4.

INDONESIA

SVLK rebranded

The European Union's decision to impose new rules

regulating the timber trade has pushed Indonesia to act. On

1 March 2023 the Ministry of Environment and Forestry

(KLHK) finalised a ‘new’ SVLK. The SVLK has changed

to the ‘Legality and Sustainability Verification System’

with the same abbreviation, SVLK.

This new regulation deals with the legality of timber

sources and identifies the sources that are sustainably

managed.

The Director General of Sustainable Forest

Management

in the KLHK, Agus Justianto, when speaking at a seminar

held by the Indonesian Timber Panel Association

(Apkindo), said the previous SVLK also had sustainability

aspects in its criteria and indicators. With the word

sustainability (for the new SVLK), now emphasises

legality and sustainability, he said.

According to Agus, the SVLK has evolved to include, for

example, a longer validity period for certificates for

cultivated wood. There are also financing facilities for

certification for micro, small and medium enterprises.

He added that the government's quick action in rebranding

the SVLK should be appreciated as it deals with market

requirements as the EU wood product market is large and

Indonesia must act to capture a greater market share.

See:

https://agroindonesia.co.id/svlk-baru-perkuat-kelestarian/

New paradigm for SVLK

The Director for Processing and Marketing of Forest

Products at the KLHK, Krisdianto, said that the SVLK

was well accepted in the international market adding that

the SVLK has a number of attributes that make it

acceptable. Among them is that the SVLK has strict and

well-maintained regulations to ensure the forest product

legality and forest sustainability.

The multi-stakeholder involvement in the development

and implementation is also an attribute that strengthens the

SVLK. In addition, the SVLK is credible because

verification is carried out by third parties which are

accredited by the National Accreditation Committee

(KAN).

Implementation of the SVLK is transparent because it

involves civil society as independent monitors.

Responding to the European Union's plan to implement

the Deforestation Free Supply Chain law, Krisdiyanto

stated that Indonesia hopes that the European Union will

continue to recognise the SVLK.

The chairman of the Indonesian Forestry Community

Communication Forum (FKMPI), Indroyono Soesilo,

stated the SVLK is a credible system for Indonesia to

satisfy the European Union's DFSC regulations. This is

because the SVLK increases accountability and

transparency which have an impact on improving forest

governance in Indonesia.

See:

https://agroindonesia.co.id/svlk-paradigma-baru-bisamenjawab/

EUDR taken up at FACT Dialogue

At the opening of the Forest, Agriculture Commodities

Trade (FACT) Retreat held in London the Deputy Minister

of Environment and Forestry, Alue Dohong, conveyed

Indonesia's stance regarding the European Union's Due

Diligence Regulations.

He said the European Union's due diligence regulations on

six commodities, especially wood products ignores

Indonesia's efforts to implement a Legality and

Sustainability Legality Verification System (SVLK) which

has been in operation since 2001 within the framework of

Forest Law Enforcement Governance and Trade (FLEGT).

In his opening speech, Alue conveyed Indonesia's views

on the EU's due diligence regulations and hoped that the

FACT Dialogue could support Indonesia's stance in

anticipating these due diligence regulations. The European

Union is a member of the FACT Dialogue.

Alue also said that the FACT Dialogue should not only be

a 'talk platform' but should pay attention to solving nontariff

barriers problems.

The FACT Dialogue is a 28-country dialogue forum

consisting of groups of producing countries and groups of

consuming countries that have the goal of agreeing on

principles of collaborative action, a common roadmap on

sustainable land use and international trade and taking

steps to protect forests while promoting development and

trade.

See:

http://ppid.menlhk.go.id/berita/siaran-pers/7118/dipembukaan-fact-retreat-wamen-lhk-sampaikan-sikap-indonesiaterhadap-regulasi-uji-tuntas-uni-eropa

and

https://forestinsights.id/2023/03/30/wamen-lhk-sampaikan-sikapindonesia-soal-eu-dfsc-di-fact-retreat-campakkan-usahamembangun-svlk/

Plywood producers and IFCC/PEFC certification

Indonesian plywood producers are considering the IFCCPEFC

certification scheme in order to strengthen

penetration into the export market as well as to support

sustainable forest management.

