|

Report from

North America

Tropical hardwood product imports fell in August

US imports of tropical hardwood and tropical hardwood

products slowed in August with nearly all categories

seeing a decrease from the previous month.

August imports of sawn tropical hardwood lumber fell

14% from the previous month and 22% below that of

August 2023; imports of hardwood plywood dropped by

4% for the month to a level 24% below the previous

August and imports of tropical hardwood veneer retreated

22%, falling 52% short of the August 2023 total.

Imports of hardwood flooring declined 20% in August—

down 26% from the previous August—while imports of

assembled flooring panels fell only 1% from the previous

month and maintained a level 34% higher than that of

August 2024.

Imports of hardwood moulding also fell only marginally,

losing 2% but remaining a healthy 34% higher than

August of last year. Imports of wooden furniture slid 5%

but held 2% higher August 2023 totals.

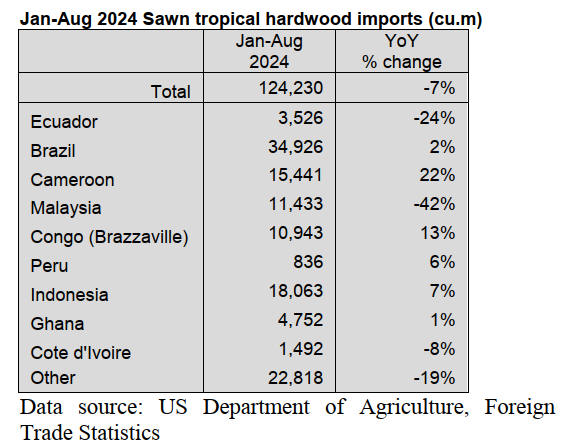

Sawn tropical hardwood imports

US imports of sawn tropical hardwood fell 14% in August.

The 15,106 cubic metres of hardwood imported was 22%

less that that imported last August as imports for many

types of hardwoods sank by about 25%. Imports of Balsa,

Sapelli, Ipe, Mahogany, Virola, Cedro and Paduak all fell

between 20-30% from the previous month.

Imports of Keruing rose 54% percent but were still 34%

below that of the previous August and are down 47% year

to date. Imports from Brazil, the top trading nation, were

down 23%, falling sharply for the second straight month.

Total US imports of sawn tropical hardwood are down 7%

so far this year versus last year.

Canada’s imports of sawn tropical hardwood also fell in

August, losing 13% from the previous month. Despite the

drop, the month’s imports were a healthy 51% above that

of August 2023 while imports from Brazil, Cameroon, and

Bolivia are more than 80% higher than last year for the

year so far. Total Canadian imports of tropical hardwood

are up 45% versus 2023 for the year through August.

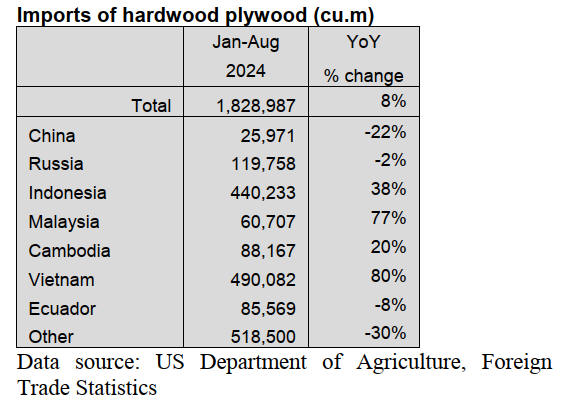

Hardwood plywood imports slip

US imports of hardwood plywood dipped 4% in August on

declines from it three top trading partners. Imports from

Russia fell 31% in August while imports slipped 14%

from Indonesia and 7% from Vietnam. The 209,888 cubic

metres of plywood imported in August was 24% less than

what was imported the previous August.

As a result, 2024 imports that were earlier greatly

outpacing the previous year, are now only ahead of 2023

by 8% for the year so far. However, imports from Vietnam

and Malaysia remain strong and are up around 80% over

last year’s totals through August.

Veneer imports weaken

July’s surge in US imports of tropical hardwood veneer

appears to be a one-month blip as August figures sank

back to their weak June level. An upsurge in imports from

India could not make up for sharp declines in imports from

Italy, China, Ghana, and Cote d’Ivoire.

Imports from Italy remain down by nearly three quarters

for the year so far while total veneer imports fell to 14%

below that of 2023 year to date.

