Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2024

Japan Yen 156.22

Reports From Japan

Rapid growth to lift

India’s GDP beyond Japan’s

According to forecasts from the International Monetary

Fund, India will overtake Japan in nominal gross domestic

product (in dollar terms) in 2025. Japan's nominal GDP in

2025 is forecast to reach US$4.31 trillion while India's is

expected at US$4.34 trillion. The timing of India's GDP

surpassing Japan's is a year earlier than the IMF projected

last October, reflecting the yen's steady depreciation.

If the forecast is correct, the Japanese economy will fall to

the fifth largest in the world. Behind the rise of India is not

only the weaker yen but also India’s rapid economic

growth driven by huge domestic demand as its population

is believed to have surpassed China's in 2023 and the

steady inflow of investment.

See:

https://www.japantimes.co.jp/news/2024/04/28/japan/india-japan-economies/

Labour pool continues to shrink

Private sector survey data compiled by Teikoku Databank

and published in the Japan Times reveals that over 50% of

the companies in the survey consider the labour shortage a

serious issue as they are finding it increasingly hard to find

enough employees.

As the labour pool continues to shrink companies say

labour shortage are one of their biggest concerns. Data

compiled by Teikoku Databank showed that out of the

over 27,000 companies surveyed in April, labour shortages

were most notable in the field of information technology

engineering.

See:

https://www.japantimes.co.jp/business/2024/05/06/economy/labor-crunch-continues-in-japan/

SMEs struggle to pass on rising labour costs

Reports in the domestic media say, according to a recent

survey, about 70% of companies in Japan will implement

pay scale increases in fiscal 2024 but for small and mid-

sized firms the number was much lower which is

unfortunate as these companies are the main employers in

Japan.

The Ministry of Finance survey found half of the small

and mid-sized firms said that they had been unable to pass

on rising labour costs. In addition, the survey found about

40% of all firms were struggling with labour shortages

even after raising wages.

According to the Tankan quarterly business sentiment

survey released by the Bank of Japan large manufacturer’s

business sentiment in March worsened for the first time in

the past four quarters.

See:

https://japannews.yomiuri.co.jp/business/economy/20240423-182000/

Several currency interventions suspected

The yen strengthened to 153.10 to the dollar at its peak on

8 May after the US Federal Reserve decided to keep

interest rates steady. The rally came after the yen was

trading close to 158 yen per dollar earlier the same day.

Financial data released by the Bank of Japan suggests that

the Japanese government possibly injected 3 trillion yen

(US$19 trillion) into currency markets to prop up the yen.

Former US Treasury Secretary, Lawrence Summers,

commented that currency interventions are generally

ineffective at shifting exchange rates in the long term,

even at the large magnitude that Japan has been thought to

have deployed recently.

See:

https://asia.nikkei.com/Business/Markets/Currencies/Yen-s-surge-after-Fed-announcement-stirs-fresh-intervention-talk

Vacant homes top 9 million

According to the Ministry of Internal Affairs and

Communications the number of vacant houses in Japan

rose to a fresh record of 9 million in 2023, up 510,000

from the previous 2018 survey and representing 14% of all

houses in the country, also a record-high.

The increase in vacant homes, known as’ akiya’ in

Japanese, can be attributed to cases where properties are

left unattended because single elderly dwellers die or enter

nursing homes, while individuals who inherited the

properties opt to live in more convenient locations,

according to the ministry.

The latest figure puts more pressure on central and local

governments to take measures to demolish or reuse such

uninhabited properties. The disadvantage to those

inheriting an old family home and considering

demolishing it is that vacant land attracts higher taxes in

Japan than land with buildings which adds to the financial

burden of knocking down old houses.

However, there is growing interest among foreigners in

this glut of empty properties,

particularly kominka (traditional) houses as an option for

cheap and unusual accommodation, holiday homes or to

rent out to tourists.

See:

https://japantoday.com/category/national/Number-of-vacant-homes-in-Japan-tops-record-9-mil

Enforcement of new law for decarbonised society

On 16 April, 2024 the Japanese government approved a

Cabinet decision that the new law for the decarbonised

society will be enforced as of 1 April, 2025.

