|

Report from

North America

US manufacturing mired in weakness

US manufacturing contracted at a moderate pace in

August amid some improvement in employment, but a

further decline in new orders and rise in inventory

suggested factory activity could remain subdued for a

while.

The monthly survey from the Institute for Supply

Management (ISM) also showed manufacturers continuing

to pay higher prices for inputs last month. The ISM said its

manufacturing PMI rose to 47.2 last month from 46.8 in

July, which was the lowest reading since November.

A PMI reading below 50 indicates contraction in the

manufacturing sector, which accounts for 10.3% of the US

economy.

The PMI remained below the 50 threshold for the fifth

straight month, but was above the 42.5 level that the ISM

said over time indicates an expansion of the overall

economy.

Of the 18 manufacturing industries surveyed, the Furniture

and Related Products sector was among five that reported

growth in August. The Wood Products sector was among

12 industries that reported contraction.

“Interest rate cuts may not happen soon enough to have an

impact this year,” reported one Wood Products executive.

“High interest rates are curtailing consumer spending on

large discretionary spending for furniture, cabinetry,

flooring and decorative trim, which has affected our

industry sales potential. At the same time, pent-up demand

seems to be growing for housing and remodeling.”

See: https://www.ismworld.org/supply-management-news-and-

reports/reports/ism-report-on-business/pmi/october/

Housing leaders laud US Federal Reserve’s biggest

rate cut in 16 years

The US Federal Reserve followed through with its much-

anticipated interest rate reduction as expected by many

Wall Street analysts. On September 18 the Federal

Reserve approved a fifty-basis rate cut (one basis point is

equivalent to 0.01%), marking its first reduction since the

pandemic, and the largest single rate cut in 16 years.

Mortgage rates started declining ahead of the Fed's

decision, giving a boost to the residential housing market.

The National Association of Realtors chief economist

Lawrence Yun commented on the Federal Reserve's rate

cut move saying, "The Fed's half-point rate cut decision is

the beginning of six to eight rounds of further rate cuts

well into 2025. Mortgage rates have already anticipated

the Fed's likely path. That is why the 30-year rate has

fallen by 150 basis points from early in the year to today.

Consumers who were priced out due to earlier higher

mortgage rates could now be back in the market."

The Mortgage Bankers Association chief economist also

commented, "Mortgage rates likely had this cut - and this

expected rate path - priced in, and lower mortgage rates,

now close to 6%, have resulted in much more refinance

and some additional purchase activity in recent weeks. We

do expect that if mortgage rates remain near these levels, it

will support a stronger than typical autumn housing

market and suggest that next spring could see a real

rebound in activity."

See: https://www.worldpropertyjournal.com/real-estate-

news/united-states/washington-dc-real-estate-news/real-estate-

news-federal-reserve-september-2024-rate-cut-data-fomc-data-

lawrece-yun-mike-fratantoni-national-association-of-realtors-

mortgage-bankers--14237.php

US single-family housing starts surge

US single-family homebuilding rebounded sharply in

August, but a moderate increase in building permits

suggested that the momentum was unlikely to be sustained

against the backdrop of a rising supply of new homes on

the market.

Single-family housing starts, which account for the bulk of

homebuilding, surged 15.8% to a seasonally adjusted

annual rate of 992,000 units last month, the Commerce

Department's Census Bureau said. Data for July was

revised higher to show starts at a rate of 857,000 units

instead of the previously reported 851,000 pace. Single-

family home building had declined for five straight

months after a surge in mortgage rates in spring weighed

on home sales, resulting in excess supply of newly built

houses.

Total housing starts (single-family and apartments) in

August were at a seasonally adjusted annual rate of

1,356,000. This is 9.6% above the revised July estimate of

1,237,000 and is 3.9% above the August 2023 rate of

1,305,000.

Single-family starts jumped 18.9% in the densely

populated South, where activity was likely weighed down

by Hurricane Beryl in July. Starts rose 47.4% in the

Northeast and increased 11.6% in the Midwest, which is

considered the most affordable region. Homebuilding rose

2.8% in the West.

