|

1.

CENTRAL AND WEST AFRICA

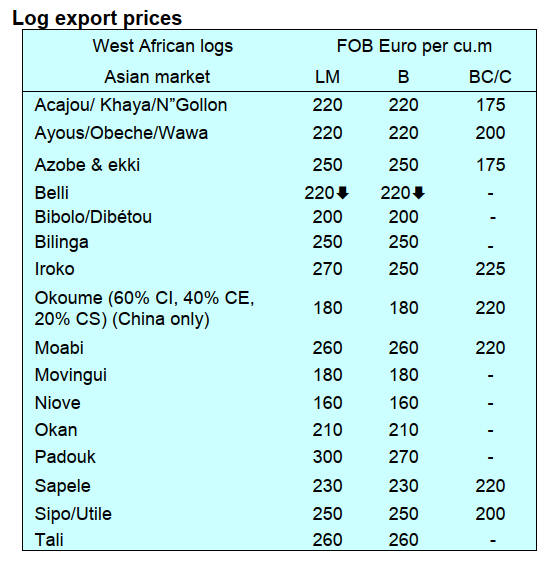

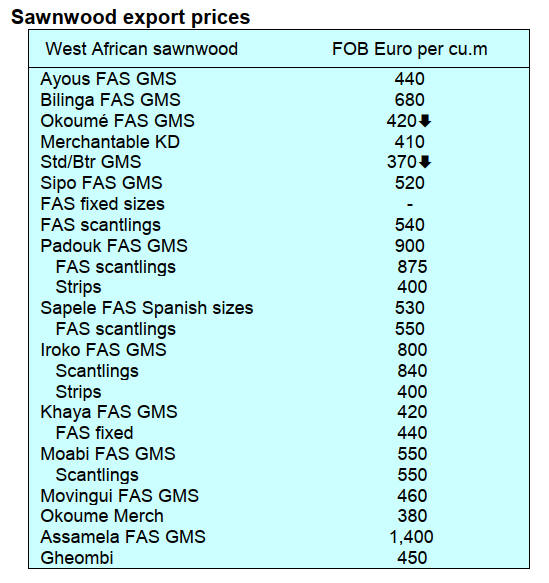

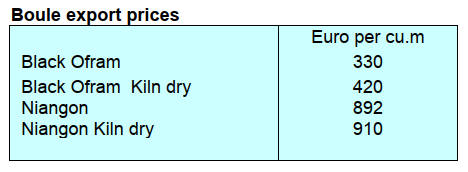

Trade sentiment

Over the past few months there has been little movement

on FOB prices across West and Central Africa. Okoume

has become more affordable while Iroko prices remain

stable in European and Middle East markets. Tali

continues to perform well, particularly exports to Vietnam.

The main challenge at the moment is the lack of recovery

in demand in China. It has been suggested the volume of

existing landed stocks in China may be sufficient for 8-12

months.

The veneer sector in the region has specific problem as

exporters are facing weak demand as the major importers,

India and China, have shifted to utilising domestic log

sources .

Shippers to Spain have observed a rise in Sapelli imports.

Importers in Portugal still source Sapelli and Tali. In

Asian markets imports of Okoume to the Philippines

remain stable.

Gabon

Trade sources report Gabon is considering an increase in

the forest land tax from 1,000 CFA per hectare to between

1,300 and 1,500 CFA per hectare. It has been suggested

that the increase is in response to declining revenue from

the forestry sector as some companies have reduced

production.

Operators report forestry regulations are being strictly

enforced. Every truck carrying timber is thoroughly

checked at the port to ensure compliance with regulations.

Companies attempting to circumvent regulations face

immediate suspension of their operations.

The main national highway, crucial for the transport of

timber from Cameroon has been severely damaged due to

heavy rain in up-country regions. The washout has

disrupted container haulage.

Power supplies continue to plague manufacturers. After a

period without power outages Gabon is now experiencing

intermittent electricity cuts every two days for several

hours which is affecting industrial operations and

production schedules.

Some relief may be on hand as dredging operations are

underway in the Port of Owendo to accommodate a

Turkish electricity generator vessel. This comes after an

agreement between Karpowership and the government of

Gabon. The Turkish floating power plant provider

continues to attract interest from other African countries in

need of quickly deployable on-grid capacity.

An article in Le Nouveau Gabon says in order to further

develop the timber sector a plywood plant will be

constructed by 2026 in the Special Industrial Zone (ZIS)

of Nkok. This project, led by the Indian company

Greenply, benefits from funding of 3.2 billion FCFA

provided by the government. This investment is part of the

government's efforts to develop the forestry and wood

processing sector, the second largest natural resource

development sector in the country after oil.

See: https://www.lenouveaugabon.com/fr/agro-bois/2910-20460-

zis-de-nkok-le-gabon-engage-greenply-pour-construire-une-

usine-de-contreplaques-de-3-2-milliards-de-fcfa

Cameroon

The Ministries of Forestry and Finance are implementing

stringent measures to control operations. Enhanced inter-

ministerial cooperation aims to reduce corruption and

ensure compliance with regulations.

This includes adherence to the Plan d'Aménagement

Opérationnel (PAO) and the requirement to follow the

Assiette de Coupe which mandates specific areas for

harvesting with clear markings on logs and sawn timber.

Non-compliance can result in immediate suspension of

operations.

The government has launched a campaign to inspect all

companies including those in the timber industry. This

rigorous scrutiny aims to enforce compliance with

financial regulations, tax obligations and laws.

Port operations are also under tighter control, with checks

to ensure all forwarding charges and related fees are paid

before shipments can proceed.

News is circulating in forestry circles that several

companies have been found non-compliant and have been

compelled to cease operations. The closures have led to

significant job losses within the sector.

2.

GHANA

FLEGT consignments to EU in June 2025

The Minister for Lands and Natural Resources, Samuel A.

Jinapor, announced that Ghana will deliver its first

consignment of Forest Law Enforcement, Governance and

Trade (FLEGT) - licensed and labeled timber to the EU in

June 2025.

