|

1.

CENTRAL AND WEST AFRICA

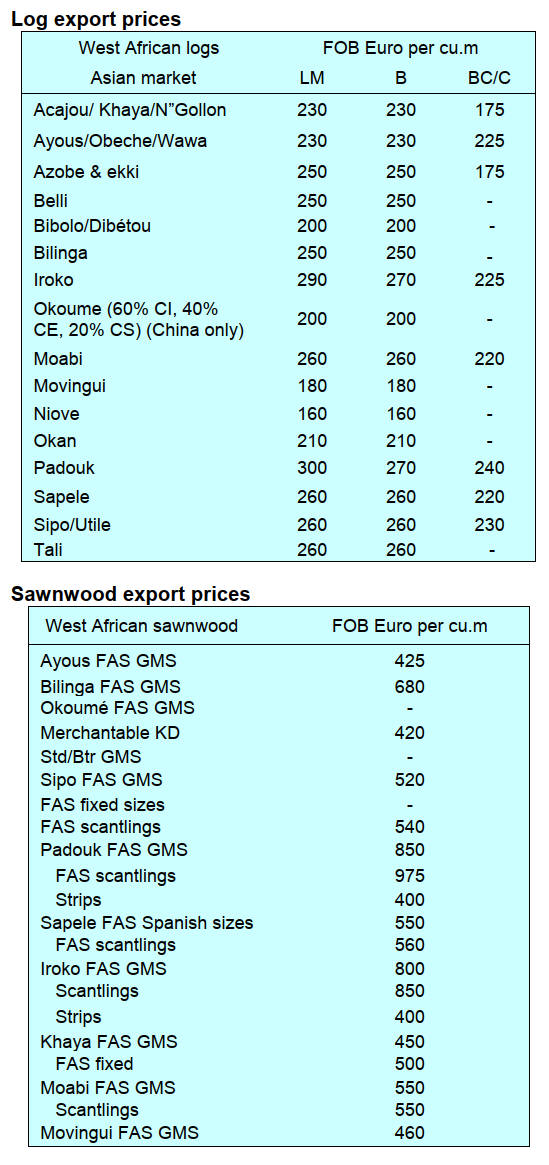

Price corrections anticipated

The FOB prices shown below are for pending contracts

and the indications are that downward corrections are

likely. As of mid-July, producers anticipate a drop in the

price for belli and weakening prices for okoume and the

redwoods.

Analysts suggest that Chinese mills in Gabon, Cameroon

and Congo which supply the Chinese market may switch

to milling species for the EU market, especially azobe and

fear this could disrupt this steady and quiet market.

In contrast to the market in China, demand remains strong

in the Philippines driven by the need for timber in the

aftermath of severe typhoons.

Cameroon

Heavy rains have returned but log stocks are reported as

adequate for the coming months. The rain season is

expected to continue until December. Mills are building up

sawn stocks in preparation for the six-month rain period.

Roads are in good condition and railways are functioning

without major disruptions. Container availability is

sufficient with enough empty containers in stock in

Cameroon.

Producers in Cameroon say, while demand in Middle East

markets remains stable, the slowdown in demand from

China has of considerable concern. Inquiry levels are

reported as stable.

There are reports the authorities are becoming strict on

sawnwood exports with all mills having to produce legal

verification papers for each truck of sawnwood heading to

Douala or Kribi. The aim, it is suggested, is to foster a

change in mentality towards legality.

Producers report slowing demand in Portugal and Spain

traditionally good markets for sapelli. In Belgium there is

said to be stable demand for iroko, padouk and doussie.

Parcels being prepared for shipment in mid-July will

arrive towards the end of the European holiday season. In

the Netherlands there is a steady demand for azobe.

Gabon

The country is still struggling with electricity power

outages which are seriously impacting production and

heavily disturbing the plywood companies. The local

water and electricity supplier, SEEG, promised

improvements by the end of the month but the problem

remains unresolved with SEEG citing low water levels in

the dam due to insufficient rain.

Adding to the challenges in Gabon is the shortage of

skilled local technicians. The government decided to

reduce the proportion of expatriates employed in mills and

this has led to protests by the industry, particularly those in

the Nkok Special Economic Zone where veneer and

plywood industries struggle with the lack of experienced

local technicians.

The government has set quotas for the employment of

foreign labour in Gabon. These are 15% of the workforce

for executives, 10% for supervisors and senior technicians

and 5% for operational staff. The cumulative maximum

level of employment of foreign labour in is 30%.

The Ministerial statement says " This decree has three

objectives: to give priority to hiring nationals and to

promote the Gabonese workforce; to restrict the use of

foreign labour in positions of responsibility; to align the

issuance of employment permits with market needs.,"

The country is in the dry period but harvesting has slowed

due to low demand for some species. Work has started in

preparation for the coming rainy season and is

concentrated on road maintenance and building log stocks.

Trucking to the ports has improved due to ongoing road

works with all-weather laterite roads under repair. Roads

are dry but the Bifoun to Ndjole road, the main route for

timber and food trucks from Cameroon, is in poor

condition.

The railway operator has increased the allocation of

wagons for log transport but obtaining wagons for

sawnwood transport is said to be difficult. Negotiations for

a second railway track from the Koulamoutou area

towards Mayumba on the coast appears to have stalled but

it has been reported that a South African/Australian

company is now studying a rail track from Koulamoutou

(southeast Gabon) to Owendo/Libreville.

Desire-Clttandre Dzonteu, writing for the gabonreview,

reports the production index for the timber sector in the

first quarter of 2024 was up 10% compared to the last

quarter of 2023. This information was provided by the

Ministry of Economy and Investments through its latest

Sectoral Economic Outlook Note. The gabonreview says

the plywood index gained 25% quarter of 2023, the

sawmill index 7% and the index for veneers gained 14%

quarter-on-quarter.

See: https://www.gabonreview.com/gabon-embellie-de-10-de-

lactivite-des-industries-du-bois-au-1er-trimestre-2024/

Congo

In North Congo the rains are easing allowing for better

transportation to Douala Port which is closer than Pointe

Noire in the south but some disruption has been reported

as not all the roads to the port are surfaced.

