|

1.

CENTRAL AND WEST AFRICA

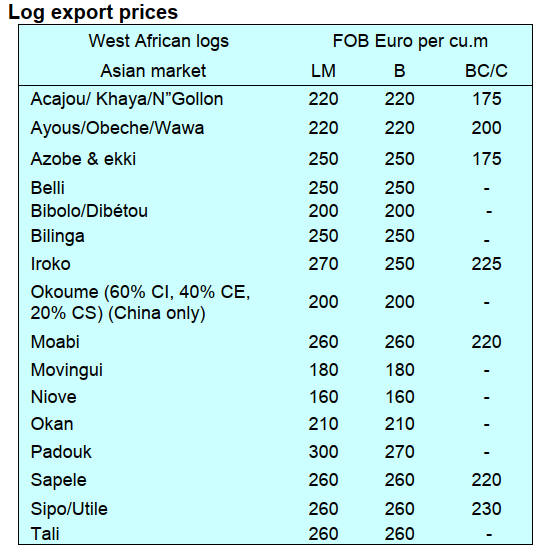

Export market update

The Azobe market in the Netherlands is buoyant,

especially for large sizes used in dragline mats. Prices are

rising due to stronger demand, partly driven by wind

turbine installations across Europe. Demand in the country

for Azobe garden products is declining as autumn

approaches but the Dutch Water Ministry (Waterstaat)

continues to require long lengths for marine piling.

Elsewhere in Europe, however, the market remains quiet.

Chinese Azobe demand has slightly increased, possibly

due to flooding damage and demand in the Philippines

also remains strong as the country needs wood for

reconstruction and housing projects.

Regional markets and operations

Both Cameroon and the Central African Republic are

experiencing heavy rains, affecting timber operations.

The okoume peeling market is stable at low levels.

Plywood production is hindered by frequent electricity

disturbances. In Libreville, power cuts are significantly

disrupting production. Some companies have reduced their

workforce due to machine downtimes. Some Chinese

owned mills have closed due to insufficient orders and

challenges in sourcing alternative species.

In the Republic of Congo operations are running smoothly

without disturbance. The country continues to supply

Okoume and red hardwoods to China and the Philippines.

Gabon

Harvesting and Production

Export contracts with China remain limited, but the local

timber industry in Gabon continues to experience demand

for Okoume wood and there has been a slight increase in

prices.

Significant improvements in infrastructure are underway,

with China funding repairs for 3,000 kilometres of roads,

upgrading them to tarmac surfaces. Container availability

is adequate, ensuring smooth logistics for timber exports.

Market demand and orders

Market demand presents a mixed picture. China

experienced a previous drop in orders, but there is a slight

resurgence in demand, particularly for species like Belli,

Okan, Okoume, and Movingui. The Philippines continues

to show steady demand, especially for reconstruction and

housing projects.

The Middle East market is improving, with increased

enquiries and growing demand for species such as

Andoung, Iroko, Padouk, and Okoume. Enquiry levels in

Europe remain stable, with continued interest in various

timber products.

Regulations, labour and health and safety

Ongoing developments in CITES regulations are having

an impact, but there are no new other government policy

changes affecting the timber industry. Similarly, no

additional changes have been reported regarding

government fees beyond increased port charges and

customs duties.

In terms of health and safety, some cases of COVID-19

have been reported, mainly manifesting as heavy flu due

to the rainy season. Additionally, two cases of Mpox

(Monkeypox) have been announced in Gabon. The

situation is being monitored, but there are no significant

health alerts affecting industry operations at this time.

Cameroon

Harvesting activity affected by heavy rain

Harvesting activities in Cameroon have been affected by

the return of heavy rains, with the rainy season expected to

continue until December, and stock levels are impacted

accordingly. Transportation remains a concern due to

weather conditions. While roads are generally in

acceptable condition, laterite-based roads are managed

with barriers, and no traffic is allowed when it rains. No

major rail disruptions are reported.

Container availability is not an issue in Cameroon, with

enough empty containers in stock to meet export demands.

Port operations are running smoothly, with no significant

disruptions in dispatch or overall activities. NGO

surveillance continues but is limited to monitoring

activities without significant interventions.

In terms of the pandemic, masks are officially required but

are not commonly worn in public. There has been one

officially reported case of Mpox.

Promoting a sustainable and legal trade in rosewood

The Regional Workshop for Range States for African

Rosewood (Pterocarpus erinaceus) was held from

September 2 to 6, 2024, in Douala, Cameroon. Organised

by the CITES Secretariat in cooperation with the

Association Internationale des Bois Tropicaux (ATIBT),

the workshop aimed to promote an integrated approach

among states to ensure sustainable and legal trade.

African Rosewood is one of the most heavily traded

tropical hardwoods globally, used in furniture, musical

instruments, medicines, and fuelwood.

Since 2022, all populations of African Rosewood have

been listed in Appendix II of CITES, requiring that

international trade is conducted in a sustainable, legal and

traceable manner.

See: https://cites.org/eng/news/regional-workshop-for-range-

states-of-african-rosewood-pterocarpus-erinaceus-2024

Republic of Congo

Market Update

In the Republic of Congo, harvesting activities are

impacted by rains in the northern region. Transporting

timber to Douala port in Cameroon is a preferred route for

some operators, as it is closer than Pointe Noire in the

south. Port operations are steady with no disturbances

reported, ensuring smooth dispatch and handling of timber

exports.

Enquiry levels are stable, with the Philippines resuming

purchases of Republic of Congo Okoume sawn timber.

There is slight demand from China, however, and prices

are not meeting expectations, indicating the need for

adjustments between supply and market pricing.

Government regulations are stringent, with businesses

contending with CITES listings for four species,

adherence to the European Union Timber Regulation

(EUTR) and preparing for the upcoming European Union

Deforestation Regulation (EUDR).

Media and trade associations report no further factors that

could affect availability and trade of tropical timber

products.

There is no COVID-19 reported, but caution is urged due

to Ebola cases in some areas and the first cases of Mpox

being reported. The situation is being monitored closely to

prevent impact on industry operations.

2.

