|

Report from

Europe

EU tropical wood imports at record low in first quarter

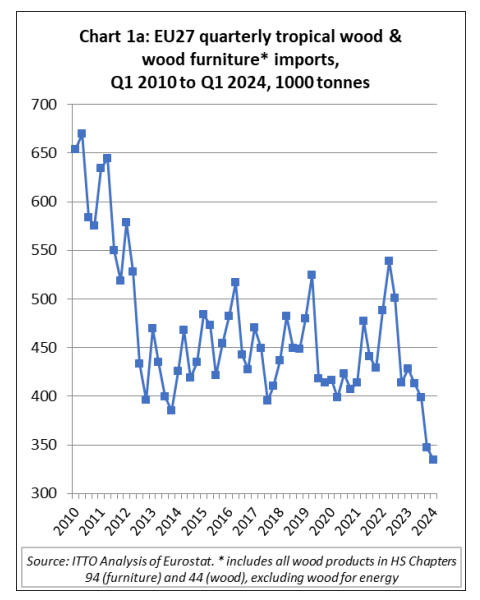

EU27 imports of tropical wood and wood furniture at

335,000 tonnes in the first quarter of this year were 4%

down compared to the previous quarter and 22% less than

in the same quarter last year. This was the lowest

quarterly import quantity recorded this century by the EU

and quite possibly ever recorded by the EU since it was

first formed (as the EEC) in 1957 (Chart 1a).

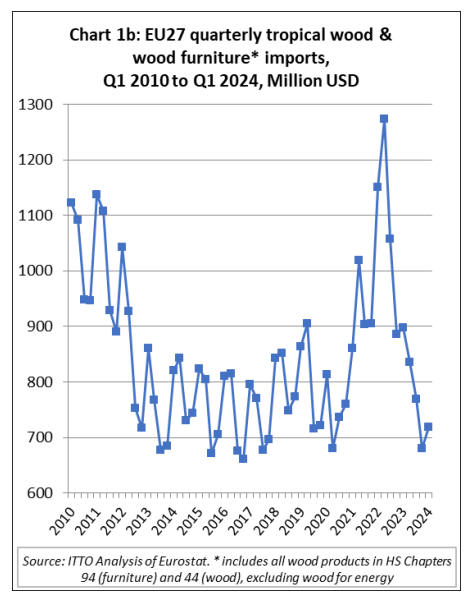

EU27 import value of tropical wood and wooden furniture

in the first quarter this year was US$718 million, 6% more

than the previous quarter but 20% down on the same

quarter last year.

Quarterly import value has fallen precipitously from a

historic high of US$1274 million in the second quarter of

2022 at the peak of the post-COVID boom (Chart 1b).

EU economy forecast to grow 1.0% in 2024 and 1.6% in

2025

While tropical wood import levels in the EU were

extremely low in the first quarter this year, the most recent

economic data is more encouraging. Following broad

economic stagnation in the EU in 2023, better-than-

expected growth at the start of 2024 and the ongoing

reduction in inflation set the scene for a gradual expansion

of economic activity for the rest of the year. This is

according to the European Commission's Spring Forecast

published on 15th May.

The European Commission forecasts GDP growth of 1.0%

in the EU in 2024 rising to 1.6% in 2025. EU consumer

price inflation is expected to fall from 6.4% in 2023 to 2.7% in 2024

and

2.2% in 2025.

According to Eurostat's preliminary flash estimate, GDP

edged up by 0.3% in the EU in the first quarter of 2024.

This expansion, which was broad-based across Member

States, should mark the end of the prolonged period of

economic stagnation that started in the final quarter of

2022.

Growth of economic activity this year and next is expected

to be largely driven by a steady expansion of private

consumption, as continued real wage and employment

growth sustain an increase in real disposable incomes. A

strong propensity to save is, however, still partially

holding back private consumption.

In contrast, investment growth appears to be softening.

Dragged down by the negative cycle of residential

construction, it is expected to pick up only gradually.

As credit conditions are set to improve, financial markets

now expect a slightly more gradual path of interest rate

cuts than forecast at the end of 2023.

Amid a more resilient global economy, a rebound in trade

is set to support EU exports. However, as domestic

demand resumes in the EU, an acceleration in imports will

largely offset the positive contribution of exports to

growth.

While the EU economy is expected to pick up gradually

this year, uncertainty and downside risks to the outlook

have further increased in recent months, mainly stemming

from the evolution of Russia's protracted war against

Ukraine and the conflict in the Middle East. Broader

geopolitical tensions also continue to pose risks.

Moreover, the persistence of inflation in the US may lead

to further delays in rate cuts in the US and beyond,

resulting in somewhat tighter global financial conditions.

