Japan

Wood Products Prices

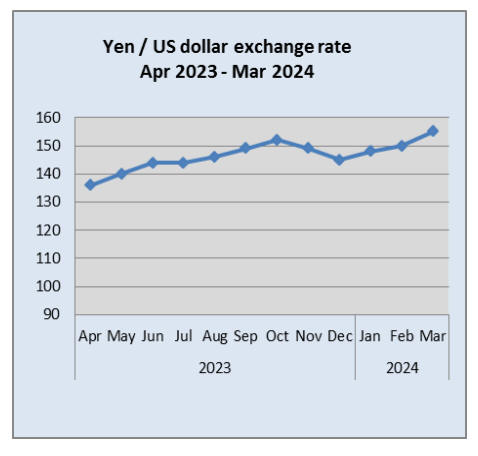

Dollar Exchange Rates of 25th

Mar

2024

Japan Yen 151.46

Reports From Japan

Japan raises interest rates for

first time in 17 years

The Bank of Japan announced on 19 March an end to

negative interest rates and a review other ultra-loose

monetary policies that have been in place for more than a

decade to buoy the stagnant economy. This comes as

wages jumped after consumer prices rose. In 2016 the

bank cut the rate below zero in an attempt to stimulate the

country's stagnating economy.

The BoJ will also raise its interest rate on part of the

balance of current account deposits that commercial banks

hold at the central bank from minus 0.1% to plus 0.1%.

The unconventional policy was aimed at encouraging

banks to increase lending to businesses.

In addition, the BoJ will abolish a policy framework,

known as yield curve control, designed to keep long-term

interest rates low by purchasing government bonds. The

policy change in Japan means that there are no longer any

countries left with negative interest rates.

Business Federation urges government to combat

deflation

Masakazu Tokura, chairman of the Japan Business

Federation known as Keidanren said that the Federation

hopes the government will take necessary measures to

fully combat the country's decades-long deflation. He is

quoted as saying "It is important for the country to work as

one to make this year a historic turning point in

completely overcoming deflation that has continued for 30

years."

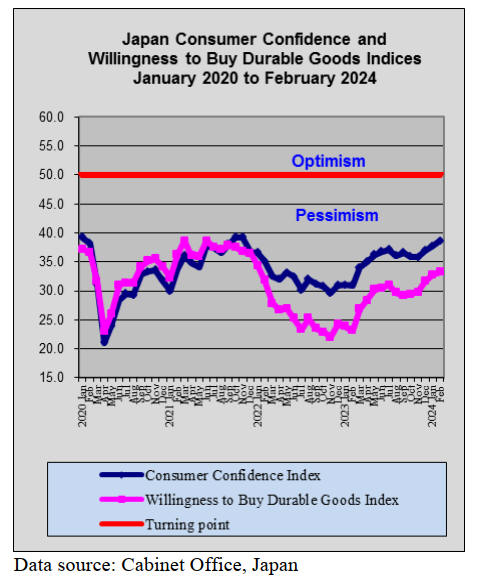

This call by the Federation appears to have been heard by

the Government as, in a budget speech, the Japanese Prime

Minister said that Japan is "only halfway" to ending

deflation, pledging to continue implementing measures to

achieve a virtuous cycle of wage and price rises. The

government plans tax cuts and policy changes to help

companies continue with wage increase in a bid to realise

disposable income growth among consumers.

A recent Nikkei survey of top executives between 26

February and 13 March just 50% of respondents say the

economy is "expanding" or "expanding slightly", down

from 72.5% in the December survey. This marks the

lowest reading since the March 2022 poll where only 13%

expected any expansion.

Corporate leaders have grown less upbeat on the economy

in recent months signaling a cautious stance ahead of wage

hikes that could begin to boost spending later this year.

Hiroyuki Isono, president and group CEO of paper

company Oji Holdings "Because of the prolonged

inventory adjustments, along with the weak consumer

spending and the weak Chinese economy, it remains

unclear when the manufacturing sector will recover."

