Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Oct

2024

Japan Yen 149.00

Reports From Japan

Growth-oriented policy to pull

Japan out of deflation

Ishiba Shigeru spelt out his economic policies in his first

news conference as Prime Minister. He said he will

continue with his predecessor Kishida Fumio's growth-

oriented policy and aims to pull Japan fully out of

deflation. Ishiba emphasised the importance of expanding

private consumption. He also said he will take immediate

measures against the effects of high prices, including

support for low-income households.

Real wages fell in August

Inflation-adjusted wages fell in August after two months

of increases, the result of summer bonus payments and this

drove down household spending undermining the

likelihood that the Bank of Japan will raise interest rates

any time soon.

Year on year real wages fell 0.6% in August, according to

the Ministry of Health, Labor and Welfare. That came

after a revised 0.3% rise in July. Separate data showed

household spending declining 1.9% year on year raising

doubts on the potential for private consumption to drive

growth.

See: https://www.asahi.com/ajw/articles/15457371

Labour shortage induced bankruptcies

Between April and September this year and for the second

consecutive year, the number of labour shortage induced

bankruptcies hit a new high. Behind the trend lies

increased market liquidity amid the momentum for

corporate wage hikes. The research firm, Teikoku

Databank Ltd. that undertook this survey suggested the

number of labour related bankruptcies will remain high in

the future, mainly among small-sized businesses.

According to the research firm, the number of labour

shortage bankruptcies during the first six months of fiscal

2024 exceeded that for the first half of fiscal 2023 when a

previous high of 135 companies went bankrupt. Japan's

labour shortage began to surface during and after the

coronavirus pandemic and has taken a serious toll on

corporate management.

The survey revealed that, 55 companies in the construction

sector failed during April-September 2024, up four cases

from the same period last year while 19 firms went out of

business in the logistics industry during the same period.

These two industries alone accounted for nearly half of

understaffing bankruptcy cases among all industries

during the first six months of 2024.

See:

https://mainichi.jp/english/articles/20241007/p2a/00m/0bu/02200

0c

Large manufacturers assess economy continues to

recover

The Bank of Japan's Tankan survey showed business

sentiment among large manufacturers was steady in the

third quarter 2024 which has been interpreted that the

Japanese economy continues to recover despite weakness

in global growth.

TheTankan results will be among key factors the BoJ will

scrutinise in setting monetary policy and releasing fresh

growth and inflation forecasts at its next meeting set to be

held late October.

See:

https://www.boj.or.jp/en/statistics/tk/gaiyo/2021/tka2409.pdf

Durable goods purchase index up in September

The consumer confidence index fell short of expectations

in September reaching 36.9, according to a report from the

Cabinet Office.

This decline reflects a decrease in consumer sentiment as

the overall livelihood index fell to 34.4. However, the

income growth indicator showed some improvement,

rising to 40.1. Additionally, the employment index

increased ending at 42.2, while the willingness to purchase

durable goods rose slightly.

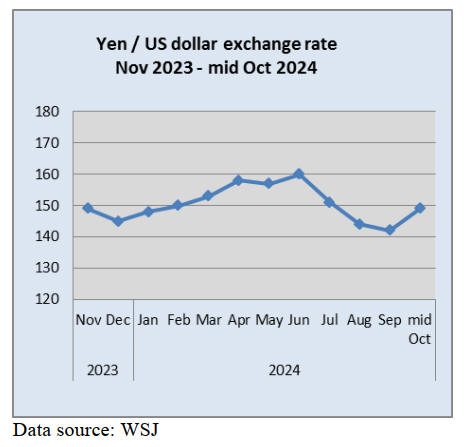

Yen down on comments economy is not ready for

more interest rate increases

In early October the yen/dollar exchange rate fluctuated

with the yen sinking to the lower-147 range against the

dollar, its lowest point in a month. The steep drop was the

markets reaction to Prime Minister Shigeru Ishiba's

comments that the economy is not ready for more interest

rate increases and to the stronger than expected September

US employment data.

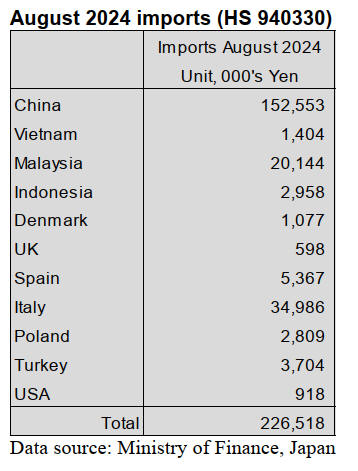

August 2024 wooden office furniture imports (HS

940330)

In August shippers in China accounted for most of wooden

office furniture imports to Japan at around 67% of the total

value of imports of HS940330. The other main shipments

in August were from Italy (16% of August imports and a

major increase from the average over the past months).