GHANA

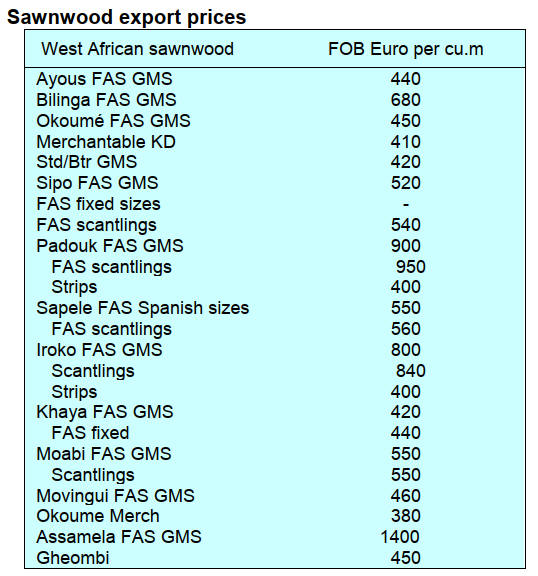

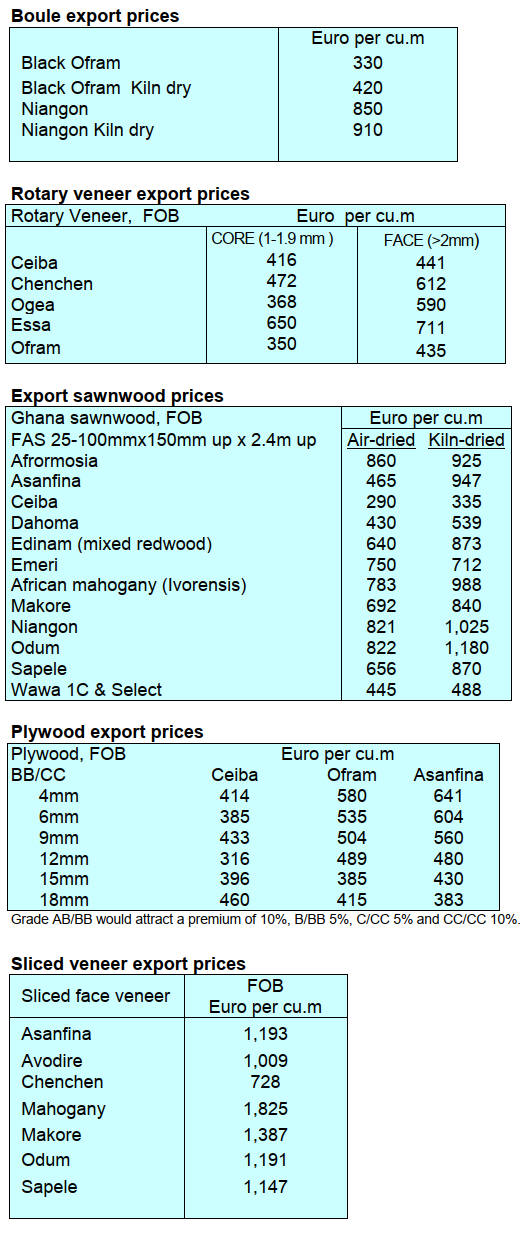

TIDD meet stakeholders for wood price review

The Timber Industry Development Division (TIDD) of the

Forestry Commission organised a meeting with

stakeholders to review the export prices of some wood

products with reference to export prices achieved between

July 2022 and August 2024.

The meeting was chaired by the Director of Operations of

TIDD, Dr. Richard Gyimah, and external stakeholders

including Samartex Timber and Plywood Company Ltd.,

the Forestry Industry Association of Ghana (FIAG),

Ghana Timber Millers Organisation (GTMO), Forest

Plantation Timber Exporters and Loggers Association

(FOPTELA), Ghana Timber Association (GTA), and other

members of the timber industry.

The Contract and Permit Manager of TIDD made a

presentation on the proposed price review of selected

species for some specific products. After extensive

discussions, the meeting agreed to increase the cubic meter

price of Niangon boules, Celtis rotary veneer, and Ohaa

rotary veneer. This became possible because since January

2024 the industry has achieved higher prices for these

products than the Guiding Selling Price (GSP), with no

immediate signs of declining.

The per cubic metre price of Denya lumber (No.1C&S

grade) to the Asian market was, however, reduced. It was

anticipated this new price will continue to serve as a boost

to exporting Denya to an already flooded market.

Details of the new prices are expected to be captured in the

TIDD Guiding Selling Price (GSP) for use by relevant

stakeholders.

See: https://fcghana.org/tidd-organises-wood-products-export-

price-review-meeting/

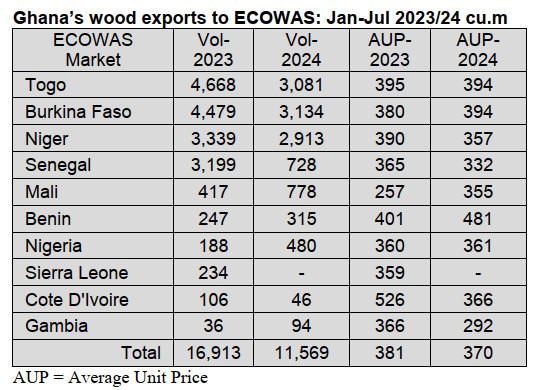

ECOWAS market accounts for largest share of wood

product exports from Ghana

According to data from the Timber Industry Development

Division (TIDD), Ghana’s wood product export to the

African continent during January to July 2024 were valued

at Euro 6.27 million with a total volume of 15,092 cu.m.

These represented 8.79% and 9.58% of Ghana’s total

wood export volume and value respectively for the period

which included lumber (air dried), lumber (kiln dried),

rotary and sliced veneers, and plywood by sea and to the

regional market.

The figures indicated decreases of 27% and 28.5% in

value and volume respectively, compared to Euro 8.60

million and 21,148 cu.m recorded between January and

July last year.

The ECOWAS sub-region market accountedfor the largest

share of the wood products exported from Ghana to

African countries, absorbing 76.7% (11,569 cu.m) in 2024

and 80% (16,913 cu.m) in 2023.

Togo, Burkina Faso, Niger and Senegal were the leading

export markets for Ghana’s wood products during the

period in both 2023 and 2024 within the ECOWAS sub-

region. These countries, however, recorded lower average

unit price (AUP) per cu.m. in 2024 compared to the

previous year. Mali, Benin and Nigeria on the other hand,

recorded significant average unit price increases in 2024

over the same period in 2023 (Graph 1). The overall AUP

decreased 3% from Euro 381 per cu.m in the January to

July period last year to Euro 370 per cu.m in the same

period this year.

Ghana’s economy surges 6.9% in Q2 2024

Ghana’s economy grew by 6.9% in the second quarter of

2024, the fastest rate in five years, boosted by expansion

in several key sectors including agriculture.

This is according to provisional figures released by the

Ghana Statistical Service (GSS). Compared to the first

quarter of 2024, the economy grew by 4.7%.

The Services sector continued to be the largest contributor

to growth in the second quarter of 2024, accounting for

44.2%, followed by the industry sector contributing

32.2%, and the agriculture sector contributing 23.6%.

Ghana's overall industrial sector grew by 9.3%, driven by

mining and quarrying, while the gold sector expanded for

the third consecutive period, by 23.6% in the quarter. The

services sector grew 5.8%, while agriculture rose 5.4%,

the government statistician Samuel Kobina Annim has

said.

The year-on-year inflation rate at ex-factory prices for all

goods and services increased to 33.2% in August 2024,

compared to 29.1% in July 2024.

The Ghana cedi depreciated by 19.6% against the US

dollar on the interbank forex market in July 2024, the

Bank of Ghana has disclosed

See: https://www.myjoyonline.com/ghanas-economy-surges-6-

9-in-q2-2024-fastest-in-five-years/

& https://www.myjoyonline.com/inflation-to-end-2024-between-

15-and-18-deloitte/

AGI recommends nuclear power mix in Ghana

The Association of Ghana Industries (AGI) has expressed

strong support for including nuclear energy in the

country’s energy mix, emphasising its potential to

strengthen energy security and reduce the cost of power –

particularly for businesses and industries. The country’s

industrial sector has long been constrained by high

electricity costs, which limit competitiveness both

domestically and internationally.

The AGI President, Dr. Humphrey Ayim-Darke, noted

that energy reliability is critical to industrial performance

and competitiveness; and nuclear power offers a long-term

solution to current challenges facing the sector.

Energy security, he indicated, is at the heart of industrial

growth and the inclusion of nuclear energy in the power

mix will provide the stability needed. This, he said, will

not only ensure consistent supply but also help reduce the

cost-burden on industries.

The AGI President, therefore called on stakeholders and

power consumers to support the Volta River Authority’s

(VRA) initiatives aimed at enhancing the cost-

effectiveness of current energy solutions while nuclear

plans are still being sought.