According to the local media this will include 20 trillion

yen (US$137.4 billion) available for decarbonisation

support to encourage companies to participate in the

emissions trading system (ETS).

Private sector company participation in the ETS, which

began on a trial basis in Japan last year, is still optional but

the government will make participation a requirement for

companies to receive its financial support for going

greener.

The government will establish industry-specific guidelines

for reducing greenhouse gas emissions with a view to

setting targets. It will also consider providing guidance

and recommendations to companies that fail to meet their

targets based on these guidelines from fiscal 2026, when

the ETS comes into full effect.

Companies will be able to set their own reduction targets

based on ministry guidelines. Whether the targets are

appropriate or not will be subject to certification by a

third-party organisation. Currently, companies are free to

choose whether or not to participate in the ETS and can set

reduction targets on a voluntary basis. The Ministry will

not mandate participation even after fiscal 2026 but will

establish a mechanism to encourage participation in the

programme.

See:

https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Japan-to-encourage-companies-to-participate-in-emissions-trading

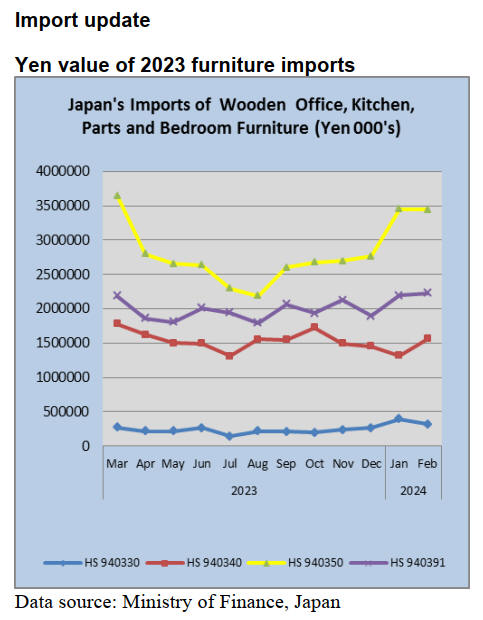

In February 2024 the yen exchange was 150 against

the

US dollar. The continued decline in the exchange rate has

pushed up the cost of imports such that the rising trend in

the value of imports appears entirely the result of the

exchange rate.

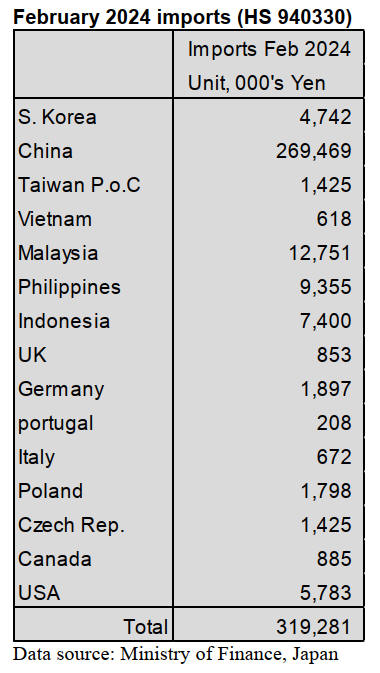

February wooden office furniture imports (HS 940330)

China and Malaysia were the top two shippers of wooden

office furniture (HS940330) to Japan, accounting for over

90% of total February arrivals.

The value of exports of HS940330 from China to

japan in

February declined 14% month on month and shipments

from Malaysia fell sharply (-70%) compared to the value

of January shipments.

The other significant shipper of HS940330 in

February

was the Philippines.

Year on year the value of Japan’s imports of wooden

office furniture almost doubled in February but compared

to a month earlier the value of imports dropped slightly.

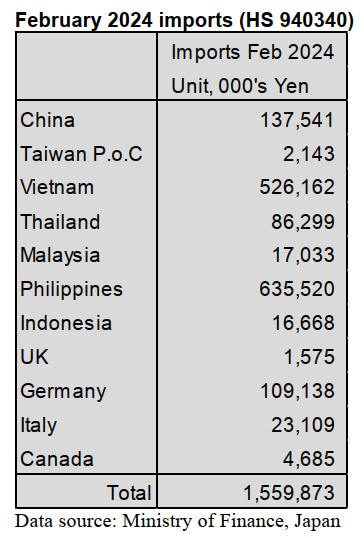

February 2024 kitchen furniture imports (HS 940340)

February marked the reversal of the three month decline in

the value of wooden kitchen furniture (HS940340) imports

into Japan.