Hardwood flooring imports fall to lowest level since

2021

In August, monthly imports of hardwood flooring fell

below US$5 million for the first time since February 2021.

Imports fell for the third straight month, dropping 20%

from the previous month to a level 26% below that of

August 2023. The decline came even though imports from

top trade partner Indonesia rose 18% and other top trade

partners also saw gains. Total imports of hardwood

flooring are down 14% versus last year through August.

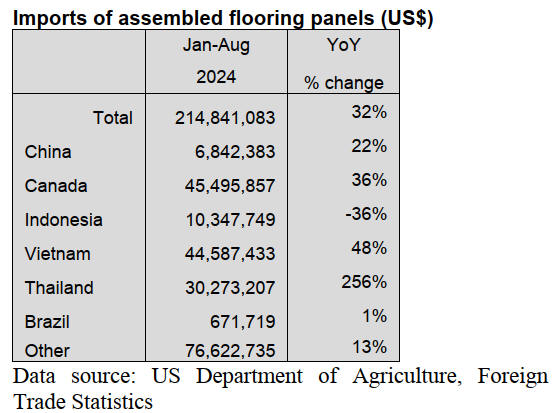

US imports of assembled flooring panels took a pause in

August after rising in each of the previous four months.

Imports fell by 1% in August but remained 34% higher

than in August 2023.

Imports from Indonesia more than doubled from the

previous month while imports from China gained 83%.

Total imports continue to outpace those of 2023 by 32%

through August.

Moulding imports slacken

US imports of hardwood moulding took a slight hit for a

second straight month but continue to stay at a level well

above that of last year. Moulding imports fell 2% in

August but remained 34% higher than that of August

2023. Imports from Brazil continue to disappoint, falling

35% in August and down more than 50% for the year so

far. Imports from Malaysia rallied 60% in August but are

still down 7% for the year to date. Total US imports of

hardwood moulding are up 26% versus 2023 through

August.

Wooden furniture imports fall

US imports of wooden furniture fell 5% in in August as

imports from nearly all trade partners slipped. Imports

from Malaysia, China and India all fell more than 10%.

Imports from Mexico saw the only gain but rose less than

1% over the previous month.

The US$1.74 billion imported in August was 2% higher

than that of August 2023. For the year so far, total imports

of wooden furniture remain ahead of last year by 6%.

See: https://usatrade.census.gov/index.php?do=login

Hurricane strikes traditional US furniture and wood

product regions

Hurricane Helene and its aftermath have devastated

communities throughout Western North Carolina and

communities in other Southern states.

Latest estimates have the death toll at more than 160 men

and women — a number sure to rise as hundreds are

reported missing. The furniture, lumber, and cabinet

industries are not immune to these effects.

Woodworking Network has reached out to more than a

dozen small and mid-sized shops throughout communities

such as Asheville, Black Mountain, Canton, Hiddenite,

and other area towns — particularly hard-hit areas — but

as power, internet and cell service is out or limited at best,

few of these local companies have answered their phones

or returned phone calls. Those that have responded have

reported outages, minor damage, and even supply

shortages.

The greatest impact has been on transportation. Hundreds

of roads remain closed, according to the US Department of

Transportation. "Road conditions are becoming clearer in

the affected area, however, travel between western North

Carolina and Tennessee is extremely limited, especially

for trucks. Interstate 40 and I-26 are closed at the

Tennessee/North Carolina line. The estimated repair time

for I-40 is unknown at this time," according to the DOT's

website.

The hurricane's effect has been with companies throughout

the region and companies are in the early stages of

gathering information and figuring out what will be

needed to resume normal operations.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/hundreds-hurricane-damaged-roads-still-closed-

or-affected

Negotiations continue as US dockworkers return to

work

Striking dockworkers along the US’s East and Gulf Coasts

agreed to go back to work 3 October after reaching a

tentative agreement with port operators for a 62% wage

increase that extends the current contract providing more

time to bargain over remaining issues. The tentative

agreement to suspend the International Longshoremen's

Association strike may have consumers and businesses

breathing a sigh of relief. Still, the deal is far from done,

according to logistics experts.

The US ports strike suspension, with the International

Longshoreman's Association union and USMX ownership

group reaching a deal on wage increases, still leaves the

contentious issue of port automation to resolve by the 15

January deadline.Many US ports remain laggards on

automation compared to the rest of the world and the

union has used aggressive rhetoric in discussing this.

See: https://www.nbcnews.com/business/business-

news/dockworkers-union-reach-tentative-agreement-wages-

suspend-strike-talks-rcna173963

|