US Dollar Exchange Rates of

25th

Feb

2023

China Yuan 6.96

Report from China

Decline in 2022 sawnwood imports

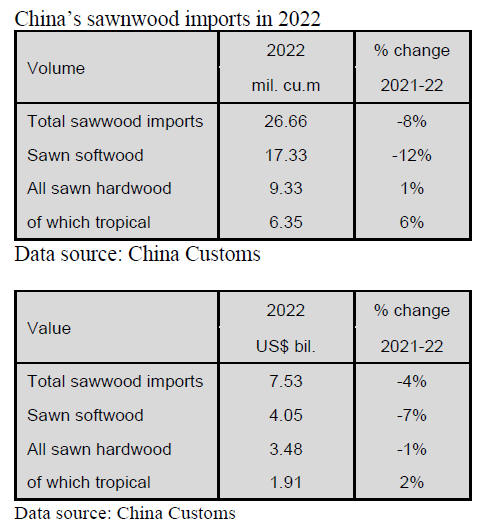

According to data from China’s Customs, 2022 sawnwood

imports totalled 26.66 million cubic metres valued at

US$7.53 billion, a year-on-year decreases of 8% in

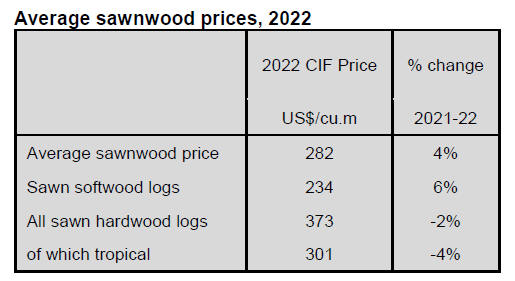

volume and 4% in value on 2021. The average price for

imported sawnwood in 2022 was US$282 per cubic metre,

a year on year rise of 4%.

China's sawnwood imports fell in 2022 because of the

impact on manufacturing of the widespread lockdowns,

the supply chain disruptions brought on by the Russian

invasison of Ukraine and the global shipping disruptions.

Of total sawnwood imports sawn softwood imports fell

12% to 17.33 million cubic metres accounting for 65% of

the national total. The proportion of sawnwood imports

dropped about 3% year on year. The average price for

imported sawn softwood was US$234 per cubic metre, up

6% year on year.

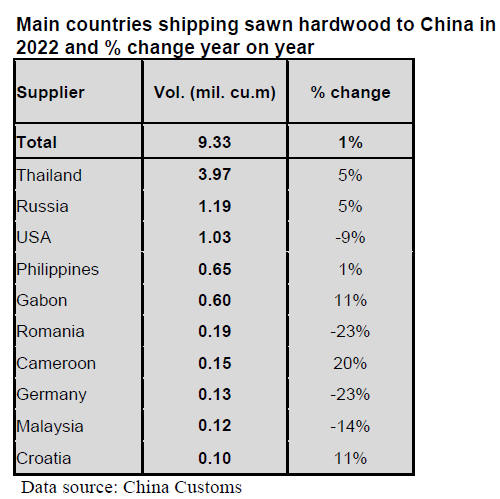

Sawn hardwood imports rose 1% to 9.33 million cubic

metres valued at US$3.48 billion, a year on year increase

1% in volume but a decrease 1% in value in 2022. The

average price for imported sawn hardwoods was US$373

per cubic metre, a year-on-year decline of 2%.

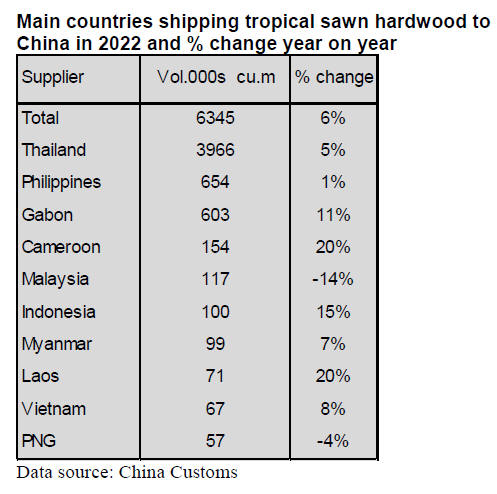

Of total sawn hardwood imports, tropical sawn hardwood

imports were 6.35 million cubic metres valued at US$1.91

billion, a year-on-year increase of 6% in volume and 2%

in value and accounted for about 24% of the national total,

up 3% on 2021 levels. The average price for imported

tropical sawn hardwood was US$301 per cubic metre,

down 4% year on year.