See:

https://thebftonline.com/2024/09/25/agi-endorses-nuclear-power-

to-boost-energy-security/

Ghana a key trade partner for Switzerland

Switzerland became Ghana’s number one export partner

with exports from Ghana to Switzerland amounting to

US$3 billion in 2023. The bilateral trade volumes shot up

from US$1.5 billion in 2019 resulting in over US$3 billion

recorded in 2023. Switzerland is not a regular importer of

Ghana’s wood products but in 2020 a Swiss based

organisation – Foundation Franklinia.

In collaboration with the Forestry Commission the

Foundation funded the planting of 100,000 seedlings of

African ‘teak’ in the Asenanyo Forest Reserve.

See: https://citinewsroom.com/2024/08/switzerland-becomes-

ghanas-top-export-partner-with-3bn-in-trade-in-2023/

3. MALAYSIA

Expanded free trade agreement

Malaysia has officially ratified the UK’s accession to the

Comprehensive and Progressive Agreement for Trans-

Pacific Partnership (CPTPP), a significant milestone as it

is effectively Malaysia’s first bilateral free trade

agreement with the UK. Malaysia joins Japan, Singapore,

Chile, New Zealand, Vietnam, and Peru in the ratification

process.

The UK’s entry into the CPTPP will increase the

combined gross domestic product value of the bloc to

US$15.4 trillion, or 15% of global GDP.

The ratification allows Malaysian exports to benefit from

immediate duty-free treatment on 94% of tariff lines,

particularly for palm oil, cocoa, rubber, electric and

electronics, chemicals, as well as machinery and

equipment. The agreement is expected to enter into force

by end-2024 for the UK and the countries that have

ratified it.

The CPTPP members are Australia, Brunei, Canada,

Chile, Japan, Malaysia, Mexico, New Zealand, Peru,

Singapore and Vietnam.

See:

https://www.freemalaysiatoday.com/category/nation/2024/09/20/

malaysia-now-officially-part-of-cptpp/

PEFC EUDR due diligence system

The Malaysian Timber Certification Council Board of

Trustees has approved adoption of the newly developed

PEFC EUDR Due Diligence System (DDS) standard,

PEFC ST 2002-1:2024 Requirements for the

Implementation of PEFC EUDR Due Diligence System

(PEFC EUDR DDS).

This standard is an extension of the existing PEFC Chain

of Custody standard PEFC ST 2002:2020 – Chain of

Custody of Forest and Tree-Based Products –

Requirements.

This modular and optional standard is designed to support

PEFC Chain of Custody (CoC) companies that currently

export to the EU market, plan to do so, or whose products

may ultimately be sold in the EU, to comply with the

requirements of the EUDR by providing a comprehensive

framework for conducting due diligence. The key

difference between the existing PEFC ST 2002:2020

standard and the PEFC ST 2002-1:2024 is the integration

of EUDR requirements into the due diligence process.

Currently there are 6.6 million hectares of MTCS – PEFC

Certified Forests in Malaysia, in 35 Certified Natural

Forest (FMUs) and nine Certified Forest Plantations

(FPMUs). MTCS – PEFC Certified Chain of Custody

certificates are held by 368 companies.

See: https://mtcc.com.my/adoption-of-pefc-technical-document-

pefc-st-2002-12024-requirements-for-the-implementation-of-

pefc-eudr-due-diligence-system-pefc-eudr-dds/

Sarawak calls for peatland restoration action

Sarawak has called for binding targets for peatland

restoration and urged international bodies to act urgently

on the issue.

Speaking at the 15th International Sago Symposium

opening hosted by the Sarawak Tropical Peat Research

Institute (Tropi), Premier Abang Johari Tun Openg said

voluntary efforts alone do not suffice.

“We need binding targets for peatland restoration,

attractive incentives for sustainable agricultural practices,

and a collective effort from the public and private sectors,”

he said.

See:

http://theborneopost.pressreader.com/article/281621015741697

Sarawak furniture makers urged to push exports

Sarawak’s furniture producers have been urged to emulate

the example of counterparts in other Malaysian states and

drive-up exports by the head of their industry organisation.

The president of the Sarawak Furniture Manufacturers

Association Kapitan Kong Kim Hong said that

opportunities in the international furniture market were

continuing to grow, and Malaysia as a whole was already

capitalising.

According to Deputy Prime Minister Datuk Seri Fadillah

Yusof, speaking at the Malaysia International Furniture

Expo last year, the global furniture market value is

expected to reach US$550 billion by 2027,” at a July

SFMA Miri branch meeting. “Since the Covid pandemic,

Malaysia’s furniture exports have remained above RM100

billion and in 2022 reached RM115 billion. This makes it

the second-largest furniture exporter in the world.”

Sarawak, he added, had not benefited as much as other

parts of the country from market growth. To grow export

sales, he recommended that Sarawak furniture makers

should diversify their ranges and target international

markets with quality products.

See:https://mtc.com.my/images/media/1742/2._Sarawak_Furnitu

re_Manifacturers_Urged_To_Boost_Exports_theborneopost.pdf

Land shortage curbs bamboo sector growth

Availability of land was highlighted as the main factor

holding back the expansion of the Malaysian bamboo

industry, according to Plantations and Commodities

Minister Datuk Seri Johari Abdul Ghani.

Speaking in parliament, the Datuk Ghani said that state

governments were limiting access of land to bamboo

plantation operators, who need at least 2,000 ha to

‘implement the concept of commercial bamboo

cultivation’.

He went to say that “in comparison, palm oil has 5.7

million ha, and rubber 1.1 million ha, while bamboo has

only 4,000 ha”. “This disparity hinders both upstream and

downstream industrial development.”

The Minister said state governments were not prepared to

allocate land for bamboo. Despite incentives, they

favoured providing land for palm oil due to its

“established ecosystem, comprehensive value chain and

export value”.

See:

https://mtc.com.my/images/media/1740/3._Land_shortage_hinde

rs_bamboo_industry_growth_says_Johari_nst.com.my.pdf

4.

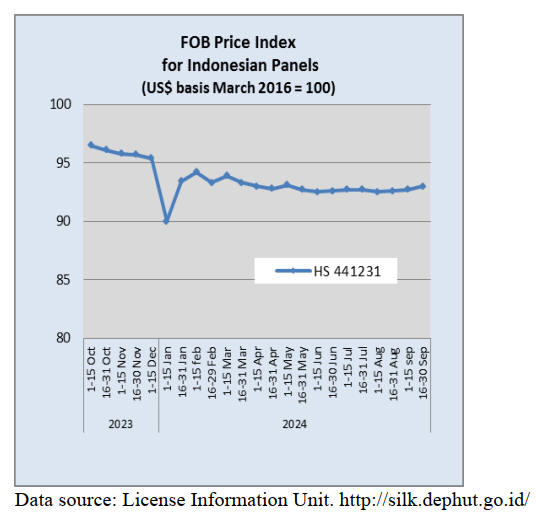

INDONESIA

Weakening plywood demand leads to layoffs

Thousands of employees in upstream and downstream

forestry industries have been laid off due to sluggish

international demand for plywood products and the

Association of Indonesian Forest Concession Holders

(APHI) says policy incentives are needed to prevent the

current situation from continuing.

According to APHI data, in the first half of 2024 2,400

employees working in Forest Utilization Business

Permit—Natural Forests (PBPH-HA) companies were laid

off, and 125 others sent home. Layoffs also occurred in the

plywood processing industry. It was reported that 6,250

people working in three plywood industry groups were

laid off.

APHI Deputy Chairman for Natural Forests Dr David

explained that the market continues to be slow in the

aftermath of the COVID-19 pandemic and due to

geopolitical conflicts. "Weakening demand for plywood in

the global market impacted the processing industry and

PBPH upstream, the suppliers of raw materials," he said

on September 17.

