|

Report from

North America

US manufacturing sector weakest in nearly three

years

US manufacturing activity slumped to its lowest level in nearly three

years in March as new orders continued to contract and activity could

decline further amid tightening credit conditions. The Institute for

Supply Management (ISM) said that its manufacturing PMI fell to 46.3

last month, the lowest reading since May 2020, from 47.7 in February.

Economists polled by Reuters had forecast the index dipping to 47.5.

It was the fifth straight month that the PMI remained below 50, which

indicates contraction in manufacturing. But other data suggests that

manufacturing, which accounts for 11.3% of the economy, continues to

grow moderately.

Manufacturing expanded at a 4.5% annualized rate in the fourth quarter,

the government reported last week. Reports last month also showed orders

for capital goods excluding aircraft eking out a small gain in February

as did manufacturing output.

Of the 18 manufacturing industries surveyed by ISM, 12 reported

contraction in March with the Furniture and Related Products sector

reporting the biggest contraction.

See:https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/march/

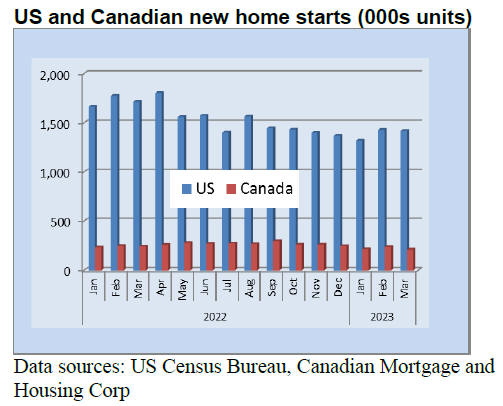

US and Canadian new home starts declined in March

US home building pulled back in March, having fallen 0.8% in February

when multifamily home construction failed to keep pace with an increase

in construction of single-family homes.

Housing starts, a measure of new home construction, was down 17% from a

year ago according to data released by the US Census Bureau. After

surging in February following five consecutive months of decline March

housing starts fell to a seasonally adjusted annual rate of 1.420

million, down from the revised February estimate of 1.432 million.

Single‐family housing starts in March rose 2.7% from the revised

February figure, at a seasonally adjusted annual rate of 861,000.

US housing starts recorded big drops in May and July last year when

spiking mortgage rates pushed many prospective home buyers to the

sidelines. Starts bounced back slightly in August but fell through

January. Since then, with more positive economic news, building has

perked up.

As mortgage rates trended lower, builders have begun to feel more

optimistic that conditions may improve in 2023.

Building permits, which track the number of new housing units granted

permits, also fell in March following two months of gains, falling 8.8%

from the revised February rate, and were down 24.8% from a year ago. In

March, building permits were at a seasonally adjusted annual rate of

1.413 million.

Canadian housing starts fell more than expected in March compared with

the previous month as groundbreaking decreased on multiple unit and

single-family detached urban homes.

The seasonally adjusted annualised rate of housing starts fell 11% to

213,865 units from a revised 240,927 units in February, the Canadian

Mortgage and Housing Corporation said.

See: https://www.census.gov/construction/nrc/index.html

and

https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-data/data-tables/housing-market-data/monthly-housing-starts-construction-data-tables

Sales for existing homes slumped in March

Existing-home sales in the US edged lower in March according to

the National Association of Realtors. Total existing-home sales fell

2.4% from February to a seasonally adjusted annual rate of 4.44 million

in March. Year-over-year sales dipped 22% (down from 5.69 million in

March 2022).

Data on mortgage applications was lower as well. The Mortgage Bankers

Association reported that higher lending rates have led to a 10% decline

in loan applications as would-be buyers face affordability challenges.

"Home sales are trying to recover and are highly sensitive to changes in

mortgage rates," said NAR Chief Economist Lawrence Yun. "Yet, at the

same time, multiple offers on starter homes are quite common, implying

more supply is needed to fully satisfy demand. It's a unique housing

market."

Existing-home sales in the Northeast were unchanged from February at an

annual rate of 520,000 in March, but down 21.2% from March 2022. In the

Midwest, existing-home sales retracted 5.5% from one month ago to an

annual rate of 1.03 million in March, falling 17.6% from the previous

year.

Existing-home sales in the South decreased by 1.0% in March from

February, to an annual rate of 2.07 million, a 20.4% decrease from the

prior year. In the West, existing-home sales declined 3.5% from the

previous month to an annual rate of 820,000 in March, down 30.5% from

the prior year.

The median price for an existing home fell by 0.9% from last March,

dropping to US$375,700 this year.

This drop is the largest since January 2012, when home prices fell 2%

year on year. It’s also the second month in a row that home prices fell.

See:

https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

US hiring remains steady

The US Department of Labor’s report on US employment for March

showed hiring slowed more than expected but remained steady. The jobs

report showed that American employers added 236,000 jobs last month, a

slowdown from February’s 326,000 and slightly below economists’

expectations. Wages, meanwhile, grew 0.3% from February to match

expectations. But year-on-year wage gains slowed to 4.2% from 4.6%.

Employment continued to trend up in leisure and hospitality, government,

professional and business services and health care but showed little

change over the month in other major industries, including construction

and manufacturing.

A cooler job market is exactly what the US Federal Reserve (Fed) is

trying to achieve. Raising rates is one of the Fed’s most effective ways

to undercut inflation but it’s a notoriously blunt tool that works only

by slowing the entire economy.

Many economists fear a recession later this year. But some say a narrow

possibility still exists where the Fed could raise rates just enough to

get inflation fully under control without causing a severe recession.

See:

https://www.bls.gov/news.release/empsit.nr0.htm

Consumer sentiment picked up in April

American consumers appear as uncertain over the state of the

economy as professional pundits and the Fed. The University of

Michigan’s estimate of consumer sentiment released in April found

consumers slightly more optimistic with its overall index rising to 63.5

from 62 in March.

However, expectations for inflation a year from now rose sharply, to

4.6% from 3.6% a month earlier while staying in the same range of 2.9%

to 3.1% they have been in 20 months. That comes even as recent reports

on inflation have shown it dropping markedly.

“Consumer sentiment was essentially unchanged this month, inching up

less than two index points from March,” said Joanne Hsu, Michigan survey

Director. “Sentiment is now about 3% below a year ago but 27% above the

all-time low from last June.” Hsu added that sentiment rose among

lower-income consumers while falling among consumers with higher

incomes. “While consumers have noted the easing of inflation among

durable goods and cars, they still expect high inflation to persist, at

least in the short run,” Hsu said.

See:

http://www.sca.isr.umich.edu/

Growth of large national home

While the US construction industry remains one of the economy’s

most fragmented industries large national home builders have seen

growing levels of concentration in market share. Of the 65,000 or so

single-family home builders in the US the 100 largest builders now

account for more than 50% of all single-family home sales, up from one

third back in 2001.

The 10 largest builders now account for about a quarter of all

single-family homes sales nationally while the top two (D.R. Horton and

Lennar) account for about one in every six new single-family homes sold.

A recent Joint Center for Housing Studies at Harvard University working

paper suggests that these large builders are increasing their scale

through strategic acquisitions and by concentrating their activities in

select major metropolitan areas across the country.

The Center’s Kermit Baker writes that for the flooring industry this

increased concentration means that securing just a few new customers can

yield a significant increase in market share. With large builders

looking to fuel their growth by concentrating in key metro areas

flooring suppliers need not have a robust national footprint to service

these customers in selected markets.

See:https://www.floorcoveringweekly.com/main/features/builder-concentration-the-flooring-industry-40991

|