Year on year the value of imports of HS940340 in

February rose with all the top shippers, the Philippines,

Vietnam and China recording increased shipments. In

addition to these three shippers exporters in Germany

managed a six fold increase in shipments of wooden

kitchen furniture to Japan in February.

Shippers in the Philippines, Vietnam and China accounted

for 83% of the value of February arrivals of wooden

kitchen furniture and all recorded month on month

increases in the value of shipments.

In previous months Thailand was among the top shippers

but the surge in imports from Germany pushed Thailand to

the 5th ranked supplier in February.

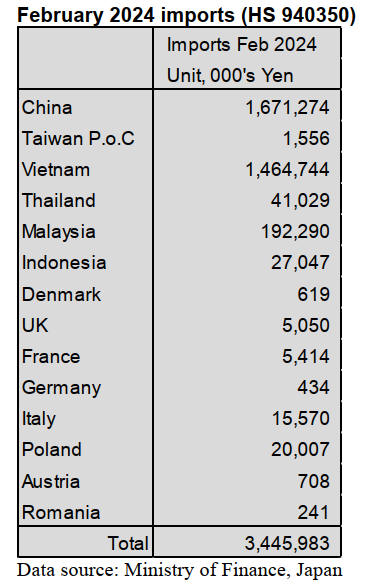

February 2024 wooden bedroom furniture imports

(HS

940350)

After five consecutive monthly increases in the value of

wooden bedroom furniture (HS930350) the value of

February imports cooled coming in at around the same

total value as January imports.

A plausible explanation for the rise in bedroom

furniture

imports over the past months is demand in the hospitality

sector.

The other factor could be the need for households to

replace furniture damaged or destroyed in the spate of

natural disasters in the country especially the earthquake

and tsunami which destroyed thousands of homes in the

Noto Peninsula.

Over 95% of the wooden bedroom furniture imported into

Japan in February was from China and Vietnam. February

arrivals from China were down from levels in January

while arrivals from Vietnam rose as did arrivals from

Malaysia.

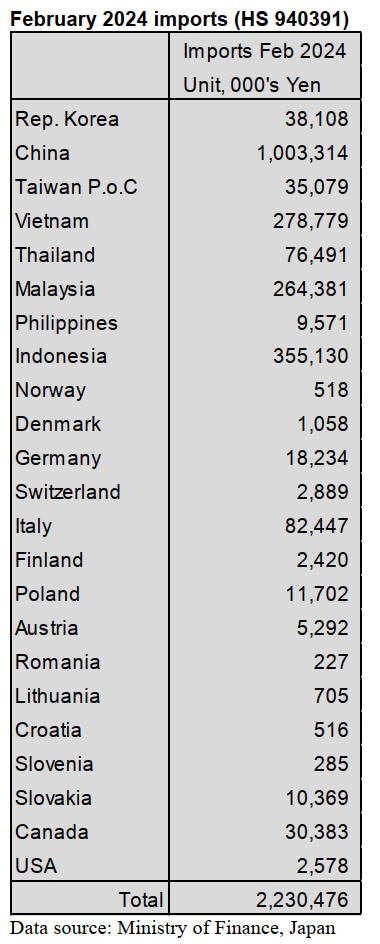

February 2024 wooden furniture parts imports (HS

940391)

There was a further slight up-tick in the value of wooden

furniture parts (HS940391) imports into Japan in

February.

Asian suppliers topped the list accounting for over 85% of

the total value of arrivals. In addition there was a wide

range of supply countries especially in Europe with

Germany and Italy at the top.

In February China was the main supplier followed by

Indonesia but these two top shippers accounted for only

around 65% of all shipments and both saw the value of

February shipments decline compared to a month earlier.

In contrast, shipments from Vietnam were higher in

February than in January while shipments from Malaysia

were little changed month on month.