See: https://fcghana.org/ghana-set-to-deliver-flegt-licensed-

timber-to-the-eu/

The Minister disclosed this during the 12th session of the

Ghana-EU Joint Monitoring and Review Mechanism

(JMRM) of the Voluntary Partnership Agreement (VPA).

The FLEGT shipment, he said, would make Ghana the

first African country to reach this landmark placing it as

the only African nation on track to comply with the

European Union Deforestation Regulation (EUDR).

He added that this milestone will make Ghana the second

in the world after Indonesia to comply with the EU Forest

Law Enforcement Governance and Trade (FLEGT)

Regulation on timber and timber products.

The Minister expressed his gratitude to partners in the

European Union for their unwavering support and

collaboration. He also extended appreciation to all

stakeholders, including the Forestry Commission, the

Ministry of Lands and Natural Resources, the private

sector, civil society organisations and community

members acknowledging their invaluable expertise and

resources offered navigating the complexities of this

process.

The Ambassador of the European Union to Ghana, H.E.

Irchad Razaaly, stated that FLEGT licensing in Ghana is

ready to go live and the EU is prepared to receive the first

shipment in June next year and considered this a historic

moment for the EU and Ghana in the partnership that

began 15 years ago.

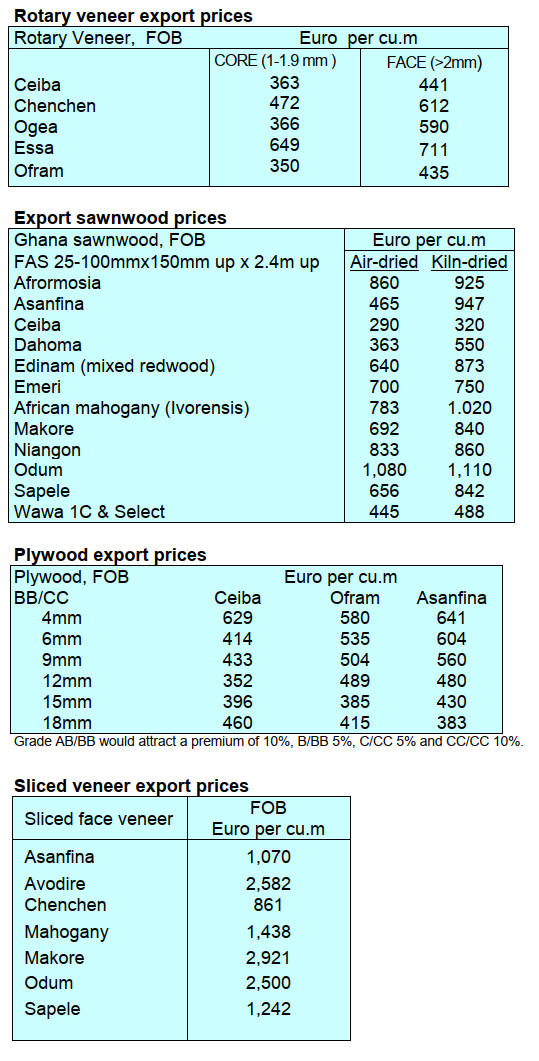

Five products – over 90% of exports

Ghana’s wood product export volume for the first eight

months of 2024 dropped by 10% to 182,542 cu.m from

203,133 cu.m in 2023 according to available data from the

Timber Industry Development Division (TIDD) of the

Forestry Commission.

Of the 182,542 cu.m, the leading products by volume were

air-dried sawnwood (104,783 cu.m), kiln-dried sawnwood

(24,135 cu.m), plywood (18,142 cu.m), billets (11,247

cu.m) and veneer (10,547 cu.m). Together these products

contributed 168,854 cu.m or 92.5% of the total export

volume for the period.

The TIDD data shows that, sawnwood and billets were

classified as primary products while plywood and veneer

were classified as secondary wood products.

Primary Products, which included air and kiln-dried

sawnwood, billets, boules, kindling, poles, roll board and

teak logs earned Eur47.92 million (58%) from 123,682

cu.m of total export earnings between January and August

2024. The figures represent decreases of 7% in volume

and 7% in value compared to the same period in 2023.

Secondary wood products comprising briquettes and

veneers earned the country Eur30.61 million (37%) from a

volume of 54,740 cu.m between January and August 2024.

These also recorded year on year decreases of 15% and

14% in volume and value respectively.

Tertiary wood products exports included mouldings and

dowels and earned Eur3.94 million (5%) from a volume of

4,120cu.m of the total wood products export earnings

between January an August 2024. This represented a drop

of 31% in volume and 23% in value against those of last

year.

Ghana obtained US$800m from carbon credit trading

The domestic media has reported Ghana earned US$800m

from carbon markets after trading with foreign countries

which included Sweden and Switzerland. President Akufo-

Addo disclosed this during the opening of the 29th

Conference of Parties (COP29) in Baku, Azerbaijan.

Ghana is on a target project to reduce its carbon emission

by 64 million metric tonnes of carbon dioxide equivalent

(MtCO2e) by 2030. The country has adopted 13 mitigating

actions intended to cut annual greenhouse gas emissions

by 43% since 2021.

The President indicated that, despite the financial and

technical hurdles, Ghana is determined to reach the Paris

Agreement goals in the areas of agriculture, forestry,

energy and other sectors and urged his peers the need to

take decisive measures to safeguard the environment.

In 2023, Ghana began receiving payments from the World

Bank for reducing emissions from deforestation and forest

degradation, known as the REDD+. While at COP28, the

country signed aUS US$50 million emission reduction

payment agreement with the Emergent Forest Finance

Accelerator Incorporated, a US-based non-profit

organisation under the Lowering Emissions by

Accelerating Forest Finance (LEAF) Coalition.

See: https://www.myjoyonline.com/ghana-mobilised-800m-

through-carbon-credit-trading-akufo-addo/

Eight percent growth for industry sector possible

According to the Ghana Statistical Service (GSS), the

year-on-year change in the Industrial Production Index for

the second quarter of 2024 was plus 8.2% signaling

positive expansion of industrial production. The growth

was driven by several sub-sectors, including mining and

quarrying, oil and gas, construction and manufacturing.

