4.

INDONESIA

Indonesia ready to challenge EUDR

The Director General of Sustainable Forest Management,

Ministry of Environment and Forestry (KLHK), Agus

Justianto, is reported as saying Indonesia is ready to

challenge the European Union (EU) at the World Trade

Organisation (WTO) regarding the enactment of the

deforestation-free law which, Indonesia considers, will

become a trade barrier for wood products. The media

reports Indonesia considers this regulation unilaterally

violates the agreement on the export of wood products

between Indonesia and the EU which was signed in 2013.

Under the new EU regulation Indonesia's main export

products will be subject to a due diligence process if they

enter the EU market. The commodities are wood, soybean,

palm oil, cocoa, coffee, rubber and beef and their

derivative products such as cowhide, chocolate and

furniture.

Agus commented that it is surprising that wood products

are included as Indonesia and the EU already have a

Voluntary Partnership Agreement (VPA) on forest law

enforcement, governance and trade (FLEGT) which was

signed on 30 September 2013 and became effective on 1

May 2014.

The Indonesian Ambassador to Germany, Arif Havas

Oegroseno, is quoted as saying Indonesia has two options

to resolve this case with a third party, the WTO or the

European Court of Justice.

See:

https://agroindonesia.co.id/terkait-regulasi-bebasdeforestasi-indonesia-siap-gugat-uni-eropa-ke-wto/

Minister approves allowing furniture makers to cut

wages

The Minister of Manpower, Ida Fauziyah, issued a

regulation allowing wooden furniture companies to cut

wages by up to 25%. This provision is contained in the

Regulation of the Minister of Manpower No. 5 of 2023

concerning Adjustment of Working Time and Wages in

Certain Export-Oriented Labour-Intensive Industrial

Companies Affected by Changes in the Global Economy.

This regulation was promulgated and took effect on 8

March 2023. The wooden furniture industry is one of the 5

categories of labour intensive and export-oriented

industries regulated in this provision. Besides furniture,

other industries are the textile and apparel industry, the

footwear industry, the leather and leather goods industry

and the children's toy industry.

Industries that are allowed to cut wages according to this

provision must meet at least 3 criteria as stipulated in

article 3 paragraph 1 of the Minister of Manpower

Regulation. First, the industry has a minimum of 200

workers or labourers. Second, the percentage of labour

costs in production is at least 15%. Third, production

depends on orders from the United States and countries in

the EU.

Emelia Yanti Siahaan, Coordinator for Sectoral Social

Dialogue (DSS) said in a press conference that Regulation

No. 5 of 2023 has legalised labour welfare degradation.

Emelia said that the wage cuts will affect more than 5

million labourers. Emelia added that wage cuts have been

occurring since last year. In 2022 Statistics Indonesia

recorded that around 51% of labourers in the five industry

sectors to be affected have been receiving wages below the

City Minimum Wage.

See:

https://forestinsights.id/2023/03/17/menaker-terbitkanperaturan-perusahaan-furnitur-kayu-boleh-pangkas-upah-buruhsampai-25-persen-download-di-sini/

and

https://en.tempo.co/read/1705101/labourers-protest-overregulated-wage-cuts

Furniture exports almost US$3 billion

Indonesia’s furniture and crafts exports reached US$2.8

billion in 2022 and the government hopes that exports will

increase to US$5 billion in 2024.

To help achieve this the Minister of Industry, Agus

Gumiwang Kartasasmita, highlighted the ministry’s

support policies including ensuring a supply of raw and

auxiliary materials, increasing technological capability and

human resource capacity, tax incentives, design

development and facilitating participation in exhibitions.

He added that the furniture industry should take advantage

of the expanding domestic market which would help

reduce the dependency on imported products which

reached US$496 million in 2022.

The Ministry of Industry has two strategies to improve

profitability in the sector. First, greater emphasis on the

domestic market as the size of this market, especially the

middle class segment, continues to expand. The second is

exports to non-traditional markets for example India and

the Middle East where growth in the property sector is

relatively stable.

