US Dollar Exchange Rates of

10th

Mar

2023

China Yuan 6.91

Report from China

Plywood production capacity in 2022

According to the statistics from the Academy of Industry

Development and Planning under the National Forestry

and Grassland Administration and the China Forestry

Products Industry Association (CFPIA), both the number

of enterprises and production capacity of China’s plywood

industry declined slightly in 2022.

There were more than 10,800 plywood manufacturing

enterprises (down 14% year on year) at the end of 2022

with a production capacity of 208 million cubic metres per

year, down 6.3% over 2021.

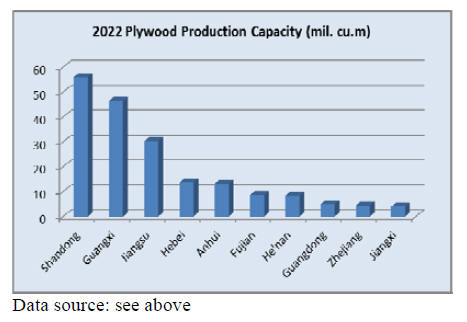

Shandong Province was the largest in terms of plywood

production capacity and enterprise numbers in 2022. There

were 3,550 mills with a capacity of 56 million cubic

metres.

The production capacity for polyurethane adhesives,

beanbased

protein adhesives, lignin adhesives, starch-based

adhesives, thermoplastic resin adhesive film and other

formaldehyde-free plywood products increased.

The first continuous flat pressed formaldehyde-free

plywood production line was operational in June 2022

marking a new stage of continuous plywood production in

China.

Five plywood manufacturers in China had horizontal

multilayer presses with automatic loading and unloading

by the end of 2022.

By the end of 2022, there were more than 350 plywood

manufacturers in China with an annual production

capacity of more than 100,000 cubic metres including

nearly 150 large manufacturers and enterprise groups with

a combined production capacity of some 27 million cubic

metres per year and accounting for 13% of the total

production capacity.

Seven of these mills have an annual production capacity of

more than 500,000 cubic metres.

At the beginning of 2023 around 2,000 plywood

production plants were under construction nationwide with

a total production capacity of about 26 million cubic

metres per year. 25 provinces and autonomous regions had

plywood production enterprises under construction except

Beijing, Shanghai, Tianjin, Chongqing, Qinghai Province

and Tibet Autonomous Region. It is expected that the total

production capacity of plywood in China will be close to

210 million cubic metres per year by the end of 2023.

Decline in solid composite floor exports

China’s plywood exports (HS code 4412 + solid

composite floors) in 2022 totalled 10.68 million cubic

metres valued at US$5.63 billion, down 14% in volume

and 4% in value year on year.

The markets for China’s solid wood composite floor

exports are numerous. In 2022 exports went to around 200

countries.

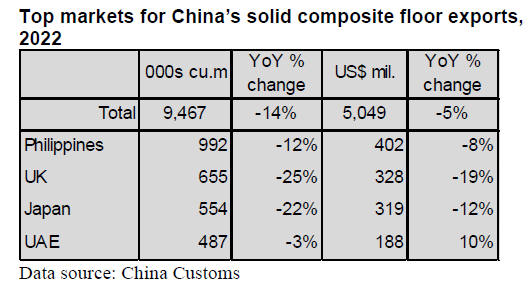

The Philippines, UK, Japan and UAE were the top markets

for China’s solid composite floor exports in 2022. The

proportion of China’s solid composite floor exports to

these top countries was just 28% of all shipments. The

volume of China’s solid composite floor exports to most

of these top countries fell at different rates in 2022.

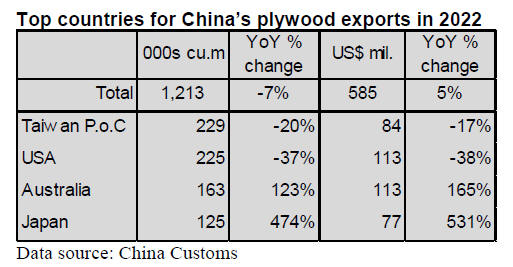

Surge in plywood exports to Australia and Japan

China’s plywood exports (HS code 4412 except solid

composite floors) to Australia and Japan in 2022 surged

more than 120% and 470% to 163,000 cubic metres and

125,000 cubic metres, valued at US$113 million and

US$77 million.

