|

1.

CENTRAL AND WEST AFRICA

Regional round-up

Gabon

The government has instructed Provincial Forestry

Directors to ensure that operators pay the 2024 land tax,

failure to comply may result operations being halted. The

following text is said to have been sent directly from the

Forestry Department to companies:

"Forestry companies subject to the area tax and having

paid their debt in full or in part are requested to submit,

before June 21, 2024 to the General Directorate of Forests

(DGF), the payment receipts for the 2024 fiscal year.

Furthermore, the area tax collection orders for 2024 that

have not been collected since 5 March 2024 available."

Additionally, there is a new regulation on the limitation of

truck weight per axle. This measure, aligned with CEMAC

standards, seeks to protect aging bridges, including the

two 40-year-old bridges in Kango.

Trucks carrying logs can operate from 06:00 to 12:00hrs

and then must park for 2 hours after which they can

continue to operate between 14:00 to 18:00hrs.

See: https://www.gabonreview.com/infrastructures-routieres-les-

camions-de-plus-de-13-tonnes-a-lessieu-bientot-interdits-sur-la-

nationale/

Frequent electricity disruptions continue to plague

operators in the Special economic Zone. The local

electricity provider, SEEG, has promised improvements

by the end of the month.

Operators report stable demand from China for bilinga,

ayous and okan. Buyers in the Philippines and Middle East

have increased inquiries.

Cameroon

The season's first heavy rains have been reported but

harvesting operations are not yet affected. Trucking

operations and railway conditions are currently stable

without major disruptions. Sawmills are building stocks in

anticipation of the advancing six-month rainy period.

Demand in the Middle East remains stable and China has

resumed purchasing various species such as bilinga,

padouk, iroko, movingui and sapelli.

Operators report road and railway operations to the port

are functioning well with no significant changes in fees or

tolls. Also, container availability is good with enough

empty containers on hand. Port operations at Douala and

Kribi are running normally. Douala Port handles general

goods while Kribi mainly handles containers.

Order levels are reported as stable, supported by the

Chinese market. Demand from China is improving

especially for species such as ayous. The Middle East

market is still slow with a focus on species such as iroko

and sapelli.

Republic of Congo

In North Congo the rains are subsiding allowing for

improved transportation to Douala Port which is closer

than Pointe Noire in the South. The distance to Pointe

Noire is approximately 1,400 km making it a long journey

across the country.

In the South rains are still prevalent but the dry period is

expected soon. Harvesting activities are resuming

especially for okoume driven by renewed Chinese

demand. There is also demand for other species such as

padouk, bilinga, movingui, sapelli and okan.

Transport to the south, particularly Pointe Noire, is mostly

on paved roads. Logs are transported to the Malukou log

parks and floated before being transported by train to

Pointe Noire Port. Operators near Pointe Noire also truck

logs directly to the port.

Operators say order levels have been stable for the past

two months. Although log exports were originally banned

quotas are currently allowed due to the economic situation.

Old stocks can still be exported and there are significant

stocks in North Congo which are being exported through

Douala Port.

Enquiry levels are also stable with the Philippines

resuming purchases of okoume sawnwood. China's

purchases of okoume, bilinga, movingui and Padouk have

increased.

In early July an international forestry conference will be

held hosted by the Minister of Forestry, Dr. Rosalie

Matondo. The programme will cover reforestation and

afforestation policies, reducing felling permits for

operators and developing downstream products for

international markets. Representatives from Congo Basin

countries and Equatorial Guinea have been invited.

See: https://gouvernement.cg/conference-internationale-sur-

lafforestation-et-le-reboisement/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240620/1718839024156844.pdf

2.

GHANA

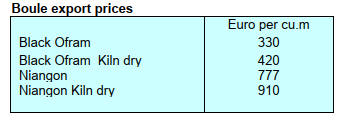

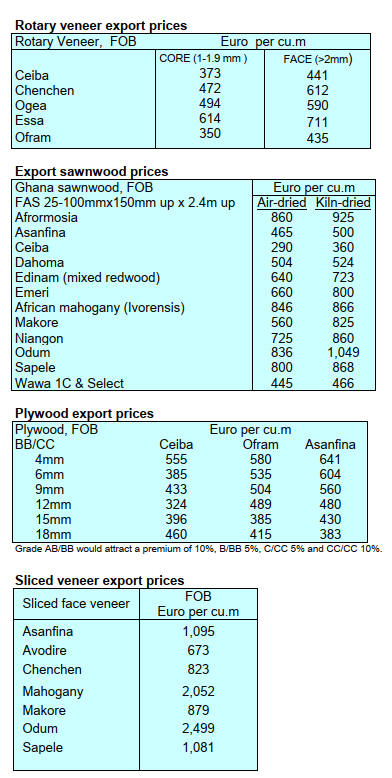

Eur29.31 million from wood product exports

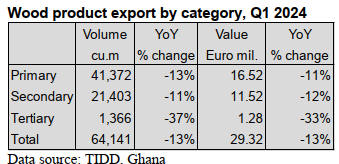

According to a Timber Industry Development Division

(TIDD) report Ghana earned Eur 29.31 million from the

export of primary, secondary and tertiary wood products

which totalled 64,141cu.m in the first three months of

2024. Disappointingly, first quarter 2024 export volumes

and values were each down around 13% compared to the

same period in 2023.

The table above shows that, year on year, the volume and

value for all products fell in the first quarter of this year.

While there has been a weakening of demand, another

reason cited was the unavailability of raw materials for

production and the impact of power outages on

production.

According to the TIDD report, primary products

contributed Eur16.52 million (56%) of the total value of

exports between January and March 2024, around the

same percent as in the same period in 2023.

The primary products were sawnwood, teak logs, billets,

boules, kindling and roll board.

Secondary wood products were ranked second with a 39%

share of the export value. These products included

plywood, veneer and briquettes. The tertiary products

comprised mouldings and dowels. Saudi Arabia was the

main importer of plywood from Ghana.

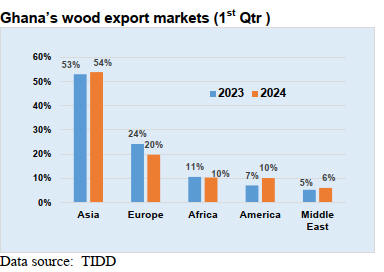

Asian markets maintained their position as the top

destination for Ghana's wood product exports in the first

quarter of this year. Ghana earned Eur15.79 million from

the export of 40,149 cu.m of wood products to Asian

markets. This performance was better than in the same

period last year when exports to Asian markets also

contributed Eur 17.84 million. The key markets in Asia

were India, Vietnam and China.

