|

1.

CENTRAL AND WEST AFRICA

Demand insights

Timber markets in China are said to be oversupplied and

storage facilities at major ports like Zhangjiagang are at

full capacity. It has been reported that Zhangjiagang Port

is only accepting logs that can be transported immediately

to the importer.

The slowdown in construction in China has led to

decreased demand and while the Chinese government has

begun to address the problems in the real estate and

construction sectors the measures will take time to have an

impact.

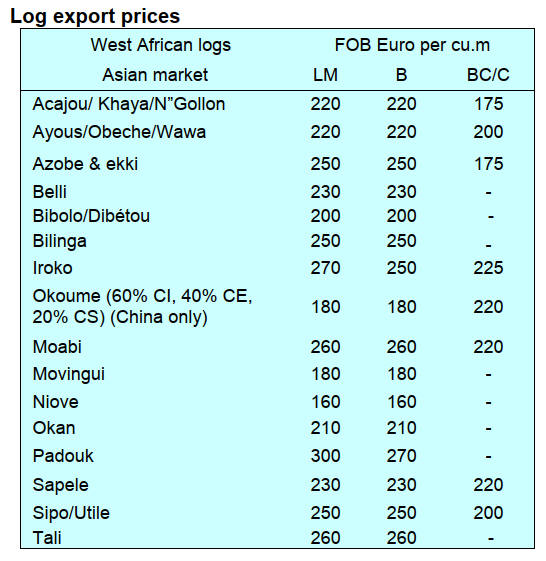

Exports of species such as okan, beli and ovangkol are

suffering due to the weak demand in China and the market

for bubinga/kevazingo, once lucrative market with prices

in the thousands, has significantly declined.

In contrast to the downturn in demand in China there is

said to be robust demand in Vietnam, especially for tali.

The Port of Owendo in Libreville is filled with large sized

tali sawnwood with dimensions ranging from 15x15 cm to

20x30 cm and lengths of 200 to 300 cm all destined for

Vietnam.

The Philippines maintains its strong demand for species

such as okoume and dabema and order levels for Middle

East markets are good with orders placed two to three

months in advance for redwoods, okoume and andoung.

The European market remains slow overall with no

significant changes.

Regional harvesting and production

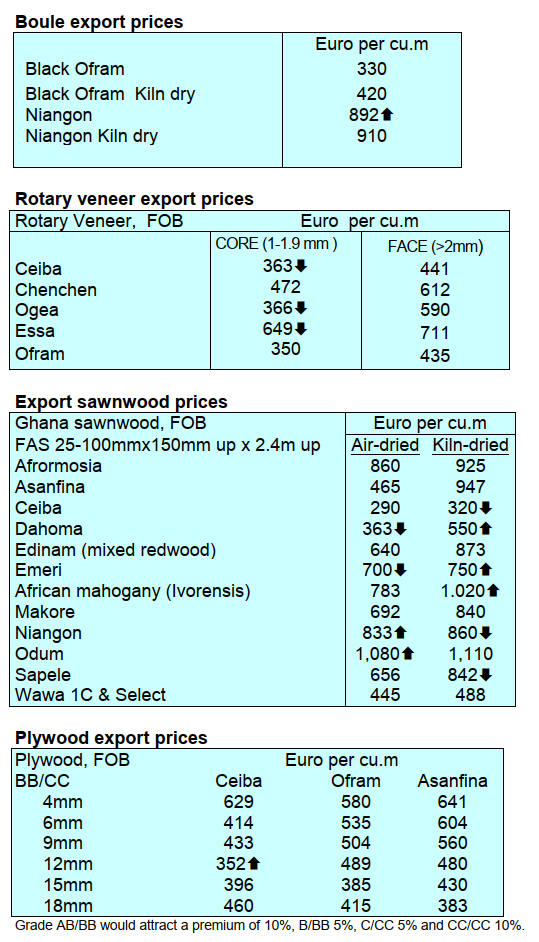

In Cameroon heavy rains are leading to transport delays

and logistical problems, particularly affecting the

movement of timber. Sawmills in Cameroon report having

secured orders for the next two months and are tending to

mill species preferred in European markets such as moabi,

douka/makore, doussie, padouk, sapelli and azobé.

The Central African Republic continues to supply logs and

sawn timber to Douala. The main species are sapelli,

iroko, sipo and doussie for which prices are good at

present.

In Gabon persistent heavy rains are delaying road

transport from the Southern and Eastern Regions where

not all roads are paved. Transportation on laterite roads in

the Central Regions like Lastourville and Makokou are

challenging, requiring two to three days for trucks to reach

their destinations. Due to weighbridge limitations in

Ndjolé trucks cannot exceed a total weight of 32 tonnes

further complicating logistics.

As in other countries in the region sawmills in Gabon are

also shifting focus to species favoured in Europe and

Vietnam such as azobé for the Netherlands and tali for

Vietnam.

A derailment in Gabonn mid month caused a four day

delay in shipments to the port.

In the Republic of Congo (Brazzaville) the Northern

Region has been experiencing heavy rain and flooding

causing transport problems from Likouala to Cameroon.

The mid and Southern Regions are also facing transport

delays due to the rain.

Production outlook

There is a noticeable shift towards European species

across West African countries due to declining demand

from China and India. Sustained demand from Vietnam

and the Philippines provides some stability with consistent

demand for specific species like tali, okoume and dabema.

The anticipated end of the rainy season in December

should alleviate some transportation challenges improving

the movement of timber to ports and markets. Operators in

the region are trying to anticipate the likely impact of the

EUDR on their businesses but this is a challenge as

nothing has been finalised as yet.

Launch of the new Bois Congo website

As part of the Support of the Private Sector Congo project

the ATIBT has created a website dedicated to the Congo

wood industry, bois-congo.org. This site is platform for all

stakeholders involved in the management, processing and

trade of sustainable Congolese tropical wood.

See: https://www.atibt.org/en/news/13554/discover-bois-congo-

the-new-internet-portal-dedicated-to-the-republic-of-congo-

forestry-sector

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20241021/1729482752156998.pdf

2.