Year on year, the value of Japan’s imports of wooden

furniture parts in February was slightly higher than in

January.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Enforcement of new law for decarbonised society

On 16th April, 2024, the Japanese government passed a

Cabinet decision that the new law for the decarbonised

society will be enforced as of 1st April, 2025. The new

law for the decarbonised society is that buildings with its

floor areas less than 10 square meters is not admitted to

the Energy Conservation Standards.

Rules of structures, such as‘Thickness of posts and an

amount of walls’, will be legislated because the solar

panels will be used for wooden structures. Office work of

building officers in the 47 prefectures of Japan and

municipalities will be revised.

Plywood

The situation of domestic softwood plywood has been

changed because several major plywood manufacturers

raised the price of plywood.

The price of structural softwood plywood had been low

because there were less orders to precutting plants and the

movement of plywood was sluggish in January to

February, 2024. However, Nisshin Group, Seihoku

Corporation and Hayashi Plywood Industrial Co., Ltd.

announced about the price hike of plywood as of April,

2024.

Some reasons for the price hike are the increased

distribution costs, labor costs, and subsidiary materials

costs. The price of structural plywood would exceed 1,300

yen, delivered per sheet in the future. In the middle of

March, several consumers purchased structural softwood

plywoo and several distributors sold a lot of plywood due

to the fiscal year-end in March. The price of 12 mm 3 x 6

structural softwood plywood was 1,250 yen, delivered per

sheet at the end of March.

Plywood manufacturers in Indonesia expect to raise the

price of plywood to Japanese buyers due to less logs in

Indonesia. 2.4 mm 3 x 6 costs around US$950, C&F per

cbm in South Asia.

3.7 mm cost around US$880, C&F per cbm. 5.2 mm costs

around US$850, C&F per cbm. 12 mm 3 x 6 structural

plywood costs US$560 – 570, C&F per cbm. Coated form

plywood costs around US$580, C&F per cbm. 12 mm 3 x

6 painted plywood for concrete form costs around

US$650, C&F per cbm.

In March, since the yen was continuing to depreciate

against the dollar, some major South Asian shippers

offered plywood for US$660 – 670, C&F per cbm. This is

US$10, C&F per cbm lower than the previous month.

Once, the yen depreciated to 160 yen against the dollar at

the end of April so Japanese buyers hesitated to sign

futures contracts.

The market price of South Sea structural plywood, South

Sea painted plywood for concrete and South Sea plywood

declined at the end of March. However, trading companies

announced the price hike of South Sea plywood as of

April. Now, the price of 12 mm 3 x 6 South Sea painted

plywood for concrete form is 1,950 yen delivered per

sheet. Structural plywood is 1,750 yen, delivered per

sheet. 2.5 mm plywood is 780 yen, delivered per sheet. 4

mm plywood is 1,000 yen, delivered per sheet.

5.5 mm plywood is 1,170 – 1,200 yen delivered per sheet.

Domestic logs and lumber

The price of domestic lumber is steady with a downward

tendency. Movement of domestic lumber was expected to

rise in April but it did not. Imported lumber was in short

supply and the price of imported lumber rose. Then,

lumber plants controlled production to balance demand

and supply.

As a result, there were not enough lumber at the market at

the end of March. However, there was not actual demand.

Even though, the price of lumber was lowered, consumers

would not purchase a lot of lumber so the price of lumber

leveled off at the market in many places.

In the southern part of Kanto region, KD cedar post is

around 55,000 yen, delivered per cbm. In the northern part

of Kanto region, KD cedar post is around 50,000 – 53,000

yen and this is 2,000 – 3,000 yen lower than the previous

month.

A cedar log for posts is 15,000 yen, delivered per cbm in

the northern part of the Kanto region, Kyushu area and

Tokai region. In Akita Prefecture, a cedar log for posts is

over 15,000 yen, delivered per cbm because Chugoku.

Lumber Co., Ltd.’s plant in Akita Prefecture started an

operation and demand for logs expanded. Ccypress log for

posts in Tokai region is 22,000 yen, delivered per cbm. In

Kyushu region, it is 21,000 yen, delivered per cbm.