To maintain growth, Seth Twum Akwaboah Chief

Executive of the Association of Ghana Industries (AGI),

called for a conducive business environment for small

businesses to thrive. He expressed concern over

underutilisation of domestic production capacity and urged

stronger enforcement of trade policies to create a level

playing field for local manufacturers.

See: https://www.myjoyonline.com/iip-release-industry-sector-

grows-by-8-2-percent-in-q2-of-2024/

and

https://www.graphic.com.gh/business/business-news/ghana-

hosts-first-inclusive-business-forum-in-accra.html

3. MALAYSIA

Removing petrol subsidy could drive up transport

costs

Following Bank Negara Malaysia's decision to maintain

the overnight policy rate at 3% which marks 18 months of

rate pause, economists expect the Bank to leave the

benchmark interest rate unchanged throughout 2025..

The continued monetary policy stance is unlike other

countries in the region which have started to cut rates in

recent weeks. One of the reasons for this is said to be the

current strength of Malaysia's economy. The only possible

negative impact on growth would be a decision to

‘rationalise’ petrol subsidies. Analysts at OCBC Global

Markets Research estimate that, if implemented, retail

prices could rise sharply.

See: https://theedgemalaysia.com/node/733002

Private sector bamboo investment

Pertama Ferroalloys Co Ltd successfully hosted a bamboo

planting programme at its facility in Samalaju, Sarawak in

collaboration with the Sarawak Timber Industry

Development Corporation (STIDC). This initiative is

considered by company representatives as an important

step towards environmental sustainability within the

ferroalloy industry.

Yuki Nakamura, General Manager at Pertama Ferroalloys,

highlighted the reliance on materials such as wood

charcoal and cork but also acknowledged their efforts to

minimise their environmental footprint. Despite producing

220,000 tonnes of ferroalloys annually their commitment

to hydroelectric power allowed them to remain among the

lowest carbon (CO2) emitting ferroalloys producers.

See:

http://theborneopost.pressreader.com/article/281831469243228

In related news, the Vice-Chancellor of Universiti Putra

Malaysia (UPM), Prof. Dr. Ahmad Farhan Mohd Sadullah,

said the Sarawak State government aims to develop 10,000

hectares of commercial bamboo plantations and 2,000

hectares of community bamboo plantation by 2030.

Huge demand for activated carbon

Zainal Abidin Abdullah the General Manager of the

Sarawak Timber Industry Development Corporation

(STIDC) has said there is a huge demand for activated

carbon derived from biomass. He noted that to benefit

from this potential it will be important to develop a strong

framework for biomass research and foster collaboration

among government, industry and academia to enhance

Sarawak’s role in the renewable energy market.

He added that collaborative research between STIDC and

the Forest Research Institute Malaysia (FRIM) showed

that Sarawak’s biomass had excellent properties for

producing energy pellets. In 2023 Sarawak’s export value

for wood pellets reached RM44.474 million, almost

double that of the previous year mainly due to demand in

France, Japan and South Korea.

See: https://www.theborneopost.com/2024/11/07/sarawak-

forestry-corporation-forges-partnership-with-uaes-mubadala-

energy-for-environmental-conservation/

Plywood exports to India

The Ministry of Commerce and Industry India had several

months ago announced that the export of panel products to

India is subject to the Mandatory Bureau of Indian

Standards (BIS) Certification requirements from 28

February 2025. The Malaysian Timber industry Board

(MTIB) has provided information on the Indian Standard.

see:

https://www.mtib.gov.my/index.php/en/announcement/penanggu

han-dan-tarikh-baharu-pelaksanaan-mandatory-indian-standard-

oleh-bureau-of-indian-standards-bis-untuk-eksport-produk-panel-

ke-india

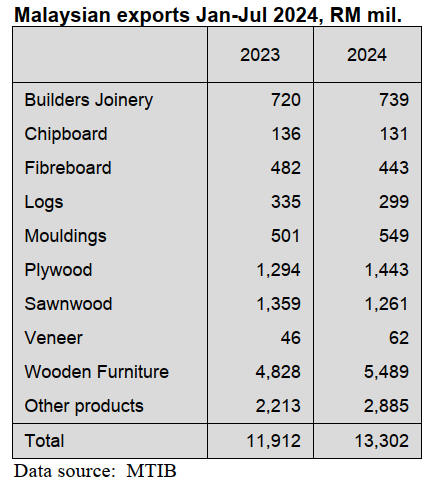

Export update

In the first seven months of 2024 the value of wood

product exports rose 11% year on year on the back of

increased exports of wooden furniture (+14%). Export

earnings from logs, sawnwood and composite panels

declined year on year.

4.

INDONESIA

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90); US$1,500/cu.m.

See: https://forestinsights.id/kemendag-tetapkan-hpe-produk-

kayu-november-2024-harga-patokan-ekspor-kayu-hutan-

tanaman-naik/

Ministry preparing task force to bolster forest

protection

The Minister of Forestry, Raja Juli Antoni, has reported

the ministry is in the process of forming a palm oil task

force to strengthen the supervision and protection of forest

areas.

"Through the task force, we can make an agreement, data

reconciliation, (determine) which data is the most valid,

the maximum fine for state revenue and everything can be

discussed in the task force," he explained. Antoni

informed that he and the Head of the Financial and

Development Supervisory Agency (BPKP), Muhammad

Yusuf Ateh, discussed the plan to form the task force .

In related news, the Minister confirmed his commitment to

implementing the forest protection targets set by President

Prabowo Subianto's initiative. He emphasised that law

enforcement will be a priority.

In a meeting at the Attorney General's Office

strengthening law enforcement in forest protection was

discussed. The minister emphasised that the government

will establish a task force for law enforcement to protect

Indonesia's forests. The prosecutor's office will participate

in this task force.

Attorney General, Sanitiar Burhanuddin, stated that they

openly accepted collaboration as a means of enhancing

inter-institutional coordination. The Attorney General’s

Office has also engaged with various ministries to bolster

law enforcement efforts.

The National Police Chief General Listyo Sigit Prabowo

stated the police and the Ministry of Forestry will

collaborate to ensure the security of Indonesia's forests by

exchanging essential information and data.

