Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Nov

2024

Japan Yen 154.63

Reports From Japan

Rising raw material costs

driving inflation

Wholesale inflation accelerated in October as renewed yen

weakness drove up import costs. Bank of Japan data

showed the corporate goods price index (CGPI), which

measures the price that companies charge each other for

goods and services, rose 3.4% in October from a year

earlier, above market forecasts for a 3.0% rise.

An increase in the price of rice, coupled with the

increasing cost of nonferrous metals, food and oil, pushed

up overall wholesale inflation, a sign companies remained

under pressure from rising raw material costs.

The Bank of Japan has signaled readiness to raise interest

rates further if inflation becomes driven more by robust

domestic demand and higher wages, rather than rising raw

material costs.

See: https://www.msn.com/en-ph/news/money/japan-s-

wholesale-inflation-jumps-in-oct/ar-AA1u1sQG

Retail sales up only 0.5% from a year ago

Factory output rose slightly in September as the economy

continued its modest recovery. The Ministry of Economy,

Trade and Industry reported that industrial production

gained 1.4% from August, led by cars and chemical

product-makers.

That beat estimates for a 0.8% increase, but output was

still down 2.8% from a year ago.

For the third quarter 2024 production slipped 0.4% from

the previous period. The ministry also reported retail sales

fell 2.3% in September from August, leaving them up only

0.5% from a year ago.

Manufacturing was held back by stagnation in

employment levels, a renewed fall in purchasing activity.

Manufacturers report input costs continue to rise but at a

slower rate than recently. Despite this, manufacturers have

raised their selling prices to the greatest extent in three

months.

See:

https://www.japantimes.co.jp/business/2024/10/31/economy/japa

n-factory-output-sept/

and

https://www.pmi.spglobal.com/Public/Home/PressRelease/a02e5

829aad74c0296ea350e883007c2

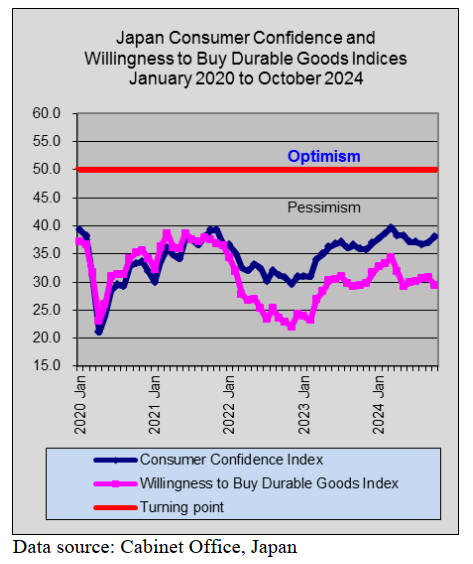

Households cut spending again as prices rise

According to a report from the Ministry of Internal Affairs

and Communications households in Japan cut spending for

a second month as rising prices continue to deter

consumption.

Spending by households dropped 1.1% from a year earlier

in September after dropping almost 2% in the previous

month. An increase in spending has only been recorded

twice in the past 12 months and this trend is a signal to the

Bank of Japan to take a cautious approach to interest rate

hikes.

Dollar strength drove the yen to a three-month

low

The Republican Party’s victory in the US presidential

election resulted in a strengthening of the US dollar as

expectations of tax cuts and tariffs on imports drove

optimism about economic growth, at the same time raising

concerns on inflation rates. The dollar strength drove the

yen to a three-month low of 155.

The weak yen boosts exports and in a bonus for tourism

but it forces up the cost of fuel and food import costs.

See: https://www.reuters.com/markets/asia/trump-victory-

heightens-risks-boj-yen-renews-slide-2024-11-07/

Residential property price index up from a year

earlier

The latest Global Property Guide (GPG) ‘Japan

Residential Real Estate Market Analysis 2024’, quoting

Land Institute of Japan data, says residential property

prices in Japan continue to increase modestly despite

slowing demand, weakening construction activity as well

as the disappointing economic performance.

In the first quarter of 2024, the nationwide residential

property price index rose by 2.65% from a year earlier,

following year-on-year increases of 1.96% in the final

quarter of 2023 2.54% in the third quarter, 4.78% in the

second and 4.12% in the first. However, adjusted for

inflation, prices were more or less steady over the same

period.

