US Dollar Exchange Rates of

25th

Mar

2024

China Yuan 7.23

Report from China

Investment in Real Estate Development in 2023

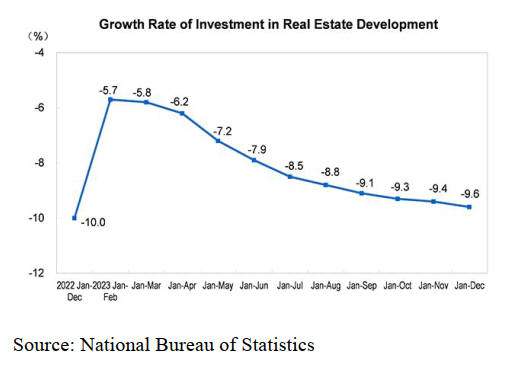

The National Bureau of Statistics has reported that in 2023

investment in total real estate development dropped by

almost 10% from the previous year and there was a

decline of 9.3% in investment in residential buildings.

In 2023 the floor space under construction was 8,383

million square metres, down by 7% over the previous year

of which the floor space for residential buildings under

construction was down by 7.7%.

The floor space of buildings newly started was down by

20.4%, of which the floor space of residential buildings

newly started was down by over 20%. Investment in real

estate in the Eastern Region was down 5%, down 89% in

the Central Region, down 19% in the Western Region and

down 26% in the North Eastern region.

See:

https://www.stats.gov.cn/english/PressRelease/202402/t20240201_1947107.html

Number of plywood production enterprises fell in 2023

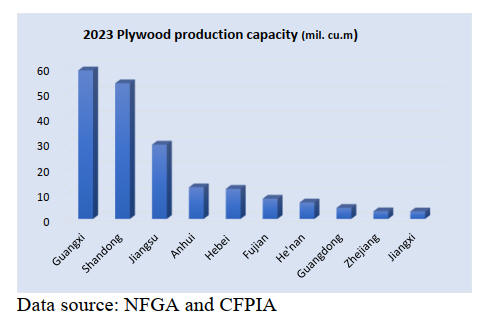

According to the Academy of Industry Development and

Planning under the National Forestry and Grassland

Administration (NFGA) and the China Forestry Products

Industry Association (CFPIA), the number of enterprises

in China’s plywood industry continued to decline in 2023.

There were more than 7,400 plywood manufacturing

enterprises in 2023, down 30% year on year, however, the

production capacity declined only slightly year on year

and stood at 205 million cubic metres in 2023.

For the first time Guangxi Zhuang Autonomous Region

exceeded Shandong in plywood production capacity in

2023 and thus became the largest in terms of plywood

production capacity. There were 1,430 mills in the

Guangxi Zhuang Autonomous Region with a capacity of

58 million cubic metres or around 30% of the national

total.

Shandong Province was the second largest in terms of

plywood production capacity and still had the largest

number of enterprises in 2023. There were 2,180 mills

with a capacity of 54 million cubic metres or 26% of the

national total.

At the beginning of 2024 around 1,500 plywood

production plants were under construction nationwide with

a total annual production capacity of about 29 million

cubic metres. 24 provinces and autonomous regions had

plywood production enterprises under construction except

Beijing, Shanghai, Tianjin, Chongqing, Qinghai Province,

Ningxia Hui Autonomous Region and the Tibet

Autonomous Region.

Sector analysts say the plywood industry must

continuously adjust its product structure to adapt to

changes in market demand and improve the quality of

products and the image of the sector. It is expected that

annual plywood production capacity in China will drop to

200 million cubic metres by the end of 2024.

Under current market conditions the supply capacity of

China's plywood industry is greater than demand. The

production of plywood for furniture making, home

decoration and furnishing accounts for about 35% of the

market in China and supply and demand in these markets

is relatively well balanced.

In contrast, production capacity for concrete formwork

plywood accounts for about 24% of the overall market and

production capacity in this sector far exceeds current

demand. The packaging plywood market was impacted by

competition from Oriented Strand Board (OSB), so

packaging plywood production declined and its market

share was less than 22% of the national total.

Blockboard production accounts for about 12% of the

national panel product capacity and other products such as

plywood for wood composite floor basic materials,

container floors and veneer laminated wood etc. account

for about 7% of the national total.