The south of the country is currently dry and harvesting

has resumed. With Chinese demand slowing sawmills are

forced to seek alternative markets. Despite the initial ban

on log exports quotas have been allocated due to the

economic situation with old log stocks allowed for export.

2.

GHANA

Millers call for investment in plantations

The Ghana Timber Millers Organisation (GTMO) is

warning that the remaining 25 member companies are

struggling to secure raw materials for production and fear

imminent closure.

Chief Executive Officer of the GTMO, Dr. Kwame

Asamoah Adam, highlighted these concerns in an

interview with Citi Business News saying “now, in terms

of the numbers, the medium to large size companies, most

of them have ceased operations”.

He added, the materials that are coming in, especially

round logs, the volume has fallen from about 1.2 million

cu.m about 20 years ago to just around 500,000 cu.m.

In related news, the GTMO has called for new, large-scale

commercial plantations to sustain the industry and ensure

the continuous flow of logs to the processing mills.

According to the GTMO Executive Officer commercial

tree plantations established by industry players would have

solved Ghana’s timber supply problem. He said it was

mow time timber firms to engage in large-scale tree

planting to produce raw material for their operations and

ensure the sustainability of Ghana’s timber industry.

He expressed these views at the 11th delegates’

conference of the Timber and Woodworkers Union of the

Trade Union Congress (TUC) in Kumasi on the theme:

“Sustainability of the timber industry in an era of climate

change: The role of social partners”.

He emphasised the need to invest to correct the damage to

the country’s forest due to climate change. He further

explained that most timber companies in the country had

collapsed because bushfires had decimated the forests.

Ghana’s government, through the Green Ghana Day

Initiative launched in 2021, has enabled the country to

make significant strides in forest restoration. Over 42

million trees of various species have been planted across

the country to cushion the effects of climate change and to

replant degraded forests. However, according to President

Nana Akufo-Addo, there is still much work to be done in

the area of forest restoration and protection in the country.

See: https://citinewsroom.com/2024/07/wood-shortage-looms-as-

75-out-of-100-local-timber-manufacturing-companies-

collapse/#google_vignette

and

https://gna.org.gh/2024/07/commercial-plantation-is-the-future-

of-the-timber-industry-dr-asamoah-adam/

https://3news.com/news/ghana-has-made-significant-strides-in-

forest-restoration-but-much-work-remains-akufo-addo/

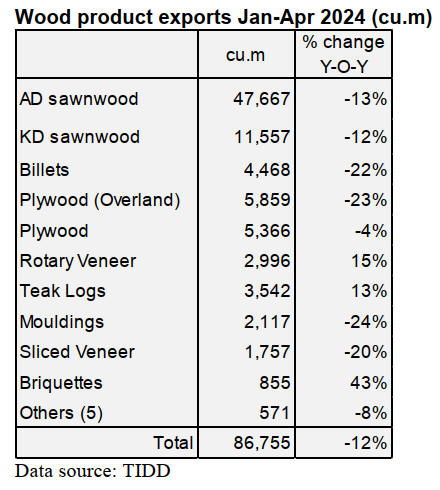

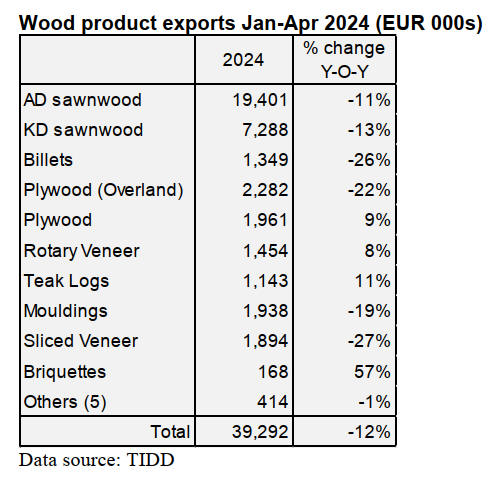

Dip in wood product exports in the first four month of

2024

According to data from the Timber Inspection

Development Division (TIDD) of the Forestry

Commission (FC), Ghana exported 86,755 cu.m of wood

products in the first four months of 2024, 12% down

compared to 98,959 cu.m in the same period last year. The

export value was EUR39.29 million in the first four

months of 2024, 12% less than EUR44.56 million in the

same period last year.

Mouldings, plywood to the regional market, billets and

sliced veneer all recorded decreases of over 20% in

volume terms during the four-month period. Products

recording more modest decreases were air and kiln

driedsawnwood and plywood for international markets.

For the four-month period exports of sawnwood were

59,224 cu.m in 2024 compared to 68,050 cu.m in 2023

while plywood was 11,225 cu.m in 2024 compared to

13,207 cu.m in 2023 and veneer was 4,753 cu.m in 2024

and 4,812 cu.m in 2023.

Of the country’s major export markets during the period,

Asia (54%), Europe (21%) and Africa (10%) accounted

for most of the EUR39.29 million total export receipts in

the first 4 months of 2024 compared to the EUR44.55

million recorded in 2023.

Forestry Commission trains staff to tackle forest

ecosystem destruction

The Forestry Commission (FC) of Ghana has trained

seventy staff in the Rapid Response Unit during a three-

week rigorous military training exercise at the 64 Infantry

Regiment Training School at Asutsuare in the Eastern

Region of Ghana.

The training was intended to equip the staff with skills in

unarmed combat, patrolling, ambush, obstacle courses,

and marksmanship and the ability to accurately handle

firearms.

This formed part of tougher measures by the Commission

aimed to tackle illegal loggers, gold mining and farming in

forest reserves which have become a danger to forest

management. The Commission is aware thar some illegal

operators carry deadly weapons in the forest.

See: https://fcghana.org/rru-trains-7o-staff/

https://www.ghanabusinessnews.com/2024/07/03/forestry-

commission-calls-for-stiffer-punishment-for-forest-offenders/

3. MALAYSIA

Furniture furnishings trading platform

The Malaysian Furniture Furnishings Market (MFFM) is a

new trading platform designed to provide an effective,

convenient and dynamic experience on furniture and

furnishings products for both exhibitors and buyers. It is

aligned with the prime furniture trading season in

September and visitors are invited to joining MFFM 5 to 7

September 2024 at the World Trade Centre Kuala Lumpur

(WTCKL).

