Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2023

Japan Yen 138.20

Reports From Japan

Consumers are spending again

The Cabinet Office has reported the economy grew by an annualised

1.6% in the first quarter of 2023 as consumers were spending again. Spending

increased in the service sector, including travel and dining and sales of

new cars were strong. Consumer spending accounts for more than half of

Japan's GDP. However, exports in the first quarter were weak.

An economy growing faster than expected, despite a global downturn, may

encourage the new Bank of Japan governor, Kazuo Ueda, to adjust the Bank

policy even before the review he called for is completed.

See:

https://www.japantimes.co.jp/news/2023/05/17/business/japan-economy-grows-more-technical-recession/

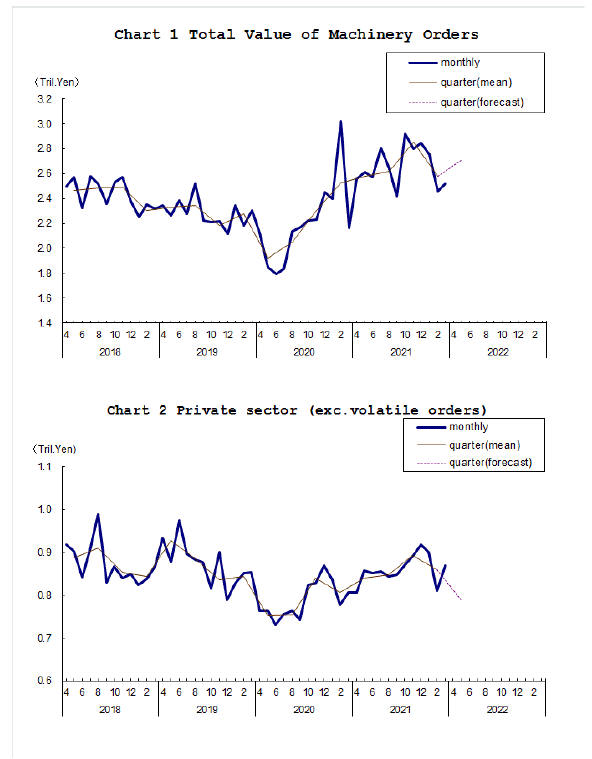

First quarter machinery orders disappoint

The total value of machinery orders received by 280 major

manufacturers operating in Japan increased by 2.5% in March from the

previous month on a seasonally adjusted basis. In the January-March period

it decreased by 9.7% compared with the previous quarter.

Private-sector machinery orders (excluding volatile ones for ships and those

from electric power companies) increased a seasonally adjusted by 7% in

March but decreased by 3.6% in January-March period.

In the April-June period the total machinery orders has been forecasted to

increase by 5.2% but private-sector orders, excluding volatile ones, were

forecast to fall by 8% from the previous quarter.

See:https://www.esri.cao.go.jp/en/stat/juchu/2022/2203juchu-e.html

Electricity price hike will drive up

manufacturing costs

The government has approved sharp increases in electricity prices

by Japan’s major power companies effective June. Price increases will be

between 14% and 42%. This will disappoint households already experiencing

inflation rates not seen for decades. The increase in electricity charges

will raise inflation by almost half a percent according to an economist at

Nomura Research Institute.

Throughout the world electricity prices have been rising since Russia

invaded Ukraine and disrupted energy markets.

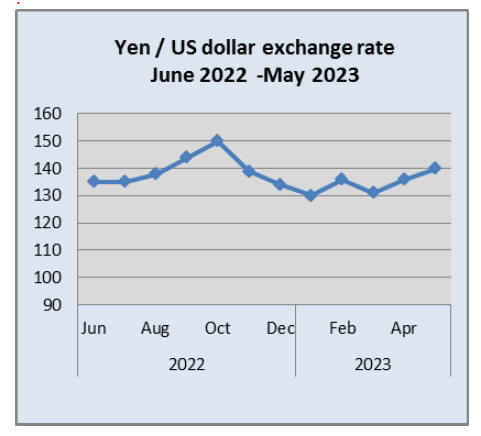

Accelerated inflation impacts exchange rate

Japanese Yen exchange rate has been influenced by Japan’s inflation

data which pointed to a continued upward trend.

In April Japan’s inflation re-accelerated after slowing earlier in the year.

This will be of concern to the BoJ as it may mean the Bank has to revise its

price outlook.

