|

Report from Europe

EU27 tropical wood imports slow as economic outlook

deteriorates

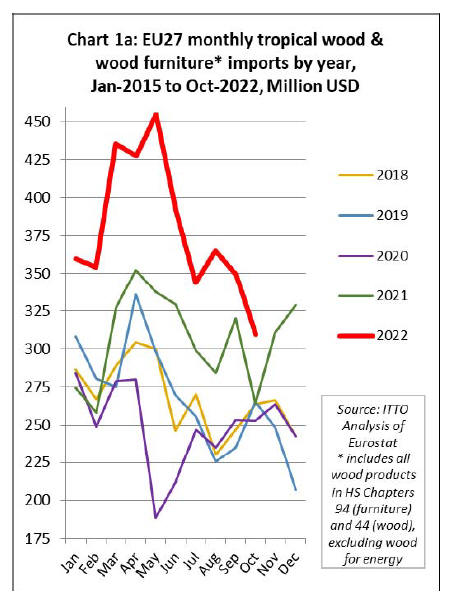

In the first ten months of 2022, the EU27 imported 1.68

million tonnes of tropical wood and wood furniture

products with a total value of US$3.79B, respectively 15%

and 24% more than the same period the previous year.

However, imports have been slowing since summer 2022

and the economic outlook in the EU deteriorated sharply

in the last quarter of the year. The war in Ukraine is

contributing to huge increases in energy prices, while

business and consumer confidence has been hit by

expectations of higher interest rates to control inflation.

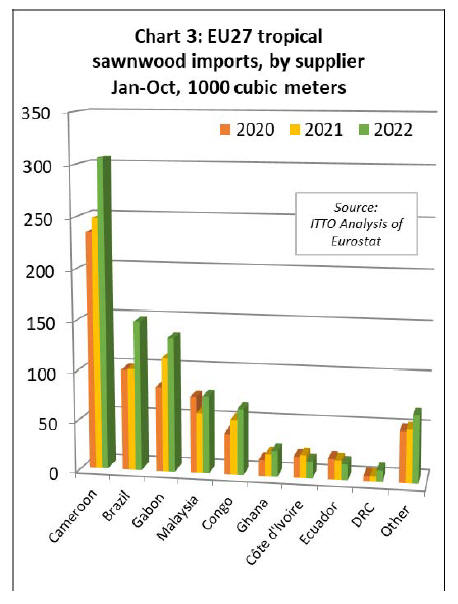

In US dollar terms, total EU27 imports of tropical wood

and wood furniture imports were still high in October last

year compared to the same month in the previous five

years despite falling sharply since the summer (Chart 1a).

However in tonnage terms, EU27 total imports of tropical

wood and wood furniture in October last year were in line

with the level achieved in that month in the previous five

years and well below levels typical of a decade ago (Chart

1b).

EU economy projected to grow just 0.2% this year

The extent of the economic downturn in the EU27 is

highlighted in the 2023 edition of the "World Economic

Situation and Prospects" (WESP) published by the United

Nations Department of Economic and Social Affairs (UN

DESA) in January.

According to the WESP report "the economic outlook for

Europe has continued to deteriorate amid the protracted

war in Ukraine. Soaring energy prices have pushed

inflation to multi-decade highs, eroding household

purchasing power and increasing production costs for

firms. Market liquidity has tightened as the region’s

central banks have accelerated interest rate hikes to rein in

inflationary pressures. Higher borrowing costs, sizeable

fiscal deficits and elevated debt levels continue to

constrain fiscal space in many European economies”.

The WESP report also notes that “the external

environment has worsened amid weakening growth in

China and the United States and heightened global

economic uncertainty”.

Against this background, the WESP report projects that

there will a “mild recession” in many European countries

during the winter of 2022 to 2023, followed by a subdued

recovery. GDP in the European Union is projected to grow

by only 0.2 per cent in 2023, a sharp downward revision

from earlier forecasts. In 2024, the WESP forecasts that

growth will pick up to 1.6 per cent as inflation eases and

the monetary tightening cycle ends.

This comes, according to the WESP report, after a

surprisingly strong expansion of 3.3 per cent in 2022,

when further relaxation of COVID-19 mobility

restrictions and pent-up demand boosted spending on

contact-intensive services, including tourism-related

activities.