The Chairman of Apkindo, Bambang Soepijanto, stated

that the certification scheme developed by the Indonesia

Forestry Certification Cooperation (IFCC)-Program for

Endorsement Forestry Certification (PEFC) is attractive to

Apkindo members because it can increase economic

growth and guarantee environmental sustainability.

Another benefit of the IFCC-PEFC scheme is that it can

already be carried out by domestic audit institutions with

accreditation from the National Accreditation Committee

(KAN). This will have an impact on time and cost

efficiency in the certification process.

The Secretary General of the National Accreditation

Committee (KAN), Donny Purnomo, revealed that KAN

has operated the IFCC-PEFC accreditation scheme since

2022. He explained that one of the requirements for

certification bodies intending to obtain KAN accreditation

for IFCC-PEFC is that they must have received

accreditation for the mandatory SVLK scheme.

See:

https://forestinsights.id/2023/03/24/produsen-kayu-lapislirik-sertifikasi-ifcc-pefc-akreditasi-kan-jadi-satu-alasan/

Rational behind carbon pricing

Director General of Climate Change Control at the

Ministry of Environment and Forestry, Laksmi Dewanthi,

stated that the main goal of developing Economic Carbon

Value (NEK) is not just about money because article 6 of

the Paris Agreement and Presidential Decree 98 of 2021

clearly indicates the aim of NEK is to achieve the NDC

target,"

She explained that, to support the achievement of the

NDCs, it is necessary to seure funding. One source of

funds is the development of the NEK and developing an

inclusive, transparent and fair carbon market.

Currently, the government is preparing to operationalise

carbon trading. The regulations are being prepared by the

KLHK concerning Procedures for Carbon Trading in the

Forestry Sector and regulations concerning

implementation of NDCs. The KLHK, together with the

Financial Services Authority (OJK), are preparing

regulations regarding technical arrangements for a carbon

exchange.

See:https://forestinsights.id/2023/03/25/klhk-tegaskan-tujuanutama-carbon-pricing-bukan-ekonomi-regulasi-disiapkan/

Downstream industry investment forecasts

The Ministry of Investment has forecast that Indonesia’s

ambitious downstream aims would require an investment

of around US$550 billion over the next two decades.

About US$432 billion in investment needs be directed to

the minerals and coal sectors. The industrial downstream

sectors will need US$68 billion and investment needs in

plantations, fisheries and forestry sectors total US$45

billion.

See:

https://jakartaglobe.id/business/indonesias-downstreamindustry-plan-needs-5453b-till-2040

KLHK-MA collaborate on environmental protection and

forestry

The KLHK is strengthening cooperation in the legal field

with the Supreme Court (MA) to build a firm legal

foundation for environmental and forest protection in

Indonesia. The signing of a memorandum of

understanding was done by the Secretary General of the

Ministry of Environment and Forestry, Bambang

Hendroyono, with the Secretary of the Supreme Court,

Hasbi Hasan.

"The memorandum of understanding is the basis for

implementing coordination between the two institutions in

supporting efforts to protect the environment and forestry

in realising sustainable development and actualising

community rights according to constitutional mandates,

said KLHK Minister, Siti Nurbaya.

See:

https://www.antaranews.com/berita/3452517/klhk-maberkolaborasi-wujudkan-perlindungan-lingkungan-kehutanan-ri

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.ittoggsc.org/static/upload/file/20230414/1681442042214477.pdf

5.

MYANMAR

The domestic press quoting the recent National

Planning

Law 2023-2024 says the governments aim is to lift per

capita GDP to MMK2.45 (about US$1,160). This would

involve an increase by MMK400,000 from the 2022-2023

financial year level.

The National Planning Law took effect on 1 April and

forecasts a rise of 4% in GDP. The legislation provides for

more than MMK8,300 billion to be invested by the State

for projects that benefit the State and citizens. In the

previous national plan the average per capita GDP was

targeted to increase from MMK2,052,528 to

MMK2,222,230.

In the current National Planning Law the participation of

the agricultural sector, the industrial sector and the

services sector in the total value of gross domestic product

are expected to reach 2.5%, 4.8% and 6.7%.

