|

Report from

Europe

No end in sight to slump in EU tropical wood imports

Total EU27 imports of tropical wood and wood furniture

of 954,200 tonnes in the first eight months of 2024 were

14% less than during the same period in 2023.

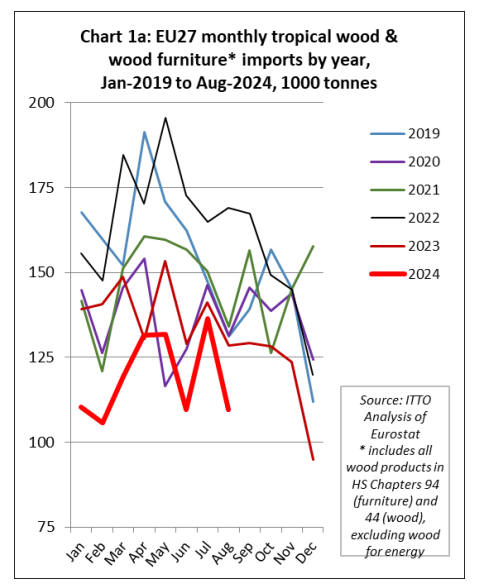

After imports fell to just under 110,000 tonnes in June, the

third lowest monthly total ever recorded, they briefly

recovered to 136,000 tonnes in July before falling again to

110,000 tonnes in August (Chart 1a).

EU tropical wood and wood furniture import quantity this

year remains on course to be at the lowest level since the

EU was first formed (as the EEC) in 1957.

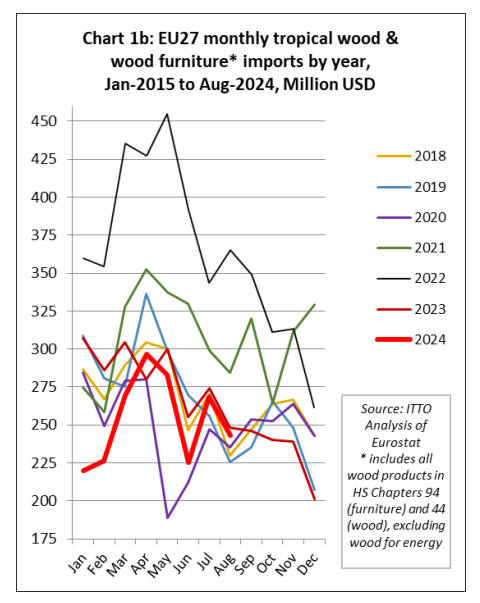

The trade figures look a little healthier when considered in

value terms. In the first eight months of 2024, the EU27

imported tropical wood and wood furniture with total

value of US$2033 million, 10% less than the same period

in 2023.

More positively, monthly import value of US$255 million

in June, US$268 million in July, and US$243 million in

August were not far short (at least in nominal terms) of the

import value for these same months in 2018 and 2019,

before the pandemic (Chart 1b).

IMF foresee only modest medium-term economic

growth in Europe

The historically slow pace of tropical wood product

imports into the EU is occurring against the background of

subdued and uncertain economic conditions in the region.

The IMF, in presenting their latest European Economic

Outlook report on 24 October, suggested that Europe's

recovery is falling short of its full potential and the

medium-term outlook is no better.

The IMF foresee only a modest increase in growth for

2024 and 2025. IMF project that the eurozone will grow

by just 0.8% in 2024, a 0.1% decrease compared to July's

outlook. For 2025, the euro area's growth is expected to

pick up slightly to 1.2%, but the forecast has been reduced

by 0.3%.

Among Europe's largest economies, Germany and Italy are

projected by the IMF to significantly underperform.

Germany's economy is forecast to contract by 0.3% in

2024, with growth flatlining at 0% in 2025. Italy is

expected to grow by 0.7% in 2024, unchanged from July's

estimates, with a slight decline to 0.6% in 2025. While

Italy is expected to benefit from the EU-financed National

Recovery and Resilience Plan, Germany faces the

combined pressures of fiscal consolidation and a sharp

decline in property prices, both of which are expected to

dampen its economic performance.

In contrast, Spain stands out as a top performer with its

IMF growth forecast for 2024 revised up by 0.5% to 2.7%,

and a steady 2.9% growth anticipated in 2025. France is

projected to maintain stable growth of 1.1% in both 2024

and 2025, although IMF’s forecast for 2025 has been

slightly downgraded by 0.2%.

On inflation, IMF expect the European Central Bank to

sustainably reach its 2% rate target by mid-2025. For most

Central and Southern European (CESEE) countries, IMF

expect that target rates will not be reached before 2026.

