|

1.

CENTRAL AND WEST AFRICA

Demand in Asian markets continues to improve

Producers report there has been a slight increase in

demand in Asian markets and for a wider range of species

than in recent month with more interest being shown in

movingui while demand for ovangkol/shedua has cooled.

Kevazingo is no longer shipped from Cameroon or Gabon

but there are reports of shipments appearing to originate in

Equatorial Guinea.

Production is showing signs of improvement in Cameroon

with sawmills actively building stocks. Despite quiet

demand in Asian and Middle East markets, renewed

buying interest in China for species like bilinga, padouk,

iroko and movingui has been welcomed.

European market are reported as stable overall with a

minor uptick in demand seen for sapele sawnwood. There

are regular orders for padouk, iroko and doussie but for

small volumes.

There are reports (unconfirmed) that a large volume of

logs has been seized in Gabon and that these have been

sold mainly to plywood factories in GSEZ at low prices.

This has caused dissatisfaction among other log suppliers.

However, the volume seized is said to be equivalent to

around one month's log requirements for veneer mills in

the Nkok special zone.

Land tax payments due

March 25th marked the deadline for operators in Gabon to

pay their land taxes at the current rates. The rates vary

based on the certification status of companies. Those with

FSC or OLB certification (Origine et Légalité des Bois)

incur a fee of 300 CFA per hectare those with only legal

agreements are charged 600 CFA per hectare with others

facing charges of 1000 CFA per hectare. It is reported that

some operators have opted for instalments until year-end

to manage their cash flow.

Towards the modern silvicultural practices in

Cameroon

Over the past two years the UFA-REFOREST project

funded by the European Union has been supporting four

forestry companies in Cameroon; AlpiCAM-GrumCAM,

PALLISCO, SEEF and SEFAC in forest restoration. More

than 45,000 trees have been planted in areas where the

forest cover has been disturbed.

The project is being implemented by ATIBT with the

support of its technical partners Gembloux Agro-Bio Tech

(ULiège), ENSET Douala and Nature Plus.

See:

https://www.atibt.org/en/news/13465/ufa-reforest-project-towards-the-modernisation-of-silvicultural-activities-in-forest-concessions-in-cameroon

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

https://www.itto-ggsc.org/static/upload/file/20240319/1710813683173232.pdf

2.

GHANA

Business Chamber bemoans high

cost of doing

business

The Ghana/South African Business Chamber has warned

the high cost of doing business in the countryis impacting

negatively on both small and large enterprises. President

of the Chamber, Grant Weber, described the current

economic conditions as unfavourable and advised

businesses they must carefully manage their costs to

withstand these challenging times.

The Ghana/South African Business Chamber’s works to

promote trade, investment and cultural interactions

between Ghana and South Africa. Members are from the

mining, trade, financial services, real estate engineering,

agro processing, manufacturing, import and export

services and energy sectors.

In related news, the local media has reported the Ghana

National Chamber of Commerce and Industries (GNCCI)

has suggested that Ghana loses shipping opportunities to

Togo over high port charges.

Disputing this the Director General of Ghana Port and

Harbours Authourity (GPHA), Michael Luguji, said the

GPHA fees and levies at the ports are not the problem

pointing to other cost centres such as custom duties, levies

and other government agency charges which cannot be

attributed to GPHA.

The Minister of Finance Dr. Mohammed Amin Adam,

called for an assessment and review of the port clearing

system and related charges.

See:

https://www.myjoyonline.com/ghana-south-african-business-chamber-bemoans-high-cost-of-doing-business/

and

(https://www.ghanaweb.com/GhanaHomePage/business/Ghana-loses-vessels-traffic-to-Togo-over-high-port-charges-GNCCI-1922391)

and

(https://www.myjoyonline.com/we-are-not-responsible-for-high-port-charges-gpha/)

Boosting the local businesses community

Speaking at a consultative meeting with members of the

Council of Indigenous Business Association of Ghana

(CIBA), The Vice President, Dr. Mahamudu Bawumia,

said many indigenous Ghanaian businesses, which

constitute the majority of the business community, are not

formalised and sadly are not reflected in government data

which does not augur well for policy planning and growth.

He said he will engage with the leadership of CIBA for

their members to be formalised and their businesses

registered.

He also mentioned tax reforms which, according to him,

are carefully thought through to help the growth of

businesses, especially indigenous businesses. He indicated

the tax reforms the government intends to roll out in 2025

include a tax amnesty for businesses and individuals, a flat

rate tax for businesses, as well as cancellation of some

taxes. These are aimed at boosting businesses and ensuring

transparency and understanding in the tax system.

See:

https://www.myjoyonline.com/formalising-indigenous-businesses-key-on-my-agenda-dr-bawumia-to-ciba/

2023 wood exports – down by 15%

Ghana’s wood product exports in 2023 dropped in both

volume and value registering 15% and 12% respectively

according to data from the Statistics and Research Unit of

the Timber Industry Development Division (TIDD).

Nineteen wood products at a volume of 293,285 cu.m

were exported in 2023 compared to the 343,543 cu.m

recorded for same period in 2022.

Air and kiln-dried sawnwood accounted for 71% of the

total export volume in 2023 (293,285cu.m). Export

volumes of air dried sawnwood dropped by 10% year-on-

year and exports of kiln dried sawnwood dropped by 15%.

Teak logs briquettes and plywood were the only products

that recorded increased export volumes in 2023. The

export statistics revealed that teak log exports in 2023

surged to Eur2.82 million in 2023 from sales of just

Eur0.17 million in 2022.

The main log export species were teak and gmelina which

were for the India market (95%) with the balance going to

the UK.

Stakeholders briefed on modalities of TREES

The Climate Change Directorate (CCD) in the Forestry

Commission, in collaboration with the Architecture for

REDD+ Transactions (ART) and the REDD+

Environmental Excellence Standards (TREES), organised

a 4-day engagement for stakeholders.