The European market was Ghana’s second highest export

destination but accounted for only around 20% of first

quarter 2024 export earnings compared to the 24%

recorded for the first quarter 2023. The main European

markets for Ghana were Belgium, Germany, UK, France

and Denmark.

Products shipped to the EU market included sawnwood,

veneers, boules, plywood and processed mouldings

produced from eucalyptus, papao/ apa, dahoma, kako/

ekki, chenchen, niangon, sapele, odum, guarea,

asanfina/anigre, koto/kyere and ananta

The African regional markets were placed third with most

being shipped to ECOWAS member countries (Burkina

Faso, Togo, Niger, Mali, Senegal, Benin, Nigeria and

Sierra Leone). The leading products shipped to the

regional markets were air and kiln dry sawnwood, veneers

and plywood.

Miro Forestry doubling plywood production capacity

Miro Forestry and Timber Products, the parent company

of Miro Forestry Ghana Limited, has announced that it has

procured equipment to double its plywood capacity in

Ghana.

The company produces plywood, edge glue boards and

utility transmission poles from its own FSC-certified

commercial forests.

The company has reported it has 200,000 tonnes of carbon

credits available per annum from its existing plantations

across Africa and has a several afforestation projects

generating carbon credits.

According to the Timber Industry Development Division

(TIDD) statistics the total export volume of plywood by

Miro Forestry Ghana Limited was 4,182 cu.m in 2022 and

12,146 cu.m in 2023.

In the first quarter of this year plywood exports by sea

accounted for 94% (3,465cu.m) of the total exported

valued at Eur1.24 million. The main wood raw material

for Miro’s plywood production is eucalyptus.

See: https://www.timberindustrynews.com/miro-forestry-and-

timber-products-doubles-plywood-production-in-ghana/

Eurobond debt restructuring completed

The government of Ghana has successfully negotiated an

agreement in principle on the terms of debt restructuring

with Eurobond investors involving approximately US$13

billion of debt.

The deal is the latest sovereign debt restructuring launched

under a G20-approved ‘common framework’ after the

process suffered many delays. The IMF described the

agreement as "a significant positive step" for Ghana. The

committee representing its international bondholders said

it would give the country a path to economic recovery.

The agreement means the IMF board is expected to

approve the next US$360 million tranche of Ghana's US$3

billion support programme.

See:

https://www.ghanaweb.com/GhanaHomePage/business/Ghana-

secures-debt-restructuring-agreement-with-Eurobond-holders-

investors-to-take-37-haircut-1936995

Increase in foreign investment

The Ghana Investment Promotion Centre (GIPC) has

reported a 16% increase in foreign investment for the first

quarter of 2024 totalling US$123.06 million. This marks a

significant rise from the US$106.02 million recorded in

the same period last year.

3. MALAYSIA

Achieving net zero requires a collaborative effort - PM

Malaysian Prime Minister, Anwar Ibrahim, has said

achieving net zero requires a collective effort and a shift in

mindset because adopting environmental, social and

governance (ESG) practices requires more than just

regulatory compliance.

He said it is crucial to recognise that achieving net zero

requires a collaborative effort involving the government,

the private sector and all Malaysians. Anwar urged all

stakeholders, including businesses, civil society and

individuals to actively participate in achieving a

sustainable and secure future for the next generation.

He added, Malaysia has taken a progressive stance

towards decarbonisation and the larger sustainability

agenda and the government has implemented policies

aimed at reducing carbon emissions, promoting social

equity, creating new growth opportunities in the green

economy and ensuring transparent governance.

See:

https://www.thestar.com.my/news/nation/2024/06/22/anwar-

urges-collaboration-for-net-zero-

goals#:~:text=KUALA%20LUMPUR%3A%20Achieving%20ne

t%20zero,says%20Datuk%20Seri%20Anwar%20Ibrahim

Challenging prospects in international furniture market

The outlook for the furniture industry in Malaysia remains

challenging with, it appears, few opportunities to increase

exports in the second half of the year.

Analysts suggest the main reason for the stagnant trade in

furniture exports lies in Malaysia’s largest export

destination, the United States. Existing home sales in the

United States fell to the lowest levels in 13 years in

October 2023 as high mortgage rates and lack of homes

for sale drove buyers from the market. In addition, home

re-sales, which account for a significant part of housing

sales, were 15% lower year-on-year in October 2023.

The weak housing market in the US contributed to the

slump in furniture exports, in particular, wooden furniture

exports. Most wooden furniture manufacturers in

Malaysia export their products to the US. Demand in the

ASEAN market is being affected by rising inflationary

pressure which means consumers tend to defer spending

on non-essential such as furniture.

See:https://www.thestar.com.my/business/business-

news/2024/06/15/local-furniture-export-outlook-hinges-on-us-

housing-

market#:~:text=THE%20outlook%20for%20the%20furniture,86

bil%20in%202022.

Rekindling discussions on a Malaysia-EU FTA

The European Union (EU) and Malaysia need to assess

global trends over the last decade before resuming the free

trade agreement (FTA) talks according to media reports of

statements by Timo Goosmann, Deputy Head of the

Delegation of European Union to Malaysia.

In 2010 a FTA was signed by the two parties but was put

on hold after eight rounds of negotiations at Malaysia’s

request. In March this year, Prime Minister Anwar

Ibrahim said the time is now “ripe” for Malaysia to

rekindle discussions on a Malaysia-EU FTA.

Goosmann reportedly said “I am very optimistic that if we

find a way to agree on the conditions to start these

negotiations then we can possibly find a good way on how

to agree on a meaningful FTA that creates opportunities

and prosperity for both sides”.

See: https://www.thestar.com.my/business/business-

news/2024/06/25/malaysia-and-eu-should-evaluate-changes-

before-resuming-fta-

talks#:~:text=PETALING%20JAYA%3A%20The%20European

%20Union,Malaysia%20deputy%20head%20Timo%20Goosmann

Sabah TLAS to be updated

Sabah’s timber industry is to update its sustainability

procedures to match with the requirements set out in the

EUDR. This comes after the Sabah Forestry Department

and the European Union officially launched a partnership

to update the Sabah Timber Legality Assurance System

(TLAS) to improve competitiveness and to enhance

environmental governance.

Over the past decade the Sabah TLAS has played a pivotal

role in gaining international acceptance in key timber trade

markets including Europe, Australia, the United States,

Japan and South Korea.

The TLAS updating exercise will involve alignment of the

Sabah TLAS with the European Union Deforestation

Regulation (EUDR). In addition to EUDR the Sabah

TLAS will also align with the EU Corporate Sustainability

Due Diligence Directive (CS3D).

The updating exercise will involve a series of

consultations and workshops with government agencies of

the Implementing Agencies Coordination Committee

(IACC), the Sabah Timber Industries Association (STIA),

the Timber Association of Sabah (TAS) and timber

companies.