China’s plywood exports (HS code 4412 except solid

composite floors) to Taiwan P.o.C and the US in 2022 fell

20% and 37% to 229,000 cubic metres and 225,000 cubic

metres valued at US$84 million and US$113 million,

down 17% and 38% year on year respectively.

The decline in the top two destination resulted in the total

volume of China’s plywood exports (HS code 4412 except

solid composite floors) to fall 7% to 1.213 million cubic

metres year on year in 2022.

The proportion of the top 4 countries for China’s plywood

exports accounted for more than 60% of the national total.

Soaring plywood imports from Russia

According to the data from China Customs plywood

imports (HS code 4412 + solid composite floors) totalled

196,251 cubic metres valued at US$188 million, up 22%

in volume and 23% in value year on year in 2022.

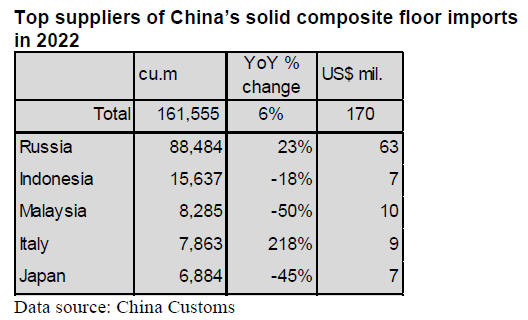

Of the total, solid composite floor imports rose 6% to

161,555 cubic metres valued at US$170 million, up 14%

year on year in 2022.

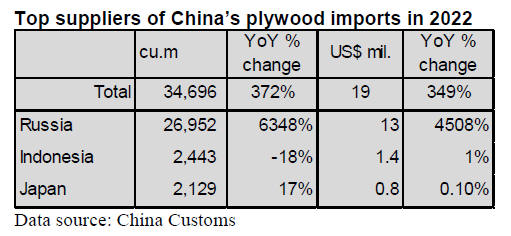

China’s plywood imports (HS code 4412 except solid

composite floors) surged 372% to 34,696 cubic metres

valued at US$19 million, soaring 349% year on year in

2022.

Russia was the largest supplier of China’s plywood

imports in 2022. China’s plywood imports from Russia

soared more than 6,000% to 26,952 cubic metres

accounting for 78% of the national total. Chinese

enterprises have built factories to manufacture plywood

and export to China by the China-Europe railway. This is

why Chinese imports of Russian plywood have soared.

Indonesia and Japan were also suppliers of plywood

imports in 2022. China’s plywood imports from Indonesia

fell 18% to 2,443 cubic metres, from Japan but rose 17%

to 2,129 cubic metres year on year.

China’s plywood imports from the three suppliers, Russia,

Indonesia and Japan made up 91% of the national total in

2022.

Russia was also the largest supplier of China’s solid

composite floor imports in 2022. China’s solid composite

floor imports from Russia rose 23% to 88,484 cubic

metres, accounting for 55% the national total.

Indonesia is the second largest supplier for China’s solid

composite floor imports in 2022. However, China’s solid

composite floor imports from Indonesia fell 18% to 15,637

cubic metres year on year.

Slight increase in furniture exports

China's furniture exports increased slightly in 2022 due to

the continuous growth of domestic furniture enterprises

and production capacity despite the impact of the COVID-

19 pandemic, the travel restrictions on executives and the

difficulties in international logistics.

China’s wooden furniture is exported to more than 200

countries. The top six markets of more than US$1billion

together accounted for only 55% of total furniture exports.

The United States was the largest exporter of China’s

wood furniture in 2022 accounting for 27% of the export

value of wood furniture. As a direct result of the weaker

demand in 2022 China's exports of wooden furniture to the

United States fell 13% to US$7.05 billion in 2022. China’s

wood furniture exports to UK fell 26% to US$1.28 billion

year on year in 2022.

In contrast, China’s wooden furniture exports to Australia,

Japan, South Korea and Hong kong rose 7%, 7%, 11% and

36% to US$1.66 billion, US$1.59 billion, US$1.44 billion

and US$1.18 billion respectively in 2022.

