Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jul

2024

Japan Yen 161.70

Reports From Japan

Confidence returns

Confidence among Japan's large manufacturing firms

showed a modest recovery for the first time in six months,

according to the latest "Tankan" survey from the Bank of

Japan marking the first improvement in two quarters.

The index for large non-manufacturing companies stood at

33 points, down two points compared to the first quarter of

2024 and for the first time in 16 quarters, but still close to

the maximum values since the bursting of the economic

bubble in the nineties.

See: https://www.agenzianova.com/en/news/Japan-

manufacturing-business-confidence-improves-for-the-first-time-

in-six-months/

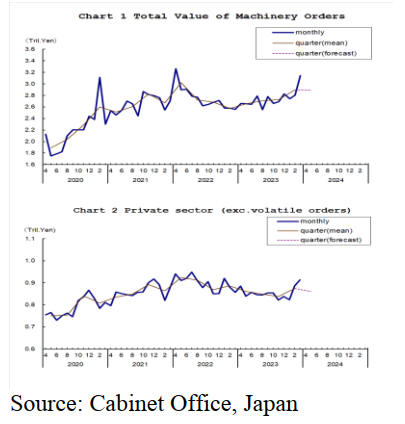

In related news, the total value of machinery orders

received by 280 manufacturers operating in Japan

increased by 12% in March from the previous month on a

seasonally adjusted basis. In the January-March period it

increased by 6.3% compared with the previous quarter.

Private-sector machinery orders, excluding volatile

ones

for ships and those from electric power companies,

increased a seasonally adjusted by 3% in March and rose

by 4.4% in the January-March period.

In the April-June period machinery orders were

forecast to

decrease by 0.1% and private-sector orders, excluding

volatile ones, were forecast to fall by 1.6% from the

previous quarter.

Weak yen a big problem for SMEs

A recent survey by the Japan Chamber of Commerce and

Industry (JCCI) showed the yen’s dramatic decline has

become a serious problem for Japan’s small and medium

size businesses as they experience surging raw material

and energy prices.

According to the survey of 2,008 small enterprises, around

half of the respondents said that the weakness of the

Japanese currency was a big problem for their operations.

Only 2% in the latest survey said that the weakening of the

yen positive for their business.

See:

https://www.japantimes.co.jp/business/2024/07/04/companies/na

gata-weak-yen-small-business/?utm_

Encouraging corporate investment in emerging

economies

The government is encouraging corporate investment

in emerging and developing countries by providing

guarantees through the Japan International Cooperation

Agency (JICA). Guaranteeing loans is not currently

among the aims and law governing JICA.

The aim of the government is to set up a mechanism that

enables JICA to compensate for losses. The government

seeks to deepen relations with those economies by

building a support system with the private sector. Foreign

Minister Yoko Kamikawa said that she would work

with government ministries and agencies to revamp ODA

with an eye on amending the JICA law.

A panel presented suggestions to the minister on the best

ways to combine public and private funds.

See: https://asia.nikkei.com/Politics/International-

relations/Japan-to-offer-guarantees-on-corporate-investments-in-

Global-

South?utm_campaign=GL_JP_update&utm_medium=email&ut

m_source=NA_newsletter&utm_content=article_link

and

https://www.jica.go.jp/activities/issues/private_sec/__icsFi

les/afieldfile/2024/05/29/Asia_investment_promotion_en_

1.pdf

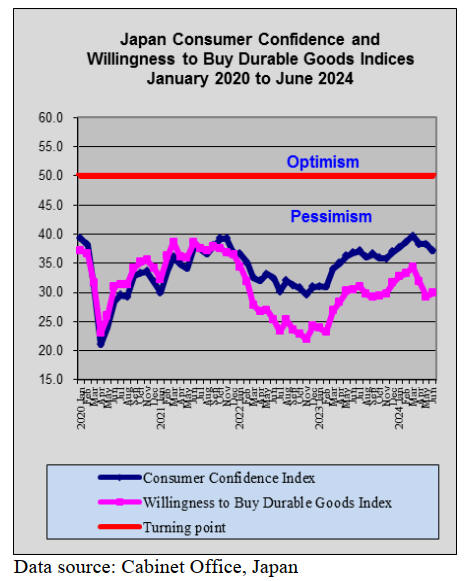

Consumer confidence up slightly in June

The seasonally adjusted Consumer Confidence Index was

up slightly in June according to the Cabinet Office. The

income growth indicator rose while the overall livelihood

index declined and the employment index dipped month

on month. The willingness to buy durable goods index

hovers at a multi-month low.