See: https://en.antaranews.com/news/332453/ministry-preparing-

task-force-to-bolster-forest-supervision

and

https://www.metrotvnews.com/read/kpLCWdOw-menteri-

kehutanan-temui-jaksa-agung-bahas-penguatan-penindakan-

perusak-hutan

and

https://www.antaranews.com/berita/4441905/kapolri-kemenhut-

bekerja-sama-jaga-hutan-indonesia

Ministry and Armed Forces – co-operation

The Ministry of Forestry and the National Armed Forces

(TNI) Headquarters are planning to sign a memorandum

of understanding which will serve as the basis for

cooperation and collaboration between the two agencies.

The MoU will include cooperation in rehabilitating

damaged forests including replanting deforested areas.

"Considering the limited human resources that we have the

success of the Ministry of Forestry in protecting forests is

very dependent on cooperation and collaboration with the

TNI which has a wide network reaching remote villages,"

said the Minister.

See: https://en.antaranews.com/news/332837/minister-antoni-

seeks-tni-support-to-protect-forests

Opportunity to increase exports to the United States

Some wood product manufacturers are of the opinion that

with the change of government in the US wood product

imports from China may decline presenting an opportunity

for Indonesia to boost its exports.

Abdul Sobur, the General Chairperson of the Indonesian

Furniture and Crafts Association (Himki), stated that

Indonesia has the opportunity to boost its exports to the

US under this condition. However, increasing Indonesian

furniture and craft exports to the US presents challenges.

Indonesia faces competition from countries like Vietnam,

Malaysia, Canada and Mexico, all of which have also

recognised this market opportunity.

Notably, Vietnam stands out as a significant competitor

due to its well-developed infrastructure and proactive

export policies. Another challenge has emerged is the

"America First" initiative which emphasises domestic

products which, said Sobur, may hinder export

opportunities particularly if the US enforces stricter import

regulations. For this reason, Sobur suggested that

Indonesia must take full advantage of export cooperation

agreements such as the Indonesia-Australia

Comprehensive Economic Partnership Agreement (IA-

CEPA).

See: https://industri.kontan.co.id/news/pengusaha-mebel-dalam-

negeri-wanti-wanti-kebijakan-proteksionisme-donald-trump

Encouraging access to the UKM BISA export

programme

The Minister of Trade, Budi Santoso, stated that the

Ministry is working to boost furniture exports and expand

into the global market and this is crucial because furniture

is a key export product of Indonesia.

Consequently, the Ministry of Trade continually supports

the SMEs’ Dare to Innovate, Ready to Adapt to Exports’

(UMKM BISA Export) programme. The UKM BISA

Export programme aims to enhance competitiveness,

innovation and adaptability to global market demands.

“To support the UKM BISA Export initiative, the Ministry

of Trade is working to enhance market access for

Indonesian products in the global market. This effort

includes several actions, such as facilitating business

participation in international product exhibitions, engaging

in trade missions, and leveraging Indonesia's trade

agreements with partner countries" said the Minister.

The Minister stated "business representatives can take

advantage of over 40 trade representatives from the

Ministry of Trade stationed overseas who are responsible

for promoting domestic products,"

Specifically for rattan furniture the Ministry of Trade will

assist rattan furniture SMEs to increase exports. "Our

support will include the creation of unique rattan designs

and prototypes to enhance their acceptance in the global

market as well as opportunities for exhibitions overseas"

said Minister Budi.

See: https://wartaekonomi.co.id/read548337/tinjau-ukm-furnitur-

mendag-ungkap-sejumlah-langkah-dorong-ukm-bisa-ekspor

and

https://www-kemendag-go-id.translate.goog/berita/foto/mendag-

pada-forum-dialog-peningkatan-umkm-bisa-

ekspor?_x_tr_sl=id&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Social Forestry - calls for multi-stakeholder

collaboration

A recent forum urged a better multi-stakeholder

collaboration to engage communities in managing local

forests aligned with Indonesia's climate goals. According

to the Director of the Regional Community Forestry

Training Centre for Asia and the Pacific (RECOFTC)

Indonesia, Gamma Galudra, communities can still make

more use of forest resources to improve their welfare.

He then called for collaboration between social forestry

groups and other stakeholders such as companies, non-

governmental organisations and academia as this can help

pave the way for better management of social forestry

programmes especially in terms of improving human

capital and institutional capacity as well as developing

business aspects.

See: https://jakartaglobe.id/special-updates/social-forestry-calls-

for-multistakeholder-collaboration

and

https://investor.id/national/379608/kolaborasi-multipihak-untuk-

tata-kelola-perhutanan-sosial

Innovative funding to support conservation activities

The Indonesian government is in the process of preparing

a regulation that will allow for funding innovations aimed

at supporting conservation activities as part of the Law on

Conservation of Biological Natural Resources and

Ecosystems (KSDAHE). Satyawan Pudyatmoko, the

Director General of Natural Resources and Ecosystem

Conservation (KSDAE) at the Ministry of Forestry stated

that there is a significant funding gap for biodiversity

management.

He highlighted that an estimated Rp33.6 trillion is needed

annually but the available funds amount to only Rp10.2

trillion, which includes allocations from the State Budget.

He mentioned that there is potential funding, including

grants from various international sources in line with the

global commitments.

See: https://www.antaranews.com/berita/4444033/kemenhut-

siapkan-aturan-inovasi-pendanaan-dukung-kegiatan-konservasi

5.

MYANMAR

Yangon’s population increases – house rents surge

The conflict in Myanmar is driving up housing demand in

Yangon. Residential property rents have soared and home

prices have risen as people in remote border regions seek

the relative safety of the city. The United Nations’ refugee

agency estimates that some 3 million people have been

displaced by fighting.

It has been estimated that Yangon’s population has risen

from around 5.5 million to as high as 10 million leading to

a shortage of housing

See: https://www.rfa.org/english/news/myanmar/myanmar-

yangon-real-estate-price-increase-10182024144056.html

Agriculture faces mounting challenges

Agriculture remains a critical pillar for Myanmar’s

economy providing livelihoods and food security for

millions. After a strong recovery in 2023, when agriculture

emerged as Myanmar’s best-performing economic sector

with a 2% growth, the sector is facing new and worsening

challenges. These include labor shortages driven by

conscription-linked migration, price controls on farm

products, suspension of agricultural loans and the fighting.

