Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Mar

2023

Japan Yen 134.0

Reports From Japan

Energy subsidies masked high inflation

The Ministry of Internal Affairs has reported inflation

slowed for the first time in more than a year in February as

energy subsidies masked the stronger underlying upward

trend. Consumer prices excluding fresh food rose 3.1%

from a year ago in February, decelerating by more than

1% from the previous month because of lower household

energy costs.

See:

https://www.japantimes.co.jp/news/2023/03/24/business/inflation-down-february/

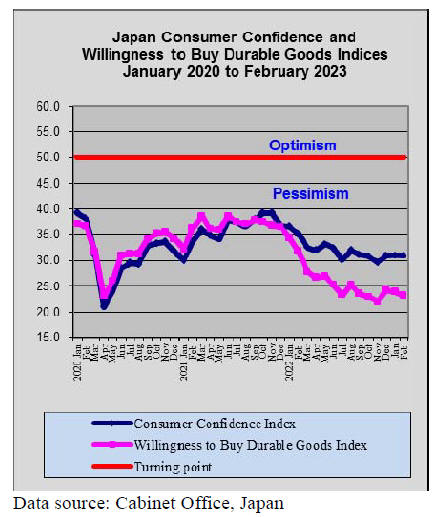

Energy bills impact private consumption

Consumer prices in Japan continue to rise and a Mainichi

poll in late March found that of all the price increases

being experienced people are most worried about the

increased cost of electricity.

The skyrocketing cost of generating electricity due to

Russia's invasion of Ukraine and the weaker yen has raised

energy bills. Japan relies heavily on imported coal, gas and

oil.In related news Japan will spend over 2 trillion yen

from the state budget to provide cash handouts to lowincome

families and cut liquefied petroleum gas bills as

part of a fresh inflation-relief package.

See:

https://mainichi.jp/english/articles/20230321/p2a/00m/0na/010000c

Decision on masks up to individuals

In a major shift toward a post-pandemic normal in Japan

the government said it is leaving the decision on masks up

to individuals but with the caveat that businesses can ask

customers or employees to wear masks to prevent

infections.

Towards a circular economy

The Ministry of Economy, Trade and Industry (METI)

will launch an industry-government-academia organisation

to realise a circular economy where resources are used

efficiently through reuse and recycling.

The new body will create a road map to implement a

government plan to expand the resources recycling market

through public and private investments worth more than 2

trillion yen over the next decade.

The organisation will set targets for the use of recycled

materials and plant-derived biomaterials and for waste

reduction. It will also launch a system in 2025 to visualise

how resources are recycled and circulated throughout

supply chains.

See:

https://www.nippon.com/en/news/yjj2023032700875/

Spring outings expected to have a positive

economic

impact

For the first time since the beginning of the pandemic

when large gatherings were discouraged and at times

blocked by local authorities, cherry blossom viewing,

or ‘hanami’, is expected to have a positive economic

impact of US$4.5 billion according to Katsuhiro

Miyamoto, a professor emeritus at Kansai University.

See:

https://www.japantimes.co.jp/news/2023/03/15/business/economy-business/cherry-blossoms-economic-impact/

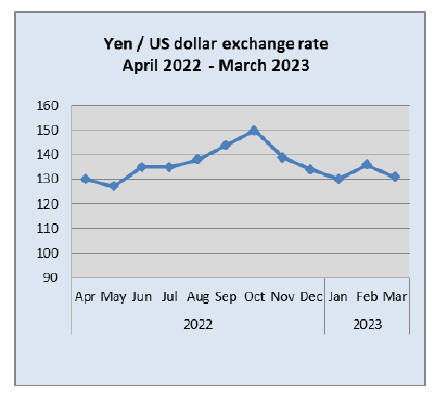

Once again the Yen the safe haven currency

The yen has, once again, become a preferred foreign

exchange safe haven after banking crises in the US and

Switzerland undermined confidence in the US dollar and

Swiss franc.

This marks a major change for the yen exchange rate

which recently needed intervention from the Bank of

Japan to stop a free fall in the yen/dollar exchange rate.

