Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jan

2023

Japan Yen 130.22

Reports From Japan

Rising prices, currency fluctuations and

supply chain

constraints hold back recovery

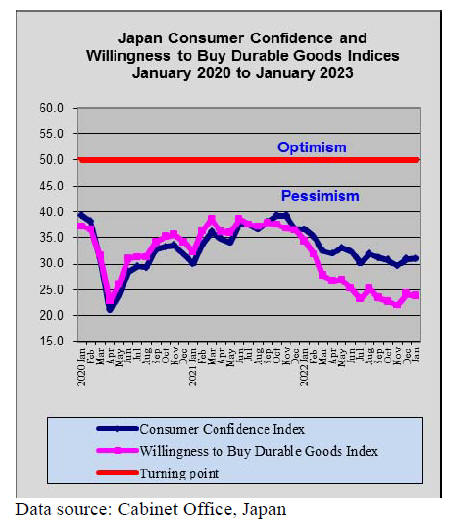

The Cabinet Office monthly report for January says that

while the economy is picking up moderately on the back

of activity in the services sector some weaknesses have

emerged. Exports to China are yet to recover but the report

has a positive outlook for personal spending as the impact

of covid on travel and other services is easing.

The report warns of downside risks including rising prices,

currency fluctuations, supply chain constraints and China's

slow recovery.

Biggest ever trade deficit

Japan recorded its biggest annual trade deficit in 2022 as

higher energy and raw material imports, along with the

yen’s depreciation, drove up costs. The value of imports

jumped 39% led by crude oil, coal and liquefied natural

gas while exports grew only 18% according to a Ministry

of Finance report.

The latest trade data underscores how dependent

Japan is

on raw material and energy.

See:

https://www.japantimes.co.jp/news/2023/01/19/business/economy-business/2022-record-annual-trade-deficit/

Re-classification of COVID-19

The government is discussing a change in policy to lower

the classification of COVID-19 from the current infectious

disease ranking of Category II, the second-highest, to

Category V which includes seasonal influenza. Ministers

ares expected to consider the specifics of reclassification

along with relaxing mask guidelines.

Certain policies would change if the classification was

lowered to Category V including that the government

would no longer be required to cover expenses for medical

bills. The government is expected to continue covering

medical expenses using public funds but this will be

phased out. According to the Ministry of Health the

number of new infections is on a downward trend.

See:

https://japannews.yomiuri.co.jp/society/coronavirus/20230119-84908/

Wage increase the only solution

The continual increases in food and non-perishable goods

show no signs of abating which is bad news for the

economy as household wage earners are still stuck without

meaningful wage growth after many years. Prices for food

saw the steepest year-on-year rise in more than 41 years in

late 2022 even outpacing increases during the bubble

economy period in the late 1980s and early 1990s.

See:

https://www.japantimes.co.jp/news/2023/01/26/business/economy-business/food-price-rises-february/

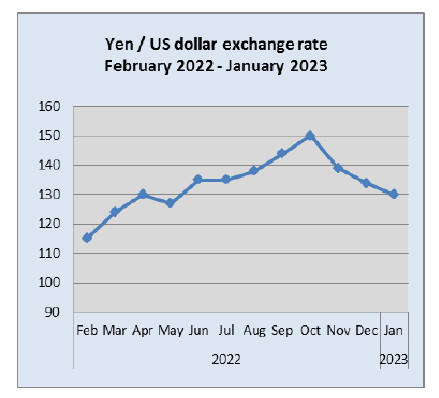

Bank of Japan policy moves causing turmoil

The stated aim of the Bank of Japan (BoJ) is to stabilise

the financial market but recently it has been accused of

causing turmoil and distrust. In December last year, the

BoJ revised its policy to raise the long-term interest rate

cap to "improve market functions" according to the BoJ

governor. This distrust has been fueled by unconvincing

explanations from the BoJ that the decision to raise the cap

was "not a rate hike."

Since the spring of 2022, while central banks in Europe

and the United States have raised interest rates to curb

inflation, the BoJ stuck to its easy monetary policy on the

grounds of underpinning the economy. This has spurred a

weakening of the yen and a rise in prices. The BoJ's

inflation forecast for this fiscal year is 3%, surpassing its

price stability target of 2%.

