4.

INDONESIA

New export record

Despite uncertain global economic conditions exports of

Indonesian wood products in 2022 continued to grow.

Data from the Ministry of Environment and Forestry

(KLHK) analyses by the Association of Indonesia Forest

Concession Holders (APHI) show Indonesia's exports of

wood products in 2022 reached US$14.51 billion. This

was a significant increase in export values compared to

2021 which were recorded at US$13.56 billion.

The export value for wood products in 2022 was a record

surpassing the previous record in 2021. In 2022 paper

products contributed the most to export earnings at

US$4.37 billion, up 18% yoy followed by wood pulp

US$3.73 billion, up 15% yoy. The other wood products

that made a large contribution were wood panels US$2.86

billion and furniture worth US$2.26 billion.

See:

https://forestinsights.id/2023/01/27/nilai-ekspor-produkkayu-melompat-7-persen-catat-rekor-baru-sepanjang-sejarah/

Market diversification - biomass trade with EU member

states

Markets such as Bulgaria, Lithuania, Slovenia and other

Eastern European countries are to be the target for

expanded wood product exports in the EU.

In addition to the current products exported such as paper,

panels and furniture efforts will be made to export wood

pellets according to the chairman of the Association of

Indonesia Forest Concession Holders (APHI), Indroyono

Soesilo. He added there is a skyrocketing demand for

Indonesian wood products in Eastern European member

States.

In Bulgaria there was a 100% increase in Indonesian wood

product exports, a 400% increase in Croatia, 125% in

Lithuania and a massive jump in exports to Slovakia.

However, currently the volumes are small but there are

opportunities for growth. Indroyono said growth in nontraditional

market countries is an opportunity to increase

exports amidst the economic challenges of 2023.

See:

https://forestinsights.id/2023/01/31/pasar-non-tradisionaljadi-incaran-indonesia-tingkatkan-ekspor-kayu-ke-uni-eropabiomassa-potensial-digarap/

and

https://agroindonesia.co.id/peningkatan-ekspor-produk-kayuindonesia-bidik-pasar-non-tradisional-di-uni-eropa/

Indonesian furniture for Swiss market

The Minister of Cooperatives and SMEs, Teten Masduki,

has pointed out that, as a results of discussion with the

Swiss Secretariat for Economic Affair, an Indonesia-

Switzerland FTA had been ratified which will benefit

businesses in both countries.

As a follow-up the Minister suggested members of the

Indonesian Furniture and Craft Industry Association

(Asmindo) take advantage of the import duty exemption

built into the FTA.

See:

https://www.neraca.co.id/article/175077/asmindo-didorongmanfaatkan-fasilitas-pembebasan-bea-masuk-ke-swiss

Government to encourage downstreaming of 21

commodities

The Indonesian government’s investment policy will

remain focused on investment in downstream

manufacturing in 21 commodity sectors in order to attract

investment worth over US$500 billion by 2040 according

to the Minister for Investment, Bahlil Lahadalia. The

ministry has prioritised investment needs of 8 sectors

namely minerals, coal, oil, natural gas, plantations, marine,

fisheries and forestry. The 8 sectors cover 21

commodities: coal, nickel, tin, copper, bauxite, steel, gold,

silver, asphalt, oil, natural gas, coconut, rubber, biofuel,

logs, pine resin, shrimp, fish, crab, seaweed and salt.

See:

https://en.antaranews.com/news/271980/govt-todownstream-21-commodities-minister

No leniency for private firms on forest fires

At a press conference on “Preparedness for 2023 Forest

and Land Fires” Environment and Forestry (LHK)

Minister, Siti Nurbaya Bakar, emphasised that the

government will take firm action against businesses found

causing forest fires in Indonesia. She is reported as saying

"if forest fires happen because of the private sector there

will be no mercy because as soon as a hotspot is detected

as we will immediately act.

See:

https://en.antaranews.com/news/270738/no-leniency-forprivate-firms-on-forest-land-fires-minister

In related news, the President urged regional military and

police chiefs to develop forest fire preparedness in their

respective jurisdictions. Th President highlighted that the

police and the military are responsible for taking forest

and land fire prevention efforts in line with the pledge they

had made years ago. He called for concerted action in

forest fire-prone areas including Riau, North Sumatra and

Kalimantan.

