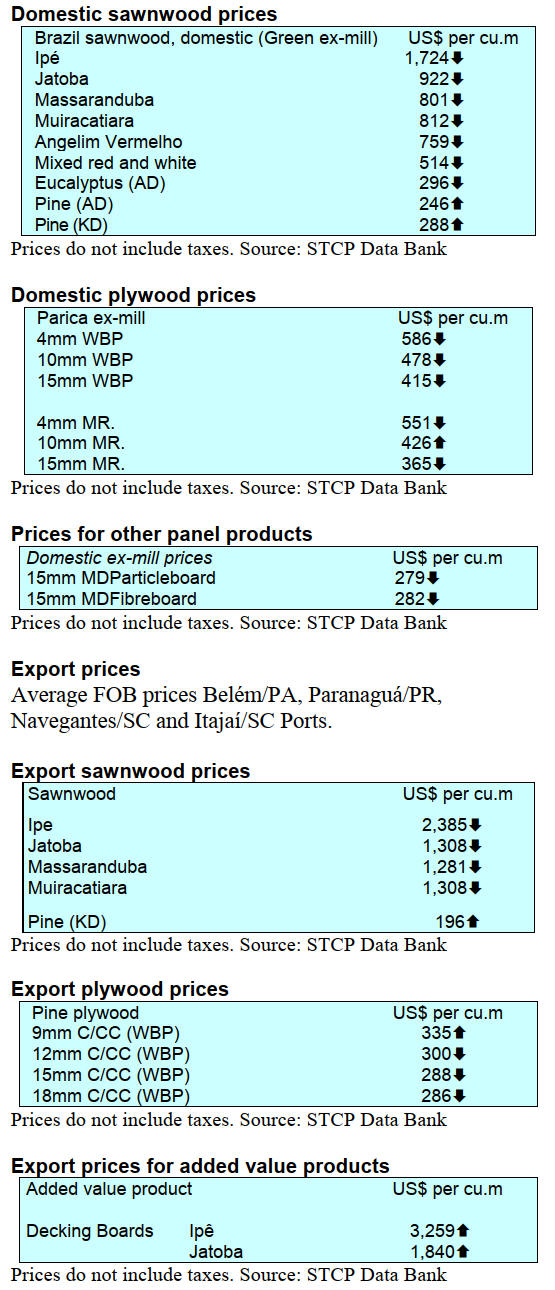

Export update

In October 2024 the Brazilian exports of wood-based

products (except pulp and paper) increased 20% in value

compared to October 2023, from US$219.9 million to US$

263.6 million.

Pine sawnwood exports increased 75% in value between

October 2023 (US$8.6 million) and October 2024

(US$50.1 million). In volume, exports increased 62%

from 127,900 cu.m (October 2023) to 206,500 cu.m

(October 2024).

Tropical sawnwood exports increased 5% in volume, from

20,600 cu.m in October 2023 to 21,700 cu.m in October

2024. However the value decreased 4% from US$9.1

million to US$8.7 million, over the same period.

Pine plywood exports increased 30% in value in October

2023 (US$43.8 million) compared to October 2024

(US$57.1 million). In volume, exports increased 20% over

the same period, from 140,600 cu.m (October 2023) to

169,100 cu.m. (October 2024).

As for tropical plywood, exports decreased 8% in

value

and increased 24% in volume, from US$1.3 million and

1,700 cu.m in October 2023 to US$ 1.2 million and 2,100

cu.m in October 2024.

As for wooden furniture, the exported value increased

from US$ 46.2 million in October 2023 to US$48.2

million in October 2024, an increase of 4% in the total

exports of the product during the period.

Participation in the Global Market Conference

Recenly ABIMCI (Brazilian Association of Mechanically

Processed Timber Industry) participated in the Global

Market Conference, held in London by Timber

Development UK (TDUK).

The event attracted around 300 representatives from

various countries and highlighted topics such as trends in

the UK timber market, supply, consumption, the role of

timber in mitigating climate change, carbon sequestration

and storage, challenges in raw material supply, growth

projections, technological innovations and international

markets.

ABIMCI presented an overview of the Brazilian plywood

segment, emphasising the sustainable origin of raw

materials sourced from planted forests, particularly pinus

species and compliance with various international

certification requirements.

