US Dollar Exchange Rates of

10th

Nov

2024

China Yuan 7.18

Report from China

Vietnam launches anti-dumping probe on Chinese

fibreboard

In September the Ministry of Industry and Trade in

Vietnam issued Notice (No. 2549/QD-BCT) stating that,

in response to the application submitted by five

Vietnamese producers, an anti-dumping probe was

initiated on wood fibreboard originating in China and

Thailand.

The Vietnamese tax codes of the products involved are

4411.12.00, 4411.13.00, 4411.14.00, 4411.92.00,

4411.93.00 and 4411.94.00.

The Vietnam Wood Composite Panel Manufacturers

Union has claimed wood fibreboard products from China

and Thailand are being dumped into the Vietnamese

market at very low prices causing serious damage to local

manufacturers.

See: http://cacs.mofcom.gov.cn/article/ajycs/ckys/202409/181921.html

English versions of national standards on wood-based

panels released

It has been reported that English versions of two National

Standards on the Formaldehyde Emission Classification

for Wood-Based Panels and Products and Indoor Load

Limit Guide for Wood-based Panels have been released.

These two Standards are important guidelines in

formaldehyde emission limits and indoor load limits for

wood-based panels.

The National Standard on the Formaldehyde Emission

Classification for Wood-Based Panels and its Products is a

refinement and supplements the mandatory national

standard GB 18580-2017 Formaldehyde Emission Limits

in Wood-Based Panels and Its Products for Interior

Decoration Materials.

These changes are aimed at promoting the production of

wood-based panels in order to meet consumer demand for

‘green wood-based panels’ and to promote the ‘green’

development and transformation and upgrading of the

wood-based panel industry.

The National Standard on ‘Indoor Load Limit Guide for

Wood-based Panels’ based on the limit for formaldehyde

emission provides guidance for the use of a number of

wood-based panels in interior decoration which is of

significance for protecting consumer health, eliminating

indoor environmental pollution and promoting the healthy

development of the wood-based panel industry.

Listed trading of log futures and options

In late October the Dalian Commodity Exchange (DCE)

released notices on the listing and trading of log futures

and options. The subject of the transaction is coniferous

logs and provides a risk management tool for the timber

industry.

Log futures will be listed on 18 November 2024 followed

by log options on 19 November 2024. Currently there is

no night trading session for log futures and options.

After the listing of log futures and options Dalian

Commodity Exchange will ensure the smooth operation of

the market and create a joint force with all parties to

continuously enhance timber industry participation.

They will also continue to enhance the influence of log

futures prices in domestic and foreign market and enhance

the ability to serve the high-quality development of

China's timber industry.

See: http://news.10jqka.com.cn/20241108/c663324743.shtml

and

http://m.dce.com.cn/DCEENMO/Media_Center44/Exchange_Ne

ws9/8620708/index.html

Policies to encourage consumption and house

renovation

China introduced preferential policies to encourage

consumption of interior decoration items and to promote

housing renovation.

Since the release of the “Action Plan to Promote the

Replacement of Old Consumer Goods with New Ones’ in

China all parts of the country have responded to this

national call to carry out the renewals by replacing old

household items.

In terms of promoting the "refresh" home improvement

for kitchens and bathrooms subsidies have been provided

to encourage decoration consumption and promote

housing transformation in the provinces of Anhui,

Shandong, Guangdong, Zhejiang, Guangxi Zhuang

Autonomous Region, Jiangsu, He’nan, Fujian and

Liaoning.

The maximum subsidy per house is not more than

RMB20,000 for the purchase of furniture and decorative

materials. Furthermore, the use of subsidies for purchasing

green building materials and home improvement products,

smart homes and house improvement suitable for the

elderly living will be encouraged.

In order to accurately implement the subsidies the

authorities will adapt implementation on the basis of local

realities and the details of subsidies may be changed. In

the home market many home furnishing companies have

begun to increase corporate subsidies on the basis of

government subsidies, launch new home furnishing

packages targeted to cater to the market.

As much of home decoration is of wood products the

wood-based panel sector benefits from this initiative. The

subsidy policy is a gradual process and it is believed that

under the continuous implementation of local policies

consumption will be stimulated. Local obserevers

comment that wood-based panel enterprises should also be

prepared to actively cooperate with the implementation of

local policies, introduce relevant marketing measures and

link dealers around the country to revive their own

development.

