|

1.

CENTRAL AND WEST AFRICA

Rain delaying operations

Operators in Gabon have been experiencing long delays in

harvesting due to heavy rain. Logging in Cameroon has

also been significantly impacted by heavy rain. The

excessive rainfall has led to some mills temporarily

reducing or ceasing operations across the region especially

in the Central African Republic and Congo.

Decline in sales of okoume

Some Chinese-owned mills have stopped production due

to the decline in sales of okoume and peeling mills in the

special economic zone are still feeling the effects of the

industrial action by workers. There are rumours in trade

circle that the government may put the special economic

zones under military control.

The new government in Gabon has taken a firm stance on

suspicions of irregularities where significant state funds

were allocated for projects but where not fully utilised for

their intended purposes. Those found to have

misappropriated funds or failed to complete projects are

required to return the money or finalsie the work paid for.

There is an ongoing effort to improve the efficiency of the

Ministry of Forestry. The new Forest Minister is

conducting visits to the provinces to evaluate operations.

Second quarter 2023 production in Gabon down

almost 30%

Lenouveaugabon.com has reported, quoting the latest

economic report from the Ministry of the Economy that at

the end of the second quarter of 2023 production by the

timber industries in Gabon was 29% lower than during the

he same period in 2022, dropping from 1.3 million cubic

metres at the end of June 2022 to 982,006 cubic metres at

the end of June 2023.

This fall, according to the same source, is the result of

logistical problems in the sector in recent months

particularly linked to recurring incidents on the railway

and the poor state of the road network during the rainy

season. These difficulties have negatively affected the

supply of factories, particularly those installed in the Nkok

special economic zone.

See:

https://www.lenouveaugabon.com/fr/agro-bois/0410-20172-industrie-du-bois-la-production-chute-de-30-au-2e-trimestre-en-raison-des-difficultes-d-approvisionnement-des-usines

Chinese buyers on the sidelines

Milling operations have slowed as mills run down log

stocks built up during the dry period. Producers report

order levels are stable but completing shipments is being

held up.

Poor weather during what was supposed to be the dry

season disrupted harvesting which is now being felt as log

yard stocks fall. The absence of Chinese buyers in the

market has contributed to lower demand.

The government has imposed tight controls on the export

of logs. Export is only possible for certain operators who

demonstrate ‘responsible’ processing.

There is no shortage of containers in Cameroon. Port

operations, particularly in Douala and Kribi, are generally

steady. Efforts have been made to better organise timber

dispatch in Douala.

Producers in Congo point to weakening prices

Heavy rain is impacting harvesting, especially in the

northern regions of the Congo. It is reported that the bad

weather extends to the northern border with Cameroon and

is seriously affecting trucking on laterite roads.

Port operations in Pointe Noire remain steady with no

significant disruptions. Order levels have been stable for

approximately two months. A log export quota system is

in operation in order to generate greater revenue, at the

same time there is pressure on millers to expand tertiary

processing.

Producers point to a softening of prices in Europe which

they suspect is linked to high landed stocks and the

cautious approach by buyers as the European winter

season approaches. Customers from countries such as

Turkey, Iraq, and Iran are not showing significant activity

as the ongoing conflicts in the region are undermining

confidence.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20231017/1697507334917952.pdf

2.

GHANA

‘Dumsor’ (power outages) plague the country

Large areas of Ghana are facing power blackouts due to

gas shortages at a major power facility adding to the

difficulties manufacturers face due to the economic crisis

in the country.

Ghana Gas Chief Executive Officer, Ben Asante, said the

problem was related to gas delivery rather than supply,

adding that the outages occurred because the pipeline

operated by the West African Gas Pipeline Company,

responsible for transporting approximately 100 million

standard cubic feet of gas per day from Takoradi to Tema,

had been temporarily taken out of service. Ghana

partly relies on natural gas for power generation

See:

https://www.africanews.com/2023/10/27/limited-gas-supply-triggers-nationwide-power-outage-in-ghana//

Banks asked to do more for SMEs

The President has added his voice to calls for local banks

to do more to support agribusinesses (incl. forest

plantations and wood processing) describing the

agricultural sector’s share of bank loans is far too low.

The President acknowledged the current efforts being

made by the banks but said “your efforts are only

scratching the surface of the crisis in the agricultural

sector”.

He added that there are about 3.5 million farmers in the

country but the level of credit that goes into financing their

activities is not only discouraging but also the lowest in

West Africa.

See:

https://thebftonline.com/2023/10/24/akufo-addo-tells-banks-to-do-more-for-agric/

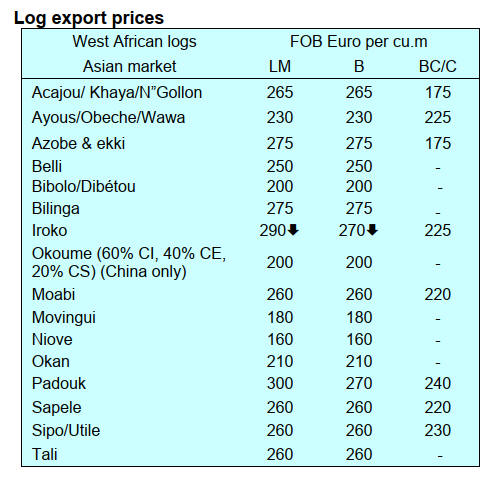

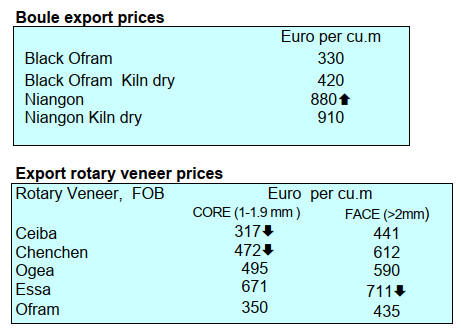

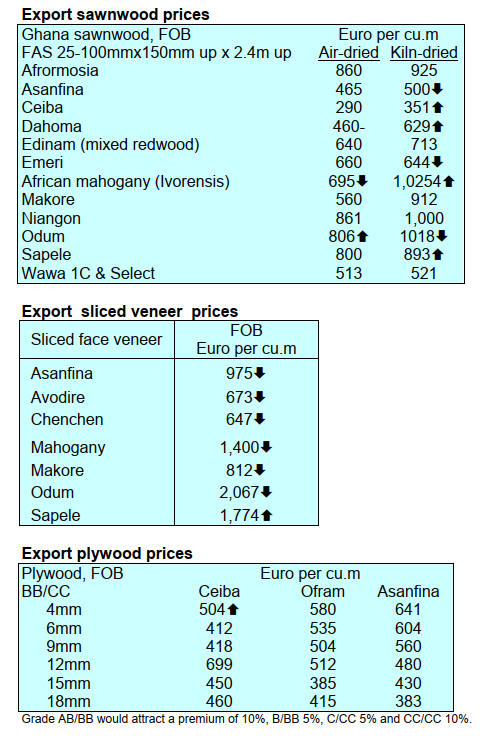

Wood product export slump

Receipts from exports of wood products in the first eight

months of 2023 slumped by 11% to Eur92.35 million

compared to the Eur103.84 million for the same period in

2022.