See:

https://www.fxstreet.com/news/usd-jpy-gathers-strength-to-print-fresh-five-month-high-above-13800-ahead-of-japans-inflation-202305180040

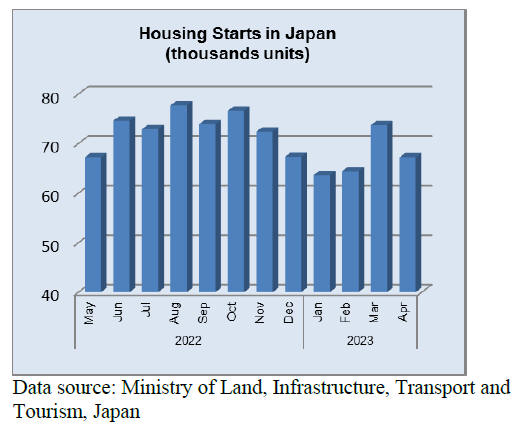

Changing demographics – declining demand for

new homes

The worldfolio.com website carries an informative interview with

the head of a major construction company which will interest wood product

exporters. Commenting on the challenges and opportunities from the

demographic changes occurring in Japan the executive said that, in a very

short time, one in three Japanese people will be over the age of 65 which

will result in two challenges; the problem of finding skilled workers and a

declining domestic market for new homes.

One of the effects of Japan's demographic situation is that demand for new

construction is decreasing, however, the executive said his company is

seeing an increase in demand for the maintenance and repair.

See:

https://www.theworldfolio.com/interviews/wings-aims-to-spread-the-japanese-way-of-wood-in-housing/5674/

Import update

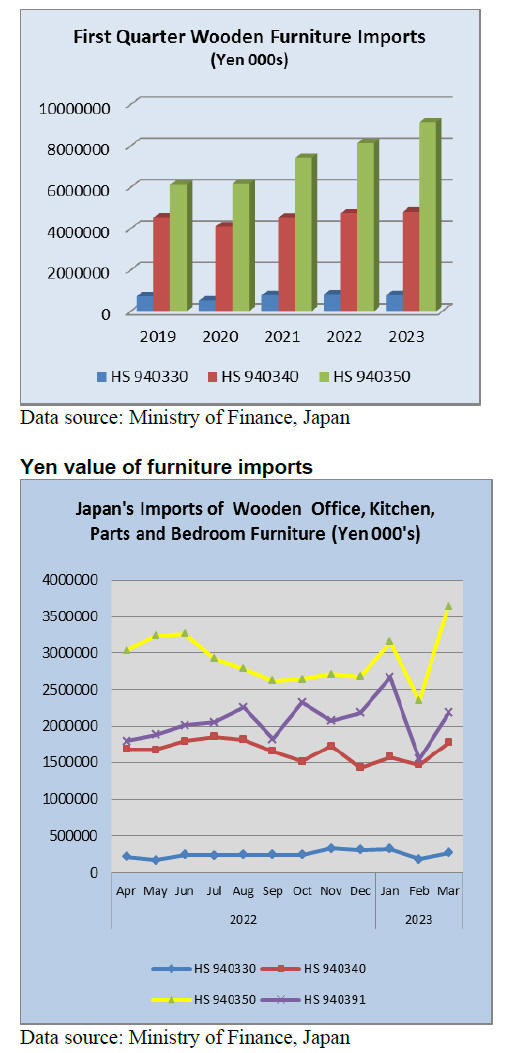

Over the past five years there has been a very noticeable

and steady rise in the value of Japan’s imports of wooden

bedroom furniture in contrast to the trends in import

values for wooden office and kitchen furniture. The steady

increase in the value of bedroom furniture cannot be

explained onlyby the impact of rising FOB prices in

supply countries or with impact of exchange rates.

See:

https://www.nippon.com/en/news/yjj2023050901086/

It can be seen in the graphic abovew that the

upswing in

the value of imports of bedroom furniture began in 2021

despite the Covid restrictions and depressed consumer

spending. One possible explanation could be that those

having to work from home had to rearrange bedrooms to

make space for a home office.

