|

1.

CENTRAL AND WEST AFRICA

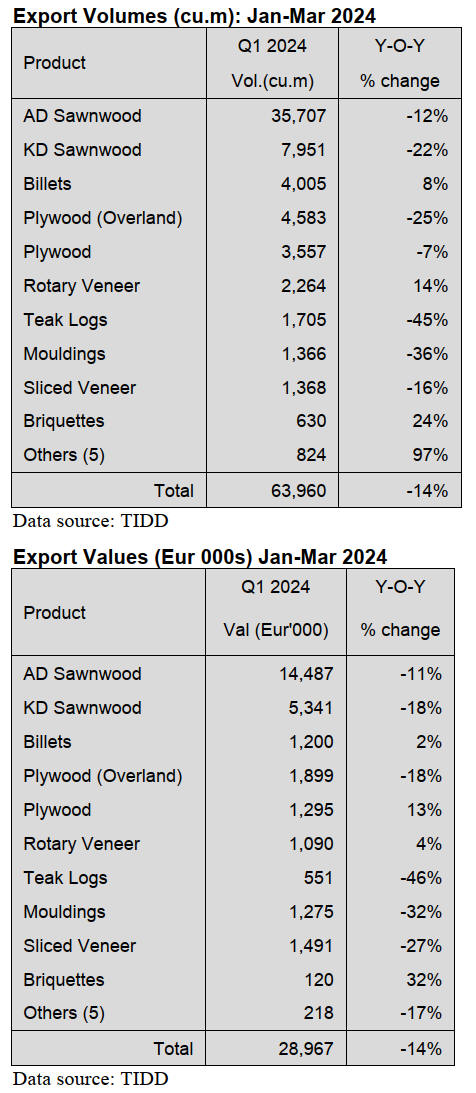

Producer comments on international demand

Demand in the Philippines remains stable with no

significant changes reported. A similar situation is

reported for Vietnam where demand is flat but with a

continued preference for tali. Producers comment that

imported stocks appear to be above normal in Middle East

markets as construction activities slow.

The markets in Europe are beginning to see the annual

slowdown which is typical for the pre-holiday season.

Padouk and iroko are in demand in Belgium wherea s here

appears a growing interest in red timbers in France.

Demand in Germany continues to be slow while in Spain

there has been more interest recently in sapelli and agba

while in Italy there is steady demand for ayous with some

recent inquiries for iroko.

Challenging harvesting condition but production

maintained

From the end of May heavy rain has impacted harvesting

in Gabon but, despite the challenging weather, production

has not been affected. Labour problems are again at the

fore, while unskilled workers can be found there is a

shortage of experienced local technicians and this

continues to be a problem for the timber industry. The

government is pressing for more technical education in

forestry-related fields to address this shortfall.

Milling operations in Gabon are still facing significant

disruptions due to ongoing electricity blackouts affecting

peeling and plywood industries especially in the Nkok

SEZ.

The weather in Cameroon is transitioning from the dry to

rain season which started in June. During the dry period

harvesting operations proceeded smoothly allowing for a

build-up in stocks in preparation for the increased

challenges that typically accompany the rainy season.

Unlike the situation in Gabon, worker availability is not a

significant issue in Cameroon currently,

In the north of Congo heavy rains are impacting the

transportation of timber to Douala Port. It is reported the

southern regions are experiencing the full rain season so

harvesting is a challenge especially as demand in China

has picked up notably for okoume, padouk, bilinga,

movingui, sapell and okan.

Gabon plans higher production

For 2024 Gabon plans to raise sawnwood timber

production to 1.351 million cubic metres compared to the

1.333 million cubic metres in 2023. This forecast was

included in the information in the latest bond issue issued

by Gabon.

A significant part of this growth is expected from mills in

the Nkok SEZ which, according to official data, account

for more than 40% of the country's export productions.

Data from the Nkok Administrative Authority shows there

was an almost 13% increase in the number of containers

shipped in February 2024 compared to January.

In other news, the government in Gabon plans to launch a

timber exchange to establish a platform for exchanges

between stakeholders and ensure the traceability. This

project also aims to create opportunities for small

operators by facilitating their access to markets.

See:

https://www.lenouveaugabon.com/fr/agro-bois/0606-20354-bois-debite-le-gabon-vise-une-production-de-1-3-million-de-men-2024-soutenue-par-les-zones-economiques-dynamiques

Resumption of the TRACER service for Nkok SEZ

Tracer Gabon and Brainforest provided ATIBT with a

statement for circulation on resumption of the Nkok

Tracer services.

The ATIBT reports the statement as saying; “we are

pleased to inform of the decision by the Minister of Water

and Forests to authorise the full resumption of the

TRACER service for the Nkok SEZ”.

See:

https://www.atibt.org/en/announcements/267/towards-thefull-resumption-of-the-tracer-service-on-the-nkok-zis-gabon

2.