Rise in plywood exports to UAE and Nigeria

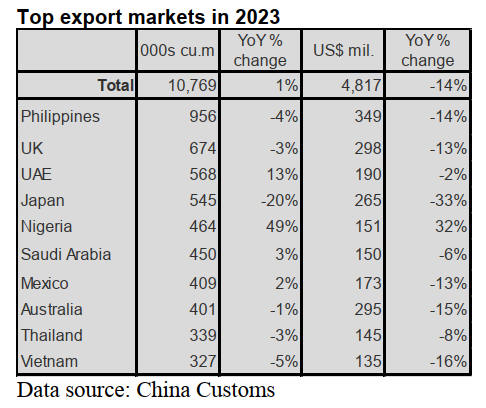

China Customs data shows plywood exports to UAE and

Nigeria in 2023 rose 13% and 49% to 568,000 cubic

metres and 464,000 cubic metres valued at US$190

million and US$150 million respectively. In contrast,

China’s plywood exports to Japan in 2023 fell 20% to

545,000 cubic metres valued at US$265 million, down

33% year on year.

China exports plywood to more than 200 countries and

markets and the market share of the top 10 countries for

China’s plywood exports in 2023 accounted for just 50%

of the national total.

China’s plywood exports totalled 10.769 million cubic

metres valued at US$4.817 billion in 2023, up 1% in

volume but down 14% in value over 2022.

The Philippines and UK are China's two major markets for

plywood but plywood exports to these two markets

declined in 2023. Export volumes to the Philippines and

UK fell 4% and 3% respectively. This has affected the

export performance of China’s plywood sector.

The US is no longer the main destination for Chinese

exports. China's plywood exports to the United States

totalled only 284,000 cubic metres in 2023 worth US$210

million, down 33% in volume and 42% in value over

2022.

Plywood imports from Russia

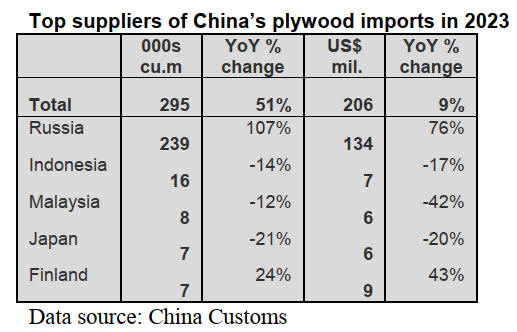

According to data from China Customs, plywood imports

in 2023 totalled 295,000 cubic metres valued at US$206

million, up 51% in volume and 9% in value over 2022.

Russia was the largest supplier of plywood to China in

2023. China’s plywood imports from Russia rose 107% to

239,000 cubic metres accounting for 81% of the national

total import volume.

Chinese enterprises have built factories in Russia to

manufacture plywood and export to China via the China-

Europe railway and these enterprises account for most of

the increased exports.

Indonesia, Malaysia, Japan and Finland were also

suppliers of plywood imports in 2023. China’s plywood

imports from Finland rose but from Indonesia, Malaysia

and Japan fell in 2023. China’s plywood imports from the

top 5 suppliers made up 93% of the national total in 2023.

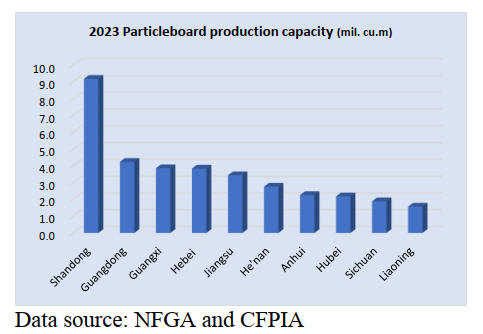

2023 particleboard production capacity

According to statistics from the Academy of Industry

Development and Planning under the National Forestry

and Grassland Administration (NFGA) and the China

Forestry Products Industry Association (CFPIA), both the

number of enterprises and total production capacity in

China’s particleboard industry rose in 2023.

There were more than 307 particleboard manufacturing

enterprises in 2023, up 4% year on year. The total annual

production capacity was 52.69 million cubic metres in

2023, up 27% over 2022.

Shandong Province was the largest in terms of

particleboard production capacity in 2023. There were 71

mills with a capacity of 9.2 million cubic metres,

accounting for 17% of the national total.

China's particleboard sector has seen a sharp rise

in

investment say local commentators and this inreases the

risk of imbalance between supply and demand. It is

forecast that mills now under construction will be

operational within 12-24 months and the annual

particleboard production capacity is expected to exceed 65

million cubic metres.

