US Dollar Exchange Rates of

25th

Oct

2024

China Yuan 7.12

Report from China

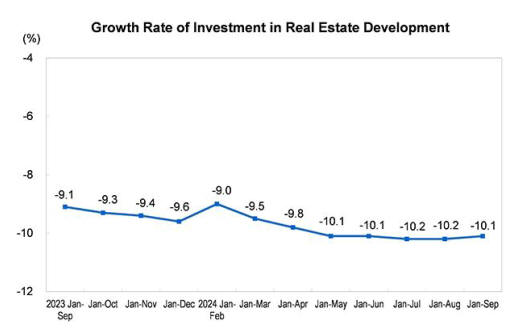

Investment in real estate development

A press release from the National Bureau of Statistics

points to a year-on-year decline of 10% in real estate

investment between January and September 2024, of

which the investment in residential buildings was down by

10.5%.

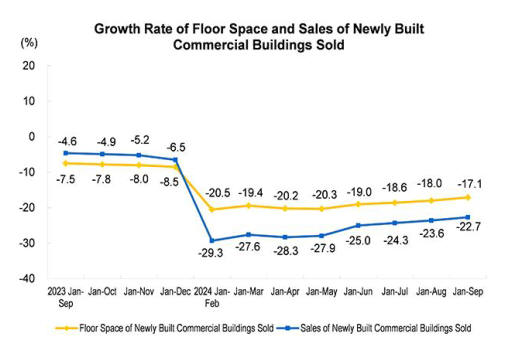

Between January and September the floor space of newly

built commercial buildings sold was, down by 17% year

on year, of which the floor space of residential buildings

sold decreased by 19%.

Sales of newly built commercial buildings dropped 23%,

of which sales of residential buildings decreased by 24%.

See:

https://www.stats.gov.cn/english/PressRelease/202410/t2024102

5_1957149.html

In an effort to support the ailing real estate sector that has

dragged down overall growth the government will extend

over US$500 billion in financing to property developers

through banks by the end of the year. In related news,

China's Ministry of Finance has outlined plans to step up

fiscal support to local governments, state-owned banks

and consumers but did not announce the size of a stimulus

package.

In a news conference, Finance Minister Lan Fo'an

introduced four policies: increasing support for local

governments to ease their debt burden; issuing special

treasury bonds to increase the capital of state-owned

banks; using local government funding to stop the

downturn in the real estate market and providing

assistance to students to encourage spending.

See: https://asia.nikkei.com/Economy/China-s-finance-minister-

says-there-is-large-room-for-fiscal-stimulus

Anti-dumping investigation of Chinese hardwood

plywood

In October the European Commission launched an anti-

dumping investigation into hardwood plywood imported

into the EU from China. The investigation was initiated at

the request of the nine European plywood producers. It is

claimed that China’s exports of hardwood plywood are

unfairly priced and use of Russian timber banned by the

EU and this trade threatens the financial viability of many

European companies and jobs.

The product under investigation is currently classified

under the HS codes ex 4412 31, ex 4412 33 and ex 4412

34 (CN and TARIC codes 4412 31 10 80, 4412 31 90 00,

4412 33 10 12, 4412 33 10 22, 4412 33 10 82, 4412 33 20

10, 4412 33 30 10, 4412 33 90 10, and 4412 34 00 10).

Several other countries, including the United States,

Morocco, Turkey and South Korea have already taken

action to protect their own industries from similar unfair

trade practices.

EU will adopt new rules for the first time to register all

imports of Chinese plywood and if it decides to impose

tariffs in the future, there will be a retrospective period to

prevent companies from hoarding goods to evade tariffs.

According to Eurostat data, the EU imported about

750,000 cubic metres of hardwood plywood from China in

2023 worth €327 million, accounting for more than half of

imports and 30% of the total EU market.

See:https://www.ttjonline.com/news/ec-investigation-into-

chinese-hardwood-plywood-imports-gets-underway/

and

https://sklejkapaged.pl/en/european-commission-launches-new-

anti-dumping-investigation-against-china/

Wood flooring sells well in the ‘Belt and Road’

countries

It has been reported that wood flooring from Huzhou City

in Zhejiang Province has been selling well in the ‘Belt and

Road’ countries.

Between January and September this year the value of

Huzhou wood flooring exports to ‘Belt and Road’

countries was about RMB230 million, an increase of 6%

year on year. The wood flooring products in Huzhou City

are exported to more than 10 ‘Belt and Road’ countries

such as Thailand, Malaysia and Vietnam.

In Nanxun District of Huzhou City there are many wood

flooring manufacturers which have successfully created

green wood industry clusters. The output value of the

cluster reached RMB11.33 billion in 2023 and its output

of wood flooring accounted for about 35% of the national

total. Solid wood flooring and multilayer laminate flooring

are exported.