He added that, due to slow plywood export trade, there is a

913,000 cu.m stock of natural forest logs from 35 PBPHs

that the industry has not absorbed. "Many PBPHs are

having difficulty operating because no industry is buying

the wood they produce while costs are getting higher due

to various factors such as fuel prices," he said.

Currently, only 94 out of 247 PBPH-HA units are in

production. PBPH-HA roundwood production is also

described as deficient. As of August 2024, it was recorded

at only 2.21 million cu.m, or 39% of the annual production

projection of 5.58 million cu.m.

Dr David proposed several policy incentives to revive the

forestry industry and avoid employee layoffs. One of them

is expanding the range of processed wood products that

can be exported.

He also proposed that to spur the processing industry and

increase the absorption of wood production, the

government should open the door to exporting sawn

timber products to exploit marketing opportunities abroad.

"Sawn timber exports will increase demand for wood

from

PBPH, while still providing added value to the processed

wood industry," he said.

See: https://agroindonesia.co.id/ribuan-karyawan-industri-

kehutanan-terkena-phk-perlu-insentif-kebijakan-dan-perluasan-

pasar-domestik/

Furniture exports January to July hit US$1.2 billion

The Ministry of Industry (Kemenperin) reports exports of

domestically made furniture products at US$1.2 billion

from January-July 2024, after achieving export earnings of

US$2.11 billion in 2023. Referring to the figures, Director

General of Small, Medium and Multifarious Industries

(IKMA) Reni Yanita said the potential of domestic

furniture products is considerable.

She attributed the strong interest of global markets in

Indonesian furniture to the fact that small and medium

industry players (IKM) continued to innovate and were

able to adjust to market trends and consumer needs. She

said IKMA supports development of local furniture IKM

players so they can be more globally competitive,

including through implementation of production technical

guidance, machine and equipment restructuring and

development of IKM centres.

See: https://voi.id/en/economy/417286

Exhibition could generate US$2.27 million for

Indonesian furniture makers

The Ministry of Trade reported that Indonesian furniture

producers could generate US$2.27 million (Rp35.01

billion) from the 2024 Korea International Furniture and

Interior Fair (Kofurn), held from August 29 to September

1, 2024.

Indonesia participation was supported by the Ministry of

Trade via the Indonesian Trade Promotion Center (ITPC)

in Busan, in collaboration with the Seoul Trade Attaché,

the Embassy of the Republic of Indonesia (KBRI) in

Seoul, and the Indonesian Furniture and Craft Industry

Association (Asmindo).

Husodo Kuncoro Yakti, Head of ITPC Busan, said the

success of the event resulted from exhibitors’ business

matching with visitors and the level of interest in the

Indonesian Pavilion at the event.

See: https://www.antaranews.com/berita/4334491/potensi-

transaksi-furnitur-indonesia-di-korsel-rp35-miliar

IFFINA attracts strong international interest

The IFFINA Indonesia Furniture & Design Expo, run by

the Indonesian Furniture and Craft Industry Association

(Asmindo), was attended by 200 foreign furniture

companies.

According to Asmindo General Chairman, Dedy

Rochimat, a key theme of the 14-17 September event was

'Sustainable by Design', with Indonesian furniture makers

focused on environmental impact.

The goal of the show was to raise the profile of the

Indonesian furniture and craft industry and awareness of

its capabilities more broadly. Dedy said that the exhibition

featured latest trends and advances in furniture production

and interior design and that the goal was a 30% increase in

transactions generated by the event over the US$200

million achieved at the 2023 edition of the show.

See: https://katadata.co.id/berita/industri/66e692d8dad57/bidik-

pasar-mebel-dunia-rp-107-triliun-asmindo-gelar-pameran-

internasional

MSMEs have potential to make Indonesia a home

decor hub

Speaking at the IFFINA exhibition, Cooperatives and

Small and Medium Enterprises (SMEs) Minister, Teten

Masduki, said Indonesia can become a global hub for

home decor given the vast potential of its local products.

“Based on data, furniture and craft products annual exports

are up to US$3.5 billion,” he said. “The industry

comprises 1,114 companies and employs around 143,000

workers.”

According to Masduki, Indonesia’s vision of becoming a

global hub involves a major push to facilitate international

market access. Consequently, the Ministry of Cooperatives

and SMEs is backing efforts to build capacity of micro,

small, and medium enterprises (MSME) in the furniture

sector. “We have established joint production houses to

push aggregation, while maintaining production quality in

accordance with world standards,” the minister said.

He said his ministry is also organising more trade forums

abroad to expand export opportunities for MSMEs. One

such forum, held at the Indonesian Embassy in

Washington generated potential business worth Rp7

billion (US$461,700).

The US event featured 13 MSMEs from the furniture

industry, and also representatives of other sectors

including fashion, food and beverages, plus startups. It

was attended by 120 in-person and 50 online participants,

including potential buyers and US business associations.

“This success demonstrates the significant market

potential for Indonesian MSMEs in the US,” Masduki

said. “It also proves that our products are world-class

quality and can compete in the global market.”

See: https://en.antaranews.com/news/326019/indonesia-will-be-

home-decor-hub-smes-minister

Success of SVLK verification highlighted to UK

Minister

The Indonesian Minister of Environment and Forestry, Siti

Nurbaya, received Anneliese Dodds, UK Minister for

Development in Jakarta on 17 September.

The bilateral meeting addressed sustainable forest

management, climate and environmental agendas and

opportunities for cooperation leading up to the Conference

of the Parties (COP16) on Biodiversity (CBD) and COP29

on Climate Change (UNFCCC).

During the meeting, Minister Siti highlighted the success

of Indonesia’s SVLK `Legality and Sustainability

Verification System’, which was developed in

collaboration with the British government. She said other

countries frequently invite Indonesia to share its

experiences in sustainable forest management.

The Minister also explained the paradigm shift in

Indonesia's forest management from previously focusing

on wood to a more holistic landscape management

approach, prioritising a balance between economic, social,

and ecological aspects.

See: https://forestinsights.id/terima-kunjungan-menteri-

pembangunan-inggris-menteri-lhk-singgung-keberhasilan-kerja-

sama-pengembangan-svlk/

Using certified products helps maintain forests and cut

emissions

The use of certified forest products will preserve forests

and their biodiversity and contribute to carbon emissions

reduction and circular economy development. This was

the conclusion of the ‘Forest Product Standards in a

Circular Economy for Green Construction’ National

Symposium held in Jakarta on September 12.

The event was hosted by the Standardization and

Instrumentation Agency of the Ministry of Environment

(KHLK) and addressed forest product standards' vital role

in supporting sustainable development, particularly in the

construction sector.

Head of the KLHK’s Standardization and Instrumentation

Agency, Ary Sudijanto, emphasised the urgency of using

certified and sustainably managed forest products.

Sustainably produced wood, he said, can preserve

biodiversity, reduce carbon emissions, and support a

circular economy.

The symposium also discussed the importance of

integrating forest product standards for green construction

to address the challenges of climate change and the

biodiversity crisis. One of the key points discussed in the

symposium was the role of the circular economy in forest

management.

See: https://rm.id/baca-berita/government-

action/235396/simposium-nasional-dorong-standar-produk-hasil-

hutan-untuk-konstruksi-hijau

Forest management no longer focused solely on wood

Deputy Minister of Environment and Forestry Alue

Dohong highlighted that the current forest management

paradigm has shifted and is no longer solely focused on

wood. Moreover, several urgent issues must be addressed

to ensure sustainable forest management.

The Deputy Minister made the comments as he opened the

16th International Symposium of the Indonesian Wood

Research Society (IWORS) at Tanjungpura University in

Pontianak, West Kalimantan.