But the report observes that “in the third quarter of 2022,

consumer confidence both in the European Union and in

the United Kingdom plunged to the lowest level since the

1980s, with only a slight improvement in October and

November”.

For 2023, the WESP report states that “while the worstcase

scenario of massive disruptions to industrial activities

will likely be avoided, Europe is still projected to see a

marked economic downturn. Private consumption will

weaken due to significant purchasing power losses by

households and tightening financial conditions.

Businesses are expected to cut back on capital spending

amid elevated uncertainty and higher input and borrowing

costs. In addition, external demand is projected to soften

further as the region’s main trading partners – China and

the United States face subdued growth prospects in 2023”.

The WESP report suggests that some European countries

will be hit much harder than others. GDP is forecast to

contract in Germany, Italy, Sweden and the United

Kingdom in 2023, as these economies are particularly

vulnerable to the combination of soaring energy prices and

rising borrowing costs. By contrast, economic growth is

expected to be more resilient in a few smaller economies,

including Ireland and Portugal.

The latest data from the S&P Global eurozone

construction purchasing managers’ index (PMI) underlines

the extent of economic deterioration. It shows that the

construction sector is suffering its worst decline since the

pandemic brought the economy to a near-standstill in

2020.

December’s PMI showed a total activity index of 42.6,

down from 43.6 in November. Figures below 50 indicate

declining activity. The data marked the eighth consecutive

month of contraction in home building. Activity declined

in all three of the 20-nation bloc’s biggest economies —

Germany, France and Italy.

Excluding periods of Covid-19 lockdowns, total homebuilding

activity dropped in December at the sharpest rate

since March 2013 and new orders for all construction

projects declined at the fastest rate since September 2014,

S&P said. The biggest falls in both cases were in

Germany. Commercial building activity also fell for the

ninth consecutive month, said S&P, adding that the

biggest drop was in France.

The gloomy findings underline how rising borrowing

costs, sharply higher raw material prices and worries that a

recession could accelerate a fall in property prices are all

weighing on the European construction industry.

According to the S&P “December data suggested that

firms were anticipating challenging economic conditions

to continue into the future”. More positively, S&P

reported a “sustained easing” in both cost and supply

pressures.

Rise in EU27 import value of tropical furniture masks

fall in quantity

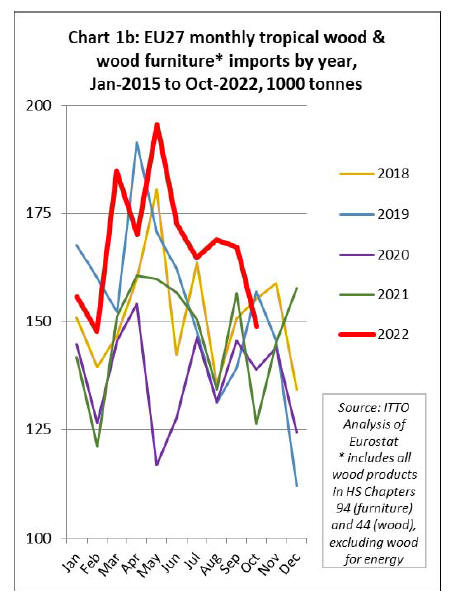

In the first ten months of 2022, EU27 import value of

wood furniture from tropical countries was US$1.52B,

14% higher than the same period in 2021. This increase in

dollar value was entirely due to higher freight rates and

prices and the weakness of the euro last year. In tonnage

terms, imports declined 6% to 305,500 tonnes during the

ten-month period.

In the first ten months of 2022, there were large increases

in EU27 wood furniture import value from Vietnam

(+21% to US$626M), Indonesia (+23% to US$454M),

Malaysia (+17% to US$108M) and the Philippines (+17%

to US$8M). Import value fell from India (-7% to

US$284M) and Thailand (-3% to US$25M). EU27 wood

furniture imports from all other tropical countries were

negligible (Chart 2).