Huzhou wood flooring industry has seized the opportunity

to expand its market share in the ‘Belt and Road’ countries

in recent years mainly due to the rising demand for wood

flooring in Malaysia and Singapore.

In order to promote wood Huzhou Customs took the

initiative to help enterprises to expand overseas sales,

strengthen communication with enterprises, understand

their export plans and needs in advance and provide

personalised customs clearance services.

Huzhou Customs also strengthened policy guidance and

training for enterprises, interpreted the preferential policies

in RCEP, China-ASEAN and other trade agreements in

detail and publicised customs supervision requirements so

that enterprises can effectively enjoy the benefits of policy

decisions.

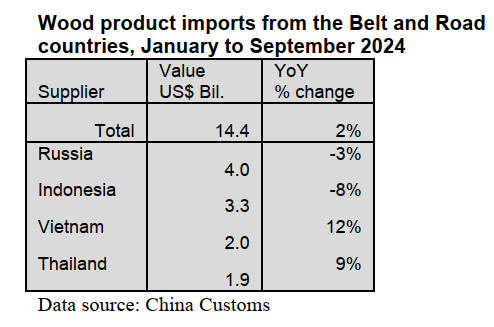

Wood product imports and exports between China and

Belt and Road countries have developed rapidly in recent

years.

According to China Customs, the value of China’s wood

product imports from the Belt and Road countries rose 2%

to US$14.4 billion between January and September 2024.

Russia, Indonesia, Vietnam and Thailand are the top four

countries with import values for wood products exceeding

US$1 billion. Nearly 80% of China’s wood products

imports from the Belt & Road countries are from these top

four countries.

The value of China’s wood product imports from Vietnam

and Thailand rose 12% and 9% respectively between

January and September 2024 contributing to the growth of

the national total wood products imports value from the

Belt and Road countries.

In contrast, the value of China’s wood products imports

from Russia and Indonesia, as the largest and second

largest supplier, fell 3% and 8% respectively over the

same period.

The value of China’s wood products imports from

Malaysia, Poland, Belarus and Myanmar grew 30%, 9%.

40% and 7% to US$970 million, US$238 million, US$213

million and US$206 million respectively boosting the

growth of China’s wood product imports from the Belt and

Road countries.

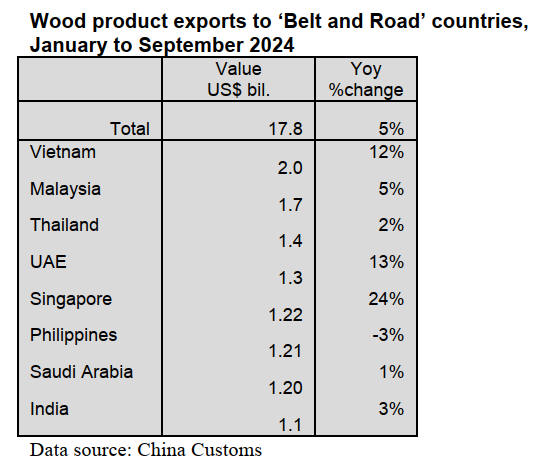

According to China Custom, the value of China’s wood

products exports to the Belt and Road countries rose 5% to

US$17.8 billion between January and September 2024.

Over 60% of China’s wood products export value to the

Belt and Road countries to the top eight countries with the

export value of wood products exceeding more than US$1

billion.

The value of China’s wood products exports to almost all

top the Belt and Road countries rose generally from

January to September 2024. However, the value of

China’s wood products exports to Philippines fell 3% to

US$1.21 billion between January and September 2024.

China exported mainly paperboard and paper products,

wood products, wooden furniture and seats to ‘Belt and

Road’ countries and the value of these products

represented around 95% of the national total.

The value of China’s wood product, wooden furniture and

seats grew 6% and 8% to US$35.7 billion and US$35

billion respectively, making up 20% and 19.6% of the

national total for the period January to September 2024.

Wood product trade with Vietnam

According to China Customs, the value of China’s wood

product imports from Vietnam rose 12% to US$2 billion

between January and September 2024. China imported

wood products, paperboard and paper products, wooden

furniture and seats.

The value of China’s wood products exports to Vietnam

rose 12% between January and September 2024 and

comprised mainly paperboard and paper products, timber

and timber products and printed products.

The value of China’s paperboard and paper products,

timber and timber products, printed products exports rose

11%, 23% and 31% to US$1.224 billion, US$517 million

and US$126 million respectively from January to

September 2024.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of China.

See: https://www.itto-

ggsc.org/static/upload/file/20241021/1729482752156998.pdf

|