|

Report from

Europe

European plywood production and imports at record

low

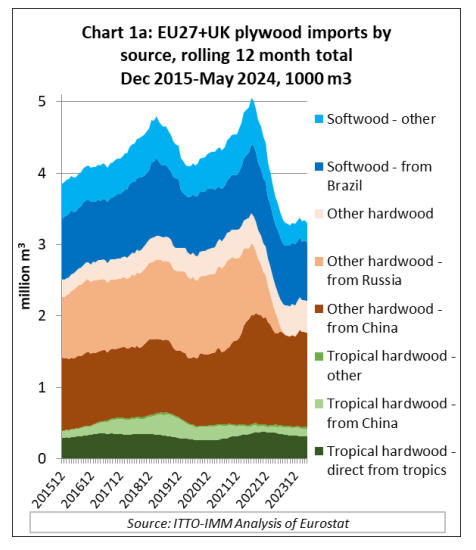

Total EU+UK imports of plywood from outside the region

in 2023 were 3.29 million cu.m, down 26% compared to

the previous year and only just exceeding the record low

of 3.1 million cu.m in 2009 during the global financial

crises.

The decline in 2023 felt even more dramatic as it followed

on from two years in 2021 and 2022 when imports were at

record levels averaging 4.5 million cu.m per annum (Chart

1a).

EU+UK imports of plywood from outside the region have

remained weak in 2024. In the first five months of the

year, total imports were 1.58 million cu.m, just 1% more

than the same period in 2023.

Imports of tropical plywood were down 5% to 180,600

cu.m and imports of softwood plywood were down 6% to

652,000 cu.m. However, these declines were offset by a

10% rise in imports of temperate hardwood plywood to

748,800 cu.m.

Despite the slight rise this year, EU+UK imports of

temperate hardwood plywood remain well down on levels

prevailing before Russia’s invasion of Ukraine in February

2022 and the subsequent imposition of economic sanctions

on Russia and Belorussia by the EU and UK, including a

total ban on all imports of timber products from both

countries.

Due to slowing economic conditions in Europe for the

second half of 2022 onwards, the anticipated surge in

plywood imports into Europe from alternative supply

countries following the removal of Russian and

Belorussian products from the market has been much less

dramatic than expected.

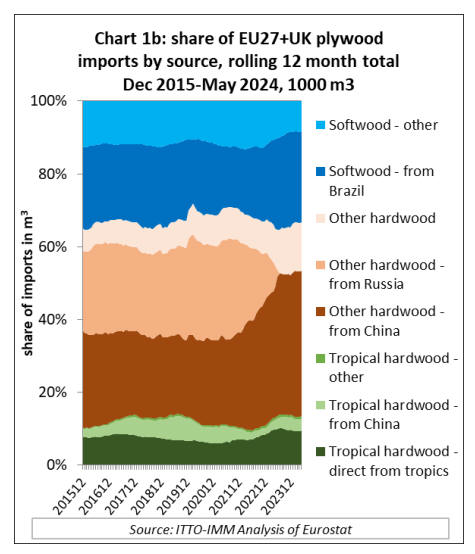

By far the biggest gain in market share has been made by

temperate hardwood plywood from China (Chart 1b).

There was also a surge in birch plywood imports into the

EU from Kazakhstan in 2023, raising immediate concerns

that some European importers were deliberately

circumventing the sanctions by sourcing Russian birch

plywood from third countries.

EU domestic plywood manufacturers were unable to

increase production in response to the supply gap that

opened following the sanctions on Russian and

Belorussian products.

Data from the European Panels Federation indicates that

total EU plywood production fell 2.5% from 3.2 million

cu.m in 2021 to 3.1 million cu.m in 2022 and then a

further 15% to just 2.6 million cu.m in 2023.

In fact, the level of EU production last year was

unprecedented, being the lowest ever recorded and only

about half the volume of nearly 5 million cu.m per annum

prevailing before the COVID pandemic.