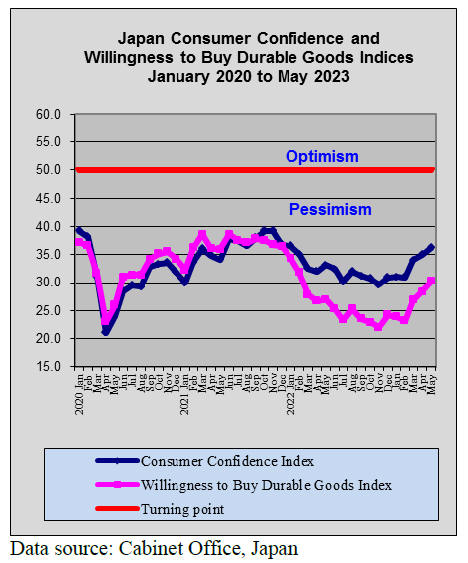

Throughout 2022 the comsumer sentiment and the

willingness to buy durable goods indices in Japan were in

neagitive territory and this depressed purchases of

furniture.

In May the Japanese furniture retailer Nitori Holdings

reported its 2022 annual returns which showed the first

decline in profits in 24 years. The main reason cited for

the poor profits was the higher cost of imported products

due to the weak yen and high ocean transportation costs.

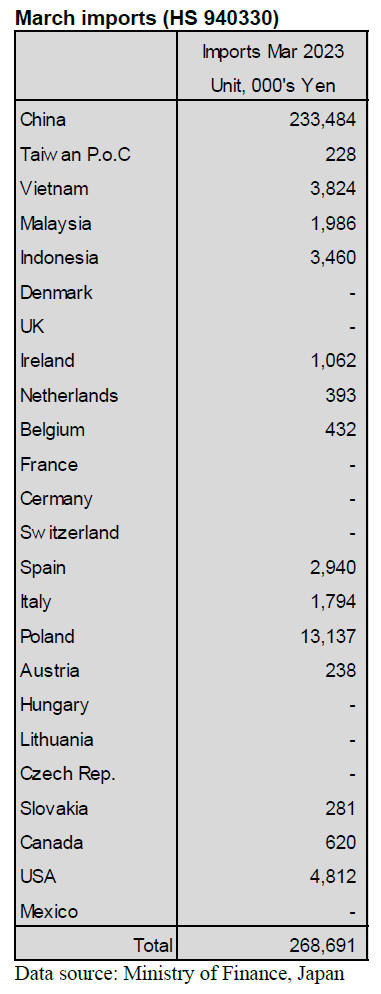

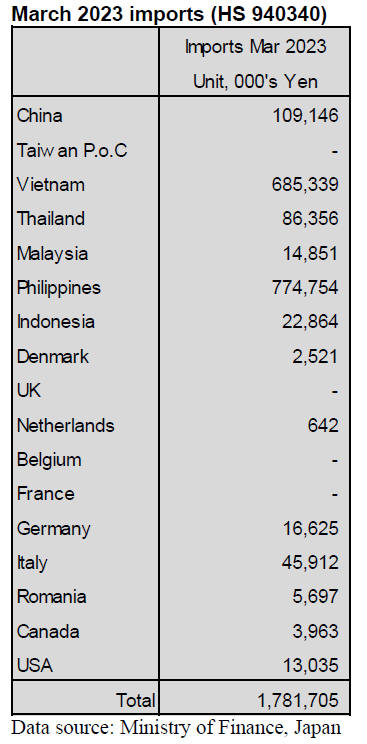

March 2023 wooden office furniture imports (HS

940330)

February shipments of wooden office furniture from China

were lower than in the previous few months because of

factory closures over the Chinese New Year. The value of

Japan’s wooden office furniture (HS940330) imports from

China almost double in March compared to a month

earlier firmly establishing shippers in China as the top

supplier accounting for 87% of Japan’s wooden office

furniture in March.

Year on year the value of wooden office furniture imports

in March increased as they did compared to a month

earlier. In March the second and third ranked suppliers in

terms of the value of imports were Poland and the USA

with each accounting for around just 2% of the total value

of March imports.

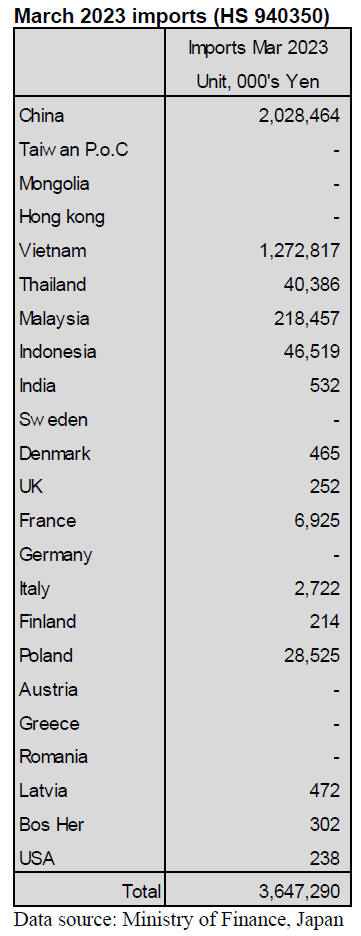

March 2023 kitchen furniture imports (HS

940340)

The Philippines and Vietnam maintained their positions as

the top suppliers of wooden kitchen furniture (HS 940340)

to Japan in March.