The percentage of respondents who expect prices to

increase over the next year was 94%, up from May, while

3% of those surveyed see them unchanged and the balance

expect prices to fall.

See: https://breakingthenews.net/Article/japans-consumer-

confidence-improves-in-june/62300247

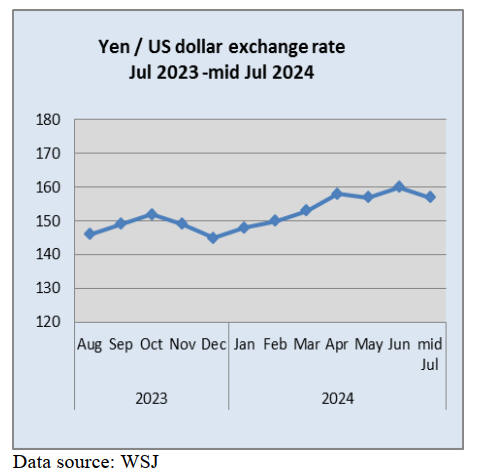

Tax-free investment scheme a factor driving down

yen

Overseas asset purchases by Japanese individuals through

a recently introduced tax-free investment scheme have

been identified as a major factor driving down the yen

exchange rate. According to data from the Ministry of

Finance, Japanese investment trust management

companies and asset management firms purchased almost

US$40 billion more offshore equities and investment fund

shares than they sold during the first six months of this

year.

These offshore investments are possible through a revised

Nippon Individual Savings Accounts (NISA) programme.

Shifting savings into investments helps beat the effects of

inflation. The recent consumer price index stood at 2.1%,

above the Bank of Japan's price stabilisation target of 2%.

There are few financial products in Japan that generate

returns of more than 2%. Japanese government bonds

being sold to retail investors this month offered yields

below 1%.

See:https://asia.nikkei.com/Business/Markets/Currencies/Japan-

households-offshore-investments-top-trade-deficit-weakening-

yen2

The yen surged against the US$ mid-month after the

release of weaker than expected US inflation data. At the

same time it appears that the Japanese government and the

Bank of Japan intervened to try and strengthen the yen.

The yen strengthened to 157 after the June US consumer

price index showed prices declined from the previous

month marking the first monthly drop since May 2020.

The yen had plunged as low as 162 in early July, its

weakest since December 1986.

Best place to live survey

In a recent national regional survey to rank the ‘desirable

place to live’ Tokyo slipped to third place giving way to

Yokohama as the best and Omiya area in the city of

Saitama second. This marked the first time since the

annual survey began in 2009 that Tokyo has fallen below

the No. 2 spot while Yokohama kept its No. 1 ranking for

the seventh year in a row.

See:

https://mainichi.jp/english/articles/20240301/p2a/00m/0na/009000c

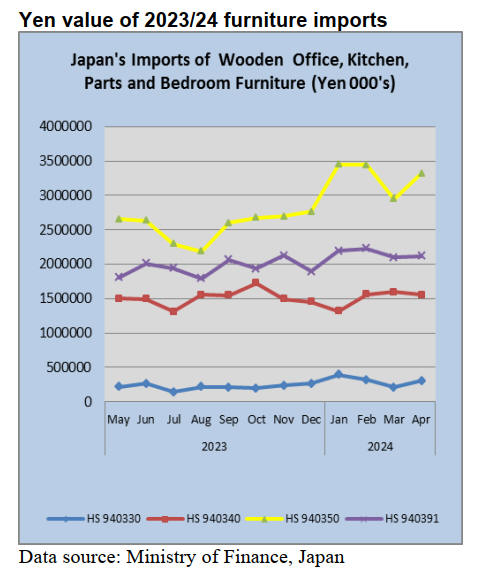

Import update

The severe weakness of the Yen against the US dollar

continues to drive up the cost of imports and drive down

discretionary purchases by Japanese households. The Yen

value of some furniture items has risen but it is unclear

whether this is the effect of the exchange rate or demand

in Japan.

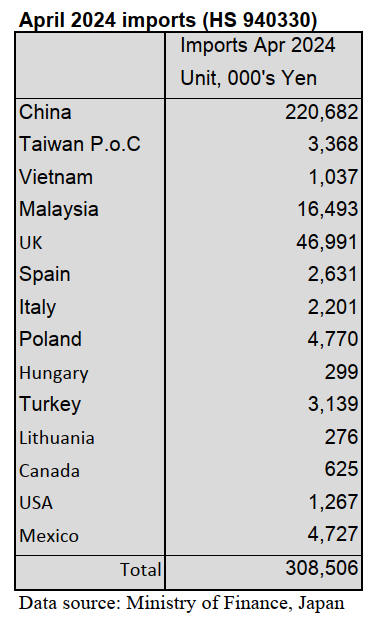

April 2024 wooden office furniture imports (HS

940330)

In a change of ranking the top shippers of wooden office

furniture (HS940330) to Japan were China supplying over

70% of April imports followed by the UK at 15%.