The Association highlighted Brazil as an important global

supplier signaling it is well-prepared to meet the needs of

the British market which imports 65% of its pine plywood

from Brazil, as well as all the other main markets, in terms

of supply and in terms of compliance with origin and

technical certifications. With declining interest rates and

inflation in the UK projections indicate growth in the UK

construction sector of 2% in 2025 and 3.5% in 2026 which

could further increase Brazilian participation in this

market.

See: https://abimci.com.br/abimci-participa-da-global-market-

conference-em-londres/

Norway support for Amazon Fund project

Norway has announced a donation of US$60 million to the

Amazon Fund, reaffirming a long-standing partnership

between Norway and Brazil on climate and rainforest

preservation. The Brazilian government has set a target of

zero deforestation in the Amazon by 2030, a critical target

for the world's largest rainforest.

The Amazon Fund, established 16 years ago, is a results-

based mechanism managing international contributions to

combat deforestation and promote sustainable

development. Since its inception, the fund has financed

114 projects, including the protection of conservations

areas, support for indigenous communities, fires

prevention and backing sustainable business activities.

See: https://www.norway.no/pt/brasil/noruega-brasil/noticias-

eventos/brasil/noruega-anuncia-doacao-de-us$-60-milhoes-ao-

fundo-amazonia/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20241120/1732064596197451.pdf

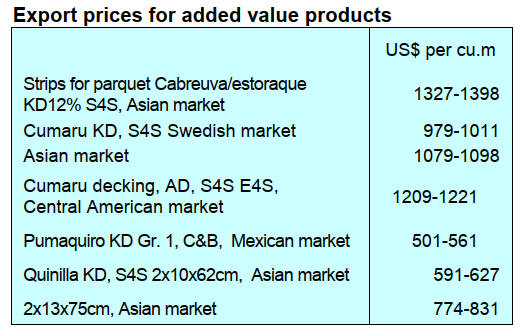

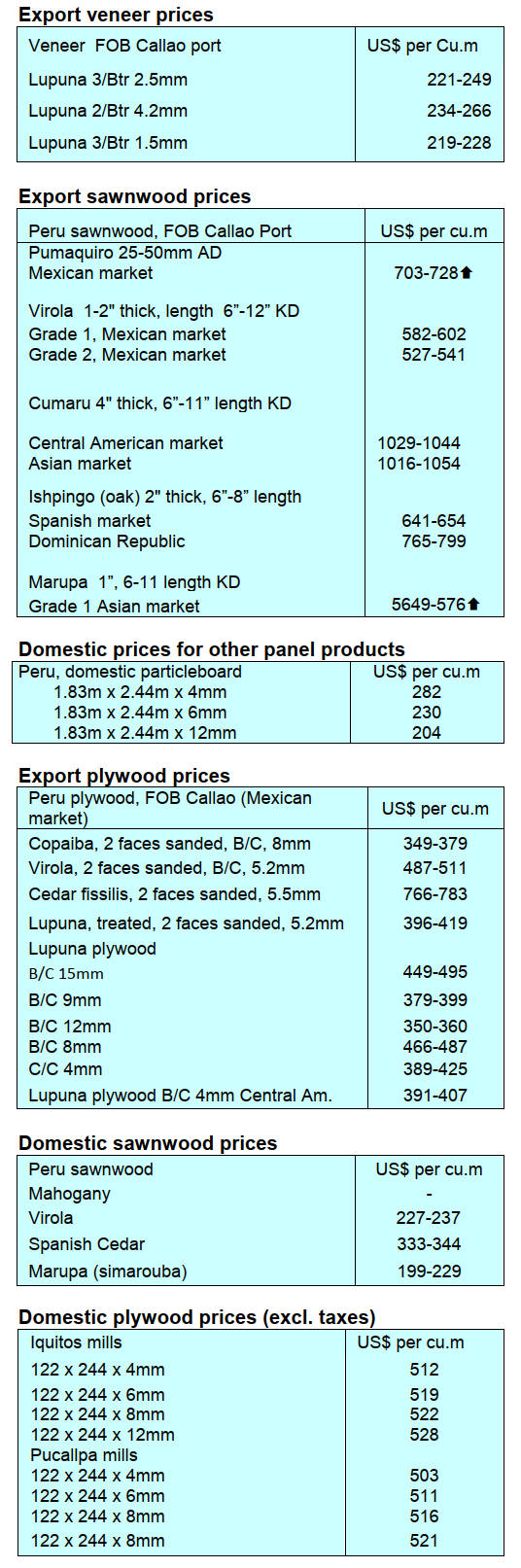

9. PERU

First three quarter

exports

The Association of Exporters (ADEX) has reported

between January and September 2024 Peru's wood product

exports earned US$64.2 million, a drop of 16% compared

to the US$76.3 registered in the same period of 2023.

