|

1.

CENTRAL AND WEST AFRICA

Power outages disrupting production

The timber industry in Gabon is under severe pressure due

to widespread disruptions in energy supply, particularly in

special economic zones. These disruptions are said to be

linked to financial difficulties within the SEEG power

company which is partly owned by the British firm

Aggreko.

The reported power company debt of 15 billion FCFA to

Aggreko has led to a suspension of the electricity supply

severely hampering production and resulting in worker

layoffs. Although SEEG has recently managed to secure

funds from Bank BFI to address the debt, ongoing issues

such as the prolonged repair of turbines and insufficient

water levels in the Kinguélé Dam are causes for concern in

Gabon.

See:https://www.lenouveaugabon.com/fr/energies/2108-20408-

electricite-aggreko-menace-darreter-ses-centrales-a-cause-de-15-

milliards-fcfa-des-factures-impayees-par-la-seeg

Intensified oversight of forest operations

The government has intensified its oversight of forestry

operations, particularly focusing on companies failing to

comply with the Community Contribution Commitment

(CCC) and land tax obligations.

The CCC mandates that operators share production figures

and contribute 800 FCFA per cubic metre of timber

harvested with local communities and regional

administrations.

Non-compliance with these regulations is met with strict

penalties, including the cancellation of logging

concessions. Some say enforcement at this time is driven

by political motivations ahead of the upcoming

presidential elections.

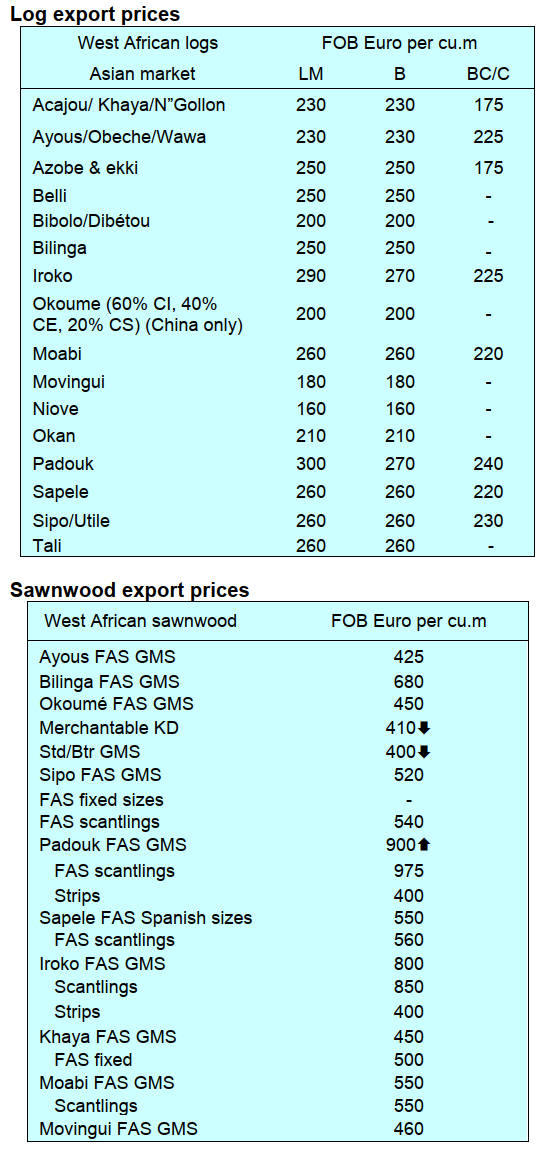

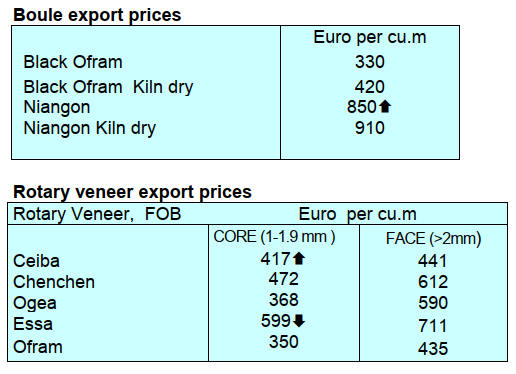

Observations on the market

Operators report timber markets are giving mixed signals.

The market for sawn azobe remains robust with steady

demand from Dutch buyers for garden squares, waterways

and dragline mats/sheets these mats provide a stable

surface for heavy machinery to move on. Most pieces

measure 20 x 20 cm and range from 5 to 7 m in length.

Conversely, the market for lower density timbers,

particularly okoume and ayous, is experiencing sluggish

demand with China making small purchases at low prices.

Producers in Cameroon are said to have an advantage as

they can offer more competitive prices than Gabon and

Congo as export duties are lower.

Producers cautiously optimistic on demand prospects

Weather conditions are impacting operations with heavy

rains affecting production in the Cameroon and the rain

season has started in Gabon and Congo. The rains make it

difficult to maintain log stocks and production schedules

tend to slide.

Producers in the region say price levels are expected to

remain stable in the near term, influenced by the end of the

holiday season in Europe and ongoing demand

fluctuations in key markets such as China, the Philippines

and the Middle East.

The industry remains cautiously optimistic though the

potential for further disruptions and the impact of stringent

regulatory enforcement needs to be closely monitored.

2.