See:

https://www.gnlm.com.mm/myanmar-aims-to-achieve-anaverage-per-capita-gdp-of-k2-45-million/

Deadline for transfer of export earnings

The Central Bank of Myanmar (CBM) is pushing

exporters to show receipts of export earnings in the

prescribed time.

According to the local media the chairperson of the CBM

held a meeting with Deputy Minister of Commerce,

Chairman of Union of Myanmar Federation of Chamber of

Commerce and Industries (UMFCCI) and Director of

Special investigation on this issue.

Under the current rules exporters are required to complete

the transfer of export earnings back to banks in Myanmar

within 45 days for exports to Asian countries and 90 days

for other markets.

The CBM is trying to stabilise the exchange rate

which

has fluctuated reaching 3500 MMK per US dollar in the

second and third quarters of 2022 and is now around 2900

MMK. However, the CBM official exchange rate is 2100

MMK per US dollar.

In order to stabilise the exchange rate the CBM seems to

be preparing to strengthen the regulation which will assure

the export earning deposited in the prescribed time.

See:

https://www.cbm.gov.mm/content/7926

6.

INDIA

Economy resilient and well positioned

to face

challenges

In its Monthly Bulletin for March the Reserve Bank of

India (RBI) said the economy is resilient and well

positioned to face a global growth slowdown as the

country has emerged from the pandemic years stronger

than initially thought.

The RBI bulletin says “Broader economic activity has

remained resilient and poised to expand further. Domestic

demand is accelerating with auto sales having rebounded,

real estate sales on the rise in spite of a pick-up in

borrowing costs and the contact-intensive hospitality

services experiencing a bounce-back. Bank credit is

increasing by double digits and the sustained surge in

goods and service tax collections is signalling growing

formalisation of the economy.

Indian equities are outperforming both advanced and

emerging peers. Selling by foreign portfolio investors is

being more than matched by domestic institutional

investors’ buying. Corporate and bank balance sheets have

become fortified through the period of the pandemic”.

As the third largest economy in terms of purchasing power

parities, India accounts for 3.6 % of G20 GDP. In 2023,

India is projected to be among the fastest growing

economies within G20.

See:

https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=21332

and

https://www.drishtiias.com/daily-updates/daily-newsanalysis/state-of-the-economy-report-rbi

Slower income growth to hold down economy

India’s GDP growth is expected to moderate to 6.3% in in

fiscal 2024 due to decline in consumption according to a

World Bank report. The Bank lowered its forecast for

India's economic growth in the current fiscal year.

India’s growth for 2023-24 is forecast to be lower due to

concerns on the global economy and because of rising

borrowing costs and slower income growth leading to a

moderation in consumption.

See:

https://www.hindustantimes.com/india-news/world-bankand-adb-cut-india-s-growth-projections

Rupee weakened as interest rates held steady

The Reserve Bank of India kept the interest rate at 6.50%

after six straight hikes which surprised analysts who were

anticipating a rise. The Indian rupee weakened slightly

after the announcement. The slowing rate increases came

despite inflation remaining above the target maximum of

6%.

See:

https://asia.nikkei.com/Economy/India-pauses-rate-hikes-insurprise-move-amid-stubborn-inflation

Bright outlook for housing

It is reported that India Ratings and Research (Ind-Ra) has

revised the outlook for the residential real estate sector for

fiscal 2024. Ind-Ra reports that house prices rose 8–10%

this fiscal year and may further increase by 5% this year.

See:

https://www.indiaratings.co.in/rating-details/2/61388

A press release from the IFC says low and middle income

borrowers will be able to own homes with improved

access to finance thanks to a new investment aiming to

boost affordable housing finance in India, while

supporting the country's climate goals by focusing on

green affordable housing.

IFC's US$250 million loan to the Housing Development

Finance Corporation (HDFC), India's largest housing

finance company, will support its affordable housing and

emerging green affordable housing portfolio by improving

access to housing for people on low incomes.

At least 25% of the financing has been earmarked for

green affordable housing which is likely to encourage this

market in India. Green housing is largely regarded as a

luxury market in the country but, given its climate

benefits, IFC intends to challenge that perception and help

boost green affordable housing by partnering with HDFC.