Beyond addressing global furniture needs, MFFM is

committed to driving industry advancement by

establishing itself as a collaborative hub with the objective

of accelerating the development of the industry. The

MFFM exhibition will focus on furniture, home décor and

lifestyle products, finishing materials, hardware and

accessories.

See:https://mffmfurniture.com/

Sarawak to reduce log harvest

The Sarawak State government, through the Forest

Department will, according to Deputy Premier Awang

Tengah Ali Hasan, reduce annual log harvests to about

two million cubic metres and ensure adherence to forest

management certification criteria. In this regard the

Premier emphasised the importance of aligning the State’s

forest management with international standards which

would allow timber products to be marketed competitively

globally.

The State government has said it aims to boost income

from forest and the Premier called on all parties involved

to collaborate towards realising the State’s Sustainable

Development Goals (SDGs) and to back the reduction of

greenhouse gas emissions by 45% by 2030.

Hasan called on forest license holders in Sarawak to

actively engage in forest restoration programmes,

particularly in degraded areas. These efforts are crucial for

creating economic opportunities in carbon trading, agro-

forestry and ecotourism, he said.

See:

https://forestry.sarawak.gov.my/web/subpage/webpage_view/1242

Debate on introduction of carbon tax

Experts are divided on Malaysia’s proposed

implementation of a carbon tax policy, with some

believing that it is a timely initiative, while others deem

that the country is not ready to consider such a move.

Universiti Tunku Abdul Rahman economics professor,

Wong Chin Yoong, said a carbon tax policy is not timely

as the country still has more important reforms to deal

with for now.

See: https://www.thestar.com.my/business/business-

news/2024/07/03/mixed-views-on-carbon-tax-introduction

4.

INDONESIA

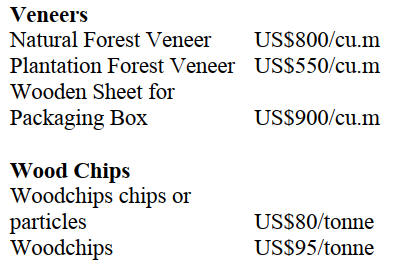

Export Benchmark Prices of wood products

for July

2024

The following prices are applicable 1-31 July, 2024.

Processed Wood

Processed wood products which are level on all four sides

so that the surface becomes even and smooth with the

provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are level on all four sides

so that the surface becomes even and smooth with the

provisions of a cross-sectional area of 4,000 sq.mm to

10,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

See:

https://jdih.kemendag.go.id/pdf/Regulasi/2024/802_Kepmendag

%20HPE%20dan%20HR%20Produk%20Pertanian%20dan%20

Kehutanan%20Juli%202024%20dan%20Lampiran.pdf

Upstream and downstream collaboration could

boost

sector performance

Krisdianto, the Director of Forest Product Processing and

Marketing Development at the Ministry of Environment

and Forestry, said collaboration between upstream and

downstream businesses could revitalise and strengthen the

performance of the timber industry in the country. Adding

that integration among industry players will bolster the

wood supply chain and support the production of high-

quality export products.

At a June meeting in Surabaya Krisdianto mentioned that

efforts are needed to address challenges created by the

Forest Utilisation License (PBPH) and Forest Product

Processing License (PBPHH). A mechanism for

cooperation between PBPH and PBPHH holders needs

further improvement to ensure a stable supply of raw

materials for PBPHH and a market for roundwood for

PBPH. Such integration would address the problem some

companies have to market roundwood and primary

industries will no longer suffer from a shortage of raw

material, he said.

Tjipta Purwita, the APHI Management Board member,

explained that production from the natural forest in 2023

was 4.7 million cu.m whereas the average over the last 10

years was 5.7 million cu.m. He added that several factors

are causing a decline in natural forest wood production.

One is the increasing transportation distances and fuel

prices, while wood prices remain constant. Additionally,

there is a decreasing trend in the demand for wood from

natural forests.

Tjipta also suggested that expanding the export market,

especially for mixed forest wood, is essential to increase

added value as it has not been utilised optimally so far.

See: https://forestinsights.id/tekad-pelaku-industri-kayu-hulu-

hilir-dongkrak-kinerja-pemanfaatan-kayu-rimba-campuran-

dipromosikan/

Processed wood industry plays strategic role in the

economy

The processed wood industry is considered to have a

strategic role in the national economy and significantly

contributes to the Gross Domestic Product (GDP)

according to Prof. Mangku Purnomo, the Dean of the

Faculty of Agriculture at Brawijaya University.

During a discussion hosted by FPUB as part of an ITTO

project, Purnomo communicated the need to develop a

comprehensive national strategy to enhance the

competitiveness of processed wood products in the

domestic market. He said "through the project advantages

and challenges in the domestic wood industry will be

studied.

Several important issues related to the processed wood

industry were discussed. The research findings from this

project confirm that the domestic market holds great

potential for the national wood industry.

The focus of the discussion was on strategies to enhance

the competitiveness of processed wood products in the

local market, particularly through product innovation,

quality enhancement, and improved production efficiency.

See: https://www.rri.co.id/bisnis/783536/industri-kayu-olahan-

dinilai-berperan-strategis-untuk-perekonomian

Rattan furniture popular in international markets

Indonesia's high-quality rattan furniture has gained

popularity among foreign importers, including those

operating in Japan, according to Deputy Minister of Trade

Jerry Sambuaga, during a visit to the office of Kimura

Rattan in Osaka, Japan

The value of Kimura Rattan's imports from Indonesia has

shown a steady increase, rising from US$2.11 million in

the period October 2020 to September 2021 to US$2.33

million in the most recent recording period. Sambuaga

emphasised that Indonesia's Ministry of Trade had

committed to supporting and facilitating the exports of

high-quality rattan products to Japan. In this regard, he

remarked that the ministry's Indonesia Trade Promotion

Center (ITPC) in Osaka will always be ready to help

promote and enhance products and find solutions to issues

that might arise.

See: https://en.antaranews.com/news/317775/indonesias-rattan-

furniture-gains-popularity-says-trade-official

Need for forest recovery strategy for Java

The Environment and Forestry Ministry has highlighted

the need for a strategy and cooperation among

stakeholders to accelerate forest and environmental

rehabilitation in Java. "The success of forest and land

rehabilitation on the island of Java involving the

community has made a real contribution to improving the

environment and forest functions and local economic

welfare," said the Ministry's Secretary General, Bambang

Hendroyono.