An editorial in the Mainichi newspaper says” the monetary

policy must be thoroughly examined including the

legitimacy of its goals”.

See:

https://mainichi.jp/english/articles/20230119/p2a/00m/0op/029000c

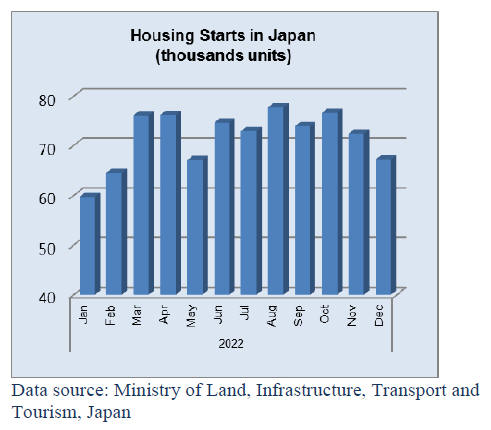

Policy makers haunted by abandoned home

issue

There are millions of abandoned homes in Japan, many of

which are a danger to the public. The government is trying

to address this problem through a revised tax credit

programme to encourage property owners to renovate or

demolish such properties but Japanese demographics are

working against any solution.

As Japanese society ages and the population declines the

stock of abandoned homes will rise.

According to the Ministry of Internal Affairs most recent

survey, nationwide empty homes accounted for almost

14% the total housing stock. The Nomura Research

Institute projects this will rise to 32% by 2038 if the issue

cannot be resolved.

A private survey found many people are unsure what to do

with their childhood home when uninhabited as their

parents had died.

Many old homes are left standing because relatives

do not

want to “part with” their childhood memories, their

parents asked them to retain the houses or it was too

difficult or expensive to clear everything left in the houses,

the group said.

In 2015 a Vacant Houses Special Measures law went into

effect with the aim of reducing the growing number of

unoccupied homes. Under this law, local authorities can

tear down houses that are on the brink of collapse, even if

they cannot locate the owners.

The government has long stuck to its policy of giving

preferential treatment in the form of mortgage tax break to

buyers of newly-built housing but it has until now ignored

the issue of what to do if those homes are eventually

abandoned.

See:

https://www.asahi.com/ajw/articles/14815634

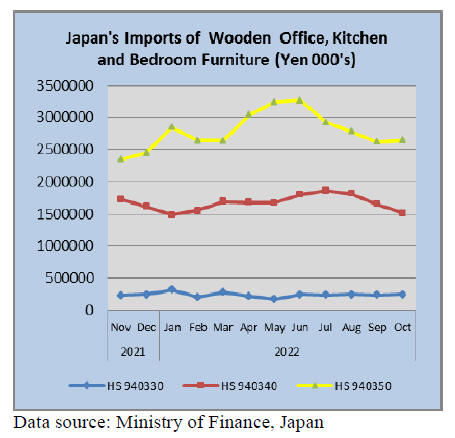

Import update

Furniture imports

Consumer demand for discretionary items such as

furniture continued to be severely affected by exchange

rate issues, unprecedented inflation and rising costs of

everyday necessities.

The downward trend in the value of imports since

midyear

reflects the current depressed state of the market for

wooden furniture in Japan. The least affected segment of

the market is that for wooden office furniture.

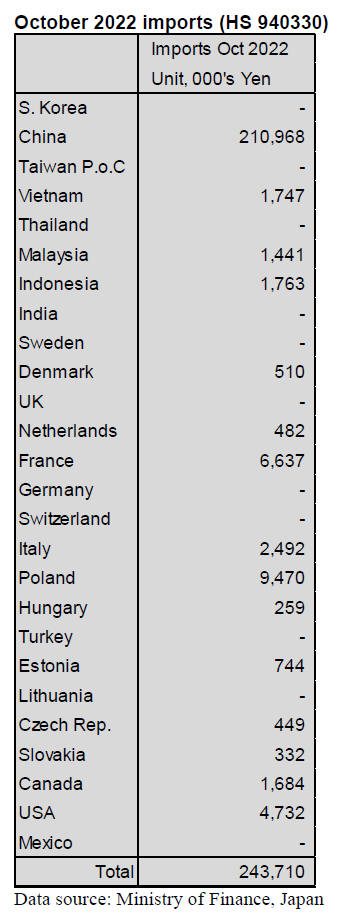

October 2022 wooden office furniture imports (HS

940330)