See:

https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=26526

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to the General Department of Customs in

March 2023 W&WP exports were valued at US$1.2

billion, up 36% compared to February 2023 but down 23%

compared to March 2022. In particular, WP exports stood

at US$823 million, up 48% compared to February 2023

but down 30% compared to March 2022.

In the first 3 months of 2023 W&WP exports amounted to

US$2.88 billion, down 28% over the same period in 2022.

In particular, WP exports contributed US$1.87 billion,

down 39% over the same period in 2022.

Vietnam's W&WP imports in March 2023 were valued at

US$220 million, up 46% compared to February 2023 but

down 7.6% compared to March 2022. In the first 3 months

of 2023 W&WP imports estimated at US$491 million,

down 28% over the same period in 2022.

Imports of logs and sawnwood in March 2023 were

415,500 cu.m, worth US$147.5 million, up 28% in volume

and 27% in value compared to February 2023. However,

compared to March 2022 imports decreased by 7% in

volume and 12% in value.

In the first 3 months of 2023 imports of logs and

sawnwood are estimated at 973,600 cu.m, worth US$350.9

million, down 21% in volume and 25% in value over the

same period in 2022.

Exports of NTFPs in March 2023 contributed US$70

million, up 24% compared to February 2023, down 22%

compared to March 2022. Overall, in the first quarter of

2023, NTFP exports generated US$172.42 million, down

35% over the same period in 2022.

W&WP exports to the EU markets in March 2023

accounted for US$55.2 million, down 26% compared to

March 2022.

In March 2023 exports of kitchen furniture brought

in

about US$89.4 million, down 29% compared to March

2022. Kitchen furniture exports in the first 3 months of

2023 contributed US$216.7 million, down 30% over the

same period in 2022.

Export of wood chips set to decline

The increasing scarcity of energy in many countries

around the world in the past year is the main factor

promoting the good growth of Vietnam's woodchip

exports. In 2023, with the factors affecting export and

domestic woodchip production, it is not expected that the

price "fever" will last.

Fluctuations in chip markets

According to Nguyen Quoc Tri, Deputy Minister of

Agriculture and Rural Development, in 2022 despite many

changes, the wood and forest product processing industry

still achieved more than US$17 billion in exports. While

the growth rate of 7% in 2022 was the lowest figure in the

past ten years it still shows that Vietnam is one of the

important suppliers for international customers.

In 2022 the export of wood chips reached 15.8 million

tonnes, up 16% compared to 2021. The export value

reached nearly US$2.8 billion, up more than 60% over the

same period last year. The expansion of woodchip export

earnings in recent years is mainly due to the sharp increase

in prices.

The average price in 2022 increased by more than 38%

compared to 2021. The FOB export price increased from

about US$130/tonne at the beginning of the year to a

record level of more than US$200/tonne in the period of

August - October 2022.

However, since October 2022 chip prices showed signs of

cooling down although it remained at a high level. China

and Japan are the two largest woodchip markets for

Vietnam accounting for nearly 95% of total export volume

and turnover.

Impact factors

According to a report by the Research Group of Wood

Associations and Forest Trends the signals for the

woodchip export markets in 2023 are not clear yet but it

can be seen that a number of factors are affecting the

situation.

Specifically, the export price in 2023 is tending to fall

compared to 2022. The export price in the first months of

2023 is down compared to the previous months.

According to assessment by some businesses this decline

may last until the end of the second quarter of 2023.

In addition, information on chip consumption demand in

major markets such as China, Japan and South Korea is

not clear yet so it is difficult to make accurate assessments

of fluctuations in markets.

However, the demand for woodchips in Japan and South

Korea is forecast to continue to increase in 2023 because

chips are used to replace coal as an input material for

power generation.

The domestic supply of special wood chips and pellets

from Korean furniture production facilities in 2023 may

decrease since these facilities have had to reduce their

production scale because the weakening world economy.

The decline in domestic supply of chips may require

Korea to expand imports in the near future.

Another factor affecting trade is Vietnam's policies on

VAT. The issue of VAT refunds for 2022 exports has not

been resolved.