In related news, Reni Yanita, the Director General of

Small, Medium and Multi-various Industries of the

Ministry of Industry urged small and medium furniture

and craft industry players continue to follow global market

trends and actively innovate products. According to Reni

Indonesia has an advantage because of the variety wood,

rattan and bamboo raw materials to produce unique and

attractive designs. The Indonesian Furniture and Craft

Association (HIMKI) chairman, Abdul Sobur, revealed

that exports to the EU declined in 2022 so HIMKI

members are now investigating the Middle East markets

such as Qatar, Israel and the United Arab Emirates.

See:

https://www.msn.com/id-id/berita/other/kemenperinmencatat-nilai-ekspor-industri-furnitur-mencapai-us-28-miliar/ar-AA18w6hF

and

https://www.antaranews.com/berita/3438735/kemenperinoptimis-indonesia-trendsetter-furnitur-ramah-lingkungan

Indonesian furniture products attract business at

Vietnam Fair

The Ministry of Trade noted that Indonesian furniture and

home decor products had managed to attract potential

transactions worth over US$850,000 at the Vietnam

International Furniture and Home Accessories Fair (VIFAExpo).

Director General of National Export Development of the

Ministry of Trade, Didi Sumedi, said that Indonesia's

participation in the 2023 VIFA-Expo was an effort to

attract more buyers of Indonesian furniture and home

decor products from many countries.

See:

https://validnews.id/ekonomi/industri-furnitur-indonesiacatatkan-transaksi-rp131-m-di-vietnam

Ministry identifies five new sources of economic

growth

At an international seminar on credit assessment

Indonesian Deputy Minister of Finance, Suahasil Nazara,

outlined five new sources of long-term economic growth

that could support people's welfare.

The first is the down-streaming of natural resources with

high added value. The next is the use of local products

and the third is acceleration of the digital economy. In

addition, the green economy and energy transition as well

as the strengthening of micro, small and medium

enterprises (MSMEs) could also serve as new sources of

economic growth.

See:

https://en.antaranews.com/news/275832/ministry-identifiesfive-new-sources-of-economic-growth

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sectors in Indonesia.

See:

https://www.ittoggsc.org/static/upload/file/20230214/1676340295137619.pdf

5.

MYANMAR

Shipments to EU and USA sharply down

According to exporters, timber shipments to EU and USA

fell sharply during the past six months as importers and

distributors are reluctant to trade Myanmar timber.

Previously timber legality issues were prominent, but now

the political situation is to the forefront.

New Protected Forest Areas

The Ministry of Natural Resources and Environmental

Conservation has designated two areas in Shan State

and Sagaing Region as Protected Public Forest under the

Forest law 2018. In Myanmar the Permanent Forest Estate

(PTE) is constituted of Reserved Forest and Protected

Public Forest (PPF). Reserved Forest is set aside in areas

suitable for commercial timber where the public has no

harvesting right. On the other hand, PPF is mainly

designed for conservation.

Economic growth forecast to rise

The State-Owned Newspaper quoted Myanmar Prime

Minister Major General Min Aung Hlaing as saying that

the country's economic growth increased by 3.4% in fiscal

2022-2023 and officials have predicted that there will be

continued growth. The Prime Minister also declared that

the monetary circulation in the country was brought back

normal in mid-2022.

In related news, the S&P Global Myanmar Manufacturing

PMI Index report released for January 2023 states that not

only the production of Myanmar manufacturing

companies but also the new businesses have reverted to

growth.

See:

https://www.gnlm.com.mm/only-when-the-economicdriving-force-improves-will-it-support-political-and-defencedriving-forces-senior-general/#article-title

and

https://www.pmi.spglobal.com/Public/Home/PressRelease/e110867c2dac415081675ac75c8b9dec

EU imposes sixth round of sanctions

A February 2023 press release from the Council of the EU

called for an end to all hostilitiesin Myanmar adding that

the military authorities must fully respect international

humanitarian law and put an end to the indiscriminate use

of force.

The press release reaffirms the European Union support

for ASEAN’s and the UN´s efforts to help Myanmar to

find a peaceful solution to the crisis and welcomes the UN

Security Council’s adoption of Resolution 2669 on

Myanmar.

The press release says Myanmar should swiftly and

faithfully implement ASEAN’s Five-Point Consensus, as

reiterated at the 40th and 41st ASEAN Summits in

November 2022 and at the EU-ASEAN Commemorative

Summit in December 2022.