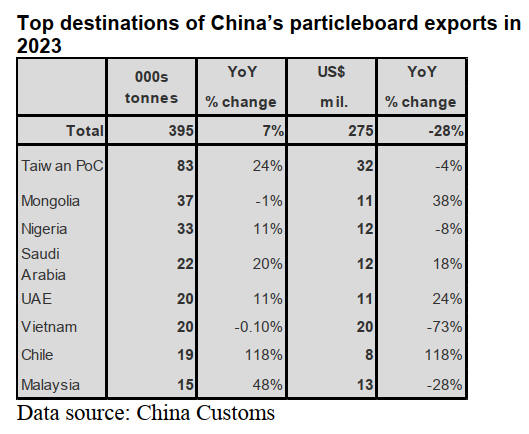

Surge in particleboard exports to Chile

China Customs data shows particleboard exports totalled

395,000 tonnes valued at US$275 million, up 7% in

volume but down 28% in value over 2022. Taiwan P.o.C,

Mongolia and Nigeria were the top 3 destinations in 2023.

Taiwan P.o.C was the largest destination for China’s

particleboard exports in 2023, up 24% to 83,000 tonnes

over 2022.

China’s particleboard exports to Chile surged 118% to

19,000 tonnes valued at US$8 million, up 118% over

2022. China exports of particleboard to Asia, Africa and

Latin America mainly for construction work associated

with the Belt and Road Initiative. The demand for low cost

particleboard in Asia, Africa and Latin America has

increased which has offered an opportunity for Chinese

exporters.

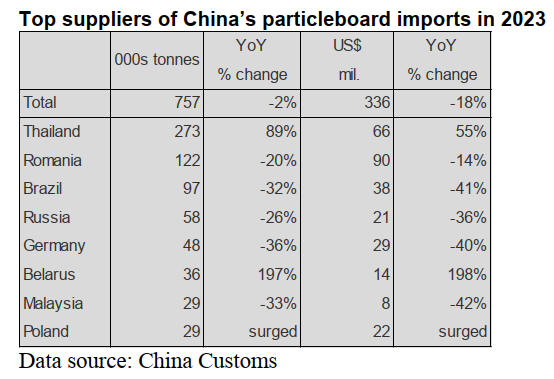

Surge in particleboard imports from Poland

Particleboard imports reached 757,000 tonnes valued at

US$336 million in 2023, down 2% in volume and 18% in

value over 2022. Thanks to the China-Europe freight train,

China has become Poland's second largest trading partner

and second largest source of imports. China’s

particleboard imports from Poland surged in 2023.

In 2023 particleboard imports from Thailand exceeded

those from Romania and became the largest supplier in

2023. The volume of China’s particleboard imports from

Thailand rose 89% to 273,000 tonnes valued at US$66

million, up 55% over 2022.

China’s particleboard imports from Belarus also surged in

2023. In contract, particleboard imports from Romania,

Brazil, Russia, Germany and Malaysia fell in 2023 which

drove down overall imports.

China GTI indices for February

In February, the GTI-China index registered 31.7%, a

decrease of 2.4 percentage points from the previous month

and was below the critical value (50%) for 3 consecutive

months indicating that the business prosperity of the

timber enterprises represented by the GTI-China index

declined from last month. In February, in celebration of

the Spring Festival, most of the timber enterprises halted

production resulting in a significant decrease of trading

activities.

As for the 11 sub-indices, the purchase price index was

above the critical value of 50%, while the remaining 10

sub-indexes were all below the critical value. Compared to

the previous month, the sub-indices for export orders,

existing orders, purchase prices, inventory of main raw

materials, and employees increased.

The sub-indices for production, new orders, inventory of

finished products, purchase quantity, import and delivery

time declined by 1.2 - 8.9 percentage points.

Main challenges reported by GTI-China enterprises

There was a slight increase in shipping costs

Orders were insufficient and it was difficult to

receive the final payments.

The production volume decreased compared with

previous years and the costs of running

equipment increased as a result of intermittent

operations.

China's timber market was sluggish due to a

downturn in real estate transactions.

In tonnage terms this was the lowest on record, 8% less

than the previous low of 430,000 tonnes in 2015 (Chart 1).

This is around half the level of tropical wood imports into

the UK typical two decades ago before the 2007-2008

recession.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

https://www.itto-ggsc.org/static/upload/file/20240319/1710813683173232.pdf

|