Hendroyono remarked that forest and land rehabilitation

can support the achievement of Indonesia's Forest and

Land Use (FOLU) Net Sink 2030. He explained that

sustainable restoration of the forest ecosystem in Java

must focus on the existing regulations without forgetting

the aspects of best practices and effectiveness.

See: https://en.antaranews.com/news/317106/govt-presses-for-

comprehensive-strategy-for-forest-recovery-in-java

Geo-AI technology can help prevents deforestation

During the 2024 Oslo Tropical Forest Forum (OTFF)

meeting, Director General of Environmental Law

Enforcement of the Ministry of Environment and Forestry

(KLHK), Ratio Ridho Sani, emphasised the importance of

legal consistency in the application of Geospatial Artificial

Intelligence (GeoAI) science and technology.

"Using accurate data and information is essential in law

enforcement. To acquire precise data, a multi-layer, multi-

tool analysis must be conducted to monitor and enforce

security in forest areas, including fires, encroachments,

and environmental pollution," explained Ratio Ridho.

He mentioned that leveraging technology with

multi-layer

analysis, including the use of GeoAI, has accelerated and

enhanced the accuracy of detecting and intervening in

activities associated with deforestation and environmental

pollution and destruction.

See: https://investor.id/international/365794/di-pertemuan-oslo-

norwegia-klhk-tegaskan-teknologi-geoai-cegah-deforestasi

Concluding the comprehensive economic

partnership

agreement (CEPA) with the EU

Indonesia is currently trying to close the comprehensive

economic partnership agreement (CEPA) with the EU by

next month. Negotiations for this trade pact have been

ongoing for eight years. The CEPA negotiations and the

environmental policies are not the only things that can

describe the bilateral relations according to EU

Ambassador to Indonesia Denis Chaibi. “Our most

significant engagement is in trade. We are doing intensive

trade negotiations” Chaibi said, acknowledging that the

EU’s environmental regulations were also a pivotal issue

in their bilateral interactions.

See: https://jakartaglobe.id/news/indonesiaeu-relations-much-

bigger-than-just-trade-envoy

5.

MYANMAR

Wood industries undermined by payment restrictions

Current international banking restrictions on foreign

exchange transactions have severely impacted exporters,

with the wood industry being hard hit. After the EU and

USA imposed restrictions on Myanmar, citing that trade

supports the military government, manufacturers have

struggled to receive payments for their exports.

Even exports to non-EU and non-USA destinations are at

risk due to the banking restrictions. If this situation

remains unchanged the timber industry faces a serious

threat of a complete shutdown say loacal analysts. This

year so far timber exports are at the lowest ever recorded.

China’s diplomatic efforts with Myanmar

The local media has reported that China continues to

engage with Myanmar's former generals hoping they can

restore stability.

Despite these efforts the Myanmar authorities continue to

face internal conflict and international pressure.

It has been reported that the US has also opened limited

communication with Myanmar's military suggesting a

potential shift in approach.

See: https://www.gnlm.com.mm/former-president-u-thein-sein-

attends-70th-anniversary-of-five-principle-of-peaceful-

coexistence-in-beijing/

Energy shortages

Myanmar is grappling with acute electricity shortages

which are having profound economic repercussions. The

power cuts are disrupting all businesses without exception.

The unpredictable outages are affecting operations,

causing significant revenue losses and forcing irregular

working hours on employees.

The broader economic impact of the power crisis is

evident across Myanmar. Many businesses report severe

challenges due to the unreliable electricity supply

compounded by inflation and the devaluation of the local

currency. The World Bank's findings underscore the

widespread impact of power outages, with a notable

increase in the percentage of companies citing electricity

shortages as their primary operational hurdle.

Despite the onset of the rainy season offering temporary

relief by reducing electricity demand for air conditioning

and replenishing hydropower dams, reports indicate that

industrial areas in Yangon still face an erratic electricity

supply.

See: https://www.channelnewsasia.com/business/russian-firms-

eye-myanmar-energy-infrastructure-4469846

and

https://www.frontiermyanmar.net/en/power-cuts-bring-

myanmars-industry-to-its-knees/

Banks face administrative action

The authorities in Myanmar announced administrative

action against executives from seven private banks for

exceeding the Central Bank's cap on home mortgage

lending set in January 2019. These banks will face charges

under Section 154 of the Financial Institutions Law which

allows the Central Bank to impose fines, restrictions or

terminate staff and board members. Officials at the Central

Bank will also be punished for inadequate supervision.

The cap restricts banks from lending more than 5% of

their total lending portfolio for home loans exceeding

three years. This cap was introduced by the previous

civilian government.

See: https://www.irrawaddy.com/business/myanmars-generals-

berate-and-scold-bankers-as-financial-crisis-deepens.html

and

https://www.irrawaddy.com/business/myanmar-banks-restrict-

cash-withdrawals-as-financial-crisis-intensifies.html

In related news the Central Bank of Myanmar (CBM)

has

intervened by injecting millions into the financial market

to stabilise the currency but with limited success. The kyat

continues to lose value against the US dollar, Thai baht,

and the Chinese yuan.

6.

INDIA

The correspondent

writes “the monsoon has set well

across India and we are looking forward to a good season.

The rain came two days sooner than expected bringing

relief from the heat wave while boosting prospects for

bumper harvests. Monsoon rains are critical to boost

economic growth as good harvests of rice, corn, cotton,

soybeans and sugarcane brings money into households and

lifts their purchasing power”.

Inflation higher in May

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 2.61% in May 2024. The positive

rate of inflation was primarily due to increase in prices of

food articles, manufacture of food products, crude

petroleum and natural gas, mineral oils and other

manufacturing. The index for manufacturing increased to

141.7 in May from 140.8 for April.

Out of the 22 NIC two-digit groups for manufactured

products, 13 groups saw an increase in prices, for 8 groups

there was a decline in prices and for 1 group there was no

change.

