|

Report from

the UK

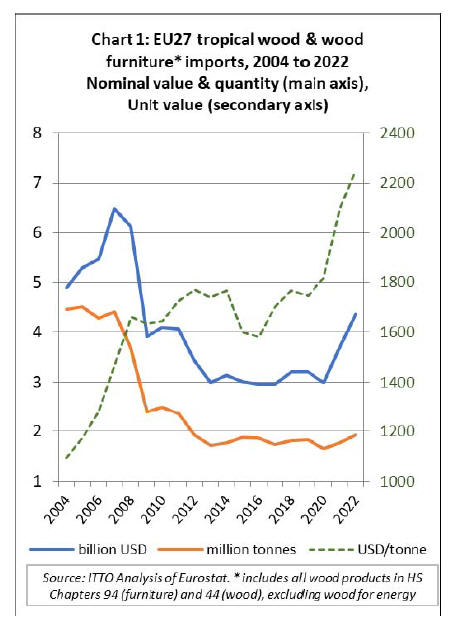

Price increases drive up EU27 tropical wood imports

In 2022 the EU27 imported 1.94 million tonnes of tropical

wood and wooden furniture products with a total value of

US$4.37 bil. respectively 10% and 18% more than the

previous year. Compared to the pre-pandemic level of

imports in 2019, imports last year increased 36% in value

terms but only 6% in quantity terms.

Chart 1 shows EU27 trade trends for the period 2004 to

2022 puts last year's trade figures into long term

perspective. The only other increase in tropical wood

import value comparable to the 2021-2022 period occurred

in 2006-2007 when abundant liquidity and a real estate

boom created a bubble economy immediately preceding

the financial crash of 2008-2009.

However, unlike in 2006-2007, the actual quantity of

EU27 imports of tropical wood and wooden furniture

products last year was only marginally above the long

term average which has remained broadly stable at around

1.8 million tonnes for the last decade.

The increase in value of EU27 imports of tropical wood

and wooden furniture products in the last two years was

driven by the sharp increase in prices. The average price

per tonne of all EU27 tropical wood and wooden furniture

imports increased progressively from US$2,800 in 2020 to

US$2,100 in 2021 and US$2,250 in 2022.

This occurred initially as severe supply shortages and a big

rise in freight rates coincided with the short-term surge in

demand due to higher refurbishment activity during

COVID lockdowns.

The surge in demand for tropical products in the EU was

further boosted in 2022 by COVID-recovery stimulus

measures and the war in Ukraine which put pressure on

supplies of alternative temperate wood products.

EU27 tropical wood imports slow as economic outlook

deteriorates

The rise in freight rates and supply shortages only began

to ease in the second half of 2022 as economic conditions

deteriorated and demand for wood products slowed

dramatically.

The war in Ukraine contributed to huge increases in

energy prices in the EU in the second half of 2022, while

business and consumer confidence was hit by expectations

of higher interest rates to control inflation.

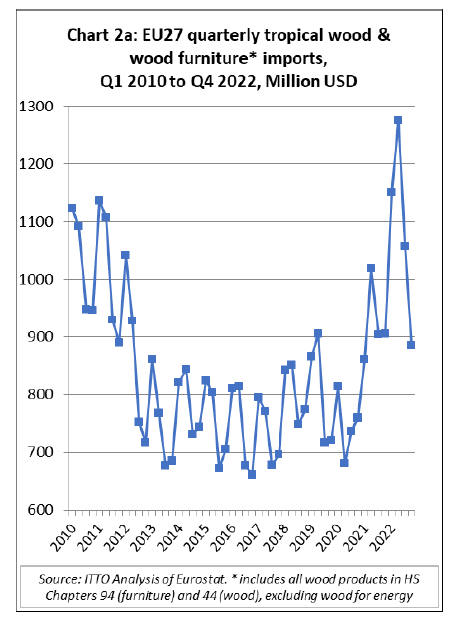

In value terms, EU27 tropical wood and wooden furniture

imports of US$1.94 bil. in the second half of 2022 were

20% less than US$2.42 bil. in the first half of the year.

However, import value was still high in the second half of

2022 relative to figures typical in the previous ten years

(Chart 2a).