On the domestic front, the decline of inflation may be

slower than projected, possibly leading EU central banks

to delay rate cuts. Furthermore, some Member States may

adopt additional fiscal consolidation measures in their

2025 budgets, not currently factored into the EC forecast,

which could impact economic growth next year.

EU27 tropical wood furniture imports continue to slide

in Q1 2024

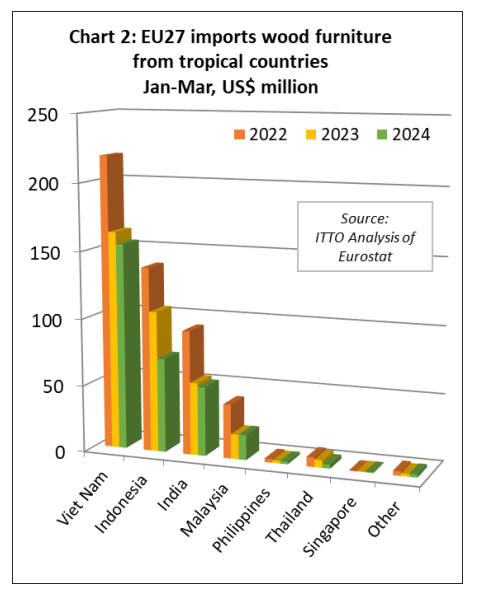

The EU27 imported 71,200 tonnes of wood furniture from

tropical countries with a total value of US$302 million in

the first quarter of 2024, down 6% and 14% respectively

compared to the same period in 2023.

In the first quarter this year compared to the same period

in 2023, EU27 import value of wood furniture decreased

from nearly all leading tropical supply countries, including

Vietnam (-5% to US$154.0 million), Indonesia (-33% to

US$70.3 million), India (-5% to US$51.5 million), and

Thailand (-47% to US$3.0 million).

Import value from Malaysia increased by 1% to US$18.6

million in the same period. EU27 wood furniture imports

from all other tropical countries were negligible during the

period (Chart 2).

Extremely slow start to year for EU27 imports of

tropical sawnwood

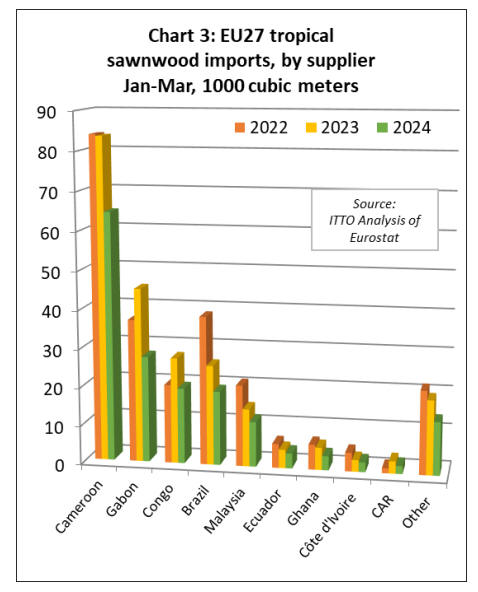

The EU27 imported 168,400 cubic metres of tropical

sawnwood in the first quarter this year, 28% less than the

same period in 2023. Import value of this commodity was

US$151 million in the first quarter this year, 31% less than

the same period in 2023.

Imports declined from all leading supply countries during

the period including Cameroon (-23% to 64,500 cubic

metres), Gabon (-39% to 27,500 cubic metres), Republic

of Congo (-29% to 19,600 cubic metres), Brazil (-26% to

19,200 cubic metres), Malaysia (-22% to 11,700 cubic

metres), Ecuador (-19% to 3,900 cubic metres), Ghana (-

37% to 3,700 cubic metres), Côte d’Ivoire (-17% to 2,500

cubic metres), and the Central African Republic (-36% to

2,000 cubic metres) (Chart 3).

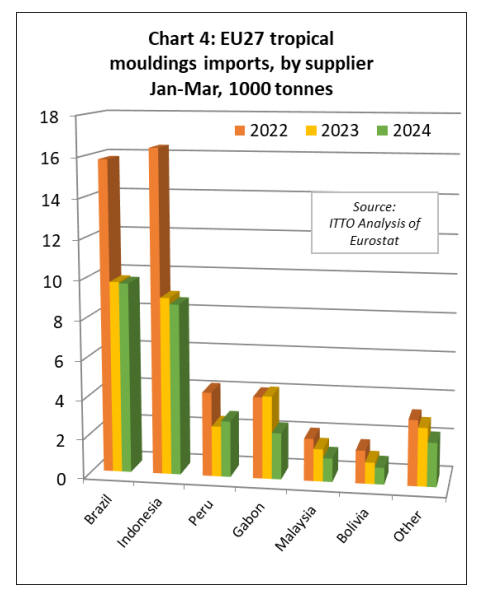

The EU27 imported 27,800 tonnes of tropical

mouldings/decking in the first quarter this year, 11% less

than in the same period in 2023. Import value of this

commodity was down 21% to US$49 million in the same

period.