GHANA

Overall exports dip but positive growths for

some

products

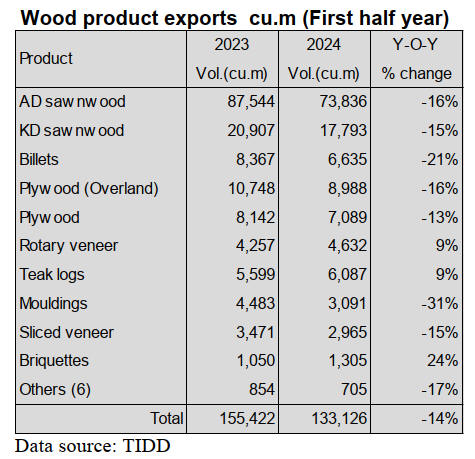

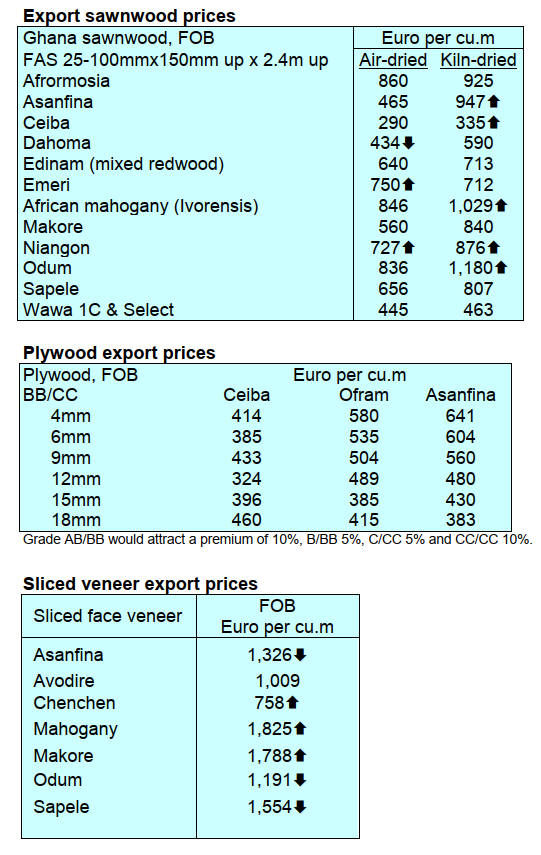

Data from the Timber Industry Development Division

(TIDD) of the Forestry Commission indicates that wood

product exports in the first half year of this year were

133,126 cu.m. In the same period in 2023 the volume was

155,422 cu.m, indicating a 14% year on year decline in

2024.

For the same period, total receipts from wood product

exports were Eur60.58 million compared to the Eur70.53

million in the first half of 2023, a 14% drop.

The decline in export volumes is partly a reflection of

insufficient raw materials high production costs and weak

international demand. As production and shipping costs

rise millers lose the incentive to boost production.

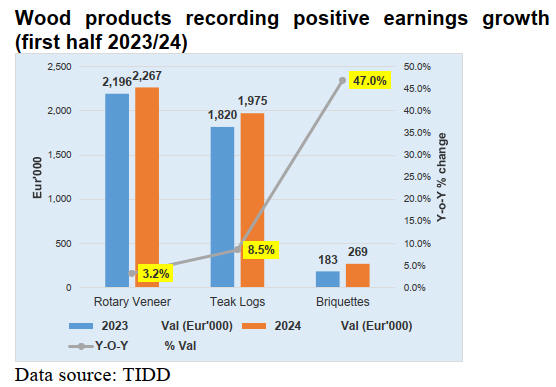

In spite of the overall decline in export volumes and

values for the half year exports of briquettes, teak logs and

rotary cut veneer registered volume increases of 24%, 9%

and 9% respectively in the current half year compared to

2023.

Revenue generated from these three products also

recorded corresponding positive growth during the period

in 2024 against the same period in 2023 as shown in graph

below;

Of the 16 products exported during the period sawnwood

(91,629 cu.m), veneers (7,597 cu.m) and plywood (16,077

cu.m) together accounted for 87% of total export volumes.

Ghana Shipping - New law to replace the 50 year old

legislation

Parliament has passed the Ghana Shippers Authority Bill,

2024, into Law to replace the 50 year old NRCD 254

(1974) Legislation. The new law seeks to regulate the

commercial activities of shippers and also to address the

issue of unfair and excessive charges that burden

importers and exporters who use Ghana’s sea, air and land

frontiers.

The new law aims to introduce transparency in the

determination of port fees and charges to ensure that there

is accountability in the legal movement of international

trade cargo across all of borders of Ghana. Additionally, it

is also to make Ghana a preferred transit trade channel for

her landlocked neighbours of Burkina Faso, Mali and

Niger and to enhance the sector’s revenue collection.

The Law empowers the Ghana Shippers Authority (GSA)

to better adapt to emerging trends and complexities within

the shipping and logistics industry. It will also protect the

interests of shippers and shipping service providers and

improve the GSA regulatory oversight of the entire

industry. The Chief Executive Officer of GSA, Kwesi

Baffour Sarpon, expressed optimism saying the passing of

the law is a huge step in the right direction and the

enforcement of the law will be fair and representative of

the interests of the shipping industry.

The Ghana Union of Traders Association (GUTA) has

welcomed the newly passed GSA Law saying it will offer

the Authority “the teeth” to effectively regulate the

shipping industry to approve or disapprove import charges

that affect the general cost of doing business in the

country.

See: https://shippers.org.gh/index.php/parliament-passes-

shippers-authority-bill-into-law/

FORM Ghana agreement with Climate Impact Partners

on carbon credits

FORM Ghana Limited has signed an agreement with

Climate Impact Partners, a carbon finance organisation, to

provide exclusive access to 371,000 high-quality carbon

credits from a reforestation project in two locations in

Central Ghana.The project aims to reforest 20,000 hectares

of degraded forest reserves in Ghana. Plantation species

for the project includes teak and some native species.

The pres release says the project has created more than

1000 jobs, with 40% of women participation in a

community impacted by climate change. The project is

expected to promote land management practices that help

to enhance food security.

See: https://www.climateimpact.com/news-insights/news/form-

ghana-and-climate-impact-partners-announce-exclusive-

agreement-on-400000-carbon-removal-credits/

Non-traditional exports almost US$4 bil. in 2023

The Ghana Export Promotion Authority (GEPA) has

reported a remarkable doubling of Non-Traditional

Exports (NTEs) earnings in 2023 which reached almost

US$4 billion a marked increase from the US$3.5 billion

recorded in 2022.

The driving force behind this expansion was the rise in

exports closely linked to improved performance in the

manufactures/semi-processed products and crafts

(handicrafts) sectors.

The growth could also be attributed to a combination of

structural changes within Ghana’s NTEs framework and

the successful implementation of the National Export

Development Strategy (NEDS).

According to the GEPA report during the period 1,702

companies were engaged in exporting 625 non-traditional

products to 156 countries. Notably, the earnings from 88

exporting companies contributed 80% of the total non-

traditional exports for the year under review.

Burkina Faso emerged as the top market destination for

Non-Traditional Exports (NTEs), accounting for 20% of

NTEs. The Netherlands followed closely, absorbing 15%

of NTEs.

ECOWAS countries, including Togo, Cote D’Ivoire and

Mali, made up 30% of the top ten market destinations for

NTEs. The remaining market shares were distributed

among North America (10%), India (8%), Italy (6%),

Belgium (6%) and the United Kingdom (6%).