GHANA

Exports slide in the first quarter

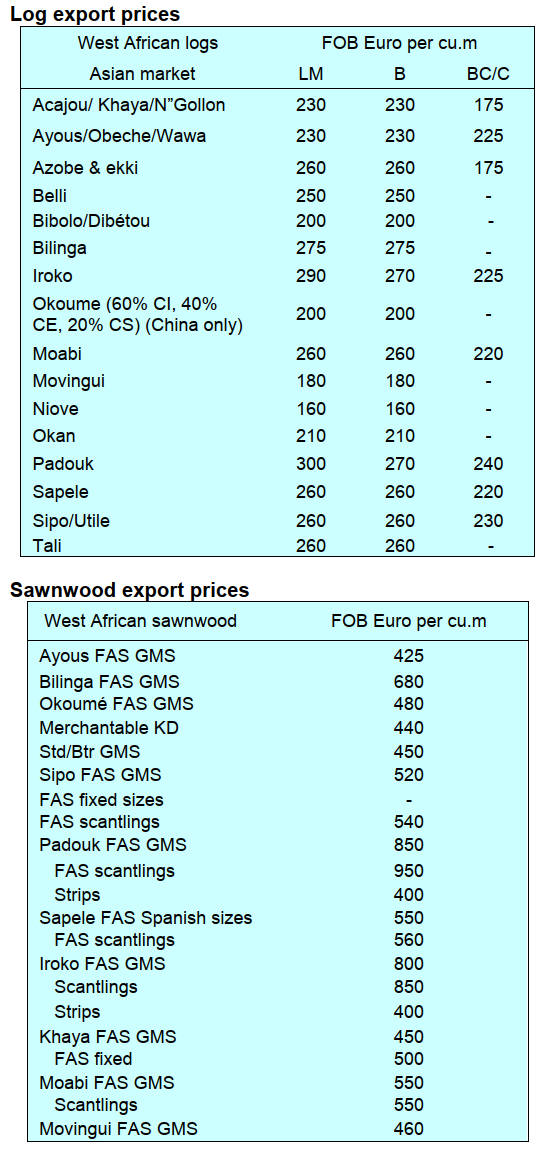

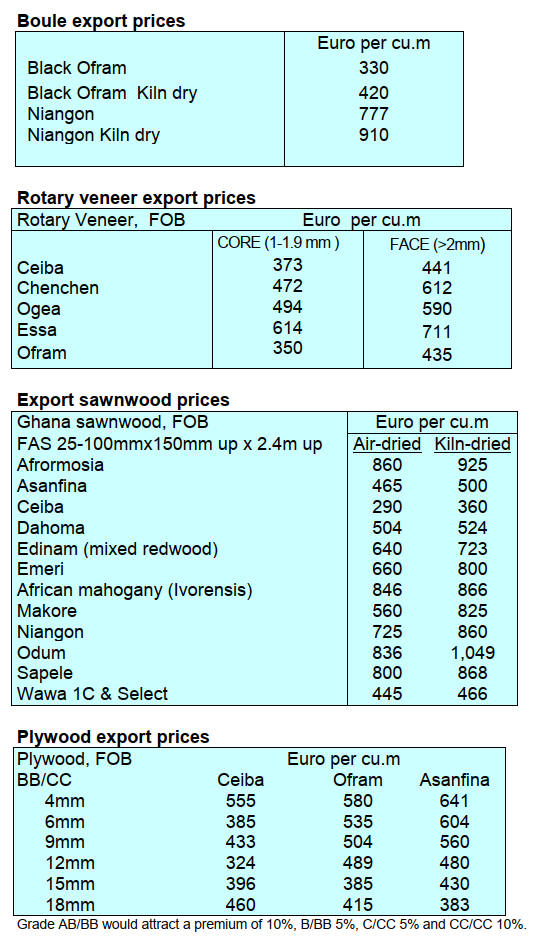

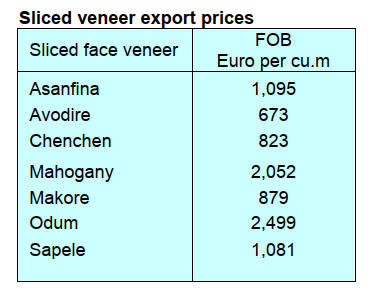

According to data from the Timber Industry Development

Division (TIDD) of the Forestry Commission Ghana’s

wood product export volumes in the first quarter of 2024

declined almost 14% compared to the first quarter of 2023.

There was a corresponding decline in export earnings.

The decline was mainly due to the decline in teak log

exports, sawnwood and plywood. In contrast there was an

increase rotary veneer export volumes and earnings.

The leading export products int he first quarter 2024 were

air and kiln-dried sawnwood, billets and plywood for the

regional market. Exports of these products totalled

55,803cu.m (Eur24.22million) which accounted for 87%

of total export volume and 84% of total export values.

Air and kiln-dry sawnwood accounted for 68% of the total

export volumes in the first quarter 2024 with a

corresponding value of Eur19.83 million. The main

markets for sawnwood were India and Vietnam and the

preferred species included teak, denya, papo, wawa,

cedrela and mahogany.

Nature based solutions in Ghana, major emission

reduction purchase agreement

A press release from Tullow Oil outlines its partnership

with the Ghana Forestry Commission to implement a highintegrity,

jurisdictional-based Reduced Emissions from

Deforestation and Degradation (REDD+) programme.

The press release says “this programme is an important

milestone on the road to achieve Tullow’s 2030 Net Zero

target for Scope 1 and 2 greenhouse gas (GHG) emissions

(on a net equity basis). The primary focus of Tullow’s Net

Zero strategy is on decarbonising its operated production

facilities in Ghana in order to eliminate routine flaring by

the end of 2025.

Residual, hard-to-abate, emissions will be mitigated by

Tullow’s investment in high quality, nature-based

solutions in the form of a REDD+ programme through a

partnership with the Forestry Commission of Ghana,

which is responsible for the sustainable management of

Ghana’s forests and wildlife.

The programme will focus on approx. 2 million hectares

of land across 14 priority districts in the Bono and Bono

East regions, which are among the areas most effected by

deforestation due to economic activities such as cash crop

clearance and overgrazing”.

See:

https://www.tullowoil.com/media/press-releases/tullowtakes-next-step-net-zero-pathway-nature-based-solutions-ghana/

Mitigating threats to forests and biodiversity

The United States Agency for International Development

(USAID) and the Forestry Commission of Ghana have

jointly developed a plan ‘Country Development

Cooperation Strategy’ (CDCS) aimed at understanding

and mitigating threats posed to Ghana’s tropical forests

and biodiversity.

At a meeting led by experts from the Cadmus Group and

the Forestry Commission it was determined the mission is

to preserve and enhance the natural landscapes that define

Ghana’s identity. One of the topics discussed wasn

mangrove forest preservation and natural regeneration.

See:

https://fcghana.org/usaid-and-forestry-commission-plan-forthe-future-of-ghanas-forests/

Massive support for Ghana Green Ghana Day

The country marked the 4th ‘Green Ghana Day’ with high

patronage from the private and public sector institutions

across the 261 districts and 16 regions in the country on

the theme ‘Growing for a Greener Tomorrow’.

The government had targeted to plant 10 million seedlings

this year nationwide with six million trees planted in

degraded forest reserves while four million trees were

planted at farms, parks, recreational grounds, along roads

and in communities. Seedlings were made available at the

Ministry of Lands and Natural Resources and District

Offices of the Forestry Commission throughout the

country.

Prior to this year’s ‘Green Ghana Day’ the sector Minister

Samuel Abu Jinapor and the Chief Executive of the

Forestry Commission Mr. John Allotey, travelled across

the country and encouraged everyone to come out to plant

a tree. The ‘Green Ghana Day’ is part of government’s

aggressive afforestation and re-forestation programme to

restore degraded forests

See:

https://thebftonline.com/2024/06/05/2024-green-ghana-daygovt-targets-planting-over-10m-trees

3. MALAYSIA

Financing forest conservation activities

A non-market-based mechanism, the Forest Conservation

Certificate (FCC), has been introduced by the Malaysian

government to finance forest conservation activities.

The Minister of Natural Resources and Environmental

Sustainability, Nik Nazmi Bin Nik Ahmad, said the FCC

(a non-market mechanism to channel funds from the

private sector to support forest conservation projects in the

country) is one of the mechanisms developed by the

Malaysia Forest Fund (MFF).

FCCs can be used by companies to meet environmental,

social and governance (ESG) reporting requirements under

the biodiversity topic, said the Minister. Also, the Ministry

of Finance has approved a 10% tax deduction for

companies that participate in FCC activities.