The same press release announced further sanctions

against 9 individuals and 7 entities in view of the

continuing escalation of violence, grave human rights

violations and threats to the peace, security and stability in

Myanmar.

See:

https://www.consilium.europa.eu/en/press/pressreleases/2023/02/20/myanmar-burma-eu-imposes-sixth-round-ofsanctions-against-9-individuals-and-7-entities/?utm_source=dsmsauto&utm_medium=email&utm_campaign=Myanmar%2fBurma%3a+EU+imposes+sixth+round+of+sanctions+against+9+individuals+and+7+entities

6.

INDIA

Low oil prices pull down inflation

rate

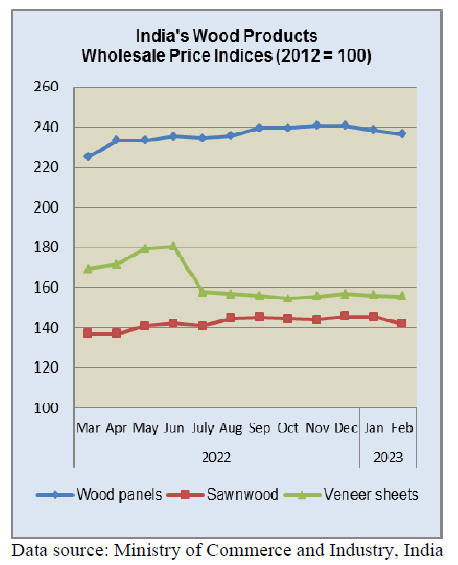

The annual rate of inflation based on the India Wholesale

Price Index (WPI) in February was 3.85% compared to

4.73% recorded in January 2023. The decline in the rate of

inflation in February was primarily because of a fall in

prices of crude petroleum and natural gas.

Out of the 22 NIC two-digit groups for manufactured

products, 13 saw increases in prices while 9 saw a decline.

The increase in prices are mainly contributed by basic

metals; fabricated metal products, machinery and

equipment; other non-metallic mineral products;

pharmaceuticals and medicines. Some wood products were

in the group where the price indices declined.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Plan to cut imports of non-essential goods

The government plans to cut imports of non-essential

goods in order to encourage greater domestic production.

The Commerce Secretary, Sunil Barthwal, said that his

ministry will coordinate with other ministries.

Containing non-essential imports would also help reduce

the trade deficit which has reached US$247 billion

between April 2022 and February 2023 as against US$172

billion in the same period in the last fiscal year. Imports

during the 11-month period of the current fiscal increased

19%.

See::

https://economictimes.indiatimes.com/news/economy/foreigntrade/government-undertaking-an-exercise-to-cut-imports-ofnon-essentialitems/articleshow/98672933.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Mid-income Housing Investment Fund report

The special support from the Affordable and Mid-Income

Housing Ivestment Fund (SWAMIH) has completed

20,577 homes since its inception in 2019 and hopes to see

completion of 81,000 homes over the next 3 years in 90

Tier 1 and 2 cities. SWAMIH has provided approval for

about 130 projects worth over Rs.12,000 crore. The fund

is sponsored by the Ministry of Finance and is managed by

SBICAP Ventures Ltd. a State Bank.

Since the Fund considers first time developers, established

developers with troubled projects, stalled projects or even

projects with litigation issues it is considered as the lender

of last resort for distressed projects.

See:

https://timesofindia.indiatimes.com/india/affordablehousing-fund-aims-to-ready-81ooo-houses-in-3-years/articleshow/98421638.cms?from=mdr

State of Forest report 2021 released

The Minister for Environment, Forest and Climate

Change, Shri Bhupender Yadav, introduced the ‘India

State of Forest Report 2021’ prepared by the Forest

Survey of India (FSI) which has been mandated to assess

the forest and tree resources of the country.

See:

https://pib.gov.in/PressReleasePage.aspx?PRID=1789635

The main findings include:

An increase of 2,261 sq km in the total forest and

tree cover of the country in last two years.

Madhya Pradesh has the largest forest cover in

the country.