This situation has been made worse by the severe flooding

in September.

The UN Development Programme (UNDP) warns that a

combination of restricted trade, declining food production

and intensified conflict has created a “perfect storm” that

threatens to plunge the region into severe food insecurity.

A press release from the UNDP highlights the dwindling

human capital saying “the conflict and economic strife are

accelerating the degradation of Myanmar’s human capital.

Essential services like healthcare, education and access to

clean water and sanitation are becoming luxuries out of

reach for many with nearly 25% of children no longer

attending school. The healthcare systems are strained to

breaking point”.

The UNDP statement continues “a mass exodus of skilled

workers is depleting the nation’s productive capacity,

exacerbating the long-term effects of this crisis.”

See https://www.undp.org/asia-pacific/publications/rakhine-a-

famine-in-the-making

and

https://news.un.org/en/story/2024/11/1156676

6.

INDIA

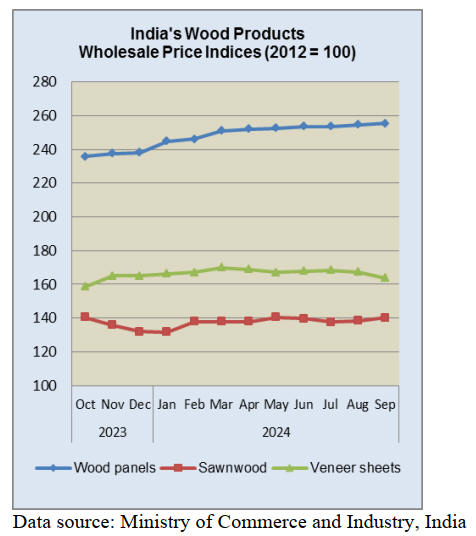

Wood based panel price

increase push up index

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 1.84% for September 2024. The

positive rate of inflation in September was primarily due

to increase in prices of food and food products, other

manufacturing, motor vehicles, trailers and semi-trailers

and machinery & equipment.

Out of the 22 NIC two-digit groups for manufactured

products 10 groups witnessed an increase in prices, 9

groups witnessed a decrease in prices and 3 groups

witnessed no change.

Some of the important groups that showed month on

month increase in prices were food products, other

manufacturing, other non-metallic mineral products,

computers and electronics, optical products and clothes.

The WPI for woodbased panels continued to rise as did the

WPI for sawnwood but the price index for veneers

declined marking two consecutive monthly drops.

Some of the groups that witnessed a decrease in prices

were basic metals, textiles, motor vehicles, trailers and

semi-trailers, chemicals and chemical products and

fabricated metal products.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Pine logs accepted for plywood core veneer

production

The correspondent reports that the switch to pine log

peeling for the production of plywood core veneer has

emerged as a survivor for this sector. Reports says that

after successful trials in Kandla based plywood mills pine

logs are now utilised in North India plywood mills.

The Indian plywood industry has been struggling due to

the high prices of plantation poplar and eucalyptus where

prices reached an all-time high in 2024. The impact of the

surge in prices resulted in some mills in North India either

reducing production or even closing mills.

It is understood that MDF manufacturing units are also

considering the use of the lower priced pine as a raw

material option.

In the past plywood sector observers suggested that few

mills would utilise pine logs for plywood manufacturing

but nowadays pine is being used but unfortunately some

people are resisting the change away from the convention

of using eucalyptus and poplar but recently pine logs are

being sold in greater volumes.

It has been observed that pine logs have started to be used

in mills in the Delhi-NCR area and in states of Yamuna

Nagar, Uttar Pradesh and Punjab.

Manufacturers welcome the change to pine as this helps

check the rising production costs which have been driven

up by the high prices of poplar logs which, in part, reflects

declining availability. Manufacturers are becoming more

confident as the issue of log supplies has eased and pine

wood for core veneer is gaining acceptance. There is also

an advantage in that plywood with a pine core is lighter

weight and the yield of veneers is higher with pine logs.

Plywood from Vietnam

The October Ply-Reporter magazine has an article

discussing the rise in orders for plywood placed by Indian

imports with manufacturers in Vietnam as reflected in the

arrival in India of 1,500 containers of plywood in

September. It is reported that as many as 2,500 containers

of plywood could be arriving in India before year end.

See: https://www.facebook.com/plyreporter/photos/welcome-to-

the-october-2024-issue-which-contains-lots-of-market-reports-

industry/1067838062012350/?_rdr

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

According to the General Department of Customs,

W&WP exports in October 2024 reached US$1.5 billion,

up 20% compared to September 2024 and up 17%

compared to October 203. Of the total WP exports fetched

US$1.01 billion, up 12% compared to September 2024

and up 15% compared to October 2023.

In the first 10 months of 2024, the W&WP exports

reached US$13.2 billion, up 21% over the same period in

2023 of which WP exports alone contributed US$9.05

billion, up 23% over the same period in 203.

W&WP exports to Japan in October 2024 amounted to

US$148 million, up 20% compared to the previous month

and up 10% compared to October 2023. In the first 10

months of 2024 W&WP exports to the Japan were to

US$1.4 billion, up 1% over the same period in 2023.

In October 2024 exports of kitchen furniture were valued

at US$129 million, up 20% compared to the previous

month and up 10% compared to October 2023. In the first

10 months of 2024 exports of kitchen furniture reached

US$1.16 billion up 25% over the same period in 2023.

Vietnam's W&WP imports in October 2024 cost US$250

million, up 7% compared to September 2024 and up 40%

compared to October 2023. In the first 10 months of 2024

Vietnam spent US$2.28 billion for W&WP imports, up

28% over the same period in 2023.

NTFP exports in September 2024 decreased for the 3rd

consecutive month, reaching US$50.44 million, down

25% compared to August 2024 and down 5% over the

same period in 2023. In the first 9 months of 2024 NTFP

exports accounted for US$594.80 million, up 10% over

the same period in 2023.