GHANA

Kiln dried boule exports register sharp rise

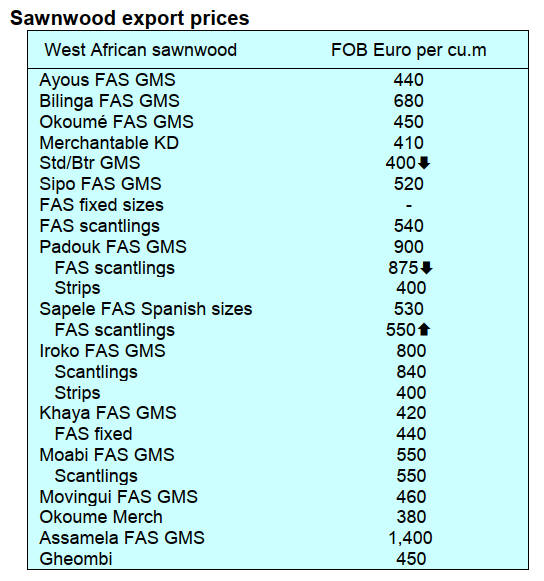

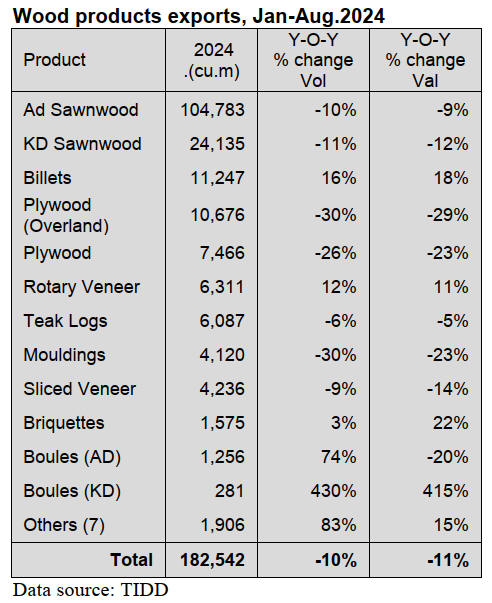

Available data from the Timber Industry Development

Division (TIDD) of the Forestry Commission show that

total wood product export volumes for the period January

to August 2024 stood at 182,542 cu.m, down 10% year-

on-year. Nineteen wood products exported in the period

earned the country Eur 82.46 mil., down from Eur 92.24

mil.earned in the same period in 2023.

There was a sharp increase in export volumes of kiln-dried

boules (281cu.m) against the volume exported in the same

period in 2023 (53cu.m) while air-dried boule exports also

recorded a 74% growth in volume but a 20% drop in

export receipts.

Boule exports comprised niangon (78% by volume) and

sapele (22%). These were exported to France, Greece and

Italy with Smartex Timber and Plywood Company

Limited and Bright Planners Ltd. as the main exporters.

Other products that recorded positive increases in export

volumes during the period were billets (16%), rotary

veneer (12%) and briquettes (3%). These products also

recorded corresponding revenue growth year-on-year

ranging from 12% to 22%.

The TIDD report also indicated there were declines

exports in most of the major export wood products during

the 8-months period in 2024 including sawnwood,

plywood and sliced veneer compared to the previous year.

Air and kiln-dried sawnwood continued to be the leading

wood product exported from Ghana, contributing 70% and

71% of the total volume of exports in 2023 and 2024

respectively.

Farmers urged to avoid excessive felling of economic

tree species

The Forestry Research Institute of Ghana of the Council

for Scientific and Industrial Research (CSIR-FORIG) has

cautioned farmers against clearing forests for agricultural

production. The research institute has observed that a

considerable volume of commercial species were being

cut.

According to the Council, preserving forests and

enhancing carbon storage was crucial for mitigating

climate change, maintaining ecosystem health and

ensuring a sustainable future, especially in carbon trading.

Dr. Reginald T. Guuroh, Principal Investigator at the

CSIR-FORIG, made this known at the sideline of the

opening ceremony of a five-day workshop on greenhouse

gas determination in West Africa’s agricultural landscape.

See:

https://www.businessghana.com/site/news/General/314706/CSIR

-cautions-farmers-against-clearing,-cutting-tree-species-for-

agric-production

Ghana secures World Bank funding to help address

energy sector losses

Ghana has signed a US$260 million agreement with the

World Bank to help solve the US$1.2 billion energy sector

losses and inefficiencies in the sector.

The agreement, under the Energy Sector Recovery

Programme, comprises a US250 mil. credit metering

procurement package and a US$10 mil. clean cooking

grant component in line with the Bank’s Programme for

Results (PforR) initiative.

In a related development, the Co-chair of the Ghana

Extractive Industry Transparency Initiative, Dr. Steve

Manteaw, has highlighted a significant revenue increase

by the Electricity Company of Ghana (ECG). According to

him, the rise in revenue is directly linked to both private

sector participation and the full deployment of digital

infrastructure, marking a turning point for the energy

sector’s financial health.

See: https://citinewsroom.com/2024/10/ghana-inks-us260m-

world-bank-deal-to-tackle-energy-sector-inefficiencies/

Economy to grow 4.0% in 2024

According to the International Monetary Fund (IMF),

Ghana’s economy is expected to grow by at least 4% this

year up from an earlier 3% projection. Ghana’s inflation is

also expected to end 2024 at 23% according to the World

Bank’s October 2024 Africa Pulse Report. Inflation is

forecast to fall to 11.5% in 2025.

See: https://www.myjoyonline.com/imf-revises-ghanas-growth-

target-to-4-for-2024/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

3. MALAYSIA

Updtaed National Climate Change Policy

The Ministry of Natural Resources and Environmental

Sustainability has launched the National Climate Change

Policy (NCCP) 2.0, an updated policy that introduces a

new framework for Malaysia’s transition towards a low-

carbon economy.

The Minister, Nik Nazmi Nik Ahmad , said the NCCP 2.0

is an umbrella policy that ties together all climate

initiatives, provides a clear pathway for governance, low

carbon development, adaptation, climate financing and

partnerships as well as serves as the backbone for the

drafting of Malaysia's very own Climate Change Act,

which is expected to be completed early next year.

Nik Nazmi also hinted that driving transboundary

collaboration would be Malaysia's priority, as it assumes

the chairmanship of ASEAN next year.

See:

https://ceomorningbrief.theedgemalaysia.com/article/2024/0838/

Home/13/728468

MTIB incentives for manufacturers

The Malaysian Timber Industry Board Certification Body

(MTIB-CB) gave a briefing to explain its role and the

incentives available to manufacturers for developing

documentation based on MTIB-CB Standard Product

requirements. The MTIB-CB provides recognition for the

Timber Product Quality Assurance Scheme.

The primary objectives are to assist the local industry in

fulfilling quality assurance requirements, ensuring

consistent product quality and guaranteeing that the

certification process adheres to the developed standards

for consumer safety. Currently, MTIB-CB oversees two

product standards: the Plywood Certification Standard

(MTIB-CB-PS-01), which outlines requirements for

various plywood types and the Formaldehyde Emission

from Wood-Based Panel Standard (MTIB-CB-PS-02),

specifying emission levels for wood-based products.