The IMF is recommending that central banks pursue a

smooth loosening path in advanced European economies

and that they be more careful and ease more cautiously in

several CESEE countries, as real wages may outpace

productivity growth there. IMF also recommend

tightening the fiscal stance across most of Europe. While

IMF is expecting a recovery, it suggests that deficits are

too large to stabilize public debt.

According to IMF, the good news is that the EU has

agreed on a fiscal rules’ framework addressing

sustainability concerns while allowing for investment in

green transitions and infrastructure. IMF also note that a

key reason why Europe is seeing moderate recovery this

year is that it is coming out of the large energy price shock

that followed on from Russia’s invasion of Ukraine in

February 2022.

Germany has been particularly affected by this shock

because of its energy intensive manufacturing. Continuing

uncertainty created by Russia's war in Ukraine is an

important factor leading IMF to moderate their

expectations for European growth next year.

However, IMF also suggest there are other longer-term

structural issues impeding Europe’s economic

performance. IMF observe that compared to the U.S.,

income per capita in Europe is now 30% lower and the gap

has remained unchanged for two decades. At the turn of

the century that gap did not exist.

IMF identifies three factors holding Europe back. First,

Europe markets are too fragmented to provide the needed

scale for firms to grow. Second, Europe has no shortage of

savings, but its capital markets fail to provide to boost

young and productive firms. In addition, Europe is missing

skilled labor where it is needed.

The IMF suggest a deeper, more integrated Single Market

can resolve most of these issues. This means removing the

barriers that still prevent goods, services, capital, and labor

to flow freely between countries.

New construction in Europe orders continue to fall

steeply

The weakness of the EU construction sector continues to

be a significant concern for the EU’s timber industry.

Forward-looking indices show that EU construction

activity has remained weak and that new orders continue

to fall steeply. The HCOB Eurozone Construction PMI

Total Activity Index — a seasonally adjusted index

tracking monthly changes in total industry activity — rose

from 41.4 in August to 42.9 in September, indicating a

softer but still large contraction in activity across the euro

area construction sector.

The latest downturn extended the current sequence of

falling construction activity to 29 months.

According to the HCOB report, negative output trends

reflected further declines across the three largest eurozone

economies in September. French construction activity saw

the steepest reduction, and at the fastest pace since May

2020.

German and Italian firms also saw activity decrease,

although the rate of decline was slightly slower than in

previous months. Lower output was also broad-based in

nature across the three monitored sectors covered by the

report. Housing activity saw the most pronounced

decrease, though falls in commercial and civil engineering

activity were also relatively strong.

EU27 tropical wood furniture imports make up for

earlier decline

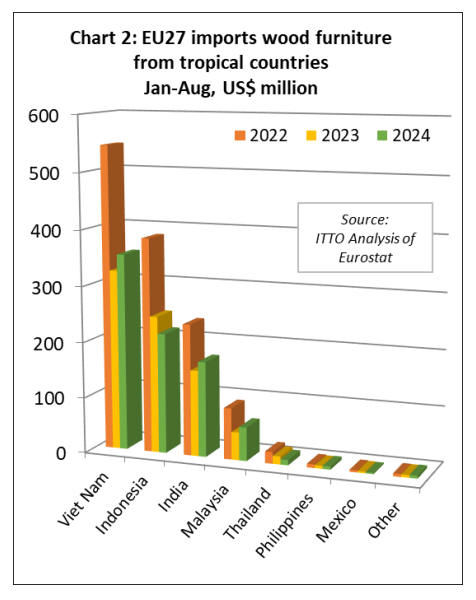

After a very slow start to the year, EU wood furniture

imports from tropical countries continued to make up lost

ground in during the summer months. In the first eight

months of the year, the EU27 imported 351,600 tonnes of

wood furniture from tropical countries with a total value of

US$822 million. Import quantity and import value were up

7% and 3% respectively compared to the same period in

2023.

In the first eight months of this year compared to the same

period in 2023, EU27 import value of wood furniture

increased from Vietnam (+9% to US$353.1 million), India

(+11% to US$170.8 million), Malaysia (+21% to US$60.3

million), and the Philippines (+7% to US$5.6 million).

However, import value fell from Indonesia (-12% to

US$215.5 million), Thailand (-34% to US$9.4 million),

and Mexico (-15% to US$2.4 million). EU27 wood

furniture imports from all other tropical countries were

negligible during the period (Chart 2).