To enhance exports, the Ghana Export Promotion

Authority (GEPA) has embarked on several initiatives,

including market research, export promotion campaigns

and capacity building for exporters.

See: https://www.gepaghana.org/export-statistic/non-traditional-

export-statistics-2023-report/

3. MALAYSIA

Solid second quarter GDP growth

Bank Negara Malaysia announced that the country’s

economy advanced by 5.9% year on year in the second

quarter of 2024. This growth was fuelled by increased

domestic demand and expansion of exports.

The Bank Governor said growth in investment reflected

robust capacity expansion by businesses as well as

continued targeted spending by government and public

corporations, adding, “the net export registered a positive

turnaround due to the stronger export recovery and higher

external demand and a global technology upcycle”.

In August the Malaysian currency strengthened to 18-

month highs against the US dollar as the U.S. Federal

Reserve contemplates a rate cut.

The Malaysian ringgit was the best-performing Asian

currency, up 5.3% for the year in mid August trading at

4.361 per dollar its highest point since February 2023. The

currency's strength is a reversal from February when

it dropped to its weakest in 26 years.

See: https://asia.nikkei.com/Economy/Malaysia-GDP-growth-

accelerates-to-5.9-in-Q2

Sabah TLAS - aligning with the EUDR

The Sabah Timber Legality Assurance System (TLAS) is

the due diligence system designed to ensure that timber

products from Sabah are manufactured from wood raw

materials harvested, processed and traded in strict

compliance with local laws and international standards.

Since 2007 Sabah has been actively participating in the

EU negotiations regarding the Forest Law Enforcement,

Governance and Trade (FLEGT) and the Voluntary

Partnership Agreement (VPA) for Malaysia.

The Sabah TLAS was developed and endorsed in 2009 in

response to growing international concerns regarding the

high-risk trade in tropical timber and to meet EU

requirements under the FLEGT programme.

The Sabah TLAS encompasses six principles and 20

criteria covering 65 upstream companies, including 43

Sustainable Forest Management License Agreements

(SFMLA) holders and 156 downstream mill and trader

companies.

Over the past decade, the Sabah TLAS has been

strengthened through stakeholder consultations and

Implementing Agencies Coordination Committee (IACC)

meetings to enhance compliance, transparency, and forest

governance.

In June 2024, the Sabah Forestry Department collaborated

with the EU to update the Sabah TLAS aligning with the

EUDR incorporating key certification elements such as

sustainability, environmental protection and social

responsibility.

See:

https://theborneopost.pressreader.com/article/281629605568196

Plantations ensure the sustainable supply of timber

Deputy Plantation and Commodities Minister, Chan Foong

Hin, concluded a working visit to Keningau in Sabah

where he underscored the critical role of forestry

plantations in ensuring the sustainable supply of timber to

Malaysia’s wood industry.

The Deputy Minister’s visit to the Sapulut Forest Reserve

was to observe sustainable forest management practices.

The Reserve is recognised locally as a leading example of

industrial tree plantation efforts in Sabah.

See:

http://theborneopost.pressreader.com/article/281612425722876

Sarawak / Australia collaboration

The Sarawak government, represented by the Forest

Department Sarawak (FDS), signed a letter of intent

(LOI) with the University of the Sunshine Coast (UniSC)

aimed at building bilateral collaboration in forestry

research, capacity building and technology transfer.

Prior to the LOI signing the Sarawak delegation was

briefed with research presentations by four lecturers and

researchers of UniSC and Forest Research Institute on the

topics including ‘Breeding and Silviculture to Improve

Plantation Productivity and Value’ as well as ‘Pest

Management in Plantation Forests in Borneo’.

See:

https://theborneopost.pressreader.com/article/281578065979482

Furniture Design Competition

The MIFF Furniture Design Competition celebrates the

creative spirit of design and to uncover young talent to

support Malaysia’s thriving furniture industry. Organised

each year since 2010 in conjunction with Malaysian

International Furniture Fair (MIFF), it offers the best

platform for emerging designers to showcase their

innovative ideas.

See: https://www.mifffdc.com/about/?cid=edm140825ebriefing

4.

INDONESIA

Furniture sector secures sales in India

The Ministry of Industry has reported that domestic

furniture makers did well at the 2024 IndexPlus Delhi

Exhibition securing Rp17 billion in orders. Ignatius

Warsito from the Ministry remarked that India is a

promising market for Indonesia furniture makers. Adding,

based on IndexPlus data the Indian consumer market has

the potential to be the third-largest in the world by 2027.

Furthermore, the percentage of the Indian population

living in urban areas is increasing and this creates a

potential market for furniture of US$40 billion.

"We hope the large market potential and dynamic furniture

market trends can be utilised by the furniture sector,

including furniture designers, who play a major role in

realising marketable furniture design trends" he remarked.

See: https://www.neraca.co.id/article/203905/industri-furnitur-

bukukan-nilai-komitmen-rp17-miliar-di-india

In related news, the chairman of the Indonesian Furniture

and Craft Industry Association (HIMKI), Abdul Sobur,

estimates that the export market will grow 5-8% this year

with the domestic market growing 4-6%. Expansion will

be supported by the government's initiative to boost the

furniture industry, including the programme to restructure

machinery and equipment for the wood processing

industry.

The restructuring programme aims to improve

competitiveness and also support the growth of upstream

industries. The chairman of the Indonesian Sawmill and

Woodworking Association (ISWA), Wiradadi

Soeprayogo, stated that there has been a surge in furniture

demand both domestically and in the international market

and Indonesia can position iself as a strategic exporter.

See: https://m.antaranews.com/amp/berita/4275899/himki-

perkirakan-pasar-ekspor-industri-mebel-tumbuh-8-persen

Indonesia targets 11 million ha. of plantations

The Ministry of Environment and Forestry (KLHK),

through the Environmental and Forestry Instrument

Standardisation Agency (BSILHK), is preparing Standards

for calculating emission reductions by Industrial

Plantation Forests (HTI) as part of efforts to mitigate

climate change.

The Head of BSILHK, Ary Sudijanto, said that the

development of industrial plantations is not only to meet

the demand for roundwood for the timber industry but also

to fulfill the Long-Term Strategy for a Low Carbon

Scenario compatible with Paris Agreement (LTS-LCCP)

and the NDC aims.

Ary stated that the target for the development of plantation

forests in Indonesia by 2030 is 11.227 million hectares.

This will significantly contribute to achieving the

'Indonesia's FOLU Net Sink 2030' target and

implementing the President's mandate through Presidential

Decree 98/2021 concerning the Implementation of Carbon

Economic Value (NEK).