According to data source from the Timber Industry

Development Division (TIDD) this was because of a 14%

drop in the volume of wood products exported (205,127

cu.m) during the period in 2023 compared to 237,464

cu.m for the same period in 2022.

In spite of the 2023 poor overall performance export

volumes of kiln dried boules, briquettes and plywood

recorded significant increases in volume during the period

compared to the same period in 2022. The top three export

products for both 2022 and 2023 were AD and KD

sawnwood and plywood for the regional West Africa

markets. These products accounted for 168,924 cu.m and

18,188 cu.m respectively of the total export volume.

During the period under review some products also

recorded significant decreases in volumes. Their

performance in 2023 negatively affected the

corresponding revenues for the period when compared to

the previous year. Receipts from exports of billet and

veneer dropped by 67% and 37% respectively to register

Eur3.03 million in 2023 against Eur9.09 million in 2022 .

About eighty exporters contributed to the export of

seventeen wood products during the period from thirty-

eight species. The leading species included teak, ceiba,

wawa, eucalyptus and rubberwood. Demand for wood

products in Asian and African markets dropped. The major

destinations for these wood products were India, United

States of America, China, Togo and the United Kingdom.

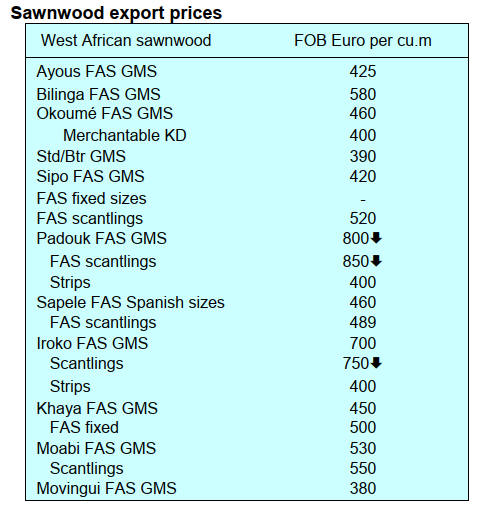

Decline in approved contracts

The volume of approved export contract in the second

quarter of this year was 61,268 cu.m and 87,000 pieces of

bamboo. Compared to the volume during the same period

in 2022 this showed a decrease of over 40% according to

TIDD data sources.

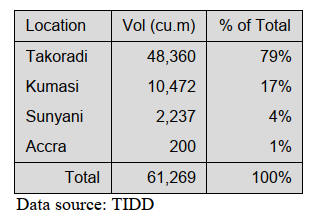

Table below shows the total contract volume processed

and approved during the period classified into Primary,

Secondary and Tertiary products;

The table below shows the contracts processed and

approved by the TIDD offices in Takoradi, Tema, Kumasi

and Sunyani in the second quarter of 2023;

The highest contract volume was processed and approved

in Takoradi followed by Kumasi with Sunyani and Accra

accounting for less than 5%.

New member for Forestry Commission board

The new Executive Secretary of Lands Commission,

Benjamin Arthur, has been sworn in as a new member of

Forestry Commission Board following the retirement of

James K. Dadson, the previous Executive Secretary of the

Lands Commission.

3. MALAYSIA

Ringgit weakening

The big issue at the moment for businesses is the

weakening ringgit and how it will impact the trading

environment. The US dollar/ringgit pair moved above the

4.75 psychological level and rose close to 4.78/dollar.

Behind the change in exchange rates is the growing

strength of the US dollar driven by is position as a safe-

haven in view of the Middle East geopolitical risks. The

other driver is the possibility of another US Federal

Reserve interest rate increase this year. Expectations are

that Malaysian interest rates will be maintained for now to

support domestic demand in view of declining external

trade.

See:

https://www.thestar.com.my/business/business-news/2023/10/21/opr-likely-to-remain-at-3-into-next-year

Adding value to peeler core residues

Sarawak based Samling Group announced it will produce

engineered wood products in cooperation with Loggo IP

Co Ltd, an Australian company. The companies will work

on a pilot project in Sarawak using Loggo IP’s patented

engineered wood technology to process small diameter

peeler cores. It is known that every year tens of thousands

of peeler cores (residues) from plywood production bu are

only used to produce low value products packaging or for

fuel.

In Australia Loggo IP uses acacia and eucalyptus to

produce engineered products for housing, commercial and

government buildings.

See:

http://theborneopost.pressreader.com/article/281702619384272

Furniture design competition

The next Malaysian International Furniture Fair (MIFF) is

scheduled for 1 – 4 March 2024 in Kuala Lumpur and a

furniture design competition is part of the 2024 show.

The MIFF Furniture Design Competition (MIFF FDC)

aims to discover young talent to support Malaysia’s

thriving furniture industry. Organised each year since

2010 in conjunction with Malaysian International

Furniture Fair (MIFF), it offers a platform to emerging

designers to showcase their innovative ideas before a

global audience.

See: https://www.mifffdc.com/about/

Eucalyptus pests invaded Asian eucalyptus

plantations

Demand for wood is expected to increase by four times by

2050 and this comes as the supply from native forests is

decreasing. This will lead to increasing dependence on

industrial tree plantations. To put the issue into perspective

Asia will face an annual deficit of 10 to 17 million tonnes

in wood chips alone.

This was the message from Dr. Simon Lawson, an

Australian professor, in a presentation made in Sabah. He

emphasised the growing importance of pest control in tree

plantations pointing out that a number of herbivore species

from the native range of eucalyptus have invaded many

eucalyptus plantations in Asia over the past 30 years and

there is a risk that pests in eucalyptus plantations can

establish on native tree species.

In related news, a Sabah Forestry Department researcher,

Dr Arthur Y. C. Chung from Sandakan, has been awarded

the 2023 Science and Technology Award by the Malaysia

Toray Science Foundation. This was for his contribution to

the nation’s science and technology through his research

on tropical forest entomology focussing on insect

diversity, insects in nature tourism and forest insect pest

management.

See:

http://theborneopost.pressreader.com/article/281526525737730

MyTLAS promotion

The Malaysian Timber Industry Board has organised a

programme to promote wider use of the Malaysia Timber

Legality Assurance System for Peninsular Malaysia

(MyTLAS), one of the earliest timber legality verification

system developed by Malaysia. MyTLAS has also put in

place comprehensive control procedures to ensure the

exclusion of unverified timber.