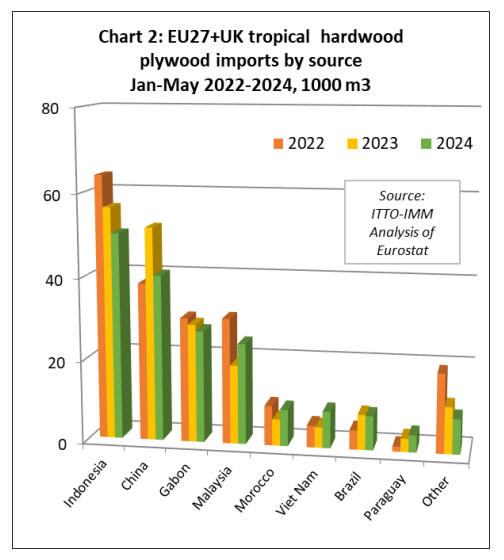

This year, EU+UK imports of tropical hardwood plywood

direct from tropical countries have held up better than

imports of plywood faced with tropical hardwood from

China. In the first five months of this year, imports from

China into the European region, which are mainly destined

for the UK, decreased 22% to 40,300 cu.m.

In contrast, imports direct from tropical countries during

the period were 129,000 cu.m, just 1% less than the same

period in 2023.

Although imports from Indonesia fell 11% to 50,100 cu.m

and were down 5% to 27,100 cu.m from Gabon, there was

a strong 27% rebound in imports from Malaysia to 24,400

cu.m, while imports from Vietnam increased 78% to 8,900

cu.m and imports from Paraguay were up 29% to 4,100

cu.m (Chart 2).

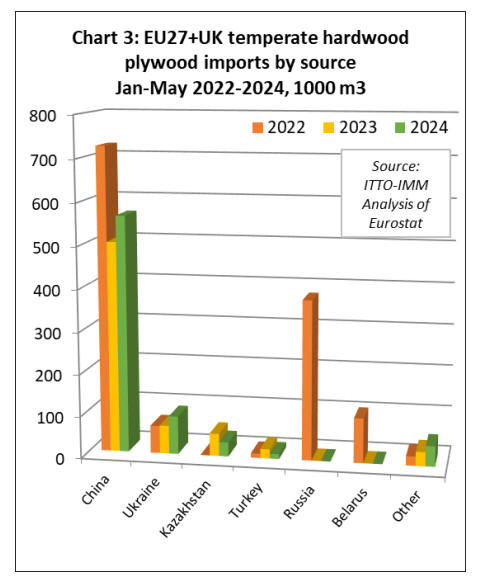

In the first five months of this year, EU+UK plywood

imports of temperate hardwood plywood increased 10% to

748,800 cu.m. The gains were mainly due to imports from

China and Ukraine, which were 564,100 cu.m and 90,800

cu.m in the January to May period this year, respectively

12% and 35% more than the same period in 2023.

Imports of temperate hardwood plywood from Kazakhstan

were down 37% to 33,700 cu.m while those from Turkey

fell 48% to 11,500 cu.m in the first five months of this

year (Chart 3).

The decline in European imports from Kazakhstan and

Turkey comes at a time when the European Commission is

extending anti-dumping measures on imports of birch

plywood, previously applied to Russian products, to

imports from the two countries.

The EC announced the extension on 14 May this year

following an EC investigation which concluded that EU

anti-dumping duties on imports of birch plywood from

Russia were being circumvented by imports transhipped

from Russia to Kazakhstan and Turkey, or sent for final

completion to these countries, preceding shipment of the

finished product to the EU.

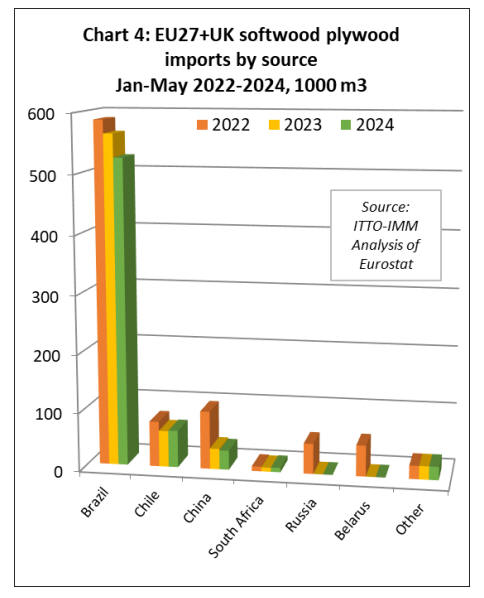

In the first five months of this year, the EU+UK region

imported 652,000 cu.m of softwood plywood, 6% less

than the same period in 2023. The decline in imports was

driven mainly by Brazilian products, for which imports

fell 7% to 524,000 cu.m.