The maximum increase in forest cover witnessed

in Andhra Pradesh (647 sq km) followed by

Telangana (632 sq km) and Odisha (537 sq km).

17 states/UT’s have above 33 percent of the

geographical area under forest cover.

The total carbon stock in country’s forest is

estimated to be 7,204 million tonnes, an increase

of 79.4 million.

The total mangrove cover in the country is 4,992

sq km, an increase of 17 sq Km observed.

In related news, according to a recent report, India

has

experienced the highest rise in deforestation in the last 30

years with a surge recorded between 2015 and 2020.

In this period the country was ranked second only after

Brazil, with average deforestation of 668,400 hectares

(ha). The report, released in March this year analyses

deforestation trends in 98 countries over past 30 years.

While India lost 384,000 ha of forests between 1990 and

2000 the figure rose to 668,400 ha between 2015 and

2020.

See:

https://www.downtoearth.org.in/news/wildlifebiodiversity/india-lost-668-400-ha-forests-in-5-years-2ndhighest-globally-report-88337

and

https://www.utilitybidder.co.uk/compare-businessenergy/deforestation-report/

114-year-old teak tree autioned for almost US$50,000

A 114-year-old teak tree planted during the colonial-era

has been auctioned for four million rupees (US$49,000),

in Kerala. The Nedumkayam Forest Depot auctioned the

tree, planted in 1909, after it fell in the Nilambur teak

plantation. Teak trees at the park are harvested only after

they fall naturally.

See:

https://www.thenationalnews.com/world/2023/02/22/indiaskerala-forest-department-auctions-teak-tree-planted-by-thebritish-for-49000/

7.

VIETNAM

Vietnam – Wood and Wood Products (W&WP)

Trade

Highlights

According to the Vietnam General Department of

Customs, W&WP exports in February 2023 were valued at

US$880.2 million, down 2% compared to February 2022.

WP exports contributed US$556.7 million, down 20%

compared to February 2022.

In the first 2 months of 2023, W&WP exports stood at

US$1.7 billion, down 32% over the same period in 2022 in

which WP exports shared US$1.05 billion, year-on-year

down 44%.

The W&WP exports to Japan in February 2023 reached

US$142.3 million, up 50% compared to February 2022. In

the first 2 months of 2023 W&WP exports to the Japanese

market reached US$270.2 million, up 11% over the same

period in 2022.

Vietnam's office furniture exports in February 2023 earned

US$20.3 million, down 0.7% compared to February 2022.

In the first 2 months of 2023 office furniture exports

generated US$39.3 million, down 29% over the same

period in 2022.

W&WP imports in February 2023 amounted to US$150.4

million, up 25% compared to January 2023 but compared

to February 2022 imports decreased by 21%.

In the first 2 months of 2023 W&WP imports were valued

at US$270.5 million, year-on-year down 39%.

Vietnam's imports of tali in February 2023 have been

reported at 45,000 cu.m, worth US$18.2 million, up 15%

in volume and 15% in value compared to the previous

month, but year-on-year imports dropped by 7% in volume

and 4% in value.

In the first 2 months of 2023, tali imports were for 84.200

cu.m worth US$34.0 million, down 14% in volume and

15% in value over the same period in 2022.

The imports of logs and sawnwood from the EU in

January 2023 totalled 36,660 cu.m worth US$10.69

million, down 45% in volume and 49% in value compared

to December 2022 and down 31% in volume and 32% in

value compared to January 2022.

Exports of wooden handicrafts in the first two months of

this year reached US$6.99 million, down 8.7% year on

year.

Exports fell in January and February

Commenting on the decline in exports in early 2023 the

Global Wood Trade Network suggested this was due to a

fall-off in demand. Industry experts argued that, since the

peak of COVID-19 pandemic where consumers spent their

purchasing power on home improvements during

lockdowns, global demand for furniture has decreased

significantly.

A local online newspaper VnEconomy cited the chairman

of the Vietnam Timber and Forest Products Association

(VIFOREST) as saying global inflation dampened demand

in the wood industry in the year-end period in 2022 and

early 2023.