MyTLAS complies with a set of principles and criteria

which include the 24 criteria, also known as the MyTLAS

Schedule.

See:

https://www.mtib.gov.my/en/maskayu

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See:

https://www.itto-ggsc.org/static/upload/file/20231017/1697507334917952.pdf

4.

INDONESIA

Interest rate increase

Just after Indonesia's surprise interest rate increase in late

October the Philippine central bank also announced an

unexpected rate increase. These moves have highlighted

the challenge Asian central banks face in defending their

currencies and curbing inflation.

See:

https://www.reuters.com/markets/asia/indonesia-cbank-unexpectedly-raises-rates-amid-falling-rupiah-2023-10-19/

Germany welcomes SVLK promotion campaign

Indonesian Deputy Minister of Environment and Forestry,

Alue Dohong, led a delegation to promote Indonesia’s

Legality and Sustainability Verification System (SVLK) to

German wood product importers and representatives of

international trade authorities.

During meetings Acting Director General of Sustainable

Forest Management (PHL), Agus Justianto, said that

Forest Law-Enforcement Governance and Trade

(FLEGT), from which the Timber Legality Assurance

System (TLAS) was developed in Indonesia is known as

the SVLK is an important tool used by the Indonesian

Government and various stakeholders in monitoring and

ensuring the legality of wood products from Indonesia.

The Director of Forest Product Processing and Marketing

Development, Krisdianto, explained the process, which is

transparent, is recorded in the Legality and Sustainability

Information System (SILK) and the data is open to all on

the 'Satu Data PHL' website.

Director Krisdianto added "the flow of wood from the

forest to industrial points is accompanied by a legal

certificate of forest products (SKSHH) and monitored so

that the chain of custody of logs can be followed. We also

carry out a similar process in community forests but of

course in a different way".

The domestic media in Indonesia reported that during the

discussion importers in Germany welcomed the SVLK

promotion campaign and hoped that trade authorities in

every European country would understand the SVLK as an

option in developing a due diligence system related to the

implementation of EUDR.

The German participants were told Indonesian wood

product exporters have questioned the status of the

FLEGT process established between the European Union

and Indonesia. The German State Secretary, Silvia Bender,

said that the German government understands the

problems of implementing the EUDR, especially for small

and medium businesses because the implementation of the

EUDR also has an impact on business actors in Germany.

The German government itself is still reviewing the

implementation of due diligence requirements, she said.

She added that the German government understands the

aspirations of the Indonesian Government and will convey

this at a higher European Union forum.

See;

https://forestinsights.id/wamen-lhk-promosikan-svlk-kepada-importir-jerman-asal-usul-kayu-bisa-ditelusuri/

and

https://www.menlhk.go.id/news/wamen-lhk-diskusikan-flegt-vpa-dan-restorasi-gambut-dengan-pemerintah-jerman/

Productivity boost can come from strong domestic

woodworking machinery sector

The Chairman of the Indonesian Furniture and Crafts

Industry Association (HIMKI), Abdul Sobur, said that

assistance with machinery restructuring and a consistent

supply of raw material will lead to an increase in domestic

sales of furniture and crafts which could reduce the need

for imports. Sobur said that to increase productivity,

efficiency and capacity companies need appropriate

technology.

He added that one of the keys to successful down-

streaming is building a technologically advanced

machinery industry. HIMKI sees China's success in

building productivity because it is supported by very

strong woodworking machinery sector.

Abdul Sobur also pointed out that the furniture and crafts

industry is expanding into new markets in response to

declining demand in Europe and the United States. The

potential markets identified include the Middle East, India,

China, Africa, Japan and other ASEAN member countries.

According to Sobur, a number of countries in the Middle

East such as Qatar, Bahrain, Oman, and the United Arab

Emirates are accelerating infrastructure development

which will have an impact on the need for furniture, crafts

and home décor.

Apart from the Middle Eas,t the next target market is

India, a country with very rapid growth. African markets,

such as Egypt, Morocco and other countries are potential

markets to explore. Meanwhile, the ASEAN market,

including the Philippines, is the next that needs to be

worked on seriously said Sobur.

See

https://agroindonesia.co.id/pelaku-industri-furnitur-garap-potensi-emerging-market/

and

https://www.msn.com/id-id/berita/other/himki-bantuan-restrukturisasi-permesinan-dapat-menahan-laju-impor/ar-AA1ieeGW

Wood pellet factory for Sumatra

A joint venture company will build and operate a

renewable energy biomass business. The company plans to

build and operate a wood pellet factory in Sumatra with

construction to start in early 2024. The company

anticipates production can start in the first quarter of 2025.

Wood pellets play an important role in the green

renewable energy landscape and has broad market

potential amidst global demands to reduce carbon

emissions. The company siad the development of the

wood pellet industry will provide added value, not only to

the company, but more broadly to society and the

environment. In the future, the community will become

one of the partners in supplying raw materials for

production, which in turn is expected to improve social

welfare, community economic resilience, environmental

sustainability and national energy security.

See:

https://swa.co.id/swa/business-strategy/pabrik-wood-pellet-di-sumatera-segera-dibangun-dengan-investasi-us48-juta

In related news the Ministry of Environment and Forestry

(KLHK) continues to promote the cultivation of non-food

biomass industries to produce low-emission energy raw

materials to replace fossil fuels.

During the period 2020-2024 the target area for businesses

to utilise production forests for bioenergy is 15,000

hectares. The KLHK noted that there are 31 units of

Industrial Plantation Forest Timber Product Management

Business Permits (IUPHHK-HTI) and Perum Perhutani

that have supported the development of energy plantation

forests.

Indonesia is striving to accelerate the energy transition

from coal to new and renewable energy through steps

including using wood-based biomass energy as a substitute

for fossil energy. The KLHK supports biomass utilisation

programs by promoting plantation forests for energy

development and optimising wood waste from forests and

the timber industry.

See:

https://en.antaranews.com/news/295746/klhk-encourages-cultivation-of-biomass-plants-to-replace-fossil-energy

Customary forests area reaches 244,000 hectares

The Ministry of Environment and Forestry (KLHK)

reported that the area of customary forests in Indonesia

reached 244,195 hectares as of October 2023. Head of the

Sub-Directorate for Determination of Customary Forests

and Private Forests, Yuli Prasetyo Nugroho, said that the

area is occupied by 131 customary groups.

Most of the inventoried customary forests are on the island

of Kalimantan with the largest in Central Kalimantan

covering an area of 62,426 hectares, followed by West

Kalimantan (50,711 hectares) and East Kalimantan (7,771

hectares).