The workshop formed part of Ghana’s preparation for the

third-party verification and validation process and

education for stakeholders on the modalities of TREES.

Ghana has submitted the TREES Registration and

Monitoring document to ART under the Lowering

Emissions by Accelerating Forest Finance (LEAF)

Programme which covers the 10 southern regions of

Ghana, excluding the Oti Region.

In his presentation, Thomas Yaw Gyambrah, Manager for

Measurement, Reporting and Verification (MRV) and

Programmes of the Climate Change Directorate, provided

an overview on Ghana’s REDD+ process leading into

ART/ TREES. He said Ghana has made impressive

progress in implementing the components of the Warsaw

Framework since the country joined the REDD+

mechanism in 2008 through the Forest Carbon Partnership

Facility.

The MRV Manager added that these systems have helped

developed a REDD+ Strategy, establish a safeguard

system, create a Forest Reference Level and put in place a

National Forest Monitoring System.

He also stated that Ghana has a REDD+ Strategy with 5

programmes with 2 of them under implementation; the

Ghana Cocoa Forest REDD+ Programme (GCFRP) and

the Ghana Shea Landscape Emission Reductions Project

(GSLERP). The Managing Director of the ART

Secretariat, Christiana Magerkurth, gave a presentation on

the verification and validation process and how the ART

Secretariat functions.

See:

https://fcghana.org/ccd-and-art-trees-engages-stakeholders/

3. MALAYSIA

Association addresses future of

industry and the way

forward

The Timber Exporters' Association of Malaysia (TEAM)

president has urged the government to assist the industry

regain its competitiveness as many companies are still

trying to recover from the impact of the Covid pandemic.

TEAM president, Chua Song Fong, said there has been a

significant drop in the volume of timber exports. The

impact, he said, can be felt throughout the supply chain

from upstream to the downstream including those involved

in logging activities, manufacturing, furniture producers,

timber treatment and also logistics. He added, the reduced

harvest from the natural forest has had an impact and that

there is a need to increase the availability of raw materials

to keep the industry going.

Chua suggested that it will soon be necessary to import

raw material for manufacturing but policies to ease the

import of timber need to be in place. In the long term more

tree plantations are needed.

See:

https://www.nst.com.my/news/nation/2024/03/1028507/future-timber-industry-and-its-way-forward

Certification of wood and biocomposite products

The Malaysia Timber Industry Board (MTIB) through the

Fibre and Biocomposite Centre (FIDEC) took the initiative

to organise a consultation on ‘Certification of Wood and

Biocomposite Products Toward Sustainability and Green

Label’.

The programme highlighted the importance of certification

of wood and biocomposite products especially from

biomass raw materials such as palm biomass, wood

residues and agricultural biomass. Five speakers

presented in the consultation.

The first was on ‘Sustainability for Wood and Furniture

Products - Requirement in Global Markets’ then ‘Chain of

Custody (CoC) Certification for Palm Oil Biomass

Products’ followed by a presentation on ‘Carbon Footprint

and Eco-Labelling Certifications’.

Nursyahida binti Mohd Ramli from the Malaysian Green

Technology and Climate Change Corporation (MGTC)

presented on MyHIJAU Mark Recognition Scheme for

Green Products and Services.

MyHIJAU Mark is Malaysia’s official green recognition

endorsed by the Government of Malaysia, bringing

together certified green products and services that meet

local and international environmental standards under one

single mark. The programme also featured a presentation

by Dr. Loh Yueh Feng from FIDEC on ‘Sustainability of

the Wood and Biocomposite Industry in Malaysia’.

See:

https://www.mtib.gov.my/muaturun/eMaskayu_Publication/eMaskayu_2023/eMaskayu%20Vol%2010_2023.pdf

Ringgit will strengthen - Central Bank

Bank Negara Deputy Governor, Datuk Marzunisham

Omar, has said the Bank is optimistic the ringgit will

strengthen towards the end of the year driven by structural

reforms and positive growth prospects and stressed that

based on the Bank’s imternal analysis the local currency is

undervalued.

The ringgit hit a 26-year low on 20 February, falling to

RM4.7965 against the US dollar, its weakest level since

the 1998 Asian financial crisis when it hit RM4.8850.

Marzunisham said household spending and private

consumption will remain the key drivers of growth with

favourable labour market wages anticipated to continue

improving which will provide support to household

spending , investment is also picking up, he added.

Malaysian Economic Association Deputy president

,Professor Dr. Yeah Kim Leng, noted that the ringgit is

relatively weak at the moment mainly because of the

interest rate differential between Malaysia and the US.

See:

https://thesun.my/business/bank-negara-optimistic-ringgit-will-appreciate-GE12259852

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malasia.

https://www.itto-ggsc.org/static/upload/file/20240319/1710813683173232.pdf

4.

INDONESIA

SVLK with geolocation verifier

An early March meeting of the Indonesia-EU Joint

Implementation Committee discussed cooperation on

improving law enforcement, governance and trade in the

forestry sector. The Director of Forest Product Processing

and Marketing at the Ministry, Krisdianto, revealed that

the SVLK continues to undergo development towards

improvement including the addition of rules regarding

geolocation.

The Indonesia Timber Legality Verification System

(SVLK) is an instrument to ensure wood products

originate from legal and sustainably managed forests.

The Acting Director General of Sustainable Forest

Management at the Ministry of Environment and Forestry,

Agus Justianto, told the meeting that Indonesia’s SVLK

has been recognised as an effective instrument to verify

the legality and sustainability of Indonesian wood

products.

The geolocation information will be integrated into

various forest product utilisation systems managed by

KLHK, such as the Forest Utilisation Business Control

Information System (SIPASHUT), the Forest Product

Administration Information System (SIPUHH), the Raw

Material Utilisation Plan Information System

(SIRPBBPHH) and the Timber Legality Information

System (SVLK).