See: https://www.theborneopost.com/2024/06/19/sabah-forestry-

eu-launch-groundbreaking-

partnership/#:~:text=KOTA%20KINABALU%20(June%2019)%

3A,Legality%20Assurance%20System%20(TLAS)%20to

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Malaysia.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240620/1718839024156844.pdf

4.

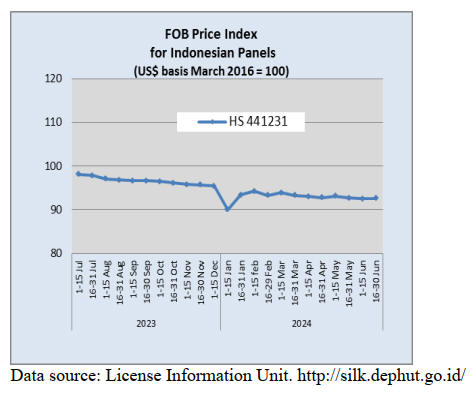

INDONESIA

Furniture contracts at Dubai expo

Indonesian furniture products worth US$6.11 million were

sold during the INDEX exhibition in Dubai according to

the Ministry of Trade. The ministry's director of export

development for manufactured products, Dewi Rokhayati,

said that Indonesian furniture products are popular in the

Middle East and Africa.

The products that were in demand included console tables,

chairs and stools made of wood and rattan, rattan baskets,

wall decorations, wooden outdoor furniture, decorative

accessories and kitchen items.

According to the Head of the Indonesian Trade Promotion

Center in Dubai, Widy Haryono, opportunities for

Indonesian furniture exports to the UAE can be increased.

Indonesia's participation in INDEX 2024 was an effort to

take advantage of the Indonesia-UAE CEPA trade

agreement and utilise Dubai as a hub for trade in the

region.

See: https://en.tempo.co/read/1879331/indonesian-furniture-

gains-us6-11mn-transactions-at-dubais-index-2024

Sustainable development of Cirebon's rattan sector

Enggartiasto Lukita, former Minister of Trade (2016-

2019) and Executive Chairman of B-Universe is

advocating the preservation and development of the rattan

craft industry in Cirebon. During his visit to a rattan

craftsmen and processing industry exhibition Enggar

emphasised the importance of maintaining and expanding

this traditional industry.

The rattan craft industry faced challenges when artisans

were asked to stop exporting raw rattan, a ban stipulated in

Minister of Trade Regulation No. 22 of 2023 regarding

Prohibited Export Goods.

Despite the dent to businesses Enggar noted that rattan

products from Cirebon are highly sought after in the

international market. Furthermore, Enggar emphasised that

design for comfort is a key aspect that must be addressed

in rattan products.

See: https://jakartaglobe.id/business/enggartiasto-lukita-urges-

sustainable-development-of-cirebons-rattan-sector

SFM - the foundation for achieving FOLU Net Sink 2030

Indonesia is leveraging its strong foundation in sustainable

forest management to meet its greenhouse gas (GHG)

emission reduction targets in the Forestry and Other Land

Use (FOLU) sector. This strategy was emphasised by

Agus Justianto, Chairman of Indonesia’s FOLU Net Sink

2030 Working Team from the Ministry of Environment

and Forestry (KLHK).

Agus detailed the implementation of sustainable forest

management, including strengthening Forest Management

Units (KPH) at the local level. The social forestry policy,

which has allocated 12.7 million hectares of forest land for

community management, also supports sustainable forest

management.

Agus highlighted the significant role of Forest Utilisation

Business Permits (PBPH) in achieving the FOLU Net Sink

target. PBPH is directed to implement the Multi-Business

Forestry (MUK) Model enabling business diversification

beyond timber to include energy plantations, ecotourism,

agroforestry, non-timber product utilisation, carbon

trading and environmental services.

See: https://agroindonesia.co.id/targetkan-folu-net-sink-

indonesia-punya-modal-kuat-pengelolaan-hutan-lestari/

Attracting investment in multi-business forestry

Multi-business Forestry (MUK) in Forest Management

Units (PBPH), as a green investment, appears attractive to

investors.

A total of 111 companies holding PBPH have been

registered to implement MUK with 75 units having

received approval from the Minister of Environment and

Forestry and 36 units are in the approval process.

Agus Julianto, the Vice Chairman of Indonesia's FOLU

Net Sink 2030 Working Team at the Ministry of

Environment and Forestry, explained by implementing

Multi-Business Forestry (PBPH) can diversify its business.

PBPH not only focuses on logging but can also develop

various other businesses such as energy plantation forests,

ecotourism, agroforestry and non-timber products

utilisation.

Implementing Multi-Business Forestry also opens up

opportunities for PBPH to enter the carbon trading and

environmental services businesses to obtain financial

incentives from forest conservation activities,

contributions to climate change mitigation and increased

environmental awareness. Agus said that MUK is a form

of green investment. He encouraged investors and

financial institutions to support green investment policies

by allocating funds and resources to sustainable projects.

See: https://agroindonesia.co.id/investasi-hijau-multi-usaha-

kehutanan-makin-diminati-investor-dukung-pencapaian-folu-net-

sink/

In related news, Indonesia has built several large-scale

nurseries to support forest, land and mangrove

rehabilitation activities as well as peat restoration. Large-

scale nurseries have been built in several places such as

Rumpin including in the National Capital of Nusantara

(IKN), said the Vice Chairman of Indonesia's FOLU Net

Sink 2030 Working Team, Agus Justianto.

According to Agus through establishing large-scale

nurseries the government is opening up opportunities for

private entities to contribute through Government

Cooperation with Business Entities (KPBU) or Public

Private Partnership (PPP) schemes.

See: https://forestinsights.id/akselerasi-folu-net-sink-indonesia-

siapkan-persemaian-bibit-skala-besar-untuk-rehabilitasi-lahan/

Communities have important role in productive forest management

Communities are important in productive and sustainable

forest management says the Secretary General of the

Ministry of Environment and Forestry (KLHK), Bambang

Hendroyono.

With the issuance of Law Number 6 of 2023, forest

management practices reflect the efforts to achieve

balance. This policy was strengthened by the issuance of

Presidential Regulation Number 28 of 2023 concerning

Integrated Planning for the Acceleration of Social Forestry

Management.

Bambang said communities were given the right to

manage forest areas in the same way as the permits given

to the private sector.

The community is provided with business development

facilitation, capital and assistance in managing forest areas

for welfare and sustainability.