The establishment of customary forests is believed to be

an important step in ensuring the living space for forest

communities, preserving ecosystems, protecting local

wisdom and traditional knowledge as well as becoming a

pattern for resolving conflicts related to communities in

and around forest areas.

See:

https://www.antaranews.com/berita/3768177/klhk-luas-hutan-adat-kini-capai-244-ribu-hektare

Trade surplus for 41 straight months

Indonesia has maintained a trade surplus for 41

consecutive months even in the face of a declining in

exports. The Central Statistics Agency (BPS) reported that

Indonesia's export earnings in September 2023 amounted

to US $20.76 billion, a 5.6% decrease compared to August

2023. Meanwhile, imports dropped by 8% to US$17.34 billion.

See:

https://jakartaglobe.id/business/indonesia-posts-trade-surplus-for-41-months-in-a-row

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20231017/1697507334917952.pdf

5.

MYANMAR

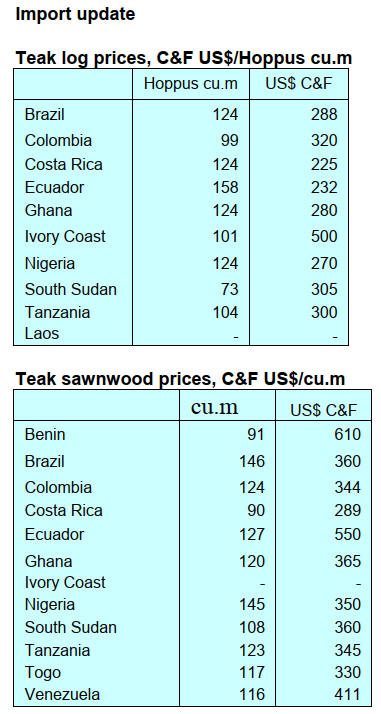

MTE offers less teak in October tender

According to the MTE website a much lower volume of

teak logs were offered in the October Tender. The offer

was for about 500 tons of teak logs compared to previous

average monthly quantity of 1,000 tons. With export

opportunities severely curtailed millers are facing

considerable challenges and for the first time are seeing

falling orders for the much prized Myanmar natural teak.

Another issue hampering trade is the suspension of online

export document processing, Myanmar TradeNet 2.0, for

companies that were deemed not to have correctly detailed

incoming remittances. This delayed some shipments to

Asian markets.

Some exporters could not settle payments for the logs

purchased from MTE in time and their ‘earnest money’ (or

good faith deposit) of US$10,000 was seized. MTE tender

conditions mention that the ‘earnest money’ will be

confiscated if the payment is not completed within sixty

days.

Recently, a government spokesperson was quoted as

saying export incentives are under consideration.

However, there is a risk that there may not be coordination

between monetary control and export incentives.

See:

https://sso.myanmartradenet.com/?locale=en

Labour shortage

The rubber sector in the south-east region is facing a

labour shortage because workers are moving to

neighbouring countries, mainly Thailand. The local media

has reported there may be as many as 5 million Myanmar

migrant workers in Thailand. In fact, the labour shortage

in Myanmar is not only in rubber plantations but also other

areas including farming. The worker shortage in the rubber

sector is having an impact on the supply of rubberwood.

See-

https://burmese.dvb.no/archives/category/news/economics-new

Pay tax before renewing passports

According to media sources passport renewal by overseas

Myanmarese will be linked to tax payments. The Union

Tax Law 2023 was recently amended to state that income

tax on the salaries of Myanmar workers in foreign

countries must be paid in foreign currency starting

October 2023.

Earlier, the government introduced a rule requiring

workers abroad to remit at least 25% of their foreign-

currency income through the country’s banking system.

The remittances will be converted at the official exchange

rate of 2,100 kyats per US dollar. The market rate is about

3,300 kyats.

Migrant workers who do not comply will be barred from

working abroad for three years after their current work

permit expires. Previous military regimes before 2010 also

levied income tax on Myanmar migrant workers but this

was repealed under the first civilian government of Thein

Sein.

See-

https://www.irrawaddy.com/news/burma/myanmar-junta-demands-expats-pay-tax-before-renewing-passports.html,

https://www.gnlm.com.mm/income-tax-on-salaries-of-myanmar-nationals-working-abroad-must-be-paid-in-foreign-currency-from-october/#

and

https://www.bangkokpost.com/world/2654338/myanmar-slaps-tax-on-migrant-workers-earnings

Myanmar economic forecast

It has been estimated the Myanmar economy grew faster

in FY 2023 (October 2022–September 2023) than in the

previous fiscal year. Business conditions in the

manufacturing sector recovered in October 2022 to

September 2023 period after deteriorating in FY 2022.

Additionally, merchandise exports continued to

expand

robustly year on year in the October-June period.

However, foreign direct investment flows into the country.

Economic activity continues to be stalled by armed

conflict, foreign exchange and trade controls, energy

shortages and sanctions.

See -

https://www.focus-economics.com/countries/myanmar/

6.

INDIA

Inflation cools

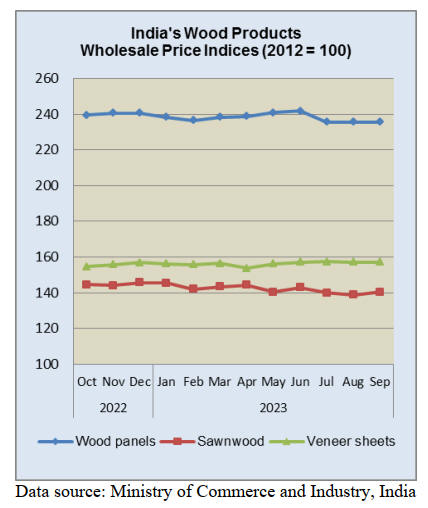

The annual rate of inflation in September based on the all

India Wholesale Price Index (WPI) was minus 0.26%

compared to minus 0.52% recorded in August 2023.

Out of the 22 NIC two-digit groups for manufactured

products, 14 groups witnessed an increase in prices in

September whereas 8 groups witnessed decreases in

prices. The month-on-month increase in prices were

mainly contributed by basic metals; other transport

equipment, fabricated metal products, machinery and

equipment, rubber and plastic products. The index for

sawnwood rose while the indices for veneers and panel

products remained flat.

Some of the groups that witnessed a decrease in price were

food products, motor vehicles, trailers and semi-trailers,

electrical equipment, leather and related products,

chemical and chemical products.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Construction - the third largest sector in India

At a recent construction sector conference participants

learned that with a US$3 trillion GDP India is one of the

largest and fastest growing economies. It is witnessing

massive public investment, robust private consumption

and structural reforms leading to rapid growth.

Construction in India is emerging as the third largest

sector and estimates suggest it could reach US$750 billion

in value in 2024. Urbanisation will contribute over 80% to

GDP by 2050 and analysts say cities need to be receptive,

innovative and productive to foster sustainable growth and

ensure a high quality of living.