August arrivals from Italy added to the month on month

rise seen in July.

The other significant shipper in August was Malaysia

accounting for 9% of the value of imports but down

sharply from a month earlier.

Year on year, the value of Japan’s imports of wooden

office furniture in August were at around the same level as

in the previous month.

August 2024 kitchen furniture imports (HS 940340)

August marked the second month on month decline in the

value of arrivals of wooden kitchen furniture. Up to June

this year there was a steady increase in the value of

HS940340 imports mainly reflecting the weakness of the

yen against the US$ but from July and into August there

was a downward correction .

Year on year, the value of imports of wooden kitchen

furniture items (HS940340) in August fell 6% and month

on month there was a 14% decline.

The top shippers in August were the Philippines, 44% of

the total value of August arrivals in Japan but this was a

sharp downturn from the previous month. August import

values from shippers in Vietnam, China and Poland were

all higer than in the previous month. Vietnam accounted

for 35% of August imports of HS940340, China 8% and

Poland just over 1% (not shown in table).

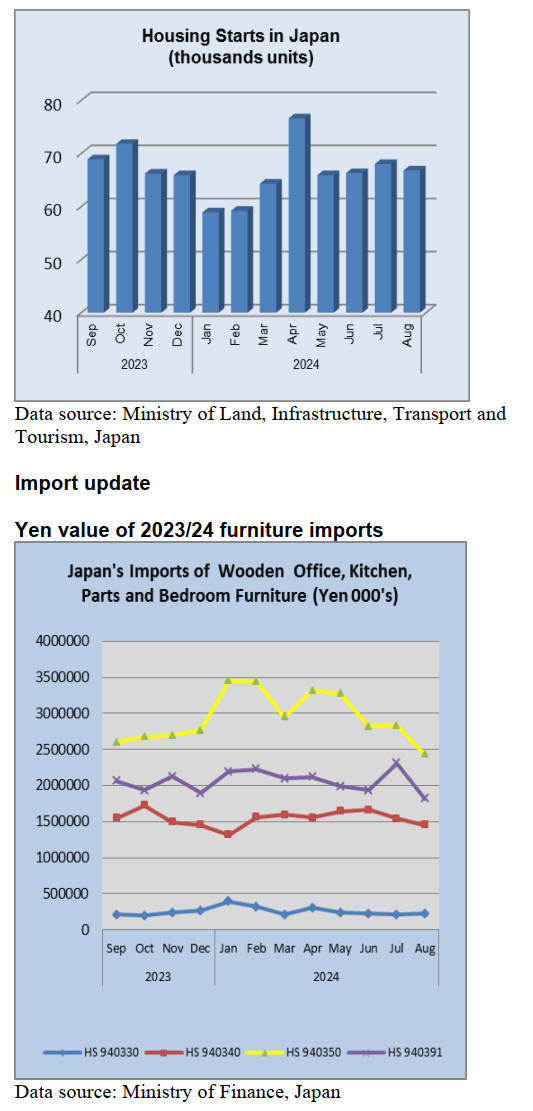

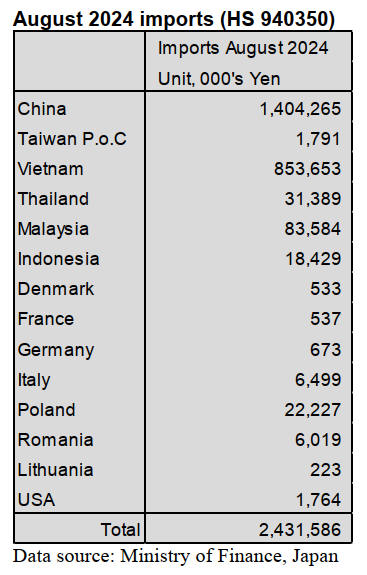

August 2024 wooden bedroom furniture imports (HS

940350)

From mid-year there has been a steady decline in the value

of Japan’s imports of wooden bedroom furniture

(HS940350). This may reflect the slowdown in creation of

new hotel accommodation as tourist arrivals surged on the

back of the weak yen.

Shippers in China and Vietnam accounted for over 90% of

the value of Japan’s wooden bedroom furniture imports in

August with 58% coming from China and a further 35%

from Vietnam. Shipments from Malaysia and Thailand

combined accounted for around 5% of the value of August

imports

Year on year the value of August arrivals of wooden

bedroom furniture were up 11% but month on month there

was a 14% decline.