The GPG report says residential construction activity is

falling. In the first five months of 2024 the total number of

housing starts in Japan dropped 3.8% to 323,445 units as

compared to a year earlier following a decline of 4.5% in

the full year of 2023 and increases of 0.5% in 2022 and

5% in 2021, according to the Ministry of Land

Infrastructure and Tourism.

In six major cities residential land prices rose by almost

1% in the year to September from a year earlier. For

the rest of the country residential land prices were up 0.7%

for the year

See: https://www.globalpropertyguide.com/asia/japan/price-

history

Furniture retailer success in Southeast Asia

One of Japan’s largest furniture retailers has been doing

well with sales at its outlets in the Philippines and this is

encouraging the company to widen investment in retail

stores in other markets. The furniture chain, which has

outlets around Japan, started its first store in the

Philippines earlier this year as it drives for growth beyond

its domestic business were retail growth has slowed.

See: https://asia.nikkei.com/Business/Retail/Japan-s-Nitori-says-

racking-up-bigger-than-expected-Philippine-sales

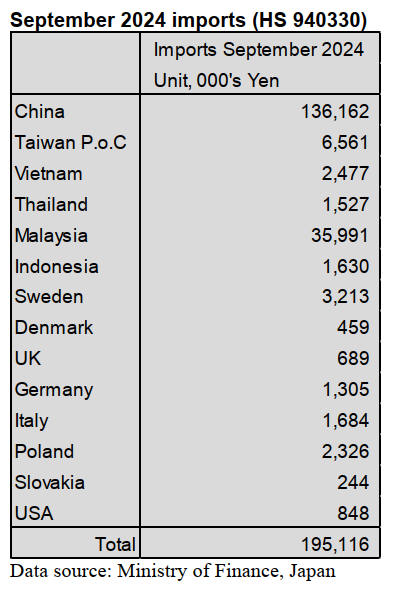

September 2024 wooden office furniture imports (HS

940330)

Year on year, the value of Japan’s imports of wooden

office furniture in September was down 10% and

compared to a month earlier the value of imports dropped

around 14% in September.

China accounted for most of wooden office furniture

imports to Japan in September at around 69% of the total

value of imports of HS940330. The other main shipments

in September were Malaysia and Taiwan P.o.C. In August

the value of shipments from Italy were second after China

but in September the value of shipments was sharply

down.

Arrivals of wooden office furniture from Malaysia

increased in September rising 80% compared to the value

of August shipments.

September 2024 kitchen furniture imports (HS

940340)

The value of arrivals of wooden kitchen furniture

(HS940340) in September declined month on month but

the pace of decline seen in previous months slowed in

September. Year on year, the value of imports of wooden

kitchen furniture items (HS940340) in September were

marginally down on the level seen in August.

The top shipper in September was the Philippines and the

share of the Philippines in the total value of arrivals rose to

53% from the 44% in August reflecting the 23% month on

month surge in shipments. Sippers in China secured the

third place ranking in terms of the value of shipments and

saw a 20% plus rise in their value of shipments to Japan.

In August Italy featured as major shippers of wooden

kitchen furniture but the value of shipments from Italy was

down sharply in September as many manufacturing plants

in Europe were still closed for the summer holidays.

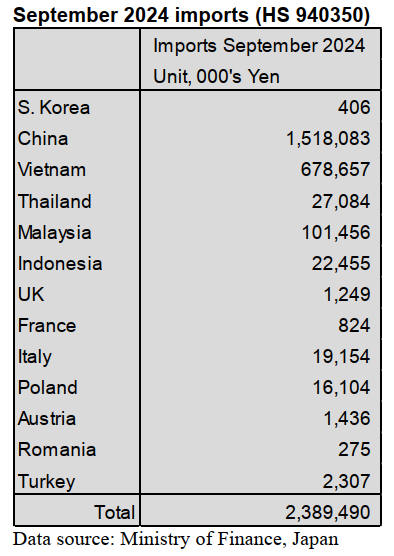

September 2024 wooden bedroom furniture imports

(HS 940350)

From mid-2024 there has been a steady decline in the

value of Japan’s imports of wooden bedroom furniture

(HS940350) and this drop in the value of imports

continued into September. The most plausible explanation

for the long down trend is the end of the boom in

establishing accommodation for the wave of tourist

arrivals this year.