The focus of the conference was on steel and concrete for

construction, there was no mention of wood which is

surprising as the conference came on the heels of the

release of a UN report “Building materials and the climate:

Constructing a new future”. This report offers policy

makers, manufacturers, architects, developers, engineers,

builders and recyclers a three-pronged solution to reduce

“embodied carbon” emissions and the negative impacts on

natural ecosystems from the production and deployment of

building materials, cement, steel, aluminium, timber and

biomass.

See:

https://www.unep.org/news-and-stories/press-release/un-plan-promises-massive-emission-cuts-construction-sector-most

and

https://ghtc-india.gov.in/Content/pdf/25-aug-conf/ppt/Emerging-Construction-Systems-for-Mass-Housing.pdf

and

https://ghtc-india.gov.in/Content/pdf/25-aug-conf/ppt/Technology-Transition-through-Light-House-Projects.pdf

Raw material from ‘Trees Outside Forest’ vital for

manufacturers

In a significant development promoting sustainable

management of trees outside of forests in India the

Network for Certification and Conservation of Forests

(NCCF), the National Governing Body in India, has

secured full endorsement of the Trees outside Forest

Certification System (ToFSTD) by the Programme for the

Endorsement of Forest Certification (PEFC).

This provides the foundation for certification of wood-

based raw material originating from Tree outside Forests

(ToF). Currently Indian wood-based industries procure

75% of their wood-based raw materials from ToF, 5%

from native forests and the balance from imports.

The NCCF, along with other key stake holders in the

industry have been working towards the development of a

country-specific certification scheme since 2016.

See:

https://plyinsight.com/nccf-achieves-100-approval-for-tof-scheme-endorsement-by-pefc/

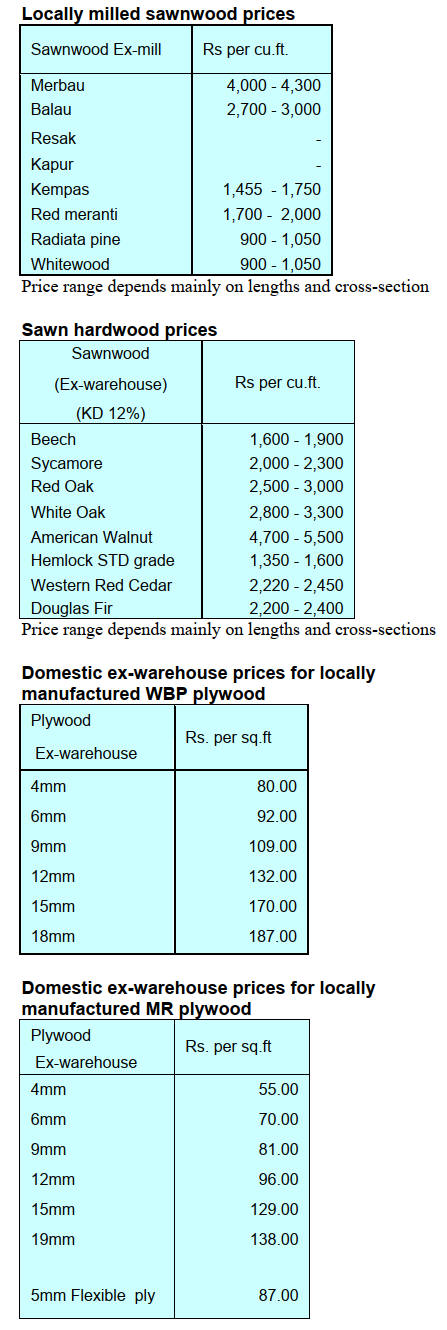

Veneer prices set to rise

PlyReporter, in its latest magazine, says production of face

veneer by mills operating in the Gabon Special Economic

Zone, NKOK has dropped due to industrial unrest. If this

continues the supply of veneer will fall and prices will

rise. PlyReporter forecasts that falling output set against

steady demand could push up prices of okoume veneer by

15-20%.

There are over 40 veneer and plywood manufacturing

companies established in Gabon through considerable

investments from Indian companies.

See:

https://www.plyreporter.com/current-issue#

NZ/India log trade to resume

A resumption of the New Zealand log trade with India

may soon be possible. New Zealand did have a modest log

export trade with India (about 1.7 million cubic metres a

year) but the implementation of a ban in NZ on the use of

methyl bromide fumigant as a log treatment brought

exports to an end because Indian regulations stipulate

methyl bromide must be used with no alternatives

proposed.

Recently the Indian authorities updated the phytosanitary

requirements for Indian log imports, allowing fumigation

of logs in ships holds on arrival in India in lieu of

treatment prior to sailing from NZ. A trial is underway.

See:

https://www.farmersweekly.co.nz/markets/rule-change-on-logs-could-kickstart-india-trade/

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

According to the General Department of Customs,

W&WP exports to the Australian market in September

2023 amounted to US$13.2 million, down 11% compared

to September 2022. In the first 9 months of 2023 W&WP

exports to Australia reached US$105.4 million, down 30%

over the same period in 2022.

In September 2023 bedroom furniture exports were valued

at US$141 million, down 11% compared to September

2022. In the first 9 months of 2023 exports of bedroom

furniture earned US$1.2 billion, down 35% over the same

period in 2022.

Vietnam's poplar wood imports in September 2023 were

30,800 cu.m, worth US$11.7 million, up 4% in volume

and 2.5% in value compared to August 2023. Compared to

September 2022 imports dropped 9% in volume and 31%

in value. In the first 9 months of 2023 poplar imports

reached 235,200 cu.m, worth US$97.8 million, down 19%

in volume and 33% in value over the same period in 2022.

Raw wood (logs and sawnwood) imported from China into

Vietnam in September 2023 amounted to 45,000 cu.m, at a

value of US$21.0 million, down 11% in volume and 4% in

value compared to August 2023. Over the first 9 months of

2023 the raw wood Vietnam imported from China totaled

380,940 cu.m with a value of US$190.74 million, down

27% in volume and 39% in value over the same period in

2022.

Wood processors awaiting market recovery

Vietnamese wood businesses are facing countless

difficulties due to a lack of orders, rising costs and slow

VAT tax refunds. Many have scaled back operations as

they wait for the market to recover.

The latest statistics from Vietnam Customs show that in

the 12 months to 15 September Vietnam’s total export

value reached US$242.04 billion, down US$23.44 billion

or 9% year-on-year. Of which, shipments of wood and

wood products fetched US$9.01 billion, a decrease of 23%

compared to the figure of US$11.67 billion achieved in the

same period last year.

Vietnam’s wood industry is targeting exports of US$17

billion in 2023. However, exports of wood and wood

products have been slow this year with most businesses

facing a shortage of orders.