See: https://www.rri.co.id/nasional/763056/klhk-masyarakat-

aktor-penting-dalam-pengelolaan-hutan-produktif

Increasing Gen-Z involvement in social forestry

The Ministry of Environment and Forestry (KLHK) is

supporting efforts to increase the involvement of youth,

including Generation Z, in various aspects of social

forestry. During an online event, Mahfudz, Director

General of Social Forestry and Environmental Partnership

(PSKL) at the ministry invited the younger generation to

get involved in social forestry schemes.

The young generation can act as assistants or young

entrepreneurs who can create new jobs and bigger

businesses. They can also help with the marketing and

development of forest products from social forestry

business groups.

See: https://en.antaranews.com/news/316629/support-increasing-

gen-z-involvement-in-social-forestry-ministry

Social forestry business transactions exceed target

The business value created by of social forestry business

groups that manage social forestry reached IDR1.13

trillion in 2023 according to the Minister of Environment

and Forestry (LHK), Siti Nurbaya Bakar, who added this

exceeded the target set at IDR1 trillion. "In 2024, the

economic value target will be increased to IDR 1.5

trillion," said Siti in the online Workshop of Social

Forestry Synergy.

Siti added that economic improvement of the communities

that manage social forestry also impacts the villages and

the region. Studies show the impact of social forestry on

various aspects such as increasing income, employment

and land cover.

Director General of Social Forestry and Environmental

Partnerships in the Ministry of Environment and Forestry,

Mahfudz, said there are five main commodities in social

forest management coffee, honey, sugar palm, eucalyptus

and other food crops.

See: https://swa.co.id/read/447875/pacu-ekonomi-desa-target-

nilai-ekonomi-di-program-perhutanan-sosial-di-2024-senilai-

rp15-triliun

and

https://www.beritasatu.com/nasional/2823774/perhutanan-sosial-

miliki-nilai-transaksi-ekonomi-rp-113-triliun

Need for increased awareness on monetisation carbon trading

The Financial Services Authority recorded transaction

values on the Indonesia Stock Exchange (IDX) for Carbon

to be IDR36.77 billion. "As of 31 May 2024, 62 users

obtained permits with a total volume of 608,000 tonnes of

CO2 and the accumulated transaction value was IDR36.77

billion according to Inarno Djajadi, the Chief Executive of

Capital Market Supervision, Derivative Finance and the

OJK Carbon Exchange, in Jakarta yesterday.

However, the transaction value on the carbon exchange

tends to be minimal.

For comparison, as of 30 April 2024 the transaction value

on the carbon exchange was IDR 35.31 billion, with a total

of 57 users. This indicates that during the period April to

May transactions on the carbon exchange only increased

by IDR 1.46 billion with the number of users increasing by

five users.

The Ministry of Finance revealed the reason for the lack of

interest in the carbon exchange. Boby Wahyu Hernawan,

the Head of the Center for Climate Change and

Multilateral Financing Policy at BKF, stated that the low

level of transactions over the past eight months reflected

the public's inadequate awareness of climate change. He

emphasised the need for increased awareness of the

economic value of carbon and the potential for

monetisation and trading.

See: https://www.neraca.co.id/article/200264/transaksi-bursa-

karbon-capai-rp3677-miliar

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240620/1718839024156844.pdf

5.

MYANMAR

Record low timber exports

Myanmar reported US$67.855 million from timber exports

for the 2023-24 Financial Year (April 2023 to March

2024). This was the lowest level for the last two decades.

The Myanma Timber Enterprise (MTE) put about 3,000

tons of teak logs and about 2,000 tons of sawn and hewn

teak for tender in the second half of the 2023-2024

Financial Year. The result of tender was not announced.

According to exporters they are not expecting any quick

revival of the timber trade as long as external financial

sanctions on the MTE remain.

More labour recruits for Japan

The Myanmar Embassy in Japan said more than 380 Japan

companies will provide jobs for over 1,300 Myanmar

workers. According to the embassy Japanese companies

will recruit up to 560 Myanmar male workers and up to

760 Myanmar female workers. The Myanmar Embassy

has determined

See - https://www.gnlm.com.mm/japan-to-recruit-up-to-1300-

myanmar-workers/

Negative consequences of weak local currency

The Authorities have attempted to control retail rice prices

by arresting merchants. The crackdown led Yangon’s

largest rice wholesale market to effectively shut down

after the arrests were reported.

The Ministry of Information confirmed interrogation of

Myanmar Rice Federation members including its

chairperson for allegedly setting prices. Despite efforts to

cap prices, market rates remain higher than the official

price. Previous attempts by the authorities to control rice

prices resulted in market turmoil and current efforts face

skepticism from businesses.

See - https://www.irrawaddy.com/business/myanmars-generals-

take-another-shot-at-market-prices-and-hit-consumers.html

Conditions for a fair election - UN

The UN Secretary-General António Guterres on

Monday called for Member States to urge the military

leadership in Myanmar to respect the will and needs of its

own people as risks to regional stability grow.

Drawing attention to the military’s stated intention to hold

elections he highlighted intensifying aerial bombardment

and burning of civilian houses, along with ongoing arrests,

intimidation and harassment of political leaders, civil

society actors and journalists.

He said without conditions permitting the people of

Myanmar to freely exercise their political rights, “the

proposed polls risk exacerbating instability.”

See: https://news.un.org/en/story/2023/01/1133002

In related news, according to an independent UN human

rights report foreign banks are allegedly helping

Myanmar’s military acquire weapons and military

supplies, facilitating a “campaign of violence and

brutality” as the civil war continues

See: https://www.ohchr.org/

Suspicions traders seeking alternative routes for teak

exports

An EIA study suggests EU and US traders are seeking

alternative routes to acquire Myanmar teak from

merchants who provide falsified origin papers. This claim

is in a recent EIA report. The EIA says “according to

Eurostat, the EU’s statistical office, between June 2021

and December 2023, the EU imported more than Eur34

million worth of teak directly from Myanmar.

Notably, total teak imports from Myanmar into the EU

decreased from around Eur23.5 million in 2022 to just

over Eur3.8 million in 2023. While this is a positive

decrease in the trade this figure should be at zero.

And does this tailing off of direct trade mean demand for

teak has decreased? It is unlikely. EIA strongly believes

that Burmese teak is being shipped into EU and US

markets via other countries by traders who disguise the

wood’s true origin to circumvent sanctions”.

See: https://eia-international.org/blog/how-come-the-eu-and-us-

are-still-importing-blood-timber-from-myanmar-when-they-

introduced-sanctions-to-prevent-it/

sites/default/files/documents/hrbodies/hrcouncil/sessions-

regular/session56/a-hrc-56-crp-7.pdf

6.

