|

Report from

North America

Tropical hardwood imports strong in 2022, but trended

down

While U.S. imports of tropical hardwood and related

products showed significant growth in 2022, optimism is

tempered by declining numbers over the last quarter of the

year. Import totals were up across the board in 2022 as

gains over the previous year ranged from 6% for

hardwood plywood and wooden furniture to 57% for

tropical hardwood veneer. However, imports of sawn

tropical hardwood, hardwood plywood, mouldings,

assembled flooring panels, and wooden furniture all ended

the year trending downward for each of the last three

months of the year or longer.

Sawn tropical hardwood imports end 2022 on weak

note

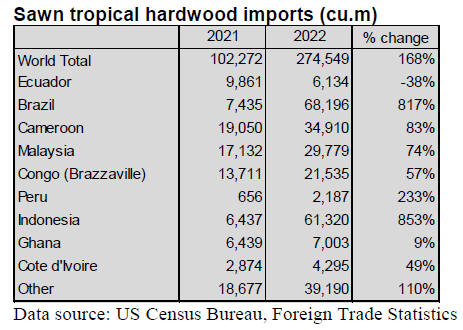

Imports of sawn tropical hardwood ended 2022 at their

lowest level of the year with volume falling for the third

consecutive month. The 17,929 cubic metres imported in

December was down 3% from November. Because the

USDA altered its categories for sawn tropical hardwood in

2021 and again at the beginning of 2022 it is hazardous to

compare 2022 data with previous years, however totals for

the year were up sharply for most woods and from most

trading countries.

The 2021 accounting depressed volume by just under half

versus the older regimen. That said, imports from Brazil

and Indonesia both rose more than 800% in 2022 over

2021 while total sawn hardwood imports rose 186%.

Imports of Padauk more than doubled in 2022 while

imports of other woods all rose sharply: Keruing (69%),

Sapelli (52%), Acajou d’Afrique (48%) and Mahogany

(44%). While imports of some woods (Jatoba, Balsa,

Virola, Teak, and Aningre) fell for the year, it is hard to

determine how much that is due to reclassification, which

led to imports of wood designated “Other Tropical” rising

more than 60-fold in 2022 and accounting for more than a

third of all imports for the year. It is certain this accounts

for most wood previously classified as Jatoba, which fell

96% in 2022 after being by far the most imported wood by

the U.S. in past years.