In the first eight months of 2023 Vietnam's exports of

wood and wood products reached about US$8.3 billion,

down nearly 26% year-on-year.

"Since May 2023 Vietnam's exports of wood and wood

products have shown signs of a recovery, with over

US$1.2 billion in exports per month on average.

Meanwhile, Vietnamese raw wood imports have climbed

5-10% per month.

This shows that wood producers are preparing for year-

end orders said Nguyen Chanh Phuong, Vice Chairman of

HAWA.

He predicted that exports in the final quarter of this year

could bring home an additional US$6 billion raising the

total exports in 2023 to between US$14-14.5 billion.

Regarding the recovery prospects of the wood industry a

representative of Thien Thanh Phat Timber Co., Ltd said

that the wood industry is completely dependent on

international markets. When the world economy remains

unsettled the Vietnamese wood industry struggles.

According to Le Hoang Hai, director of CMH Vietnam

Import-Export Trading Co., Ltd., there are signs of uneven

recovery in the wood industry reflected in the irregular

number of orders while at the same time raw material

prices are escalating.

"The current wood market is unpredictable, with unstable

prices and orders. For example, to produce domestic

furniture we need to buy wood. But furniture orders are

irregular with only short-term orders of two or three

months causing difficulties for the balancing of production

materials.

The recovery of the wood market depends much on the

real estate industry which is forecast by the Vietnam

National Real Estate Association to remain quiet until the

end of 2023 and only recover and develop healthier from

the second or third quarter of 2024, thanks to legal

improvements, economic growth and removal of financial

bottlenecks.

In addition, many wood businesses revealed that one of

the current difficulties is the delay in refunding value-

added tax (VAT). In fact, many of them have had tax

refunds delayed for two years in a row which disrupts their

financial planning.

See:

https://theinvestor.vn/vietnam-wood-processors-await-market-recovery-d6746.html

Improvement in exports to the US

Wood product exports to the US are warming up although

sales over the past few months were down compared to the

same period last year.

The Ministry of Industry and Trade's Agency for Foreign

Trade Information Center reports the US remained the

main market for Vietnamese wood. In the first half of

2023 exports reached US$3.3 billion, accounting for 54%

of the total but down 33% over the same period in 2022.

The driver of demand growth in the US market is low

inventories and increased construction activity.

Furthermore, the market becomes more active as the

holiday shopping season approaches.

Low availability of housing combined with the numerous

incentives offered by construction companies has

increased buyer interest in new homes which has lifted

demand for imported wood and wood products particularly

wooden furniture.

The U.S. economy is showing signs of revival with

consumer demand increasing. The U.S. government and

its corporations continue to pay attention to Vietnam and

pledge robust business collaboration. As a result of the

positive rebound, big US retail chains have begun to

resume orders with Vietnam.

According to Tran Lam Son, Deputy General Director of

Thien Minh Import-Export Co., Ltd., the US market is

exhibiting signs of improvement. Thien Minh specialises

in plantation wood as well as bamboo and rattan.

Two years ago the Japanese market accounted for

approximately 50-60% of this enterprise's overall export

earnings while the US accounted for approximately 40%.

However, the U.S. market currently accounts for

approximately 50–60% of the company's overall export

revenue.

Son said that, while shipments to the US were still down

from the previous year, orders were up because clients

were gearing up for the holiday shopping season.

He noted that during peak times, shipping costs to the US

were more than US$10,000 per container but that cost has

fallen which allowed more competitive pricing.

According to a representative of Bao Hung Co., Ltd., a

manufacturer of wooden furniture, shipments to Japan

accounted for 60% of its total export revenue two years

ago, while the U.S. accounted for 40%. Now, 60-70% of

exports are to the U.S. The U.S. market gained somewhat

due to end-of-year imports while the Japanese market

remained stagnant.

See:

https://theinvestor.vn/wood-exports-to-the-us-warming-up-association-d6153.html

Building a brand

In the context of an increasingly difficult and challenging

world market, building a brand for Vietnamese wood and

bringing higher value to wooden and interior products is a

"problem" that businesses face.

In addition to meeting the average domestic consumer

demand of about US$3-4 billion/year, Vietnam's wood

industry exports an average of over US$15 billion each

year, making Vietnam the 5th largest W&WP exporter.

Currently, the export markets for Vietnamese wooden

furniture have expanded from 60 countries and territories

in 2008 to over 120 countries and territories in 2022.

Although wooden furniture has a solid foothold in the

domestic market, strong brands in Vietnamese wood and

furniture such as Hoang Anh Gia Lai Wood Joint Stock

Company (Gia Lai), An Cuong Wood Joint Stock

Company (Binh Duong) ), Thuan An Wood Joint Stock

Company (Binh Duong) has still not been able to make a

mark in the international.

Most Vietnamese wood products have only won the trust

of wholesalers and foreign agents but are almost

"unknown" to the final consumer.

According to the General Department of Forestry the

cause of this situation is that the policy to develop the

wood processing industry's brand has not been

implemented. Meanwhile, Vietnamese wood and wood

product businesses do not have experience and do not have

enough resources in terms of capital, people and

management qualifications to develop an overseas sales

system, a foundation to build a brand.

Developing overseas markets requires large-scale

production capacity and few Vietnamese enterprises can

meet this requirement.

Mr. Nguyen Quoc Khanh, Chairman of the City

Handicraft and Wood Processing Association ( Ho Chi

Minh HAWA) and Chairman of the Board of Directors of

AA Company said it is time for Vietnamese businesses to

change their thinking of making money by diligence in

production, taking work as profit but need to build their

own brand.

Branding will help businesses develop vision, direction,

increase customer base, easily access international markets

and optimise profits.

The brand itself will increase commercial value not only

contributing to increasing export turnover and domestic

wholesale value but also positioning Vietnam's wooden

furniture industry on the world map.

Through building brands for themselves businesses will

contribute to creating a brand for the Vietnamese wood

industry.

At the workshop "Bringing Vietnamese fashion, furniture

and household goods into the foreign distribution system"

recently organised by the European-American Market

Department (Ministry of Industry and Trade) Nguyen

Chanh Phuong, Deputy Chairman and Secretary General

of HAWA emphasised that Vietnam has the advantage of

a complete, sustainable supply chain in terms of policies

people, and raw material supply.

But to promote the export of Vietnamese wood products

and furniture more effectively it is necessary to form a

logistics and trade promotion center for Vietnamese

furniture. In terms of market, businesses need to break

away from traditional markets and target markets with

good purchasing power such as Canada, England, Japan,

Korea, India and Saudi Arabia.

At the same time, the timber and furniture industries also

need to actively expand online exports and exports by

projects. Promoting the promotion of national furniture

brands at international furniture fairs is a strategy that

Vietnamese businesses need to focus on for highly

effective trade promotion.