In related news, the founder of the Indonesian Forestry

Certification Cooperation (IFCC), Dradjad Hari Wibowo,

has suggested the government must swiftly adapt to the

European Union Deforestation-free Regulation for

exported forest products.

Dradjad mentioned that the EUDR will be implemented in

December 2024 and that the IFCC is developing a draft

document and scheme that exporters can use as a

reference. This will enable exporters to obtain a geo-

location after a certification audit,” said Dradjad. The aim

is to assist exporters adapt to the EUDR regulations.

The Secretary General of the Ministry of Trade, Suhanto,

stated that the Ministry supports the efforts of the

Indonesian Forestry Certification Cooperation (IFCC)

while waiting for the European Union to establish

technical rules regarding EUDR as it is better for

Indonesia to prepare early.

Regarding the development of IFCC certification, Agus

Justianto, emphasised that, as a voluntary scheme, the

IFCC/EUDR certification must still comply with legality

aspects according to SVLK. “Voluntary certification must

ensure that all SVLK criteria and indicators are met in the

issuance of voluntary certificates.

See:

https://forestinsights.id/svlk-has-geolocation-verifier-complies-with-eu-deforestation-regulation/

and

https://www.medcom.id/ekonomi/sustainability/aNr7Z1Vb-svlk-jamin-legalitas-dan-kelestarian-kayu-indonesia

and

https://www.antaranews.com/berita/4018374/uni-eropa-buat-aturan-bebas-deforestasi-indonesia-diminta-antisipasi

Ministry asks furniture industry to track global trends

The Ministry of Industry has asked small and medium

furniture industry players to continue to innovate by

tracking global trends.

The ministry’s Director General of Small and Medium

industries, Reni Yanita, said that innovations can be driven

by exploring the cultures of Indonesia and incorporating

them in modern furniture. Through this, she said,

Indonesia could become a trendsetter in developing an

environment-oriented lifestyle and the furniture industry

business climate would improve.

To encourage small and medium furniture industry players

to further innovate the Ministry has been holding

exhibitions to increase the competitiveness of the sector.

One such exhibition, Jogja International Furniture and

Craft Fair Indonesia (JIFFINA), was held in March.

In the 2024 JIFFINA the Ministry of Industry organised a

business matching programme that brought together

prospective buyers and producers in the furniture sector.

It also invited small and medium furniture industry players

to participate in the procurement of goods and services for

the central government, regional governments, state-

owned enterprises (SOEs) and regional-owned enterprises

by getting a domestic component level (TKDN)

certificate.

See:

https://en.antaranews.com/news/308550/ministry-asks-furniture-industry-to-innovate-follow-global-trends

Carbon market still sluggish

The Ministry of Environment and Forestry (KHLK) has

determined that the development of the carbon market

depends on promoting Indonesia's commitment to mitigate

climate change and reduce greenhouse gas (GHG)

emissions. The Ministry has indicated the carbon market

in Indonesia is still not optimal.

At an event on ‘Expanding Indonesia's Carbon Market:

Opportunities for Growth and Sustainability’ the Director

General of Climate Change Control at the Ministry of

Environment and Forestry, Laksmi Dwanthi, said

"Indonesia will never be able to increase the capacity of

our carbon market if we do not increase climate change

mitigation efforts”.

She added, “the carbon market is a tool for achieving

emission reduction targets adopted in Nationally

Determined Contribution (NDC). Indonesia has committed

to reducing its emissions target by 31.89% through own

efforts and the balance with international assistance”.

See:

https://www.msn.com/id-id/ekonomi/ekonomi/klhk-ungkap-penyebab-pasar-karbon-indonesia-masih-lesu/ar-BB1kccHx

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia.

https://www.itto-ggsc.org/static/upload/file/20240319/1710813683173232.pdf

5.

MYANMAR

6.