He said Indonesia has established five essential pillars to

ensure sustainable forest management and the welfare of

its people. They comprise [forest] area certainty, business

guarantees, productivity, product diversification, and

competitiveness. These, said the Deputy Minister, serve as

the guiding principles from planning to forest utilization.

“Integrating forest policy and management is crucial, not

only for environmental conservation but also for economic

prosperity and social welfare,” he emphasized.

Growing challenges, such as deforestation and climate

change, require comprehensive strategies that align policy

frameworks with practical management approaches, he

concluded

See: https://forestinsights.id/wamen-lhk-tegaskan-pengelolaan-

hutan-tak-lagi-berpusat-pada-kayu-beberkan-masalah-mendesak/

Indonesian minister stresses importance of carbon

trading system

Minister of Environment and Forestry, Siti Nurbaya, has

emphasised the importance of carbon trading in reducing

greenhouse gas emissions.

"There is a misunderstanding,” she said during a focus

group discussion with Commission IV of the House of

Representatives in Jakarta. “People might think carbon

trading means selling all the carbon from our forests, but it

is actually about reducing emissions by planting more to

increase carbon absorption."

Nurbaya stated that carbon pricing aims to meet the

climate targets outlined in the Nationally Determined

Contribution (NDC) document, which reflects Indonesia's

commitment to the global community in reducing

emissions.

Carbon services, she added, must come from high-

integrity environments and activities carried out with

integrity. To ensure it’s not greenwashing, not just any

carbon can be traded. "Carbon trading requires

transparency, accountability, comparability, and

consistency," said Nurbaya.

See: https://en.antaranews.com/news/326791/indonesian-

minister-stresses-importance-of-carbon-trading-system

5.

MYANMAR

Continued currency sales by Central Bank

In late September 2024, the Central Bank of Myanmar

(CBM) sold significant amounts of US dollars, Chinese

Yuan, and Thai Baht. On September 25, it sold nearly

US$13 million at a rate of 3,524 kyat per US dollar along

with 700,000 Yuan. Earlier, on September 23, the CBM

sold US$23 million, and on September 20, it sold US$1.28

million and 800,000 Yuan.

Mid-September the CBM conducted various sales,

including US$30 million to fuel oil companies. It also sold

US$8.5 million and over 2 million Thai Baht on

September 19, followed by another 3 million Baht the next

day. In the preceding days, smaller sales included

US$300,000 on September 17, US$5 million on

September 16, and US$230,000 on September 13. The

CBM has been using the foreign exchange market to

stabilize the currency and manage liquidity amid ongoing

economic challenges.

See: https://elevenmyanmar.com/news/cbm-sells-nearly-13-

million-at-3524-kyats-per-dollar-and-700000-yuan-on-

september-25

Investment urged by Myanmar’s China Ambassador

At the 21st China-ASEAN Expo in Nanning, Myanmar's

ambassador to China, Tin Maung Swe, urged China and

ASEAN countries to invest in Myanmar's agriculture,

livestock, and various other sectors.

He highlighted the importance of uninterrupted global

supply chains and increased market opportunities for

Myanmar, inviting cooperation in areas such as transport,

IT, energy, infrastructure, and manufacturing. Despite

Myanmar's challenges following political developments in

February 2021, ASEAN and China remain its largest trade

partners.

However, foreign investment in Myanmar has

significantly declined with many investors either leaving

or suspending operations.

See: https://eng.mizzima.com/2024/09/27/14431

Flood death toll reaches nearly 270

The death toll from ongoing flooding in Myanmar has

risen to nearly 270, and 88 others are still missing,

Myanmar’s authorities report. The United Nations has

warned that 630,000 people in Myanmar may need

assistance following Typhoon Yagi. In response to this

emergency, the government has called for international

aid.

See:.unocha.org/publications/report/myanmar/myanmar-flood-

situation-report-3-27-september-2024

Passport rule changes for students in Thailand

Myanmar nationals studying in Thailand on short-term

education visas will no longer be able to renew their

passports at the embassy in Bangkok or the consulate in

Chiang Mai and must return to Myanmar for renewals.

This restriction comes as the military junta seeks to

address troop shortages following losses to rebel groups.

Many draft-eligible individuals have fled or joined

opposition groups. Around 3,700 Myanmar nationals are

studying in Thailand. However, those in undergraduate

and postgraduate programs can still apply for a special

"Passport for Education" to remain legally in Thailand.

See: https://www.rfa.org/english/news/myanmar/myanmar-

thailand-students-passports-09202024201855.html

6.

INDIA

Standards Bureau builds

awareness of mandatory

plywood QCO

The BIS (Bureau of Indian Standards) and DPIIT

(Department for promotion of industry and internal trade)

have stepped up efforts to inform industry via testing

laboratories and awareness workshops about

implementation of the Quality Control Order (QCO) for

Plywood and Flush Doors in February 2025.

Up to August 2024, 900 plywood manufacturing units had

managed to obtain the mandatory certification required for

conformance out of an estimated total of 3,000. Concerns

have been raised that the remaining 2,100 units will find it

difficult to undertake the required testing and secure

certification in time, with certificates taking three months

for BIS to issue.

To solve the problems faced by micro, small, medium

sized enterprises (MSMEs) in relation to the cost of

logistics associated with testing, the government is

working with the established laboratories of companies

like Tata Steel and facilities recognised by the National

Accreditation Board for Testing and Calibration

Laboratories, which can be used for testing plywood and

panel products.

The QCO does not affect goods manufactured

domestically in India for export but does apply to imported

products.

The BIS has stated that stakeholders with concerns about

the QCO can address them direct to its centres or mail

them to the DPIIT.

See: https://www.bis.gov.in/wp-

content/uploads/2023/09/Notified-Plywood-and-Wooden-flush-

door-shutters-Quality-Control-Order-2023-in-e-Gazette.pdf

and https://induceindia.com/bis-certification-for-plywood-and-

wooden-flush-door-shutters/

World Bank says Indian economy continues to grow

The Indian economy continues to grow at a healthy pace

despite challenging global conditions, according to the

World Bank’s latest India Development Update: India’s

Trade Opportunities in a Changing Global Context

(IDU). However, it says to reach its goal of US$1trillion

merchandise exports by 2030, India needs to diversify its

export basket and leverage global value chains.

The IDU reports that India remained the fastest-growing

major economy and grew at 8.2% in the 2023-24 financial

year. Growth was boosted by public infrastructure

investment and an upswing in household real estate

spending.

On the supply side, it was supported by a buoyant

manufacturing sector, which grew by 9.9%, and resilient

services activity, which compensated for

underperformance in agriculture. Reflecting these trends,

urban unemployment has improved gradually since the

pandemic, especially for female workers.

Female urban unemployment fell to 8.5% in early 2024,

although urban youth unemployment remained at 17%.

Despite challenging external conditions, the World Bank

expects India’s medium-term outlook to remain

positive. Growth is forecast to reach 7% in FY24/25 and

remain strong in FY25/26 and FY26/27.

The IDU also highlights the critical role of trade for

boosting growth. The global trade landscape has witnessed

increased protectionism in recent years.

The post pandemic reconfiguration of global value chains,

triggered by the pandemic, has created opportunities for

India. The report emphasizes that India has boosted its

competitiveness through the National Logistics Policy and

digital initiatives that are reducing trade costs. However, it

also notes that tariff and non-tariff barriers have increased

and could limit potential for trade focused investments.

See: World Bank

https://documents.worldbank.org/en/publication/documents-

reports/documentdetail/099513209032434771/idu113d06cd810fe

c1465e1a7e318a711ea131b8

Russia’s timber giant target India

At present just 3% of Russian timber is traded into India

but, according to a report by Wood Central, that may

change as the Segezha Group, Russia’s largest timber

exporter responsible for more than 30% of its trade, is

targeting the country’s expanding market.