EU27 imports of tropical sawnwood up 24%

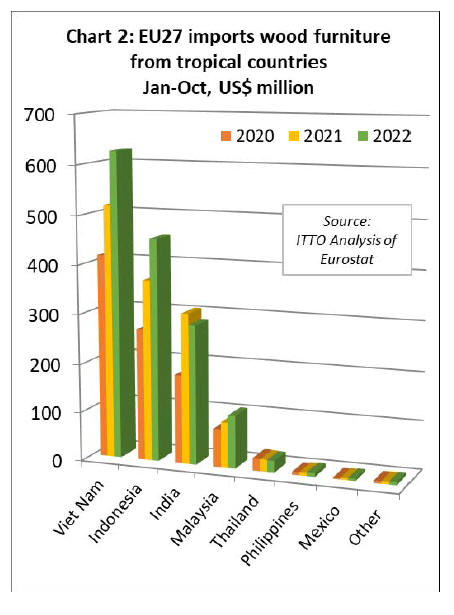

After two slow years during the global pandemic, EU27

imports of tropical sawnwood recovered ground in the first

ten months of last year. Imports of 869,000 cubic metres

between January and October last year were 24% higher

than the same period in 2021 and 34% more than the same

period in 2020.

Sawnwood imports increased during the ten-month period

last year from all the largest tropical suppliers to the EU27

including Cameroon (+23% to 306,400 cubic metres),

Brazil (+47% to 148,700 cubic metres), Gabon (+18% to

133,600 cubic metres), Malaysia (+29% to 77,000 cubic

metres), Congo (+20% to 65,600 cubic metres) and Ghana

(+17% to 25,800 cubic metres).

Of smaller sawnwood supply countries, there were large

percentage increases in imports from DRC (+113% to

11,500 cubic metres), Suriname (+64% to 9,400 cubic

metres), Indonesia (+46% to 9,000 cubic metres), Angola

(+35% to 6,200 cubic metres), and CAR (+167% to 5,700

cubic metres). In contrast imports from Côte d'Ivoire fell

26% to 16,800 cubic metres and from Ecuador were down

17% to 25,800 cubic metres. (Chart 3).

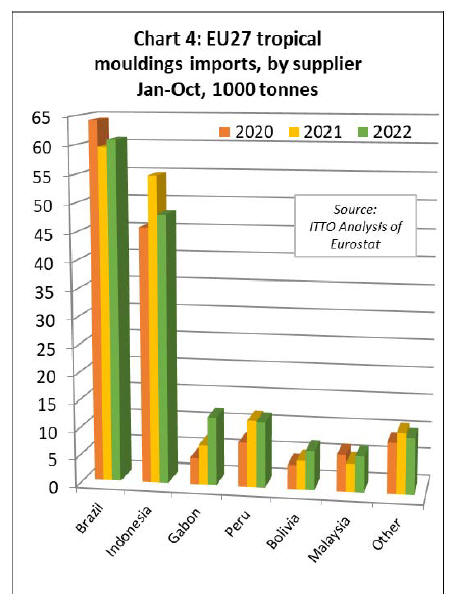

Unlike sawnwood, EU27 imports of tropical

mouldings/decking were slow between January and

October last year. Imports of 156,600 tonnes between

January and October 2022 were just 1% more than the

same period in 2021.

Supply shortages contributed to falling imports from

Indonesia, which declined 12% to 48,000 tonnes during

the ten-month period. The fall in imports from Indonesia

was offset by rising imports from Brazil (+2% to 60,800

tonnes) and Gabon (+72% to 12,400 tonnes).

Of smaller suppliers, there were increases in imports from

Bolivia (+36% to 7,000 tonnes) and Malaysia (+25% to

6,400 tonnes). Imports from Peru declined by 2% to

11,900 tonnes in the first ten months of last year after

strongly rising the previous year (Chart 4).