Vietnamese wooden furniture in the US

Vietnamese wooden furniture is bolstering its export value

and market share in the US wooden furniture market as

imports. According to the US International Trade

Commission the importation of wooden furniture into the US

during the first eight months of 2024 amounted to US$13.8

billion, a 5.6% increase from the same period in 2023.

Vietnamese wooden furniture exports to the US were

US$5.6 billion in the first eight months and accounted for

around 40% of the total US import value for wooden

furniture.

The interest of American consumers in products from

Vietnam is indicative of the increase in value and market

share of Vietnamese wooden furniture.

As the US housing market recovers it is anticipated that

US wooden furniture imports will continue to increase. As

the Federal Reserve commences to reduce interest rates it

is probable that home loan rates will continue to fall which

will stimulate home sales and, as a result, stimulate the

demand for wooden furniture.

The Institute for Supply Management (ISM) has reported

that US inventory levels are declining at the quickest rate

in 2024, indicating that manufacturers are maintaining low

inventory levels.

The positive growth trajectory of Vietnam's W&WP

exports to the US is anticipated to be bolstered by this

favorable supply-demand factor in the final months of

2024.

However, the US imposes trade protection measures on

Vietnamese exports. The intensity of domestic competition

for US industries is on the rise as a result of the increased

imports.

In this context it is probable that US companies will

intensify their utilisation of trade instruments in order to

mitigate competitive pressures. Consequently, the

Vietnamese wood industry must exercise caution and

establish close relationships with the Vietnamese Trade

Office abroad and the Trade Remedies Authority (Ministry

of Industry and Trade) in order to receive early warnings

of trade protection investigations. This allows for the

implementation of proactive strategies to maintain market

share in critical markets.

Vietnam is one of the three largest net exporters to the US

according to Mr. Do Ngoc Hung, the Head of the

Vietnamese Trade Office in the US. Consequently,

Vietnam is perpetually "on the radar" of US trade defense

activities.

There is a trend towards increased trade protection

activities. In these instances US authorities prioritise the

protection of domestic companies.

Mr. Hung recommends that exporters to the US remain

prepared to address prospective litigation filed in the US

against their export products. This entails striving to

achieve the most favorable outcome possible by

maintaining close collaboration with the Ministry of

Industry and Trade and the Vietnamese Trade Office in the

US to provide the investigating authorities with

comprehensive and expeditious information.

Vietnam's wood industry sector aims to export US$15.2

billion worth of its products this year, an increase from

US$14.47 billion last year.

Since the slowdown in 2023 from the beginning of this

year W&WP associations and enterprises have been

proactive in production and seeking export markets.

A series of market exploration fairs were held attracting

customer interest in Vietnamese wood products in key

production areas, including Ho Chi Minh City and Binh

Dinh and Binh Duong Provinces.

See: https://vietnamagriculture.nongnghiep.vn/the-market-share-of-

vietnamese-wood-furniture-in-the-united-states-expanded-

d408363.html

Vietnam’s ambitious forestry master plan

Decree No. 895/QD-TTg of 24 August 2024 presents a

master plan for the sustainable development of the forestry

sector. Key objectives encompass the conservation,

cultivation and enhancement of forest resources and land.

The focus of this planning extends to forested lands as well

as those earmarked for afforestation and forestry

infrastructure such as plant nurseries, ranger stations and

timber transport routes.

Minister of Agriculture and Rural Development, Le Minh

Hoan, underscored the pivotal role of this master plan in

unlocking the forest's potential to contribute to socio-

economic growth, environmental protection and climate

change mitigation.

Director Tran Quang Bao of the Forestry Department stated

that the 2021-2030 National Forestry Master Plan with a

vision to 2050 constitutes a significant stride in the

implementation of the Planning Law and the Forestry Law.

Specific objectives of the plan include:

maintaining a forest cover ranging from 42-43

percent nationwide

augmenting the quality of natural forests

achieving a 5-to-5.5 percent annual growth rate in

forestry production value

Moreover, the planning sets forth targets to double the

income derived from commercial plantations by 2030

compared to 2020 with projected timber and forest product

exports reaching US$20 billion in 2025 and US$25 billion in

2030.

According to Director Tran Quang Bao, the plan also

outlines a target of a 5% annual increase in forest

environmental services reaching approximately VND4

trillion (US$161 million) per annum during the 2026-2030

period.

Key strategies encompass the transfer of advanced forestry

technologies, the formulation of sustainable forest

management plans and the provision of livelihood support to

communities adjacent to special-use forests.

The total estimated investment for the plan through 2030 is

approximately VND217.3 trillion (US$8.7 billion), sourced

from both the state budget and other channels.

See: https://en.sggp.org.vn/vietnam-unveils-ambitious-forestry-

master-planning-post113030.html

Remove bottlenecks in the wood supply chain

The legal origin of wood products is one of the most

essential requirements for Vietnam's two main export

markets, the US and the EU. This is considered a vital

factor for export enterprises.

According to a survey by the Forest Trends research group

led by To Xuan Phuc, wood raw materials in Vietnam

come from: domestically planted wood (acacia,

eucalyptus, and rubberwood), wood from domestic

farms/gardens, imports of plantation and natural forest

species. It is acknowledged that many wood products in

the group of bedroom furniture, office furniture, kitchen

and wooden furniture parts exported to the EU are

processed wood grown on areas that were previously

natural forests but converted to rubber plantations.

When using this wood source businesses face challenges

in traceability and transparency and accountability

especially the requirement to clearly state the names of all

types of wood used in exported products. Another factor

pointed out by Phuc is evidence related to the legality of

raw material sources, including species names and

commercial details. Some countries also require other

evidence, such as forest product lists, raw wood purchase

invoices or logging licenses.

See: https://vietnamagriculture.nongnghiep.vn/remove-the-

bottlenecks-in-the-wood-industry-supply-chain-d406028.html

8. BRAIL

Bank and Forest Service partnership for

Amazon

restoration

The Brazilian Development Bank (BNDES) and the

Brazilian Forest Service (SFB) within the Ministry of the

Environment and Climate Change recently signed a

contract to develop new forest concession projects. The

contract covers 11 conservation units with a total area of 6

million hectares.