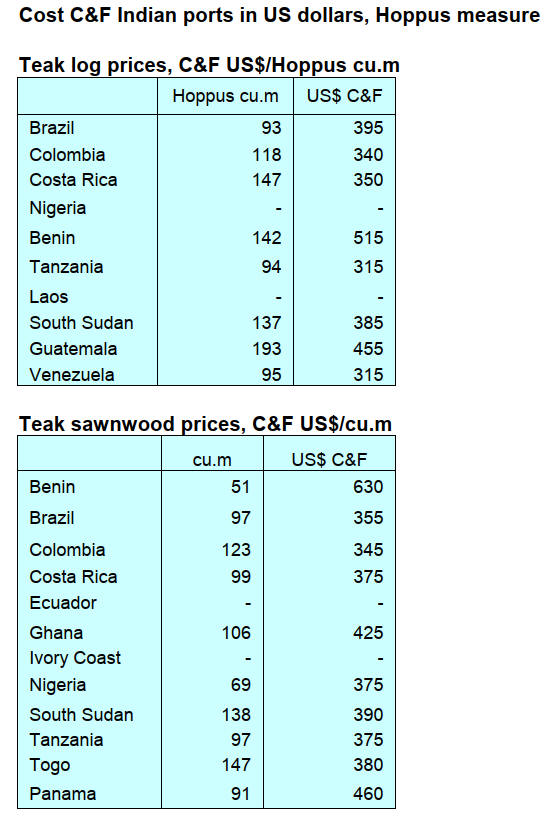

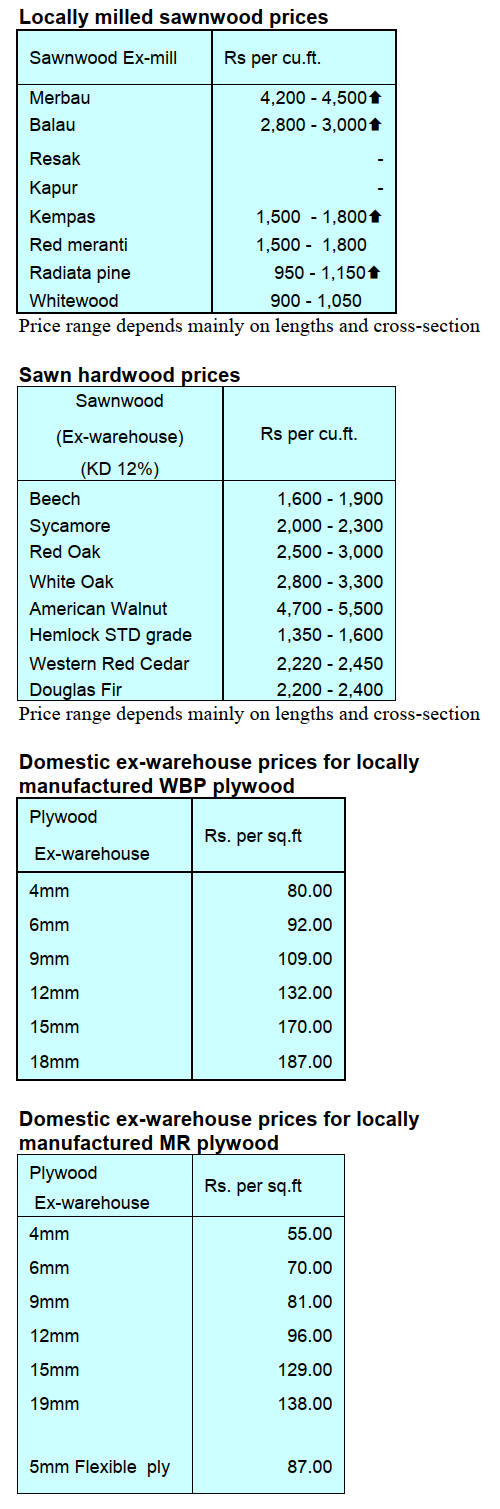

INDIA

Rise in panel and

sawnwood price inides

The annual rate of inflation based on the all India

Wholesale Price Index was 0.2% (Provisional) for

February 2024 (compared to January 2023). The positive

rate of inflation in February 2024 was primarily due to

increases in prices of food, crude petroleum and natural

gas, electricity, machinery and equipment and motor

vehicles, trailers and semi-trailers etc.

The index for manufactured products remained unchanged

at 139.8 in February. Out of the 22 two-digit groups for

manufactured products, 10 groups saw an increase in

prices whereas 8 groups saw a decline in prices and 4

groups remained constant.

Some of the important groups that showed month on

month increases in prices were textiles, pharmaceuticals,

medices, chemical and botanical products, motor vehicles,

electrical equipment and tobacco products. Some of the

groups that witnessed a decrease in prices were metal and

non-metallic mineral products, fabricated metal products

and rubber and plastic products.

The sawnwood and wood panel indices in February rose

significantly month on month and the wood veneer index

also rose but not as sharply.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

SMEs need affordable credit and marketing support

Merchandise exports are expected to come in at US$450

billion by the end of this fiscal year despite geo-political

challenges such as the Red Sea shipping crisis, according

to the newly elected president of the Federation of Indian

Export Organisations (IEO), Ashwani Kumar. He said that

the exporting sector, particularly MSMEs, need affordable

credit and marketing support to further boost the country's

exports.

India recorded the highest monthly exports in fiscal 2023

in February registering an almost 12% growth mainly

driven by increased shipments of engineering goods,

electronic items and pharma products.

Read more at:

https://economictimes.indiatimes.com/news/economy/foreign-trade/indias-exports-may-reach-450-billion-this-fiscal-new-fieo-president/articleshow/108609515.cms?tm_source=contentofinte

rest&utm_medium=text&utm_campaign=cppst

SMEs given time to prepare for QCO

An announcement from the Department for Promotion of

Industry and Internal Trade, Ministry of Commerce and

Industry says that the implementation of the Quality

Control Order (QCO) for mandatory BIS on panels and

other wood products will be delayed.

This comes as a relief for local manufacturers and

importers. This is because the time was too short

particularly for the ‘unorganised’ manufacturers who will

be required to apply for the certification after adjusting

their production processes and introducing testing to meet

the new Standards

See:https://egazette.gov.in/(S(blb1llyrkm4jnctjtmt12mrq))/SearchGazetteID.aspx?id=593392

and

https://egazette.gov.in/(S(blb1llyrkm4jnctjtmt12mrq))/SearchGazetteID.aspx?id=593392

Heat waves and intense rainfall a feature in 2023

The 11th edition of the ‘State of India’s

Environment’ series provides the latest update on

environment-related events and developments. This

document is an annual publication from the Centre for

Science and Environment (CSE) the Down To

Earth magazine.

India witnessed extreme weather events almost every day

in the first nine months of 2023, thanks to record-breaking

temperatures and rainfall, says the report from the Centre

for Science and Environment. More than 3,200 people

died and around 2 million hectares of cropland were

damaged.

Extreme weather events broke several records in India last

year says the report. India witnessed its warmest ever

August and September in 122 years according to the

Indian Meteorological Department and February 2023 was

also the warmest on record since 1901.

In many areas there was lass rain. South India received its

lowest June rainfall in over 120 years due to several

factors including the interactions of wind directions and

cyclone “Biparjoy”, an extremely severe cyclone that

disrupted the monsoon in some parts of India, while

bringing heat waves simultaneously to other regions.

Central India received the lowest rainfall ever since 1901

and India’s northwest experienced a 76% rainfall deficit.