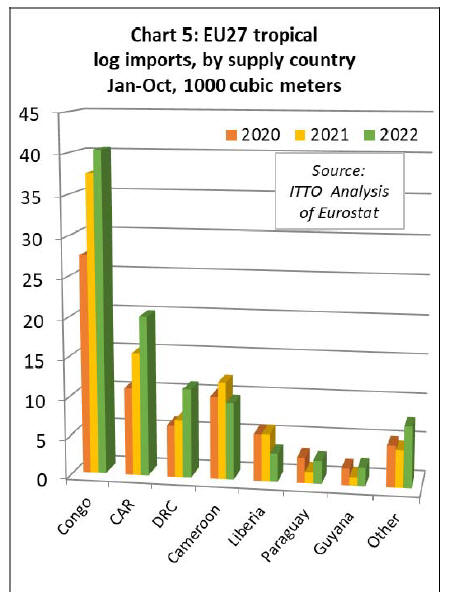

Between January and October 2022, the EU27 imported

98,100 cubic metres of tropical logs, 14% more than the

same period in 2021. (Chart 5)

EU27 log imports increased from all three of the largest

African supply countries in the first ten months of last year

compared to the same period in 2021; Congo (+7% to

40,400 cubic metres), CAR (+31% to 20,100 cubic

metres), and DRC (+56% to 11,200 cubic metres).

In the first ten months of last year imports also increased

sharply from negligible levels in 2021 from two South

American countries, Paraguay (+101% to 2,900 cubic

metres) and Guyana (+123% to 2,300 cubic metres).

However, log imports were down 21% to 9,700 cubic

metres from Cameroon and down 40% to 3,600 cubic

metres from Liberia.

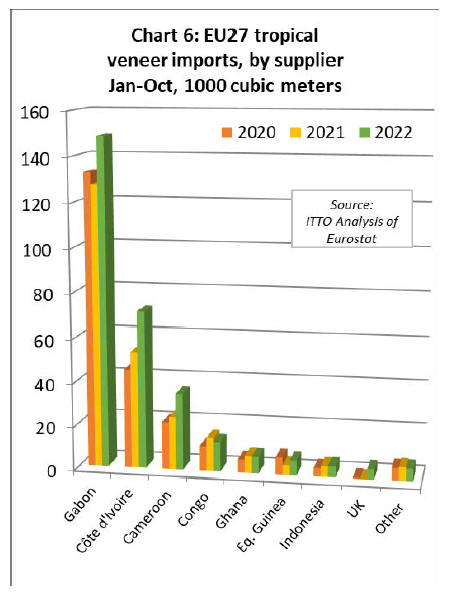

Large gains in EU27 imports of tropical hardwood

veneer from Africa

Between January and October 2022, the EU27 imported

298,300 cubic metres of tropical veneer, 22% more than

the same period in the previous year.

Imports of tropical veneer from Gabon, by far the largest

supplier to the EU27, increased 16% to 148,800 cubic

metres. There were also large gains in imports from Côte

d'Ivoire (+34% to 71,300 cubic metres), Cameroon (+45%

to 35,100 cubic metres) and Equatorial Guinea (+53% to

6,800 cubic metres).

After virtually no indirect trade in tropical veneer to the

EU27 via the UK in 2021, this trade totalled 4,600 cubic

metres between January and October last year. These gains

in EU27 tropical veneer imports were partly offset by a

12% decline in imports from Congo to 13,400 cubic

metres and a 3% fall in imports from Ghana to 7,500 cubic

metres (Chart 6).

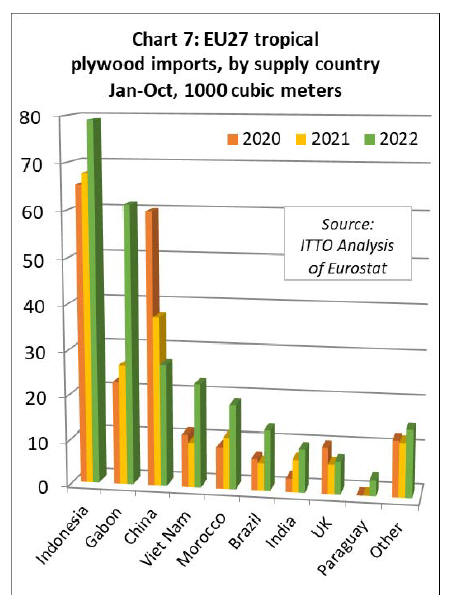

Between January and October 2022, EU27 tropical

plywood imports of 257,900 cubic metres were 39% more

than the same period the previous year. Imports from

Indonesia, at 79,100 cubic metres, were up 17% compared

to the same period in 2021.