See: https://sta.org.my/images/STAReviewSep2024.pdf

Technology in the forests

Huawei has developed what is termed the TECH4ALL

programme an initiative to protect biodiversity and prevent

illegal logging in Sarawak's rainforests. The project

enables forest rangers to use tracking devices from

Huawei's cloud technology and artificial intelligence.

According to Huawei Public Affairs and Communications

Manager, Atiqah Khairudin, one of the domains focused

on by Huawei at TECH4ALL in Malaysia is the

environment which sees them working closely with

partners in Sarawak to ensure that forests are protected

using technology.

"Since the implementation of this project in 2021 with the

Sarawak Forestry Corporation, Sarawak Multimedia

Authority and the Sarawak Forestry Department, 77

sounds of activity have been detected including chain saws

and vehicles in real time," he reported.

See:

https://mtc.com.my/images/media/1762/10._Teknologi_TECH4

ALL_Huawei_cegah_pembalakan_haram-

_lindungi_hutan_Sarawak_-_TVS.pdf

and

https://www.huawei.com/en/tech4all/environment

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20241021/1729482752156998.pdf

4.

INDONESIA

Could wood energy boom threaten SE Asian

forests

and communities?

Research presented at the recent ASEAN Summit has

warned of threats to Southeast Asia's tropical forests due

to the rapid growth of the wood-to-energy sector. The

report, ‘Unheeded Warnings: Forest Biomass Threats to

Tropical Forests in Indonesia and Southeast Asia’,

suggests energy policies push a “false climate solution”

that could result in significant deforestation.

The report, published by organisations such as Earth

Insight, Auriga Nusantara and Forest Watch Indonesia

highlights the risk of negative impacts from biomass

energy policies.

See: https://www.bioenergy-news.com/news/new-report-

highlights-biomass-threat-to-southeast-asian-forests/

and

https://en.tempo.co/read/1926703/report-wood-energy-boom-

threatens-southeast-asian-forests-and-communities

A guide for smallholders on EUDR

Indonesia, Malaysia and the European Union plan a

practical guide to the EUDR for smallholders according to

the Council of Palm Oil Producing Countries (CPOPC).

The guide will be for smallholders and small businesses in

the palm oil, coffee, rubber, timber and cocoa sectors.

CPOPC is an intergovernmental organisation for palm oil

producing countries.

Indonesia has said it fears the regulation risks driving

smallholders and SMEs out of the global supply chain.

See: https://op.europa.eu/en/publication-detail/-

/publication/13116422-7869-11ee-99ba-01aa75ed71a1

and

https://www.reuters.com/world/asia-pacific/indonesia-malaysia-

eu-work-guide-smallholders-eu-deforestation-rules-2024-10-11/

Shrinking middle class

The national statistics agency has warned Indonesia's

economy is suffering from "long COVID" in the form of a

shrinking middle class as people struggle with widespread

layoffs, rising interest rates and de-industrialisation.

The proportion of middle class Indonesians dropped from

21.4% of the 267 million population in 2019 to 17.1% of

the 289 million population in 2024, according to the

Central Statistics Agency (BPS), while the proportion of

people classified as "aspiring middle class" rose slightly

from 48.2% to 49.2%.

Those regarded as vulnerable jumped from 20.6% to

24.2% over the same period. In absolute terms the middle

class shrank by 9.5 million people.

See:

https://www.benarnews.org/english/news/indonesian/indonesias-

shrinking-middle-class-alarms-economists-

09132024151821.html

Forestry Minister - Raja Juli Antoni

The newly appointed Minister Forestry, Raja Juli Antoni,

has called on all stakeholders to collaborate in protecting

and managing forests for the benefit of the Indonesian

people.

The previous Ministry of Environment and Forestry has

been eliminated and replaced by a Ministry of Forestry

and a Ministry of Environment.

Raja Juli made this statement after receiving the handover

of office from the former Minister, Siti Nurbaya Bakar.

Raja Juli emphasised that, as Minister, he would not

merely change the name of the programme but address

challenges in the sector.

The Minister mentioned that President Prabowo Subianto

has repeatedly called for the protection of forests to ensure

that they provide benefits and welfare for all Indonesian

people.

In related news, Minister Raja Juli Antoni stated that he

will focus on resolving several forestry issues including

data transparency to address the problem of mis-allocating

of palm oil plantations in forest areas.

He specifically mentioned the issue of monitoring palm oil

governance in Indonesia, as previously expressed by the

Financial and Development Supervisory Agency (BPKP).

See: https://www.medcom.id/nasional/peristiwa/Wb7Q2ZrK-

menteri-raja-juli-antoni-ajak-semua-pihak-kolaborasi-kelola-dan-

jaga-hutan

and

https://www.antaranews.com/berita/4414433/menhut-raja-juli-

fokus-selesaikan-keterlanjuran-sawit-di-kawasan-hutan

Indonesia and UNEP establish cooperation on

environment and forestry

Before the change of government the former Ministry of

Environment and Forestry and the UN Environment

Programme (UNEP) agreed on cooperation in the fields of

environment and forestry, including the conservation and

sustainable use of natural resources.

The cooperation was founded in a memorandum of

understanding (MoU) by former Environment and

Forestry Minister, Siti Nurbaya and Regional Director of

UNEP in Asia and the Pacific, Dechen Tsering.

Dechen said that through this collaboration the UNEP will

provide support for priority programmes related to

environmental and forestry issues as well as commitments

and initiatives at the international, regional, and national

levels.

See: https://en.antaranews.com/news/329058/indonesia-unep-

establish-cooperation-in-environment-forestry

Trade Minister hoping to wrap up IEU-CEPA talks

The new Minister of Trade, Budi Santoso, has affirmed

that he will pursue the speedy conclusion of negotiations

on the Indonesia-European Union Comprehensive

Economic Partnership Agreement (IEU-CEPA).

He noted that the deadline for the completion of the

agreement has been pushed back as Indonesia and the EU

are not in agreement on several matters and it is necessary

to find solution as soon as possible.

Earlier, the Director General of International Trade

Negotiations at the Ministry of Trade, Djatmiko Bris

Witjaksono, advised that the IEU-CEPA negotiation has

stalled due to policy disagreements.

Witjaksono also described the European Union

Deforestation Regulation (EUDR) as a major stumbling

block that has prevented the two parties from finalising the

long-awaited economic agreement.