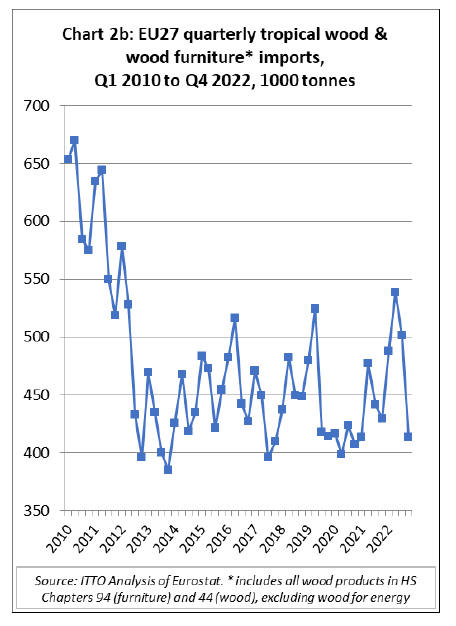

In quantity terms, total EU27 imports of tropical wood and

wooden furniture of 414,000 tonnes in the fourth quarter

last year were 18% down compared to the previous quarter

and well below the quarterly average of around 450,000

tonnes in the last decade (Chart 2b).

EU economy faces challenges but should narrowly

avoid recession

The challenges now facing the EU27 economy are

identified in EU’s winter 2023 Economic Forecast

published on 13 February which notes that “Core inflation

increased further in January. Consumers and businesses

continue to face high energy costs and … inflationary

pressures are still broadening. Monetary tightening is

therefore set to continue, exerting a drag on investment.

Weakness in consumption is set to persist in the near term

as inflation keeps outpacing nominal wage growth.

Finally, the external environment is expected to continue

providing little support to the EU economy”.

Nevertheless, the 2023 Winter Forecast identifies some

positive developments in the EU economy since the

previous 2022 Autumn Forecast. The new Forecast notes

that “the European gas benchmark price has fallen below

its pre-war level, helped by a sharp fall in gas consumption

and continued diversification of supply sources”.

Furthermore, “the resilience of households and

corporations has been impressive”.

For these reasons, the slowdown in the EU economy in the

second half of 2022 turned out milder than previously

estimated by the EU despite the energy shock and ensuing

record high inflation. In the fourth quarter, the EU

economy managed a broad stagnation, instead of the 0.5%

contraction expected in the Autumn Forecast.

The peak rate of inflation increase may already have

passed and economic sentiment is slowly improving. This

suggests, according to the EU Winter Forecast, that

“economic activity will avoid a contraction also in the first

quarter of 2023” and “the EU economy is thus set to

narrowly escape the recession that was pencilled in back in

autumn”.

Rise in EU27 import value of tropical furniture masks

fall in quantity

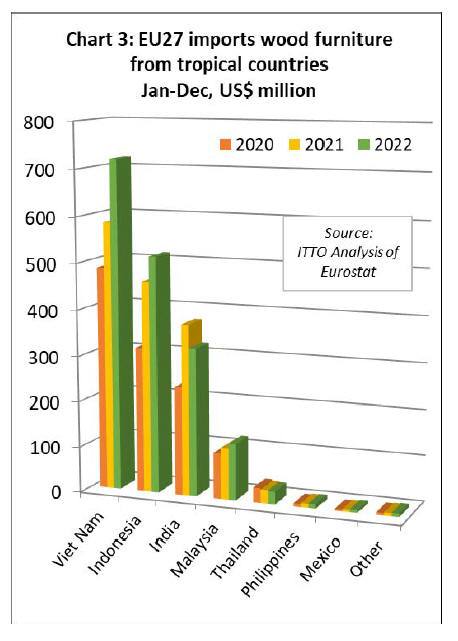

In 2022, EU27 import value of wooden furniture from

tropical countries was US$1.73B, 10% higher than the

previous year. This increase in dollar value was entirely

due to higher freight rates and prices and the weakness of

the euro last year. In tonnage terms, imports declined 8%

to 349,400 tonnes during the year.

In 2022 there were large increases in EU27 wooden

furniture import value from Vietnam (+23% to US$720

mil.), Indonesia (+12% to US$515M), Malaysia (+9% to

US$123 mil.) and the Philippines (+10% to US$10 mil.).

Import value fell from India (-13% to US$324 mil) and

Thailand (-7% to US$28 mil.). EU27 wooden furniture

imports from all other tropical countries were negligible

last year (Chart 3).