The aim is to introduce sustainable forest management

over 1.4 million hectares and restore 334,000 hectares of

degraded forests.

BNDES is leading the financial modeling while the SFB is

conducting forest inventory and social studies with the

resources provided by the Inter-American Development

Bank (IDB). It is estimated that the structuring studies in

these 11 conservation units will be conducted in stages

enabling the call for concession in 2026.

The forest concession process includes technical

modeling, public consultations with local communities and

project evaluation to ensure sustainable forest use and

respect for social rights is included in the management

plan. The contract between BNDES and SFB covers areas

across five Amazonian states (Pará, Roraima, Amazonas,

Rondônia and Mato Grosso) and involves sustainable

forest management projects in several national forests and

conservation areas.

See: https://forestnews.com.br/bndes-e-servico-florestal-

estruturam-concessao-de-11-unidades-de-conservacao/

Traceability - key to verifying sustainability in natural

forests

The 3rd event “Sustainable Timber: the future of the

market” held in the State of Minas Gerais organised by the

National Forum for Forest-Based Activities (FNBF) and

the Center of Timber Producing and Exporting Industry of

Mato Grosso (CIPEM-MT) highlighted the sustainable

forest sector in the State of Mato Grosso in the Amazon

region.

Trade in timber from natural forests in the Minas Gerais

State up to October rose around 40% year on year and

involved about 100 native timber species.

As of October around 71,944 cu.m of timber from Mato

Grosso State were sold to companies in Minas Gerais

generating approximately R$69.6 million, 40% more than

in the same period in 2023.

The market event covered topics such as traceability and

sustainability in the production chain with the use of the

Sisflora 2.0 system which provides monitoring and control

throughout the entire production chain. This system

enables traceability from the origin to the final point of

sale as each log is tracked with precision.

Traceability and chain of custody were also emphasised as

mechanisms to ensure transparency and environmental

control meeting the standards required in both national and

international markets while promoting the preservation of

the Amazon forest.

See: https://www.cenariomt.com.br/mato-grosso/rastreabilidade-

na-producao-sustentavel-de-madeira-nativa-em-mato-grosso-e-

abordada-em-evento-nacional/

Brazil renews partnership with BM Certification

ABIMCI (Brazilian Association of Mechanically

Processed Timber Industry) has renewed its partnership

with BM Certification (a certification body) ensuring the

continuity of the CE Marking and UKCA Marking (UK

Conformity Assessment) for the Brazilian plywood sector.

This certification verifies that a company maintains

standardisation in its products, production processes and

quality allowing certified wood products to be marketed in

27 European Union countries (CE Marking) and in the

United Kingdom (UKCA).

In addition to international certifications, ABIMCI offers

its members technical support and Sectoral Quality

Programs (PSQ) focused on the domestic market, such as

the PSQ-PME for Wooden Doors and the PSQ for Film-

faced Plywood and it plans to launch a new quality and

certification programme for pallets.

To further strengthen these technical initiatives ABIMCI

offers the National Timber Quality Program (PNQM) a

quality management tool that provides a framework for

standardisation and quality control throughout the

production process. The Tool also contributes to optimise

production, reducing costs and facilitate the attainment of

both national and international certification. ABIMCI also

coordinates the Brazilian Timber Committee (CB-031) of

the Brazilian Association of Technical Standards (ABNT)

which defines standards for wood products in Brazil.

See: https://abimci.com.br/abimci-renova-parceria-com-bm-

certification-para-certificacoes-internacionais-ce-e-ukca/

Importance of certification and sustainable trade

The Institute of Agricultural and Forest Management and

Certification (Imaflora) participated in the FSC ‘Amazon

Business Meeting’ in Belém which focused on the

sustainable timber trade and analysing the role of forest

management and certification in building a responsible

value chain.

The event covered topics such as the potential impact of

the EUDR which requires strict traceability for forest

products and the adaptations by FSC to ensure compliance

with the new requirements.

Imaflora emphasised the role of FSC certification in

verifing supply chains. The Brazilian Trade and

Investment Promotion Agency (ApexBrasil) presented a

market analysis of tropical timber, highlighting that in

2023 the sector generated around US$310 million.

Brazilian exporters face trade barriers that hinder their

competitiveness. International demand for tropical timber,

especially from the United States and Europe is high, but

environmental requirements pose compliance challenges.

The event emphasised the need to modernise the forest

sector, promote responsible practices and increase demand

for certified timber which, in addition to being

environmentally friendly, should be promoted as the top

choice for consumers. To ensure forest sustainability

collaboration among producers, certifiers and regulatory

bodies was highlighted as essential.