EU27 imports of tropical sawnwood down 19% in the

first eight months of 2024

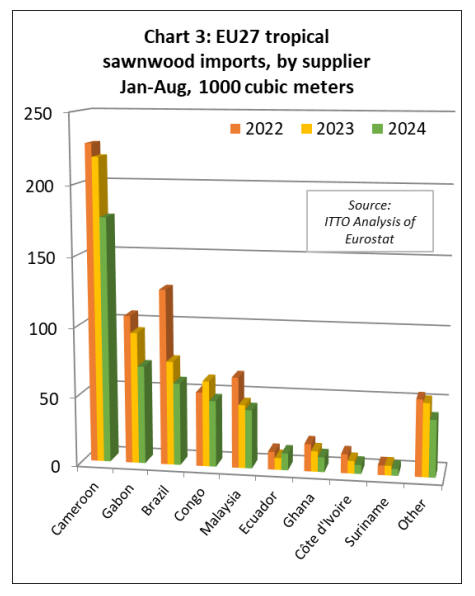

The EU27 imported 371,600 cu.m of tropical sawnwood

in the first eight months of this year, 19% less than the

same period in 2023. Import value of this commodity was

US$435.8 million in the January to August period this

year, 20% less than the same period in 2023.

Imports declined from nearly all leading supply countries

during the period including Cameroon (-19% to 176,400

cu.m), Gabon (-25% to 70,600 cu.m), Brazil (-21% to

59,300 cu.m), Republic of Congo (-23% to 47,700 cu.m),

Malaysia (-8% to 42,300 cu.m), Ghana (-28% to 10,700

cu.m), Côte d’Ivoire (-29% to 6,400 cu.m), Suriname

(-30% to 4,900 cu.m) and the Central African Republic

(-53% to 4,100 cu.m).

Sawnwood imports from Ecuador bucked the overall

downward trend in the first half of this year, at 12,200

cu.m, up 43% compared to the same period in 2023 (Chart

3).

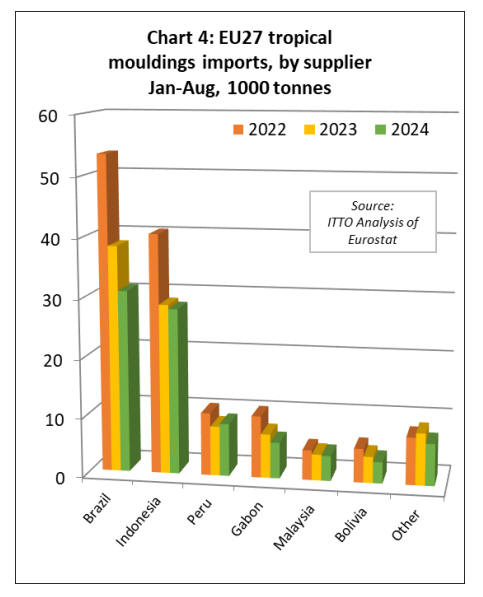

The EU27 imported 88,600 tonnes of tropical

mouldings/decking in the first eight months of this year,

12% less than in the same period in 2023. Import value of

this commodity was down 20% to US$154.7 million in the

same period.

During the first eight months, imports increased year-on-

year from Peru (+6% to 8,900 tonnes) but fell from all

other leading supply countries including Brazil (-20% to

30,800 tonnes), Indonesia (-2% to 28,000 tonnes), Gabon

(-18% to 6,100 tonnes), Malaysia (-3% to 4,200 tonnes),

and Bolivia (-18% to 3,600 tonnes) (Chart 4).

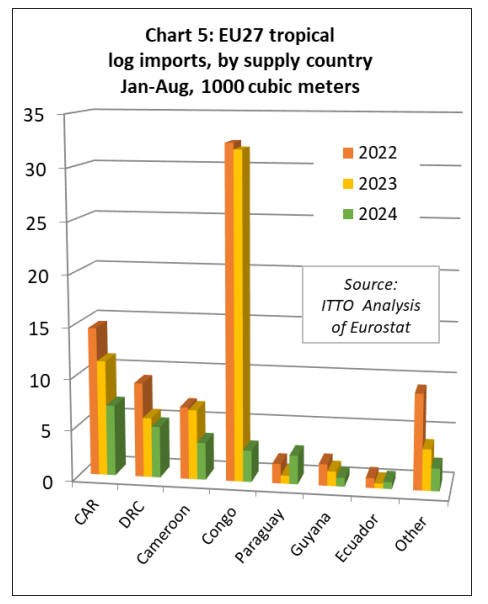

The EU27 imported 25,100 cu.m of tropical logs with a

total value of US$15.3 million in the first eight months of

this year, respectively 60% and 62% less than in the same

period last year. The decline was driven mainly by an 90%

decline in imports from the Republic of Congo to 3,100

cu.m.