See: https://woodcentral.com.au/russias-timber-giants-target-

india-as-ukraine-sanctions-bite/

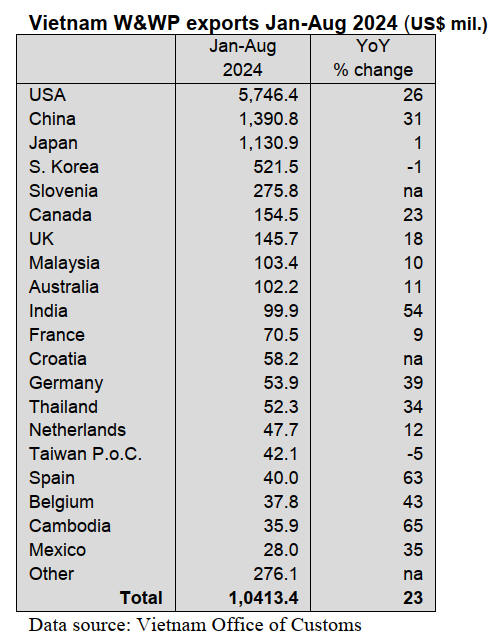

7.

VIETNAM

Wood and wood products (W&WP) trade

highlights

According to statistics from the General

Department of Customs, in August 2024, Vietnam’s

W&WP export turnover reached US$1.5 billion, up

9.2% compared to July 2024 and up 16.7% compared

to August 2023. Of this, the WP export turnover,

alone, was US$1.03 billion, up 5.1% compared to July

2024 and up 22% compared to August 2023.

In the first 8 months of 2024 W&WP exports reached

at US$10.4 billion, up around 23% over the same

period in 2023. WP export turnover, in particular,

contributed US$7.1 billion, up 24% over the same

period in 2023.

The W&WP exports to the Dutch market in

August 2024 amounted to US$2.7 million, down 64%

compared to August 2023. Generally, in the first 8

months of 2024, the W&WP export turnover to this

market brought about US$47.7 million, up 12% over

the same period in 2023.

Vietnam's office furniture exports in August

2024 were valued at US$16.2 million, down 38%

compared to August 2023. Generally, in the first 8

months of 2024, the exports of office furniture

contributed US$173 million, up 0.2% over the same

period in 2023.

Vietnam's W&WP imports in August 2024

accounted for US$270.7 million, up 3.1% compared to

July 2024 and up 46.1% compared to August 2023.

Generally, in the first 8 months of 2024, W&WP

imports reached US$1.79 billion USD, up 26.6% over

the same period in 2023.

Vietnam's poplar import volume in August

2024 was 42.6 thousand cu.m, worth US$17.0 million,

up 3.1% in volume and 3.2% in value compared to

July 2024; an increase of 44.1% in volume and 48.7%

in value compared to August 2023. Generally, in the

first 8 months of 2024, poplar imports accumulated at

259.7 thousand cu.m, worth US$100.1 million, up

26.6% in volume and 15.9% in value over the same

period in 2023.

Import volume of raw wood (log, lumber

and wood-based panels) from China in August 2024

was 85 thousand cu.m, with a value of US$34 million,

up 1.2% in volume and 6.1% in value compared to

July 2024; bringing the total volume of raw wood

imported from China in the first 8 months of 2024 to

591.82 thousand cu.m, with a value of US$234.54

million, up 76.2% in volume and 46.8% in value over

the same period in 2023.

W&WP exports/imports in the first 8 months of 2024

According to the statistics from the General Department of

Customs, Vietnam's W&WP export turnover in August

2024 reached US$1.5 billion, up 9.16% over the previous

month, and up 16.65% over the same period in 2023. Of

which, WP exports fetched US$1.03 billion, up 5.11%

compared to July 2024 and up 21.97% over the same

period last year.

Over the first 8 months of 2024, the W&WP exports

totaled US$10.41 billion, up 22.6% year-on-year, ranking

6th in value amongst Vietnam's export commodity groups.

Of this, the WP export turnover was US$7.12 billion, up

24.02% over the same period last year, accounting for

68% of the total W&WP export turnover (this proportion

last year was 67.61%).

Foreign direct investment (FDI)

In August 2024, the W&WP export turnover contributed

by FDI enterprises reached over US$690 million, up

3.75% over the previous month, and up 17.97% over the

same period last year. In which, WP export turnover

reached US$638 million, up 3.55% compared to July

2024, and up 22.33% over the same period in 2023.

In the first 8 months of 2024, W&WP export turnover

shared by FDI enterprises amounted to US$4.8 billion, up

25% over the same period last year and accounting for

46% of Vietnam’s total W&WP export turnover. In which

W&WP export turnover reached US$4.38 billion, up

25.16% over the same period in 2023, accounting for 91%

of the total export turnover attained by FDI enterprises and

accounting for 61.6% of the total export turnover of

Vietnam’s WP exports. In 2023, this proportion for the

same period was 61.03%.

Export markets

In August 2024, W&WP export turnover to the US market

reached US$858 million, a slight increase compared to the

previous month (5.5%), but up 279% over the same period

last year, accounting for 57% of the country's W&WP

export turnover. The US remains the top export market,

making an important contribution to the industry-wide

growth in August 2024.

In August, W&WP export turnover to South Korea valued

at US$69 million, up 116% over the previous month and

up 11% over the same period in 2023. W&WP exports to

China grew strongly compared to July (up 26%) but

decreased slightly over the same period (down 7%). In

contrast, compared to the previous month, W&WP export

turnover dropped sharply to France (20%), the

Netherlands (30%), Thailand (10%).

In the first 8 months of 2024, W&WP exports to top

markets increased significantly. The US remains the

largest export market, reaching over US$5.74 billion, up

26% over the same period last year and accounting for

55%t of the country's total W&WP exports.

The W&WP exports to the Chinese market increased by

31%, Canada 23%, the UK 18%, Germany 39%. while

other markets have recorded quite high growth over the

same period last year.

Japan is Vietnam's 3rd largest W&WP export market, but

export turnover in the first 8 months of 2024 to Japan

recorded a low increase, only up 1.5% over the same

period. Eight months saw a slight decline in W&WP

export turnover to the South Korean market, down 0.5%.

Imports of W&WP

According to statistics from the General Department of

Customs, W&WP import turnover to Vietnam in August

2024 recorded at US$270 million, up 3% compared to July

2024 and up 46% compared to August 2023.

In the first 8 months of 2024, W&WP import turnover to

Vietnam reached US$1.79 billion, up 27% over the same

period last year.

Foreign Direct Investment (FDI) Enterprises

In August 2024, the import turnover of W&WP

contributed by FDI enterprises reached nearly US$95

million, down 1.51% compared to the previous month and

up 53.2% over the same period in 2023.

In the first 8 months of 2024, the W&WP imported by FDI

enterprises reached US$675 million, up 37.8% over the

same period in 2023, accounting for 37.71% of the total

Vietnam’s W&WP imports. This rate of the same period

last year was 27.36%.

Imports

In August 2024, W&WP imports from Thailand, Chile,

Brazil, Italy and Indonesia increased significantly

compared to July 2024, of which, imports from Chile

soared by 90% and Brazil by 69%. In contrast, compared

to July 2024, imports from the US, France, Germany, and

Belgium decreased by 167%, 124%, 21%, 36%,

respectively, and imports from Cambodia decreased by

22%.