Russia remains the largest supplier of

sawnwood

imports

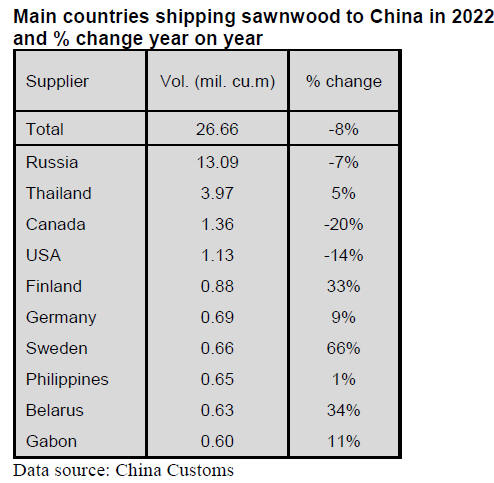

Russia remained the largest supplier of China’s sawnwood

imports in 2022 but imports from Russia fell 7% to 13.09

million cubic metres, accounting for 49% of the national

total. The proportion of China’s imports from Russia

remained the same level year on year.

China’s sawnwood imports from Canada and USA

decreased 20% and 14% respectively to 1.36 million cubic

metres and 1.13 million cubic metres in 2022. Other

suppliers of sawnwood imports in 2022 saw increased

business in many cases.

Jump in China’s sawnwood imports from Sweden

China’s sawnwood imports from Sweden surged 66% to

660,000 cubic metres in 2022. This was in contrast to

imports from Sweden falling 45% in 2020 and by 57% in

2021 due to the pandemic.

China’s sawnwood imports from Sweden began to rise in

2012 and jumped 136% to more than 1 million cubic

metres in 2019.

The reason for the increase in China’s sawnwood imports

from Sweden for many years is that the quality of the

sawnwood is are high and is suitable for manufacturing

furniture and construction.

Sharp drop in sawnwood imports from Ukraine

China’s sawnwood imports from Ukraine plummeted 80%

to 185,000 cubic metres in 2022. China’s sawnwood

imports from Ukraine had been increasing since 2013 and

reached more than 1 million in 2020 but fell to 2017 levels

in 2022.

Decline in Canada’s share of sawnwood imports

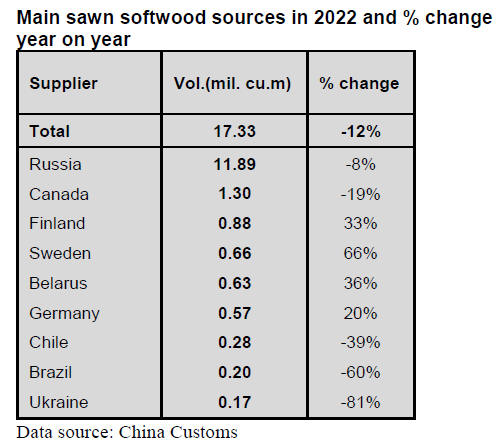

According to China Customs, Russia and Canada, the two

main source countries of China’s sawn softwood imports,

dropped 8% and 19% in volume respectively in 2022,

which was the main reason for the decrease in the total

sawnwood imports.

The volume of China’s sawn softwood imports from

Russia accounted for over 60% of the national total in

2022, up 3% on 2021 levels.

The market share of China’s sawn softwood imports from

Canada has declined significantly since 2014 and

continued to decline year on year (-7%) in 2022 In

contrast, most of the other suppliers, Finland, Sweden,

Belarus and Germany sawn softwood imports in 2022 rose

33%, 66%, 36% and 20% respectively.

Rise in sawn hardwood imports

Sawn hardwood imports rose 1% to 9.33 million cubic

metres valued at US$3.48 billion, a year on year increase

1% in volume but decrease 1% in value in 2022. Thailand,

Russia and USA still are the main sources for China’s

sawn hardwood imports in 2022 and accounted for 42%,

13% and 11% respectively accounting for 66% of the

national total in 2022.

China’s sawn hardwood imports from Thailand and Russia

rose 5% and 4.7% to 3.97 million cubic metres and 1.19

million cubic metres respectively. In contrast, China’s

sawn hardwood imports from USA declined 9% in 2022.

Thailand the largest supplier of sawn

tropical

hardwood imports

Thailand was the largest supplier of sawn tropical

hardwood to China in 2022. Sawn tropical hardwood

imports from Thailand totalled 3.966 million cubic metres

valued at US$990 million, a year on year increase of 5%

in volume but a drop 3% in value in 2022.

Thailand’s market share for sawn tropical hardwood

exports to China rose to 62% in 2022 amking Thailand the

number one supplier.

The Philippines and Gabon were the second and third

largest supplier of China’s sawn tropical hardwood

imports in 2022. Sawn tropical hardwood imports from the

Philippines and Gabon amounted to 654,000 cubic metres

and 603,000 cubic metre, a year on year increase of 1%

and 11% respectively in 2022. The top three countries

supplied 82% of China’s tropical sawn hardwood

requirements in 2022, namely Thailand (62%), Philippines

(10%) and Gabon (9.5%) in 2022.

The average price for imported tropical sawn hardwood

was US$301 per cubic metre, down 4% year on year. CIF

prices for most suppliers of China’s sawn tropical

hardwood imports fell in 2022.

The CIF prices for the top suppliers of China’s tropical

sawn hardwood imports, Thailand, Philippines and Gabon

declined 7%, 5% and 1% respectively in 2022.

|