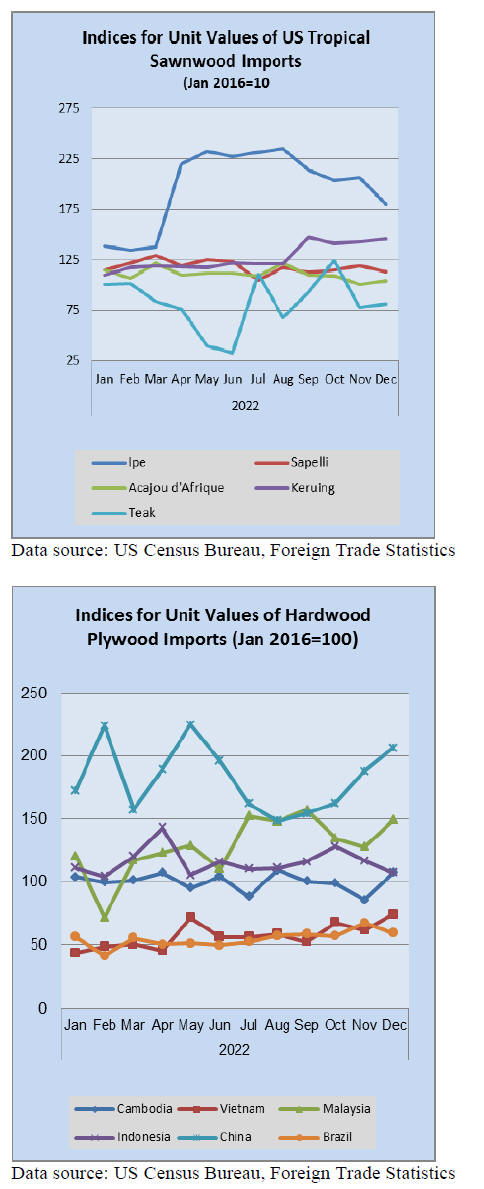

Hardwood plywood imports hit 10-year low

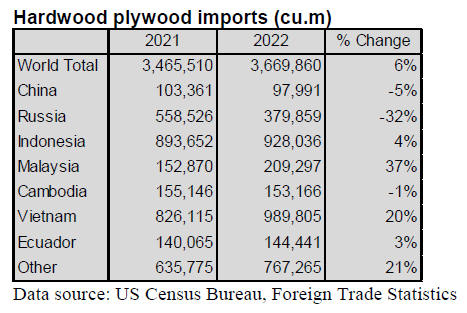

After sinking 20% in November, U.S. imports of

hardwood plywood skidded an additional 31% in

December to fall to its lowest level since February 2012.

The 152,707 cubic metres imported was well below half

the volume imported the previous December. Due to the

downturn, total hardwood plywood imports for 2022

exceeded those of 2021 by only 6% after being much

further ahead for most of the year.

Imports from Malaysia and Vietnam saw the most growth

in 2022, up 37% and 20%, respectively. Imports from

Russia were down 32% in 2022 while imports from China

fell 5%. The U.S. imported 3.67 million cubic metres of

hardwood plywood in 2022 with a value of US$2.85

billion.

Veneer imports rose 57% in 2022

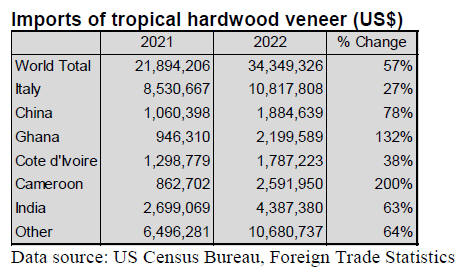

U.S. imports of tropical hardwood veneer grew by 57% in

2022 with imports from nearly all top trading partners

rising by more than 25%. Imports from Italy, which alone

account for nearly a third of all veneer imports, rose by

27% in 2022, while imports from the second largest

trading partner, India, rose 63%. Imports from Cameroon

tripled in 2022 and imports from Ghana more than

doubled.

Imports from China rose 78% in 2022 as December

imports from China hit their highest level since 2019.

Despite falling 21% in December from the previous

month, overall tropical hardwood veneer imports for the

month remained 84% higher than the previous December.

The U.S. imported tropical hardwood veneer with a value

of more than US$34.3 million in 2022.

Hardwood flooring imports showed modest gain in

2022

Imports of hardwood flooring rose 8% in 2022 as

December imports rose 2% over the previous month.

Imports from Indonesia rose more than 200% in 2022,

taking a strong bite from the market share of imports from

Brazil, which fell 10% in 2022.

Imports from Malaysia also showed a significant gain last

year, growing 53%, while imports from Vietnam fell 59%

and imports from China were off 16%. The U.S. imported

more than US$79.3 million in hardwood flooring in 2022.

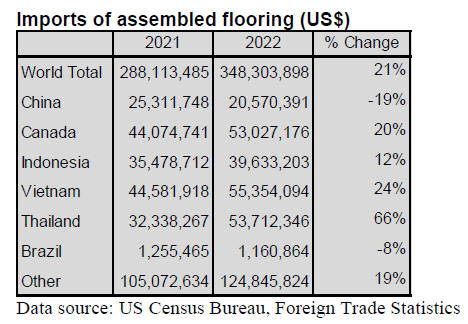

Imports of assembled flooring panels gained 21% in 2022

over the previous year as imports from Thailand rose 66%

for the year, imports from Vietnam rose 24%, and imports

from Canada were up 20%. Imports from China fell in

2022 by 19%.

Imports ended the year poorly, falling for a third straight

month in December, down 18% from November and 26%

lower than the previous December. Total imports of

assembled flooring panels reached over US$348.3 million

in 2022.