See:

https://nasional.tempo.co/read/1689073/jokowi-bilangancaman-copot-pangdam-kapolda-soal-kebakaran-hutan-masihberlaku

UNDP Funding for Climate and Sustainable Forest

Management

Indonesia has received a first disbursement of US$46

million from the US$103.8 million approved by the Green

Climate Fund (GCF), following the success in emission

reduction from Indonesian forestry sector in the period

2014 to 2016.

The United Nations Development Programme (UNDP)

has transferred the funds to the Indonesian Environment

Fund (IEF) which has a mandate to manage environment

funds. The IEF was officially formed to channel

environmental and climate funds to support achievement

of Indonesia’s Nationally Determined Contribution (NDC)

commitments to achieve net-zero emissions by 2060 by

reducing Green House Gas (GHG) as part of the global

mandate and commitment to combat climate change.

See:

https://www.undp.org/indonesia/press-releases/indonesiareceives-usd-46-million-its-stewardship-climate-action-andsustainable-forest-management

ADB to support rural livelihood and agroforestry

The Asian Development Bank (ADB) signed a US$15

million loan facility with PT Dharma Satya Nusantara Tbk

(DSNG) to help the company expand sustainable wood

processing, rural livelihood development and climateresilient

agroforestry in Java. The ADB money will be

used to implement energy-efficient and water-saving

processes and procurement of cultivated native Indonesian

Sengon and Jabon saplings.

DSNG sources timber from Central, East and West Java.

The majority of Sengon and Jabon trees are cultivated by

smallholders and are inter-cropped with coffee, corn and

rice. As well as enabling the utilisation of otherwise

unproductive land, intercropping trees with food crops can

reduce erosion, enhance soil health and in many cases

improve crop yields.

See:

https://www.devdiscourse.com/article/business/2333576-adb-signs-15m-loan-with-dsng-to-support-rural-livelihood-andagroforestry-in-indonesia

5.

MYANMAR

No indication logging ban will

continue

The Ministry of Natural Resources and Environmental

Conservation (MONREC) announced a logging ban in a

mini-budget for 2021-22 and for 2022-23. There has been

no announcement of a logging ban for 2023-24. However,

MONREC has indicated harvesting will be less than

Annual Allowable Cut (AAC).

See -

https://www.independent.co.uk/news/martial-law-apmyanmar-bangkok-yangon-b2274606.html

Uncertainty looms over Myanmar economy: World

Bank

Myanmar’s economy remains subject to significant

uncertainty with ongoing conflict disrupting businesses

according the World Bank ‘Myanmar Economic Monitor’

published this year. It says, while some firms show signs

of resilience, household incomes remain weak and

Myanmar’s potential for growth has been severely

weakened.

Mariam Sherman, the World Bank’s country director said

“while conflict remains, families suffer from insecurity

and violence. Firms, particularly those in the agriculture

sector, are experiencing higher costs and delays”.

The World Bank expects that a gradual economic recovery

could be seen in the near term and growth is estimated at

3% year ending in September. However, economic activity

continues to be adversely affected by conflict, electricity

shortages and changing regulations, with per-capita gross

domestic product expected to remain about 13% below

pre-Covid levels.

The depreciating kyat, high global prices and ongoing

logistics constraints have caused import costs to rise

sharply and these shocks fuel inflation and further reduce

real incomes, said the report.

“Losses in education along with increased unemployment

and internal displacement will reduce already low levels of

human capital and productive capacity over the long term

the report says.

The report recommends a more unified and marketoriented

foreign exchange system which would help

stabilise the economy, reduce inflation and remove market

distortions.

See:

https://www.worldbank.org/en/country/myanmar/publication/myanmar-economic-monitor-reports

Martial declared in many areas

Martial law was declared in several areas a day after

authorities announced that a state of emergency has been

extended throughout the country which is wracked by

violence.

State-run MRTV television broadcast an announcement by

the State Administration Council (SAC), imposing martial

law in 37 townships across eight of the country’s 14

Regions and States.

Eleven of the affected townships are in Sagaing Region

and seven in Chin State, areas in the northwest where

fighting has been fiercest between the army and people

belonging to pro-democracy People’s Defense Forces and

their allies. Most of areas identified in the statement are

timber producing areas.

See:

https://www.aa.com.tr/en/asia-pacific/myanmar-militaryjunta-declares-martial-law-in-37-more-townships/2805072

Sanctions affect everyone

The local media has highlighted the impact of

international sanctions on businesses and households

saying while the international economic sanctions target

the current military-led government everyone is affected.

