US Dollar Exchange Rates of

10th

Oct

2024

China Yuan 7.06

Report from China

Investment in real estate development

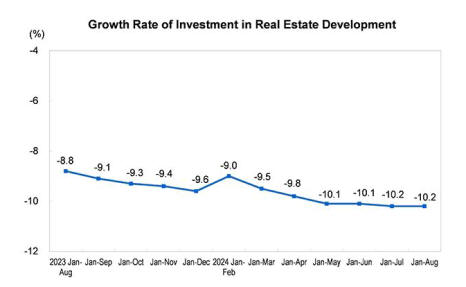

The national Bureau of Statistics released details of real

estate investment between January and August indicating

there was year-on-year decrease of 10.2% in investment,

of which the investment in residential buildings was down

by 10.5%.

See:

https://www.stats.gov.cn/english/PressRelease/202409/t2024092

4_1956651.html

China to 'significantly increase' debt to revive growth

The Chinese economy faces strong deflationary pressures

due to a sharp real estate market downturn and frail

consumer confidence. A wide range of economic data in

recent months has missed forecasts, raising concerns that

the government's 4-5% growth target for this year may not

ne achieved.

See: https://www.channelnewsasia.com/east-asia/china-says-it-

will-significantly-increase-debt-revive-economic-growth-

4674346

In early October the government announced it will

"significantly increase" debt to revive the economy but is

yet to provide details of the package. At a press conference

the Finance Minister, Lan Foan, said the central

government will help local governments tackle their debt

problems, offer subsidies to people with low incomes,

support the property market and replenish state banks'

capital, among other measures.

A wide range of economic data in recent months has

missed forecasts, raising concerns that a longer-term

structural slowdown could emerge.

See: https://www.reuters.com/world/china/china-says-will-

significantly-increase-debt-revive-economic-growth-2024-10-12/

and

https://www.channelnewsasia.com/east-asia/china-says-it-will-

significantly-increase-debt-revive-economic-growth-4674346

Revised national standards

14 national standards related wood products have been

released recently in China. These standards are:

GB/T 44689-2024: Odor classification and evaluation

method for Wood-based panel and products

GB/T 44690-2024 Volatile organic compound release

classification for wood-based panels and products

GB/T 23472-2024 Impregnated film paper veneer straw

board

GB/T 30364-2024 Reconstituted bamboo flooring

GB/T 44290-2024 Method for calculating biochar content

in wood and wood products

GB/T 17664-2024 Charcoal

GB/T 44346-2024 Wood activated carbon identification

method

Increased log imports from US

According to China Customs, log imports from US rose

4% to 1.5 million cubic metres between January and

August 2024, surging 60% in July 2024.

North American hardwoods, Douglas fir and oak log

imports from the US rose 30%, nearly 400% and 41%

respectively in July 2024.

The main reason for increase was that China extended

tariff exemptions on hardwood logs and sawnwood

imported from US from 1 August 2024 to the end of

February 2025.

This policy update means that until the end of February

2025 US timber suppliers will not be subject to the tariffs

imposed by China. By extending the tariff exclusion

period the import cost of related wood is expected to

remain unchanged which is conducive to stabilising

market expectations, providing a stable market

environment for North American wood importers in

today's complex and changeable international trade

environment and greatly promoting the rapid development

of Sino-US wood trade.

Surge in sapelli imports

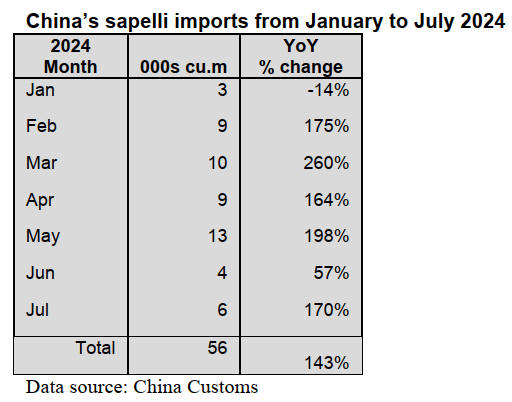

According to China Customs, between January and July

2024 China’s sapelli imports surged over 140% to 56,000

cubic metres valued at US$31 million, jumping over 140%

over the same period of 2023.

Monthly data on China’s sapelli imports were affected by

seasonal factors and China’s Spring Festival holiday,

China’s sapelli sawnwood imports suffered a brief trough,

down 14% in the following months.

In March 2024 import volumes of sapelli sawnwood

increased 260% year-on-year which became a turning

point in the growth of imports up to July 2024. In May,

sapelli sawnwood imports reached a peak, up to 12,600

cubic metres, an increase of nearly 200% year on year.

However, after June the growth rate of imports fell sharply

but it was still 57% higher than the same period last year.

Cameroon and the Republic of Congo were the largest and

the second largest suppliers of China’s sapelli imports.

93% of China’s sapelli imports were shipped from the two

countries between January and July 2024.

