Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Oct

2024

Japan Yen 151.84

Reports From Japan

No party secures overall majority

The Liberal Democratic Party and its coalition partner

have lost their majority in the Lower House following the

27 October general election. The domestic press suggested

voters were harshly critical of candidates involved in the

Liberal Democratic Party’s financial scandal with many

protesting by voting for other candidates.

The loss of its majority would require the Prime Minister

to seek a third party to join the coalition to remain in

power. The Constitutional Democratic Party of Japan, the

largest opposition force, increased its seats. At least one of

the two smaller opposition parties that also made gains in

the election could now play the role of kingmaker for the

ruling coalition.

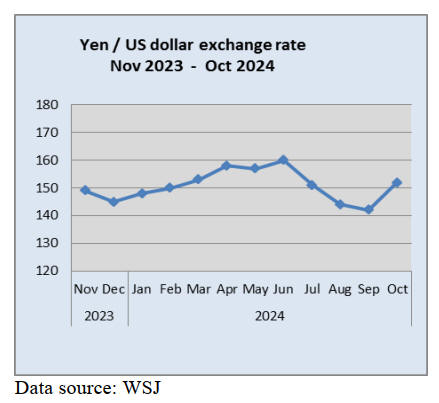

Immediately after the election results were available the

yen exchange rate against the US$ fell a three-month low

as investors concluded that the political landscape would

likely slow future interest rate hikes. The downward trend

of the yen was heightened by a stronger US dollar. The

yen hit its weakest since late July at 153.3 and fell

to165.36 against the euro.

The yen weakened after opposition parties gained a

significant extra number of seats following the recent

general election which the media say pushes Japan into a

period of heightened political uncertainty.

Analysts commented that the pace of interest rate

increases could be slowed as opposition parties have more

influence in policymaking.

See:

https://www.japantimes.co.jp/news/2024/10/28/japan/politics/lo

wer-house-election-results/

SMEs would suffer if minimum wage raised too quickly

In advance of the general election held on 27 October

political parties in Japan were promising to raise the

minimum wage but analysts were quick to point out such a

move would undermine the fragile recovery of small and

midsize companies. The wage-hike pledges threaten small

businesses which account for two-thirds of jobs and over

half of economic output as they are already struggling to

manage rising costs.

The political parties did not offer any suggestions on how

they would help firms offset the cost of a higher minimum

wage prompting Japan’s main business federation to urge

caution.

The head of the Federation Masakazu Tokura told a press

conference “We must aim for challenging goals as a whole

but I feel uneasy about pushing something that is utterly

impossible” adding that the pace of wage hikes needed to

hit the minimum wage hike goal may be hard for many

small companies to adopt.

See: https://www.asahi.com/ajw/articles/15479621

Economy drivers shifting from external back to

domestic demand

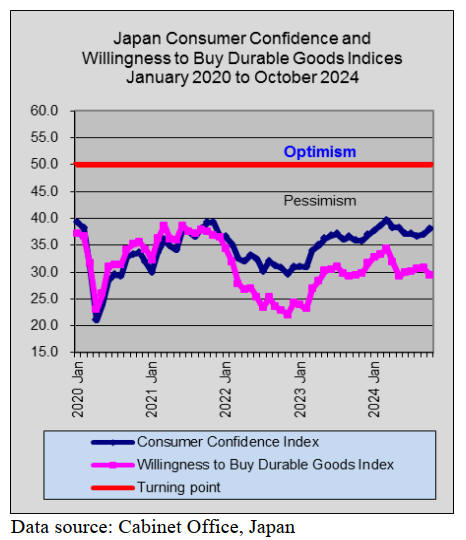

A report from Deloitte ‘Japan Economic Outlook’ of

October 2024 points to the driver of Japan’s economy

shifting back from external to domestic demand but

suggests domestic demand growth will continue but future

gains will be modest as inflation limits the benefits of

stronger wage growth.

The recent rise in wages has finally given households the

confidence they needed to spend more. A stronger yen

would also help alleviate some inflationary pressures

which will further bolster consumer spending. However,

inflation is likely to remain an issue in the near term, says

the Deloitte report, which will keep the pace of spending

relatively modest.