There are shortages, costs are climbing, development aid

has been cut, trade has been cut and investment has

slowed. To adjust to the new economic reality the

government restricts imports to try and balance foreign

currency earnings and outgoings.

In stark contrast to the reality the Prime Minister, General

Min Aung Hlaing, said at a meeting last year that if

Myanmar makes efforts it will reach the middle income

level among ASEAN countries in the next 5 years.

See -

http://burmese.dvb.no/archives/577628

6.

INDIA

Strong economy not reflected in rupee

exchange rate

According to a Reuters poll of foreign exchange strategists

the rupee is likely to strengthen only slightly in coming

months and will still trade above the 80 to the US dollar

all year.

Although India is a fastest growing emerging economy

that relative strength is not reflected in the exchange rate

movements. Underlying economic problems, including a

reliance on imported oil and persistent unemployment

continue to hold down the exchange rate.

Title

The real estate industry fears the recent interest rate rise

announced by the Reserve Bank of India (RBI) will harm

the housing industry. The real estate sector believes that

the increased rate will push upthe cost of servicing home

loans at a time when the sector has begun showing

promising sales numbers. The decision by the RBI will

lead to higher borrowing costs which could again reduce

the demand for home loans.

However, on the positive side real estate industry

stakeholders in Bengal are of the opinion that the state

government’s rebate on stamp duty will have some

positive impact on the housing market in the short term.

The Monetary Policy Committee of the RBI increased

interest rates in a bid to arrest retail inflation.

Anuj Puri, chairman of property consultancy ANAROCK

Group is quoted as saying “The Indian housing market

continues to be largely end-user driven -- and end-users,

unlike investors, focus less on return on investment and

more on the perceived value of home ownership.

Furthermore, commodity prices are now falling and

inflation is moderating. As such, we are unlikely to see

any hikes in the near future, which will be positive for the

housing sector in times to come.”

See:

https://www.millenniumpost.in/bengal/rbis-65-hike-in-reporate-bound-to-impact-indias-housing-market-508051

Launch of the ‘Trees Outside Forests in India’

In a press release the Government of Rajasthan’s Forest

Department and the U.S. Agency for International

Development (USAID) announced the launch of the

“Trees Outside Forests in India (TOFI)” programme in

Rajasthan which will bring together farmers, companies

and other private entities to rapidly expand tree coverage

outside of traditional forests in the state.

The new initiative will enhance carbon sequestration,

support local communities and strengthen the climate

resilience of agriculture, thereby supporting global climate

change mitigation and adaptation goals.

See:

https://www.usaid.gov/india/press-releases/feb-07-2023-government-rajasthan-and-usaid-launch-new-initiative-increasetree-coverage-rajasthan

Green bonds to lower borrowing cost

For the first time the Reserve Bank of India (RBI) issued

sovereign green bonds on behalf of the Government of

India. The initial announcement was made by Union

Finance Minister, Nirmala Sitharaman, in her 2022 budget

speech. The government had later announced it would

issue such bonds worth Rs.16,000 crore this year as part of

the overall market borrowing programme.

There are investors who are willing to accept

comparatively low returns to support green

initiatives. Some institutional investors are also mandated

to invest in such instruments. Corporations engaged in

green businesses can secure funds at relatively low rates.

A lower cost of borrowing would help Asia’s third-largest

economy finance infrastructure and meet clean energy

goals, while managing a record debt issuance plan. The

first green bond sale will take place before the end of the

fiscal year in March and discussions are underway with

ministries to identify projects.

See:

https://economictimes.indiatimes.com/industry/renewables/indiais-counting-on-debut-green-bond-to-cut-financingcosts/articleshow/94193033.cms