See:

https://lestari.kompas.com/read/2024/08/12/162610986/klhk-

hutan-tanaman-industri-disiapkan-sebagai-pengurang-emisi-

karbon.

Geo-spatial data to determine forest areas

The Indonesian government, through the Ministry of

Environment and Forestry (KLHK), is actively working to

finalise the process of determining forest areas. This is

being done to establish legal certainty regarding the status,

location, boundaries, and extent of forest areas. It is also

aimed at preventing forestry crimes such as encroachment,

illegal logging and unauthorised occupation.

The Directorate General of Forestry Planning and

Environmental Management (Ditjen PKTL) in the

Ministry plays a strategic role in accelerating the

determination of the legal status of forest areas.

The Director of Forest Area Establishment and

Management (PPKH), Donny August Satria Yudha,

revealed that the Ministry is committed to accurately

demarcating forested area saying;

“We have completed the boundary marking and as of July

2024 106.5 million hectares of forested areas have been

determined. Currently, we are in the process of correcting

documents for the remaining 16% to ensure proper

administrative order and prevent any future discrepancies."

To monitor forest areas, the Directorate General of PKTL

uses geo-spatial data. Erik Teguh Primiantoro, Director of

Forest Resources Inventory and Monitoring, mentioned

that the Ministry of Environment and Forestry has

introduced the National Forest Monitoring System

(SIMONTANA) and the Ministry of Environment and

Forestry Geospatial Information System (SIGAP KLHK).

See: https://news.detik.com/berita/d-7494236/klhk-manfaatkan-

data-geospasial-dalam-penetapan-kawasan-hutan-di-ri.

Boosting downstream sector

The Minister of Environment and Forestry, Siti Nurbaya,

has called for boosting the downstream sector, including

marketing to support products from Social Forestry areas

which cover more than 8 million hectares. According to

Siti, access to 8.08 million hectares was given to 1.3

million heads of families.

Siti also emphasised the expansion of markets for primary

forest products through the Forest Product Processing

Business License (PBPHH) utilising community wood as

raw material. She mentioned that the programme had

established community forests to ensure the continuous

availability of raw materials through collaboration with the

community.

See: https://wartaekonomi.co.id/read542086/produk-perhutanan-

sosial-perlu-digenjot-hilirisasi-begini-kata-menterinya-jokowi

In related news, the steadily increasing value of economic

transactions involving forest farmer groups (KTH) has

been driving growth of regional economies according to

Minister Siti Nurbaya Bakar. She highlighted that the total

value of KTH economic transactions jumped from Rp448

billion (US$28.5 million) in 2022 to Rp730 billion

(US$46.4 million) in 2023. As of July 2024, as many as

4,736 KTHs have made economic transactions worth

Rp535 billion (US$34 million).

She added, KTH activities have contributed not only to the

finances of the farmers but also to the growth of regional

economies through the forestry sub-sector. She noted that

the positive trend has been the result of the schemes and

programmes implemented by her ministry.

She highlighted the vital role played by forestry extension

workers in empowering and guiding people at the

grassroots level in managing forest areas and business

development.

Furthermore, she underscored that the economic

performance of KTH is a manifestation of people's

genuine participation in environmental and forestry

development efforts in Indonesia which she believes have

intensified in recent years.

See: https://en.antaranews.com/news/322559/forest-farmers-

playing-vital-role-in-boosting-local-economies-govt

5.

MYANMAR

Merchants seek review of mandatory FX

conversion

poicy

The Central Bank of Myanmar (CBM) has reduced the

mandatory conversion of foreign currency export earnings

into the kyat (MMK) from 35% to 25%. This policy,

initially introduced in August 2022, required exporters to

convert 65% of their earnings into MMK. The local media

says, despite these reductions merchants argue that being

forced to convert at rates far below the market value

remains should be reviewed.

Myanmar's ongoing currency crisis, exacerbated by this

policy, is reportedly providing the military authorities with

significant income from controlling foreign currency

exchange rates.

An analysis reported by the press estimates that the gap

between market and enforced conversion rates could have

earned the regime up to 6.4 trillion kyats (US$1.8 billion)

by June 2023. This gap stems from forcing businesses to

convert their foreign currency at rates that overvalue the

kyat, far exceeding other forms of government revenue.

Since 2021, the market rate for MMK has plummeted

from around 1,300 to around 6,000 per US dollar, while

the CBM’s official rate is 2,100 kyats per dollar. The

authorities regulation of forex rates has been viewed as

having led to significant economic distortions contributing

to a decline in economic activity and growth of the

informal economy.

See: https://www.irrawaddy.com/business/myanmar-central-

banks-latest-forex-conversion-move-fails-to-impress-traders.html

and

https://www.irrawaddy.com/news/burma/myanmars-junta-is-

funding-its-war-through-forex-scams-economists-say.html

Fuel importers struggling with payments due to Kyat

devaluation

The Central Bank of Myanmar announced that it would

inject US$100 million into the foreign exchange market to

support fuel importers struggling with payments due to the

ongoing devaluation of the kyat against the US dollar.

Since the military takeover in 2021, the kyat has plunged,

making it difficult for importers to secure fuel shipments.

Rising costs for cooking oil, rice and other essentials have

compounded the crisis as the kyat continues to depreciate.

See: https://www.pattayamail.com/thailandnews/myanmars-

central-bank-injects-100-million-us-dollar-to-aid-fuel-importers-

amid-currency-crisis-468927

Interest rate increased

The Central Bank of Myanmar (CBM) announced on 14

August 2024 that it has revised its interest rates to address

inflation, offer better deposit return and boost economic

growth by enhancing the bank loan capabilities. The new

interest rate on deposits will be 9% and interest rate on

loans will be 15%.

See: https://eng.mizzima.com/2024/08/18/12948

Authorities try to ‘capture’ more of overseas worker

remittances

Myanmar regime has intensified its scrutiny of labour

agencies in a bid to capture more from overseas workers'

remittances. Under the current regulations, both the

agency and the worker are required to sign an employment

contract in the presence of a labor ministry official before

going abroad. The contract requires workers to remit at

least 25% of their earnings via authorized channels. It also

states that non-compliance will result in a three-year ban

from working overseas on the expiration of their current

permit.