Imports from China also declined, by 6% to 33,000 cu.m.

Imports from South Africa increased by 10% to 8,000

cu.m. Imports from Chile were stable at 63,000 cu.m.

European plywood importers look to 2025 for market

upturn

Leading European plywood importers have forecast trade

to be on a level with 2023 or be only marginally up this

year. They are not expecting a more robust recovery until

next year.

A UK importer-distributor of temperate and tropical

plywood said their market ‘still feels depressed’. “We

expect 2024 to remain flat,” they said. “We don’t

anticipate much change until interest rates fall and house

building kick starts the UK economy. We just hope that

the new UK government lives up to its pledge to back

construction to build 1.5 million new dwellings in the next

five years.”

An EU-based importer, who described their business as

‘heavily dependent on construction’, said that some of

their national plywood markets have been doing better

than others.

“The Netherlands and UK have performed slightly below

2023 so far but are picking up slowly and expected to be

in line with last year at the end of 2024,” they said.

“However, France and Germany have performed below

expectation.” A key concern for European importers has

been the hike in freight rates.

“Part of the increase is justifiably attributed to the attacks

on shipping in the Red Sea, leading to vessels having to

avoid the Suez Canal and take the long route around the

tip of Africa,” said an EU importer-distributor. “But the

feeling is that some shipping lines are taking advantage of

the situation and increasing rates over and above what is

justified.”

“This situation has been causing real issues for us,” said a

UK importer. “A 40-ft container from Southeast Asia had

fallen from the peaks we saw in the pandemic to around

US$1,000 in December 2023, but in 2024 rates returned to

above US$10,000 and we’re now paying around

US$7,500. We expect the situation to remain challenging

until rates go down below US$5,000 a box, but we don’t

anticipate that happening until 2025.”

Plywood prices on a firming trend

“Far East and China FOB rates haven’t changed a lot, but

prices have of course been driven by the logistic costs,”

said an EU importer-distributor. “For Africa and South

America logistic cost have remained more stable, but FOB

rates increased throughout Q1and Q2 this year.”

A UK importer qualified this by saying that Brazilian

plywood prices were still below their previous peak, kept

down by cuts in the price for competing EU-made OSB

which manufacturers have made to ‘combat imports’.

Another European importer said their best performers so

far this year have been ‘Chinese commodity and high

quality plywood’, okoumé plywood and eucalyptus

plywood from South America.

“We’ve also sold some volumes of tropical hardwood

plywood from Indonesia, and some marine plywood into

the UK from Malaysia and Indonesia,” they said.

Another importer reported an increase in offers of

rubberwood and acacia plywood from Malaysia and

Indonesia.

Following the UK and EU embargo on Russian and

Belarusian timber and wood products, one UK importer

said birch plywood of unknown provenance was coming

into the market.

“We can’t comment on its true origins, but we hope it is

being fully checked by the UK Office of Product Safety

and Standards [which polices legality of timber imports],”

they said.

Some importers say that the ban on Russian birch plywood

in the EU is actually opening up opportunities.

“It has had a positive effect on our business as we’ve been

able to replace birch with high quality film-faced plywood

from China with better margins,” said an EU importer.

No major availability issues are being reported by

importers. “We experienced some shortness in supply in

Q1 2024 due to logistics issues from China and the rest of

Southeast Asia, but overall, it’s been sufficient to meet

demand,” said an EU importer.

A continuing concern of the EU plywood sector is the EU

Deforestation Regulation (EUDR), which comes into force

at the end of 2024. It will require that companies which

place timber and wood products from all origins on the EU

market undertake due diligence to ensure their production

is not implicated in deforestation or forest degradation.

They will also have to provide geolocation coordinates for

the origins of products.

“It will create huge administrative burdens,” said one

importer. “We are working with a third party to ensure

compliance, as we did under the previous EU Timber

Regulation (EUTR), and we expect the cost of this to go

up 40% to 50% under the EUDR compared to under the

EUTR. We also think the EUDR may lead to some

suppliers looking to alternative markets to the EU,

including some Chinese suppliers. There have been calls

from the EU timber sector for introduction of the

Regulation to be delayed to give business a longer

transition period, and we would support that.”

That prospects for 2025 are looking more promising seems

to be the general view among European importers.

“While the rest of 2024 is looking unexciting, there are

signs things will be better in 2025,” said a UK importer.