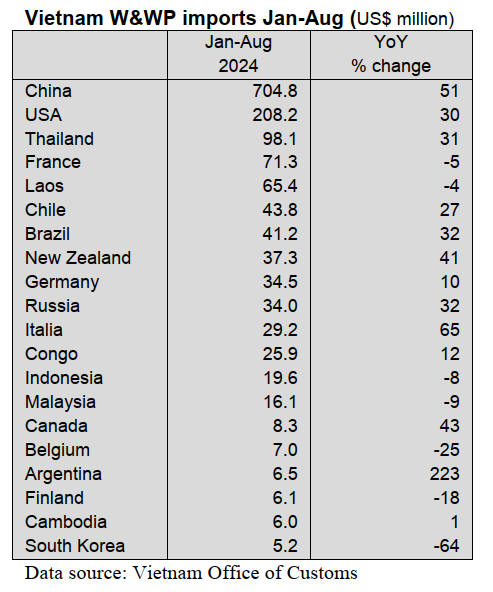

In the first 8 months of 2024, W&WP imports from China,

the US, Thailand, Chile, New Zealand and Italy surged.

Leading the list of import sources was China with a share

of US$704 million, up 51% over the same period,

accounting for 39% of the country's imports. Next to

China was the US with a turnover of US$208 million, up

30%, accounting for 12% of the total imports. In contrast,

imports decreased slightly in some key markets such as

France, Laos, Indonesia and Malaysia.

8. BRAIL

Boosting private investment in forest

sector

The National Bank for Economic and Social Development

(BNDES) has launched the BNDES Forests Credit

programme with a R$1 billion fund to boost private

investments in the forest sector for companies of all size

using native timber species.

To access the BNDES Forests Credit, companies need to

operate in one of the following: sustainable forest

management; restoration of vegetation cover; forest

concessions; planting of native species and agroforestry

systems; support for the production chain of timber and

non-timber products from native species; acquisition of

machinery and services associated with these activities.

The programme combines resources from the Climate

Fund (R$456 million) and R$544 million from BNDES

traditional credit lines, such as BNDES Finem

Environment, offering financing at low rates and flexible

terms. Project value can be up to R$100 million. Financing

will be structured according to BNDES’ standard

regulations, considering the specifics of each project.

BNDES also aims to attract the private sector,

collaborating with commercial banks and companies with

the aim of transforming Brazil into one of the global

leaders in forest restoration.

During the United Nations Framework Convention on

Climate Change (UNFCCC) COP 28, at the end of last

year, the Brazilian government launched an initiative to

transform the “Arc of Deforestation” into the “Arc of

Restoration,” by restoring 24 million hectares of natural

forest by 2050, potentially removing around 1.65 billion

tonnes of carbon dioxide from the atmosphere over 30

years.

In addition to capturing carbon, the project aims are to

promote biodiversity, generate jobs and income, and

stimulate the sustainable production of food, such as açaí

and cocoa.

See: https://www.remade.com.br/noticias/20218/bndes-lanca-

programa-para-impulsionar-investimentos-em-florestas-nativas-

no-pais

Furniture industry contributes to recovery in Rio

Grande do Sul

After the extensive flooding in the state of Rio Grande do

Sul in the south of Brazil from April into May 2024, the

furniture sector has played a crucial role in its economic

recovery.

Despite logistical challenges and losses, more than 2,400

furniture manufacturers recorded sales of R$ 6.14 billion

in the first half of the year, an increase of 9% compared to

the previous year. Exports also rose by 6.8%, reaching

US$ 119.7 million, with particularly strong growth to the

United States, Chile, and Uruguay.

In addition to the furniture sector showed solidarity with

local communities, with campaigns such as “Sponsor a

city” (Apadrinhe uma Cidade) and “United for Bento

Gonçalves” (Unidos por Bento)”, donating furniture,

helping rebuild roads and creating new jobs.

See: https://www.movergs.com.br/noticias/industria-moveleira-

colabora-com-a-retomada-do-rs

August wood-based product exports down on

previous year

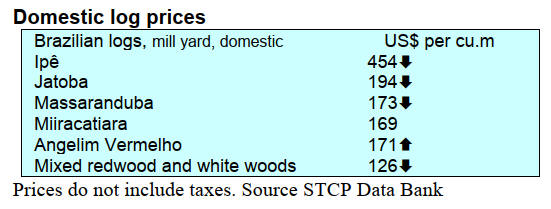

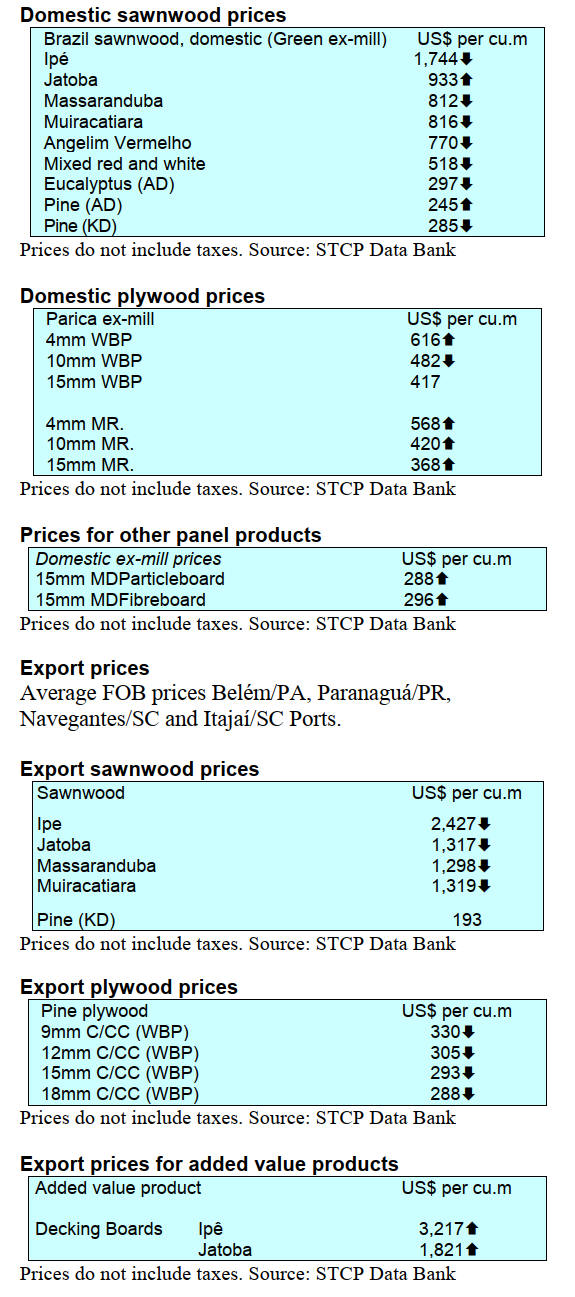

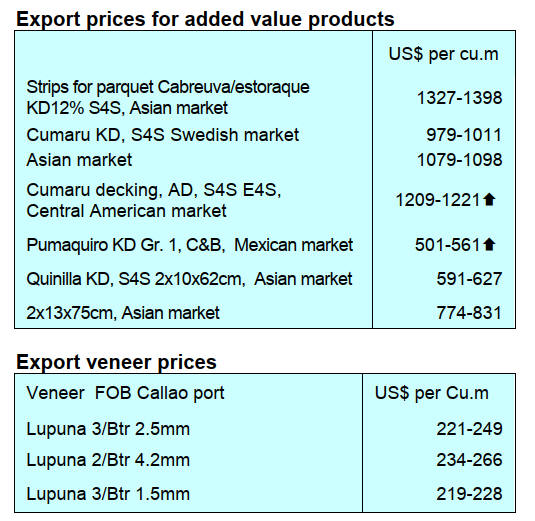

In August 2024, Brazilian exports of wood-based products

(excluding pulp and paper) decreased 10.8% in value

compared to August 2023, from US$300.7 million to

US$268.4 million.