Wooden buildings assisting de-carbonisation

efforts

Demand for timber buildings is rising against the backdrop

of the need for de-carbonisation.

The Ministry of Land and Housing has reported 36

applications were filed in 2022 for the construction of

wooden buildings with four or more floors above ground.

This compares with 2 10 years ago.

Particularly on the increase are wood-hybrid structures

utilising timber, steel frames and reinforced concrete. Data

from the Forestry Agency show at least 22 such buildings

with six or more stories will be completed by fiscal 2028.

An increasing number of contractors are building more

affordable wood-based hybrids than their pure-timber

counterparts with the hope of attracting tenants that value

their offices’ environmental sustainability. Expectations

are growing that the trend may revitalize forestry and other

industries in rural communities.

With wooden buildings possibly assisting in decarbonisation

efforts, the government is extending support

and offering subsidies to cover construction and timber

procurement costs.

See:

https://www.asahi.com/ajw/articles/14856719

Land prices rising

Land prices in Japan rose in 2022, the second year of

increase. Government data suggests increases have been

observed across the country. In January this year the

Ministry of Land surveyed about 26,000 locations

nationwide and found the average valuation was 1.6%

higher than a year earlier.

See:

https://www.mlit.go.jp/en/totikensangyo/totikensangyo_fr4_000002.html

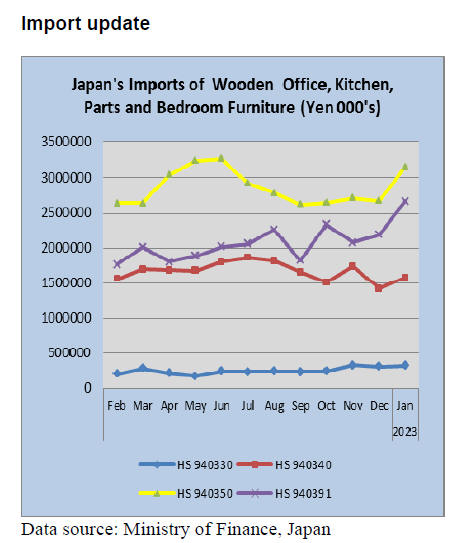

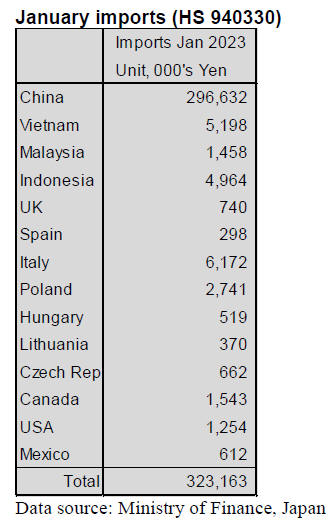

January 2023 wooden office furniture imports

(HS

940330)

Wooden office furniture shipments to Japan from

manufacturers in China accounted for 91% of the value of

all imports of HS 940330 in January. Italy, Vietnam and

Indonesia were the other main sources of imports of

wooden office furniture in January this year.

January shipments from these three sources were down

compared to the value of December 2022 shipments.

Year on year, January 2023 imports were little changed

but compared to the value of December 2022 imports there

was a 7% increase in January 2023.

January 2023 kitchen furniture imports (HS

940340)

Around 75% of the total value of wooden kitchen furniture

(HS940340) imported by Japan in January this year was

from just two sources, the Philippines (42%) and Vietnam

(33%). Other suppliers in the top group were China and

Italy each accounting for around 7% of all wooden kitchen

furniture.

The value of wooden kitchen furniture imports in January

2023 was 6% up on January 2022 and compared to

December 2022 there was a 7% increase.