See: https://en.antaranews.com/news/330573/trade-minister-

santoso-hoping-to-wrap-up-ieu-cepa-talks-quickly

5.

MYANMAR

Conflict and natural disaster – millions need help

A press statement from the UN says “Amid escalating

hostilities in Myanmar that have plunged millions into a

deepening humanitarian crisis, UN Secretary-General

António Guterres urged the country’s neighbours “to

leverage their influence” to bring about peace.

The appeal comes as aid agencies warn that millions of

people remain in acute need across Myanmar, particularly

in the north, southeast and Rakhine state. Their plight has

been made even worse by torrential rainfall and

catastrophic flooding amid a lack of humanitarian access

and insufficient relief funding.

“The humanitarian situation is spiralling. One-third of the

population is in dire need of humanitarian assistance -

millions have been forced to flee their homes”

Guterres told a meeting of ASEAN.

See: https://news.un.org/en/story/2024/10/1155596

Meeting of the ASEAN Ministers on Agriculture and

Forestry

On 24 October the Minister for Agriculture, Forestry,

Livestock and Irrigation, U Min Naung, chaired the 45th

ASEAN Ministers on Agriculture and Forestry (AMAF)

meeting.

On the first day of the meeting representatives from

ASEAN countries, Timor-Leste, ASEAN Secretariat and

Deputy Secretary-General of ASEAN discussed progress

in the implementation of ASEAN food security,

agriculture and forestry in 2023-2024 the sustainable

agricultural programmes especially ASEAN directives on

reducing crop burning and reducing the use of dangerous

chemicals, implementation of the blue economy,

digitalisation and a joint venture of governments and the

private sector.

The ASEAN Ministers reviewed the completed tasks

mentioned in the ASEAN food security, agriculture and

forestry strategic plan and approved the 16 critical

deliverables for ASEAN food security, agriculture and the

forestry sector.

They also recorded 11 action plans and added to the

ASEAN agriculture, food security and forestry strategic

plan (2026-2030).

See: https://www.moi.gov.mm/moi%3Aeng/news/15853

Data on border trade shows decline

Exports were worth US$3.5 billion and imports were

valued at US US$3.27 billion in the first quarter of this

financial year 2024-2025 according to the Ministry of

Commerce. The data indicated a significant year on year

decline in the trade balance. Seaborne trade in the first

quarter was US$5.48 bil., down year on year from US$5.6

bil.

The border trade value declined to US$1.32 billion from

US$2.69 billion.

Myanmar exports agricultural products, animal products,

minerals, forest products, and finished industrial goods,

while it imports capital goods, intermediate goods, raw

materials imported by the CMP enterprises and consumer

goods.

See: https://www.gnlm.com.mm/myanmar-foreign-trade-shows-

surplus-in-q1/

Mandatory remittance requirements extended to cover

workers in Laos

The authorities recently extended remittance requirements

to Myanmar workers in Laos mandating that 25% of their

wages must be sent back to Myanmar through official

channels. This policy adds to existing remittance

obligations imposed on workers in Thailand.

The new regulation, enforced by Myanmar's Ministry of

Labour, requires workers to use approved remittance

channels despite concerns over unfavourable exchange

rates and high charges. This move has been met with

criticism from many sectors.

See:

https://www.rfa.org/english/myanmar/2024/10/24/myanmar-

migrant-workers-laos/)

In related news, Myanmar's humanitarian and economic

crisis has worsened under mandatory conscription.

Targeting working-age men and women this policy has

driven thousands to flee the country. The forced enlistment

comes on top of economic decline and widespread

displacements and a labour shortage is reportedly affecting

key sectors like agriculture.

It has been reported the Myanmar authorities aim to draft

5,000 people per month which has caused many young

citizens to flee the country.

Myanmar nationals, now among the top foreign property

buyers in Thailand but face growing documentation issues

due to restrictive passport renewals and forced

remittances.

See: https://eastasiaforum.org/2024/10/26/myanmar-faces-

manifold-crises-as-military-conscription-drives-mass-

exodus/?utm_source=rss&utm_medium=rss&utm_campaign=my

anmar-faces-manifold-crises-as-military-conscription-drives-

mass-exodus

6.

INDIA

Diwali – busy time for

many businesses

The week 21-25 October was the last working week before

the festive season of "Diwali" and Hindu New

Year holidays which will run until 3 November.

Businesses are often at their busiest before major holidays.

The upcoming Diwali festival, one of the most important

holidays in India, is no exception.

Diwali is one of the most important holidays in the Indian

economy, boosting consumer spending on new clothes,

gifts, home decorations, food, and beverages. As the most

celebrated holiday in the community, Diwali also leads to

increased consumer spending.

However, businesses typically close for several days

during the holiday, resulting in manufacturing delays and

inventory shortages which significantly impact the Indian

supply chain.

Shortage of affordable land holding back home

construction

In a press release, the Confederation of Real Estate

Developers' Associations of India (CREDAI) has

pinpointed two aspects that it believes would help boost

both the supply and demand for affordable housing in

India.

According to CREDAI the availability of land and the

current price cap on land for affordable housing needs to

be addressed to ensure sustained growth of the affordable

housing segment.

CREDAI asserts that the cost of land, which accounts for

nearly 50% of the total cost of any housing project, is a

huge financial burden. This is a problem for developers

especially in Tier 1 cities, where the cost of land is much

higher than other regions of the country. CREDAI believes

affordable land costs for affordable housing projects

would help and enable developers to build more houses

under the segment.

Data from the National Housing Bank reveals a 24%

increase in house prices in India since June 2018

underscoring the need for revision of the price cap on

affordable house prices.

The real estate industry advocates a re-evaluation

that

reflects current market realities and ensures adequate

availability of affordable housing units. CREDAI believes

the definition should be based on the size of the house and

not the price.

Boman Irani, President, CREDAI “Affordable Housing

has been one of the most important segments of Indian

Real Estate in the past few years, which has fulfilled the

dreams of millions of Indians to become homeowners.

Currently, there is a need to alter some fundamental

aspects to get the segment back on a robust growth

trajectory that can lead to sustained and sustainable

growth”.

See: https://www.credai.org/media/view-details/492

In other real estate news, a press release from CREDAI

says a recenta Colliers-CREDAI Report forecasts the

Indian real estate is set for 16% annual growth to propel

the market to US$10 trillion by 2047. The interplay

between real estate and India’s economic growth journey

over the next few decades is explored in the latest

report “Indian Real estate: The Quantum Leap” by

Colliers in collaboration with the Confederation of Real

Estate Developers' Associations of India (CREDAI).