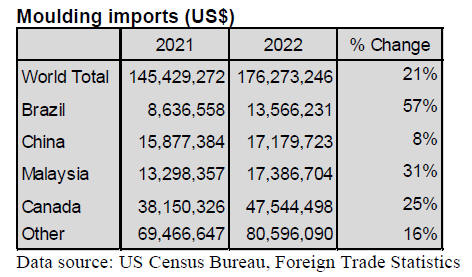

Moulding imports gained 21% in 2022

U.S. imports of hardwood moulding rose above $176

million in 2022, beating 2021 totals by 21%. Imports from

Canada, the top U.S. trading partner, rose 25% in 2022

while imports from Brazil surged 57% and imports from

Malaysia grew 31%. December numbers were

disappointing as imports fell for a third consecutive

month. December imports were down 16% from

November and 17% from the previous December as

imports from Brazil fell to a 20-month low.

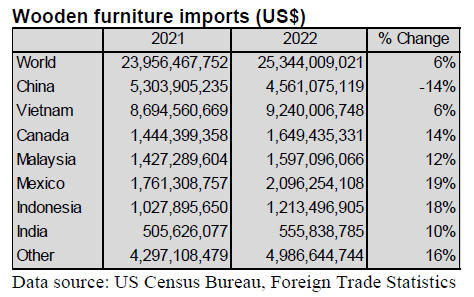

Wooden furniture imports topped US$25 billion in 2022

Despite trending steadily downward since May, U.S.

imports of wooden furniture set a record in 2022 of more

than US$25.3 billion, a 6% increase over 2021. Imports

from most trading partners rose in the 20% to 10% range

for the year with imports from Mexico rising 19% and

imports from Indonesia rising 18%.

Imports from top trading partner Vietnam rose 6% for the

year while imports from China fell 14%. Yet the outlook

for 2023 is cautious as December imports fell 5% from

November to a level 11% below that of the previous

December.

The latest Smith Leonard survey of residential furniture

manufacturers and distributors by Smith Leonard yielded

results deemed “not very pretty, yet somewhat in line with

expectations.” For the month of November 2022, net new

orders were off 35% compared to November 2021, in line

with recent results for much of the year.

But most of the recent comparisons have been to prior

year results that were not that strong compared to 2020

results. The survey reported that business is “definitely

off” with 97% of the participants reporting a decline in

orders for the month. Year to date, orders were down 34%,

and declining for 94% of survey participants.

See:

https://www.smith-leonard.com/january-2023-furnitureinsights

U.S. trade deficit at record level in 2022

The U.S. trade deficit hit a record of almost US$1 trillion

in 2022, with more than a third of the total coming from

trade with China. The annual goods and services trade

deficit rose 12.2% to US$948.1 billion, the Commerce

Department reported February 7. The goods deficit

jumped 9.3% to US$1.19 trillion, while the services

surplus declined 0.6% to US$243.7 billion.

The deficit with China was the largest, climbing $29.4

billion to US$382.9 billion. It was followed by the

European Union (EU) at US$203.9 billion, Mexico at

$130.6 billion, and Vietnam at $116.1 billion. The U.S.

recorded a trade surplus with South and Central America,

totaling US$76.2 billion, and the Netherlands at US$38.3

billion.

Imports of goods were up 14.9% to US$3.28 trillion. They

increased the most for industrial supplies and materials,

led by crude oil. Import gains were also reported for

capital goods, consumer goods, automotive vehicles, parts,

and engines, and food, feed, and beverages. Services

imports added 23.7% to US$680.5 billion, with travel and

transport higher. Exports reached US$2.09 trillion, a rise

of 18.4%, driven up by fossil fuel shipments.

See:

www.investopedia.com/us-trade-deficit-hit-nearlyone-trillion-in-2022-7106686

Disclaimer: Though efforts have been made to ensure

prices are accurate, these are published as a guide only.

ITTO does not take responsibility for the accuracy of this

information.

The views and opinions expressed herein are those of

the correspondents and do not necessarily reflect those

of ITTO

|