INDIA

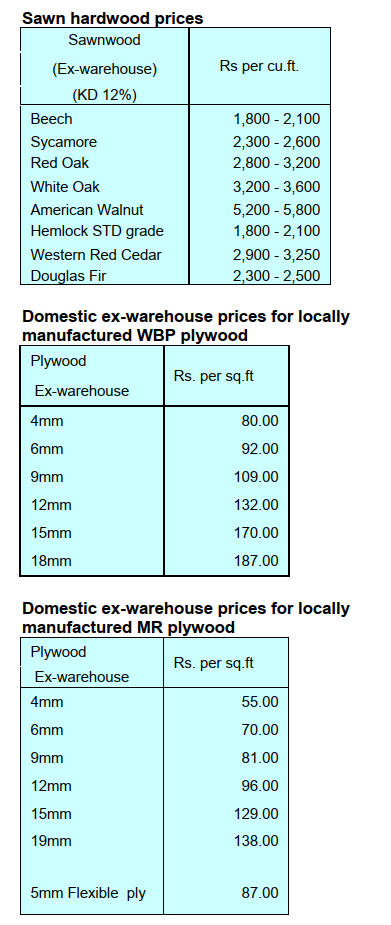

Plywood prices set to rise

A media release from Haryana Manufacturers Association

and an article in Plyreporter says that, because of the rising

prices for wood raw material, plywood prices must be

raised. Log prices are reported to be at an all time high in

Northern India with poplar and eucalyptus prices around

Rs.1800 (US$21.50) per quintal and Rs.1300 (US$14.50)

per quintal respectively.

The Plywood Manufacturers Association in Punjab State

decided members should increase prices of plywood by

5% with immediate effect. Members of Bihar State

Plywood Manufacturers Welfare Association also decided

to increase prices of plywood by 5%.

The Bangalore Plywood Manufacturers Association issued

a statement saying that the increase in production costs has

had a significant impact on industry making it difficult for

them to maintain the current pricing structure.

After consultation with the Kerala Plywood Association

the Kannur Plywood Association and Karnataka Plywood

Association decided that it is necessary to implement a

price increase. In effect it can be cocluded that there has

been a nationwide increase in plywood prices.

Source: media release from Haryana Manufacturers Association

and Plyreporter

See: https://www.plyreporter.com/article/153841/plywood-

associations-advise-a-price-hike-of-5-due-to-high-timber-cost

Demand for office space at a historical high

Cushman and Wakefield have released a report ‘India

Office Outlook 2024’ saying “2024 is likely to be a

significant year for India’s office market marked with

accelerated growth and renewed optimism. With domestic

office demand reaching a historical high of 74.7 mil. sq.ft

surpassing the previous record set in 2022 followed by

limited supply in core markets 2024 is the right year to

invest in tier 2 cities”.

A recent survey conducted by furniture & design

technology magazine of around 70 furniture and outfitting

firms and 135 architects and design firms concluded there

growth in the office market will be positive news for

quality and premium grade panel producers.

Plyreporter says “This change is resulting into growing

demand for high quality and better designed pre-laminated

boards and surfaces compared to what it was earlier. The

facts indicate a growth of 30% rise in quality prelam

particleboard consumption compared to 2020”.

See: https://www.cushmanwakefield.com/en/india/insights/india-

office-outlook

and

https://www.plyreporter.com/article/153914/particle-board-

market-expected-to-look-up-following-growing-office-space-

demand

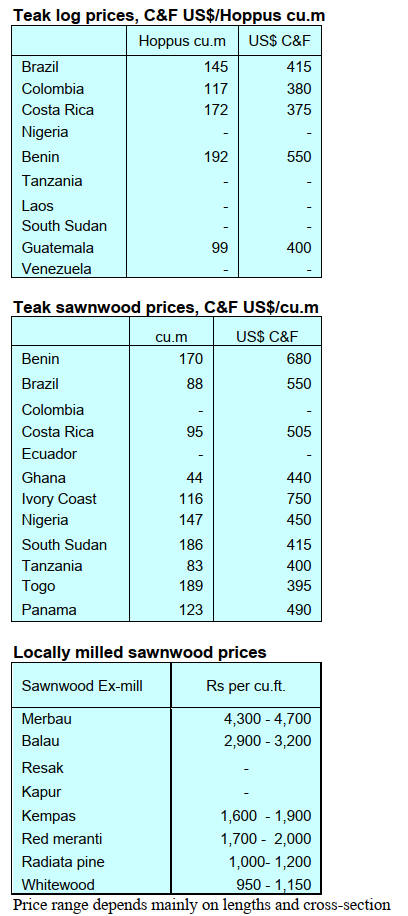

Cost C&F Indian ports in US dollars, Hoppus measure

7.

VIETNAM

Wood and wood products (W&WP) trade

highlights

According to Vietnam Office of Customs data W&WP

exports to the EU in May 2024 reached US$42 million, up

45% compared to May 2023. In the first 5 months of 2024

W&WP exports to the EU totalled US$247.3 million, up

37% over the same period in 2023.

Vietnam’s woodchip exports in May 2024 were valued at

US$224 million, down 8% compared to April 2024 but up

67% compared to May 2023. In the first 5 months of 2024,

woodchip exports contributed US$1.08 billion, up 30%

over the same period in 2023.

Vietnam's pine imports in May 2024 were 75,500 cu.m

worth US$17.0 million, up 7% in volume and 7% in value

compared to April 2024.

Compared to May 2023, imports increased by 11% in

volume and 22% in value. In the first 5 months of 2024

pine imports were 302,900 cu.m, worth US$66.1 million,

up 44% in volume and 45% in value over the same period

in 2023.

Imports of raw wood (logs and sawnwood) from the US in

May 2024 amounted to 55,000 cu.m with a value of

US$24.0 million, up 7% in volume and 10% in value

compared to April 2024 bringing the total amount of raw

wood imported from the US in the first 5 months of 2024

to 249,290 cu.m with the value of US$107.29 million, up

15% in both volume and value over the same period in

2023.

In the first 5 months of 2024 W&WP exports earned

US$6.2 billion, up 24% over the same period in 2023 of

which the share of WP exports was US$4.2 billion, up

24% over the same period in 2023.

Vietnam's office furniture exports in May 2024 earned

US$25.7 million, up 18% compared to May 2023. In the

first 5 months of 2024 office furniture exports reached

US$117.6 million, up 11% over the same period in 2023.

Vietnam’s W&WP imports in May 2024 were valued at

US$247.8 million, up 6% compared to April 2024 and up

15% compared to May 2023. In the first 5 months of 2024

W&WP imports were valued at US$1.02 billion, up 20%

over the same period in 2023.

Vietnam's poplar imports in May 2024 were estimated at

29,500 cu.m worth US$11.1 million, up 7% in volume and

6% in value compared to April 2024. However, compared

to May 2023, imports dropped by 4% in volume and 21%

in value. In the first 5 months of 2024, poplar log and

sawnwood imports amounted to 132,200 cu.m, worth

US$49.4 million, up 19% in volume and 4% in value over

the same period in 2023.