Rise in forest land diverted to other uses

In India, while the number of environmental crimes

decreased a report from the Ministry of Environment,

Forest and Climate Change found that 17,381 hectares of

forestland was diverted for non-forestry purposes in 2022-

23, under the Forest Conservation Act (FCA), 1980. This

is a rise of 3.5% than when compared to 2021-22.

More than half of these diversions occurred for road

construction, mining activities and transmission line

development. This was before the implementation of the

latest amendment to forestry regulations that will, among

other things, weaken the protection that the Forestry Act

offers.

Once the new Act comes into force some have raised

concerns that more forestland could be diverted for non-

forestry use. However, a recent interim order by the

Supreme Court that seeks to prevent the diversion of such

forests has brought hope to conservationists.

See:

https://www.cseindia.org/state-of-india-s-environment-2024-11989

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

The General Department of Customs has reported W&WP

exports to Canada in February 2024 were valued at

US$10.2 million, down 26% compared to February 2023.

In the first 2 months of 2024 W&WP exports to Canada

totaled US$36 million, up 47% over the same period in

2023.

In February 2024 the exports of kitchen furniture earned

US$65 million, down 1% compared to February 2023. In

the first 2 months of 2024 exports of kitchen furniture

earned US$192 million, up 51% compared to 2023.

Vietnam's poplar wood imports in February 2024

amounted to 17,000 cu.m, worth US$6.8 million, down

44.3% in volume and 44.4% in value compared to January

2024. However, compared to February 2023 earnings were

up 24% in volume and 14% in value. In the first 2 months

of 2024 imports of this item reached 47,700 cu.m, worth

US$19.1 million, up 98% in volume and 85% in value

over the same period in 2023.

Vietnam’s imports of wood raw material from Southeast

Asia in February 2024 totalled 46,000 cu.m with a value

of US$13.0 million, down 49% in volume and 49% in

value compared to January 2024 and down 34% in volume

and 31% in value compared to February 2023.

Imports of wood raw material from SE Asia

Imports from the Southeast Asia in January 2024 soared

to the highest level in the past 14 months reaching 90,440

cu.m at a value of US$25.23 million, up 10% in volume

and 11% in value compared to December 2023 and up

seven times higher in volume and almost double the value

compared to January 2023.

Imports in February amounted to 46,000 cu.m worth

US$13.0 million, down 49% in volume and 49% in value

compared to January 2024 and down 34% in volume and

31% in value compared to February 2023.

In the first 2 months of 2024 imports of wood raw material

from Southeast Asia stood at 136,440 cu.m with a value of

US$38.0 million, up 46% in volume and 35% in value

over the same period in 2023.

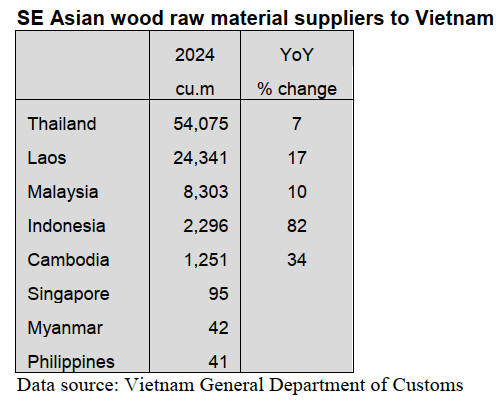

Suppliers in SE Asia

Among ASEAN countries Thailand was the largest

supplier of wood raw materials to Vietnam in January

2024 reaching 54,075 cu.m at a value of US$10.73

million, up 7% in volume and 6% in value compared to

December 2023 and up significantly higher (a factor of 10

times) compared to January 2023.

The top 3 wood products imported from Thailand in

January 2024 were particleboard, fibreboard and

sawnwood. In particular, particleboard imports increased

compared to December 2023, while imports of fibreboard

and sawnwood imports dropped.

The second largest supplier in January was Laos at 24,340

cu.m worth US$10.98 million, up 17% in volume and 18%

in value compared to December 2023 and an increase of

81% in volume and 63% in value compared to January

2023.

Sawnwood was the main wood product imported from

Laos market in January accounting for 86% of the total

wood imported from Laos at 20,870 cu.m worth US$10.29

million, up 18% in volume and 19% in value compared to

December 2023.

Thailand was the main supplier of fibreboard to Vietnam

in January accounting for 98% of total imports with a

minor imports from Singapore, Indonesia and Malaysia.

Imports of wood raw material from Malaysia in January

came to 8,300 cu.m with a value of US$2.32 million, up

10% in volume and 9% in value compared to December

2023 and up 59% in volume and 131% in value compared

to January 2023.

Sawnwood and particleboard are the main products

imported from the Malaysia. Imports of these two items in

January 2024 increased sharply compared to December

2023 as well as compared to January 2023.

Laos was the largest supplier of sawnwood to Vietnam in

January 2024 followed by Malaysia, Thailand and

Cambodia. January imports from Laos, Malaysia and

Cambodia increased against December 2023 while

sawnwood imports from Thailand decreased.

China Vietnam's largest wood chip export market

Vietnam exported wood chips to 13 markets in 2023.

China, Japan and the Republic of Korea were the country's

three main wood chip export markets. Vietnam exported

over 9.38 million tonnes of wood chips to China in 2023

worth over US$1.43 billion and accounting for 65% in

volume and 65% in value of chip sales.

In the Chinese market the average FOB price for wood

chips dropped from US$183-185 per tonne at the

beginning of last year to less than US$140 per tonne by

the middle of the year after which prices improved slightly

to around US$150 per tonne.

The second market was Japan and here the FOB price for

wood chips declined by up to US$36 per tonne last year.

Specifically, the price of wood chips in this market was

US$181 per tonne in January last year but had fallen to

US$145 by December.

Wood chip exports to South Korea reached 548,590 tonnes

worth US$91.88 million accounting for 4% of export

volumes.