Some of the important groups that showed month-on-

month increases in price were basic metals, food products,

computer, electronic an optical products, electrical

equipment, other manufacturing. Some of the groups that

witnessed a decrease in prices were fabricated metal

products (except machinery & equipment) other non-

metallic mineral products, chemicals and chemical

products, tobacco products and other transport equipment.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Government and private sector join to expand rubber

plantations

The Indian Natural Rubber Operations for Assisted

Development (INROAD) has converted nearly 70,000

hectares of land into rubber plantations in Northeast India

over the past 3 years. INROAD is hosted by the Ministry

of Commerce and Industry and brings together the rubber

consuming sector and government agencies to fund rubber

plantations. The private sector is represented by the

Automotive Tyre manufacturers Association (ATMA).

Over 30 million trees have been planted across 93 districts

in the North-east Indian states. The project entails socio-

economic development of resource poor populations in

these States.

The industry has committed Rs.1000 crore towards a new

plantation of 2 lakh hectares and another Rs.100 crore

towards improvement in quality of Natural Rubber (NR)

through best practices and training.

The demand-supply gap for natural rubber in India

continues to be high. At present nearly 40% of the

natioanal requirement is met through imports.

It is estimated that by 2030 the country would require

about 20 lakh tonnes of natural rubber annually and the

INROAD project will help meet some of the growing

requirements within the country.

See: https://www.thehindubusinessline.com/economy/agri-

business/inroad-project-brings-70000-hectares-under-natural-

rubber-in-north-

east/article67887224.ece#:~:text=Against%20the%20target%20o

f%2080%2C000,said%20Anshuman%20Singhania%2C%20Chai

rman%20ATMA.

Farmers encouraged to plant sandalwood

The latest budget includes support for boosting

sandalwood cultivation which has generated optimism

among farmers. Officials say steady demand and better

prices are key to lifting sandalwood cultivation.

One suggestion is to transform Forest Department timber

depots into sandalwood collection centres allowing

individuals to harvest sandalwood trees from private land

and sell directly to the Forest department.

A retired forest official residing at Moolamattom is

reported as saying “to encourage sandalwood planting the

government should train forestry and revenue offices on

the relavent laws and regulations as most of the officials

are unaware of the cultivation of sandalwood and the

reality is that anyone can easily cultivate the tree and earn

income.“

See: https://www.thehindu.com/news/national/kerala/budget-

announcement-to-promote-sandalwood-cultivation-offers-new-

hopes-to-farmers/article67818022.ece

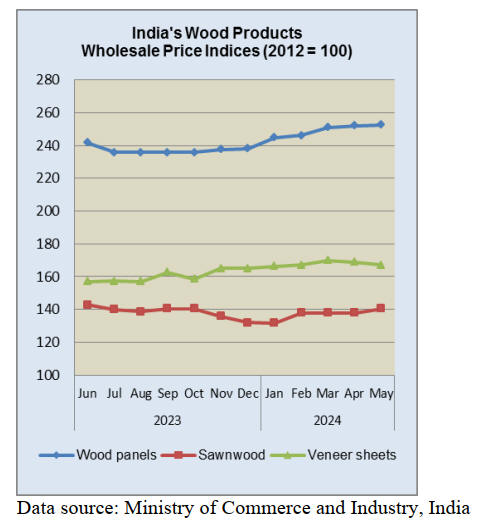

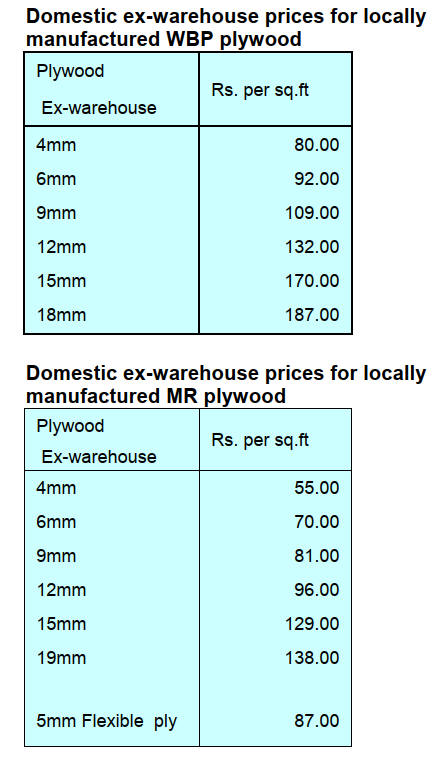

Plywood

Plywood manufacturers have agreed price increases but

the new price structures have not been released primarily

because panel demand is currently slow and company

finances are under stress. Any move by manufacturers to

raise prices now could further undermine demand.

The correspondent writes - manufacturers are not in a

position to revise the prices yet because if they do so then

their orders will decrease. But soon a point has come

where without increment their survival will become even

more difficult. I expect that by this month end all major

players will increase prices.

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

Statistics provided by Vietnam Office of Customs reveal

that in June 2024 W&WP exports reached US$1.25

billion, down 1% compared to May 2024 but up 14%

compared to June 2023. WP exports alone earned US$840

million, up 0.6% compared to May 2024 and up 10%

compared to June 2023.

In the first 6 months of 2024 W&WP exports earned

US$7.4 billion, up 22% year on year. WP exports

contributed US$5.03 billion, up 21% over the same period

in 2023.

The value of Vietnam's W&WP imports in June 2024 was

US$250 million, up 0.9% compared to May 2024 and up

31% compared to June 2023.

Over the the first 6 months of 2024 W&WP imports

totalled US$1.266 billion, up 22% year-on-year.

Logs and sawnwood (raw wood) imports in June 2024

were 510,400 cu.m, worth US$168.4 million, up 1.5% in

volume and 1% in value compared to May 2024.

Compared to June 2023 imports increased by 24% in

volume and 24% in value.

In the first 6 months of 2024 imports of raw wood totalled

2.5 million cu.m, worth US$838.4 million, up 18% in

volume and 11% in value against the same period in 2023.

Vietnam’s NTFP exports in June 2024 brought in about

US$70 million, up 5.5% compared to May 2024 and up

0.8% over the same period in 2023.

In the first half of 2024 NTFP exports were valued at

US$404.54 million, up 13% over the same period in 2023.

W&WP exports to Canada in May 2024 reached US$16.5

million, up 5% compared to May 2023. In the first 5

months of 2024 W&WP exports to Canada reached US$94

million, up 24% over the same period in 2023.