This move is part of the regime's broader strategy to

alleviate its foreign currency shortage, which has

contributed to rising economic instability but many

migrant workers are reluctant to use formal banking

channels to send their wages home due to the significant

gap between the authorised bank and market exchange

rates. The bank rate is set at 4,150 kyat per dollar while

the market rate is around 6,000 kyat to the dollar.

See: https://asia.nikkei.com/Spotlight/Myanmar-

Crisis/Myanmar-reins-in-employment-agencies-to-harvest-

remittances

6.

INDIA

Construction sector - developers

facing liquidity

issues

A report from real estate data provider Prop Equity says

that 2,000 new housing projects in India are being stalled

by administrative and financial hurdles. That amounts to

over 500,000 new dwellings. These building developments

are across 42 cities, with Delhi, Mumbai and Bengalaru

worst affected.

The causes of delay are cited as financial constraints faced

by developers, regulatory issues and problems in land

acquisition and obtaining necessary approvals. Added

problems include high levels of unsold housing inventory.

The construction sector is urging government to provide

financial support for developers facing liquidity issues, to

streamline regulatory processes and enforce project

timelines more strictly.

See: https://www.constructionworld.in/latest-construction-

news/real-estate-news/nearly-2000-housing-projects-stalled-in-

india/61017

Government urged to consider allowing more Chinese

investment

An annual report on the health of the Indian economy has

departed from previous editions and recommended

government to allow more foreign direct investment (FDI)

from China. There have been strict controls on Chinese

investment since 2020. The emphasis has since been on

developing trade but the July report by India's Chief

Economic Adviser, V. Anantha Nageswaran, recommends

a relaxation of the FDI rules.

"Choosing FDI as a strategy appears more advantageous

than relying on trade,” he said. "As the U.S. and Europe

shift their immediate sourcing away from China, it is more

effective to have Chinese companies invest in India and

then export the products to these markets rather than

importing from China, adding minimal value, and then re-

exporting them.”

See:

https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

and

https://asia.nikkei.com/Economy/India-economic-report-card-

triggers-debate-over-China-investment

Plywood manufacturer expanding plantations

One of India’s largest wood panel manufacturers is

expanding plantation operations to meet its raw material

requirements. The company has planted about 52,983

acres (21,441 hectares) with over 42 million saplings. The

target of its current programme is a total of 60,000 acres

by 2025. The plantations are in Nagaland, West Bengal,

Odisha and Gujarat.

The company has engaged Rain Forest Research Institute,

local communities and farmers to develop plantations of

eucalyptus, khokan (Duabanga grandiflora) and neem

(Azadirachta indica).

India’s Ministry of Defence has also announced a tree

planting project. At various MOD sites across India, along

with the Delhi Development Authority and other local

governments, it plans to plant 1.5 million saplings.

Source: https://www.plyreporter.com/

https://timesofindia.indiatimes.com/business/india-

business/greenply-gets-into-plantation-drive-to-ease-raw-

material-supply/articleshow/109504616.cms

and

https://www.mediaeyenews.com/news/announcement/mas

sive-tree-plantation-drive-to-be-launched-by-defence-

ministry-next-month-on-independence-day/126819.html

Estonian mission explores opportunities in India

Seven Estonian timber companies recently visited India on

a trade mission organised by Enterprise Estonia. Starting

in Kandla, Gujarat, one of India’s major timber port hubs,

the Estonian delegation interacted with owners of trading

houses and sawmills to identify potential business

opportunities and partners.

The group met with the Kandla Timber Association

representing over 2,000 timber-related businesses in the

region. Companies expressed a strong desire to collaborate

with Estonian businesses to help meet increasing demand

for high-quality wood products in India.

In Mumbai, the delegation met with architects, importers

and log house builders to discuss their timber

requirements.

Source: https://www.mediaeyenews.com/news

Climate change impacts Indian forest CO2 absorption

Global warming-induced weather changes are reducing the

CO2 absorption potential of India’s forests and their

capacity in turn to mitigate climate change say researchers.

According to studies by researchers at the Institute of

Technology in Bombay and Birla Institute of Technology

and Science, Goa, the key to the issue is the impact of

rising temperatures on photosynthesis.

Higher CO2 levels in the atmosphere can boost

photosynthesis but very high temperatures hinder enzymes

crucial for the process. The research found that in

northeast regions of India and the Western Ghats, despite

an increase in green cover from 2001-2019, there has been

a decrease in forest CO2 uptake.

See: https://pwonlyias.com/current-affairs/carbon-absorption-of-

indian-forest/

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

According to statistics from the General Department of

Customs, in July 2024 Vietnam’s wood and wood

products (W&WP) exports reached US$1.38 billion. That

was up 111% compared to June 2024 and up 23%

compared to July 2023. Of this, the wood product exports

contributed US$981.1 million, up 15% compared to June

2024 and30% compared to July 2023.

In the first seven months of 2024, W&WP exports were

US$8.9 billion, up 24% over the same period in 2023. Of

the total, wood products accounted for US$6.1 billion,

which was 24% ahead of the same period in 2023.

W&WP exports to Germany in July 2024 amounted to

US$4.3 million, up 25% compared to July 2023. In the

first seven months, they reached US$48.8 million, an

increase of 44% over the same period in 2023.

Exports of kitchen furniture in July were worth US$136

million, 37% up on July 2023. The first seven months total

reached US$787.4 million, an increase of 31% year on

year.

Vietnam's W&WP imports in July 2024 were worth

US$262.6 million, up 13% compared to June 2024 and

38% compared to July 2023. Imports in the first seven

months reached US$1.52 billion, up 24% on the same

period in 2023.

Vietnam imported 38,400 cu.m of oak in July 2024, worth

US$22.3 million. That was up 13% in volume and 13% in

value compared to June 2024 and 39% and 56%

respectively on July 2023. In the first seven months of the

year, oak imports reached 207,900 cu.m, worth US$119.7

million, up 27% in volume and 33% in value over the

same period in 2023.

Imports of raw wood (logs and lumber) from the US in

July 2024 reached 73,000 cu.m, with a value of US$31.5

million.

This was an increase of 11% in volume and 14% in value

compared to June 2024 and took the total of raw wood

imports from the US in the first 7 months to 394,290 cu.m,

at a value of US$169.14 million. Volume and value were

both up 29% on the same period in 2023.

Vietnam acts to boost timber sector

International market recovery resulted in the rise in

Vietnam’s timber export value in the year-to-date 2024.

However, the sector is expected to continue facing

external difficulties in ther last quarter of 2024 and next

year.