Shipments from manufacturers in the Philippines

accounted for 43% of March arrivals while shipments

from shippers in Vietnam accounted for 38% of March

arrrivals, almost double that of February shipments.

Exorters in China and Thailand accounted for around 5%

each of March shipments bringing the total for the top four

shippers to 87% of March arrivals.

Year on year the value of Japan’s March imports of

wooden kitchen furniture rose from a month earlier and

the same trend was seen in month on month imports.

Rising input costs and higher prices in supply countries

and the weak yen had an impact on the total value of

imports.

February 2023 wooden bedroom furniture

imports (HS

940350)

In February there was a massive downward correction in

the value of shipments of wooden bedroom furniture as in

each of the main supply countries, China and Vietnam

there were extended holidays in the month. The value of

March arrivals of wooden bedroom furniture (HS 940350)

more than made up for the decline reported for February in

fact in March there was a 55% rise in the value of imports

lifting the monthly value well above the average for the

previous 12 months.

Much of the increase in the value of shipments is because

of higher FOB prices reflecting increased production costs

and the impact of the weak yen.

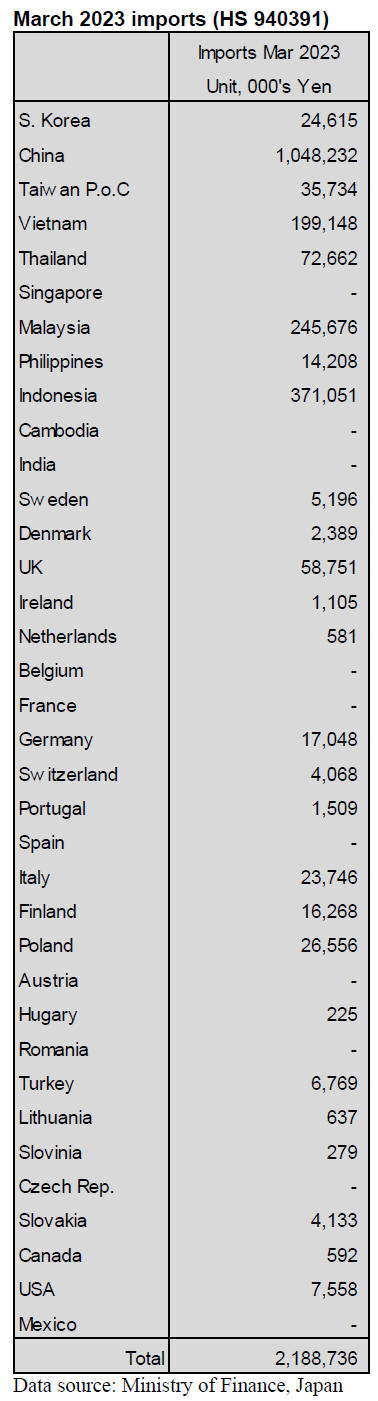

March 2023 wooden furniture parts imports

(HS 940391)

After the decline in the value of February imports, the

value for March restored the value of monthly imports

back only to the average for the past 12 months. This was

unexpected as the impact of higher FOB prices and the

weak yen was a factor in the rising import values for

office, kitchen and bedroom furniture.

Shipments of wooden furniture parts from China in March

were almost double that in February as factories resumed

full time operation. There was also a sharp rise in month

on month shipments from Vietnam. Indonesia and

Malaysia were the other two shippers of note in March.

The March value of Japan’s imports of wooden furniture

parts was little changed from that in March 2022 but,

compared to February, there was an over 40% rise in the

value of imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

LVL made of domestic larch

Key Tec Co., Ltd. will expand selling high strength

structural LVL. The company used to produce the high

strength LVL by Russian logs or Russian veneers but the

company reduced producing and selling the high strength

structural LVL due to banned importing Russian logs and

Russian veneers.