During the first quarter imports increased year-on-year

from Peru (+11% to 2,800 tonnes) but fell from all other

leading supply countries including Brazil (-1% to 9,700

tonnes), Indonesia (-4% to 8,700 tonnes), Gabon (-44% to

2,400 tonnes), Malaysia (-27% to 1,200 tonnes), and

Bolivia (-22% to 800 tonnes) (Chart 4).

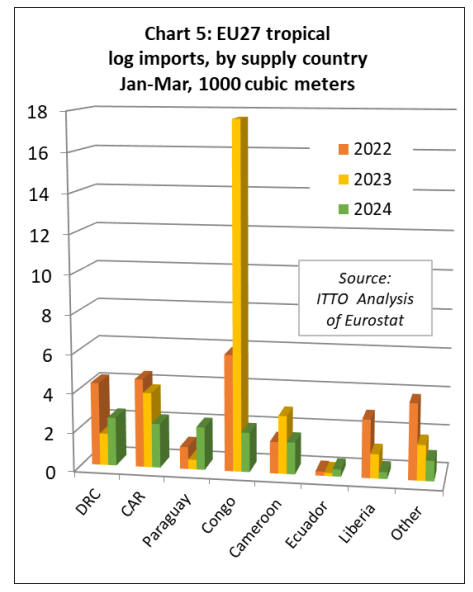

The EU27 imported 12,400 cubic metres of tropical logs

with a total value of US$7.2 million in the first quarter this

year, respectively 59% and 62% less than in the same

period last year. The decline was driven mainly by an 89%

decline in imports from the Republic of Congo to 2,000

cubic metres. This follows the ban on exports of most logs

from the country since 1st January 2023.

EU27 imports of logs in the first quarter of this year were

also down compared to the same period last year from the

Central African Republic (-41% to 2,300 cubic metres),

Cameroon (-45% to 1,600 cubic metres), and Liberia (-

72% to 300 cubic metres).

However, EU27 log imports increased from the

Democratic Republic of Congo (+52% to 2,500 cubic

metres), Paraguay (+341% to 2,200 cubic metres), and

Ecuador (+123% to 400 cubic metres) during the three-

month period (Chart 5).

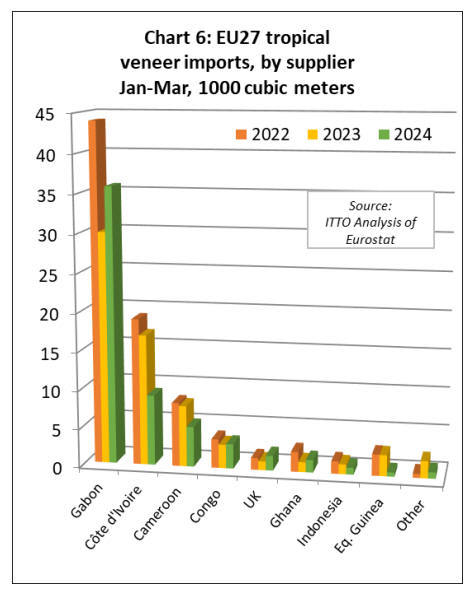

EU27 imports of tropical hardwood veneer down 11%

in first quarter

The EU27 imported 59,000 cubic metres of tropical veneer

with a total value of US$41 million in the first quarter this

year, down 11% and 13% respectively compared to the

same period last year. Imports of tropical veneer from

Gabon, by far the largest supplier to the EU27, were

35,800 cubic metres in the first quarter this year, 19%

more than the same period in 2023.

EU27 imports of this commodity also increased during the

period from the Republic of Congo (+4% to 3,200 cubic

metres), the UK (+69% to 1,900 cubic metres), and Ghana

(+26% to 1,600 cubic metres). However, these gains were

insufficient to offset falling imports from Côte d'Ivoire (-

46% to 9,100 cubic metres), Cameroon (-34% to 5,200

cubic metres), Indonesia (-31% to 900 cubic metres), and

Equatorial Guinea (-80% to 500 cubic metres) (Chart 6).