According to the Department of Forestry of the Ministry

of Agriculture and Rural Development, Vietnam’s export

value of timber and forestry products reached US$9.361

billion, up 21% over the same period last year and

equivalent to 62% of the full-year target.

Trieu Van Luc, Deputy Head of the Forestry Department,

said the timber and forestry export target for 2024 is

US$15.2 billion, with timber and timber products

accounting for US$14.2 billion.

At the same time, he says Viet Nam’s timber sector faces

challenges. They include high interest rates across the

global economy, geopolitical tensions undermining market

confidence and ‘commodity protection’ issues in key

export destinations.

Rising marine freight rates are also pushing up raw

materials prices, with some reporting increases of up to

40% against last year.

This will affect the prices of final products, at a

time when

importers are looking for reductions.

Against this backdrop, the Vietnamese industry’s growth

rate for 2024 is projected to be 2.6% compared to 3% in

2023. Vietnam also has potential to expand international

market share, given it currently accounts for 6% of global

timber trade and, to support export trade generally, the

government has secured ‘many free trade agreements’.

See: https://en.nhandan.vn/vietnam-takes-active-measures-to-

boost-timber-exports-post138331.html

New procedures for forest leasing

A new decree has been issued introducing changes in the

processes of forest leasing in Vietnam.

Decree 91/2024/ND-CP was promulgated on July 18,

2024, amending and supplementing several provisions

of Decree 156/2018/ND-CP, which details the

implementation of certain articles of the Law on Forestry.

A Clause within the Law amends and supplements a

previous Article regarding forest leasing.

See: https://lawnet.vn/thong-tin-phap-luat/en/legal-

counselling/procedures-for-forest-leasing-in-vietnam-from-july-

18-2024-168689.html

Decarbonisation a priority for Vietnamese wood processing

With support from the International Labour Organisation

(ILO) Productivity Ecosystems for Decent Work Viet

Nam team, efforts are underway to further enhance

awareness of the need for sustainable practices and to

promote emission reduction best practices within the

Vietnamese wood processing sector.

ILO states many wood processing enterprises in Vietnam,

including those exporting to the EU market, have yet to

recognise the opportunities and challenges of adopting

sustainable procedures. It cites lack awareness of their

environmental impacts and the benefits of greener

practices. Other obstacles include limited resources,

technological constraints, and regulatory

uncertainties. Until 2022 no domestic wood processing

enterprises in Vietnam had conducted a comprehensive

greenhouse gas (GHG) inventory or set clear GHG

reduction goals. Green transition, says the ILO, had been

minimally addressed in the sector's formal agenda.

In response, the organisation’s Productivity Ecosystems

for Decent Work Viet Nam team, in collaboration with the

Swiss Import Promotion Program (SIPPO), has organised

a programme of awareness-raising activities to enhance

wood sector enterprises' understanding of new market

trends and the opportunities available through emission

reduction best practices.

The ILO says initial achievements of the Productivity

Ecosystems for Decent Work project have laid foundations

to advance decarbonisation as a priority for wood sectoral

association partners, aiming to benefit over 100 enterprises

and reach over 10,000 workers within the sector.

These outcomes will provide valuable insights to

present

to the Ministries of Industry and Trade, of Natural

Resources and Environment and of Agriculture and Rural

Development in later project phases, ‘facilitating learning

from best practices and influencing the design and

implementation of net-zero enterprise support programs’

states ILO.

See: https://www.ilo.org/resource/article/decarbonisation-new-

priority-viet-nams-wood-processing-industry

Carbon credit opportunities opening for Vietnam

Carbon credits hold significant potential for the

Vietnamese forestry and wood sectors says a report on the

Vietnamese Chamber of Commerce and Industry WTO

and international trade news website.

According to Dr Vu Tan Phuong, Director of the Vietnam

Forest Certification Office (VFCO), from 2010-2020, the

average annual net emissions in Vietnamese forestry were

around -40 million tonnes of CO2 equivalent. If converted

into monetary value, reducing 40 million tons of CO2 is

equivalent to about VND3,500 billion, assessed on the

basis that reducing emissions by 1 tonne of CO2 is

equivalent to US$5.

Recently, Vietnam also received more than US$51 million

from the World Bank from the transfer of more than 10

million forest carbon credits. That, says the website report,

shows that the interest of foreign organizations in carbon

projects in general and carbon projects from the wood

industry in particular in Vietnam is huge.

Currently, the Vietnamese government is developing a

domestic carbon market with the promise of opening up

opportunities to buy, sell, exchange and trade carbon

credits between businesses and of promoting investment to

reduce greenhouse gas emissions and increasing carbon

absorption in forestry activities.

Meanwhile, a range of environmental goals have been set

for Vietnam’s forestry and timber sector to accomplish by

2030. These include having 1 million hectares of forest

certified for sustainable forest management and ensuring

100% of wood and wood products for export and domestic

consumption derive from legal sources.

Dr. Vu Tan Phuong affirmed that, based on market

requirements, using certified wood materials will be the

main trend in the coming years and that direct financial

benefits from carbon trading can be generated, if

businesses meet carbon market requirements.

See: https://wtocenter.vn/su-kien/24267-dual-benefits-for-the-

wood-industry-from-creating-carbon-credits

8. BRAZIL

Partnership to develop Forest+ Sustainable

Plan

The Ministry of Agriculture and Livestock (MAPA) has

signed Protocols of Intent with four forestry sector

associations to strengthen the “Forest+ Sustainable Plan”

(Plano Floresta+ Sustentável). They are the Paraná

Association of Forest-Based Companies (APRE), the

Brazilian Association of Mechanically Processed Timber

Industry (ABIMCI), the Brazilian Tree Industry (IBÁ),

and the Association of Reforesters of Mato Grosso

(Arefloresta/MT).

The partnership aims to expand opportunities for foresters

while supporting the Forest+ Network, and promote

projects for the recovery of degraded areas, reforestation,

and the development of the forest production chain. The

Forest+ Sustainable Plan aims to boost the development of

Brazil’s planted forest sector.

The associations emphasised the importance of

collaboration with the government to promote sustainable

practices and strengthen the forest production chain.

ABIMCI said that through the National Planted Forest

Development Plan and the Forest+ Sustainable Plan,

MAPA has been representing the interests of the forestry-

based production sector, which continues to grow

economically, adding both ‘preservation and productivity’.