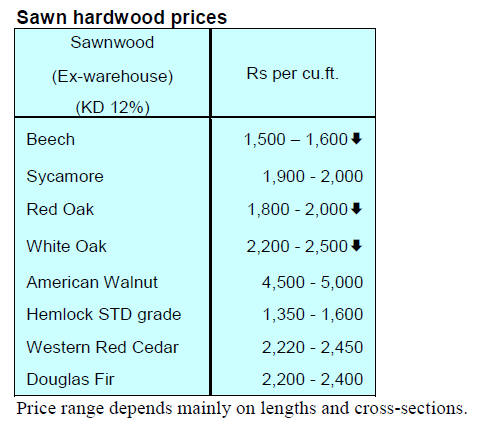

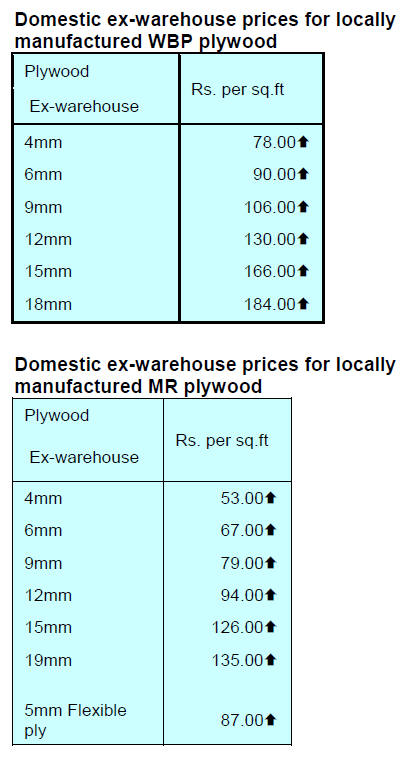

Plywood

Ex-warehouse prices for plywood have been increased to

compensate for the higher costs of logs and resins used in

manufacturing. Last month the North India Plywood

Associations advised its members to charge 7% extra from

their dealers to compensate for the rising production costs.

7.

VIETNAM

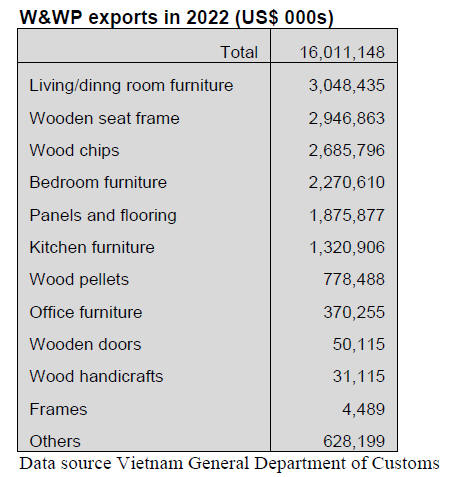

Wood and Wood Product (W&WP) Trade highlights

According to the Vietnam General Department of Customs

W&WP exports in December 2022 were US$1.3 billion,

up 11.5% compared to November 2022, but down 8.4%

compared to December 2021. WP exports, in particular,

accounted for US$875 million, up 15% compared to

November 2022 but down 19% compared to December

2021.

In 2022 W&WP exports were valued at US$16 billion a

year-on-year growth of 8%. Of this WP exports

contributed US$11.04 billion, down 0.3% compared to

2021. Exports of wooden furniture in December 2022

were valued at US$798.6 million, down 19% compared to

December 2021. In 2022 exports of wooden furniture

totalled at US$10 billion, down 0.4% over the same period

in 2021.

W&WP exports to the US in December 2022 stood at

US$678 million, down 19% compared to December 2021.

In 2022, the total W&WP exports to the US amounted to

US$8.7 billion, down 1.3% compared to 2021.

Vietnam's imports of logs and sawnwood in December

2022 were 440,200 cu.m, worth US$157.2 million, down

9% in volume and 8% in value compared to November

2022. Compared to December 2021 however, imports

increased by 17% in volume and 7% in value.

In 2022 imports of raw wood were reported at 5.993

million cu.m equivalent to US$2,270 billion, down 4% in

volume, but up 5% in value compared to that of 2021.

Vietnam's tali wood imports in December 2022 reached

57,900 cu.m,, worth US$23.2 million, up 8% in volume

and 8% in value compared to November 2022. Compared

to December 2021, tali imports increased by 203% in

volume and 211 % in value.

In 2022 tali imports totalled 557,300 cu.m, worth

US$226.0 million, up 46% in volume and 44% in value

compared to 2021.

Imports of logs and sawnwood from the US in December

2022 experienced the fourth consecutive monthly decline

and stood at 44,160 cu.m, at a value of US$19.19 million,

down 18% in volume and 22% in value. In 2022 imports

of logs and sawnwood from the US to Vietnam totalled at

689,430 cu.m, worth US$327.11 million, up 0.8% in

volume and 3% in value compared to 2021.