Vietnam’s imports of logs and sawnwood from China in

May 2024 were reported at 92,000 cu.m with a value of

US$36.0 million, up 3% in volume and 1% in value

compared to April 2024 bringing the total imported from

China in the first 5 months of 2024 to 346,510 cu.m with a

value of US$134.99 million, up 71% in volume and 38%

in value over the same period in 2023.

Vietnam’s imports from the US increasing

According to statistics from Vietnam Customs imports of

raw wood (logs and sawnwood) from the US in April 2024

were 51,480 cu. m with a value of US$21.89 million,

down 25% in volume and 26% in value compared to

March 2024 but up 20% in volume and 13% in value over

the same period in 2023. In the first 4 months of 2024

imports of raw wood from the US reached 194,290 cu.m,

with a value of US$83.295 million, up 32% in volume and

28% in value over the same period in 2023.

In May 2024 Vietnam imported 55,000 cu.m of logs and

sawnwood with a value of US$4.0 million, up 7% in

volume and 10% in value compared to April 2024 bringing

the total amount of logs and sawnwood imported from the

US in the first 5 months of 2024 to 249,290 cu.m with a

value of US$107.29 million, up 15% year-on-year.

The increased imports of logs and sawnwood reflected the

recovery of W&WP consumption in major markets

especially the US, Japan, China, South Korea and the EU.

Wood raw material imports by category

Sawnwood imports

In April 2024 Vietnam imported 33,800 cu.m of

sawnwood from the US with a value of US$15.52 million,

down 23% in volume and down 28% in value compared to

March 2024 but up 17% in volume and 9% in value over

the same period in 2023. In the first 4 months of 2024

sawnwood imports from the US amounted to 125,150

cu.m, with a value of US$59.45 million, up 33% in

volume and 29% in value over the same period in 2023.

The average price of imported sawnwood in April 2024

was US$459/cu.m, down 6% compared to March 2024 and

down 7% over the same period in 2023. In the first 4

months of 2024 the average price of sawnwood from the

US stood at US$475/cu.m down 3% over the same period

in 2023. The price of imported poplar decreased by 8%,

ash decreased by 5%, maple decreased by 24% while oak

prices increased by 8% and walnut increased by 2%.

In April 2024 imports of poplar, oak, walnut and pecan

sawnwood decreased compared to March 2024. In

contrast, imports of sawn alder increased by 69% in

volume and 61% in value. Compared to the same period in

2023, imports of most sawnwood species from the US

decreased.

In the first 4 months of 2024 imports of many types of

sawnwood increased against the same period in 2023 for

example poplar imports increased by 23% in volume and

13% in value; oak increased by 29% and 40% respectively.

Alder import volumes and value increased by 129% and

118% respectively; maple increased by 94% and 48%

respectively. In contrast, walnut imports decreased slightly

by 5% in volume and by 3% in value.

Log imports

Imports of logs from the US in April 2024 reached 17,670

cu. m with a value of US$6.37 million, down 28% in

volume and 22% in value compared to March 2024 but up

27% in volume and 23% in value over the same period in

2023. In the first 4 months of 2024 log imports from the

US reached 69,120 cu. m with a value of US$23.7 million,

up 31% in volume and 27% in value over the same period

in 2023.

The mean price of logs imported from the US to Vietnam

in April 2024 was US$360/cu.m, up 8% compared to

March 2024 but down 3% year-on-year. In the first 4

months of 2024 the average price of logs imported from

the US was US$343/cu.m, down 3% over the same period

in 2023. The price of imported pine decreased by 9%, oak

decreased by 1%, walnut decreased by 21% and poplar

decreased by 33%.

In April 2024 imports of both pine and oak, the main

timbers imported from the US to Vietnam decreased

sharply compared to March 2024. Pine imports decreased

by 45% in volume and by 43% in value while oak log

imports decreased by 30% in volume and by 32% in value.

In contrast, walnut log imports increased 21% in volume

and 8% in value.

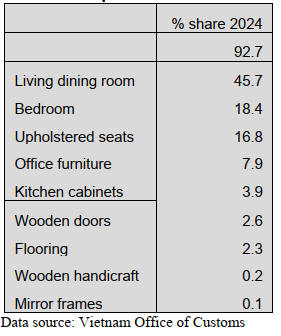

Wooden furniture dominates Vietnam’s exports to UK

Exports of wood and wood products to the UK in May

2024 earned US$16.5 million, up 5% compared to May

2023. In the first 5 months of 2024 W&WP exports to the

UK were valued at US$89.7 million, up 18% over the

same period in 2023.

In the first 4 months of 2024 wooden furniture exports to

the UK recorded positive growth, earning US$68 million,

up 24% over the same period in 2023 .

Over 90% of exports to the UK are of wooden furniture.

The majority of wooden furniture exports are doing well in

the UK except for kitchen furniture. In particular, wooden

doors exported to the UK in the first 4 months of 2024

surged by 30% over the same period in 2023.

The UK, with the population of 68 million, is seen as a big

market for wooden furniture made in Vietnam. With the

UKVFTA (UK-Vietnam Free Trade Agreement) and

CPTPP (Comprehensive snd Progressive Trans-Pacific

Partnership Agreement) in place Vietnamese operators

benefit fromreferential tariffs when shipping to the UK.

In addition, the UK’s recent recognition of Vietnam as a

market economy further favors Vietnamese exporters by

easing trade remedies that may be imposed on W&WPs

exported from Vietnam to UK.

Added value wood product exports to the UK, percent

share Jan-Apr 2024

Vietnam plans to establish 238,000 hectares of forest

annually

The Saigon Times has reported Vietnam’s national plan

includes planting 238,000 ha of forest annually with the

aim of increasing the national forest cover at between 42

to 43%. This goal is outlined in the draft National Forestry

Planning for the 2021-2030 period, with a vision toward

2050.

According to the draft, the total forest and forestry land

area will be 15.85 million hectares divided into special-use

forests (15.5%), protection forests (33%) and production

forests (51.5%).The plan emphasises improving forest

quality, especially natural forests.

The forestry sector aims for an average annual growth rate

of 5% to 5.5% in added value from forestry production.

Vietnam also aims to increase the export value of wood

and forest products to US$20 billion by 2025 and US$25

billion by 2030. Domestic consumption is projected to

reach US$5 billion by 2025 and US$6 billion by 2030.

Revenue from forest environmental services is expected to

grow 5% annually, reaching VND3.5 trillion per year in

2021-2025 and VND4 trillion in 2026-2030.