See: https://www2.deloitte.com/us/en/insights/economy/asia-

pacific/japan-economic-outlook.html

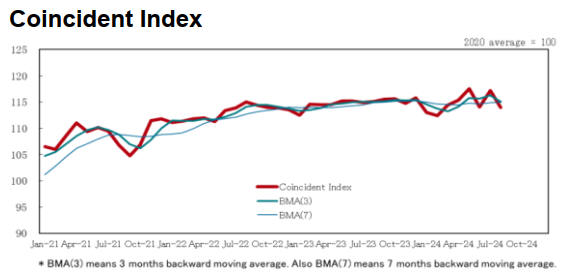

Fourth monthly fall in factory activity

Japan's factory activity contracted for the fourth straight

month in October on subdued demand and weak orders, a

private-sector survey showed. The index stayed below the

50.0 threshold separating growth from contraction for a

fourth straight month.

The Coincident Index released by the Cabinet Office

is a

single summary statistic that tracks the current state of the

Japanese economy. A rise in the index indicates an

expansion of economic activity and a decline in the index

indicates a contraction in economic activity.

See:

https://www.japantimes.co.jp/business/2024/10/24/economy/japa

n-factory-activity-october/

Exports weak mid year

Year on year, Japanese exports fell in the April-September

period as the economic downturn in China and stalled

automobile demand in the US canceled the advantage of

the weak yen. The country recorded a trade deficit of 3.11

trillion yen (US$20.6 billion) between April-September

term marking a seventh straight monthly deficit.

See: https://www3.nhk.or.jp/nhkworld/en/news/20241017_B04/

Record number of female CEOs

According to a survey by credit research firm Tokyo

Shoko Research, the number of female CEOs in Japan hit

a record 649,262 this year, comprising more than 15% of

all CEOs for the first time.

The annual survey also showed that the number of

female

presidents among 4.25 million companies had increased

threefold from 2010 when the figure was just above

210,000.

The Research team commented that “support by the

central and local governments for women to start

businesses as well as efforts to improve working

conditions for women are steadily improving”.

See: https://www.japantimes.co.jp/business/2024/10/25/female-

presidents-survey/

Weak yen boost to exports but households face rising

prices of imports

Nada Choueiri, the IMF Mission Chief in Japan has said

the weak yen is beneficial for Japan's economy as the

benefit to the economy from higher exports exceeds the

increase in the cost of imports. a view that ignores the

negative impact on households from rising prices of

imported fuel and food.

Choueiri urged Japan to raise interest rates at a gradual

pace and compile supplementary budgets only when a big

shock hits the economy.

See:https://www.channelnewsasia.com/business/imf-sees-weak-

yen-beneficial-japans-economy-4703136

The Bank of Japan concluded its two-day policy meeting

on the 31st October maintaining interest rates at 0.25%

and continuing to signal its intention to raise rates when

the time is right.

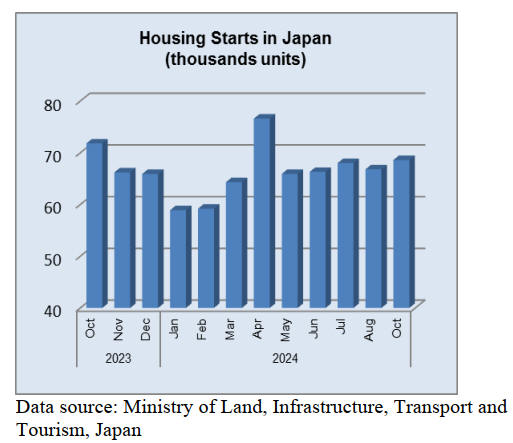

Household debt outpacing income

According to a Ministry of Internal Affairs’ ‘Family

Income and Expenditure Survey’ Japanese household debt

is outpacing income due to surging home prices and this is

raising concern about the ability of borrowers to keep up

with payments as interest rates are likely to rise.

Liabilities held by households of two or more averaged

6.55 million yen (US$43,500) in 2023 exceeding the

average annual income of 6.42 million yen for the first

time since records began in 2002.

