|

Report from

North America

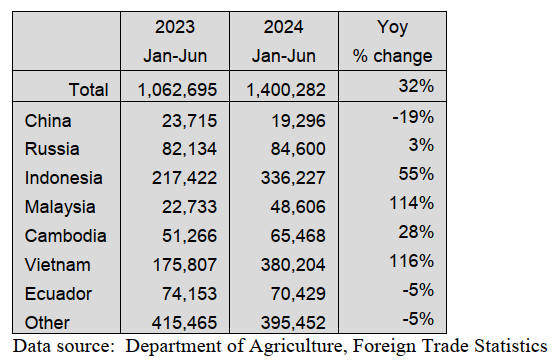

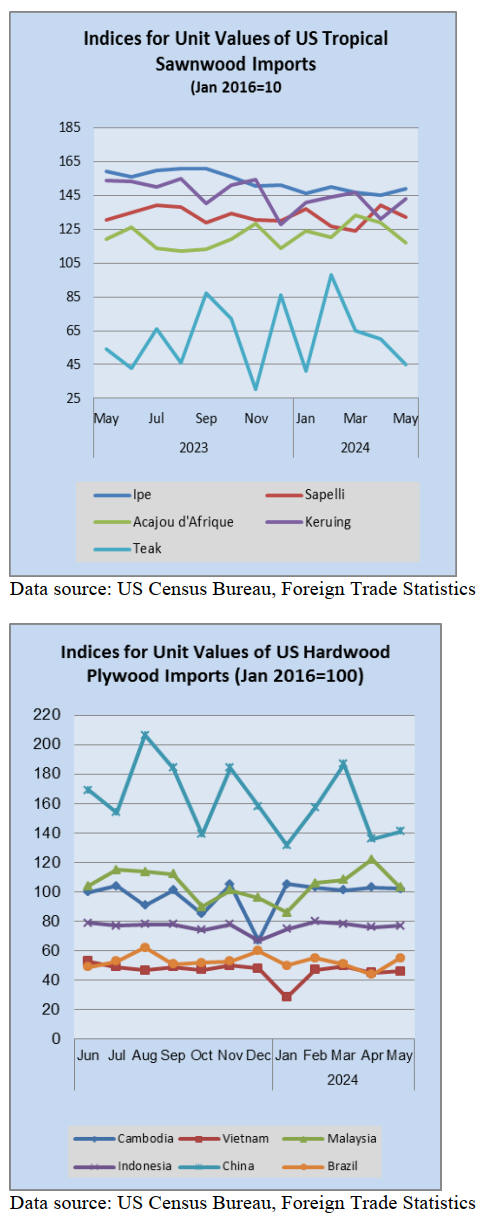

Hardwood plywood imports up 32% in first half of year

US imports of hardwood plywood fell 17% in June, a slow

finish to a relatively strong first half of the year. The

201,632 cubic metres imported in June was 21% lower

than last June’s volume. Imports from Russia, Malaysia,

and Ecuador all fell by more than a third while imports

from the US’s top trading partner, Vietnam, decreased by

18% for the month.

Despite the drop, for the first half of the year, imports

from Vietnam and Malaysia are more than double that of

last year while imports from Indonesia are up 55%. Total

US imports of hardwood plywood for 2024 are outpacing

2023 by 32% through the first half of the year.

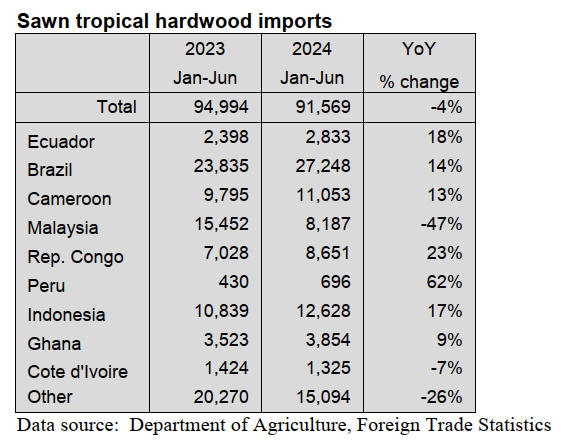

Sawn tropical hardwood imports rebounded in June

Imports of sawn tropical hardwood rose 16% in June,

recovering from a May which saw the lowest volume of

the year. Despite the gain, the 15,678 cubic metres

imported in June was 12% less than the amount imported

in June 2023.

Imports from top-supplier Brazil rose 64% in June and

were up 14% over 2023 for the first half of the year.

Imports from Malaysia, however, were down 47% so far

versus 2023. Imports of virola are more than triple last

year so far and imports of iroko, mahogany, balsa and ipe

are also outpacing last year through the first half of the

year.