See:

https://panelsfurnitureasia.com/vietnam-wood-and-woodproducts-exports-fell-in-january-and-february-2023/

Vietnam remains fourth largest wooden furniture

supplier to Canada

Despite accounting for only 15% of Canada’s imports

value last year Vietnam remains the fourth largest wooden

furniture supplier to the country according the General

Department of Vietnam Customs.

The Vietnam Timber and Forest Products Association has

assessed that there is a wealth of opportunities ahead for

Vietnamese wood furniture to expand their market share in

Canada in the near future.

Most notably, the enforcement of the Comprehensive and

Progressive Agreement for Trans-Pacific Partnership

(CPTPP) has helped Canadian businesses to gain greater

insights about Vietnamese production capacity.

Moreover, both sides are members of the CPTPP and the

Asia-Pacific Economic Cooperation (APEC), with the two

countries establishing a mechanism of a Joint Economic

Committee to periodically exchange views on economic

and trade co-operation prospects.

Recently, the two countries have put into operation

a large

container ship route running directly from Hai Phong to

Vancouver, thereby reducing the transit time to 17 days

and lowering transportation costs for Vietnamese

exporters.

See:

https://wtocenter.vn/chuyen-de/21497-vietnam-remainsfourth-largest-wood-furniture-supplier-to-canada

Wood sector urged to step up trade promotion

Vietnam’s wood industry is strong at manufacturing but

has yet to master marketing so it’s time for businesses and

associations to hold large-scale trade promotion events to

attract buyers in the long term.

For many years, the industry has posted double-digit

growth rates thanks to the fast-expanding global market

and the attractiveness of its production capacity, especially

products requiring skillful workers to be made.

However, because of that advantage, most businesses in

the sector have focused only on manufacturing while

lacking attention to trade promotion. This has means firms

are a not well aware of market trends leaving them

exposed.

To develop sustainably, businesses and associations

should invest in promoting trade, popularising brands,

staying updated with information and improving

production capacity to meet international buyer demand.

Le Hoang Tai, Deputy Director of the Trade Promotion

Agency at the Ministry of Industry and Trade, said 2022

was full of difficulties for Vietnam’s trading activities.

Though the situation is forecast to improve in 2023, wood

businesses will still face unpredictable challenges due to

global uncertainties, strategic competition among powers,

economic recession and soaring inflation in many

countries.

He recommended businesses and associations work with

ministries, central agencies and localities to organise

world-class fairs and exhibitions in Vietnam to raise the

sector’s standing.

They should also open Vietnamese pavilions at

international and reputable events in key and potential

markets like the US, the EU, Russia, Japan, the Republic

of Korea, China and Canada.

In addition, it is necessary to promote the capacity of

developing products and researching markets to grasp

consumer tastes and importing markets’ standards, thereby

improving the competitiveness of their products and build

national brands for wood and forestry products of

Vietnam, Tai added.

Source:

https://en.vietnamplus.vn/wood-sector-urged-to-step-uptrade-promotion/248127.vnp

Measures for healthy forests

Vietnam has been taking practical steps to manage, protect

and promote the multi-use value of forest eco-systems and

effectively respond to climate change, said Phạm Hồng

Lượng, Chief of Office, General Department of Forestry.

At a forum on the International Day of the Forest Lượng

stressed the importance of raising awareness about the role

of forests in human life to work together in forest

protection and sustainable forest exploitation.

See:

https://vietnamnews.vn/environment/1500764/viet-namcarries-out-measures-for-healthy-forests.html

AFoCO and Vietnam in strengthening climate

resilience

In early March Deputy Minister of Agriculture and Rural

Development, Nguyen Quoc Tri, met Park Chongho,

Executive Director of the Asian Forestry Cooperation

Organization (AFoCO).

As a member of the Asian Forestry Cooperation

Organization, Vietnam is always ready to cooperate for

further development. Nguyen Quoc Tri said that the

Government of Vietnam highly regarded the support of

AFoCO through effective projects, bringing great benefits

to the development of the forestry sector.

At the meeting, both sides shared and exchanged a

thoughts on the World Bank (WB) REDD+ Project in six

North Central provinces (Thanh Hoa, Nghe An, Ha Tinh,

Quang Binh, Quang Tri, and Thua Thien-Hue).