W&WP exports to South Africa in May 2024 contributed

US$360,000, down 18% compared to May 2023. In the

first 5 months of 2024 W&WP imports from South Africa

reached US$2.4 million, up 48% over the same period in

2023.

Imports of padouk in May 2024 came to 8,300 cu.m,

worth US$3.3 million, up 7.5% in volume and 7.4% in

value compared to April 2024.

Compared to May 2023 imports fell by 8% in volume and

by 16% in value. In the first 5 months of 2024 imports of

padouk reached 47,000 cu.m, worth US$19.2 million,

down 15% in volume and down 9% in value year-on-year.

Raw wood imported from the EU in May 2024 increased

for the 3rd consecutive month reaching 73,000 cu.m with a

value of US$23.0 million, up 12% in volume and 11% in

value compared to April 2024.

However imports declined by 1.5% in volume and

increased by 0.5% in value over the same period in 2023.

In the first 5 months of 2024 imports of raw wood from

the EU reached 272,510 cu.m, with a value of US$87.2

million, up 3% in volume and 8% in value year-on-year.

First half 2024 W&WP exports grew at double digit rate

In the first half of 2024 W&WP exports totalled around

US$7.4 billion, up 22% year-on-year. The high-end/higher

value commodity group, dominated at US$5.03 billion, up

21% over the same period in 2023. Leading these exports

were wooden frame seats, living room and dining room

furniture (US$1.0 billion, up 38%), wood-based panels

and floorings (US$814.7 million, up 25%) and bedroom

furniture (US$772.7 million, up 32%).

Data from Vietnam Office of Customs show strong

growth of W&WP exports to the US, China and the EU.

In the first 5 months of 2024 the US imported US$3.3

billion, up 26% over the same period in 2023. The US is

the main target market for made-in-Vietnam furniture.

China, as the second largest market, imported W&WP

valued at US$887.8 million, up 51% over the same

period in 2023.

Exports to the EU were valued at US$240.3 million,

up

33%, Canada US$94 million, up 24%, UK US$89.7

million, up 18% and Indonesia US$77.8 million up

102.3%.

With the gradual recovery of the world economy,

especially the 5 top markets namely the US, Japan,

China, South Korea and the EU, many Vietnamese

businesses have secured orders until the end of 2024.

Because of this imports of raw wood have been

increasing.

However, in the second half of 2024 there will be

still

many challenges facing Vietnamese operators such as

intense geopolitical conflicts and rising freight rates. In

addition, trade protection remedies relating to anti-

dumping anti-subsidy and countervailing investigations

as well as the environment/forest protection barriers,

including EUDR, are all expected to impose further

pressure on Vietnam’s W&WP exports.

Strengthening enterprise governance, improvement of

designing capability, fostering digital transformation,

diversifying export destinations by taping potential

markets, such as the Middle East, Africa, Eastern Europe

and Northern Europe, along with others, are expected to

be tackled by Vietnamese entrepreneurs.

Rising imports of wood raw material

According to Vietnam’s Department of Forestry in the

first 5 months of 2024 the area of newly planted

commercial forests was 98,200 hectares, up 1.3% over the

same period last year and the timber harvest amounted to

741,300 cu.m, up 6.6

Shippers of wood raw material

In the first 5 months of 2024, the volume of raw wood

imported from major suppliers such as China, the EU, the

US, Thailand, Chile, Laos, Brazil and New Zealand

increased over the same period in 2023. On the other hand

imports from Cameroon, Malaysia, Congo, Suriname and

Indonesia declined.

Most raw wood imports were from China and accounted

for 17% of the total import volume in the first 5 months

of 2024 reaching 348,500 cubic metres worth US$137.1

million, up 72% in volume and 40% in value over the

same period in 2023.

Imports from the EU increased 4% in volume and 9% in

value over the same period in 2023 reaching 275,300

cu.m, worth US$88.6 million and accounted for 14% of

total imports.

Imports from the US increased by 18% in volume and

18% in value reaching 255,400 cu.m worth US$110.1

million and accounted for 13% of total imports.

Imports from other shippers also increased over the same

period in 2023 such as from Thailand by 27%; Chile by

88%; Laos by 3.4%; Brazil by 40%; New Zealand by

26%; and Papua New Guinea by 71%.

Import from other sources in the first 5 months of

2024

decreased against the same period in 2023 such as from

Cameroon down 36%; Malaysia down 13%; Congo

down 33%; Suriname down 28% and Indonesia down

7%.

Import prices

In the first 5 months of 2024, the average import price

stood at US$332.4/cu.m, down 7.4% over the same period

in 2023.

The import price of raw wood from China decreased by

19% down to US$393.4/cu.m; from Cameroon decreased

by 3.5% to US$425.4/cu.m; Chile by 5%, to

US$235.1/cu.m; Laos by 4% to US$461.8/cu.m; Brazil

by 5.5%, to US$248.1/cu.m.

Vietnam’s W&WP exports to S. Africa

According to statistics from Vietnam Office of Customs

W&WP exports to South Africa in May 2024 reached

US$360.000, down 18% compared to May 2023.

However, in the first 5 months of 2024 W&WP exports to

South Africa earned US$2.4 million, up 48% year-on-

year.

Amongst W&WPs exported to South Africa wooden

furniture has been dominating at 68% of total exports.

Leading exports was living-room and dining-room

furniture reaching US$756,000, up 45% over the same

period in 2023 followed by wooden frame chairs

US$243,000, up 7%; bedroom furniture US$224,000, up

21. In addition, in the first 4 months of 2024, wood-based

panels and floorings shipped to South Africa also

increased sharply.

According to statistics from the International Trade

Center (ITC), South Africa's imports of wooden furniture

in the first 3 months of 2024 reached US$24 million, up

26.5% over the same period in 2023.

China and the EU were the 2 main suppliers. Vietnam

was the 4th largest supplier, but the value of imports

from Vietnam accounted for only 6% of the total

imports.

In the South African market, rapid urbanisation has

led to

increased demand for furniture.

Vietnamese operators are still facing many

challenges

while having their wooden products shipped out to the

South Africa especially competition with Chinese

exporters, and import payment procedures.