Wooden office furniture shipments to Japan from

manufacturers in China accounted for 87% of the value of

all imports of HS 940330 in October, little changed from

the value of shipments in September. Poland and France

together made up a further 7% of the value of October

imports. The value of imports from these two suppliers

was down compared to a month earlier.

The big surprise was the steep decline in the value of

shipments from Vietnam. Year on year, October shipments

of HS 940330 to Japan were down slightly with only

shippers in China maintaining the value of exports.

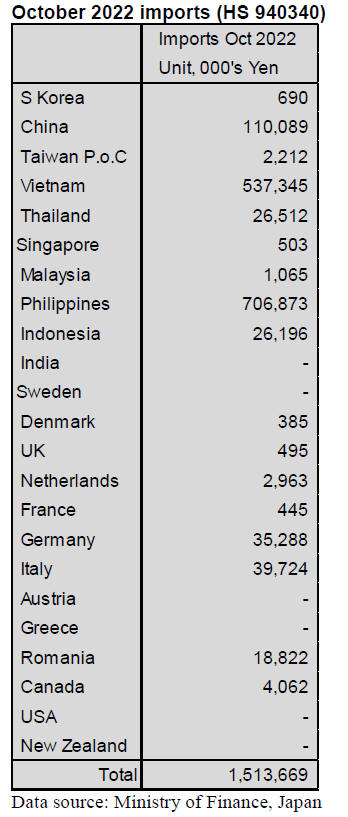

October 2022 kitchen furniture imports (HS

940340)

The top shippers of wooden kitchen furniture to Japan in

terms of value in October were the Philippines, accounting

for 47% of the value of total October arrivals and up from

the previous month and Vietnam (35%) but down slightly

month on month. Three other suppliers, China, Germany

and Italy together accounted for just less than 10% of

October arrivals.

The value of October 2022 imports of wooden kitchen

furniture was around 30% higher than in Ocober 2021 but

month on month there was a drop in the value of

shipments.

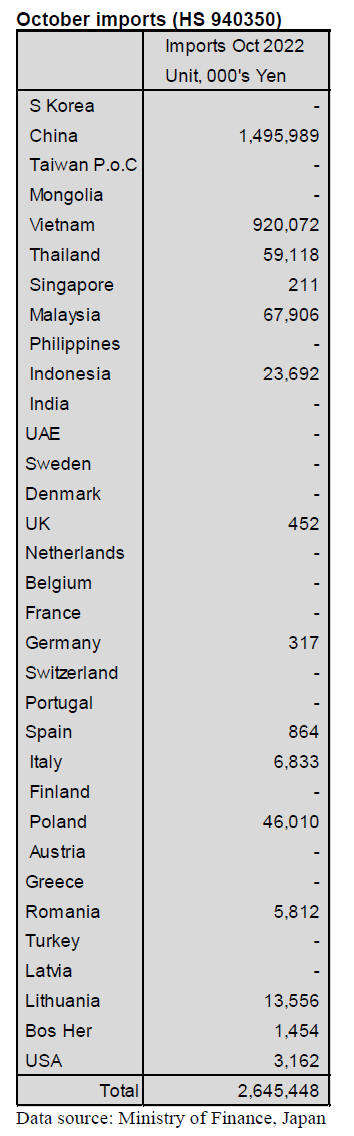

September wooden bedroom furniture imports

(HS

940350)

After three consecutive month declines in the value of

Japan’s imports of wooden bedroom furniture (HS940350)

there was a slight upward correction in October which

came in some 53% higher than in Ocober 2021.

Shipments of HS 940350 from China and Vietnam

dominated Octber imports accounting for over 90% of the

value of imports for the month. Shipments from China

were down compared to a month earlier while those from

Vietnam rose month on month. The other shippers of note

in October were Thailand and Malaysia.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Projection of import wood products

The Japan Lumber Importers Association disclosed a

projection of imported wood products for the first half of

this year.