See: https://asia.nikkei.com/Business/Markets/Property/Japan-s-

growing-mortgages-lift-household-debt-above-income

Launch of COP29 Japan Pavilion websites

In advance of the 29th Conference of the Parties to the

United Nations Framework Convention on Climate

Change (COP29), the Ministry of the Environment (MOE)

launched webpages on the showcases and seminars to be

held at the Japan Pavilion.

The MOE will exhibit Japan's environmental technologies

and climate initiatives at the Japan Pavilion during COP29

in Baku, Republic of Azerbaijan. The virtual showcase site

has also been designed to show additional technologies

over and above those shown in the on-site pavilion.

See: https://www.env.go.jp/earth/cop/cop29/pavilion/en/

and

https://jprsi.go.jp/en/cop29/showcase

Import update

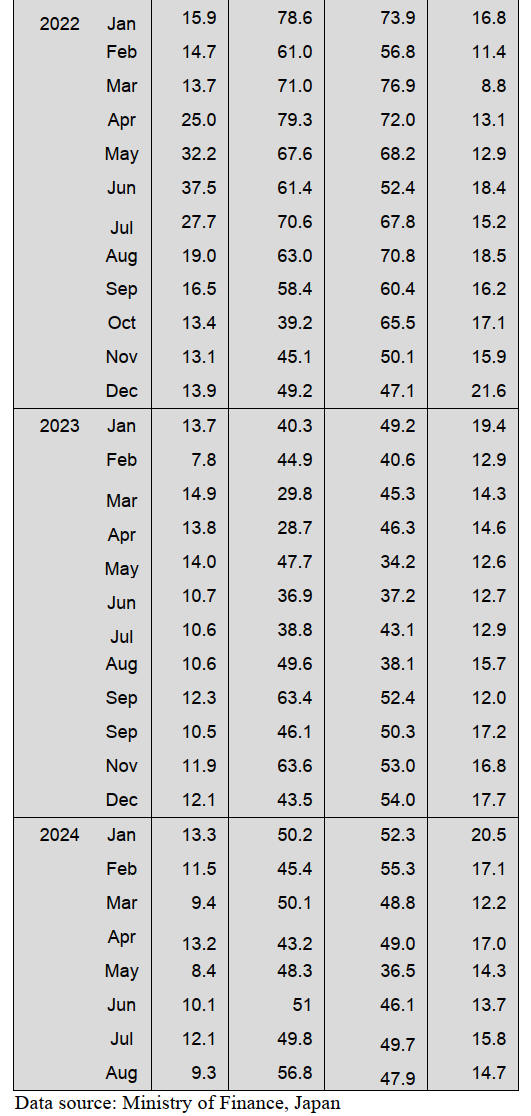

Assembled wooden flooring imports

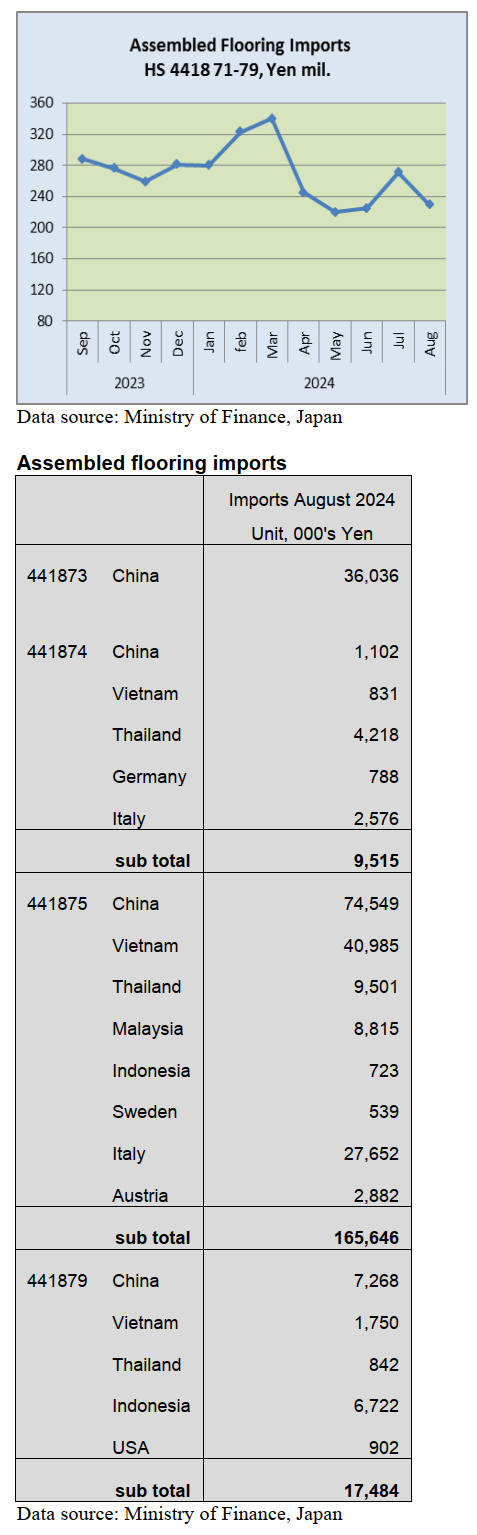

After two consecutive monthly increases the value of

assembled wooden flooring (HS441871-79) reversed

direction in August, dropping 15% compared to the

previous month. This brought the value of August imports

down to the level seen in May.

As in previous months the main category of assembled

flooring imports was HS441875, accounting for 72% of

the total value of assembled flooring imports, slightly up