The report identifies that long-term growth in real estate is

underpinned by six salient growth levers which

include rapid urbanisation, infrastructure development,

digitalisation, demographic shifts, sustainability and

investment diversification, all of which will form the

foundation for a leap in Indian real estate sector growth.

See: https://www.credai.org/media/view-details/491

Farmers - poplar and eucalyptus offer best returns

The Indian trade magazine Plyinsight has an article

reporting that in Northern India innovative farmers have

begun to plant poplar and eucalyptus which, they consider,

have potential to yield more profits than traditional agri-

crops. The wood panel industry is well-established in the

Yamunanagar Region of Haryana State of Northern India

and industries there produce about one-third of the

country’s panel products so there is a ready market for

logs.

To stimulate the promotion of agroforestry, the Punjab

government has formulated a plan that includes

establishing a consortium of government bodies ensuring

fair pricing for farm woods, creating cultivation

agreements between farmers and industries, providing

annuity payment through soft loans and developing

infrastructure.

See: https://plyinsight.com/september-edition-2024/

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

According to Vietnam Customs statistic, in September

2024 W&WP exports earned US$1.25 billion, down 17%

compared to August 2024 but up 11% compared to

September 2023. The share of WP exports was US$902.5

million, down 12.5% compared to August 2024 but up

20% compared to September 2023. In the first 9 months of

2024 W&WP exports hit US$11.7 billion, up 22% over

the same period in 2023. Of this WP exports were valued

at US$8.04 billion, up 24% over the same period in 2023.

In the first 9 months of 2024 exports of wood and wood

products to the EU earned about US$378 million, up 25%

over the same period in 2023.

Vietnam's office furniture exports in September 2024

reached US$27.3 million, up 18% compared to September

2023. In the first 9 months of 2024 exports of office

furniture were valued at US$216.9 million, up 11% over

the same period in 2023.

In September 2024 W&WP imports cost US$234.5

million down 13% compared to August 2024 but up 24%

compared to September 2023. In the first 9 months of

2024 Vietnam spent US$2.03 billion on W&WP imports,

up 26% over the same period in 2023.

Vietnam's tali imports in September 2024 totalled 36,900

cu.m worth US$13.0 million, down 2% in volume and

down 2% in value compared to August 2024 but compared

to September 2023 imports increased by 18% in volume

but decreased by 2.5% in value. In the first 9 months of

2024 imports of tali were estimated 240,400 cu.m, worth

US$89.7 million, down 19% in volume and down 28% in

value over the same period in 2023.

Vietnam’s imports of logs and lumber from the US in

September 2024 surged again reaching 65,000 cu.m, with

a value of US$28.0 million, up 11% in volume and 6% in

value compared to August 2024 this represented a sharp

increase of 54% in volume and 61% in value over the

same period in 2023.

In the first 9 months of 2024 imports of logs and

sawnwood from the US reached 518,380 cu.m, with a

value of US$222.96 million, up 32% in volume and 33%

in value over the same period in 2023.

Exports of wooden upholstered chairs in September 2024

earned US$255 million, up 11% compared to September

2023. In the first 9 months of 2024 exports of this item

earned US$2.4 billion, up 22% over the same period in

2023.

Vietnam's pine imports in September 2024 were estimated

at 96,600 cu.m, worth US$22.8 million, down 14% in

volume and down 13% in value compared to August 2024

but compared to September 2023 imports increased by

12% in volume and 21% in value. In the first 9 months of

2024 imports of pine stood at 712,500 cu.m, worth

US$159.8 million, up 40% in volume and 43% in value

over the same period in 2023.

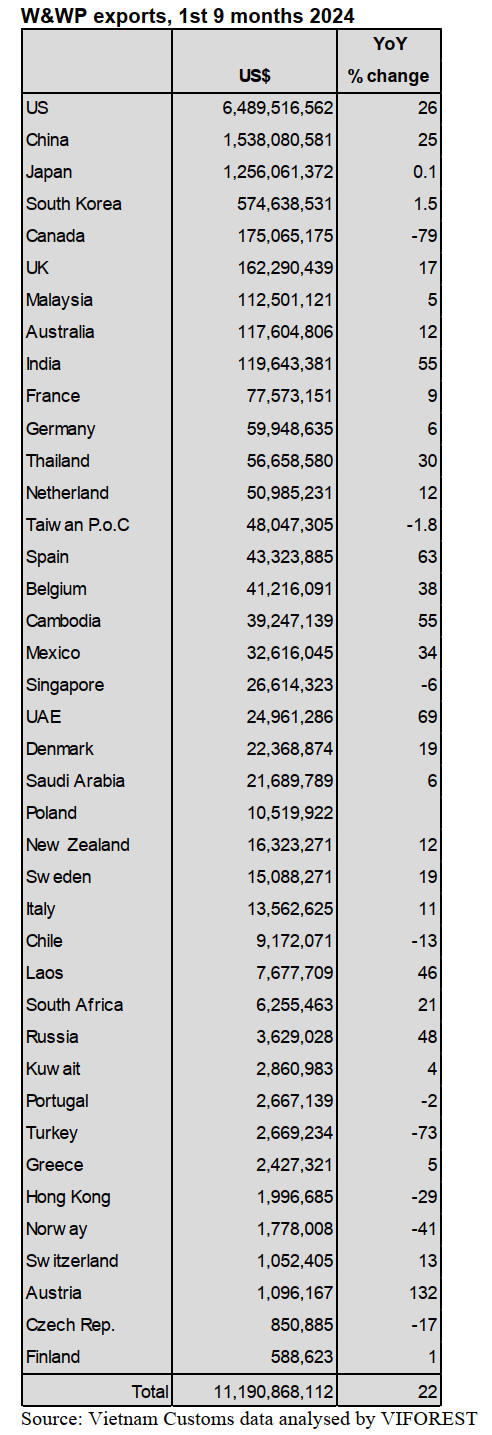

First 9 months W&WP trade

Exports

In the first 9 months of 2024 W&WP exports were valued

at US$11.7 billion, up 25% over the same period in 2023

ranking 7th among Vietnam’s export commodity groups.

In which, the WP exports shared US$8 billion, up 24%

over the same period last year, accounting for 69% of the

total W&WP exports.

Export markets

In the first 9 months of 2024 W&WP exports to the US

and China increased sharply compared to the same period

in 2023 by 26% (US$6.5 billion) and 25% (US$1.53

billion) respectively. Exports to Japan did not increase

over the same period and exports to South Korea

decreased slightly.