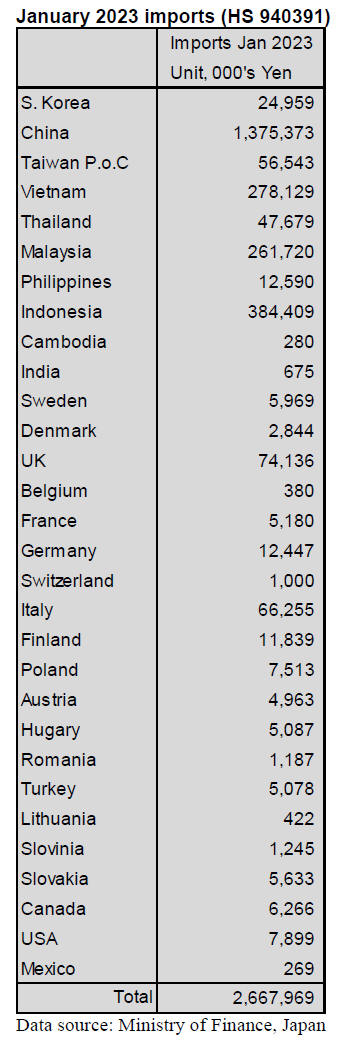

January 2023 wooden furniture parts imports

(HS 940391)

Japanese furniture makers import wooden furniture

components from a variety of sources and in January 2023

there were 30 source countries indentified in the Ministry

of Finance statistics.

The data shows that in January the top 10 sources

accounted for over 90% of all arrivals of wooden furniture

parts and the main suppliers were in Asia with most of the

balance coming from suppliers in Europe. There were

small shipments from Canada and the US in January.

The top shippers in January were China (51%), Indonesia

(14%, Vietnam (10%) and Malaysia (10%). There was a

22% increase in the value of HS940391 in January

compared to a month earlier and this marked the second

monthly increase. Year on year, January 2023 imports

were 14% up on January 2022.

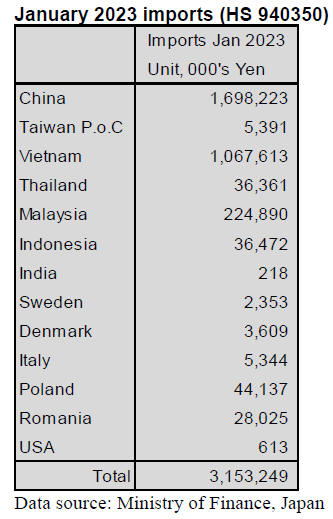

January 2023 wooden bedroom furniture

imports

(HS 940350)

The value of Japan’s imports of wooden bedroom furinitre

in January 2023 surged almost 18% from a month earlier

breaking a period of 3 months when imports remained flat.

The January 2023 imports were also well up (11%) on the

value of January 2022 imports.

Shipments of HS 940350 from China and Vietnam

dominated January imports accounting for around 95% of

the value of imports for the month. Shipments from both

sources were well up on December values and exporters in

China and Vietnam benefitted from the rise in imports at

the expense of other shippers.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

A new plant in Indonesia

Nankai Plywood Co., Ltd. in Kagawa Prefecture

announced its new plant of PT. Nankai Indonesia, which is

a subsidiary of Nankai Plywood, in Jember Regency of

East Java, Indonesia. The plant will start producing

laminated falcata panels by December, 2023.

The new plant is about 120km far away from Lumajang

plant, which was damaged by an eruption from Mount

Semeru in December, 2021. Then, the company decided to

build a new plant in another area to avoid eruptions.

Lumajang plant is now finished repairs and is back in

operations.

The new plant is conveniently located because there are a

lot of falcata in an afforestation area. Lumajang and

Jember plants will increase the production by 1.5 times.

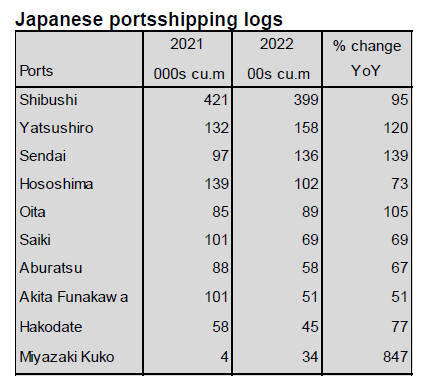

A list of top ports exporting logs

According to The Trade Statistics of Japan, Shibushi port

in Kagoshima Prefecture exported logs to overseas the

most in 2022. It was 399,844 cbms, 5.2% down from

2021. Since there had been an effect of the woodshock and

the economy had been sluggish in China, many ports in

Japan did not exceed the previous year’s result.