Pine sawnwood exports decreased 9.2% in value between

August 2023 (US$53.2 million) and August 2024 (US$

48.3 million). In volume, exports decreased 10.4% from

230,100 cu.m (August 2023) to 206,200 cu.m (August

2024).

Tropical sawnwood exports decreased 33.1% in volume,

from 26,300 cu.m in August 2023 to 17,600 cu.m in

August 2024. In value, exports decreased 48.4% from

US$12.6 million to US$6.5 million, over the same period.

As for tropical plywood, exports decreased 40.0% in value

and 37.5% in volume, from US$1.5 million and 2,400

cu.m in August 2023 to US$0.9 million and 1,500 cu.m in

August 2024.

As for wooden furniture, export value decreased 10.6%

from US$54.0 million in August 2023 to US$48.3 million

in August 2024.

Pine plywood was the one wood-based product category

which saw an increase in foreign sales. Exports rose 8.9%

in value in August 2024 (US$ 58.5 million) compared to

August 2023 (US$53.7 million).

In volume, exports increased 3.0% over the same period,

from 168,500 cu.m (August 2023) to 173,600 cu.m.

(August 2024).

The 21% fall in Brazilian exports of wood products in

August 2024 compared to July was attributed to shipping

difficulties. Uncertainties related to maritime transport are

negatively impacting the sector, even as exporters manage

to overcome challenges such as high production costs and

internal logistics. Competition for space on ships and

rising freight costs are among the main factors affecting

the sector.

In the first half of 24, Brazil’s southern ports saw a 30%

increase in container shipments. While the Port of

Navegantes, in Santa Catarina state recorded a 22% drop

in timber cargo volume, volumes through the Ports of

Paranaguá in Paraná state and Itapoá in Santa Catarina

grew by 84% and 14%, respectively.

See: https://www.woodflow.com.br/blog/dificuldades-no-

embarque-derruba-exportacoes-de-madeira

Brazil participates in the Global Legal and Sustainable

Timber Forum

The "Global Legal and Sustainable Timber Forum 2024"

was held on September 11 and 12, in Macau, China. The

aim was to promote sustainable forest management and

foster global trade in legal and sustainable timber.

Brazilian participants included the Association of Wood

Exporting Industries of the State of Pará (AIMEX) and the

Brazilian Association of Mechanically Processed Wood

Industry (ABIMCI). The event was also attended by

STCP, a Brazilian company in the sector, which gave a

presentation on ‘Innovative Measures to Promote Legal

and Sustainable Timber Supply Chains at a Global Level’.

Many companies participated in the “B2B Matching”

event, strengthening connections with key stakeholders in

the region.

STCP also took part in the specialized subforum on

potential impacts on tropical timber producers of emerging

timber trade requirements and their responses to the latter.

During the presentation STCP discussed the impacts of the

European Union Deforestation Regulation (EUDR) on the

Brazilian forest sector.

See: STCP https://www.stcp.com.br/stcp-participa-do-forum-

global-da-madeira-legal-e-sustentavel-2024-de-2-dias-em-

macau-china/

9. PERU

Exports declined in

first seven months of 2024

Peruvian shipments of wood and its derived products from

January to July 2024 totalled US$47.4 million, a drop of

23% compared to the same period in 2023 (US$61.9

million) according to the Extractive Industries and

Services Management of Exporters Association ADEX.

The decline was partly attributed to uncertainty in

international markets over purchasing 'shihuahuaco'

(Dipteryx spp.) due to its inclusion in Appendix II of the

Convention on International Trade in Endangered Species

of Wild Fauna and Flora (CITES).

In the first seven months of 2024, France was the largest

export destination for Peru’s wood sector, with a share of

16%, although sales to the country dropped 29% compared

to the same period in 2023.

The US is Peru’s second biggest timber export market. It

accounted for 15.6% of the country’s total timber exports

in the first seven months of 2024, with an increase in

purchases of around 50%. China is the country’s third

largest export destination, accounting for 14% of Peruvian

exports, although its purchases in the first seven months

were down 45%.

Plywood was one wood product export category that grew

substantially between January and July 2024, although

from a small base. According to ADEX, export value of

US$956,046 was 38 times higher than the same period last

year (US$24,420). Mexico was the largest export market,

accounting for US$691,662 (72%), followed by Ecuador

(US$221,231) and Colombia (US$ 42,508). Plywood

shipments were mainly out of Lima (US$734,395) and

Loreto (US$221,231).

Peruvian particleboard imports fall

In the first seven months of 2024, Peru’s particleboard

imports totalled US$78.9 million, representing a decrease

of 12.6% compared to US$90.3 million in the same period

in 2023. The main countries of origin were Ecuador,

declining 11.3% to US$38.6 million during the period, and

Spain down 14.0% to US$18.3 million. In contrast,

imports of this commodity from Brazil increased 16% to

US$11.8 million, while imports from Chile suffered a 34%

decline to US$8.9 million.

See: https://www.adexperu.org.pe/

OSINFOR strengthens forest supervision with new

technologies

Peru’s Forest and Wildlife Resources Supervision Agency

(OSINFOR) is turning to new technology to aid species

identification and strengthen forest monitoring. It has

been working on a pilot in Madre de Dios in conjunction

with the Forestry Wood Network, which comprises CITE

Madera Lima, CITE Forestal Maynas and CITE

Productivo Madre de Dios of the Technological Institute

of Production .

The joint effort had the logistical support of the United

States Forest Service and World Forest ID. It is using the

Xylotron field-portable wood species identification tool

and DART-TOFMS (Direct Analysis in Real Time-Time

of Flight Mass Spectrometry). These allow for the precise

identification of timber species, even as sawn timber. The

aim is to strengthen the traceability and, hence, ensure

legality of timber products in the first stage of the

production chain.

As part of the project, OSINFOR forest supervisors were

trained in the use of both tools. Together with

professionals from Red Forestal Madera, they collected

anatomical and dendrological samples of species of

interest and put them through the technologies’

identification process.

With the information obtained in the pilot collection of

anatomical and dendrological samples, OSINFOR will be

able to update its protocol for identifying forest species

during supervisions. This will allow for more effective and

timely detection of irregularities in the forest production

chain.

See: https://www.gob.pe/institucion/osinfor/noticias/1024022-el-

osinfor-fortalece-la-supervision-forestal-con-nuevas-tecnologias-

de-identificacion-de-especies-maderables

Peru to issue Deforestation-Free Certificate to facilitate

EUDR conformance

On 10 September 2024, Ministerial Resolution No. 0309-

2024-MIDAGRI was published, approving the electronic

document called "Deforestation Free Certificate" for

agricultural producers. This certificate will be issued after

verifying the non-existence of deforestation in the

evaluated area and ensuring compliance with Peru’s

forestry regulations.

Peru’s Deforestation Free Certificate has been created to

assist EU operators importing regulated products from

Peru to comply with the European Union Deforestation

Free Regulation.

Peru’s General Directorate of Statistics, Monitoring and

Evaluation of Policies of the Ministry of Agrarian

Development and Irrigation is responsible for verifying the

non-existence of deforestation. The directorate, with the

support of the National Forestry and Wildlife Service, is

also tasked with updating and systematizing the public

information contained in the certificate.

See: https://www.lexology.com/library/detail.aspx?g=6237ec73-

0cb0-4767-abe3-9a6164ac7c1b

|