As was the case in the Chinese and Japanese markets,

export prices to South Korea dropped by around

US$27 per tonne last year with strong fluctuations during

the year. The market recorded an average export price of

US$200 per tonne in January 2023 but the price decreased

continuously to bottom out at US$136 but bounced back to

US$172 in the last months of the year.

The Vietnam Timber and Forest Product Association has

suggested demand for imported wood chips in China

would tend to continue to decline in the short term leading

to a decline in chip export prices in this market.

The Association said the export market structure for wood

chips will not change significantly in the near future.

However, the wood chip industry in Vietnam will continue

to compete for raw materials with the pellet industry

especially in the northern provinces because plantation

wood is the main input for both industries in this area.

The Association added, businesses and management

agencies need to consider investing in building up raw

material sources to ensure a stable supply for production

and export.

See:

https://english.vov.vn/en/economy/china-becomes-vietnams-largest-wood-chip-export-market-post1083618.vov

Vietnam to auction 5 million tonnes of carbon credits

The Vietnamese Government intends to auction

approximately five million tonnes of carbon credits

through international trading platforms.

This information was outlined in a report sent by the

Ministry of Agriculture and Rural Development (MARD)

to the Prime Minister regarding the implementation status

of the Emission Reductions Payment Agreement (ERPA)

in the North Central Region and the proposal to dispose of

the surplus credits for the period of 2018-2019.

Last October the World Bank confirmed Vietnam's

emission reduction of 16.21 million tonnes. Of this

amount, Vietnam received a payment of VND1.25 trillion

(around US$28 million) from the Bank for reducing 10.3

million tonnes of carbon emissions between 1 February

2018 and 31 December 2019.

Of the excess 5.9 million tonnes of carbon credits the

Ministry of Agriculture and Rural Development (MARD)

plans to sell 1 million to the World Bank while the rest

will be auctioned through international trading platforms.

The Ministry plans to seek the World Bank's assistance to

find potential buyers under the established ERPA or assist

Vietnam in contacting pilot auctions through international

trading platforms.

Vietnam has received US$51.5 million for verified

emission reduction results from the WB, due to forest loss

limitations, forest degradation and increased carbon

storage through afforestation and reforestation.

See:

https://hanoitimes.vn/vietnam-receives-us515-million-from-world-bank-for-forest-emission-reduction-326393.html

and

https://hanoitimes.vn/vietnam-plans-to-auction-5-million-tons-of-carbon-credits-326417.html

Vietnam has the potential to generate annual revenues of

US$200 million by selling approximately 40 million

carbon credits according to calculations by the Department

of Forestry, as reported by the local media.

The Ministry of Agriculture and Rural Development has

outlined seven targets and 11 solutions for forestry

management this year.

Key priorities include finalising the national

forestry plan

and providing support to companies transitioning from

production to forestry businesses.

See:

https://carbonherald.com/vietnam-may-earn-200m-per-year-from-selling-carbon-credits/

and

https://carbonherald.com/vietnam-wraps-up-51-5m-carbon-credits-sale-to-world-bank/

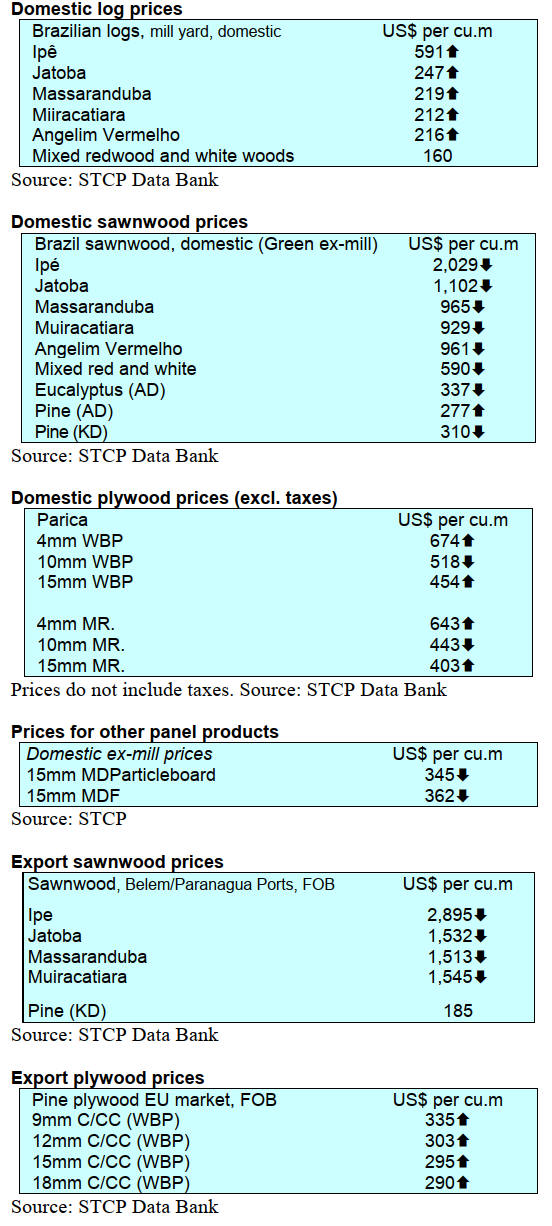

8. BRAZIL

Forest industries to have

ABNT certification

If negotiations go well the Brazilian forest sector will have

its products certified by the Brazilian Association of

Technical Standards (ABNT). During the ‘Sustainable

Wood Forum’ held in Rio de Janeiro 14 March 2024

representatives of the Center for Timber Producing and

Exporting Industries of Mato Grosso State (CIPEM), the

National Forum of Forest-Based Activities (FNBF) and

the Federation of Industries of Mato Grosso State

(FIEMT) met with ABNT to continue negotiations on the

new certification process.