“Once construction picks up, as is predicted, everything

will improve from there.”

“Increased prices as of Q2 into Q3 and Q4 this year will

help us improve turnover and margins in 2024, and we

have seen some increase in import volumes, although that

may be the follow on from logistics issues for Far East and

Chinese cargoes we saw earlier in the year,” said an EU

importer. “It remains to be seen how stocks will evolve in

Q4. But we see further market improvement from Q2 2025

and for the second part of the year we are more

optimistic.”

Europe’s wood panel manufacturing sector had a

difficult 2023 - anticipates improvement this year

According to the European Panel Federation’s (EPF) latest

Annual Report, Europe’s wood panel manufacturing sector

had a difficult 2023. This year the EPF expects to see a

degree of improvement in sales, however, a stronger

upturn is not anticipated until 2025.

A summary of the EPF report, covering market

development and European panel producer performance

through 2023/24 was presented at the EPF agm in Riga in

June.

The event was reported by Wood Based Panels

International as attracting an audience of 180, drawn from

across particleboard, plywood, MDF, OSB, hardboard and

softboard industries. It underlined the EPF’s

‘representation of all panel types and the whole of

Europe’, said WBPI, with the organisation reporting

market statistics for the EU 27, UK and EFTA and some

‘all-Europe figures’, including those of Belarus, Russia,

Turkey and Ukraine.

Delegates heard that Europe’s total wood panel production

declined by 6.3% in 2023 to 56.5 million cu.m, hit by poor

construction and furniture production. European wood

furniture output was 8% down and consumption11% in

2023 after declines of 11% and 12% respectively in 2022.

Furniture production in the EU27+UK was valued at

€39.7bn and consumption at €39.4bn. Euroconstruct

reports that overall construction output last year in the 19

countries it covers was down 1.4%.

According to the EPF report, last year’s contraction in

European panel production followed a 7.7% decline in

2022 after the post-pandemic home improvement surge

resulted in record output the year before.

Oriented strand board (OSB) was the only panel product

area that saw production growth in 2023, with an

EU27/UK/EFTA increase of 2% to 6.6 million cu.m,

versus 6.5 million cu.m in 2022.

Particleboard output was down 5% in 2023 at 30.9 million

cu.m, while MDF production fell 11% to 11.1 million

cu.m. After growing significantly in recent years,

softboard production – mainly for the insulation sector -

was 6% lower in 2023 at 4.8 million cu.m. Down most

sharply was hardboard production, which was 17% lower

than 2022 at 400,000 cu.m. Plywood manufacture fell 15%

to 2.6 million cu.m.

The EPF reports that furniture production remained the

biggest consumer of European wood panel products last

year. But with furniture sales falling due to the uncertain

economic situation, high interest rates and inflation and

consequently decreased consumer confidence, the sector

accounted for 47% of total panel output, down from 48%

in 2022. The building industry accounted for 39%, while

3% went to the packaging sector and 11% to other

applications.

The EPF projects that 2024 will see a return to market

growth, but with total European wood panel output up

only about 500,000 to 600,000 cu.m at 31.5 million cu.m.

OSB output is forecast to rise 150,000 cu.m to 6.75

million cu.m, with MDF production up around 90,000

cu.m.

Plywood production is also expected to show a slight rise.

EPF forecasts that EU27 output will be up 40,000 cu.m,

with a total Europe production increase (including output

from Belarus, Ukraine, Russia and Turkey) of 50,000

cu.m.

Discussion topics at the EPF AGM also included the

European Commission’s communication on ‘Building the

future with nature’ and its potential impact on the wood

panel sector. It states that biotechnology and

biomanufacturing are among the most promising

technological areas for the EU in the 21st century, with the

capacity to modernise and advance forestry and bio-based

materials sectors, among other industries.

Katharina Knapton-Vierlich, Head of Unit at the EC

Directorate General which supports growth and resilience

of the EU economy detailed possible next steps for

developing the bio-based materials sector. These include

creating an EU biotech hub, introducing labelling for bio-

based materials, and revising Product Environmental

Footprint rules to ensure fair comparisons between bio-

based and fossil- based products.

See: https://europanels.org/annual-report/

and

https://ec.europa.eu/commission/presscorner/detail/en/STATEM

ENT_24_1610

and

https://www.wbpionline.com/

|