US Dollar Exchange Rates of

10th

Jul

2024

China Yuan 7.28

Report from China

Investment in real estate

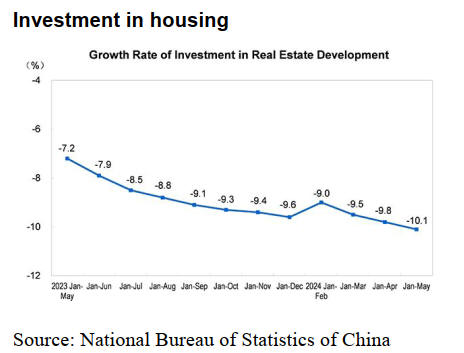

Between January and May there was a year-on-year

decline of 10% in total investment in real estate and a

10.6% decline in investment in residential buildings.

Between January and May the floor space under

construction was down by almost 12% year on year and

the floor space of residential buildings under construction

was down by 12%.

See:

https://www.stats.gov.cn/english/PressRelease/202406/t2024062

5_1955165.html

New formaldehyde emission standard for woodbased

panels

A revised "Interior decoration materials wood-based panel

and products formaldehyde emission limit" has been

drafted. The revision of the national mandatory standard

for the industry will usher in a new round of industrial

quality improvements. The revised national standard will

introduce formaldehyde emission E0 level for the first

time.

Production of ‘green’ wood products

The Nanxun wood industry has stable industrial supply

chain and great brand influence and is one of the 100

characteristic industries for quality improvement in

Zhejiang Province. At present, there are 68 green product

certification enterprises and 99 certified products in the

province.

There are 61 enterprises certified as "Made in Zhejiang"

and 77 certified products. There are 2 national green

factories, 2 provincial and municipal government quality

awards and enterprises have participated in the preparation

and revision of 5 international standards and more than

160 national and industry standards.

Nanxun District Market Supervision Bureau regards

quality improvement and green development of the wood

industry as key to success of the industry and has

successively issued policy documents to promote the high-

quality development of the wood industry. For example it

approved the national home decoration product

standardisation pilot (wood flooring) project.

Nanxun City took the lead in Zhejiang Province in

formulating and releasing the "Green Production of Wood

Industry Technical Specification for Raw Material Source

Replacement and Waste Gas Treatment with Low Volatile

Organic Compounds Content" Standard guiding

enterprises to speed up the development of green and high

quality products.

Imported rubberwood price increasing

The latest Customs data shows that, in the first five

months of 2024, China's imports of rubberwood from

Thailand increased by 27% to 2.12 million cubic metres

and the value of rubberwood imports also rose 32% to

US$530 million.

However, recent news from the Thai Rubber Association

suggests rubberwood shippers have begun to raise prices.

It is reported that the export price increase for Thai

rubberwood is not merely rumour but has been driven by

the following reasons:

Raw material costs are rising. The arrival of the

rain season created challenges for collection and

transportation of rubberwood logs resulting in a

tight supply.

Surge in shipping costs. Sharp fluctuations in

international shipping rates have increased

shipping costs pushing up landed prices.

Market price is rebounding. The rubberwood

market price had been at a low level for a long

time (ranging from US$200-400 per cubic metre)

but a rebound in prices has become the market

consensus.

Over the past months the price of Thai rubberwood

imported by China has shown a clear upward trend. Since

February the average unit price (CIF) of Thai rubberwood

has shown a month-on-month increasing trend. Compared

to the same period in 2023 prices edged up 1% in February

then increased by 3% in March and again rose 7% in

April.

Given that Thailand is the main source of China's

rubberwood import, the sharp increase in prices will have

a direct impact on the Chinese demand. It is anticipated

that the price of rubberwood arriving in the third quarter of

2024 cost even more.