According to FIEMT, ABNT launched ‘Technical

Standard PR 1020’ related to the process for verifying the

traceability of the origin of wood in December 2023 and

stressed that the focus is now on creating a certification

seal for companies that meet this Standard.

CIPEM pointed out that timber from the state of Mato

Grosso complies with a strict traceability process

guaranteed by a chain of custody system among other

tools such as the System for the Trading and

Transportation of Forest Products (Sisflora 2.0) and the

Forest Origin Document (DOF+ Traceability) of the

Federal government which aims to control and certify the

origin of timber from natural forests along the supply

chain.

ABNT certification seeks, not only to benefit the segment

in the state of Mato Grosso, but the entire country through

the traceability process. FNBF emphasised that the aim of

certification is to raise competitiveness and market

recognition through applying sound environmental and

social conditions for logging, processing and the transport

of wood.

See:

https://simenorte.com.br/noticias/industrias-de-base-florestal-de-mato-grosso-fomentam-o-setor-em-eventos-no-rio-de-janeiro-2/

Sustainable forest management for a green economy

Timber from areas with Sustainable Forest Management

Plans can be used in various stages of civil construction.

As a resistant and versatile material the use of wood helps

mitigate the climate crisis as it is a natural and renewable

material.

The use of wood products is a viable option in

construction especially with the new products, such as

Glued Laminated Timber, which makes it possible to

replace concrete and steel in buildings. According to the

Ministry of the Environment, wooden buildings cost 30%

less than masonry. Wood offers environmental gains

through the absorption of CO2 which is stored in the

building itself.

The Mato Grosso State Environment Secretariat points out

that by increasing the area under forest management plans

to 3.6 million hectares by 2050 the state of Mato Grosso

will be able to reduce CO2 emissions by approximately 1

million tonnes, an essential step for the state to neutralise

carbon emissions.

See:

https://www.yumpu.com/pt/document/read/68646578/florestal-260web

Export update

In February 2024 Brazilian exports of wood-based

products (except pulp and paper) increased 16% in value

compared to February 2023 from US$262.2 million to

US$304.2 million.

Pine sawnwood exports increased 9% in value between

February 2023 (US$50.9 million) and February 2024

(US$55.6 million). In volume, exports increased 15.5%

over the same period from 215,200 cu.m to 248,600 cu.m.

However, tropical sawnwood exports declined 12.5% in

volume, from 24,000 cu.m in February 2023 to 21,000

cu.m in February 2024. In value, exports fell 18% from

US$12.7 million to US$10.4 million, over the same

period.

Pine plywood exports increased 10% in value in February

2024 (US$57.1 million) compared to February 2023

(US$51.7 million). In volume, exports increased 9% over

the same period, from 165,700 cu.m (February 2023) to

180,300 cu.m. (February 2024).

Exports of tropical plywood dropped 61% in volume and

by 52% invalue from 4,600 cu.m and US$2.1 million in

February 2023 to 1,800 cu.m and US$1.0 million in

February 2024, respectively.

On a brighter note, exports of wooden furniture increased

from US$38.6 million in February 2023 to US$45.9

million in February 2024, an increase of 19%.

Chile - a strategic market for the Brazilian furniture

industries

Chile has been gaining prominence as an important

consumer of Brazilian furniture. Considered one of the

most dynamic economies in Latin America, Chilean

families spend an average of 5.25% of their income on

furniture, according to IEMI (Inteligência de Mercado).

Indicators point to significant growth in demand for

furniture in the country driven by rising living standards

and an expanding consumer market. Due to the limited

production of furniture in Chile the market presents good

opportunities for Brazilian manufacturers.

In 2022, Chilean furniture imports totalled approximately

US$592 million. This was 22% less than the previous

year. , Brazilian furniture exports to Chile peaked in 2021

reaching US$109.2 million for the year. In 2022, however,

there was a sharp drop in the value of imports.

With the elimination of customs tariffs for furniture traded

among the member countries of the free trade agreement

between Chile and Mercosur the Brazilian furniture sector

has an even greater opportunity in the Chilean market.

With short and medium-term growth potential estimated at

US$57.6 million, Brazilian exports to Chile represent a

strategic opportunity for companies in the furniture sector,

especially medium and small-sized companies looking to

expand their international sales.

See:

https://forestnews.com.br/chile-mercado-estrategico-industria-moveleira/

Positive timber sector trade balance in Santa Catarina

The timber sector was one of the positive sectors in terms

of trade balance in the State of Santa Catarina in the

southern region of Brazil having boosted sales by around

30% in January 2024 compared to the same period in

2023. The Federation of Industries of Santa Catarina State

(FIESC) points out that the sector is representative of

Santa Catarina's exports and the gradual recovery of sales

abroad is reflected in the maintenance and creation of jobs.

Exports of furniture in January totalled US$19.2 million,

sawnwood US$25.8 million and carpentry US$24 million.

According to FIESC, the positive performance of the

furniture sector was due to firm demand in the US and

reflects the increase in short-term demand from single-

family homes and the impact of US government incentives

for civil construction.

The United States continued to be the main destination for

exports from Santa Catarina state in January 2024, with

purchases 17% higher than in January 2023.

See:

https://www.remade.com.br/noticias/19787/motores-e-produtos-de-madeira-sao-destaques-nas-exportacoes-de-janeiro

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

https://www.itto-ggsc.org/static/upload/file/20240319/1710813683173232.pdf

9. PERU

Forestry and wildlife

regulations explained to private

owners

The Forestry and Wildlife Resources Supervision Agency

(OSINFOR) briefed holders of forestry permit titles on

private properties and forest concessionaires in Atalaya on

forestry and wildlife regulations. 24 participants were

trained on the necessity to comply with regulations for

more effective and responsible forest management.

During the workshop the roles and functions of regulatory

entities such as the Regional Forestry and Wildlife

Authority (ARFFS), FEMA and OSINFOR were

explained to participants. The workshop focused on

explaining the supervision process and how they can

voluntarily correct some deficiencies during forest

management.