This follows the ban on exports of most logs from the

country since 1st January 2023. EU27 imports of logs in

the first eight months of this year were also down

compared to the same period last year from the Central

African Republic (-39% to 6,900 cu.m), the Democratic

Republic of Congo (-14% to 5,000 cu.m), Cameroon (-

47% to 3,600 cu.m), and Guyana (-40% to 800 cu.m).

However, EU27 log imports increased from Paraguay

(+259% to 2,800 cu.m), and Ecuador (+38% to 700 cu.m)

during the eight-month period (Chart 5 above).

EU27 imports of tropical hardwood veneer, plywood

and joinery down sharply

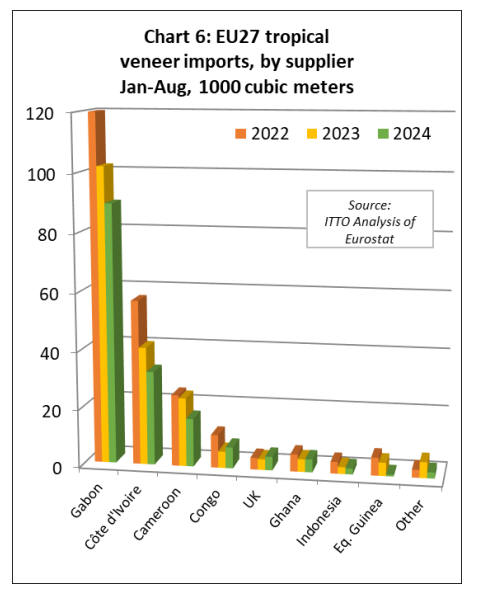

The EU27 imported 159,800 cu.m of tropical veneer with

a total value of US$108.5 million in the first eight months

of this year, down 17% and 18% respectively compared to

the same period last year. Imports of tropical veneer from

Gabon, by far the largest supplier to the EU27, were

89,500 cu.m in the first eight months of this year, 12% less

than the same period in 2023.

EU27 imports of this commodity also decreased during the

period from Côte d'Ivoire (-20% to 32,400 cu.m),

Cameroon (-30% to 16,600 cu.m), Indonesia (-14% to

2,000 cu.m), and Equatorial Guinea (-87% to 600 cu.m).

Veneer imports into the EU27 increased during the eight-

month period from the Republic of Congo (+29% to 7,300

cu.m), the UK (+28% to 4,700 cu.m), and Ghana (+2% to

4,500 cu.m). (Chart 6).

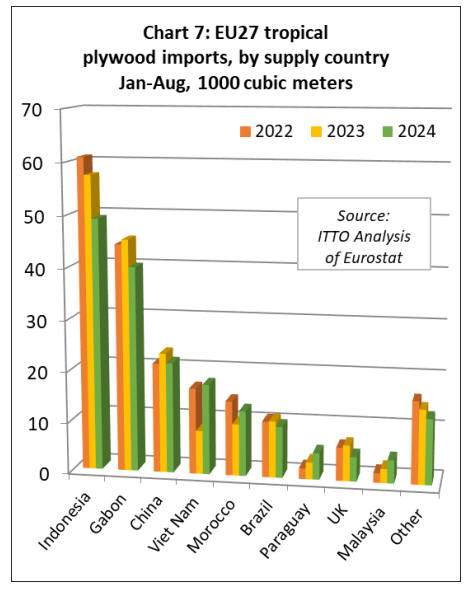

The EU27 imported 178,600 cu.m of tropical plywood

with a total value of US$129.0 million in the first eight-

months of this year, respectively 3% and 5% less than the

same period last year. Imports fell from the three leading

supply countries during the period including Indonesia (-

14% to 49,200 cu.m), Gabon (-12% to 40,000 cu.m), and

China (-8% to 21,600 cu.m).

Imports from Brazil were also down, by 9% to 10,000

cu.m, while indirect imports via the UK fell 32% to 4,800

cu.m. However, these losses during the eight-month period

were partly offset by rising imports from Vietnam (+108%

to 17,700 cu.m), Morocco (+26% to 12,800 cu.m),

Paraguay (+58% to 5,200 cu.m), and Malaysia (+65% to

4,500 cu.m) (Chart 7).