Shippers in Malaysia were beaten to third place by the

surprising UK imports.

The value of exports of HS940330 from China to Japan

in

April rose from a month earlier. The high value of

shipments from the UK was a record since the UK did not

appear in the list of March shippers of wooden office

furniture. April shipments from Malaysia were around half

the value of March shipments.

Year on year, the value of Japan’s imports of wooden

office furniture in April 2024 increased by over 40% and

month on month the value of imports was up by 40%.

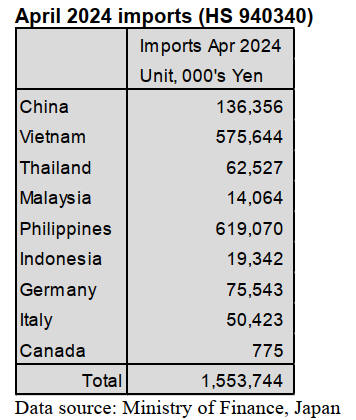

April 2024 kitchen furniture imports (HS 940340)

Year on year, the value of imports of wooden kitchen

furniture items (HS940340) in April were little changed.

The same trend was observed when comparing the value

of April imports with that of March.

The top shippers in April were the Philippines, accounting

for about 47% of the value of April imports followed by

Vietnam at 37% with shippers in Germany driving imports

to third place pipping Thailand which was, in previous

months in third place. The top three shippers accounted for

around 85% of the value of April imports.

After two consecutive monthly increases in the value of

imports of wooden kitchen furniture there was only a

slight increase in the value of April imports.

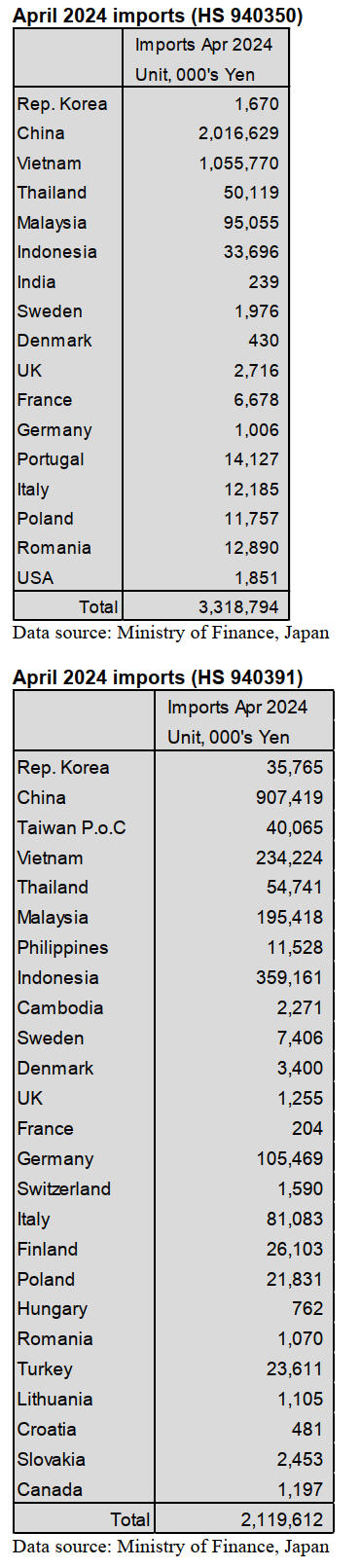

April 2024 wooden bedroom furniture imports (HS

940350)

The steady month on month rise in the value of wooden

bedroom furniture (HS930350) imports there was a

correction in March but that was short lived as the value of

April imports moved higher.

Year on year, the value of April imports was up 19% and

there was a 15% month on month increase in the value of

imports. China accounted for just over 60% of the value of

April imports to Japan followed by Vietnam at 32% and

Malaysia at 3%.

The April increase in the value of imports was almost

entirely due to the rise in imports from China compared to

a month earlier. The top three shippers accounted for over

90% of the value of April wooden bedroom furniture

imports.

April 2024 wooden furniture parts imports (HS

940391)

Shippers in just three countries, China, Indonesia and

Vietnam accounted for around 70% of the value of April

imports of wooden furniture parts. Suppliers in China

accounted for around 43% of April arrivals, up slightly

from the previous month, followed by Indonesia at 17%.