On the other hand, in the first 9 months of 2024 there was

a sharp increase in exports to markets such as India, Spain,

Germany and Belgium. W&WP exports to India increased

sharply, reaching US$120 million, up 55%. India is listed

in the top 7 consumer of W&WPs exported from Vietnam.

Plywood and veneer are the main export products exported

to India.

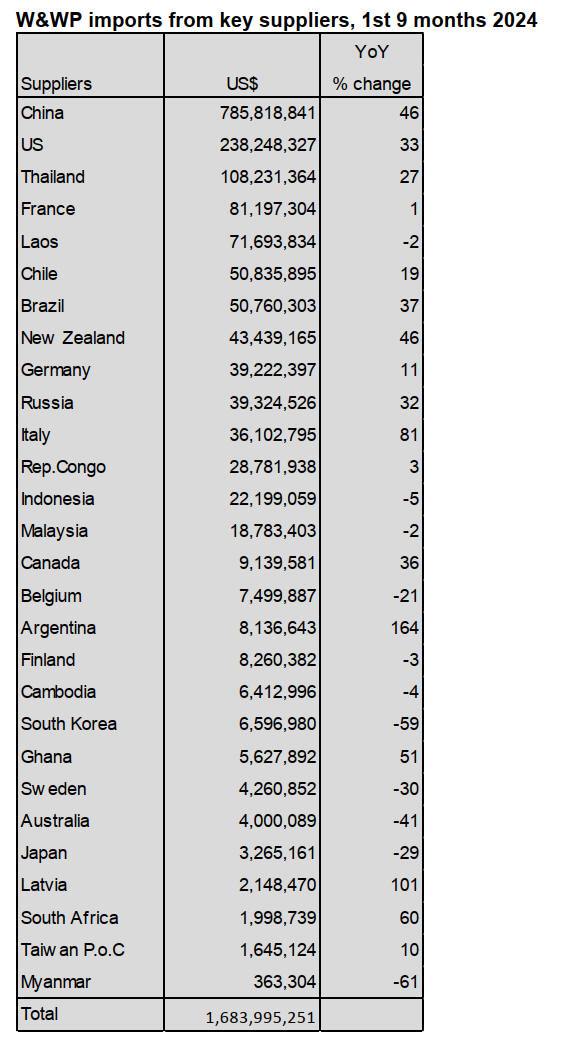

Imports

In the first 9 months of 2024 W&WP imports amounted to

US$2.02 billion, up 26% over the same period last year.

Import by foreign (FDI) enterprises

In the first 9 months of 2024 W&WP imports by FDI

enterprises topped US$760 million, up 38% over the same

period in 2023 and accounted for 38% of the country's

total W&WP imports. The rate for the same period last

year was 27%.

Import sources

In September 2024 W&WP imports from key suppliers

decreased. Specifically, imports from China decreased by

13% (US$81), Thailand by 36% (US$10 million), Chile

dropped by 15% (US$7 million). In contrast, compared to

August 2024, imports from Brazil and the Republic of

Congo increased by 11% and 18% respectively.

In the first 9 months of 2024 W&WP imports from key

supply markets increased against the same period in 2023.

Specifically, imports from China increased by 47%

(reaching US$785 million), the US increased by 33%

(US$238 million), Thailand by 27%.

8. BRAZIL

Teak included in tax incentive programme

At the 23rd meeting of the Deliberative Council for the

Mato Grosso Development Programme

(CONDEPRODEMAT) the inclusion of teak among the

products eligible for tax benefits in the state was approved.

The State of Mato Grosso, the largest teak producer in

South America, has 68,000 hectares of planted forests.

According to CONDEPRODEMAT the inclusion of teak

in the programme will stimulate the teak sector which

stands out in the forest industry as teak products are

widely exported to Asia and Europe.

See: https://forestnews.com.br/conselho-aprova-inclusao-da-teca-

como-produto-de-madeira-para-incentivos-fiscais-em-mt/

Seeking solutions for exports amid new CITES

requirements

Representatives of Mato Grosso's forest sector took part in

meetings with the Brazilian Institute of Environment and

Renewable Natural Resources (IBAMA), the Ministry of

Agriculture and Livestock (Mapa) and the National

Confederation of Industry (CNI) to find solutions to

unblock timber exports.

The focus of the discussions was the new requirements set

by CITES on regulating exports of ipê (Handroanthus) and

cumaru (Dipteryx odorata) set to come into force at the

end of November. The meeting included participation

from the Federation of Industries of Mato Grosso

(FIEMT), the Center for Timber Producing and Exporting

Industries (CIPEM) and the National Forest-Based Forum

(FNBF).

During the meeting with IBAMA the forest sector

representatives expressed their concerns on the economic

impact of these new regulations.

IBAMA reaffirmed its commitment to applying CITES

guidelines without negatively affecting the production

sector. FIEMT also highlighted the importance of joint and

integrated action between the Federation and the

employers´ unions to find effective solutions.

With the inclusion of ipê and cumaru under CITES new

requirements and procedures for exporting these woods

have emerged. The forest sector representatives stressed

the impact of these regulations on the economic viability

of export operations. CIPEM emphasised the importance

of ongoing dialogue between the government and the

forest sector, including discussions about logistical

difficulties at the ports.

During the meeting with IBAMA's board it was agreed

that the Federal Environmental Agency will communicate

with the Ministry of Foreign Affairs detailing the

procedures for issuing CITES certificates.

IBAMA will undertake informing importing countries

about the Brazilian procedures.

See: https://cipem.org.br/noticias/setor-florestal-de-mato-grosso-

busca-em-brasilia-apoio-as-exportacoes

In related news, the CITES Secretariat has just published

an important notification concerning the implementation

of the Convention for cumaru green ebony and tabebuia.

For more information, see CITES Notification N° 2024/116.

and

See: https://cites.org/eng/node/141138

and https://www.atibt.org/en/news/13556/cites-implementation-

for-cumaru-and-green-ebony-in-brazil

Partnerships with academic institutions to boost

innovative forest management

The Center for Timber Producing and Exporting Industries

of Mato Grosso State (CIPEM) has established

partnerships with academic institutions to enhance and

strengthen native wood production in the State.

Over the past two years 12 initiatives have been

implemented including the 1st Meeting of Amazon Native

Tree Identifiers which brought together experts to

exchange experiences on timber species essential for the

sustainable forest management in the region.

Other projects include studies on energy, potential of

wood residues, converting sawdust into fertiliser,

developing forest management software and creating a

system to identify timber species in the Amazon.