The top shippers of wooden bedroom furniture to Japan in

September were China (64% share of September import

values) Vietnam (28%) and Malaysia (4%). Italy and

Poland were significant shippers in August but this was

not the case in September. Month on moth the value of

September arrivals of wooden bedroom furniture was little

changed from the value of August arrivals up year on year

the value of September 2024 arrivals were down 8%.

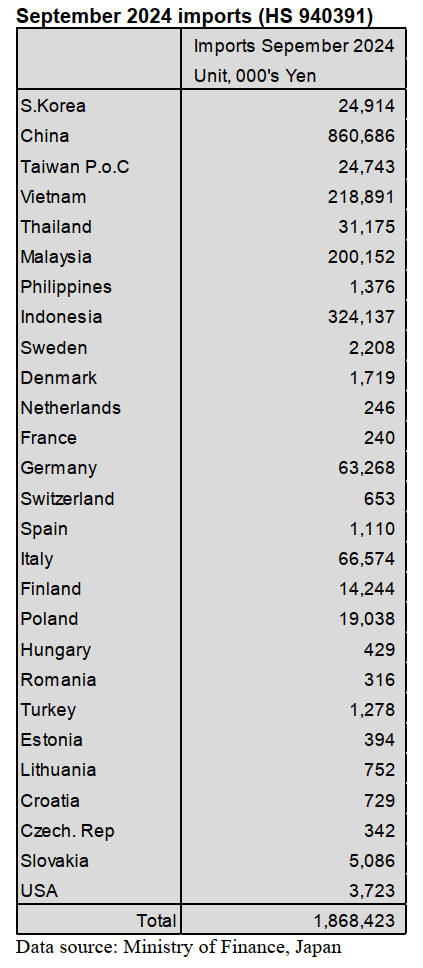

September 2024 wooden furniture parts imports (HS

940391)

Japan imports wooden furniture parts from a large number

of suppliers and while suppliers in Asia account for a large

proportion of imports there are significant imports from

European member states.

The top four shippers in September were China (46% of

total HS940391 imports) Indonesia (17%), Vietnam (10%)

and Malaysia (10%). September arrivals from China were

up 8% month on month but arrivals from Indonesia were

down 6%. Arrivals from both Vietnam and Malaysia were

down month on month but shippers in Germany, Italy and

Thailand did well in September.

Year on year, the value of September imports of wooden

furniture parts into Japan was down 9% but, compared to

August arrivals in September were almost unchanged.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Restart operation to produce domestic lamina and

wooden chip

Kawai Ringyou Co., Ltd. in Iwate Prefecture has

completed renewal work on production lines for domestic

lamina and wooden chips at its one of plants, Shizukuishi

plant, and started an operation.

The plant will be able to consume 1,200 – 1,300 cbms of

logs by one shift in a day. Monthly consumption of logs

will be about 30,000 cbms and annual consumption will be

360,000 cbms.

To respond Work Style Reform and to solve s labor

shortage, the company decided to renew the equipment at

the plant. The company will manufacture large diameter

cedar logs for Wooty Kawai Co., Ltd.’s domestic

laminated structural lumber to expand supply. Wooty

Kawai is one of Kawai Ringyou’s related companies in

Iwate Prefecture.

The former Shizukuishi plant used to consume about

200,000 cbms of logs annually and it had been fifteen

years in an operation. The company decided to remove all

equipment at the plant and built a new plant on site

adjacent to the former plant. Then, the company installed

cutting edge production lines. The new equipment is able

to consume about 1,000 cbms of logs by one shift in a day.

3.65 m or 4 m length and 14 – 50 cm diameter of logs are

put into the new equipment.

As for manufacturing large diameter logs, about 250 cbms

of logs will be consumed by one shift in a day. The length

of logs will be 2 m, 3.65 m and 4 m. The diameter of logs

will be 20 – 80 cm. There are 36 employees including

office staff at the plant and the company did not increase

or decrease the employees. All edged tools at the plant are

polished by the company. Now, 4 m log occupies 95 % of

all products and large diameter log occupies 20 – 30 %. 95

% of cedar log is used and 5 % of larch is used at the

company. However, the company will expand consuming

more Japanese red pine and Larix.

Production of domestic structural lumber of Wooty Kawai

in 2023 is about 90,000 cbms and it will be 108,000 cbms

in 2024.