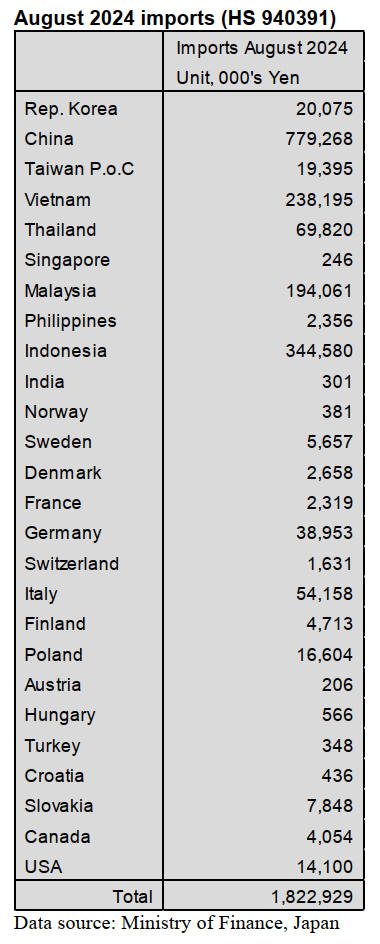

August 2024 wooden furniture parts imports

(HS 940391)

Arrivals of wooden furniture parts (HS940391) in August

were from a large number of suppliers, particularly those

in SE Asia supplying over 80% of the value of imports.

The top four shippers in August were China (43% of total

HS940391 imports) Indonesia (18%) Vietnam 13%) and

Malaysia (11%). August arrivals from China and

Indonesia were down sharply and the value of arrivals

from Vietnam and Malaysia were also below the value of

July arrivals.

Of all the shippers outside of Asia those in Germany, Italy

and Poland stand out as supplying wooden furniture parts

to Japan together accounting for just over 7% of the value

of August imports.

Year on year, the value of August imports of wooden

furniture parts was little changed but compared to a month

earlier the valus of August arrivals was down 21%

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

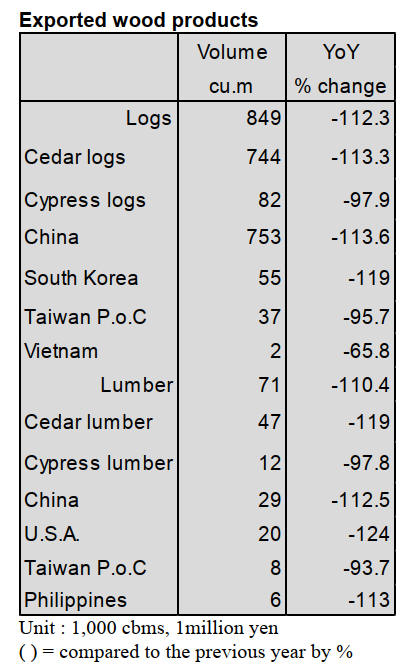

Export logs and lumber

Volume of exporting logs during January to June, 2024 is

849,000 cbms, 12.3 % more than January to June, 2023.

The amount is 13.3 billion yen, 19.5 % more than the

same period last year. The volume and the amount of

exporting logs increase for consecutive two years.

Volume of exporting lumber had kept decreasing since

2022 but it increases in 2024 and it is 71,000 cbms, 10.4 %

more than the same period last year. The amount of

exporting lumber is 3.4 billion yen, 12.3 5 more than the

same period last year.

Especially for logs, the high-priced logs and the weak yen

are double effects for rising amount. The forecast for the

second half of this year would be positive as same as the

firsthalf of this year.

The volume of exporting logs in 2024 would reach

1,700,000 cbms for the first time ever and the volume of

lumber would be more than 2023 for the first time in three

years. Cedar log is 744,000 cbms, 13.3 % more and cedar

lumber is 47,000 cbms, 19.0 % more than the first half of

2023. Exporting cedar logs to China is 671,000 cbms, 14.9

% up from the same period last year and it occupies 79 %

of total exporting logs. The exporting cedar lumber to

China declines but to the U.S.A. recovers.

On the other hand, exporting cypress log is 82,000 cbms,

2.1 % less than the first half of 2023. Cypress lumber is

12,000 cbms, 2.2 % down from the same period last year.

Exporting cypress log has been declining since 2022 and

exporting cypress lumber has been declining since 2021.

Cypress logs for South Korea, Taiwan P.o.C and Vietnam

decrease. Cypress lumber for South Korea decreases by

31.4 % declined. The reason is that the price of cypress

lumber has been high after the woodshcok in 2021.

Logs for China is 753,000 cbms, 13.6 % increased and

lumber for China is 29,000 cbms, 12.5 % increased from

the same period last year.

Demand for building materials is low but demand for

crating is still firm and there are inquiries to cedar logs due

to lower price than cypress’s price.

The price of 4 m cedar logs to China during January to

June, 2024 is US$115 – 119, C&F per cbm. The price was

around US$105 – 120, C&F per cbm during January to

June, 2023. A purchase price in this year is 11,000 yen, at

the port per cbm, and this is 500 – 1,000 yen up from the

same period last year. Lumber for the U.S.A. is 20,000

cbms, 24.0 % more than the same period last year.