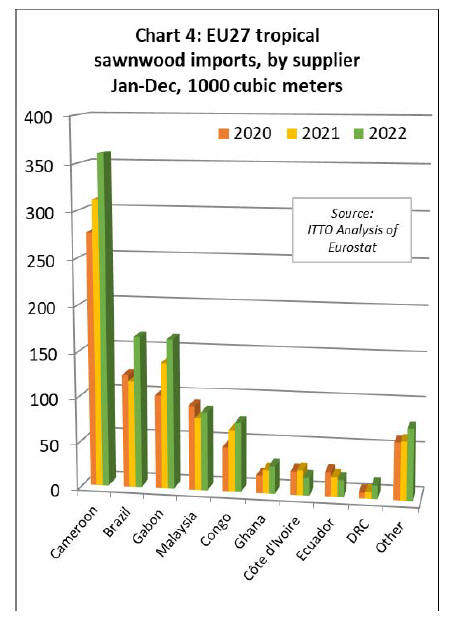

EU27 imports of tropical sawnwood up 18% in 2022

After two slow years during the global pandemic, EU27

imports of tropical sawnwood recovered ground last year.

Imports of 1,014,000 cubic metres last year were 18%

higher than in 2021 and 30% more than in 2020. EU27

import value of tropical sawnwood increased 22% to

US$904 mil. in 2022.

Sawnwood imports increased last year from all the largest

tropical suppliers to the EU27 including Cameroon (+16%

to 360,700 cubic metres), Brazil (+42% to 166,200 cubic

metres), Gabon (+19% to 164,500 cubic metres), Malaysia

(+8% to 85,800 cubic metres), Congo (+12% to 75,800

cubic metres) and Ghana (+18% to 30,100 cubic metres).

Of smaller tropical sawnwood supply countries, there were

large percentage increases in EU27 imports from DRC

(+114% to 15,000 cubic metres), Suriname (+66% to

10,800 cubic metres), Indonesia (+39% to 10,600 cubic

metres), CAR (+150% to 6,800 cubic metres), and Angola

(+8% to 6,700 cubic metres). In contrast imports from

Côte d'Ivoire fell 29% to 19,400 cubic metres and from

Ecuador were down 14% to 18,700 cubic metres. (Chart

4).

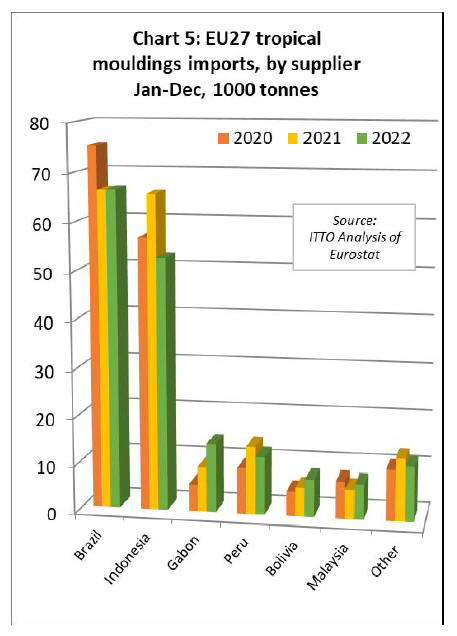

Unlike sawnwood, EU27 imports of tropical

mouldings/decking were slow last year. Imports of

172,900 tonnes in 2022 were 5% less than the previous

year. The trend in value terms was more positive, rising

21% to US$396 mil. last year indicating a sharp rise in

import prices.

Supply shortages and concerns about future demand

contributed to a fall in the quantity of mouldings imports

from Indonesia, which declined 20% to 52,600 tonnes last

year.

The fall in imports from Indonesia was partially offset by

a 54% increase in imports from Gabon to 14,600 tonnes.

Imports from Brazil, the largest supplier in recent years,

were stable at 66,400 tonnes last year.

Of smaller suppliers, there were increases in imports from

Bolivia (+30% to 8,000 tonnes) and Malaysia (+19% to

7,400 tonnes). Imports from Peru declined by 14% to

12,300 tonnes in 2022 after strongly rising the previous

year (Chart 5).