Assessing the challenges of Vietnam's wood industry, Mr.

Eryk Dolinski, Director of Wood Product Business

Development, Supply Department of IKEA Group in

Southeast Asia said that Vietnam's wood processing and

furniture industry is still highly labour-intensive and raw

material sources are mainly located in small farmers so

origin is difficult to trace.

To solve the above problems, Mr. Dolinski said that the

wood products and furniture industries need to focus on

investing in automation to help increase production

efficiency and product quality.

Automation not only in the factory but throughout the

supply chain to meet the increasing demands of the

market. At the same time, we must create a better working

environment and reduce carbon emissions;

And increase efficiency in wood origin certification.

Optimising the supply chain from raw material

transportation, sawmills to production and transportation

stages must be focused on to maximise savings on raw

materials, energy and logistics costs.

With the burden of origin and quarantine, Vietnam needs a

different approach in exporting wood and wood products.

In addition, businesses need to invest more in production

to have green, clean production processes and reduce

emissions to keep up with increasing demands from

buyers.

See:

https://www.vietnam.vn/en/dinh-vi-thuong-hieu-go-viet-khi-ra-bien-lon/

Rubber Group Green Growth Development Strategy

According to Le Thanh Hung, General Director of the

Vietnam Rubber Group (VRG) the Group always

determines its pioneering role in developing the rubber

industry. The new Green Growth and Sustainable

Development Strategy is one of the Group's important

guidelines to simultaneously implement three goals:

economic development, environmental protection and

responsibility towards the community and society.

Accordingly the strategy was built to meet the sustainable

development trend of Vietnam and the world, contributing

directly to reducing greenhouse gas emissions towards a

long-term carbon-neutral economy.

Greening the supply chain

Specifically, the target for 2030 is to reduce greenhouse

gas emissions in energy activities by at least 15%

compared to 2023 and by 2050 reduce greenhouse gas

emissions in energy activities by at least 30% compared to

2023.

From there, it is possible to meet the increasingly high and

demanding requirements of customers, especially the

requirements of tire manufacturers, wood processers,

industrial rubber producers, etc., as well as meet policies

to only purchase natural rubber from companies

committed to ensuring sustainability throughout the entire

supply chain.

VRG continues to implement national and international

certifications on sustainable development towards the goal

of the business committing to sustainable supply, having

transparent traceability policies, completing the

governance system and improving business standards for

international integration.

Regarding the supply chain the Group sets a goal that by

2030, 60% of rubber areas and production forests will

achieve national and international sustainable forest

management certifications (VFCS, PEFC, FSC, etc.), and

100% of latex processing factories will achieve the chain

of custody certificate.

From the moment the European Commission (EC)

proposed the EUDR the Ministry of Agriculture and Rural

Development (MARD) and the Vietnam Rubber Group

(VRG) directed relevant units to focus on monitoring and

controlling the growing area to avoid deforestation and

forest degradation.

See:

https://vietnamagriculture.nongnghiep.vn/vrg-finalizes-its-green-sustainable-growth-strategy-d363947.html

8. BRAZIL

Biomass survey of the

Amazon rainforest

A biomass map of the Brazilian Amazon from multisource

remote sensing, conducted by INPE (National Institute for

Space Research), resulted in the creation of the largest

above-ground biomass map of the Amazon Forest. This

map was generated by combining aerial scans with

airborne lasers, satellite images and geolocation field

inventories, integrated by heavy computational processing

with machine learning.

The study estimated the total biomass of the Amazon

rainforest based on the mapping of 3,600 square

kilometers through transects distributed across all the

region's vegetation categories. It showed an average

biomass concentration of 174 tonnes per hectare and a

maximum of 518 tonnes per hectare, providing crucial

data for planning policy, conservation and sustainable

management, especially at a critical time for the Amazon

due to concerns about carbon emissions and loss of

biomass due to deforestation.

In deforested areas, cross-referencing map data with

deforestation information provided by INPE's Prodes

system makes it possible to calculate the loss of biomass

with greater precision.

The research is relevant in the context of the

environmental crisis in the Amazon and has significant

implications for decision-making regarding forest

conservation and climate change mitigation.

See:

https://www.remade.com.br/noticias/19527/mapa-mostra-levantamento-da-biomassa-da-floresta-amazonica

Technical standard for light wood frame buildings

Wood frame construction, an industrialised construction

system, is common in countries such as the United States,

Canada, Germany, Finland and Sweden and this

construction method is gaining importance in Brazil,

especially after the approval of the new ABNT (Brazilian

Association for Technical Standards / Associação

Brasileira de Normas Técnicas) regulating wood frame

construction in the country.

Wood frame combines construction efficiency,

versatility

and energy benefits, aspects that are increasingly valued in

the civil construction industry. In addition, this system

offers a solution to Brazil's housing shortage.

The ABNT NBR 16936 technical standard which regulates

light wood frame buildings is the result of an extensive

collaborative effort involving associations, universities,

companies in the timber industry, system suppliers and

construction companies.

With this regulation the sector now has technical

guidelines to ensure the quality and safety of buildings

built with this system for up to two-storey building,

representing an important milestone for the civil

construction industry in Brazil.

However, challenges such as public policies, inclusion of

the construction system in financing credit lines and a

coordinated communication campaign presenting its

differentials and benefits should be addressed in order to

boost the growth of wood frame in the country.

See:

https://www.remade.com.br/noticias/19514/entenda-a-norma-abnt---edificacoes-em-light-wood-frame

Export update

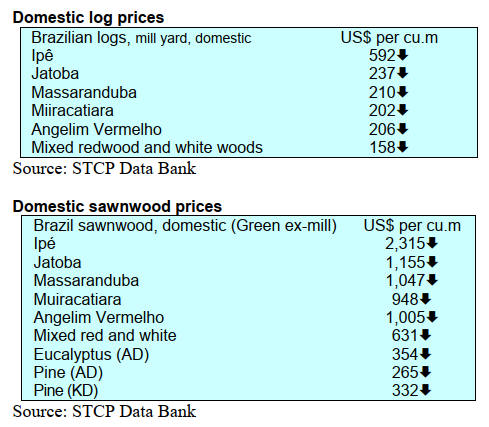

In September 2023 the value of Brazilian exports of wood-

based products (except pulp and paper) decreased 24% in

value compared to September 2022, from US$341.3

million to US$259.7 million.

Pine sawnwood exports declined 41% in value between

September 2022 (US$69.6 million) and September 2023

(US$41.3 million). In volume, exports dropped by 25%

over the same period, from 242,300 cu.m to 182,000 cu.m.