China’s sapelli imports from Cameroon and the Republic

of Congo amounted to nearly 31,000 cubic metres and

21,000 cubic metres, surging over 150% and 120% year

on year and accounted for 55% and 37% of the national

total.

The strong performance of sapelli sawnwood in China’s

domestic market recently benefited from a combination of

factors. Sapelli wood is widely used in furniture,

architecture and musical Instruments. It is currently

favored by Chinese consumers. The steady growth of the

market demand for sapelli wood has promoted a

significant increase in its imports.

In addition, reduced export prices and a significant

increase in the output by exporting countries have jointly

promoted the rapid growth of China's sapelli sawnwood

imports.

Growth of wood-based panel industry

The development of China's wood-based panel industry in

2023 was generally stable. According to a 2023 statistical

report on China's wood-based panel industry total

production capacity of the wood-based panel secor was

about 335 million cubic metres, up 2.2% year on year. The

output value of wood-based panel products was about

RMB764 billion, an increase of 15% year on year. The

consumption of wood-based panel products was about 318

million cubic metres, an increase of 10% year on year.

In addition to Beijing, Tianjin, Shanghai, Tibet, Qinghai,

Ningxia, the remaining 25 provinces had wood-based

panel production in 2023. Eight provinces had a

production of more than 10 million cubic metres.

Production growth in Central and South China regions was

noted with Guangxi exceeding Shandong to become

China's largest wood-based panel production province.

At the end of 2023 there were more than 10,100 wood-

based panel manufacturers in China, down 17% year-on-

year.

Through the continuous promotion of supply-side

structural reform the structure of China's wood-based

panel industry has accelerated its adjustment, low

production capacity has been eliminated and enterprises

that have lost competitiveness have ceased operation.

Although the number of wood-based panel enterprises has

decreased, the average production capacity of enterprises

is steadily improving and new production lines were

mostly large-scale and technologically advanced.

In order to enhance market share and drive the

development of wood-based panel enterprises the scale of

top enterprises continued to expand. By the end of 2023

there are nearly 235 large-scale wood-based panel

production enterprises and enterprise groups. As of August

2024 there were 12 wood-based panel manufacturers with

a total production capacity of more than 1 million cubic

metres, of which 5 enterprises have a production capacity

of more than 2 million cubic metres per year.

The total import and export volume of China's wood-based

panels was 15.75 million cubic metres in 2023, an increase

of 1.2%; The total value of imports and exports was

US$6.761 billion, down 15% year-on-year.

China still is the major supplier of wood-based panels but

in the context of the overall global trade China's wood-

based panel industry needs to overcome many challenges.

Rise in wood product imports through Lanshan Port

It has been reported that up to July this year 6.678 million

cubic metres of wood was imported through Lanshan Port,

up 19% (log imports 6.566 million cu.m., sawnwood

imports 112,000 cubic metres), accounting for 17.5% of

China’s wood imports.

The wood industry in Lanshan District, Rizhao City,

Shandong Province has become the largest integrated

industrial base for log imports, processing and distribution.

Lanshan Port imported 9.656 million cubic metres of

wood (9.306 million cubic metres of logs, 350,000 cubic

metres of sawnwood), accounting for 15% of the national

total wood imports, accounting for 25% of the national

total log imports.

At present, there are more than 400 wood trade and

processing enterprises in Lanshan District (87 timber

enterprises with more than RMB20 million of an annual

main business incomes), with RMB12 billion of an annual

trade and processing output value and 7 large-scale

centralised processing zones with an annual wood

processing capacity of 6 million cubic metres, directly

supporting around 20,000 employees.

GGSC – China report

In August the People's Bank of China held a conference

seeking a more vigorous push for financial support to

facilitate large-scale equipment upgrades and the trade-ins

of bulk durable consumer goods.

In addition, the conference emphasised the prevention and

resolution of financial risks in the real estate sector and the

effective implementation of a 300-billion-yuan (about

US$42 billion) relending facility to support government

subsidised housing.

Also in August the National Bureau of Statistics released

data on the total retail sales of consumer goods which

showed that from January to July China's furniture retail

sales totalled 85.1 billion yuan (about US$12 billion),

representing a year-on-year increase of 2%.

August is generally a dull month for sales by China's

timber sector and in the south of the country

the duration and volume of rainfall exceeded that of

previous years which further impacted wood processing

and domestic sales.

In August the GTI-China index registered 43.1%, a

decrease of 0.4 percentage point from the previous month

and was below the critical value (50%) for 4 consecutive

months

As for the eleven sub-indexes, two indices (inventory of

main raw materials and delivery time) were above the

critical value of 50% while the remaining nine indices

(production, export orders, new orders, existing orders,

inventory of finished products, purchase quantity,

purchase price, import and employees) were all below the

critical value.

Compared to the previous month, the indices for existing

orders, purchase quantity, purchase price and inventory of

main raw materials increased by 0.5-4.7 percentage points.

The index for new orders was unchanged from the

previous month and the indices for production, export

orders, inventory of finished products, import, employees,

and delivery time declined by 0.4-5.7 percentage points

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

|