This has caused many enterprises in the sector to consider

their production and export activities in the future. If some

pull out it will affect export earnings from woodchips.

In 2023 it is anticipated there will no longer be a shortage

of input materials for woodchips as in 2022. The export of

veneers to China market has shown signs of recovery.

Residuesf rom the production of veneers and plywood is

used for chip and pellet production.

See:

https://wtocenter.vn/chuyen-de/21596-export-of-woodchips-will-decline

And

https://en.vcci.com.vn/export-of-wood-pellets-under-downwardpressure

Benefits from a carbon credit market -Reducing

emissions and deforestation

As a country with almost 15 million hectares of forest,

Vietnam’s forestry sector can play an important role in not

only reducing greenhouse gas emissions but also

generating revenue from the market for carbon credits.

Revenue from forest carbon credits could prove to be very

profitable for Vietnam. However, this will require finding

ways to protect these areas and to reduce deforestation.

Planting more trees to increase forest acreage could be one

way to offset the impacts of deforestation.

Many Vietnamese agricultural firms from large

corporations to smaller startups have expressed an interest

in a carbon credit market. Sokfarm, for example, is

looking to sell carbon credits from coconut trees. This may

have the added benefit of reducing hardships and

mitigating risks posed by climate change for farmers.

Quang Nam is the first locality in Vietnam licensed by the

government to carry out a pilot project for developing

forest carbon credits.

Quang Nam’s natural forest area is 466 hectares. If one

cubic meter of forest trees is equal to 1.1 tons of carbon,

after the pilot phase this project could help Quang Nam

earn up to US$5 million per year at a selling price of

US$5/ton carbon dioxide equivalent (CO2e).

Despite billions of dollars being spent on carbon

removal

the profit from selling carbon credits is still not high

enough to persuade a critical mass of owners to

discontinue clearing forests.

This is due to increasing demand for wooden furniture in

both domestic and global markets and high prices as a

result. In the first 11 months of 2022, wood and wooden

products exports of Vietnam were worth an

estimated US$14.6 billion, increasing 9% over the same

period in 2021.

Prospects for Vietnam’s carbon market

Creating a carbon credit market in Vietnam will be highly

beneficial for the carbon capture industry and, more

crucially, the environment.

By reducing greenhouse gas emissions, a successful

carbon trading market will aid Vietnam in fulfilling its

COP26 commitments while enabling individuals and

businesses to profit from selling credits overseas.

Despite the absence of a carbon market in Vietnam at

present, the groundwork is being laid and carbon

emissions management is steadily advancing towards this

goal. The move is not only necessary for Vietnam to

achieve its climate commitments but also to ensure

seamless international trade.

See:

https://www.vietnam-briefing.com/news/vietnams-carbonmarket-2023.html/

Vietnam tries “community forestry” model to protect

forests

To date, 280,000 hectares of the total 15.3 million hectares

of forests have been allocated to local people for forestry

production and 513,000 hectares have been allocated for

management and protection. The figures would be

increasing sharply in the future as local authorities have

realized that Vietnam needs to rely on the community to

protect forests.

Local people can best protect local forests

Reports by local authorities all showed that the forests can

be protected best once responsibility is assigned to local

people. However, a problem still exists in the legal status

of the communities that take the responsibility of

protecting forests and in the unreasonable policies.

Dr. Nguyen Nghia Bien, Director of Institute of Forest

Inventory and Planning noted that communities assigned

to protect forests are mostly ethnic minority people, while

the forests allocated to people are mostly the poor forests

in remote areas with bad infrastructure conditions.

Dr. Pham Xuan Phuong from the Ministry of Agriculture

and Rural Development said in many localities people still

have not received the money for the forest development.

Therefore, they are not encouraged enough to continue the

work of developing the forests.

The Institute of Forest Inventory and Planning is

implementing projects on strengthening community

forestry in Vietnam. Bien emphasized the necessity of

mobilising society’s resources for forest protection and

development.