Tropical sawnwood exports decreased 25% in volume,

from 30,800 cu.m in September 2022 to 23,000 cu.m in

September 2023. In value, exports decreased 31% from

US$14.8 million to US$10.2 million, over the same

period.

In contrast, pine plywood exports saw a 14%

increased in

value in September 2023 compared to September 2022,

from US$41.6 million to US$47.4 million and in volume,

exports increased 34% over the same period, from 114,100

cu.m to 153,400 cu.m.

However, tropical plywood exports decreased in volume

39% and in value by 48%, from 3,300 cu.m and US$2.3

million in September 2022 to 2,000 cu.m and US$1.2

million in September 2023, respectively.

Wooden furniture export earnings in September dropped

from US$53.8 million in September 2022 to US$ 47

million in September 2023, a 13% fall.

Paricipation in Macau Forum

Entrepreneurs from the forest sector in the state of Mato

Grosso in the Amazon Region are preparing to take part in

the Global Legal and Sustainable Timber Forum (GLSTF)

2023 to be held 21-22 November in Macau, China.

This event represents a valuable opportunity for the forest

sector to access new markets, expand business and

diversify sales of native timber species on the international

market. The Center of Timber Producing and Exporting

Industries of the State of Mato Grosso (CIPEM) discussed

the importance of participation of forest companies in this

event with its members from the eight forestry unions.

CIPEM considers the GLSTF an important agenda for the

forest sector as it is specific to the segment and more than

300 forest products importers are expected to participate in

the event facilitating direct contact with clients and

strengthening business relationships.

The Chinese market is an important consumer of wood

products coming from sustainable forest management

areas. In the first eight months of 2023 forest-based

companies of the state of Mato Grosso exported 7,784

tonnes of wood to China.

This volume represents 13% of the total (62,000 tonnes)

traded by industries in Mato GrossoSstate, with a turnover

of US$5.8 million, equivalent to 9% of the US$64.9

million earned from the State's wood product exports

according to the Ministry of Agriculture and Livestock

(MAPA).

The participation of entrepreneurs from Mato Grosso State

at the GLSTF is important because there is an opportunity

to show that the state has a high production volume,

product quality and traceability and has joined efforts to

consolidate the State's position in the international market.

See:

https://forestnews.com.br/industrias-mato-grosso-forum-global-da-madeira/

Latin America conference discusses SFM

The opening of the IUFRO (International Union of Forest

Research Organizations) 2023 Latin America Conference

was attended by the conference's Organizing and Scientific

Committee emphasising the importance of the diversified

programme to reflect on sustainable management in

natural and planted forests and the sustainable use of

timber as a renewable raw material.

Genetic improvement, planting trees to absorb carbon

emissions, new uses for planted forests with renewable

and sustainable raw materials were among the priority

topics.

In addition, the conference emphasised the importance of

forests in the context of the Sustainable Development

Goals, addressing issues such as food security, sustainable

agriculture and environmental management, while also

promoting collaboration among various stakeholders to

boost the country's economic growth through solid

partnerships, including the internationalisation of

knowledge in the area of forestry.

Brazil plays an important role in environmental

sustainability management which is essential for biosafety

especially in relation to research into genetically modified

organisms according to EMBRAPA (Brazilian

Agricultural Research Corporation). Sustainably managed

natural and planted forests have become sources of energy

generation, manufacture of timber products and economic

growth, resulting from national and international

cooperation.

See:

https://www.embrapa.br/florestas/busca-de-noticias/-/noticia/84134935/manejo-sustentavel-de-florestas-e-tema-de-conferencia-iufro-2023-america-latina

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20231017/1697507334917952.pdf

9. PERU

Bill presented for

development of the forest industry

Peru has about 72 million hectares of natural forests and

according to Antonio Castillo of the Garay Institute of

Economic Studies, National Society of Industries (SNI), of

this 7 million hectares are feasible for the development of

the forest industies.

He explained that currently around 500,000 ha. of

operationing concessions generate wood products worth s

between US$125 million and US$130 million in exports

despite the problems that the sector has such as poor

traceability and lack of financing.

He added that through SFM and robust traceability exports

can grow and jobs can be created. Castillo said that the bill

that the SNI has prepared focuses on forestry sector

development.

B-to-B with foreign buyers

During an October business conference held in Pucallpa

169 business-to-business meetings were arranged for

manufacturers and buyers of sawnwood, flooring,

moldings, boards, beams, doors, finger joint boards among

others.

Foreign buyers had the opportunity to check the quality of

the Peruvian timber and commitments for trade to the

value of US$8 million were made wit some US$600,000

immediate sales contracts signed.

Ten buyers from South Korea, the United States, Mexico

and the Dominican Republic and 25 exporting companies

from Ucayali, Loreto and Lima participated bringing

together in one place wood producers, processors,

exporters, importers, distributors, investors and other

professionals related to the value chain of the sector and

its products.

The Peruvian companies pointed out they have sustainable

management certifications ensuring environmentally

sound and legal production.

See:

https://agraria.pe/noticias/compradores-extranjeros-demandaron-oferta-maderera-por-us-8--33524

Government allocation to promote forestry sector

The Ministry of Economy and Finance (MEF) approved

the transfer of US$ 1.3 million to the National Forestry

and Wildlife Service (Serfor) to finance the additional

goals of interventions that promote the forestry and

wildlife sector.

According to Supreme Decree 223-2023-EF, published in

the Official Gazette El Peruano the resources will be taken

from the MEF Contingency Reserve. The supreme decree

is endorsed by the President of the Republic, Dina

Boluarte and the Minister of Economy and Finance, Alex

Contreras.

See:

https://agraria.pe/noticias/ejecutivo-destina-s-4-9-millones-para-impulsar-sector-forest-33569

Illegal logging and timber trade – a decline in 2019

Efforts made by the Forest and Wildlife Resources

Supervision Agency (Osinfor) have resulted in a reduction

in the rate of illegal logging and trade in illegal wood.

This is the conclusion of the study "Estimation of the

Illegal Logging and Timber Trade Index in Peru in 2019"

carried out jointly by OSINFOR, the Regional and

Wildlife Authorities (ARFFS) and the National Forest and

Wildlife Service (Serfor) with technical support of the

FOREST+, a programme of USAID and the US Forest

Service.

With the data provided by the study, regional and national

forestry authorities, as well as decision makers in the

sector, will have a clearer understanding of the existing

weaknesses within their powers.

In addition, it establishes a concrete framework for action

to combat illegal logging as they carry out their functions

and design improved public policies, in order to strengthen

efforts to combat illegal logging and move towards

sustainable forest management in Peru.

See:

https://www.gob.pe/institucion/osinfor/noticias/852223-tala-y-comercio-ilegal-de-madera-se-redujo-en-2019-de-acuerdo-con-estudio-del-osinfor

|