See:

https://thesun.my/local-news/govt-introduces-fcc-tofinance-forest-conservation-activities-FO12497983

and

https://theedgemalaysia.com/node/713084

Alternative revenue sources

According to Sarawak Premier, Abang Johari Tun Openg,

the State is transitioning from an era of a logging-based

economy to sustainable management of forests.

He added, Sarawak no longer depends on logging

activities as a major source of income but is now exploring

renewable energy and other sustainable initiatives to drive

economic growth.

He is reported in the domestic media as saying “I want the

industry to understand why we have reduced the export of

logs and why we are discouraging the cutting of trees

unlike before. This is because we now have alternative

ventures that we can pursue to grow our economy.”

The Premier reported that Sarawak has reduced the

volume of timber harvested by about two million cubic

metres per year.

See:

https://theborneopost.pressreader.com/article/281483576532515

Ecological Fiscal Transfer

Federal funding allocated to various states has played a

pivotal role in safeguarding critical forests and marine

ecosystems from destruction, making it crucial for state

governments to fully utilise such incentives.

Introduced in 2019 the Ecological Fiscal Transfer for

Biodiversity Conservation (EFT) has effectively preserved

vital areas serving as primary water sources and fishing

grounds which are also sources of income for coastal

communities and food.

More than 90,000 ha spanning across Kedah, Perak, Perlis,

Penang, Selangor, Terengganu, Sabah and Sarawak have

been gazetted as permanent forest reserves via the EFT

implementation.

See:

https://www.thestar.com.my/news/nation/2024/05/26/crucialforests-and-marine-life-saved-by-eft

4.

INDONESIA

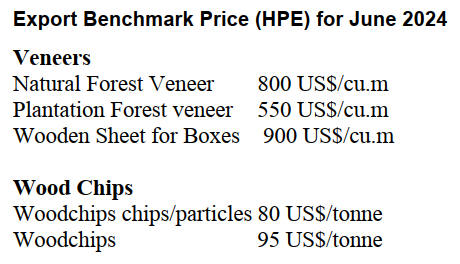

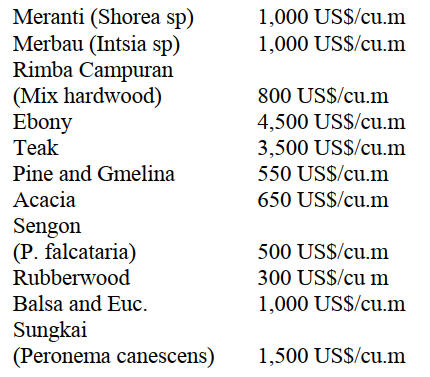

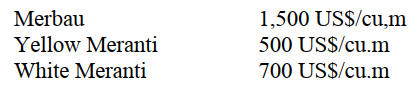

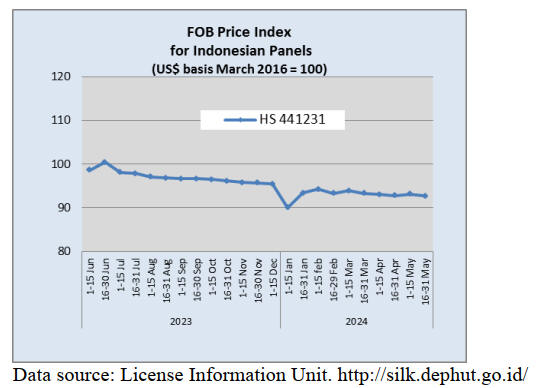

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4,000 sq. mm to

10,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 10,000 sq.mm to

15,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

See:

https://jdih.kemendag.go.id/pdf/Regulasi/2024/661_Kepemendag%20HPE%20dan%20HR%20Produk%20Pertanian%20dan%20Kehutanan%20Juni%202024.pdf

and

https://forestinsights.id/keputusan-menteri-perdagangan-terbitberikut-harga-patokan-ekspor-hpe-produk-kayu-juni-2024/

Aligning land inventory method with that used

for the

EUDR

The Minister of Environment and Forestry, Siti Nurbaya

Bakar, has emphasised the need for adjustments to land

inventory measurement methods in Indonesia to align with

the European Union Deforestation Regulation (EUDR).

Field observations conducted jointly with the World

Research Institute (WRI) underscore the need to tailor the

measurement approach used in Indonesia with that used to

implement the EUDR, she added.

See:

https://mediaindonesia.com/humaniora/675221/menteri-lhkpengukuran-deforestasi-di-ri-perlu-metode-yang-lebih-akurat

Study China and Vietnam to boost competitiveness of

furniture industries

The Indonesian Furniture and Crafts Industry Association

(HIMKI) is seeking government support to improve the

competitiveness of the national furniture industry. HIMKIi

Chairman, Abdul Sobur, said the Association is exploring

potential markets and working to improve the sector

performance.

He called for the government to play a significant role in

supporting improved industrial productivity and cited

examples in China and Vietnam where the governments

are supportive and encourage competiveness.

Sobur explained that the past poor performance of

Indonesia’s furniture sector was due to low demand from

traditional markets, especially the United States and

Europe. To address this industry players are now focusing

on the domestic market and exploring potential nontraditional

markets.

According to Sobur, Indonesia should follow China's

example in increasing furniture exports.

He highlighted that, while Indonesia's average exports in

recent years have only reached US$2.5 billion, China's

exports have reached almost US$20 billion.

He explained that industrial competitiveness can be

enhanced by implementing policies that improve the

business climate.

See:

https://www.msn.com/id-id/berita/other/ri-diminta-tiruchina-dan-vietnam-tingkatkan-daya-saing-industri-mebel/arBB1n4wD2?ocid=BingNewsSearch

Indonesia’s rattan as a replacement for plastic

furniture

The Indonesian Furniture Industry and Handicrafts

Association (ASMINDO) plans to promote Indonesian

rattan as a raw material for furniture material as an

alternative to plastic. General Chairman of ASMINDO,

Dedi Rochimat, stated that the Association is committed to

introducing Indonesian rattan products to the global

furniture market as an alternative to plastic materials.

"In March, we declared bamboo and rattan as alternatives

to plastic. This is one of our commitments," said Dedy at

the Furniture Industry Gathering by IFFINA.

As a sign of his commitment to introducing rattan to the

global market Dedy stated that ASMINDO would assist

the government in establishing a logistics centre. One

wood logistics centre has been completed and ASMINDO

is currently constructing a rattan logistics centre in

Cirebon.

See:

https://www.detik.com/properti/berita/d-7358007/bakalgantikan-mebel-plastik-rotan-ri-siap-serbu-pasar-global.

EUDR, a possible barrier to furniture and handicraft

exports

The export of Indonesian forestry and plantation products

are facing numerous barriers. Most recently, the European

Union (EU) has introduced a new regulation, the European

Union on Deforestation-Free Regulation (EUDR).