Currently, more than 5 million hectares of natural forests

are under sustainable management plans in Mato Grosso

with the potential to expand this to over 6 million hectares.

According to the Brazilian Institute of Geography and

Statistics (IBGE), the state of Mato Grosso is the second

largest producer of roundwood from natural forests in

Brazil, with a production of 2.1 million cubic metres

(R$498.1 million) in 2023 representing 76 % of the total

value of harvesting in the State. Together, Mato Grosso

and Pará States account for 63% of harvests in natural

forests.

Of the State’s trade balance timber is among the ten most

traded products adding up to US$78.2 million in the first 8

months of 2024.

See: https://cipem.org.br/noticias/pesquisa-parcerias-com-

instituicoes-academicas-fortalecem-gestao-florestal

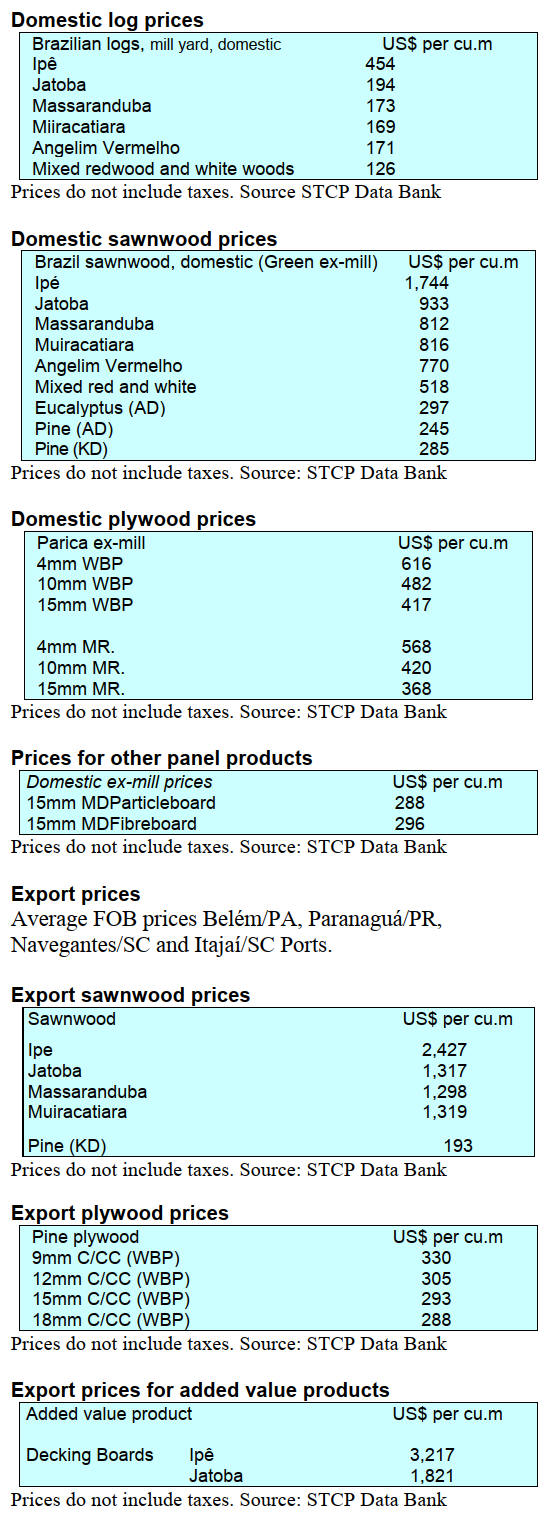

Export Update

In September 2024 the total Brazilian exports of wood-

based products (except pulp and paper) increased 20% in

value compared to September 2023, from US$260.9

million to US$ 313.5 million.

Pine sawnwood exports increased almost 10% in value

between September 2023 (US$41.4 million) and

September 2024 (US$45.3 million). In volume, exports

increased 5% from 182,000 cu.m (September 2023) to

190,900 cu.m (September 2024).

Tropical sawnwood exports increased 12% in volume,

from 23,000 cu.m in September 2023 to 25,700 cu.m in

September 2024, however, export earnings decreased 2%

from US$10.2 million to US$10.0 million over the same

period.

Pine plywood exports decreased 40% in value in

September 2024 (US$48.5 million) compared to

September 2023 (US$68.0 million). In volume terms

exports increased 32% over the same period, from 153,400

cu.m (September 2023) to 202,900 cu.m. (September

2024).

As for tropical plywood, exports increased 33% in value

and 35% in volume, from US$1.2 million and 2,000 cu.m

in September 2023 to US$1.6 million and 2,700 cu.m in

September 2024.

The value of wooden furniture exports increased from

US$47.1 million in September 2023 to US$51.0 million in

September 2024, an increase of 8%.

SFB Funds Forest Bioeconomy Projects in the Amazon

and Caatinga biomes

The Brazilian Forest Service (SFB) held meetings with

Civil Society Organizations (CSOs) in early October to

present a Public Call for proposals from the National

Forest Development Fund (FNDF).

The call, in line with the Regulatory Framework for Civil

Society Organizations (MROSC), providesthe opportunity

for support ranging from R$350,000 to R$500,000 for

projects in the Amazon and R$200,000 to R$400,000 for

projects in the Caatinga biome.

Projects should have a three-year duration and focus on

themes such as forest management, native vegetation

restoration, environmental services and development of

Value Chains. The final results of the call for proposals are

expected to be released in early November of this year.

The National Forest Development Fund (FNDF), managed

by SFB, aims to promote the development of sustainable

forest activities in Brazil and foster technological

innovation in the forest sector.

See: https://www.gov.br/florestal/pt-

br/assuntos/noticias/2024/setembro/sfb-faz-reuniao-aberta-para-

detalhar-edital-de-chamamento-sobre-bioeconomia-florestal

Brazil creates global fund for tropical forest

preservation

Brazil has launched a billion-dollar fund for tropical forest

preservation called the Tropical Forest Finance Facility

(TFFF) with operations expected to begin after the

UNFCCC COP 30 in 2025 which will be held in Brazil.

The fund aims to raise US$25 billion to finance the

conservation of 1 billion hectares of tropical forests

worldwide focusing on key biomes that are essential for

the global climate and biodiversity. The initiative will also

feature a satellite monitoring system to ensure

transparency and effectiveness in forest preservation.

During a meeting of the Finance Track (which addresses

strategic macroeconomic issues and is led by finance

ministers and Central Bank Governors of G20 member

countries) the Brazilian government emphasissed the

importance of international participation in the project

stressing that the fund was designed to attract the

engagement of developed countries.