See: https://www.gov.br/agricultura/pt-

br/assuntos/noticias/mapa-formaliza-parceria-para-potencializar-

acoes-do-plano-floresta-sustentavel

Forest sector proposes measures to stimulate timber

businesses

Representatives of the forest sector met with the governor

of Mato Grosso, one of the main timber producer states in

the Amazon Region, to discuss the economic impact of the

national environmental agency´s strike and propose

measures to promote the timber industry. During the

meeting, a joint plan was agreed for development and

strengthening of the sector's production chain. This

included organisation of international fairs and promotion

of timber in civil construction, especially in public works.

CIPEM (Center of Timber Producers and Exporters of

Mato Grosso) suggested the creation of a timber-based

homes programme for low-income families as a solution

to the housing deficit.

See: https://cipem.org.br/noticias/setor-florestal-propoe-ao-

governador-acoes-de-fomento-as-industrias

Export update

Brazilian exports of wood-based products (except pulp and

paper) were up 9.9% in July on the same month in 2023,

from US$278.3 million to US$305.7 million.

Pine sawnwood exports increased 33.7% in value from

US$40.1 million in July 2023 to US$53.6 million in June

2024. In volume, exports were up 31.8%, from

173,500cu.m to 228,700 cu.m.

Tropical sawnwood exports decreased 5.3% in volume,

from 26,400 cu.m in July 2023 to 25,000 cu.m in July

2024. In value, exports decreased 14.9% from US$ 13.4

million to US$ 11.4 million.

Pine plywood exports increased 13.8% in value to US$

59.2 million in July 2024 compared to US$ 52.0 million in

July 2023. In volume, exports increased 6.8% from

159,900 cu.m to 170,800 cu.m..

Tropical plywood, exports decreased 35.3% in value and

34.5% in volume, from US$1.7 million and 2,900 cu.m in

July 2023 to US$1.1 million and 1,900 cu.m in July 2024.

Wooden furniture export value increased 2.3% from

US$47.5 million in July 2023 to US$48.6 million.

Timber sector export stability in first half of year

Brazil’s timber product exports remained stable during the

first half of 2024, although June stood out,showing an 8%

volume decrease compared to the previous month. Despite

logistical challenges faced total export value reached

US$164.7 million, a reduction of only 2% compared to

May.

When comparing data from the second quarter of 2024

with the same period last year volumes and values were

relatively stable with a difference of -8% in volume and

1% in value.

Compared to the same period in 2023 there was a 17%

increase in export value, driven by the appreciation of the

US dollar. Among the main products exported in June

2024 were softwood sawnwood (42%) and softwood

plywood (38%), followed by hardwood logs (14%).

Timber sector companies reported stability in orders,

although they continue to face logistical and production

cost challenges.

See: https://www.woodflow.com.br/blog/madeira-exportacoes-

mes-a-mes-mostram-estabilidade-no-primeiro-semestre-de-2024

Native forest restoration gets German and EU support

The National Bank for Economic and Social Development

(BNDES) and Germany announced the award of

approximately R$88 million/€15 million) for the Amazon

Fund, through German state-owned investment and

development bank, KfW.

With this, Germany has become Brazil's first international

partner in the ‘Floresta Viva Program’, aimed at ecological

restoration of Brazilian biomes. The initiative supports

implementation of projects focused on increasing

vegetation cover with native species, from seed collection

to forest nursery and planting programmes.

The German government's funds add to contributions of

other Amazon Fund donors, including Norway,

Switzerland, the US and Japan and Petrobras. Funds are

also set to be disbursed by the UK.

In addition, the European Union signed a letter of intent to

formalize donation of €20 million to the Amazon Fund,

which is the world's largest REDD+ instrument, for

reducing emissions from deforestation and forest

degradation.

The Fund, which has about R$3.9 billion in resources,

supports 114 projects, ranging from Restoration Arc (the

largest natural forest restoration project), to a programme

to strengthen the Fire Department´s efforts in combating

organized crime in the region.

BNDES emphasized the importance of preserving the

Amazon, which represents 25% of the world's tropical

forest cover and is home to approximately 29 million

people.