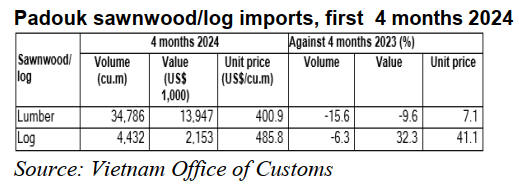

Padouk sawnwood and log imports

According to statistics of Vietnam Custom Office, sawn

padouk imported into Vietnam in the first 4 months of

2024 volumed at 34,8000 cu.m, worth US$13.9 million,

down 16% in volume and 10% in value over the same

period in 2023.Imports of padouk round wood reached

4,400 cu.m, worth US$2.2 million, down 6% in volume

but up 32% in value over the same period in 2023.

The average price of padouk imported into Vietnam in

the first 4 months of 2024 stood at US$410.5/cu.m, up

11% over the same period in 2023. Of this, the price of

padouk imports from Africa increased by 0.6% to

US$310.5/cu.m, from China by 2.4%, to US$286.7/cu.m

and Tanzania by 1.4%, to US$290.5/cu.m.

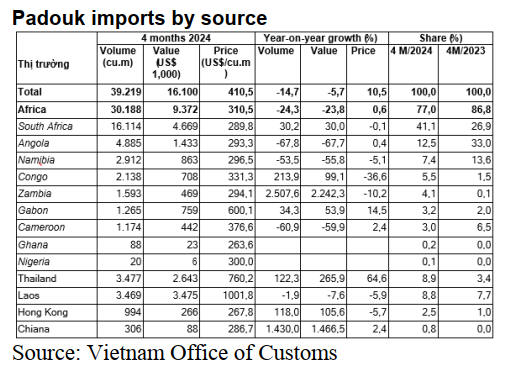

Padouk suppliers

In the first 4 months of 2024 padouk was imported mainly

from Africa with a small volumes from other sources.

Import from Africa accounted for 77% of total imports in

the first 4 month of 2024, reaching 30,200 cu. m, worth

US$9.4 million, down 24% in volume and down 24% in

value over the same period in 2023. Imports from Angola

decreased by 68%; Namibia by 54%; and Cameroon by

61%.

Similarly, imports from Laos decreased by 2% in

volume

and by 8% in value over the same period in 2023, with

the import of 3,500 cu.m, worth US$3.5 million.

In contrast, padouk imports from Thailand increased

by

122% in volume and 266% in value over the same period

in 2023 reaching 3,500 cu.m, worth US$2.6 million.

In addition, the import volume of padouk from some

other markets increased (Hong Kong increased by 118%,

China increased by by a huge magin, Papua New Guinea

increased by 89.8%). The net contribution from these

suppliers was small as the volumes are small.

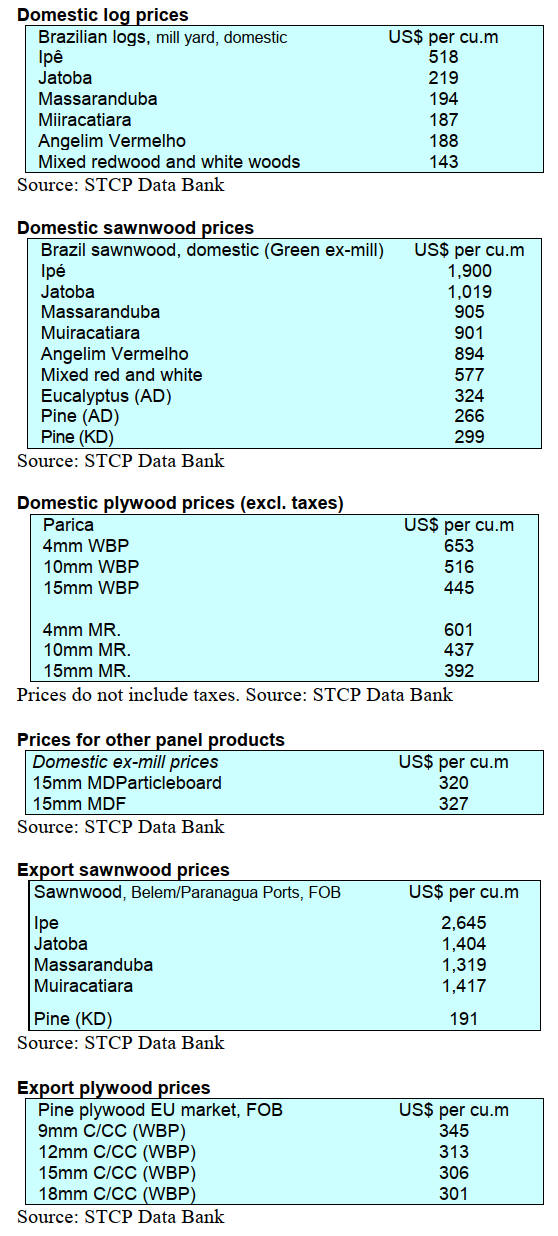

8. BRAZIL

Improving competitiveness

of Brazil's timber

industries

The Senai Institute of Technology in Wood and Furniture

(Instituto Senai de Tecnologia - IST) has completed a

project in partnership with the Wood Industries Union

(Sindusmadeira).

This initiative, made possible by the FIEP Innovation

Programme, brought significant technological advances to

the wood industry in Guarapuava Municipality (Southern

Brazil) especially in improving production processes. The

project included eight companies from Sindusmadeira and

ended in May 2024.

IST carried out laboratory tests and technical analyses and

implemented actions to improve the quality of wood

products. The main objective was to improve the quality

of plywood and other wood products using national and

international standards as a reference. The project also

aimed to reduce losses and costs and to train employees on

technical standards, process organisation and quality

control.

Participating companies had the opportunity to carry out

laboratory tests on their products to collect technical

information that is essential for entering new markets. The

technological and process improvements implemented

strengthened collaboration between IST and the timber

industries in Guarapuava Municipality and increased the

market competitiveness and quality of products.

See: https://www.madeiratotal.com.br/instituto-senai-de-

tecnologia-em-madeira-e-mobiliario-melhora-a-competitividade-

da-industria-madeireira/

Forestry sector and technological innovation in Brazil

The Brazilian forestry sector has emerged as an essential

pillar for agribusiness contributing significantly to the

economy, society and the environment. In 2022 the sector

registered a contribution to GDP of R$107.2 billion,

representing 4.1% of the national agricultural production.