However, the volume does not reach 36,000 cbms, which

was the peak at the first half of 2021, even though it is a

historical weak yen.

One of reasons is that there were not enough containers to

export lumber to the U.S.A. in June, 2024. Also, the

inquiries for lumber started to rise in spring this year.

55,000 cbms of logs are exported to South Korea and this

is 11.9 % increase. 3,000 cbms of lumber are exported to

South Korea and this is 5.3 % up from the same period last

year. Lumber for Philippines is 6,000 cbms, 13.0 % more

than the first half of 2023.

Use of wooden chips in 2023 the Ministry of Agriculture,

Forestry and Fisheries announced the result about the use

of wooden biomass energy in 2023. Wooden chips for

wood biomass power plants in 2023 are 11,497,906 BD

tons, and this is 4 % more than 2022.

The survey was held for 1,489 companies, which have

biomass power plants or boilers, and this is 53 companies

less than the previous year. 1,410 companies, 17

companies less than last year, had answered the survey.

1,349 out of 1,410 companies were effective responses

and the ratio of effective responses is 90.6 %. These

results do not include imported pellets nor PKS.

Thinned wood and forest scrap in 2023 are 4,924,398 BD

tons, 9.0 % more than 2022. This is 405,887 BD tons up.

The operations or new operations at medium or small

wood biomass power plants, which consume unused

woody materials, were stable. Scraps of lumber are

1,734,806 BD tons, 0.2 % up. Since the new starts are low,

there are a lot of wood offcuts of lumber and plywood,

from plants. Wastes of building material is 3,913,336 BD

tons, 0.7 % down from the previous year. This is also due

to less new starts.

Imported wooden chips and logs manufactured in Japan is

539,756 BD tons, 25.8 % more than 2022. Some

companies supplement domestic wooden chips in several

places. Pruned branches and others are 385,612 BD tons,

12.0 % less than last year. The reasons are that labor costs

and overhead expenses skyrocketed so there were less

opportunities to prune branches.

Joint meeting for plywood

There were five organisations, which are Japan Lumber

Importers’ Association, Japan Plywood Manufacturer’s

Association, APKINDO, Sarawak Timber Association,

and Sabah Timber Industries Association had a 24th joint

meeting for exports and imports of plywood on September

17, 2024. The joint meeting was held in Japan for the first

time in six years.

Representatives from each organisation reported its market

and economic conditions. Some suppliers of South Sea

plywood requested Japanese buyers’ cooperation to

protect the resource. There were several softwood

plywood manufacturers, trading companies and

wholesalers in Japan attended the joint meeting.

The chairman of Japan Plywood Manufacturer’s

Association said that it is important to cooperate for

competing against wooden panels such as OSB or MDG.

There was an opinion about the high export cost from the

chairman of APKINDO and the foresters in South Asia

have been struggling with loss.

A report of the market from Indonesia was to preserve the

forest resources by afforestation. This is one of

Indonesia’s measures. As for plywood, the price kept

dropping after COVID-19 but the production cost kept

rising. As a result, the added value of plywood is not good.

They will raise awareness of using natural wood material

such as lauan wood and measure the quality of products.

Moreover, they will advocate the value of products instead

of the price.

A Malaysian representative proposed other countries to

cover the cost because the cost has been increasing.

Budget request for 2025

The budget request was made by The Ministry of Forestry

and Fisheries. 347.8 billon yen was requested and this was

15.8 % more than it was planned at first. The budget will

be used for carbon neutrality, and a solution of hay fever

in wood, forestry and lumber industries. The budget

request for 2025 is 2 % less than 2024.

The details of the budget request are 233.4 billion yen for

public projects such as forest management and

afforestation projects, 17.8 % more than the first budget

request and 114.3 billion yen, 12 % more than the first

budget request, for non-public projects.

As for Green Growth Strategy Through Achieving Carbon

Neutrality 2050, 15.6 billion yen, 8.3 % more than first

budget request, was requested. A policy objective is to

supply and use 42,000,000 cbms domestic lumber in 2030.

This is 20 % more than 2022’s policy objective and this is

9.2 % more than the first budget request. 300 million yen

is for comprehensive package of digital innovation.

However it is and this is 25 % less than the first budget

request. 1.2 billion yen is to strengthen in supplying and

using more structural lumber and it is 20 % more than the

first budget request. About hey fever measures, about 20

% of cedar artificial forest will be reduced.

The supplementary budget in last year was 6 billion yen

but the budget request for next year is 3.5 billion yen. The

details of 3.5 million yen are 700 million yen for cutting

down the cedar artificial forest and replanting, 1.5 billion

yen for expanding use of cedar lumber and 700 million

yen for expanding production of seedlings with less

pollen. The budget request for the forest management is

148.9 billion yen, 18.7 % more than the first budget

request.

|