See: https://agenciagov.ebc.com.br/noticias/202407/governo-

alemao-libera-mais-recursos-ao-fundo-amazonia-e-se-torna-1o-

doador-internacional-do-floresta-viva

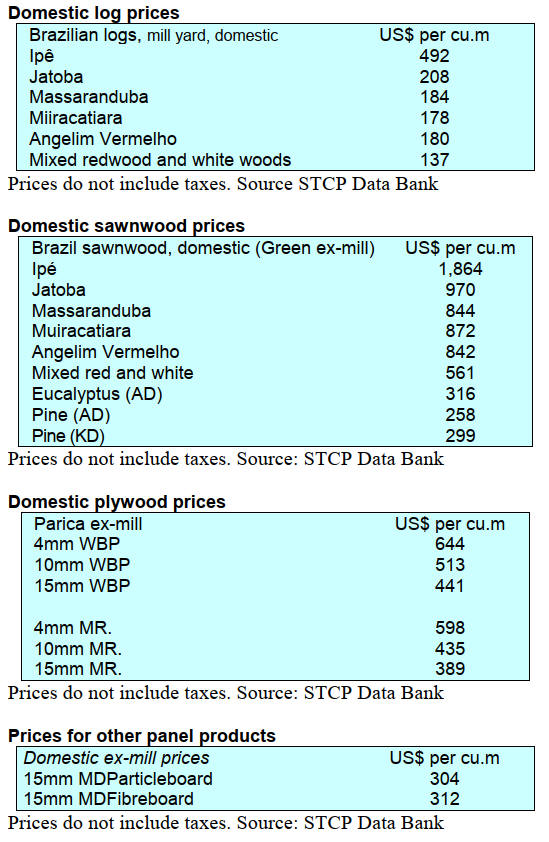

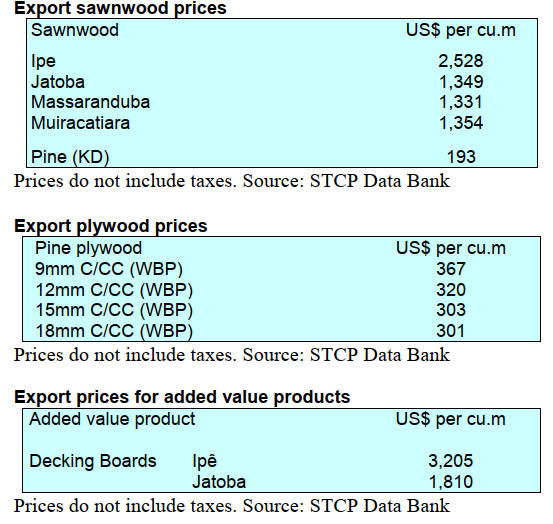

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

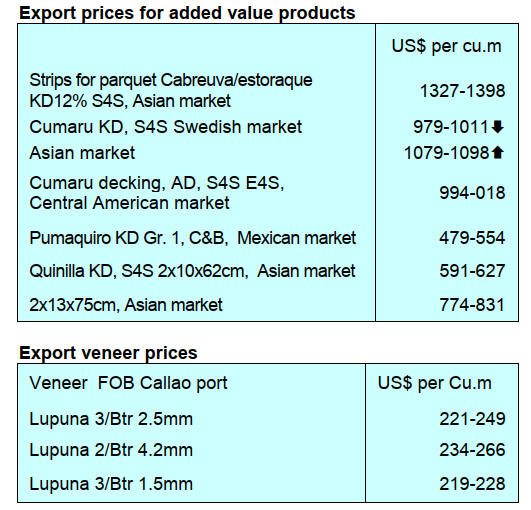

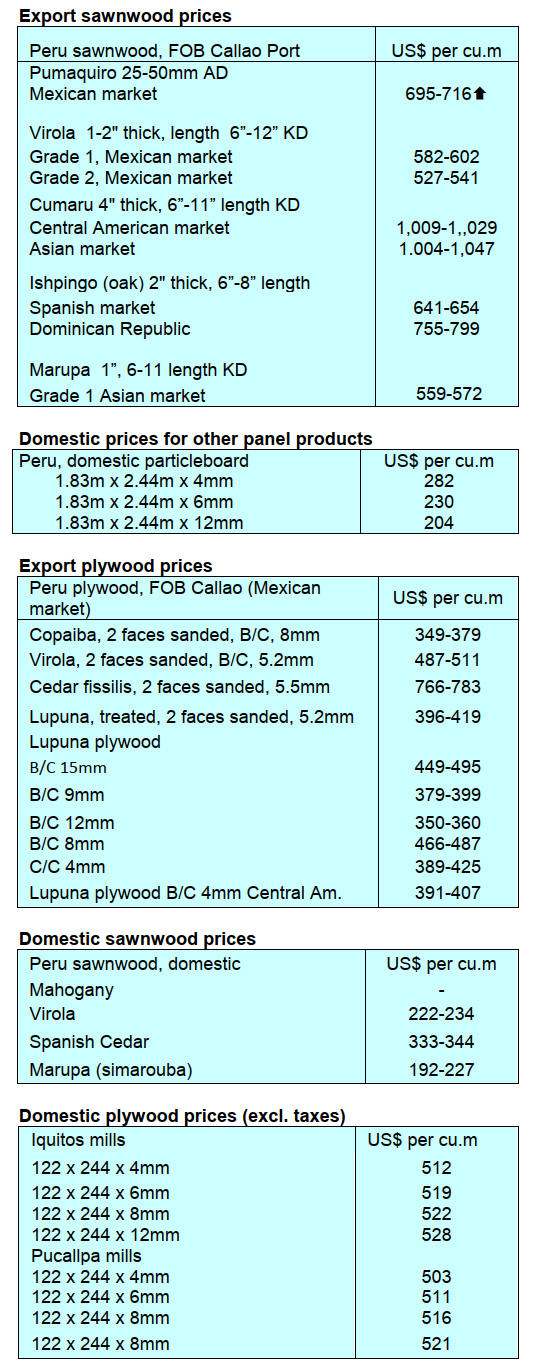

9. PERU

Exports continue to decline

Shipments of wood products in the first 5 months of 2024

totalled US$ 34.9 million, a drop of 25% compared to the

same period in 2023 (US$46.2 million) according to the

Management of Services and Extractive Industries of the

Association of Exporters (ADEX). This contraction is

partly explained by the lower orders from China and the

EU.

During these first five months France was the main export

market with a share of 16%, however, shipments were

down 43% compared to the same period in 2023. The

United States is in second place with a 15% share but for

this market shipments rose sharply. The Dominican

Republic and China were in third and fourth place with a

share of 15% each but exports to the Dominican Republic

were down.

According to figures from the ADEX Data Trade

Commercial Intelligence System, sawn wood was the most

traded wood product in wood exports in the first five

months of 2024, earning US$13.4 million, despite having

contracted 26% year on year. The second most traded

products were semi-manufactured products that reached

US$ 12.7 million but shipmentwere down 37%. Other

products were for construction (US$2.2 million), firewood

and charcoal (US$1.9 million) and furniture and its parts

(US$1.7 million).

Low rainfall and reduced humidity – fire risk rises

In the third week of August 2024 six forest fires were

reported in Ucayali. The National Meteorological and

Hydrographic Service (SENAMHI) warned that low

rainfall, reduced humidity, increases in daytime

temperatures and industrial or agricultural activities were

the main factors resulting in forest fires.

The Regional Forest and Wildlife Management of Ucayali

(GERFFS-Ucaya¬li) indicated that SERFOR reported 611

hot spots in the region between 20 August 20 and 22

August. 326 hot spots were identified in the Province of

Coronel Portillo, 114 hot spots in the Province of Padre

Abad and 171 hot spots in the Province of Atalaya.

Promoting the wood value chain

In order to promote the trade of legally harvested forest

products and support sustainable economic activities the

National Forest and Wildlife Service (SERFOR) develops

technological tools to guarantee traceability in the supply

chain.

Speaking at the plenary session of the Expert Group on

Illegal Logging and Associated Trade (EGILAT) of the

Asia-Pacific Economic Cooperation Forum (APEC) 2024,

Nelly Paredes del Castillo, Executive Director of SERFOR

is reported as saying “we focus on giving productive value

to our forests, adopting a preventive approach against

illegal logging and promoting legal trade in forest

resources from managed forests, framed in a clear and

transparent traceability mechanism that accredits the legal

origin of our timber resources, contributing to the

sustainable development of our region”

She highlighted the implementation of the 32 strategic

checkpoints of mandatory passage located on the main

transport routes in Peru, including border areas, in order to

carry out permanent control of the flow of wood.

She also highlighted the innovations in the Remote Forest

Monitoring System, in conjunction with the

Environmental and Fire Alert System, which allows for

constant monitoring and rapid response to any impact on

forest ecosystems.

|