Canadian housing starts fell sharply in August, dropping to

their lowest level in nine months due to a pullback in the

construction of multi-unit dwellings, like condominiums

and row houses. Canada Mortgage and Housing Corp. said

that housing starts in August across the country totaled

217,405 units on a seasonally adjusted, annualized basis,

or a 22% drop from the prior month. The August result

missed market expectations by a wide margin - with

traders looking for housing starts to hit 245,000, according

to economists at Bank of Nova Scotia.

See:

https://www.census.gov/construction/nrc/current/index.html

and

https://www.cmhc-schl.gc.ca/professionals/housing-markets-

data-and-research/housing-data/data-tables/housing-market-

data/monthly-housing-starts-construction-data-tables

Home sales slump in August

Sales of previously owned homes in the United States fell

sharply in August, despite mortgage rates falling that

month. But much more housing demand will likely be

unleashed onto the market after the Federal Reserve

finally cut interest rates this month for the first time in four

years — and signaled more rate cuts by year’s end.

Existing home sales, which make up the vast majority of

the market, fell 2.5% in August from the prior month to a

seasonally adjusted annual rate of 3.86 million, the

National Association of Realtors reported. That was the

lowest August sales level since 1995, NAR chief

economist Lawrence Yun said on a call with reporters.

Meanwhile, home prices continued to climb last month,

with the median price of an existing home rising 3.1% to a

new record high of US$416,700, which marked the 14th

straight year-over-year increase.

See: https://www.nar.realtor/research-and-statistics/housing-

statistics/existing-home-sales

US job growth picks up moderately and unemployment

rate falls

US employment increased less than expected in August,

but a drop in the jobless rate to 4.2% suggested an orderly

labour market slowdown.

The below-expectations rise in non-farm payrolls reported

by the Labor Department likely reflected a seasonal quirk

that tends to push the initial August print lower.

Nonetheless, labour market momentum is slowing, with

the closely watched employment report also showing the

economy added 86,000 fewer jobs in June and July than

previously reported.

Employment gains in August were led by the construction

sector, which added 34,000 jobs, driven by heavy and civil

engineering construction and non-residential specialty

trade contractors, though manufacturing employment

dropped by 24,000.

See: https://www.bls.gov/news.release/empsit.nr0.htm

US consumer sentiment rises for second month

Americans' outlook on the economy improved for the

second straight month in September, bolstered by lower

prices for long-lasting goods such as cars and furniture and

the prospect of interest rate cuts by the Federal Reserve.

The University of Michigan's consumer sentiment index

ticked up to 69 in its preliminary reading, its highest level

since May and up from 67.9 in August. The gain was

driven by consumers' perceptions that prices have

improved for durable goods, the report from University of

Michigan said.

The survey bottomed out in June 2022, when inflation

peaked at 9.1%, and has since risen by about 40%, though

it remains significantly below pre-pandemic levels. The

long-term average for the index is nearly 85, according to

Capital Economics.

Rising consumer confidence can sometimes signal a

greater willingness to spend, though Americans have

largely continued to spend at a healthy pace even though

their confidence, as measured in surveys, has been

subdued.The economy expanded at a 3% annual rate in the

April-June quarter, and retail spending picked up in July.

Yet Americans have been saving less and running up more

credit card debt, which has raised concerns among some

economists that consumers will soon have to cut back,

potentially slowing growth.

See: http://www.sca.isr.umich.edu/

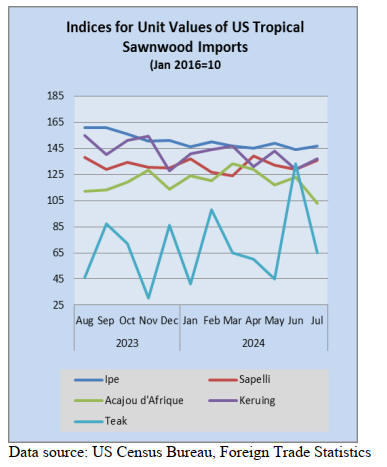

Note: the doubling of the unit value for teak may be a statistical

error. Use with caution.

Disclaimer: Though efforts have been made to ensure

prices are accurate, these are published as a guide only.

ITTO does not take responsibility for the accuracy of this

information.

The views and opinions expressed herein are those of

the correspondents and do not necessarily reflect those

of ITTO

|