Italy and Germany the top sources of wooden furniture

imports

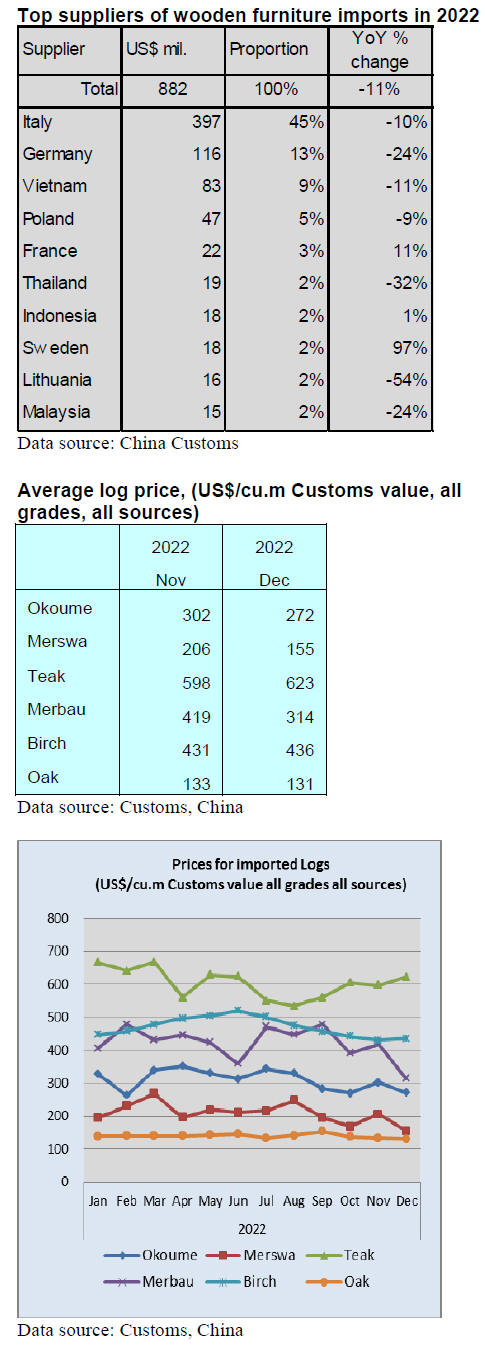

China’s imports of wooden furniture have been falling

steadily for several years. China’s wooden furniture

imports fell 11% to US$882 million in 2022.

Italy and Germany were the two major suppliers of

wooden furniture to China. Italy was the largest supplier

and Germany was the second largest supplier for China’s

wooden furniture imports in 2022 but imports fell 10%

and 24% to US$397 million and US$116 million

respectively. China’s wood furniture from the two main

sources accounted for 58% of the national total.

China's imports of wooden furniture from Sweden

increased significantly and surged 97% year on year in

2022. This is because of Amazon’s cross-border ecommerce

expanded during the epidemic.

February Global Timber Index Report

The Global Timber Index has the following to report on

the situation in China’s timber sector in February. After

the Chinese New Year holiday production resumed and

social mobility recovered which spurred domestic demand

and boosted manufacturing, the vitality of markets has

been enhanced and China's economy is accelerating its

recovery.

Data released by the National Bureau of Statistics shows

that, China's production and trade grew rapidly in January

and February this year. Industrial added value increased by

7.5% year-on-year, total trade increased by 13.3% yearon-

year and employment and prices were stable.

China's GDP growth is expected to be 5% in 2023

according to data released by the Institute of Economics,

Chinese Academy of Social Sciences. Driven by the

recovery of macroeconomics the positive changes in

China's timber processing and manufacturing industry

increased significantly in February with both supply and

demand showing a growth trend. Production and orders of

enterprises increased compared with the previous month,

the downward trend of orders from overseas was

alleviated and activities such as procurement and supplier

distribution were more active than in the previous month.

However, enterprises still feel worried about the pace of

improvement in demand. In February the GTI-China index

registered 52.4%, an increase of 30.9 percentage points

from the previous month and rose above the critical value

indicating that the business prosperity of the timber

enterprises represented by the GTI-China index has

expanded from last month.

See: See:

https://www.ittoggsc.org/static/upload/file/20230214/1676340295137619.pdf

|