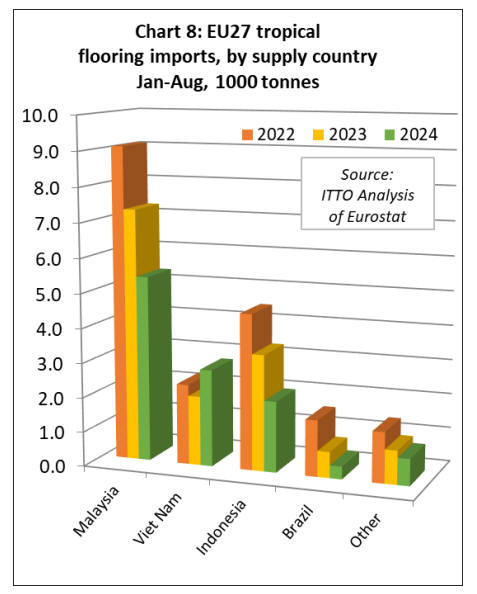

The EU27 imported 11,400 tonnes of tropical wood

flooring with a total value of US$29.7 million in the first

eight months of this year, down 21% and 29% respectively

compared to the same period in 2023. Imports of 5,400

tonnes from Malaysia in the eight-month period this year

were 26% less than the same period in 2023.

Flooring imports also fell from Indonesia (-39% to 2,100

tonnes) and Brazil (-41% to 400 tonnes). However,

imports increased from Vietnam (+40% to 2,800 tonnes)

(Chart 8).

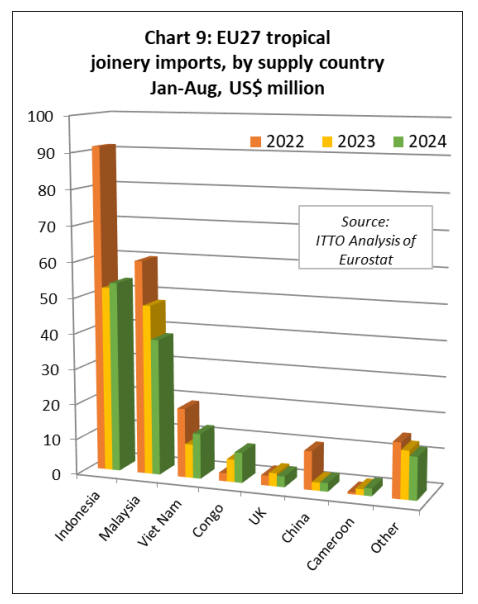

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors was

US$132.7 million in the first eight months of this year.

This was down 3% compared to the same period in 2023.

Import quantity was also down 3% to 58,100 tonnes

during the same period.

Between January and August this year, EU27 import value

of other tropical joinery products was down 20% to

US$38.4 million from Malaysia. Indirect imports from the

UK also fell, by 18% to US$3.0 million.

However, import value increased 3% to US$53.6 million

from Indonesia and was up 34% to US$12.7 million from

Vietnam. In a potentially significant longer-term

development, given efforts in central Africa to shift up the

value chain as log exports are banned, EU import value of

laminated joinery products in the first eight months of

2024 was up 33% to US$8.5 million from the Republic of

Congo and up 26% to US$2.1 million from Cameroon

(Chart 9).

Proposal to delay EUDR and new EUDR Guidance

Documents

On 2 October, the European Commission (EC) published a

proposal to delay application of the provisions of the EU

Deforestation Regulation (EUDR) for a period of 12

months to give concerned parties additional time to

prepare.

The proposal to delay was approved by the European

Council on 16 October. If the European Parliament now

approves the proposal in a vote scheduled for 14

November, EUDR would become applicable on 30

December 2025 for large companies and 30 June 2026 for

micro- and small enterprises.

If the European Parliament does not approve the proposal,

the start dates contained in the existing legal text – 30

December 2024 for large companies and 30 June 2025 for

micro- and small enterprises – would still apply.

The proposal to amend the start date does not affect the

substance of the already existing rules, which is to

minimise the EU’s contribution to deforestation and forest

degradation worldwide, by only allowing placing on the

EU market, or exporting from the EU, deforestation-free

products. Deforestation-free products are products that

have been produced on land not subject to deforestation or

forest degradation after 31 December 2020.

The EC proposal to amend the start date was published

alongside additional guidance documents and a stronger

international cooperation framework to support global

stakeholders, Member States and third countries in their

preparations for the implementation of the EUDR.

See:

https://ec.europa.eu/commission/presscorner/detail/en/ip_24_500

9

https://www.consilium.europa.eu/en/press/press-

releases/2024/10/16/eu-deforestation-law-council-agrees-to-

extend-application-timeline/

|