ADEX reports that in the first nine months of this year the

main export products were semi-manufactured items

which earned US$24.1 million or 37% of total export

earnings for the period followed by sawnwood (US$21.5

million, 33% share), firewood and charcoal (US$4.5

million, 7% share) then construction products, US$4.3

million and finally furniture and parts, US$3.4 million.

The main destinations were France (US$0.6 million), the

United States (US$9.9 million), China (US$8.8 million),

the Dominican Republic (US$8.3 million) and Mexico

(US$7.7 million). The top ten export destinations included

Vietnam, Denmark, Belgium, Germany and Chile.

Progress on an Andean agenda to protect forests

The creation of an Andean agenda to protect forests and

combat illegal logging in accordance with the roadmap

established in the proposed regulatory framework and

approved by the Andean Parliament, was addressed at the

Second Regional Workshop on ‘Dissemination of

Regulatory Frameworks in Environmental Matters’ which

took place in Ecuador.

The Andean parliamentarian, Juan Carlos Ramírez,

participating in the meeting on behalf of Peru held a series

of meetings with authorities from the neighboring country

that allowed for an exchange of experiences and

challenges to strengthen sustainable forest management in

the countries of the Andean Community (CAN).

The Peruvian Andean parliamentarian held meetings with

officials from the Ministry of Agriculture and Livestock of

Ecuador with whom firm steps were taken towards the

establishment of a regional agenda to confront illegal

logging and protect the Amazonian forests of the Andean

region.

See: https://www.elperuano.pe/noticia/257733-tala-ilegal-

avanzan-en-una-agenda-andina-para-proteger-los-bosques-de-la-

region

Reinforcing measures to lower risk of corruption

The National Forest and Wildlife Service (SERFOR) in its

capacity as the governing body of the National Forest and

Wildlife Management System (SINAFOR) and within the

framework of the implementation of the Integrity Model,

held a working group with the technical assistance of

representatives of the Green Corruption Program and the

Subnational GFP Programme (Swiss Economic

Cooperation) implemented by the Basel Institute on

Governance.

This was in order to establish technical cooperation

mechanisms to evaluate and prioritise corruption risks

throughout the wood value chain and propose measures

for mitigation.

As a result of the working group, SERFOR, with the

technical assistance of the Basel Institute on Governance,

presented to the Secretariat of Public Integrity (SIP) of the

Presidency of the Council of Ministers (PCM), within the

framework of the implementation of the Preventive

Capacity Index against Corruption (ICP), the

identification, evaluation and treatment sheets on the

corruption risks identified in the institution.

In this way, SERFOR took on the challenge of promoting

and reinforcing the implementation of a series of measures

to lower corruption risks at an institutional level.

New Director at SERFOR

Through Supreme Resolution No.018-2024-Midagri the

Government appointed forestry engineer, Desiderio

Erasmo Otárola Acevedo, as the new executive director of

the National Forest and Wildlife Service (SERFOR).

Otárola Acevedo is a graduate of the National Agrarian

University - La Molina and holds a Master's degree in

Integrated Management of Natural Resources with an

emphasis on management and silviculture of natural

forests from the Tropical Agricultural Research and

Higher Education Center (CATIE) in Costa Rica. He has

more than 17 years of experience in public administration.

Pilot study on extent of illegal logging in Madre de

Dios

In a joint action to address illegal logging and timber trade

in the Amazon the Forest and Wildlife Resources

Oversight Agency (OSINFOR) and the Regional Forest

and Wildlife Management of Madre de Dios (GERFOR

Madre de Dios) began a pilot study to estimate the rate and

percentage of illegal logging in 2024.

The head of OSINFOR highlighted that this study will

provide specific information to identify improvements

required in the regional work plan.

|