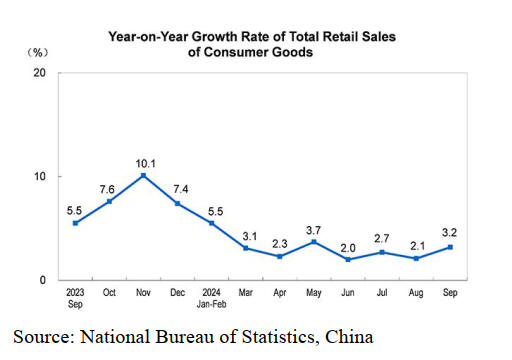

Retail sales of consumer goods

In a press release the National Bureau of Statistics has

reported in September retail sales of consumer goods

increased by 3.2% year on year. Between January and

September online retail sales nationwide reached 10,892.8

billion yuan, up by 8.6% year on year.

See:

https://www.stats.gov.cn/english/PressRelease/202410/t2024102

5_1957147.html

Rise in log imports from US

According to China Customs between January and

September this year China’s log imports from the US rose

4% to 1.66 million cubic metres. However, China's total

log imports fell 4% to 27.52 million cubic metres in the

same period. The decrease mainly resulted from a decline

in log imports from the top suppliers, PNG, Germany and

Russia. China's log imports from Germany fell the most

(as much as 60%). China’s log imports from PNG and

Russia dropped 11% and 12% respectively over the same

period.

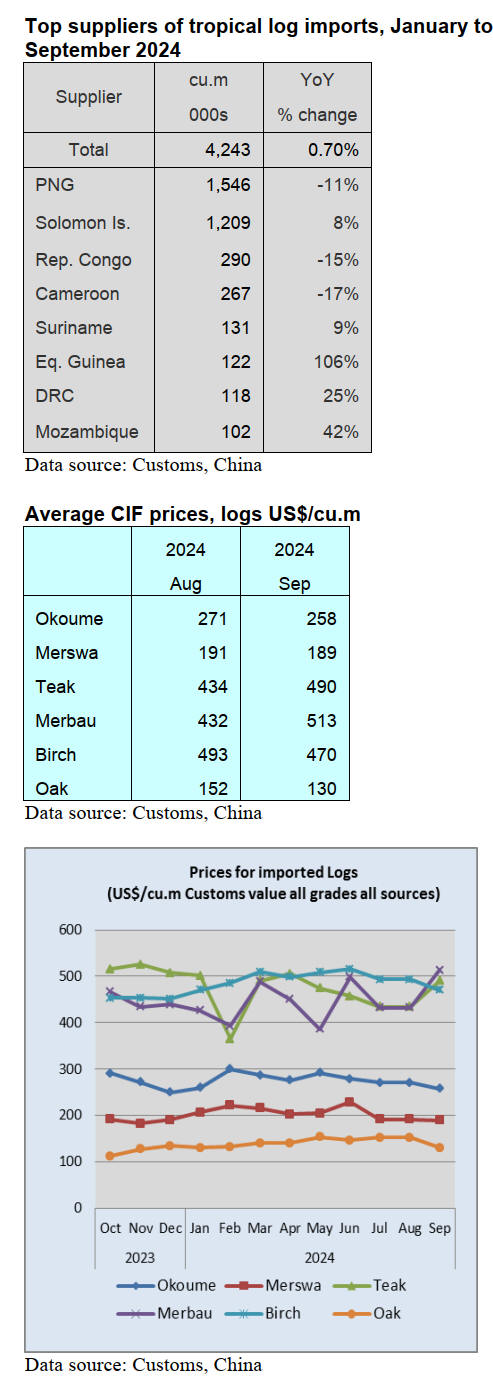

Slight rise in tropical log imports

According to China Customs, tropical log imports rose

0.7% to 4.243 million cubic metres between January and

September 2024. China’s tropical log imports from PNG,

the largest supplier, fell 11% year on year to 1.55 million

cubic metres between January and September 2024 and

tropical log imports from the Republic of Congo and

Cameroon dropped 15% and 17% respectively year on

year.

In contrast, China’s tropical log imports from Equatorial

Guinea more than doubled to 122,000 cubic metres

between January and September 2024 compared to the

same period in 2023.

China’s tropical log imports from Solomon Islands,

Suriname, DRC and Mozambique rose 8%, 9%, 25% and

25% respectively over the same period.

|