from the previous month. The second largest category in

terms of value was HS441879 (8%) followed by

HS441874 (4%). Of HS441875 imports 45% was provded

by shippers in China, 25% by shippers in Vietnam and

17% from shippers in Italy.

Two other countries shipping assembled flooring

(HS441875) to Japan in August were Thailand and

Malaysia. The value of August arrivals of assembled

wooden flooring was little changed from the value in

August 2023.

Plywood imports

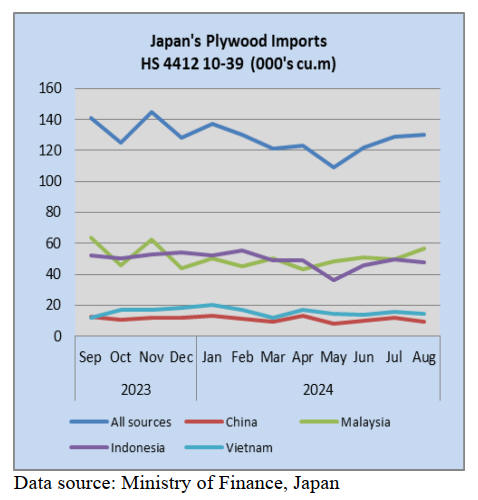

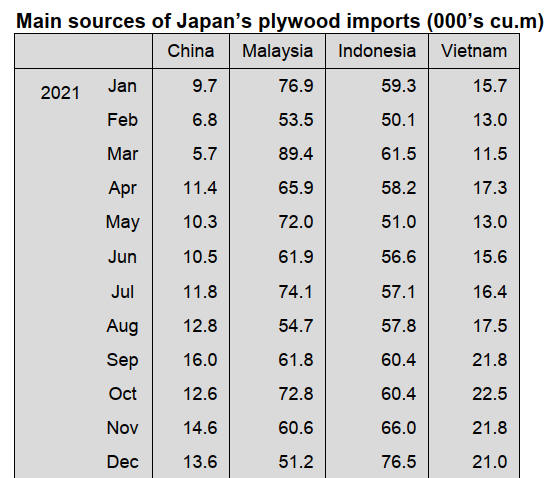

The volume of August plywood imports (441210-39) was

129,826 cu.m, this was around the same level imported in

July. Year on year the volume of August plywood was

down 8% but compared to a month earlier August import

volumes were up 20%

In August plywood arrivals from China and Vietnam were

down compared to levels in July while arrivals from

Malaysia rose month on month. August arrivals from

Indonesia were at around the same level as in July.

As in previous months, of the various categories of

plywood imported August most was HS441231. Of total

shipments from Malaysia and Indonesia, over 90% was

HS441231. Shipments from China were more varied with

HS441233 and HS441239 accounting for around 40%

each of August shipments with HS441231 accounting for

most of the balance.