In Chugoku region, 19,000 yen, delivered per cbm. These

prices are higher than the previous year.

Movement of small sized lumber is firm but movement of

structural lumber is dull. The selling price of lumber is low

so it is hard to get enough profits.

Hardwood log market in Hokkaido Prefecture

A hardwood log market was held in Asahikawa city,

Hokkaido Prefecture on 19th April, 2024. Volume of

hardwood logs at the market reached a level of 3,000 cbms

for the first time in five years.

Many lumber manufacturers and plywood manufacturers

did not purchase a lot of softwood logs because they have

been reducing products and the plywood price has been

falling. However, the price of hardwood logs is high so

loggers motivated to cut down a lot of hardwood trees.

Moreover, there had been enough space to put hardwood

logs at the market because it did not snow much in this

winter.

Volume of hardwood logs was 3,028 cbms at the market.

Usually, volume of hardwood logs in Hokkaido Prefecture

increases from the end of the year to next spring. It is easy

to deliver logs in this period because the ground and the

roads become hard by cold weather. Also, it is good for

logs because the cold weather keeps logs fresh. Many

buyers expect to purchase good quality logs at the market

during January to March.

There were several kinds of hardwood logs, such as Oak

logs and ash logs, at the market and the price of hardwood

logs were high. On the other hand, the price of softwood

logs such as larch logs, were low. The average unit price at

this market was 51,200 yen, per cbm and this is 12,400

yen, per cbm less than March. It was 63,600 yen, per cbm

in March. The reason is that qualities of hardwood logs

were not good enough.

New labeling system for export lumber

Japan Wood Products Export Association will enforce a

Japanese wood products export labeling system within this

fiscal year. Japan Wood Products Export Association held

information sessions about the new system in Japan and

overseas last year. Many Japanese exporters and foreign

buyers were interested in the new system very much.

The new system is to proof that lumber is made of

Japanese timber and is manufactured in Japan. Moreover,

when clients apply for a Japan Wood Products Export

Association’s logo, quality of lumber and management

system of the manufacturer will be checked. By putting a

label of ‘JAPAN WOOD’ on the lumber, it is reliable

lumber and it will strengthen Japanese brand. Also, it will

be easy for clients in overseas to find Japanese lumber.

Japan Wood Products Export Association will manage the

label.

It is able to put the label for lumber, veneers, and thin

boards, which are made of 100 % Japanese timber. Other

products are plywood, laminated lumber, LVL, furniture,

and daily use items, which consists 50 % of Japanese

timber. Japanese timber must be based on the Clean Wood

Act and logs must be cut down legally.

Establishment of private organisation in northern

Kanto region

There are ten domestic lumber companies in the northern

part of Kanto region and they will jointly receive orders.

Since they work together, they will be able to respond

several kinds of needs from customers.

The ten domestic lumber companies are

Ninomiyamokuzai Co., Ltd. in Tochigi Prefecture,

Tochimou Wood Industry Co., Ltd. in Tochigi Prefecture,

Miya Seizaisyo LLC. in Tochigi Prefecture, Watanabe

Seizaisyo Co., Ltd. in Tochigi Prefecture, Maruhachi LLC.

in Tochigi Prefecture, Yagisawa Inc. in Tochigi

Prefecture, Morishima Ringyo LLC. in Ibaraki Prefecture,

Ltd. Nogami sawmill in Ibaraki Prefecture, Hokota

Seizaisyo Co., Ltd. in Ibaraki Prefecture and Minakawa

Seizaisho LLC. in Ibaraki Prefecture. They established a

private organization.

All those companies are famous lumber companies in

Tochigi Prefecture and Ibaraki Prefecture. Each company

has its specialty. For example, one of the companies is

good at mass production and the other company is good at

producing small to large lumber, KD cypress / cedar posts,

interior construction materials, decorative laminated sheet,

JAS lumber and so on. Total log consumption of the ten

lumber companies will be 250,000 cbms annually.

The reason for establishing the private organization is that

Ninomiya mokuzai had an increase in orders for KD cedar

beams / posts and interior construction materials and the

company could not accept the all the orders.

The private organization will also host study groups

for

young executives and young successors of the companies

with architectural design firms and local forestry.

|