See: https://www.imaflora.org/noticia/imaflora-participa-de-

discussao-sobre-comercio-sustentavel-e-certificacao-no-fsc-

amazon-business-encounter

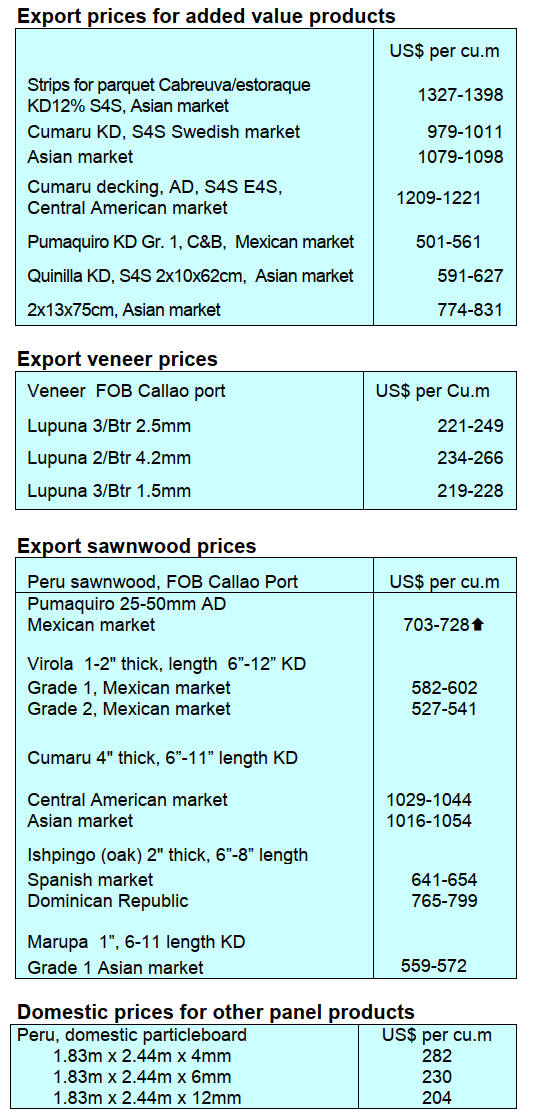

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

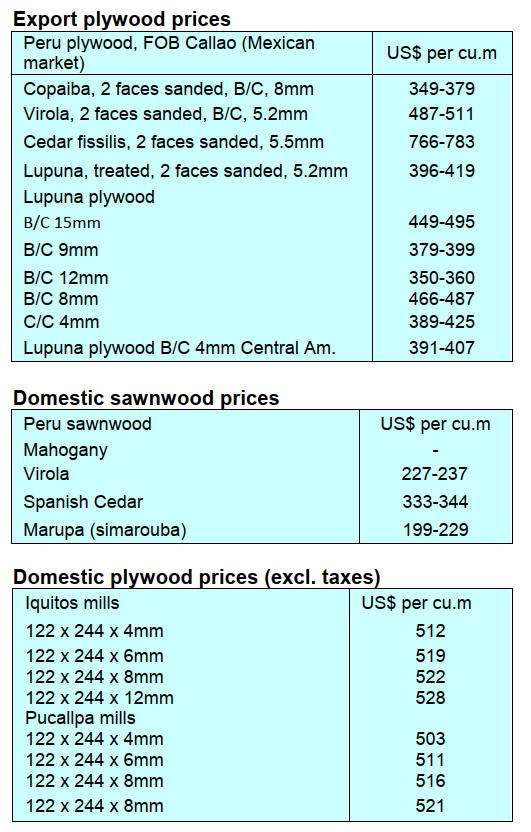

9. PERU

Tools to identify forest

species in the Peruvian

Amazon

The National Forest and Wildlife Service (SERFOR), in

coordination with the Center for Productive Innovation

and Technology Transfer of Wood (CITEmadera), held an

event to present “Tools for the identification of forest

species and their contribution to the sustainable

management of forest resources” and the second edition of

the “Manual for the anatomical identification of wood

from forest species in the Peruvian Amazon” was

presented.

At the same time, manuals for the botanical identification

of forest species in the Peruvian Amazon Vol. I and Vol 2,

and the booklet for identification of Dipteryx

(shihuahuaco) and Handroanthus (tahuarí) in the Peruvian

Amazon were introduced.

Recently developed applications were presented:

IDmaderas

https://x.com/UNODC_ENV/status/176323542880160173

7

MaderApp

https://envol-vert.org/en/fd/envol-vert-and-maderapp-as-

part-of-research-to-protect-amazonian-forests/

and

IDÁrbol

https://conexionambiental.pe/id-arbol-nueva-plataforma-

que-permitira-reconocer-especies-forestales-maderables-

de-nuestros-bosques/

Experts pointed out that the information and application

presented will help in the identification of what type of

wood is being sold and obtain evidence that can support

the work of the Attorney General's Office when it is

required to intervene in relation to the illegal trade of

forest products.

Sylvia Reategui García, Senior Advisor to ProAmbiente

stated that "there are almost 240 species that have been

listed in the manuals (for botanical identification of forest

species in the Peruvian Amazon) which includes joint

work between academia and various actors to promote

legal management of wood, hand in hand with a market

that demands legality”.

Gino Catturini Ruiz, Director of CITEmadera Lima, stated

that "the manual (for the anatomical identification of wood

from forest species in the Peruvian Amazon) can be used

by all users of the forest to take advantage of the potential

we have in the country and continue promoting scientific

research in the country”.

See: https://www.gob.pe/institucion/serfor/noticias/1054119-

serfor-y-citemadera-lima-presentaron-herramientas-para-

identificar-especies-forestales-de-la-amazonia-peruana

International Forum on ‘Commercial Forest

Plantations’

The National Forest and Wildlife Service and its

Sustainable Productive Forests Programme hosted an

International Forum on Commercial Forest Plantations

within the framework of the National Forest Week 2024

which brought together leading specialists from Peru,

Chile, Brazil, Argentina and Costa Rica.

One of the goals of the forum was to promote the

exchange of knowledge, experiences and best practices in

the sustainable management of commercial forest

plantations.

The head of the Plantations Project in SERFOR’s

Sustainable Productive Forests Programme said that in the

Cajamarca Region there are approximately 60,000

hectares established which will supply wood for the

domestic market.

See: https://www.gob.pe/institucion/serfor/noticias/1054384-

cajamarca-serfor-realiza-foro-internacional-de-plantaciones-

forestales-comerciales

Native communities trained

With the aim of promoting the sustainable use of forest

resources in native communities in the Peruvian Amazon

the Agency for the Supervision of Forest and Wildlife

Resources (OSINFOR) trained 34 members of native

communities in Ucayali on their rights and obligations as

holders of enabling forest titles.The attendees strengthened

their knowledge about the obligations of holding forest

titles, wood cubing(measurement) and completing

registrations in the Book of Operations.

The training included measurement of standing and round

timber, essential techniques for keeping a precise control

of the resources used, respecting the management plans

approved by the Administraciones Técnicas Forestal y de

Fauna Silvestre (ARFFS) and technically supported by

SERFOR.

In field work the participants applied what they had

learned in an exercise measuring standing trees, the data of

which will be used to update the forest censuses of their

management plans. In addition, they carried out the

measurement of round timber, an essential practice to

complete the record in the Operations Book.

See: https://www.gob.pe/institucion/osinfor/noticias/1056289-el-

osinfor-capacita-a-comunidades-nativas-en-ucayali-sobre-los-

titulos-habilitantes-y-la-cubicacion-de-madera

|