AFoCO has learned of the carbon credit trading project

and wishes to carry out some feasibility studies. This may

serve as the basis for AFoCO to continue cooperation

activities in the six North Central provinces in the near

future.

Regarding the REDD+ Project, Deputy Minister Nguyen

Quoc Tri said that after the Vietnamese Government

signed Decree No. 107, the Vietnamese side had agreed on

the contents of the benefit-sharing plan with WB and

started implementing the carbon credit program in the six

North Central provinces.

Currently, Vietnam’s forestry sector is facing a number of

challenges in terms of gaining quick access to practical

situations in localities and applying digital technology to

support some of the sector’s activities. Deputy Minister

Nguyen Quoc Tri called for AFoCO's assistance in the

field of digital transformation in the forestry sector and

said he would invite relevant units and experts to provide

information and discuss further with AFoCO about future

climate change activities.

See:

https://vietnamagriculture.nongnghiep.vn/afocoaccompanies-vietnams-forestry-in-strengthening-climateresilience-d345593.html

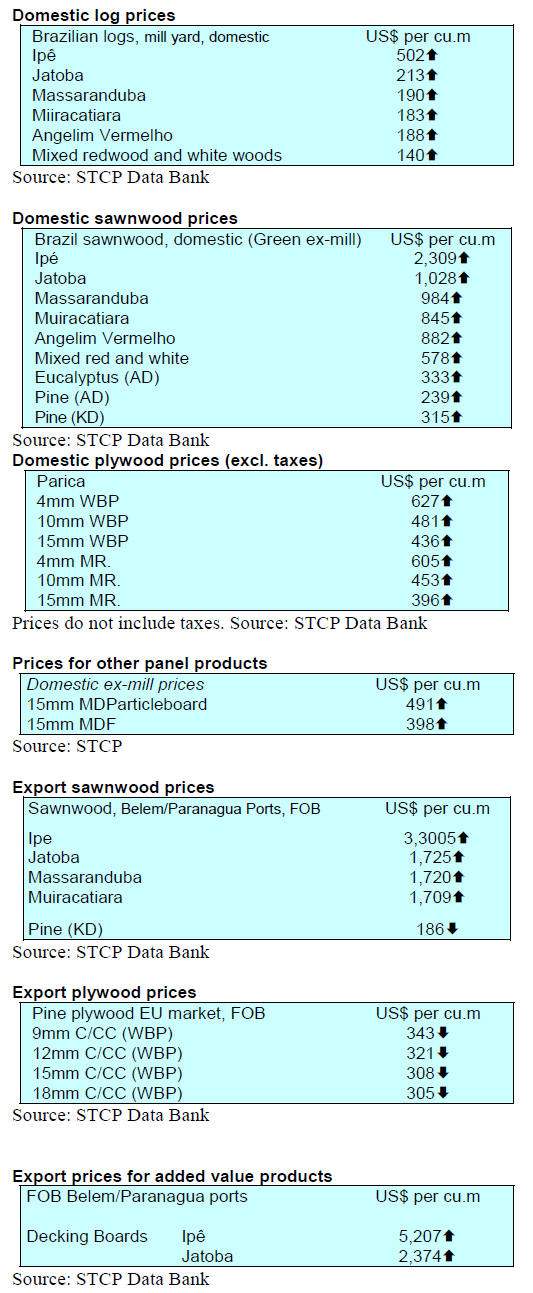

8. BRAZIL

Accounting for carbon in wood products

A Brazilian Agricultural Research Corporation

(EMBRAPA) study measured data on carbon

accumulation in wood and forest products such as

sawnwood, plywood, paper and cardboard. The first

survey was undertaken in 2020 using 2016 as a reference

year when an estimated 50 million tonnes of CO2

equivalent or 3.5% of total greenhouse gas (GHG)

emissions were captured.

That data were included in the National GHG Inventory

submitted to the United Nations Framework Convention

on Climate Change (UNFCCC).

The report, published every five years, presents an

overview of the implementation of the Climate

Convention in the country and has as one of its main

components the review and update of the National

Inventory of Anthropogenic Greenhouse Gas Emissions

and Removals.

