|

Report from

North America

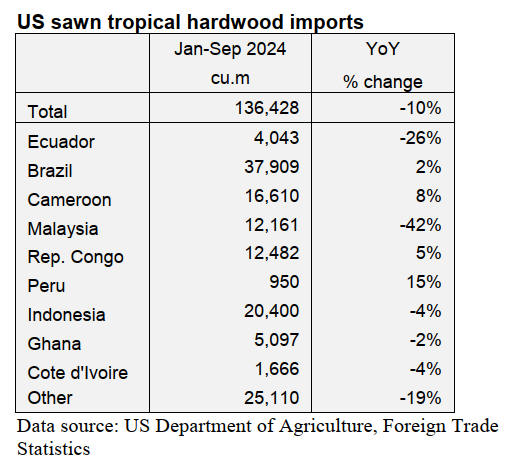

Sawn tropical hardwood imports drop further

US imports of sawn tropical hardwood fell by more than

10% for the second straight month in September. Imports

fell by 19% in September after a 14% decline in August.

The 12,198 cubic metres of tropical hardwood imported in

September was 32% less that that imported in September

2023 and was the lowest volume imported in any month so

far this year.

Imports from top trading partners Brazil and Indonesia

were down 11% and 13%, respectively, while imports

from Malaysia sank 63% and imports from Cameroon fell

29%. Imports of Ipe (down 31%) and Sapelli (down 24%)

both fell sharply for the second consecutive month. Total

US imports of sawn tropical hardwood are down 10%

versus last year through September.

Canada’s imports of sawn tropical hardwood tell a similar

story, falling 19% in September after falling 13% in

August. Despite the drop, the month’s imports were 23%

above those of last September.

Imports from Cameroon rose 72% in September and were

up 81% for the year so far. Imports from most other

trading partners fell sharply for the month but remain

ahead of last year’s pace through September. Total

Canadian imports of tropical hardwood were up 43%

versus 2023 for the year through September.

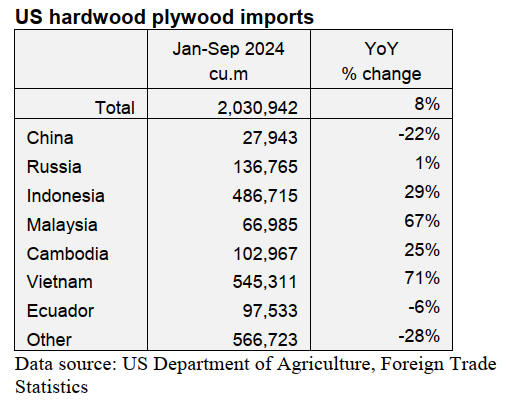

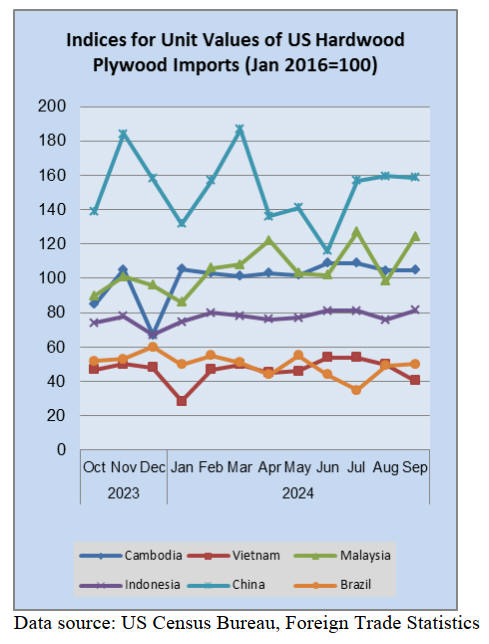

Hardwood plywood imports – volumes down costs up

US imports of hardwood plywood dipped 4% in volume

for the second consecutive month in September. The

201,955 cubic metres of plywood imported was, however,

11% more than the volume imported in September 2023 as

imports didn’t decline as steeply as they do historically in

early autumn.

Despite the loss of volume, the dollar value of imports

rose 4% over the previous month. Imports from China fell

41% in September and are down 22% for the year while

imports from most other top trading partners are up

sharply for the year.

Total volume of hardwood plywood imports for the year is

up 8% over last year through September.

Veneer imports fall in September, but not as much as

in other years

A 29% decline in September in US imports of tropical

hardwood veneer is hardly good news, but it is not as bad

as it may appear. September is usually a slow month for

these imports. Over the past five years imports for

September have plunged to only half to a third of what

they’ve been in August, so a loss of only 29% is minor.