However, the biggest percentage increases were in imports

from Gabon and Vietnam, both rising 130% to 61,300

cubic metres and 23,000 cubic metres respectively.

Imports of tropical plywood also increased from Morocco

(+63% to 18,700 cubic metres), Brazil (+119% to 13,400

cubic metres), India (+33% to 9,700 cubic metres), and the

UK (+10% to 7,300 cubic metres).

Tropical plywood imports from Paraguay increased from

negligible levels in 2021 to 3,500 cubic metres in the first

ten months of last year. These gains offset a 28% decline

in imports of tropical hardwood faced plywood from

China to 27,000 cubic metres (Chart 7).

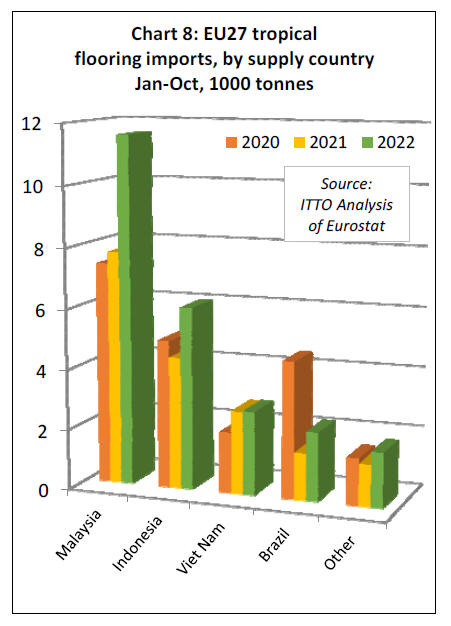

Rise in EU27 imports of tropical flooring from Malaysia

continues

Between January and October 2022, the EU27 imported

24,500 tonnes of tropical wood flooring, 38% more than

the same period in 2021. The rise in EU27 wood flooring

imports from Malaysia that began in 2020 continued last

year.

Imports of 11,600 tonnes from Malaysia in the first ten

months of 2022 were 49% more than the same period in

2021.

There were also large gains, from a smaller base, from

Indonesia (+39% to 6,000 tonnes) and Brazil (+46% to

2,300 tonnes). Flooring imports from Vietnam were, at

2800 tonnes in the ten month period, at the same level as

the previous year (Chart 8).

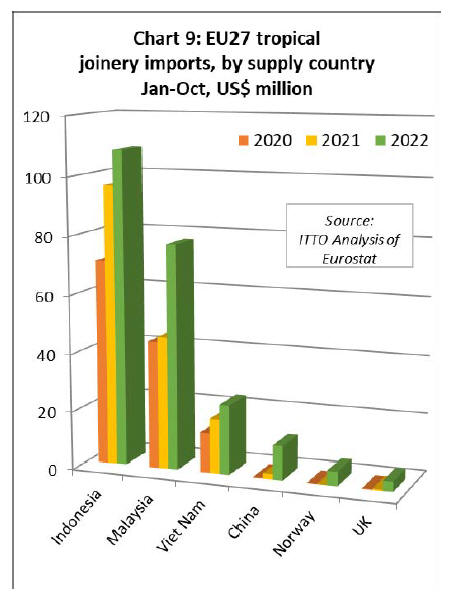

The dollar value of EU27 imports of other joinery

products from tropical countries - which mainly comprise

laminated window scantlings, kitchen tops and wood

doors - increased 40% to US$249M in the first ten months

of 2022. Import value increased 12% to US$108M million

from Indonesia, 69% to US$77M from Malaysia, and 27%

to US$24M from Vietnam. (Chart 9)

The apparent large increase in imports of this commodity

group from China, from negligible levels to US$12M in

the first ten months of last year, is due to a change in

product codes from the start of 2022 allowing more

joinery products manufactured using tropical hardwood in

non-tropical countries to be separately identified (Chart 9).

Unlike for furniture, the rise in import value for joinery

last year was not driven entirely by rising prices but was

also indicative of an increase in import quantity. In

quantity terms between January and October last year, the

EU27 imported 92,800 tonnes of tropical joinery products,

29% more than the same period in 2021.

|