The Ministry of Agriculture and Rural Development

estimates the total investment needed for the plan at

VND217.3 trillion, with nearly VND107 trillion required

for the 2021-2025 period.

The national forestry planning is one of four sectoral plans

prepared by the Ministry of Agriculture and Rural

Development.

See: https://english.thesaigontimes.vn/vietnam-wants-to-plant-

238000-hectares-of-forest-annually/

8. BRAZIL

Mato Grosso promotes event on forest management

The state of Mato Grosso held the 5th event on forest

management 20-21 June in Alta Floresta municipality in

the north of the State in the Amazon Region. The event

was organised by the Center of Timber Producing and

Exporting Industries of the State of Mato Grosso (CIPEM)

with support of the National Forum of Forest-Based

Activities (FNBF) and the Mato Grosso State Secretariat

for Economic Development (SEDEC).

The event aimed to promote the sustainable use of native

timber species. During the event participants visited forest

management areas to learn about the techniques used for

the conservation of native vegetation and the process of

harvesting and transporting trees in accordance with

environmental legislation. The visit concluded with

examination of industrial manufacture of sawnwood,

decking and wood panels.

Entrepreneurs and representatives of various institutions

such as the Brazilian Trade and Investment Promotion

Agency (ApexBrasil), the Brazilian Institute of

Environment and Renewable Natural Resources

(IBAMA), the National Environment Council

(CONAMA) and the government of Mato Grosso attended

the event.

The state of Mato Grosso currently has 5.2 million

hectares of forest under management areas with the

potential to expand to 6 million hectares. These forests are

sustainably managed and are contributing to carbon

absorption to aid mitigation of the effects of climate

change.

See: https://cipem.org.br/noticias/mato-grosso-promove-evento-

sobre-gestao-florestal

CO2 capture through commercial reforestation

Brazil is emphasising the importance of commercial

reforestation in its environmental planning for 2024 and

has launched three initiatives for the forestry sector.

Changes in legislation now favour forest plantations which

sequester carbon dioxide and when harvested reduce

pressure on natural forests.

According to a study conducted by the Totum Institute and

the Luiz de Queiroz College of Agriculture (ESALQ) a

tree in the Atlantic Forest can capture about 163.14 kg of

CO2 in its first 20 years contributing to the reduction of

greenhouse gases. In 2024 the National Plan for the

Development of Planted Forests was updated with

adjustments to strategies aimed at contributing to the

development of the planted forest chain in the country.

According to the National Plan Brazil has 10 million

hectares of planted forests with 6 million hectares of

protected area (4.75 million hectares of Legal Reserve

areas (LR) and 1.89 million hectares of Permanent

Preservation Areas (PPA).

The Government’s plan is part of a broad strategy to

reduce atmospheric greenhouse gas and is a contribution

to Brazil's Nationally Determined Contribution target of a

43% emissions reduction by 2030.

The activity is part of the Sectoral Plan for Mitigation and

Adaptation to Climate Change for the Consolidation of a

Low Carbon Emission Economy in Agriculture (ABC+

Plan) of the Ministry of Agriculture and Livestock, which

proposes the following programmes: Recovery of

Degraded Pastures; Crop-Livestock-Forest Integration and

Agroforestry Systems; Direct Planting System and

Biological Nitrogen Fixation.

Recently, forestry was deemed a non-polluting activity by

the Federal Government simplifying environmental

licensing and eliminating the need to pay environmental

fees for commercial forest planting.

See:

https://cartaodevisita.com.br/conteudo/50703/reflorestamento-

comercial-reduz-co2-e-ganha-destaque-no-planejamento-

ambiental-brasileiro

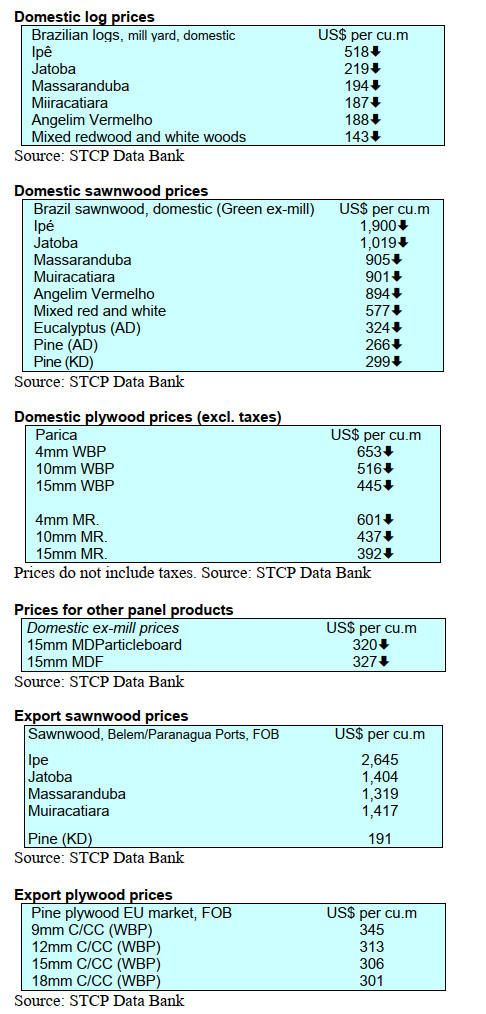

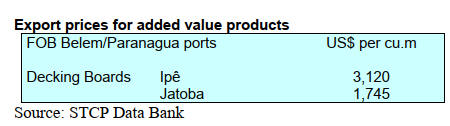

Export update

In May 2024 the Brazilian exports of wood-based products

(except pulp and paper) increased 2.7% in value compared

to May 2023, from US$328.3 million to US$337.0

million.

Pine sawnwood exports decreased 14% in value between

May 2023 (US$74.5 million) and April 2024 (US$64.1

million). In volume terms exports decreased 11% over the

same period, from 306,300 cu.m to 271,300 cu.m.

Tropical sawnwood exports decreased 18 % in volume,

from 29,000 cu.m in May 2023 to 23,900 cu.m in May

2024. In value, exports decreased 36 % from US$14.9

million to US$9.6 million, over the same period.

As for tropical plywood, exports increased in volume by

9% and in value by 11%, from 3,200 cu.m and US$1.9

million in May 2023 to 3,500 cu.m and US$2.1 million in

May 2024, respectively.

As for wooden furniture the exported value increased from

US$52.1 million in May 2023 to US$54.6 million in May

2024, an increase 5% during the period.

Opportunities in the Indian furniture market

In the search for new trade partnerships, India, with its

robust economy and vast population, emerged as a

promising market for Brazilian furniture. This was the

conclusion of a recent report "Study of Opportunities for

the Brazilian Exporters of Furniture and Mattresses –

Target Country: India," developed by IEMI. This says

demand for furniture in the country has increased

significantly with domestic consumption reaching

approximately US$21.7 billion in 2022, a growth of 28%

since 2018. Imports also show a post-pandemic recovery

with an increase of 7% in 2022 compared to 2021.