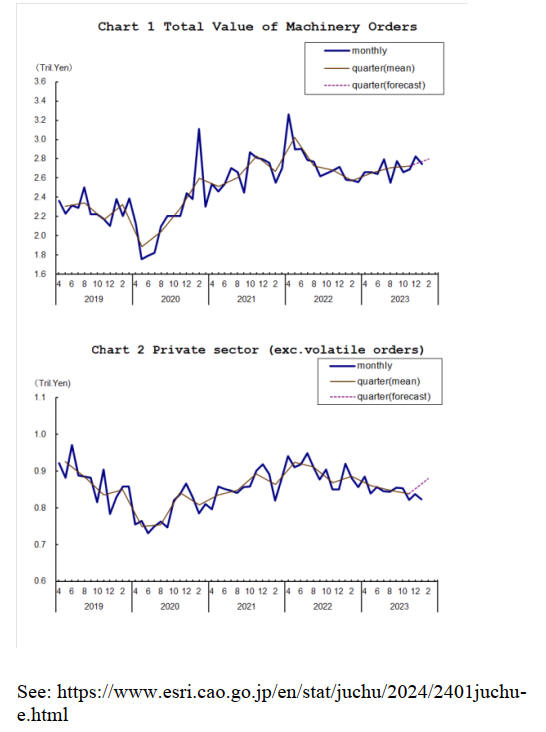

Orders for machinery down in January

The Cabinet Office has reported the total value of

machinery orders received by 280 surveyed manufacturers

operating in Japan fell by almost 3% in January from the

previous month. Private-sector machinery orders,

excluding volatile ones for ships and those from electric

power companies, decreased a seasonally adjusted by 2%

in January.

Part-time worker wages below that of full time

employees

The major Japanese corporations have agreed record pay

rises signaling the employers have finally stopped holding

back on pay in order to to build up their dash reserves.

This comes after around 30 years of extremely low

nominal wage growth.

In past years, Japanese companies had been

preoccupied

with controlling production costs in the face of global

competition but the labour shortage has proven, again, that

when supply cannot meet demand prices (in this case

wages) go up.

Japan has one of the world's oldest populations which has

led to a decline in the number of working-age individuals

making it challenging for companies to fill job vacancies.

Another issue is that companies took advantage of recent

laws allowing an increase in the number of so-called ‘part-

time workers’ whose wages are below that of full time

employees.

Japan lags far behind other big economies in minimum

wages and the minimum wage in Japan was 45% of

median full-time wages in 2022. The percentage of

workers in Japan whose income was below the new

minimum-wage level when it was raised in fiscal 2022

came to 19%, a sharp rise from an earlier survey reflecting

an increase in part-time workers.

See:

https://asia.nikkei.com/Spotlight/Market-Spotlight/Japan-s-wage-hikes-create-game-changing-inflation-dynamic-as-BOJ-meets

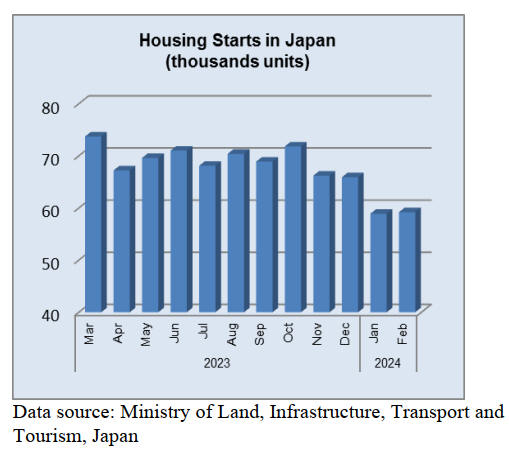

Residential property growth slowing

Data compiled in the Global Property Guide indicates

Japan’s residential property growth is slowing amidst

falling demand and weakening construction activity.

During the third quarter of 2023 the nationwide residential

property price index rose by a modest 2.4% from a year

earlier, a slowdown from y-o-y increases of 4.8% in the

second quarter and 4.1% in the first quarter according to

the Land Institute of Japan.

See:

https://www.lij.jp/monthly.html

and

https://www.globalpropertyguide.com/

Japan – the the last major economy to end

negative

interest rate policy

After the Bank of Japan (BoJ) ended its negative interest

rate policy, the last major economy to do so, the yen fell

sharply against the US dollar.

The US dollar hit a four-month high of yen 154 recently

way beyond the lowest seen in October 2022 when Japan

carried out so-called stealth interventions, buying yen to

sell dollars without announcing the moves immediately.