Plywood

Inquiries to domestic plywood for recutting recovered in

September and October 2024 and shipment was

increasing. Workdays in October are more than September

so and the actual demand increased. Movement of

domestic plywood recovers but the price of domestic

softwood plywood is in a bearish tone and has not

bottomed out.

Prices for 12mm 3 x 6 domestic structural softwood

plywood decreased to 1,030 – 1,050 yen delivered per

sheet in the middle of October 2024 in the Tokyo

metropolitan area.

The price in some local areas was 1,000 yen, delivered per

sheet. One of reasons for, the decrease is that there had

been competitions between precutting plants to get orders.

Also, there were battles over market share of plywood

between plywood manufacturers due to the less new starts.

The price of 12 mm painted plywood for concrete form

from Malaysia was USUS$20, C&F per cbm high in

August and September, 2024.

Some thin plywood made of natural wood from Indonesia

is USUS$50, C&F per cbm, high and medium thickness

plywood is USUS$20, C&F per cbm high.

A ringgit and a rupiah are strong against the U.S. dollar in

October, 2024 and manufacturers in Malaysia and

Indonesia have less profits. They expect to raise the selling

price of plywood strongly.

12 mm 3 x 6 painted plywood for concrete form is

USUS$600 – 620, C&F per cbm. Plywood form is

USUS$510 – 530, C&F per cbm. Structural plywood is

USUS$520 – 540, C&F per cbm. These prices are

stabilized from last time.

Domestic logs and lumber

Movement of domestic lumber is also sluggish in October,

2024. In northern part of Kanto, there are still logs which

are damage from insects.

Production of raw logs is low and the inventories of cedar

and cypress logs are decreasing. Some lumber plants are in

a precarious day-to-day situation due to less logs.

However, there are fresh logs and the log market has been

rising. Cypress sills and posts are in short supply. KD 105

mm cypress sill is 70,000 yen, delivered per cbm. KD 105

mm cypress post is around 67,000 yen.

The log price in the northern part of Kanto is skyrocketing.

The inquiries do not increase even though the lumber

market is low due to less logs.

Cedar log for a post is 15,000 yen, delivered per cbm in

Tochigi Prefecture. Medium sized cedar log is 16,800 yen,

delivered per cbm and this is 2,000 yen more than last

month.

Cypress log for a post is 18,000 yen, delivered per cbm

and for a sill is 20,800 yen, delivered per cbm. This is

1,000 yen higher than the previous month.

Medium sized cypress log is 25,000 yen, delivered per

cbm and this is 5,000 yen higher than last month.

3.65 m cedar log is 12,000 yen, delivered per cbm in

Akita Prefecture. 3 m cedar log for a post is 14,000 yen,

delivered per cbm in Kyushu region and this is leveled off

from last month. 4 m cedar log is 14,500 yen, delivered

per cbm and this is 500 yen less than last month.

3 m cypress log for a post is 19,000 yen, delivered per

cbm in Chugoku region and this is 1,000 yen down. 4m

cypress log for a sill is 20,000 yen, delivered per cbm and

this is 500 yen down.

Slight rebound in PKS price

The price of PKS, which is imported fuel and consumed at

woody biomass power plants or thermal power plants,

increased slightly in South Asia.

The spot price of Indonesian certified PKS in August,

2024 was US$80, FOB per ton. However, the spot price

increased to US$85-90, FOB per ton in September and

increased to US$90-95, FOB per ton in October, 2024.

Some South Asian shippers offered US$100, FOB per ton.

The spot price of Vietnamese wooden pellet is US$128-

130, FOB per ton in Vietnam and this is US$3-5 more

than the previous month.

The reason for the price hike is that production of PKS

decreased because heavy rain occurred in Indonesia and

Malaysia. It was the best time for harvesting palm trees.

Palm oil plants and South Asian shippers raised the spot

price. The futures price of PKS is US$120-128, FOB per

ton in South Asia.

The inventory of imported fuels such as PKS or wooden

pellets in Japan was once over-stocking but the inventory

is proper volume. There are inquires for imported fuels to

trading companies. However, the fire occurred at a large

wood biomass power plant and the operation was stopped

so demand for imported fuels has not fully recovered yet.

Also, there were failures at other wood biomass power

plants and it is unable to start an operation.

On the other hand, the spot price of Vietnamese wooden

pellet is gradually rising due to a typhoon, which

influenced the production, in September, 2024. Also,

demand for wooden pellets in Europe has increased.

|