Despite an 8% growth in Brazilian exports to India

between 2006 and 2022 there has been a sharp decline in

recent years. However, the IEMI study suggests a large

untapped potential, especially for high-end and higher

value-added products such as wooden furniture which

accounted for 87.9% of Brazilian exports in 2022.

Initiatives such as the Prospective Mission, suggested by

the Brazilian Furniture Project, aim to expand the presence

of Brazilian furniture in India taking advantage of the

tariff reduction provided by the Mercosur-India

agreement. It was concluded that Brazilian industries have

a strategic opportunity to diversify their export markets

and capture a significant share of Indian demand

promoting internationalisation and the recognition of

Brazilian quality and design.

See: https://abimovel.com/com-foco-na-maior-populacao-do-

mundo-estudo-do-brazilian-furniture-elenca-oportunidades-para-

as-industrias-brasileiras-de-moveis-e-colchoes-no-mercado-

indiano/

Future of the timber industry in Brazil

During a recent WoodFlow podcast forestry and timber

industry experts discussed the need for the creation of a

national agenda for the timber production chain

highlighting the importance of a sustainable management

plan that encompasses the entire production chain from the

forest to the final product. The discussion also covered

topics such as the performance of timber exports, the

quality of Brazilian forests and changes in legislation that

removed forestry from the list of potentially polluting

activities and States such as Paraná and Santa Catarina

which faced port problems beginning at the end of last

year.

The companies needed to adjust their exports, mainly due

to the reduced cargo handling capacity of the main ports.

As a result, the companies had to reroute their shipments

to other terminals, which caused product backlogs.

With the recent legislative change it is expected that

forestry in Brazil will benefit from less bureaucracy and

lower costs thus boosting timber production in a

sustainable and competitive manner.

See: https://www.madeiratotal.com.br/brasil-o-futuro-da-

industria-da-madeira/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Brazil.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240620/1718839024156844.pdf

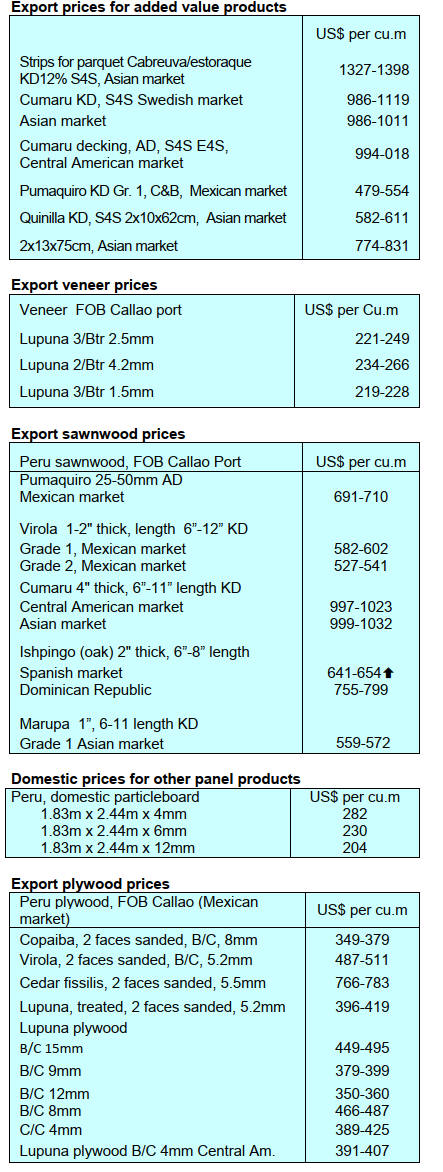

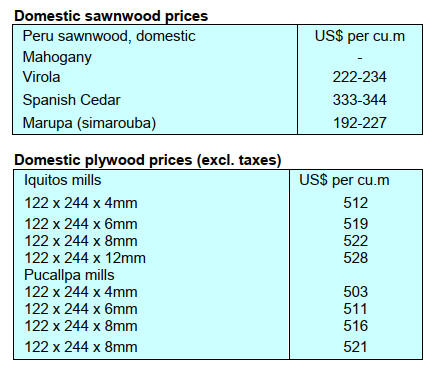

9. PERU

Veneer and plywood exports see major decline

The Association of Exporters (ADEX) has reported

shipments of veneers and plywood in the first quarter of

2024 were valued at US$195,000 a contraction of a

massive 69% compared to the same period of 2023 when

they reached US$638,000.

The main market for veneer and plywood in the first

quarter was Mexico and it was the steep drop in orders in

this market that caused the overall decline in export

earnings. The second ranked market in terms of the value

of exports was Chile and for this market there was a 17%

decline in demand.

According to figures from the ADEX Data Trade

Commercial Intelligence System the other countries that

imported veneer and plywood from Peru dropped out of

the market in the first quarter of 2024.

Activities to raise productivity and improve

sustainability

The National Forestry and Wildlife Service (SERFOR)

and its Sustainable Productive Forests (BPS) programme

announced that in the second half of this year two projects

with high environmental, economic and social impacts

will be implemented in the Amazon Department. This was

announced during a Regional Forum ‘Ucayali:

Perspectives for a Prosperous and Sustainable Region’

organised by the Ucayali Regional Environmental

Authority within the framework of Environmental Week

2024.

The head of the Forest Project of SERFOR's BPS

programme reported that incentives will be targeted at

different users (indigenous communities, concessionaires,

organised producers and SMEs) in order to stimulate co-

finance for projects that increase production and

productivity for timber and non-timber products as well as

ecosystem services.

The Forests Project will provide technical assistance to

improve access to forest resources and thus increase the

area of sustainably managed forests.

Activities will focus on primary transformation and added

value production.

See: https://www.gob.pe/institucion/serfor/noticias/972354

ucayali-serfor-implementara-proyectos-para-poderar

producttividad-y-sostenibilidad-de-los-bosques

National Convention for Timber industrialists

The Association of Forestry Producers of Ucayali

(APROFU), the Chamber of Commerce of Ucayali and

CONAFOR (National Forestry Confederation of Peru)

together with Tropical Forest is organising the first

National Convention of Timber Industrialists set for 21

and 22 August in Pucallpa.

The themes of the convention are; role of the state as a

facilitator of the development of the forestry/timber sector,

development proposals for the forestry industry in Peru,

financing mechanisms for innovation in the forest industry

and panorama of national and international trade in the

wood sector

It should be noted that within the framework of the

Convention the new Forestry Agreement, which has

attracted much criticism, will be signed.

|