Abdul Sobur, General Chair of the HIMKI, said "this nontariff

barrier regulation has the potential to hinder the

export of Indonesian furniture and craft products to

Europe, adding, it is possible Indonesian exports will be

impacted if we fail to meet EUDR requirements." Sobur

stressed that the EUDR procedure, specifically the due

diligence for product traceability will be a major challenge

for many HIMKI members as not all will be able to put in

place proceedures to satisfy the EUDR requirements.

Sobur explained that HIMKI is working to assist furniture

and crafts entrepreneurs in addressing current issues such

as the regulations in the EUDR. They are also urging the

government to anticipate the impact of these EU

regulations. "The government must take the lead in

anticipating the impact of the EUDR by engaging in

cooperation negotiations or other initiatives", he said.

See:

https://agroindonesia.co.id/eudr-ranjau-baru-bagi-ekspormebel-dan-kerajinan-nasional/

and

https://www.industry.co.id/read/133283/himki-angkat-suarasoal-kebijakan-eudr-ranjau-baru-ekspor-mebel-dan-kerajinanindonesia

Promoting furniture in Dubai

The Ministry of Trade has promoted high-quality

Indonesian furniture and home decoration products at the

furniture exhibition, known as INDEX which was held in

Dubai.

According to the ministry the global furniture and home

decoration market offers promising opportunities. The

projected revenue for the global furniture market is

expected to reach US$280 billion in 2024 with an

estimated annual growth rate of 9% over the next 5 years.

The largest segment within this market is living room

furniture and this was the focus of Indonesia's

participation at INDEX 2024. Dubai is seen as a trade hub

for the Middle East, Africa and South Asia taking

advantage of the existing trade agreement between

Indonesia and the UAE known as the Indonesia-UAE

CEPA.

See:

https://www.kemendag.go.id/berita/foto/kemendagpromosikan-furnitur-di-dubai-dengan-memanfaatkan-indonesiauae-cepa

Partnership among tropical countries on climate

change mitigation

Collaboration among tropical forest nations is deemed

crucial for supporting sustainable management,

biodiversity conservation and climate change mitigation.

Acting Director General of Sustainable Forest

Management at the Ministry of Environment and Forestry

(KLHK), Agus Justianto, emphasised the need for

collaborative efforts among nations to align their work in

forest management and conservation.

The Tropical Forest for Climate Action Partnership,

initiated by Indonesia, Brazil and the Democratic Republic

of Congo, aims to reduce greenhouse gas (GHG)

emissions by preserving and restoring tropical forests.

These countries share knowledge and best practices in

forest management and work together to enhance the

benefits of their tropical forests for the environment and

communities.

See:

https://forestinsights.id/strategic-partnership-amongtropical-forest-nations-to-boost-climate-change-mitigation/

Deforestation success evidence of effective fund

management: Minister

Finance Minister Sri Mulyani Indrawati emphasised that

Indonesia’s successful reduction in deforestation is

evidence of effective management of environmental funds

from overseas. She made the statement after attending a

meeting between President Joko Widodo and Norwegian

Climate and Environment Minister Andreas Bjelland

Eriksen.

She added, the Indonesia Environment Fund has gained

international trust as an institution capable of efficiently,

accountably and transparently and is delivering results.

Indonesia and Norway collaborate through

result-based

contributions for Reducing Emissions from Deforestation

and Forest Degradation (REDD+). A 20-million-ton

reduction in carbon emissions during 2014–2016 was

offset by REDD+ funding through the BPDLH.

See:

https://en.antaranews.com/news/315045/deforestationsuccess-evidence-of-effective-fund-management-minister

5.

MYANMAR

World Bank cuts Myanmar's growth forecast

Economic growth in Myanmar will be around 1% for the

2024-2025 fiscal year according to the World Bank

Economic Report. Growth prospects have been eroded by

the armed conflict, labour shortages and a depreciating

currency, all of which make it hard to do business. In

December the Bank projected a 2% GDP growth.

Faced with expanded armed resistance the Myanmar

authorities announced a conscription plan to replenish the

depleted military manpower. This has resulted in

migration to rural areas or overseas leading to labour

shortages.

Access to some key land borders with China and Thailand

has been lost leading to a sharp drop in overland trade.

Overall, merchandise exports fell by 13% and imports

dropped by 20% in the six months to March 2024

compared to the same period a year earlier according to

the World Bank.

See:

https://www.worldbank.org/en/news/pressrelease/2024/06/12/threat-to-livelihoods-deepens-as-myanmareconomic-outlook-remainsweak#:~:text=The%20World%20Bank's%20Myanmar%20Economic,forecast%20of%202%20percent%20growth.

Malaysia and Thailand call for innovative approaches

on Myanmar

Ahead of Malaysia assuming the ASEAN chairmanship,

Malaysia’s Prime Minister, Anwar Ibrahim, repeated his

calls for an end to violence and political marginalisation in

Myanmar.

He pointed to the ASEAN five-point consensus) and stated

Malaysia’s commitment to working with other ASEAN

member states and influential dialogue partners to push for

peace, effective humanitarian mechanisms and the

eventual political engagement of all relevant stakeholders.

The authorities in Thailand have also called for ASEAN to

take a more proactive role in trying to resolve the crisis in

military-ruled Myanmar after weeks of fighting near its

border that halted trade and led to an influx of refugees.

See:

https://www.straitstimes.com/asia/se-asia/malaysian-pmanwar-calls-for-an-end-to-violence-in-myanmar

and

https://www.channelnewsasia.com/asia/thailand-urges-biggerasean-role-resolving-myanmar-conflict-2021-coup-4295161

More restrictions on importers

From July this year importers in Myanmar will face new

restrictions aimed at reducing the outflow foreign

exchange. The restrictions, announced by the Ministry of

Trade and Commerce, include penalties for importers who

land goods before securing an import license. It was

common practice for importers to place orders before they

get official authorisation due to the length of time that it

takes to get such approval. If goods arrive before the

license is issued the goods would be held by Customs.

See-

https://myanmar-now.org/en/news/myanmar-junta-imposesmore-restrictions-on-imports/

Impact of conflict on Thai condominium market

The Thai condominium market is facing challenges due to

a crackdown by authorities in Myanmar on nationals

purchasing properties abroad. This has significantly

impacted the Thai real estate market which had seen a

surge in Myanmar buyers.

Myanmar nationals became a major segment in Thailand’s

real estate market, rising from the sixth largest group of

foreign buyers in 2022 to the second in early 2024. The

change came after the 2021 military coup in Myanmar

which led to economic and political instability.

Despite the crackdown, there is still interest in Thai

properties from Myanmar nationals. However, further

restrictions on currency remittance could impact the

market further. The influx of Myanmar money has led to

areas such as Hua Hin becoming known for the

concentration of properties owned by families of top

Myanmar military officials.