Thailand largest supplier of particleboard imports

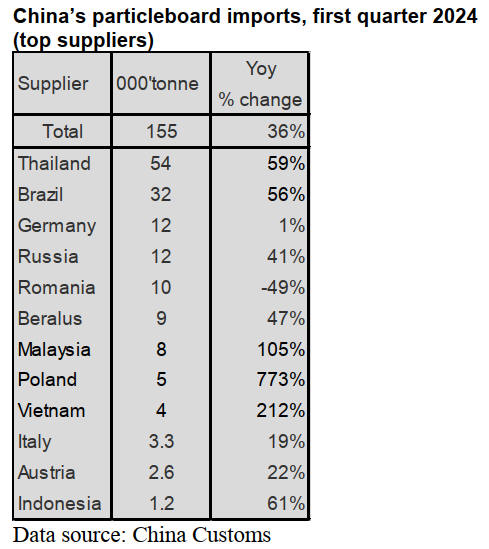

According to China Customs in the first quarter of 2024

China’s particleboard imports from Thailand amounted to

54,000 tonnes valued at US$13 million, up 59% in volume

and 45% in value over the same period of 2023 making

Thailand the top shipper to China.

China’s total particleboard imports were 155,000 tonnes

valued at US$60 million in the first quarter of 2024, up

36% in volume and 13% over the same period of 2023.

China’s particleboard imports from Brazil, the second

largest supplier, rose 56% to 32,000 tonnes in the first

quarter of 2024 and this contributed to the rise in total

particleboard imports.

In addition, China’s particleboard imports from Malaysia,

Poland and Vietnam surged more than 100%, 700% and

200% respectively in the first quarter of 2024 resulting in

the increase in total of particleboard imports. In contrast,

China’s particleboard imports from Romania, alone among

the top suppliers, fell 49% to 10,000 tonnes in the first

quarter of 2024.

Surge in fibreboard exports to Saudi Arabia

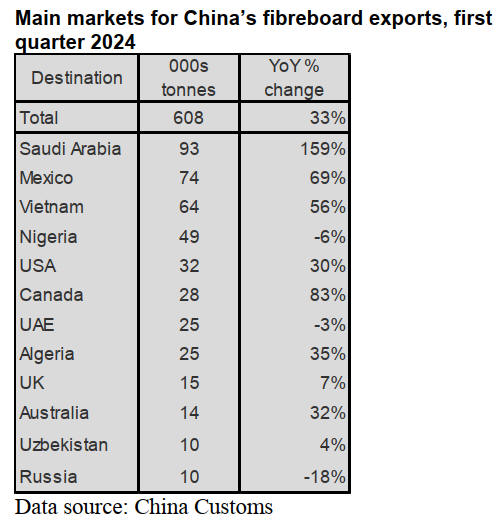

According to China Customs, fibreboard exports to Saudi

Arabia surged 159% to 93,000 tonnes in the first quarter of

2024. In the first quarter of 2024 China’s fibreboard

exports totalled 608,000 tonnes valued at US$312 million,

up 33% in volume and 24% in value from the same period

of 2023.

China’s fibreboard exports to Mexico, Vietnam, USA,

Canada, Algeria and Australia increased at different rates

in the first quarter of 2024. But fibreboard exports to

Nigeria, UAE and Russia fell.

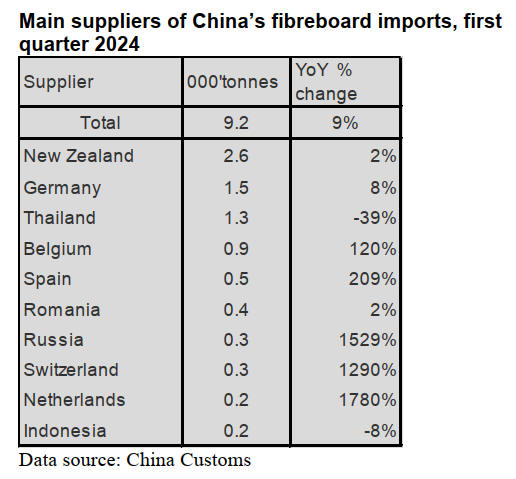

Decline in fibreboard imports from Thailand

China’s fibreboard imports from Thailand dropped 39% to

1,300 tonnes and imports from Indonesia fell 8% in the

first quarter of 2024. In contrast, fibreboard imports from

all top destination countries rose with imports from

Belgium, Spain, Russia, Switzerland and Netherlands

rising sharply.

In the first quarter of 2024 China’s fibreboard imports

grew 9% to 92,000 tonnes due to surge in imports from

most countries compared to the same period in 2023.

|