Imports of both teak and keruing are off by nearly 50% so

far this year while imports of padauk are off by 82%.

Overall imports of sawn tropical hardwood are down 4%

versus 2023 through the first half of the year.

Imports of tropical hardwood veneer fell 5% in first half

of 2024

While US imports of tropical hardwood veneer fell 26% in

June, the monthly total was still 57% higher than that of

June 2023.

After falling well behind last year’s monthly totals early in

the year, imports advanced steadily in recent months to

end the first half of the year down only 5% versus 2023.

Imports from Cameroon continue to drive gains, rising 5%

in June and up 55% for the first half of the year. Imports

from India and Cote d’Ivoire are also ahead of 2023 for

the first half, while imports are down sharply from Italy (-

83%) and China (-43%).

Assembled flooring panel imports remain strong

US imports of assembled flooring panels rose for a third

straight month in June, topping US$28 million for the first

time since September 2022. The 3% gain over the

previous month was chiefly due to a 20% rise in imports

from Vietnam and a 46% rise in imports from China.

Imports from Vietnam, Thailand, and Canada are all well

ahead of last year through the first half of the year.

Imports from China are also ahead of last year,up 13%

while imports from Indonesia are lagging (-34% for the

year and down 6% in June). Total imports of assembled

flooring panels are up 32% over last year through the first

half of the year.

Imports of hardwood flooring fell 7% in June as imports

from Malaysia plunged 90% to about one-fifth of what

they were the previous June. Imports from Malaysia ended

the first half of the year down 48% versus last year.

Imports from Indonesia are also weak, falling 41% in June

and down 39% through the first half of the year.

Conversely, imports from Vietnam rose 49% in June and

are up fivefold for the year so far. Imports from Brazil

have also been strong, gaining 15% in June and up 63% so

far this year. Total imports of hardwood flooring are down

13% versus 2023 through the first half of the year.

Moulding imports up 25% in first half of 2024

US imports of hardwood moulding rose to their highest

level since September 2022, increasing 13% in June to

nearly US$15.7 million. That total is 94% higher than that

of June 2023. Imports from Canada, the top US trading

partner, rose 14% in June. Imports from Canada for the

year to date are up 8%. Total imports for the first half of

the year are up a robust 25% over 2023.

However, imports from several traditional trading partners

are lagging. Imports from Brazil and down 57%, imports

from China are down 15% and imports from Malaysia are

down 10% through the first half of the year.

Much of the 2024 increase in hardwood moulding imports

is coming from a variety of suppliers including Thailand

and Vietnam.

Wooden furniture importsUS$10 billion in first half of

2024

The US imported more than US$10.2 billion of wooden

furniture in the first half of 2024, a 6% increase over the

amount imported in the first six months of 2023. Furniture

imports for June were down 4% from May but at US$1.72

billion were 2% higher than the previous June.

Increased imports from Vietnam (up 18%) and Malaysia

(up 9%) have driven the gains for the year so far, although

both were down about 8% from May to June. Imports

from Mexico and Indonesia fell 3% and 30% in June,

respectively, and are both down for the year so far by

more than 5%. After sliding 11% in June, imports from

India are less than 1% ahead of 2023 for the year through

June.

Home sales fell in June to slowest pace since

December

The US housing slump deepened in June as sales of

previously occupied homes slowed to their slowest pace

since December, hampered by elevated mortgage rates and

record-high prices.

Sales of previously occupied US homes fell 5.4% last

month from May to a seasonally adjusted annual rate of

3.89 million, the fourth consecutive month of declines, the

National Association of Realtors said. Existing home sales

were also down 5.4% compared with June of last year.

“Right now, we’re seeing increased inventory, but we’re

not seeing increased sales yet,” said Lawrence Yun, the

NAR’s chief economist. “The latest data is implying that

maybe we’re seeing a slow shift away from what had been

a sellers’ market and slowly moving into a buyers’

market.”

Existing-home sales in the Northeast in June withdrew

2.1% from May to an annual rate of 470,000, a decline of

6% from June 2023. In the Midwest, existing-home sales

decreased 8% from one month ago to an annual rate of

920,000 in June, down 6.1% from the prior year.

Existing-home sales in the South slid 5.9% from May to

an annual rate of 1.76 million in June, down 6.9% from

one year before. In the West, existing-home sales declined

2.6% in June to an annual rate of 740,000, identical to a

year ago.

See: https://www.nar.realtor/newsroom/existing-home-

sales-slipped-5-4-in-june-median-sales-price-jumps-to-

record-high-of-426900

|