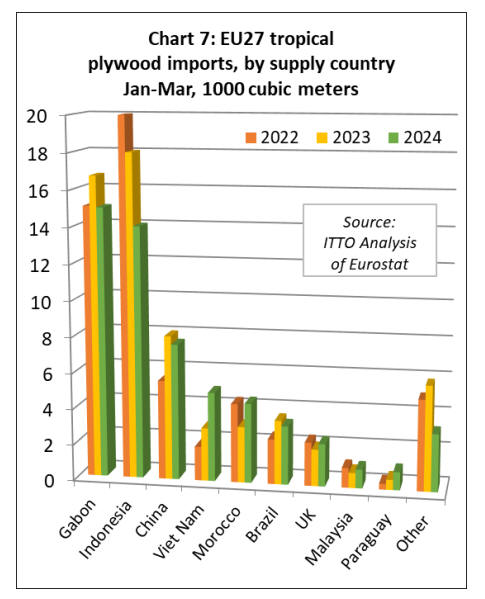

The EU27 imported 56,900 cubic metres of tropical

plywood with a total value of US$43 million in the first

quarter this year, respectively 8% and 11% less than the

same period last year. Imports fell from all the leading

supply countries during the period including Gabon (-10%

to 15,000 cubic metres), Indonesia (-22% to 14,000 cubic

metres), and China (-6% to 7,600 cubic metres).

Imports from Brazil were also down, by 8% to 3,300 cubic

metres. However, these losses were partly offset by rising

imports from Vietnam (+68% to 5,000 cubic metres),

Morocco (+42% to 4,400 cubic metres), the UK (+16% to

2,400 cubic metres), Malaysia (+25% to 1,100 cubic

metres), and Paraguay (+81% to 1,000 cubic metres)

(Chart 7).

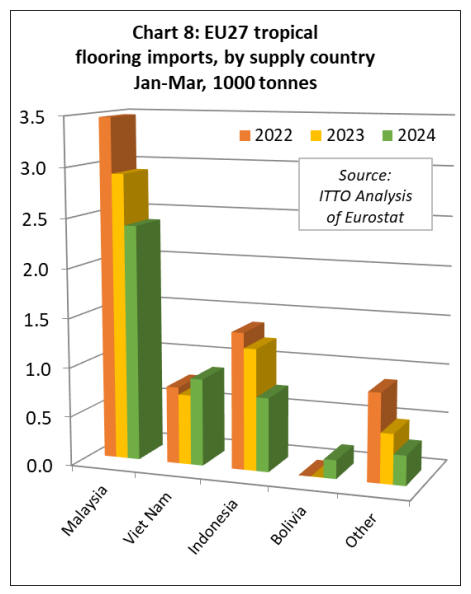

The EU27 imported 4,500 tonnes of tropical wood

flooring with a total value of US$12 million in the first

quarter this year, down 18% and 26% respectively

compared to the previous year.

Imports of 2,400 tonnes from Malaysia in the first quarter

this year were 18% less than the same period last year.

Imports also fell from Indonesia (-39% to 800 tonnes).

However, flooring imports increased from Vietnam (+24%

to 900 tonnes), and Bolivia (from a negligible level to 200

tonnes) (Chart 8).

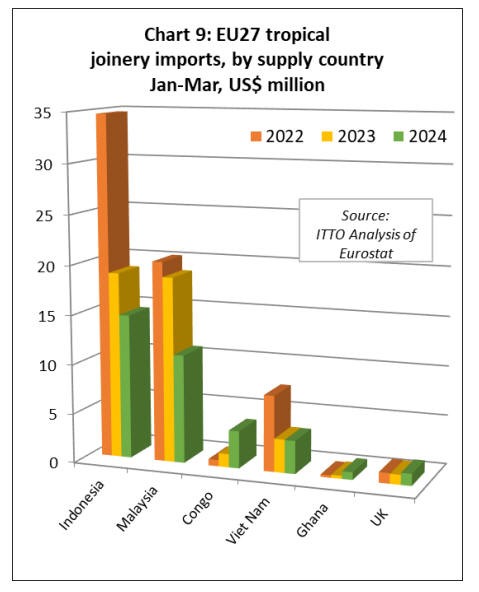

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors – was

US$39 million in the first quarter this year, down 22%

compared to the same period in 2023.

Import quantity fell 15% to 16,700 tonnes during the same

period. Imports were down 22% to US$14.7 million from

Indonesia, down 41% to US$11.0 million from Malaysia,

and down 1% to US$3.3 million from Vietnam.

In a potentially significant longer-term development, given

efforts in the country to shift up the value chain as log

exports are banned, EU imports of laminated joinery

products from the Republic of Congo were valued at

US$3.8 million in the first quarter this year, up 180%

compared to the same period last year. Imports from

Ghana also increased, by 147% to US$0.8 million in the

same period (Chart 9).

|