Vietnam’s W&WP exports increased by 8.1% in 2022

Over the last 10 years Vietnam's W&WP exports have

been increasing steadily. The mean growth in the period

2012 - 2022 is calculated at 14% per year. Growth was

fast in 2018, 2019 and 2020 and surprisingly in 2021,

amid the Covid-19 pandemic, exports grew nearly 20 %.

However, by 2022, the growth rate of W&WP exports

slowed as the value of exports was US$16 billion, up just

8% compared to 2021.

Forecasts and suggestions for manufacturers

from

VIFOREST

Vietnam’s wood sector has been targeting 5 major

markets; the US, Japan, China, South Korea and the EU.

The current global situation and problems facing these

markets for W&WP from Vietnam can hardly give an

optimistic forecast on Vietnam’s W&WP trade.

According to Vietnam Wood and Forest Products

Associations (VIFOREST) the growth of W&WP exports

in 2023 is expected to be up between 7% - 9% year on

year far below the growth rate over the last 10 years. With

this expected growth W&WP exports in 2023 will be

between US$17 billion - 17.5 billion. To face the

downturn in the major markets Vietnamese traders have

been advised by VIFOREST to adopt the following

measures and solutions:

expand utilisation of domestic wood raw

materials to reduce input costs

apply improved technologies to enhance labor

productivity

apply digital transformation to reduce production

costs

promote low-emission production

coordinate with localities to build specialised

wood processing and trading zones in various

regions of the country

enhance W&WP trade promotion with attention

given to attending international trade fairs for

wood products, wood technologies and wood

manufacturing machines

diversify export markets and increase customer

outreach through improving designs, focusing on

high-value commodity groups, opening trade

representation in key markets

utilise of the advantages gained from the Free

Trade Agreements Vietnam has concluded with

important trade partners

8. BRAZIL

Instilling responsibility in young

entrepreneurs

The “Amazon Journey” initiative aims to promote

businesses that support the maintenance of tree cover. The

initiative is also called "the Genesis Program" being aimed

at young talents to encourage research oriented towards

products and processes that have a minimal impact on the

forest.

The initiative is coordinated by the Certi Foundation in

collaboration with participation and investments from

Bradesco, Fundo Vale, Itaú-Unibanco and Santander,

partners in the Amazon Plan, an alliance among the three

banks and Vale's Bioeconomy Program Fund.

The programme will bring together young people from the

nine states of the Legal Amazon to debate local

opportunities, market demands, in addition to the

socioeconomic and environmental sustainability of the

Amazon rainforest. The main topics will be biotechnology,

innovation ecosystem, impacting business.

The Genesis programme is a launch pad for a second stage

“Synapse Program” which seeks to help entrepreneurs get

their idea off the ground. In 2022, a programme was held

in Pará state with 516 young people resulting in 105 new

ideas for entrepreneurial solutions for a bio-economy

agenda in the Legal Amazon.

See:

https://epocanegocios.globo.com/um-soplaneta/noticia/2023/02/programa-vai-formarempreendedores-que-apoiem-floresta-amazonica.ghtml

Forestry careers on offer

The domestic and international demand for pulp and paper

produced in the state of Mato Grosso do Sul encouraged

companies increase recruitment and offer training. In

2023, through on-site and distance courses, some 2,145

new employees were trained.

A large pulp and paper company located in Três Lagoas

municipality, State of Mato Grosso do Sul, has more than

5,300 workers, 2,900 of them work on forest operations.

Another pulp and paper company, in Ribas do Rio Pardo

municipality, in the same State partnered with SENAI

(National Service for Industrial Training) to conduct

training. The company plans to recruit 2,000 people by

2024 for forest operations.

See:

http://www.remade.com.br/noticias/18917/em-altano-mato-grosso-do-sul--carreira-florestal-e-protagonistaem-2023

UAE/Brazil Business Council

In 2022 the Brazilian Furniture Project took many member

companies on a trade mission during Expo Dubai and attracted

more than US$2.8 million in immediate business and US$15.6

million in potential orders.

Between 2006 and 2021 Brazil exported around US$60.3 million

in furniture to the UAE. This was a period in which there was

57% growth. Brazilian exports to the UAE jumped from US$6.9

million in 2017 to US$10.8 million in 2021.

In 2022 the CNI (Brazilian National Confederation of Industry)

and the FCCI (Federation of Chambers of Commerce and

Industry of the United Arab Emirates) established the United

Arab Emirates/Brazil Business Council to strengthen trade and

investment between the two countries.