In Tohoku area, there were many inquiries about logs for

plywood from domestic manufacturers because it was

difficult for them to import Russian veneers from Russia

due to the war in Ukraine. Therefore, some ports in

Tohoku area could not export logs very much. On the

other hand, Yatsushiro port in Kumamoto Prefecture had a

good result.

Exporting lumber to overseas is not good even though the

freights are low because the inventory of fences and decks

in the U.S. is overstocking.

South Sea logs and lumber

Bullish inquiries from steelmakers and shipbuilders are

good at the end of the fiscal year in March as usual. In

South Asia, there are not many logs due to the rainy

season. Additionally, there was a localized downpour and

the rainy season will end lately in this year.

There are many orders for South Sea log from South

Korea to Papua New Guinea so the prices of South Sea

logs are high. Markets of South Sea and Chinese lumber

are bearish. The Chinese New Year’s holiday ended in

China and plants are trying to get many orders. Also,

Indonesian manufacturers try to get muchorders by

lowering the prices.

The lumber is popular for building facilities in Japan.

Since distributors’ stock in Japan is not enough, Japanese

distributors buy to fill current needs. The prices in South

Asia are declining but the prices in Japan are level off due

to the weak yen. There is a possibility that the prices of

South Sea lumber for decks would decrease due to less

orders from North America.

To expand Japanese wooden buildings in

overseas

Six Japanese companies started up a council to spread

Japanese wooden buildings in foreign countries on 8th,

March. The six companies are, BX Kaneshin Co., Ltd.,

Tsuzuki Corporation, Polus Group, Meiken Lamwood

Corp., Life Design KABAYA, Inc. and Innosho Forestry

Co., Ltd. The council will spread not only Japanese

wooden buildings but also to develop Japanese business in

overseas. Also, the council will provide information about

parts of wooden buildings and use of the parts.

The president of the council is an associate professor of

The University of Tokyo, Kenji Aoki. The council will

teach a method of constructing a low-rise wooden house.

Additionally, the council will hire people in overseas.

The council starts this project in South Asia such as China,

Vietnam or South Korea. The council plans to operate

precutting plants in foreign countries in the future.

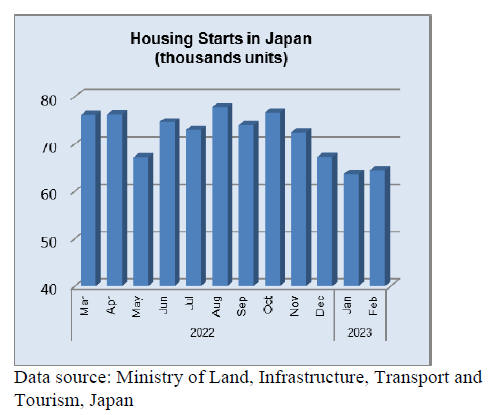

A special feature of floor space

The floor space of per house in 2022 declines 3% from the

previous year. The floor space of per wooden house is 2%

down and 7% down from ten years ago.

Since the cost of land, raw materials, workers and

transportation increased, the price of house became high.

For wooden houses, it is 4.9% down in Tohoku area

and4.4% down in Hokuriku area. The floor space is easily

influenced by a decrease in structural lumber, interior /

exterior finishing materials and other kinds of building

materials. Some housing companies or builders build

luxury and huge houses so it is not for all houses to be

small houses. However, the woodshock and the ironshock

actually influenced many housing companies to build

smaller houses. In the Greater Tokyo Metropolitan area,

there are houses without a garage, a passageway or doors

for storages. In Kyushu area and the suburbs of a city,

demand for a one-story house is popular.

A declining birthrate and aging population, unmarried

people and a tendency to marry later would be the reasons

for a decrease in the floor space.

Some precutting plants have already felt that orders are

getting less and less. Total starts would be about 600,000

units in the future and it is a very hard situation for the

precutting plants to survive in this housing business.

|