Domestic larch will be used for the product this time. It is

able to order the high strength structural LVL by other

materials such as Douglas fir or radiata pine. Product of

high strength structural LVL made of Russian larch was

about 50,000 cbms annually before the invasion in

Ukraine by Russia. Then, the product declined to 35,000

cbms. Now, the company produces the high strength

structural LVL by domestic larch for 6,000 cbms in a year

and will raise to 10,000 cbms.

Domestic softwood plywood

Movement of domestic softwood plywood will be bearish

in May. Distribution companies start to procure materials

because the inventory clearance at the end-of-term setting

of accounts is over. However, shipment is on the road to

recover. Some plywood companies lower the price if they

got a large number of orders from clients.

Inventory of plywood is less than before because the

shipment has been exceeding product since March. The

price of 12mm 3 x 6 structural softwood plywood is 1,800

– 1,850 yen, delivered per sheet and this is about 50 yen

lower than the previous month. The price for a large

number of orders is around 1,700 yen.

Orders to the precutting plants have been increasing since

February, 2023 but consumers still purchase only for the

present use. One of the reasons is anticipation of falling

prices. Plywood manufacturers take time to control the

inventory because there are not enough inquires yet.

However, demand and supply are recovering slightly for

sure because the inventory of structural softwood plywood

at the end of March is 147,383 cbms and this is 1.7%

down from February, 2023. This is for the first time

decreasing in nine months. Product is 173,907 cbms and

this is 5.8% up from the previous month. Shipment is

176,425 and this is 9.2% up from the previous month.

The inventory in May would be less than April’s inventory

because there was a big holiday at the end of April through

May.

If the inventory continued decreasing, consumers would

buy more plywood in a hurry. Then, the plywood

manufacturers would be able to stop lowering the price.

This is what the plywood manufacture were planning for.

South Sea logs and lumber

Inquiries for South Sea lumber are better than before.

However, there are less inquiries from Japanese plywood

manufacturers because of sluggish movement of imported

South Sea plywood.

Therefore, there are not enough South Sea Logs and

it is difficult to get South Sea logs for lumber. It takes a lot of time to

get lumber for the deck or for the body of trucks. There are less inquiries

for laminated fixture lumber because the yen fell to 130 yen against the

dollar.

Indonesian sellers are not positive to get a lot of orders for Merkusii pine

lumber by lowering the price. The reasons are that it is a strong Rupiah

against the dollar now and it is a season for fresh Merkusii pine logs so it

is difficult to buy low-priced Merkusii pine logs.

There are not many inquiries for Chinese red pine lumber and product is low.

Chinese sellers would not lower the price because the electricity rates and

the production costs are rising.

Japan established a law of green transformation

The Japanese Parliament enacted a bill for promoting so-called

green transformation to drive a transition to a carbon-neutral society. The

government will issue 20 trillion yen in 10 years from fiscal 2023. The

government will promote to support decarbonization and energy saving in

public transportation, distribution industry and housing / structure

industry.

The Ministry of Land, Infrastructure, Transport and Tourism will change the

social system of any business related to green transformation. For housing

industry, all houses and non-housing buildings must be ZEH (Net Zero Energy

House) or ZEB (Net Zero Energy Building).

Radiata pine logs and lumber

The price of Chilean radiata pine lumber in Japan has been weak

since spring of this year. In the Greater Tokyo Metropolitan area, the price

of Chilean radiata pine lumber was lowered by around maximum 3,500 yen, FOB

per cbm in April.

Then, the price was 58,500 – 60,500 yen, FOB per cbm for thin boards and was

56,600 – 58,500 yen, FOB per cbm for squares. One of the reasons is that the

lumber shipped to Japan in November, 2022 arrived and the price was $50, FOB

per cbm lower than the previous time at that time in Chile. Japanese

wholesalers will also lower the price by maximum 3,500 yen, FOB per cbm in

May.

The price of lumber shipped to Japan in April is US$350, CIF per cbm and

this is US$10, FOB per cbm higher than last time. The lumber will arrive to

Japan in the middle of June because the vessel was delayed by Chilean

shippers due to the inventory in Japan.

New Zealand logs for Japan cost US$150- 160, C&F per cbm and this is

stabilized from last time. The price of NZ lumber in Japan is 62,000 –

64,000 yen, per cbm and this is leveled off from the previous time. Some

reasons are that electricity charges and cost of antifungal agent are

rising.

The price of Vietnamese plywood for crating in Japan is 1,150 yen, delivered

per sheet. The size is 8.5mm, 4 x 8. The price is 50 yen, per cbm down from

last month.

|