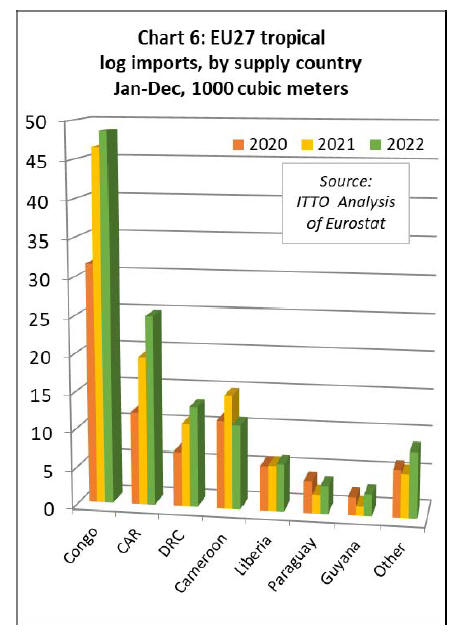

The EU27 imported 119,400 cubic metres of tropical logs

with value of US$65 mil. in 2022, respectively 11% and

10% more than the previous year. EU27 log imports

increased from all three of the largest African supply

countries last year; Congo (+4% to 48,600 cubic metres),

CAR (+28% to 25,000 cubic metres), and DRC (+21% to

13,200 cubic metres). Imports from Liberia also increased

4% to 6,300 cubic metres last year.

However, log imports were down 26% to 11,000 cubic

metres from Cameroon. Log imports increased sharply last

year from negligible levels the previous year from two

South American countries, Paraguay (+50% to 3,700 cubic

metres) and Guyana (+148% to 2,800 cubic metres).

(Chart 6).

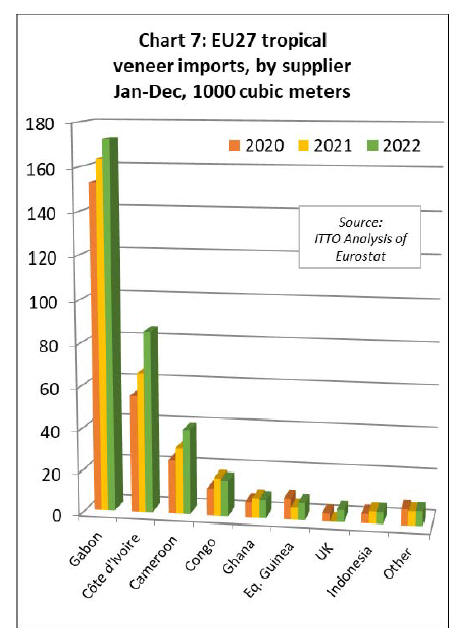

Large gains tropical hardwood veneer from Africa

The EU27 imported 350,000 cubic metres of tropical

veneer with value of US$234 mil. in 2022, respectively

14% and 13% more than the previous year. Imports of

tropical veneer from Gabon, by far the largest supplier to

the EU27, increased 5% to 172,400 cubic metres in 2022.

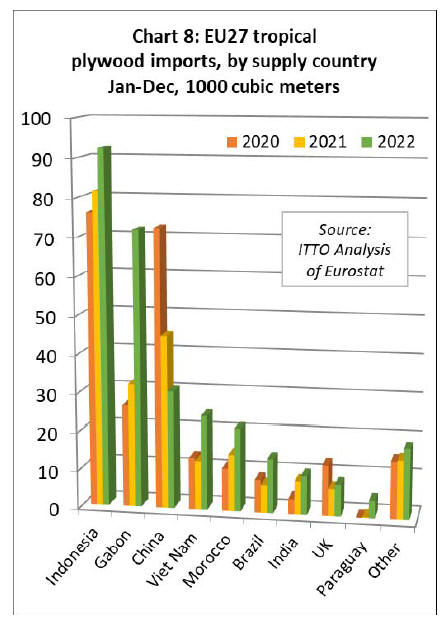

EU27 tropical plywood imports of 296,800 cubic metres

with value of US$254 mil. in 2022 were respectively 32%

and 52% more than the previous year.

Demand for tropical plywood was boosted in the EU last

year due to sanctions on trade with Russia leading to

shortfalls in supply of birch plywood which in certain

applications is a direct competitor to tropical products.