See-

https://www.rfa.org/english/news/myanmar/myanmarthailand-property-06122024033523.html

and

https://thethaiger.com/news/national/thai-condo-market-facesturbulence-with-myanmar-buyers-blocked

Myanmar and Russia talks to revive Dawei Port project

Myanmar has begun talks with Russia to revive the longstalled

Dawei deep-sea port project in the country’s south

according to a senior regime official.

According to Aung Soe, Chair of the Dawei Special

Economic Zone Management Committee, the two sides

met for preliminary discussions after the Russian embassy

and several private Russian companies expressed an

interest in the project.

See:

https://myanmar-now.org/en/news/myanmar-junta-andrussia-begin-talks-to-revive-dawei-port-project/

6.

INDIA

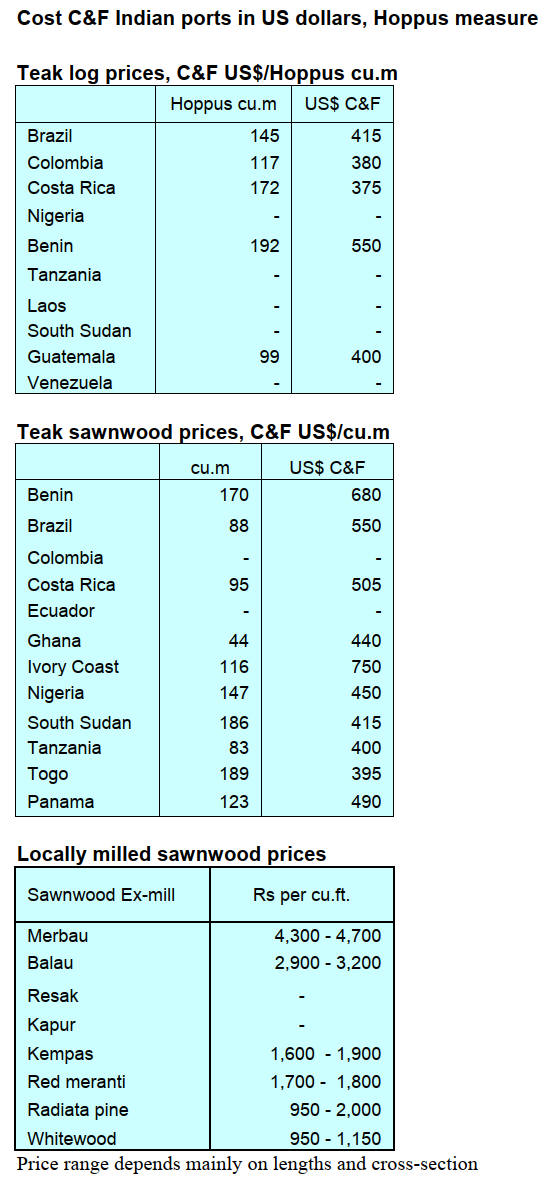

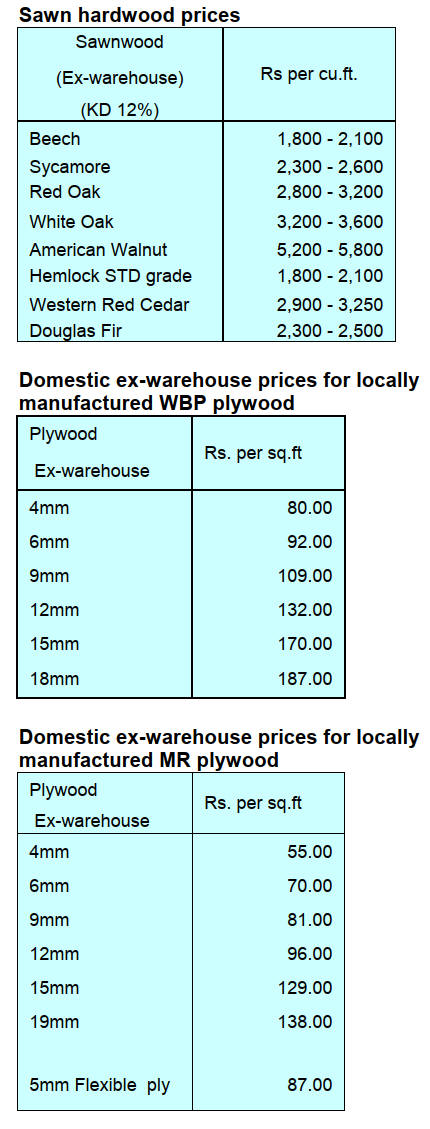

Only monsoon rain will

quell fires

The correspondent writes; “the North-West Monsoon has

arrived in Southern India and is gradually heading north.

Presently, summer is very strong and forest fires are

appearing in hilly areas amid the dry spell. State

governments in Northern India are trying to keep the fires

under control until the end of June when the entire country

will be experiencing monsoon rains. On the domestic

manufacturing front, plywood, MDF and

particleboard manufacturers are considering increasing

prices as raw material cost climb.

In additional news, ocean freight rates continue to rise but

it appears they have peak-out and settled. Indian importers

are keeping their fingers crossed that rates will come down

but until then it is too costly to import large volumes of

timber especially lower valus items such as small diameter

teak logs.

Why surge in freight rates?

Container freight rates fluctuated dramatically between

January 2023 and May 2024. Freight rates slumped to

their lowest level in October 2023 when the cost for a 40-

foot container was only US$1,342. Since then global

freight rates have gradually increased, rising to over

US$4,200 in June 2024.

There are several reasons behind the rise in rates; the crisis

in the Red Sea means that ships to Europe must sail

around Africa instead of through the Suez Canal, charges

related to climatic requirements also contribute to price

increases. Additionally, at the end of April and the

beginning of May, there was unfavorable weather in Asia

which obstructed navigation.

Against this background of port congestion, a shortage of

containers and lack of ships, even a small increase in

demand was enough to drive up freight rates significantly.

See:

https://www.logisticsinsider.in/freight-rates-surge-amidst-rising-demand-and-supply-chain-disruptions/

and

https://trans.info/en/sea-freight-rates-388882

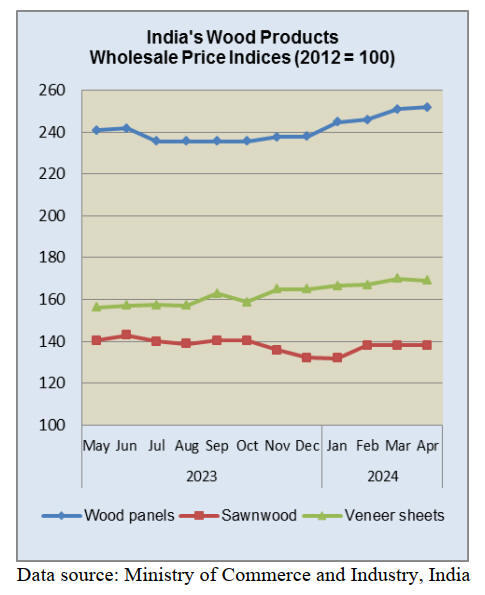

Manufacturing inflation slows

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 1.26 % for April 2024. The

positive rate of inflation in April was primarily due to

increase in prices of food, electricity, petroleum and

natural gas and some manufactured products.