The production and use of wood products is a way to

increase the removal of CO2 from the atmosphere

contributing to reduce the effects of climate change and

representing about 13% of gross emissions of the land use

sector.

According to the methodological guide of the

Intergovernmental Panel on Climate Change (IPCC-2006),

the estimates of carbon in forest products can be made by

three different approaches (stock change, atmospheric

flow and production).

It is up to each country to decide which is the most

suitable to prepare its inventory of emissions. This is

because each is influenced by the production,

consumption, export and import characteristics of forest

products in each country.

The approach used by Brazil for estimating the

contribution of wood forest products is that of atmospheric

flow, which favors the large timber producing and

exporting countries.

See:

https://cipem.org.br/noticias/brasil-passa-a-contabilizarcarbono-de-produtos-florestais-madeireiros

Tax incentive for the timber sector

The Timber Industry Union of Northern Mato Grosso

State (SINDUSMAD) has conducted a lecture "PRODEIC

and Tax Planning" which deals with the tax benefit in the

program for Industrial and Commercial Development of

the State of Mato Grosso (PRODEIC).

The lecture had 80 participants, including representatives

of the Union of Accounting firms (SESCON-MT) that

presented the requirements, the advantages and obligations

of companies that qualify for the programme. The timber

sector can benefit as PRODEIC is directed to the

industrial, agro-business and mineral sectors to develop

the economic activities and provide tax benefits.

After registration with the PRODEIC scheme at the Mato

Grosso Sate Secretariat of Finance, support is

forthcoming. In the case of the timber sector there is tax

reduction of 65% in sales of sawnwood, 75% in sales of

plywood and 85% in interstate operations.

Today with high inflation and increasing production

volume companies are exceeding the ceiling of the

simplified tax system, known as “Simples Nacional”

(eligible companies pay a single tax based on their

monthly gross income) and migrating to the presumed tax

method (taxation based on the pre-fixed margin) and

adhering to tax benefits.

See:

https://www.sindusmad.com.br/Noticias/Palestra-apresentaincentivo-fiscal-para-o-setor-madeireiro/

Export update

In February 2023 the value of Brazilian exports of woodbased

products (except pulp and paper) decreased 36% in

value compared to February 2022, from US$413.6 million

to US$264.2 million.

Pine sawnwood exports decreased 26% in value between

February 2022 (US$68.6 million) and February 2023

(US$50.9 million). In volume, exports dropped 15% over

the same period, from 252,800 cu.m to 215,200 cu.m.

Tropical sawnwood exports fell 22% in volume, from

30,800 cu.m in February 2022 to 24,000 cu.m in February

2023. In value, exports increased 2.4% from US$12.4

million to US$12.7 million over the same period.

Pine plywood exports faced a staggering 44% decrease in

value in February 2023 compared to February 2022, from

US$91.0 million to US$51.4 million.

In volume terms, exports decreased 28% over the same

period, from 228,700 cu.m to 165,700 cu.m.

As for tropical plywood, exports declined in volume by

22.0% and in value by 28%, from 5,900 cu.m and US$2.9

million in February 2022 to 4,600 cu.m and US$2.1

million in February 2023.

As for wooden furniture, the exported value fell from

US$60.1 million in February 2022 to US$ 38.6 million in

February 2023, a 36% fall.

Furniture exports disappoint

In January 2023 Brazil's furniture exports were US$45

million, representing a 25% drop compared to December

2022. December export earnings were also down on the

prvious month. In the monthly comparison with the

previous year, the decline was 27% where, in January

2022, the amount of furniture export was US$62 million.

According to Market Intelligence Institute (IEMI) the

reasons for the decline in exports are internal factors

related to the economics, politics, the business

environment for the industry and national trade.

In addition, there are external factors such as exchange

rate fluctuations, tariff barriers, diplomacy, international

competition, logistics, the global supply chain situation

and the international demand and the economic situation

in the main importing markets.

The United States was the main destination for Brazilian

furniture exports at US$14.4 million, representing almost

32% of total exports but still below the last two years

where in 2022 the amount was US$21 million and US$19

million.

Uruguay was the second destination and in January 2023

Brazil exported US$4.3 million, representing 9.5% of total

furniture exports.