EU27 imports of tropical plywood from Indonesia, the

largest supplier, increased 13% to 92,500 cubic metres last

year. However, the biggest percentage increase was in

imports from Gabon which increased 124% to 72,000

cubic metres.

Imports of tropical plywood also increased sharply from

Vietnam (+92% to 24,500 cubic metres), Morocco (+47%

to 21,700 cubic metres), Brazil (+94% to 14,100 cubic

metres), India (+18% to 10,200 cubic metres), and the UK

(+17% to 8,300 cubic metres).

Tropical plywood imports from Paraguay increased from

negligible levels in 2021 to 4,500 cubic metres last year.

These gains offset a 32% decline in imports of tropical

hardwood faced plywood from China to 31,000 cubic

metres (Chart 8).

Rise in imports of tropical flooring from Malaysia

continues

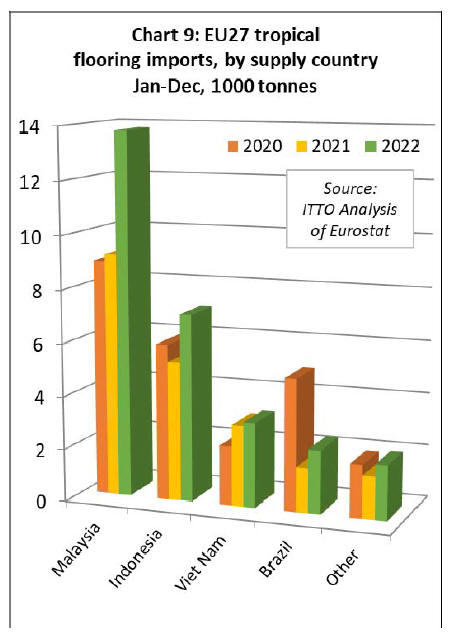

The EU27 imported 28,600 tonnes of tropical wood

flooring with value of US$89 mil. in 2022, respectively

37% and 45% more than in the previous year. The rise in

EU27 wood flooring imports from Malaysia, that began in

2020, continued last year.

Imports of 13,800 tonnes from Malaysia in 2022 were

50% more than in 2021. There were also large gains, from

a smaller base, from Indonesia (+34% to 7,100 tonnes) and

Brazil (+42% to 2,400 tonnes). Flooring imports from

Vietnam of 3,200 tonnes in 2022 were just 4% more than

in the previous year (Chart 9).

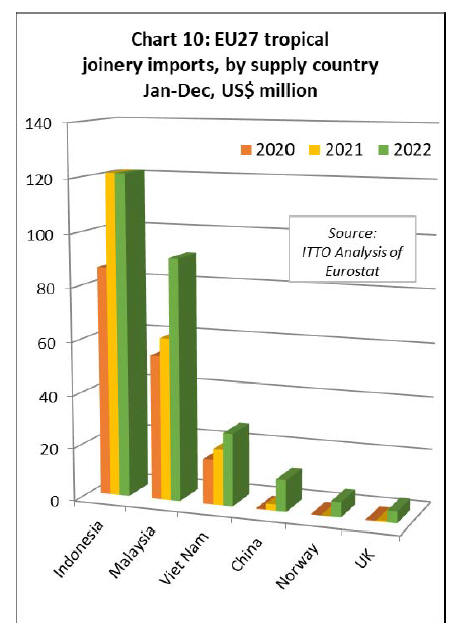

The dollar value of EU27 imports of other joinery

products from tropical countries, which mainly comprise

laminated window scantlings, kitchen tops and wood

doors, increased 27% to US$286 mil. in 2022.

Unlike for furniture, the rise in import value for joinery

last year was not driven entirely by rising prices but was

also indicative of an increase in import quantity. In

quantity terms, the EU27 imported 106,600 tonnes of

tropical joinery products in 2022, 20% more than in the

previous year.

Import value from Indonesia, the largest tropical supplier

of this commodity group to the EU, was stable at US$121

mil. million in 2022. However import value increased by

49% to US$91 mil. from Malaysia, and by 30% to US$27

mil. from Vietnam.

The apparent large increase in imports of this commodity

group last year from China, Norway, and the UK, from

negligible levels to US$12 mil., US$6 mil., and US$4 mil.

respectively is due to a change in product codes from the

start of 2022 allowing more joinery products manufactured

using tropical hardwood in non-tropical countries to be

separately identified (Chart 10).

|