Exports did not start the year well

The Extractive Services and Industries Management of the

Association of Exporters (ADEX) has reported shipments

of Peruvian wood products in January 2024 were valued at

US$5.95 million, a drop of around 25% compared to the

same month in 2023 (US$7.91 million).

This result is explained by the slower demand from China

where imports from Peru went from US$1.78 million in

January 2023 to just US$0.75 million in January of this

year.

In January exports to France were worth US$0.78 million

an over 50% decline followed by the Dominican Republic

(US$0.77 million, -11%), Mexico (US$0.76 million, -

15%) and the United States (US$0.71 million,

-31%).

Completing the top ten export markets were Chile

(US$0.64 million), Vietnam (US$0.36 million), Denmark

(US$0.23 million), Belgium (US$0.18 million) and the

United Arab Emirates (US$0.15 million). It should be

noted that demand in Chile and Denmark rose.

According to the ADEX Data Trade Intelligence System

sawnwood (US$2.51 million) led exports, accounting for

42% of the total export value, a year on year drop of 6.2%.

Other export products were ‘other wood sawn or chipped

longitudinally’ (US$0.56 million), ‘other sawn or chipped

pine wood’ (US$0.44 million) and ‘sawn wood of tropical

wood’ (US$0.17 million).

Exports of semi-manufactured products earned US$1.89

million despite suffering a drop of -54%. Profiled wood

(except ipe) and moulded wood stood out (US$1.64

million), molded wood of tropical wood (except ipe)

(US$0.48 million) and slats and friezes for unassembled

parquet floors (US$0.41 million).

In addition, exports of furniture and parts earned US$0.45

million, firewood and charcoal (US$0.44 million),

manufactured products (US$0.22 million), construction

products (US$0.21 million), fibreboards and particleboard

(US$0.16 million).

SERFOR seeks improvement in management plan

approvals

The National Forestry and Wildlife Service (SERFOR)

organised workshops to identify bottlenecks and propose

alternatives for improvements to the process for approval

of Forest Management Plans.

The workshops brought together representatives of the

Regional Forestry and Wildlife Authority of Loreto,

Madre de Dios and Ucayali, the National Service of the

National Service of Natural Areas Protected by the State

(Sernanp), the Agency for the Supervision of Forestry

Resources and Wildlife (Osinfor) and the Ministry of the

Environment (MINAM), entities that participate directly

and indirectly in the evaluation, approval and supervision

of forest management plans.

As a result of this proposals to simplify speed up the

processes were agreed upon. The workshops were held

with the support of the Executive Board for the

Development of the Forestry Sector of the Ministry of

Economy and Finance (MEF) and the Forest+ Project of

the Technical Cooperation of USAID and the U.S. Forest

Service.

New initiative on gender equality

The National Forestry and Wildlife Service (SERFOR)

held an event: ‘8M, Always visible: contribution of

women in the forestry and wildlife sector’ in early March

in commemoration of International Women's Day.

At the event SERFOR launched an initiative on Gender

Equality in response to the need to include the diversity of

women and the knowledge and different visions of women

that contribute to the management of resources.

See:https://www.gob.pe/institucion/serfor/noticias/920967-serfor-anuncia-conformacion-de-comite-para-la-igualdad-de-genero-que-impulsara-la-labor-de-las-women-in-the-sector

During the event the role of women in the forestry and

wildlife sector in Peru was reported and through their

diverse experiences they identified the gaps to be closed

regarding equality and recognition of the current role of

women in forestry sector activities for the benefit of all

Peruvians.

In the forestry and wildlife sector, according to the study:

“Challenges of female employment in the Peruvian

forestry sector - A first approximation” published by

SERFOR in 2021, women find few incentives to follow

professions related to the sector due because the

perception is that forestry is a man’s job. This perception

was dismantled.

Ucayali concludes forest zoning

Thanks to the work of the Regional Government of

Ucayali with the technical assistance of the National

Forestry and Wildlife Service (SERFOR) the Ministry of

Agrarian Development and Irrigation (MIDAGRI) the

forest zoning (ZF) for the Department of Ucayali was

approved.

This marks an important step in the territorial planning in

this region. Ucayali is the second largest Department in

the country after Loreto and one of the largest producers

of forest products. According to the ZF, the forest area

covers 9,849,351 hectares extending over around 94% of

the Department. Permanent production zones comprise

56% of the Department.

The category Special Treatment zones cover 8.6% of the

Department and include reserves for indigenous peoples,

agroforestry and silvopastoral zones, residual or remnant

forest zones and non-forest plant zones.

.

See:

https://www.gob.pe/institucion/serfor/noticias/920908-ucayali-concluye-la-zonificacion-forestal-de-todo-su-territorio

Proposals for the National Forestry and Wildlife Policy

2030

The National Forestry and Wildlife Service (SERFOR)

conducted a series of presentations on the proposed new

National Forestry and Wildlife Policy (PNFFS) for 2030

to various key actors in the sector.

If approved the PNFFS will have a positive impact on the

more than 72 million hectares of forest that the country

has (more than 60% of the national territory) and ensure

its conservation. This transparent and participatory process

contributes to articulating efforts for the subsequent design

and implementation of the new policy.

In January and February the PNFFS proposal was

presented to the representatives of the National Forestry

and Wildlife Management System (SINAFOR), the

National Chamber of Commerce, Production, Tourism and

Services (PERUCAMÁRAS), the Confederation National

of Private Business Institutions (CONFIEP) and the

Association of Exporters (ADEX).

See: https://www.gob.pe/institucion/serfor/noticias/920485-actores-claves-del-sector-conocen-y-aportan-en-la-propuesta-de-la-politica-nacional-forestal-y-

of-wildlife-by-2030

|