The index for manufacturing increased to 140.8 in April

from 140.1 for March. Out of the 22 NIC two-digit groups

for manufactured products, 15 groups saw an increase in

prices, for 5 groups there was a decline in prices and for 2

groups there was no change.

Some of the groups that showed month on month increase

in prices were basic metals, other manufactured goods,

textiles, food products and chemical products.

Some of the groups that witnessed a decrease in prices

were other non-metallic mineral products, paper and paper

products, motor vehicles, trailers and semi-trailers,

furniture and leather products.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Rising eucalyptus log prices

In April domestic Eucalyptus log prices supplied to MDF

mills in Northern India have risen to INR7,500 per tonne

(around US$90) which is undermining profit margins of

MDF producers. The rise in price is the result of

competition for raw materials by new manufacturing

plants in this region. Producers are of the view that MDF

prices will inevitable rise.

See:

https://www.plyreporter.com/emagazine

India - 4th largest furniture market world wide

In May Research and Markets annonced their latest

assesmnet of the furniture market in India saying; “The

Indian furniture market is valued at US$20 billion and has

grown at an annual average rate of 6% during the last ten

years.

This growth trend makes India the 4th largest furniture

market worldwide, climbing from the 10th position held

ten years ago.

Within Asia and Pacific, India is the second largest

furniture market after China, and one of the projected

fastest growing in 2024 and 2025, driven mainly by

increasing urbanisation, expansion of the middle class,

growing investments in the residential and non-residential

sectors, government support and modernisation of

furniture retail.

Even though imports satisfy less than 10% of the Indian

furniture market, they have grown fast in the last few years

and the potential for high-end / luxury furniture imports is

particularly high“.

See:

https://www.researchandmarkets.com/report/india-furniture-market#src-pos-1

7.

VIETNAM

Wood and wood products (W&WP) trade highlights

According to the statistics provided by Vietnam

Office

of Customs in May 2024, Vietnam’s W&WP exports

earned US$1.25 billion, down 8% compared to April 2024

but up 18% against May 2023. Of this, WP exports

accounted for US$812 million, down 14% compared to

April 2024, but up 6% compared to May 2023. In the first

5 months of 2024 W&WP exports reached US$6.1 billion,

up 24% year-on-year. The WP exports alone earned

US$4.16 billion, up 23% over the same period in 2023.

W&WP exports to the US in May 2024 earned

US$710 million, down 8% compared to April 2024, but up

13% compared to May 2023. In the first 5 months of 2024

W&WP exports to the US earned US$3.4 billion, up 27%

over the same period in 2023.

In May 2024 bedroom furniture exports were valued at

US$163 million, up 58% compared to May 2023. Over the

first 5 months of 2024 exports of bedroom furniture

brought in about US$777 million, up 34% over the same

period in 2023.

Vietnam's W&WP imports in May 2024 were valued

at US$250 million, up 7% compared to April 2024 and up

16% compared to May 2023. In the first 5 months of 2024

W&WP imports cost US$1.02 billion, up 20% over the

same period in 2023.

The volume of tali imports in May 2024 was at 45,300

cu.m, worth US$16.5 million, up 8% in volume and 7% in

value compared to April 2024. Compared to May 2023,

the imports decreased by 19% in volume and by 35% in

value. In the first 5 months of 2024 imports of tali

amounted to 136,700 cu.m, worth US$51.3 million, down

31% in volume and down 39% in value over the same

period in 2023.

Preparing readiness for aligning EUDR in Vietnam’s

rubber sector

Implementation of the EUDR will mean commercial

agricultural goods delivered to the EU market will have to

meet and demonstrate the conditions of the EUDR

throughout the entire supply chain. For Vietnam, the main

three sectors affected will be coffee, rubber, wood and

wood products.

Implementing sustainable development of the rubber

industry

In May 2024 the Vietnam Rubber Group (VRG)

coordinated with the Vietnamese Academy of Forest

Sciences (VAFS) and the Vietnam Forest Certification

Office (VFCO) and organised a workshop “Developing

Action Plan to Adapt to EUDR Regulation”. The

workshop was hosted by Mr. Tran Cong Kha, Chairman of

VRG, most VRG Board of Directors and about 100

delegates who are leaders and technical staff of 63 rubber

companies.

At the workshop, Mr. Tran Lam Dong, Vice President

of

VAFS and Mr. Vu Tan Phuong – Director of VFCO

discussed the requirements of EUDR, the draft

PEFC/EUDR Due Diligence System (PEFC/EUDR DDS).

The workshop discussed and agreed to prepare for EUDR

implementation through establishing EUDR/DDS, building

capacity and implementing PEFC/ EUDR certification in

the framework of the Vietnam Forest Certification Scheme

(VFCS/PEFC).

VFCO will continue to coordinate closely with PEFC

and VRG to promote sustainable rubber industry

development through certification of sustainable forest

management (SFM) and chain of custody (CoC)

associated with the EUDR Due Diligence System (PEFC

EUDR DDS).

See:

https://vfcs.org.vn/en/news/preparing-readiness-for-aligning-eudr-in-vietnams-rubber-sector/

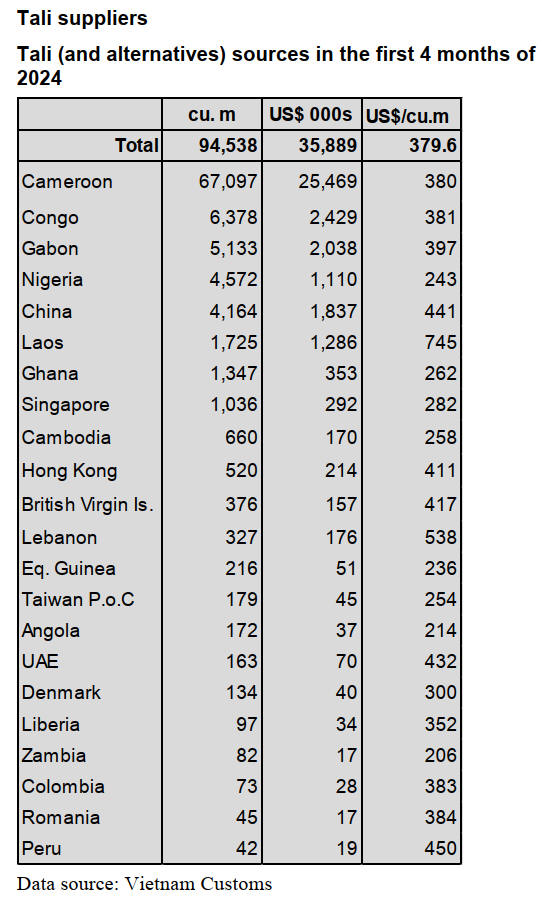

Cameroon top shipper of Tali to Vietnam

At the top of tali wood suppliers to Vietnam, was

Cameroon with a share of over 70% of total tali imports in

the first 4 months of 2024 at 67,100 cu. m, worth US$25.5

million, down 35% in volume and 40% in value over the

same period in 2023.