Malaysia was a significant shipper in March but the value

of April shipments was down sharply.

Compared to the value of February imports the value of

March imports from China were down around 14% and

there was a 25% decline in the value of imports from

Vietnam while the value of March arrivals from Indonesia

and Malaysia were at around the same level as in

February.

Year on year the value of April arrivals of wooden

furniture parts was up 14% bu compared to the value of

March imports there was little change.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Demand and supply of lumber at Tokyo port

According to Tokyo Lumber Terminal Co., Ltd., the

lumber inventories in June, 2024 have increased for four

months continuously. The arrival volume of lumber

decreases slightly and the shipment of lumber is low. The

arrival volume exceeed the shipment.

European lumber is 19,000 cbms and this is 6,000 cbms

less than May, 2024. The vessel had to avoid passing

through the Suez Canal to Japan from Europe and there

were a lot of lumber arrived to Japan last month. However,

the arrival volume of European lumber is settled down in

June, 2024. The volume of North American lumber is

12,000 cbms and this is 5,000 cbms less than the previous

month.

The arrival volume is also settled down in June, 2024.

Russian lumber is 9,500 cbms and this is 800 cbms down

from last month. Due to a confusion of logistic

circumstance in Russia, there is a big difference in arrival

volume of Russian lumber in each month. Even though the

arrival volume of several countries’ lumber is low, the

volume of shipment does not grow due to low demand for

lumber in Japan.

The inventory of North American lumber is 47,000 cbms

and this is 1,000 cbms more than last month. European

lumber is 41,000 cbms and this is 3,000 cbms higher than

the previous month. Russian lumber is 16,000 cbms and

this is 1,000 cbms up from last month.

Plywood

Movement of domestic softwood plywood June 2024 had

consumers buy plywood to fill current needs. The price

reached the bottom until Maybut the price of plywood has

been bearish after June. Plywood manufacturers

announced to raise the price of plywood because the log

and transport cost has increased

Movement of plywood in May was not good then the price

started to decrease. The price of 12mm 3x6 domestic

structural softwood plywood was 1,270-1,280 yen

delivered per sheet, in the beginning of June the price was

1,230 delivered per sheet.

Plywood manufacturers in Indonesia and Malaysia still

expect to raise the price because there are not enough logs.

12mm 3x6 painted plywood for concrete form is

aroundUS$650,C&F per cbm. Structural plywood is

around US$570 C&F per cbm. Plywood form is around

US$570 C&F per cbm. 2.4mm 3x6 normal plywood is

around US$950 C&F per cbm. 3.7mm normal plywood is

around US$880 C&F per cbm, 5.2 mm normal plywood is

US$850 C&F per cbm.

In Japan, 2.5 mm normal plywood is 780yen delivered per

sheet. 4mmnormal plywood is 1,000 yen delivered per

sheet. 5.5 mm normal plywood is 1,170-1,200 yen

delivered per sheet. Plywood form is 1,750 yen delivered

per sheet. 12mm 3x6 painted plywood for concrete form is

1,950 yen delivered per sheet

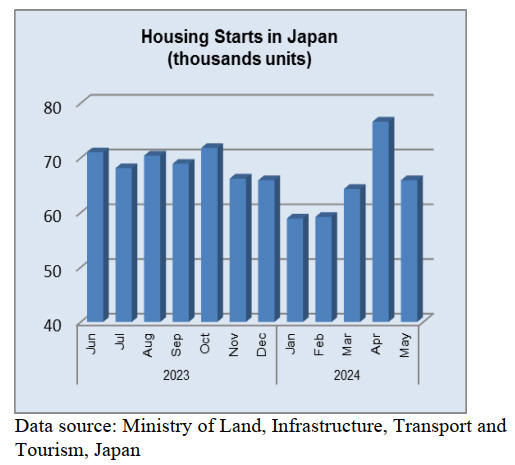

Orders for house builders

Major housing companies’ results in May, 2024 exceed

May, 2023. However, it is hard to say that low demand for

houses is solved because the results of May, 2023 were

very bad. The sales of high-priced houses are good but a

number of orders is not enough. The inquiries and

document requests to the housing companies have

recovered slightly but many clients wait and see to

purchase a house or not because they are concerned about

the unstable economies.

There is a last-minute increase in demand for unit built for

sale due to the heightened expectations of higher interest

rates. The orders for apartment buildings and remodeling

of a house are firm compared to the orders for detached

houses..

|