See:

https://vietnamnet.vn/en/vietnam-tries-community-forestrymodel-to-protect-forests-E92236.html

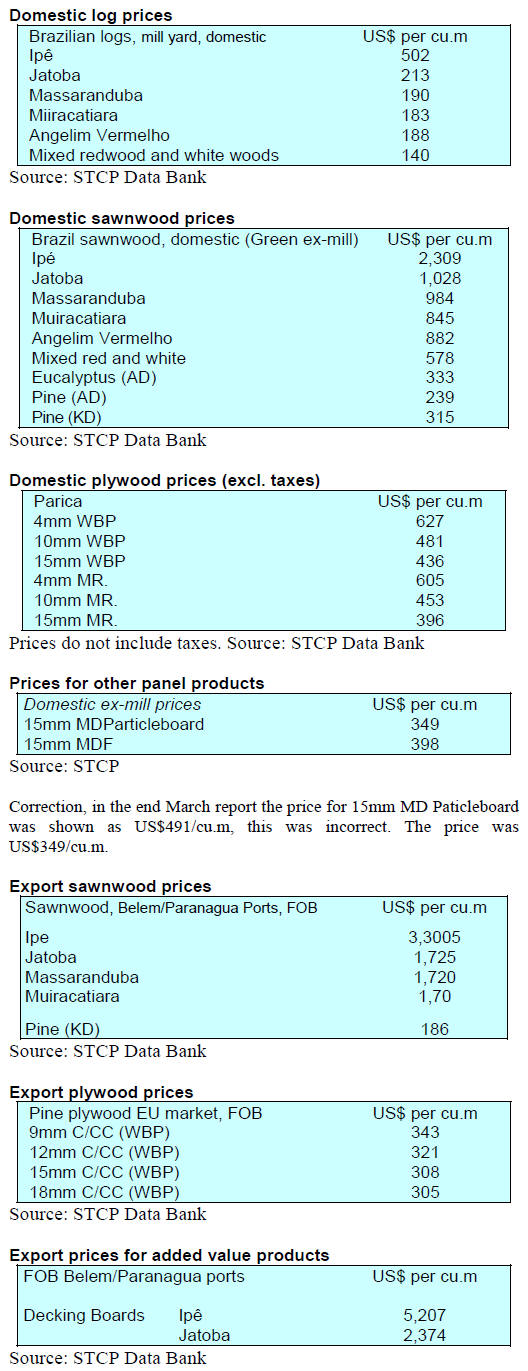

8. BRAZIL

Sustainable Wood - The future of the

market

A National Forum for the Forest Base (FNBF) which

gathers 23 organisations from the Brazilian forest sector

totalling more than 3,500 associated companies, organised

an event "Sustainable Timber - The future of the market”

to discuss the advantages of forest management.

Wood coming from SFM sources effectively contributes to

the preservation and conservation of Brazilian forests,

fauna and flora. A misunderstanding of the differences

between illegal sources, deforestation and SFM sources

results in many professionals in architecture, urbanisation

and engineering avoiding the use of wood products

believing, by doing so, they will not contribute to

deforestation of the Amazon Forest when the opposite is

the case.

One of the reasons for holding the event was to present

science and knowledge to professionals, interior designers

and dealers who sell wood from natural forests.

The Forum heard that Brazil has the capacity to double its

wood production through SFM. Brazil has 489 million ha.

of forests and of this total 334 million ha. are in the

Amazon biome. The country has 39% of the world's

tropical forests but only 10% of tropical wood

consumption is produced in the country and of this around

3% is exported.

For example, the state of Mato Grosso is responsible for

85% of the sustainable timber production in the country

followed by the state of Pará, with 28% and Rondônia,

20% according to IBAMA. Mato Grosso State alone has

the capacity to double the production of timber from

sustainably managed forests and through this combat

illegal harvesting.

Currently, there are 3 million ha. of production forests

with the possibility to rise to 6 million by 2030 according

to CIPEM.

See:

http://www.forumflorestal.org.br/2023/03/09/arquitetosambientalistas-e-madeireiros-participam-de-evento-para-discutirmanejo-florestal/

Rules governing carbon credits for concession

holders

The House of Representatives has approved a Provisional

Measure 1151/22 which changes the regulations in the

Public Forest Management Law (forest concessions)

allowing non-timber production activities and the

commercialisation of carbon credits.