Shippers in Vietnam supplied mainly HS441231 (69%)

with HS441234 making up most of the balance. Other

shippers appearing in Japan’s plywood import statistics in

August included Finland and Latvia.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Orders for house builders

Orders for major housing companies and house builders in

August, 2024 exceed the result of August, 2023. A number

of buildings is low but the price for per building is high.

However, it is hard to say that the house market is lively.

Demand for a high-priced building is stable. Wealthy

people think that buying a house is not going to be

influenced by the real wages, which is difficult to grow.

The competition to get customers among housing

companies is getting fierce.

The companies struggle with selling a level of thirty

million yen house. However, there are inquires for lumber

of one-story house and they help the sales. Orders for

rental houses are firm.

Many housing companies have good results in unit built

for sale. Orders for remodeling are very good. Many

housing companies strengthen in building eco-friendly

houses because demand for eco-friendly products will

keep increasing in the future.

South Sea logs and products

6,833 cbms of South Sea logs have been delivered to

Japan from Sabah and Sarawak in August. Also South Sea

Logs from Papua New Guinea in July 2024 so there is a

shortage so far.

Lumber manufacturers in Japan have orders for blocks

from steel or shipbuilding companies stably and demand

and supply are balanced in Japan.

There are constant inquiries to South Sea or Chinese

lumber. Lumber for decks are popular for condominiums

or second houses. There are enough lumber for truck

bodies so inquiries settled down.

The price of laminated boards is raised slightly in South

Asia due to the strong yen. Japanese buyers accept the

price hike

Demand and supply for lumber in 2023

Demand for lumber in 2023 was 79,853,000 cbms, 6.1 %

less than 2022. This is for the first time in three years to be

below 80,000,000 cbms.

Demand for wooden fuels increases but demand for

lumber, plywood, pulp, and chips decrease by two-digit

numbers. Domestic and imported lumber do not exceed

the 2022’s result but volume of imported lumber dropped

widely so the self-sufficiency rate of wood rises to 42.9 %,

2.2 points up from the previous year. This is for the first

time in fifty-one years to become the standard.

The domestic lumber is 34,259,000 cbms, 1 % less and the

imported lumber is 45,594,000 cbms, 9.7 % less than the

previous year.

The new starts and the floor areas decrease so the

consumption of lumber is influenced by these facts.

Especially, the imported structural lumber is 13,088,000

cbms, 28.2 % down from the previous year.

There are several reasons for the decrease and they are low

demand for lumber and high procurement cost due to the

weak yen. Japanese purchasing power has been weakening

and Japanese buyers could not negotiate about the price of

lumber with suppliers in overseas.

Demand for lumber is 21,790,000 cbms, 17.0 % down.

Demand for plywood is 7,474,000 cbms, 23.9 % down and

for pulp / chip is 27,797,000 cbms, 5.9 % down from

2022.

On the other hand, pulp / chip made in Japan increases

nearly 5 % from the previous year. Paper and paperboard

are needed for packing products on online-shopping. Also,

it is needed for sanitary goods for the elderly or inbound

tourists.

However, demand and supply for pulp / chip is balanced

contraction and several plants reorganize or close

operations. Demand and supply for wooden pellet increase

in domestic and imported wooden pellet. Many wood

biomass power plants had started operations after FIT

(Feed - in Tariffs) was enforced.

Especially, demand for wooden pellet at coal fired power

plants has increased. Imported wooden pellet is 9,156,000

cbms, 28.5 % up. 1 ton is converted into 1.282 cbms.

Exports of lumber is 3,395,000 cbms, 11.6 % up and of

logs is 1,595,000 cbms, 20.5 % up from last year. Exports

of pulp/chips is 1,371,000 cbms, 14.5 % increased.

The self-sufficiency rate of lumber is 38.6 %, 2.8 points

more than 2022. The total self-sufficiency rate of wood is

42.9 %, 2.2 points up from the previous year. It is about 24

points up from 2020, when year-on-year comparison was

18.8 %.

|