Tali price fluctuation

According to Customs statistics the average price for

imported tali in the first 4 months of 2024 reached

US$379.6/cu.m, down 8% over the same period in 2023.

In particular, the price of tali imported from Cameroon

dropped by 8% down to 379.6 US$/cu.m.

The price from Congo was down by 20% to US$380.8/cu.

m and from Cambodia by 3% to US$257.6/cu. m.

In the first 4 months of 2024 imports of tali from most

sources decreased over the same period in 2023 except for

Nigeria, China and Cambodia. Imports of tali from the

Congo reached 6,400 cu. m, worth US$2.4 million, down

49% in volume and down 59% in value over the same

period in 2023.

Tali imports from most other markets decreased against

the same period in 2023 such as from Gabon, down 35%;

Laos by 57%; Ghana by 32.5%, Hong Kong by 80% and

Equatorial Guinea by over 90%.

In contrast tali imports from Nigeria increased 61% over

the same period in 2023 reaching 4,600 cu.m and from

China by 72% at 4.200 cu. m and from Cambodia tali

imports doubled to 660 cu.m.

8. BRAZIL

Advances in wood

construction systems in Brazil

An assessment of wood construction systems in Brazil was

presented at the plenary meeting of the Brazilian

Association for Mechanically Processed Timber

(ABIMCI). The meeting brought together industries from

the wood and forestry sector, government representatives,

technical and educational institutions and associations to

discuss a wide range of issues and advances in wood

construction especially the wood frame and engineered

wood systems.

One of the major advancements presented was the

proposed development of a digital platform that will

centralise data on wood construction, including research,

courses, events, workshops, standards and regulations. The

platform will be managed by Senai State of Paraná which

aims to facilitate access and dissemination of information.

The Research, Development and Innovation working

group identified the main needs of the wood frame and

engineered wood industry required to guide future

research and development. The Public Policies working

group proposed solutions to encourage architectural

competitions and the construction of public works using

models adopted by the Council of Architecture and

Urbanism (CAU) and the Institute of Architects of Brazil

(IAB).

Tax issues and improvements in bidding processes for

projects that include wood construction were also

discussed. The Market, Promotion and Dissemination

working group defined strategies to reach different

audiences such as developers, insurance companies,

researchers and architects as well as planning participation

in important events such as the International Wood Week

(SIM). The Workforce Qualification working group

highlighted the development of new courses and

international partnerships for the training of specialised

workers with curricula being developed by Senai Paraná.

ABIMCI also emphasised that wood constructions

represent a unique opportunity to combine efficiency,

sustainability and economic development with the solid

support of various industry sectors and the government

marking a positive leap for the market and the sector as a

whole.

See:

https://abimci.com.br/consolidacao-dos-sistemas-construtivos-em-madeira-no-brasil-tem-importantes-avancos/?utm_campaign=Abimci+News&utm_content=Um+momento%E2%80%A6&utm_medium=email&utm_source=dinamize&utm_term=Abimci+News+114+-+Edi%C3%A7%C3%A3o+Maio+2024

Digital platform for National Forest Inventory data

A digital platform with open data from the National Forest

Inventory (IFN) was launched by the Ministry of the

Environment and Climate Change (MMA) and the

Brazilian Forest Service (SFB) in May 2024 aiming to

facilitate public access to forest information.

The National Forest Information System (SNIF) will host

the data made available through interactive panels and

digital spreadsheets also covering information about local

communities.

Brazil has 4.96 million sq.Km of forests (60% of the

national territory) holding the largest area of national

tropical forests in the world. The National Forest

Inventory is a tool that delivers information on natural and

planted forest resources.

The IFN will collect and disseminate qualitative and

quantitative data about forests and local communities to

guide public policies, investments and scientific research.

To-date, more than 125,000 botanical samples have been

collected from over 10,000 sampling points, cataloging

more than 900,000 trees and identifying 8,400 species,

including the discovery of 13 new species.

The IFN's efforts have covered 100% of the Pampa biome

and partially the Caatinga (71%), Cerrado (78%), Atlantic

Forest (58%) and Amazon (44%) biomes. The Pantanal is

the next biome to be inventoried.

The project is supported by the Inter-American

Development Bank (IDB), the Inter-American Institute for

Cooperation on Agriculture (IICA), the National Bank for

Economic and Social Development (BNDES) through the

Amazon Fund and the United Nations Food and

Agriculture Organization (FAO).

See:

https://forestnews.com.br/inventario-florestal-nacional-plataforma-digital/

Participation in Carrefour International du Bois

A delegation of forest sector entrepreneurs of Mato Grosso

State participated in the Carrefour International du Bois

Fair held at Exponantes Park in Nantes.

The event is recognised as one of the most important in the

timber sector and featured the participation of

approximately 670 exhibitors. Additionally, the event

attracted the interest of importers from various countries

including Belgium, Germany, Italy, Portugal, Denmark,

South Africa, the United States and France.

The delegation from Mato Grosso State consisted of 30

entrepreneurs associated with the Center of Timber

Exporting Industries of the state of Mato Grosso (CIPEM)

which represents 523 companies in the forest sector.

Among the most sought after tree species in international

consumer markets are angelim-pedra (Hymenolobium

petraeum), ipê (Tabebuia impetiginosa), cumaru (Dipteryx

odorata), itaúba (Mezilaurus itauba), garapa (Apuleia

leiocarpa), jatobá (Hymenaea courbaril), cherry (Prunus

avium), Amazon cedar (Cedrelinga catenaeformis),

jequitibá-rosa (Cariniana legalis) and caixeta (Simarouba

amara).

With 5.0 million hectares of managed and conserved

forests the private sector in the State of Mato Grosso

produced the equivalent of 7 million cubic metres of wood

in 2022 from sustainably managed forest areas and

contributed R$66 million in taxes.

Mato Grosso State is a centre for sustainable timber

production, generating jobs and providing significant

revenue for the local economy. The state maintains a

forest production tracking system (Sisflora 2.0) ensuring

the origin and legality of the products.