According to the new regulation, the right to

commercialise carbon credits and other similar

instruments for the mitigation of greenhouse gas emissions

is included along with a mention of participation by the

Brazilian Forest Service (SFB).

Production of non-timber forest products and services may

be another aim of forest concessions as long as they are

carried out in the management unit under the terms of the

regulation. Forest restoration with agroforestry systems

combining native and exotic species of economic and

ecological interest may also be carried out in the

management unit.

An addendum to concession contracts will set the

conditions/requirements and allow for the preparation of a

single Sustainable Forest Management Plan (SFMP) with

the managing agency (SFB) being responsible for making

the necessary adjustment.

See:

https://forestnews.com.br/camara-mp-creditosdcarbono-gestao-de-florestas/

Updated information on African Mahogany in Brazil

The Brazilian Association of African Mahogany Producers

(Associação Brasileira de Produtores de Mogno Africano -

ABPMA) founded in 2011 released updated information

regarding the production of African mahogany in Brazil in

its March 2023 journal.

Information provided includes:

There are large plantations of Khaya grandifoliola, K.

senegalensis as well as K. anthotheca and K. ivorensis

plantations.

The expansion of African mahogany cultivation in Brazil

extends over 9 states but 66% of the forest plantations are

concentrated in the state of Minas Gerais.

Brazil has about 66,300 hectares of planted Khaya. More

specifically: K. grandifoliola: 42,000 ha; K. senegalensis:

23,000 ha; K. anthotheca: 800 ha; K. ivorensis: 500 ha.

The data in the journal are from several producers updated

based on the ABPMA database. The Association reported

that the data provided is an estimate.

See:

https://drive.google.com/drive/folders/1sZLedFP_hUDViGoDCdkegVTxWhWWAlA3?usp=share_link

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.ittoggsc.org/static/upload/file/20230414/1681442042214477.pdf

9. PERU

Serfor provided

timber to repair docks

The Rural Agrarian Productive Development (Agro Rural)

programme received almost 30 cubic metres of sawn

Myroxylon balsam donated by the National Forestry and

Wildlife Service (Serfor) to repair docks on the guano

islands, located in the ports Ancon and Callao.

"The docks in question serve as loading points for Guano

that is then marketed to different farmers in the country”.

Guano from the islands is a 100% organic product that

forms part of the State's natural resources and its

extraction, packaging, distribution and commercialisation

is carried out only by Agro Rural.

New standards for wooden sleepers

Peru has 2,000 kilometers of railways and there is a steady

demand for sleepers for the maintenance of existing tracks

as well as for the development of new lines.

The Ministry of Agrarian Development and Irrigation

(MIDAGRI) recently approved "unpreserved wooden

sleepers for narrow gauge railways" and "unpreserved

wooden sleepers for normal gauge railways" through

Resolution No. 0089-MIDAGRI on March 22 of this year.

This sets out how these products should be made so that

the State can acquire them more quickly and effectively

and can also be offered to other markets.

Forest users in Ucayali and Loreto trained on SFM

regulations

In order to promote compliance with forestry regulations

the Agency for the Supervision of Forest Resources and

Wildlife (OSINFOR) interacted with and advised forest

users in cayali and Loreto on the scope of the forest

supervision and the applications of sustainable

management of forest resources.

OSINFOR held two workshops, the first on 24 March in

the Auditorium of the Pucallpa Bar Association in

Ucayali; while the second took place on 31 March in

Yurimaguas, in the province of Alto Amazonas, Loreto;

The Pucallpa workshop was aimed at holders of forestry

concessions for timber purposes in the Ucayali region.

Native communities trained in the use of drones for

forest surveillance

Representatives of the native communities in Sinchi Roca,

Santa Rosa de Aguaytia, Fernando Sthal and Puerto Belén,

from the Ucayali Region have been trained on the use of

drones to detect and prevent forest crimes in their

communal forests.

In coordination with the Ucayali Regional Forestry and

Wildlife Management (GERFFS) OSINFOR trainers

explained, through the Forest Backpack methodology, the

measures that can be taken to prevent various forest

crimes, file complaint and how to present these complaints

to the corresponding authorities.