The fund, considered as an innovative tool in climate

finance, aims to attract international engagement and boost

the market for green, blue (related to water resource

conservation) and sustainable bonds, promoting a

mechanism of mutual benefits for wealthy countries that

preserve their tropical forests.

The TFFF is expected to be officially presented at

UNFCCC COP29 in Azerbaijan in November 2024.

See: https://www.g20.org/pt-br/noticias/brasil-cria-fundo-

bilionario-para-preservacao-de-florestas-tropicais

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20241021/1729482752156998.pdf

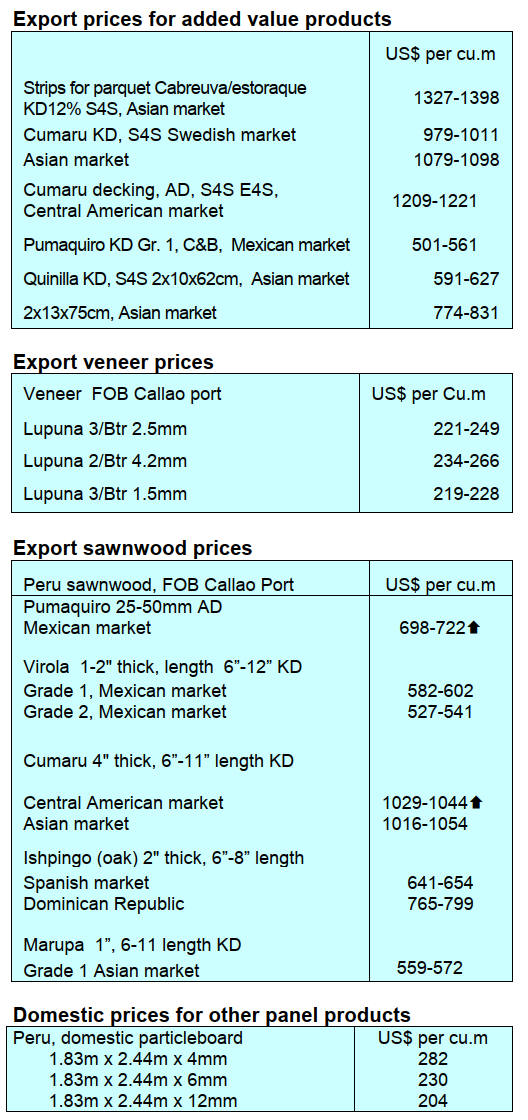

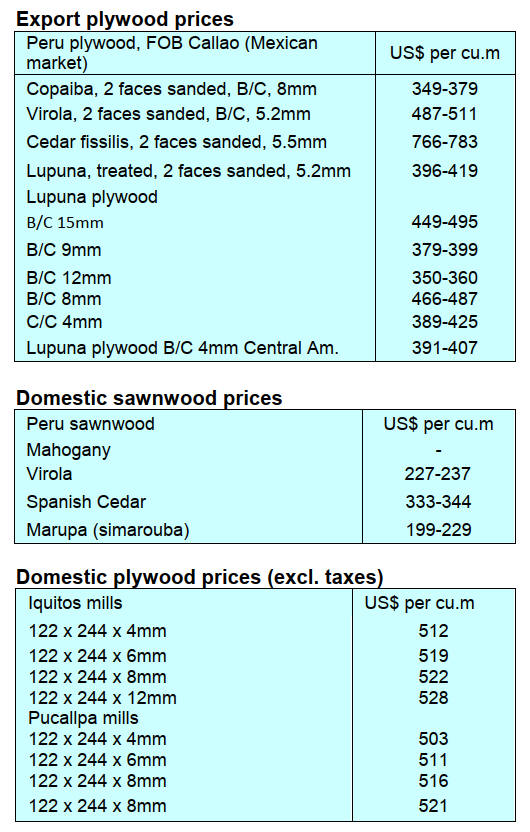

9. PERU

Plywood shipments

declined in first eight months of

the year

Between January and August 2024 plywood exports

earned US$1.80 million which represented a year on year

decline of 3.5% as reported by the Services and Extractive

Industries Management of the Exporters Association

(ADEX).

The main market for veneer and plywood in the first eight

months was Mexico, with a share of 84% but down year

on year by almost 5%. The second market was Ecuador

with a share of 12% up significantly on the same period in

2023.

Progress in addressing illegal logging

During a bilateral meeting with representatives of the

United States to assess the implementation of the Forest

Sector Management of the Trade Promotion Agreement

between the two countries the Forest and Wildlife

Resources Oversight Agency (OSINFOR) presented

progress and results from the contribution of this initiative

to the governance of the sector and the fight against illegal

logging.

OSINFOR highlighted the achievements made in the last

decade with the support of the United States. The on-going

initiative, supported by academia and international

experts, incorporates cutting-edge technology such as

high-resolution satellite images, selective logging

detection algorithms and the use of drones.

The results are evident from the lower number of forest

law infringements from 32% in 2015 to 1% in 2023 while

the volume of illegal wood seized dropped. This

significant progress has been made possible by the

expansion of supervision coverage in forested areas and

the optimisation of resources.

In its role as the Technical Secretariat of the Permanent

Multisectoral Commission to Combat Illegal Logging

(CMLTI), OSINFOR promoted the implementation of a

methodology to measure illegal logging which showed a

reduction from 37% to 20% in the period 2017-2021.

Progress in combating illegal logging was strengthened

with the approval in 2021 of the New National

Multisectoral Strategy to Combat Illegal Logging.

See: https://www.gob.pe/institucion/osinfor/noticias/1046700-en-

encuentro-peru-estados-unidos-se-presentan-avances-en-la-

lucha-contra-la-tala-ilegal

Capacity prosecutors strengthened to confront illegal

timber trafficking

In order to strengthen the fight against illegal timber

trafficking and promote inter-institutional cooperation the

Agency for the Supervision of Forest and Wildlife

Resources (OSINFOR), with the technical and financial

support of the United Nations Office on Drugs and Crime

(UNODC) and the Federal Ministry for Economic

Cooperation and Development of Germany (BMZ),

organised a workshop for justice department professionals.

The event included presentations and roundtables where

critical issues such as inter-institutional cooperation and

the role of civil society in reporting and preventing timber

trafficking were discussed.

This workshop contributed to strengthening the capacities

of justice system operators and other entities with related

responsibilities.

See: https://www.gob.pe/institucion/osinfor/noticias/1045478-

fiscales-y-operadores-de-justicia-fortalecen-sus-capacidades-

para-hacer-frente-al-trafico-ilegal-de-madera-en-loreto

|