The participation of entrepreneurs from Mato Grosso in

the international Fair not only highlights the importance of

the forest sector in the State but also indicates the efforts

made to search for new business opportunities and

commercial partnerships in an increasingly demanding

global market.

See:

https://simenorte.com.br/noticias/empresarios-do-setor-florestal-de-mato-grosso-participam-de-feira-internacional-na-franca/;

https://cipem.org.br/noticias/setor-florestal-de-mato-grosso-promove-rodadas-de-negocios-durante-feira-internacional-na-franca

Furniture exports, four consecutive monthly increases

Brazilian furniture exports recorded their fourth

consecutive rise in April 2024 reaching US$59.5 million,

an almost 1% increase compared to March. According to

the Brazilian Association of Furniture Industries

(ABIMÓVEL) this continued growth reflects the gradual

recovery of the sector which saw a 0.6% increase in the

first quarter of 2024 compared to the same period last

year.

ABIMÓVEL points out that, despite the increase in

exports, competition with imported products especially

from China, continues to challenge the sector. Imports

grew by 75% in the first quarter of 2024 and 49% in the

last 12 months, although there was a 2% decline between

March and April. The furniture trade balance remained

positive with a surplus of US$36.5 million in April and

over US$126.7 million for the first quarter.

The National Confederation of Industry (CNI) attributes

the rise in imports to competitive pricing of imported

products compared to local product prices resulting from

high-interest rates and the burdensome tax system in

Brazil.

The lack of oversight and dumping practices also harm the

national industry leading to the loss of nearly 500,000 jobs

and a reduction in Federal revenue. The most impacted

sectors include wood, clothing, leather, metallurgy, metal

products and furniture.

To address these challenges, ABIMÓVEL supports the

approval of a draft bill revising the tax for imported

products to reduce tax inequality. Additionally, the New

Industrial Policy and measures such as accelerated

depreciation of assets are seen as essential for modernising

the industry and promoting more sustainable production.

The adoption of automation and digitalisation technologies

along with sustainable practices is essential for reducing

operational costs and increasing competitiveness and

should be supported by government incentives, says

ABIMÓVEL.

See:

http://abimovel.com/exportacoes-de-moveis-e-colchoes-registram-quarto-aumento-consecutivo-em-2024/

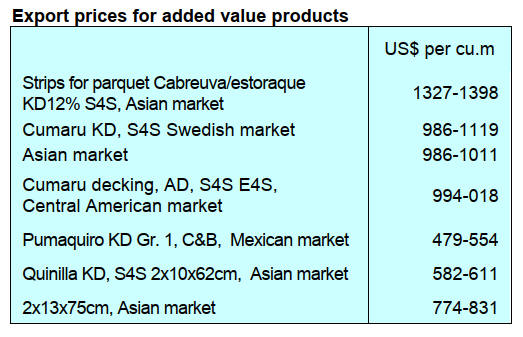

9. PERU

First quarter of

2024 exports fell

The Services and Extractive Industries Management of the

Association of Exporters (ADEX) has reported shipments

of wood products in the first three months of this year

totalled US$20.23 million, a drop of 28% compared to the

same period in 2023 (US$27.99 million)

This decline is partly explained by lower orders from the

main buyers, China (US$3.1 million) and the Dominican

Republic (US$2.9 million) for which demand dropped

48% and 7%, respectively. Other top markets were the US

and France. Shipments to the US accounted for 14% of

first quarter shipments and France 13% and a negative

percentage variation of -56%. Orders from Mexico fell

sharply in the first quarter.

According to figures from the ADEX Data Trade

Commercial Intelligence System, sawnwood was the most

top export product in the first quarter earning US$8.38

million, despite contracting by 24% compared to the same

period in 2023. Second ranked category included semi-

manufactured products (US$7.18 million, down 42%,

furniture products (US$1.26 million), firewood and

charcoal (US$1.10 million) and manufactured products in

general with US$0.99 million.

Concessionaire receives incentive for good forestry

practices

In an important advance for the sustainable management

of forests in Ucayali the Parihuelas El Sol consortium

became the first forest permit holder to receive an award

for good forestry practices. The incentive, granted by the

Regional Forestry and Wildlife Management of Ucayali

(GERFFS), was because of their good management as

accredited by the Management Information System

(SIGOSFC) of the Forestry and Wildlife Resources

Supervision Agency (OSINFOR).

The incentive is a 15% discount on the payment for the

‘Right to Forestry Use’ in accordance with the policy

approved by the National Forestry and Wildlife Service

(SERFOR) in 2023.

See:

https://www.gob.pe/institucion/osinfor/noticias/970568-retrabajo-a-la-sostenibilidad-concesionario-maderero-recibe-el-primer-incentivo-por-buenas-practicas-forestales-en-ucayali

Law agencies trained in the use of tools to combat

timber trafficking

In a joint effort to strengthen the fight against timber

trafficking the Forestry and Wildlife Resources

Monitoring Agency (OSINFOR) and an Environmental

Team from the United Nations Office on Drugs and Crime

(UNODC) organised a workshop to strengthen the

technical capabilities of law officers in Ucayali.

A workshop ‘Implementation of information tools for the

investigation of illegal timber trafficking’ was held in

Pucallpa.

With the support of the German Cooperation (BMZ) and

within the framework of the second phase of the project

Criminal Justice Responses to Forestry Crimes. The

workshop brought together 35 professionals including

prosecutors, judges and administrators from the forestry

sector.

The objective was to strengthen the coordination of justice

system operators regarding the legal framework applicable

to the sustainable use of forest resources and the use of

information tools that contribute to the investigation of

environmental crimes.

See:

https://www.gob.pe/institucion/osinfor/noticias/963166-operadores-de-justicia-en-ucayali-se-capacitan-en-el-uso-de-herramientas-tecnologicas-del-osinfor-para-enfrentar-el-trafico-de-madera

SERFOR meets with fire experts from Latin America

and the Caribbean

In its capacity as host the National Forestry and Wildlife

Service (SERFOR) led the 6th Meeting of the ‘Group of

Experts on Forest Fires in Latin America and the

Caribbean’ (GEFF LAC) which aimed to share good

practices and identify strategies to improve the

management of these incidents in the region.

This meeting brought together experts from the entire

region (Brazil, Colombia, Chile, Mexico, Ecuador,

Uruguay, Bolivia, Argentina and Peru), and managers

from the relevant ministries and organisations, responsible

for the management of forest fires in their different phases,

from prevention, preparation, fire-fighting to restoration of

damaged areas.

See:

https://www.gob.pe/institucion/serfor/noticias/959553-serfor-se-reune-con-expertos-de-america-latina-y-el-caribe-para-mejorar-gestion-integral-ante-incendios-forestales

|