According to IEMI, ABIMÓVEL (Brazilian Association

of Furniture Industries) and APEX-Brazil (Brazilian Trade

and Investment Promotion Agency) wooden furniture

represented 81% of the total exported by the country in

January 2023; others were upholstered furniture (11.5%),

mattresses (3.6%) and metal furniture (3.5%).

See:

http://abimovel.com/exportacoes-de-moveis-e-colchoesabrem-2023-em-queda/

Timber exports from Acre State

Timber exports represented 39.5% of Acre state exports in

February 2023. According to the Secretary of Foreign

Trade under the Ministry of Development, Industry and

Foreign Trade the state's trade balance recorded a surplus

of more than US$1.4 million in February.

Between January and February 2023 the accumulated

balance was US$3.4 million representing a retraction of

60% in relation to the previous year.

Up to February 2023 timber was the most exported

product representing 37% of the total exported value. The

main export destinations were China (32%), Peru (31%),

India (25%) and Bolivia (25%).

See:

https://forestnews.com.br/exportacoes-madeira-balancacomercial-acre/

Plantation mahogany furniture showcased at ABIMAD

Fair

The March Journal from ABPMA (Associacao Brasileira

dos Produtores de Mogno Africano) reports a visits by

Association executives to the recently concluded

ABIMAD fair (Brazilian Furniture and High Decoration

Accessories Fair).

The objective of the visit was to assess the adoption of

plantation grown mahogany in the manufacture of wood

products. It was found tha,t while manufacturers in Bento

Gonçalves and São Bento do Sul tend to use tauarí as raw

material, one manufacturer showcased items made with

domestically grown mahogany.

The ABPMA Journal can be viewed at:

ttps://drive.google.com/drive/folders/1sZLedFP_hUDViGoDCdkegVTxWhWWAlA3

9. PERU

Digital information system for crime

prevention in the

forestry sector

As part of its contribution to information management in

the forestry and wildlife sector the Agency for the

Supervision of Forest Resources and Wildlife (OSINFOR)

has improved its region information system (SIADO) to

allow for the capture of information from regional

authorities.

See:

https://www.gob.pe/institucion/osinfor/noticias/730943-osinfor-optimiza-el-sistema-de-informacion-digital-para-laprevencion-de-delitos-en-el-sector-forestal-y-de-fauna-silvestre

These improvements were possible through technical

support from USAID's Prevenir project. One of the most

significant advances implemented is the improvement of

document transfer in the SIADO Region module which

allows the Regional Forestry and Wildlife Authorities

(ARFFS) to preserve digital information that can be

accessed from anywhere.The use of the SIADO Region

has allowed the Regional Governments of Ucayali, Loreto

and Madre de Dios to rapidly make available management

data.

OSINFOR and the National Forest and Wildlife Service

(SERFOR) have implemented a process so that incoming

information is also available within the framework of the

National Forest and Wildlife Information System.

Algorithm to detect logging in Peru

With the aim of improving the supervision of resources in

the Amazon the OSINFOR announced an algorithm that it

has been using to detect felling in the Peruvian Amazon.

The algorithm was developed and perfected jointly with

the World Resources Institute (WRI) and expert

researchers from the University of Sheffield in order to

timely identify cases of legal and illegal logging and thus

contribute to the traceability of the value chain of the

wood from the source.

The algorithm can identify more subtle disturbances, not

just in areas of massive deforestation.

See:

https://www.gob.pe/institucion/osinfor/noticias/726199-conel-apoyo-de-la-academia-internacional-osinfor-aplica-algoritmopara-deteccion-de-tala-selectiva-en-el-peru

OSINFOR and SERFOR renew commitment to

strengthen the forestry and wildlife sector

OSINFOR and SERFOR have signed addendums to the

Framework Agreement and the Specific Inter-institutional

Cooperation Agreement to reinforce their strategic alliance

to contribute to the strengthening of the forestry and

wildlife sector in Peru.

The renewal of these agreements extends to 2025 the

commitments by both parties in terms of providing

technical and legal support to strengthen their functions,

identifying opportunities for improvement in the forest

regulatory framework, designing strategies for training,

capacity building and exchange of experiences, promotion

of information technologies and information exchange.