This is reflected in the fact that the month’s imports were

6% above those of September 2023. Imports from China

were especially robust, rising to their highest level since

last October. Total veneer imports for the year are 13%

below that of 2023 through September.

Hardwood flooring imports recover

After falling to a three-year low in August, imports of

hardwood flooring rose by 17% in September. Even with

the gain, imports for the month came in 8% lower than for

September 2023. A 26% increase in imports from

Indonesia helped fuel the gain while imports from China,

Malaysia, Vietnam and Brazil all trended downward. Total

imports of hardwood flooring are down 13% versus last

year for the year so far.

US imports of assembled flooring panels rose again in

September, gaining 7% over the previous month. The

increase is the fifth gain in the last six months. Imports

from top-supplier Canada grew by 50% while imports

from Indonesia jumped by 92%. Total imports continue to

strongly outdo last year, up 36% over 2023 figures

through September.

Moulding imports rise to highest level in two years

US imports of hardwood moulding rose 16% in September

to hit their highest level since September of 2022. At over

US$16 million, the total for the month was 33% better

than that of a year ago. The gain was fueled by a 22% rise

in imports from top-supplier Canada and a 93% leap in

imports from Brazil.

Despite the rally, imports from Brazil are still down 45%

versus last year as Canada continues to gain market share.

Total US imports of hardwood molding are up 27% versus

2023 through September.

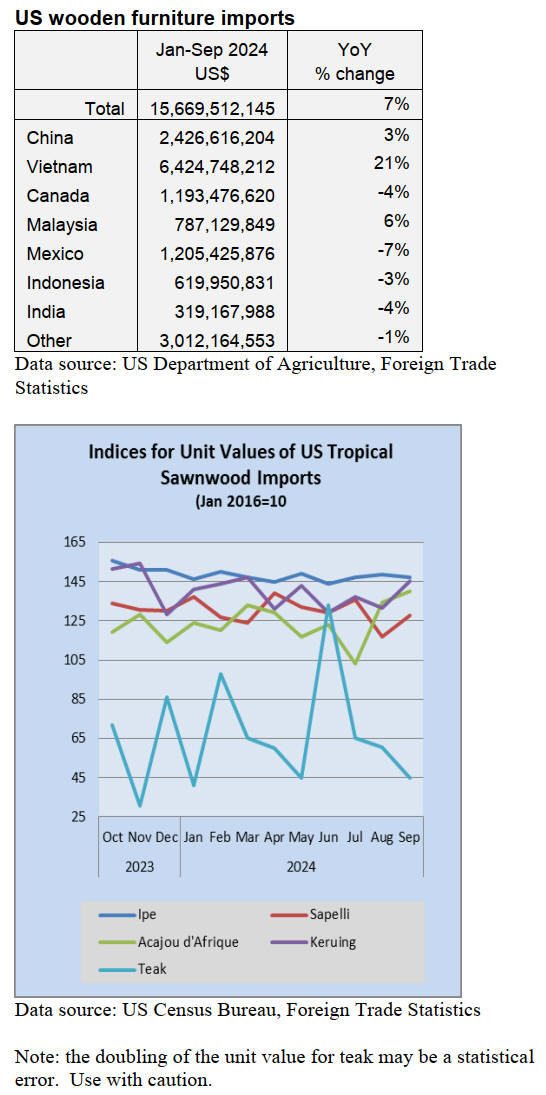

US wooden furniture imports also hit a two-year high

US imports of wooden furniture moved higher in

September, rising 6% over the previous month. The gain

pushed imports to their highest level since September

2022, which was the last time monthly imports were above

US$2 billion.

The US$1.85 billion of wooden furniture imported in

September, while not quite back to 2022 levels, was an

impressive 19% better than September of last year.

Imports from Vietnam and Canada were both up 14%,

while imports from India and Indonesia both rose more

than 25%. Total imports of wooden furniture for 2024 so

far are up 7% over 2023.

On a seasonally adjusted basis, sales at furniture and home

furnishings stores were down 1.4% in September from the

previous month, and down 2.2% from September 2023,

according to the latest survey by Smith Leonard. Sales

were also down 5.1% for year-to-date September 2024

compared to the same period for 2023 on an unadjusted

basis.

New orders for residential furniture dropped 7% in August

compared to 2023 figures, continuing the trend of year-

over-year declines in growth, according to the October

issue of Furniture Insights. Approximately 40% of the

survey participants reported increased orders in August

compared to a year ago.

New orders were up 12% compared to July figures, and

are up 1% for the year-to-date, “though that spread has

continued to narrow with the last four months’ declines,"

said Mark Laferriere. assurance partner at Smith Leonard.

Laferriere added that the mood of the market seemed to be

largely positive, though the US elections and potential for

tariffs were also on many people’s minds.

|