This was in contrast to an almost 2% decline contribution

from the overall agricultural sector.

Brazil has been investing heavily in technology to increase

efficiency and reduce costs in forestry production. This

investment includes the use of drones, remote sensing,

geographic information systems, biotechnology and

genetic improvement as well as the application of big data

and artificial intelligence systems.

The application of biotechnology techniques has also

supported the development of more resistant and

productive forest species adapted to Brazil's climatic and

environmental conditions. The forestry sector in Brazil

stands out for investing in innovation that combines high

technology with sustainable practices. In 2022 the area

planted reached 9.94 million hectares and comprised

mainly with eucalyptus (7.6 million hectares) and pine

(1.9 million hectares), almost double the 5.1 million

hectares planted in 2013.

The selection of high-performance seedlings and clones is

still carried out manually requiring the human expertise

ensuring employment in rural areas. In addition to the

economic impact,the forestry sector promotes job creation

and income distribution especially in rural areas.

See: https://agrorevenda.com.br/opiniao/a-importancia-do-setor-

florestal-e-a-inovacao-tecnologica-no-brasil/

Boosting exports of wood products from sustainably

managed forests

In June 2024 the "Export More Brazil (Exporta Mais

Brasil)" programme, organised by the Brazilian Trade and

Investment Promotion Agency (ApexBrasil) was held in

Alta Floresta Municipality in the state of Mato Grosso in

the Amazon region.

The goal was to boost exports of processed wood products

from sustainably managed forests. The event brought

together 12 international buyers from seven countries

(South Africa, Germany, Belgium, France, Mexico,

Poland and Uruguay) for business rounds with 30

Brazilian companies in the sector.

The programme included visits to industries to observe

sustainable practices and raise the international perception

of Brazilian products in terms of the sustainability, the

functioning of the local market and its potential.

The Brazilian Forest sector, which already employs

160,000 people in more than 11,000 companies, stands out

for job creation and the adoption of sustainable practices.

The state of Mato Grosso, with over 5 million hectares of

managed forests, is an example of this as satellite

monitoring, the adoption of traceability techniques as well

as the control of harvest volumes has been adopted.

According to the Mato Grosso Environment Secretariat

(Sema-MT) sustainable forest management in the region

contributes an estimated 16% reduction in greenhouse gas

emissions. By 2030 the expectation is to achieve 6 million

hectares of forest under SFM in Mato Grosso.

ApexBrasil, through the "Export More Brazil" programme,

aims to position the country as a world reference in

sustainable forest management, promoting economic

development with environmental responsibility.

In 2023, with an investment of R$5 million, the “Export

More Brazil” programme completed 13 business events in

13 Brazilian states. The programme generated R$275

million in business transactions and promoted 3,496

business rounds between 143 international buyers from 41

countries and 487 Brazilian companies. In 2024 the

programme will visit the other 14 states in the country.

See: https://cipem.org.br/noticias/exporta-mais-brasil-chega-em-

alta-floresta-mt-para-impulsionar-o-manejo-florestal-sustentavel-

nacional

US announces new contribution to Amazon Fund

The domestic media has reported the United States has

announced a new contribution of US$47 million to Brazil's

Amazon Fund reinforcing the collaboration between

Brazil and the United States for the protection of the

Amazon rainforest. This contribution highlights the

priority of environmental issues on the United States'

agenda on promoting policies aimed at reducing carbon

emissions and combating climate change.

The relationship between Brazil and the United States is

essential, particularly considering the Amazon's

importance in global climate regulation.

Continued support for the Amazon Fund is crucial as

maintaining robust environmental policies and funding

programmes such as the Amazon Fund are vital for the

preservation of the forest and for global efforts to combat

climate change.

See: https://g1.globo.com/politica/blog/valdo-

cruz/post/2024/07/05/eua-anunciam-nova-contribuicao-de-us-47-

milhoes-para-o-fundo-amazonia.ghtml

9. PERU

Furniture imports

rose during the first quarter of 2024

During the first four months of 2024 the value of Peruvian

imports of wooden furniture was US$15.3 million, an

increase of 8% compared to the same period in 2023

(US$14.1 million).

Brazil maintained its position as the main supplier of

wooden furniture to Peru during the first four months

contributing US$9.8 million, which represented 64% of

the country's total wooden furniture imports. After Brazil,

China supplied wooden furniture worth US$1.8 million a

decline on the US$1.9 million imported in the first four

months of 2023.

Wood product export earnings down year on year

According to the Management of Services and Extractive

Industries in the Association of Exporters (ADEX)

shipments of wood products in the first four months of

2024 earned US$26.6 million, which was 29% less than

the same period in 2023 (US$37.4 million)

This decline is partly explained by the lower purchases by

the main buyer, China, which at US$ 4.1 million, was a

42% drop year on year. On the other hand, the Dominican

Republic increased imports from Peru to US$3.9 million.

France, which was ranked third in purchasing Peruvian

wood products bought just US$3.8 million, down by half

from the same period in 2023.

According to figures from ‘ADEX Data’ the Trade

Commercial Intelligence System, sawnwood was the top

export product in the first four months of 2024 earning

US$10.6 million, despite a 27% drop compared to the

previous year. Second were semi-manufactured products

that earned US$9.6 million but this represented a year on

year contraction of 42%.

Others export products were furniture and its parts

(US$1.6 million), construction products (US$1.5 million)

and wood energy products (US$1.4 million).

OSINFOR reports progress in fight against illegal

logging

The Forestry and Wildlife Resources Supervision Agency

(OSINFOR) announced a notable reduction in the rate of

illegal logging in forest units with permitting titles. This

information was provided at an event to commemorate the

16 years of OSNFOR establishment

OSINFOR presented the results of a study "Estimating and

measuring the legality of wood in Peru in 2021" which

offers a standardised and replicable methodology to

annually measure illegal logging and trade in illegal wood

in the country.

When presenting the results the Director of OSINFOR,

Ildefonzo Riquelme, indicated that in 2023, 884,577

hectares of forest were under supervised management and

by the end of 2024 it is planned to extend this to 932,694

hectares.

|