The yen’s recent weakness reflects a view among market

players that the BoJ is unlikely to raise interest rates

further anytime soon as premature tightening of monetary

policy with additional interest rate increases could quickly

undo the gains made in tackling deflation and the benefits

to exporters of a weak currency.

See:https://asia.nikkei.com/Business/Markets/Japanese-yen-slides-past-150-after-BOJ-decision-to-raise-rates

Import update

Assembled wooden flooring imports

Imports of assembled wooden flooring (HS441871-79) in

January 2024 were at around the same value as in

December 2023, a pattern that has been consistent in most

years reflecting the quiet demand due to the construction

sector holidays in January.

Year on year the value of January 2024 imports was down

15% which, when viewed against the rate at which the yen

has weakened over the past 12 months signals a significant

decline in the volume imported.

In January the main category of assembled flooring

imports was HS441875 accounting for around 70% of the

total value of assembled flooring imports. The second

largest category in terms of value was HS441873

exceeding that of HS 441879.

The main shippers of assembled flooring in January were

China 59%, up from slightly from a month earlier, the US

12%, Vietnam 11% with a further 6% being shipped from

Indonesia.

Plywood imports

Of the four main suppliers of plywood (HS441210-39) to

Japan it was only those in Indonesia that did not see a rise

in shipments in January. Month on month there was a rise

in import volumes from Malaysia in January (50,175

cu.m) but a decline in the volume from Indonesia (52,288

cu.m).

The volume of plywood imports from Vietnam in January

was, once again, higher than that from China and was up

month on month. Plywood imports from China began to

decline in mid 2022 and bottomed out in mid 2023 and

since have started to recover but are far from levels seen

prior to 2022.

Of the various categories of plywood imported, 85% was

HS441231 in January with HS441233 and HS441234

accounting for around 5% each. The four main shippers of

plywood to Japan, Indonesia, Malaysia, Vietnam and

China consistently account for over 90% of plywood

imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Quake damages in Noto Peninsula in Ishikawa

Prefecture

There has been heavy damage at mountains and forests in

Noto Peninsula in Ishikawa Prefecture due to the massive

earthquake. Production of raw material in 2022 was

113,000 cbms in Ishikawa Prefecture. About 30 – 40 % of

raw materials are from Wajima City, Suzu City and Noto

town where are damaged by the earthquake badly.

Forest Owners’ Co-operative Association in Ishikawa

Prefecture announced that three forest associations

Ishikawa Prefecture, which had less damage by the

earthquake, will supply raw materials for a forest

association of Noto. The forest associations aim to supply

a level of 90,000 cbms of raw materials annually.

South sea logs and lumber

Movement of hardwood still sluggish. Demand have been

dull and movement of deck or laminated boards is

sluggish. yen is 150 yen against the dollar and it is not

good timing to purchase lumber.

Demand for South Sea lumber and Chinese lumber have

not been increasing and the distributors in Japan expect to

purchase lumber when the yen is strong.

Especially, the price of South Sea lumber is high in South

Asia because of less South Sea logs so the foreign

exchange is very important for Japanese buyers to

purchase South Sea lumber or not.

The price of laminated boards in South Asia is

unchanged

from the previous month. Production is high in South

Asia so laminated board manufacturers would not lower

the price.

Imported South Sea logs and lumber in 2023

Import of South Sea logs in 2023 is 30,749 cbms, 34.8 %

less than 2022. Import of South Sea lumber in 2023 is

136,298 cbms, 15.4 % less than last year. Imported

laminated board in 2023 is 160,930 cbms, 16.4 % less than

last year. Reasons are that there is low demand for South

Sea logs and lumber in Japan and there are not enough

South Sea logs in South Asia.

Local manufacturers in the state of Sabah and the state of

Sarawak, Malaysia reduced producing South Sea lumber

so there were not a lot of South Sea logs.

Logs in Papua New Guinea, which exports logs to China

the most, were less because there were not a lot of

inquiries from China due to the sluggish economy in

China. Some manufacturers in Papua New Guinea, which

produce and export logs and lumber to Japan, struggled to

purchase logs through a year. South Sea products are

popular for blocks for steels and for truck bodies in Japan.

|