See:

http://abimovel.com/exportacao-de-moveis-e-colchoesoportunidades-para-a-industria-brasileira-nos-emirados-arabes/

2022 not a great year for the Bento Gonçalves furniture

cluster

2021 was a year of atypical growth in revenue and exports

for companies in the Bento Gonçalves furniture cluster, in

the state of Rio Grande do Sul with export demand surging

as people focused on furnishing their homes during the

COVID-19 pandemic.

In 2022 even when life in the US started to return to

normal sales of durable goods such as furniture lost

momentum and this resulted in a decline in export

earnings for the 300 Brazilian manufacturers.

Companies in the Bento Gonçalves furniture cluster ended

2022 with R$3.1 billion in revenues and US$54.5 million

exported, a decrease of 3% and 28%, respectively

compared to 2021 according to SEFAZ (Secretariat of

Finance), Comex Stat and CAGED (General Register of

Employed and Unemployed Workers). The slowdown in

sales also resulted in job losses with employment in the

sector dropping over 2%.

According to the Furniture Industry Union of Mato Grosso

State (SINDMÓVEIS) it is projected that demand will

remain stable in 2023 with the possibility of a slight

increase of 2% to 3% in the cluster's revenues. In 2022,

despite the declining export earnings, there was success in

diversifying markets. Products from the region were

exported to 59 countries, a 15% increase compared to

2019, the year prior to the COVID-19 pandemic. The top

10 export destinations were the United States, Uruguay,

Chile, the United Kingdom, Peru, Mexico, Colombia,

Paraguay, Puerto Rico, and Panama.

See:

https://emobile.com.br/site/industria/balanco-do-polomoveleiro-de-bento-goncalves-em-2022/

‘Through the eyes of industry’, challenges and

suggestions from Brazi and Mexico

See:

https://www.ittoggsc.org/static/upload/file/20230214/1676340295137619.pdf

9. PERU

Guidelines for SERFOR audits of timber

producers and

exporters

The National Forest and Wildlife Service (SERFOR) has

approved "Guidelines for conducting audits and

verification of producers and exporters of timber forest

products". These guidelines establish the provisions for

SERFOR or the Regional Forest and Wildlife Authorities

(ARFFS) to conduct periodic audits of producers and

exporters of timber forest products.

The aim is to verify compliance with the obligations for

international trade as established in Law No. 29763,

Forestry and Wildlife Law and in the Trade Promotion

Agreements signed by Peru.

Increase in particleboard imports

The value of Peruvian imports of particleboard reached

US$161.9 million in 2022 (versus US$159.5 million in

2021). This was a record and a 1.6% year on year growth.

Ecuador, once again, was the main supplier to Peru during

2022 with shipments worth US$70.7 million which

represented an increase of 4% compared to 2021. Spain

was the second ranked supplier with US$35.1 million, a

9% drop compared to the US$38.6 million shipped to Peru

in 2021.

Forest fire prevention campaign

SERFOR in coordination with the Provincial Municipality

of Satipo, started the campaign for the prevention of forest

fires in the Central Jungle (Amazonía del Perú) area of the

country.

The Technical Administrator of the ATFFS-Central Forest

said he objective of this technical assistance is to promote

the preparation of fire prevention action plans to reduce

the risks of forest fires. The initial training highlighted the

importance of disaster risk management in the country.

Peruvian exports in 2022 grew 4%

The Association of Exporters (ADEX) has reported

Peruvian export shipments in 2022 at US$63,193 million,

up 4% year on year despite five months of declines during

the year the deepest being those of the last quarter

(October -6 %, November -19% and December -8%).

After growing 8%, 23% and 8% in 2016, 2017 and 2018

respectively, in 2019 and 2020 export earning dropped

-2% and -11% to reverse to expand 48% in 2021, the

rebound after the easing of covid responses in the US and

the EU.

ADEX president, Julio Pérez Alván, expressed his concern

about prospects for January this year as production and

supply chains have ben disrupted due to civil unrest. He

added “There is tension and concern for the welfare of

workers, damage to private property and trust with

international buyers”.

Exports of primary products in 2022 totalled US$44,914

million the leading sub-sector was mining with US$35,032

million, down -7% due to political-social unrest.

In second place was hydrocarbons (US$6,151 million),

followed by fishing (2%) and agriculture (57%).

Despite lower demand (-2%) China was the top export

market followed by the US and Japan. Other markets in

the top five were Canada and South Korea.