Volume of imported lumber will be decreased by 25%

from the first half of 2022 and importers adjust supply and

demand. Volume of European lumber, glulam and Russian

lumber will be decreased by 30% from the same periods in

last year.

Total volume of lumber and glulam in the first half of this

year will be 2,455,000 cbms, 25.8% less than the same

periods in last year. It will be about 852,000 cbms

decreasing.

In the second half of 2022, the volume was 2,771,000

cbms and it will be 316,000 cbms lower in the first half of

this year. Total volume during October, 2022 to June,

2023 will be 5,226,000 cbms and this is 741,000 cbms

lower than the 2021’s result. One of the reasons for

decreasing is that there is too much inventory at markets.

That is why the volume of European lumber, glulam and

Russian lumber will be decreased by 30%.

Also, there will be a decrease in volume of North

American lumber. Total volume of European lumber

during October, 2022 to June, 2023 will be 2,135,000

cbms, of North American lumber will be 1,051,000 cbms

and of Russian lumber will be 640,000 cbms. These results

are lower than the 2021’s result. However, there is a

possibility that the volume of lumber would be

overstocking at the end of 2023 to 2024.

On the other hand, volume of logs will be the same

volume from January to June in 2022. Nearly, 90% of logs

will be North American logs. Russian logs are still banned

to import to Japan. South Sea logs will be decreased by

25%.

There are several concerns about wood product business in

this year in Japan. One of them is that the rule of Plant

Quarantine will be strict in August so Japanese importers

might order many logs from overseas before August.

Other concerns are less demand for lumber due to a high

mortgage rate, stagflation in European economy, sluggish

economy in China, the strong yen caused by high interest

rate and a decrease in new starts.

It has been almost a year since Russia had invaded

Ukraine and the war would be worse. If there would be

more economic sanctions for Russia by the nations of the

West, there would be an influence to supply and demand

of forest products. It would be important to balance supply

and demand of imported and domestic wood products.

Plywood

Enquiries for domestic plywood in December, 2022 are

still dull and manufacturers still control production. The

manufacturers do not change the prices and they will wait

until clients start to buy products again.

An issue is the volume of inventory. At the end of

November, 2022, it was 172,811 cbms, 94.5% more than

November, 2021. It was 4.9% more than the previous

month.

However, a rate of increase is getting slow because a rate

of increase at the end of September, 2022 was 33.8%

increasing and a rate of increase at the end of October,

2022 was 10.4 increasing.

Volume of the inventory against shipment is 0.79% month

and this is a proper volume. It was 0.32 month in

November, 2021. There will be less demand for plywood

after the New Year because the inventory will be

controlled for closing accounts at the end of March, 2023

in distribution business. For manufacturers, it will be low

productivity in winter.

A futures price of 12mm South Sea plywood is $10 – 20

lower than before. The yen is recently 130 yen against the

dollar but it was 148 yen when the contracts were signed

up so the import cost is not low. The prices of concrete

forming panes for coating 3 x 6 are $830 – 840, C&F per

cbm and the prices in Japan are 2,590 yen, FOB per panel.

The prices of 12mm 3 x 6 form plywood are $740 – 750,

C&F per cbm and the prices in Japan are 2,310 yen, FOB

per cbm.

In Japan, form plywood for coating is 2,400 yen, delivered

per panel and form plywood is 2,200 yen, delivered per

panel. The prices have to be raised by 200 yen for profit.

South Sea log and products

Demand for South Sea logs increased in last year because

South Sea lumber could not arrive to Japan smoothly due

to delays by a confusion of COVID-19 at ports. However,

in this year, production at Japanese lumber companies get

back to normal and business confidence in the world

worsens so there won’t be much demand for South Sea

logs.

Since demand for decks in the U.S. calms down, there

might be supply to Japan.

The prices of lumber in any size had been high but

Chinese and Indonesian exporters started to lower the

prices since the second half of 2022. Inventory at

distribution business reaches the standard level and

inquiries are good so the prices in Japan will be controlled

as the prices in South Asia decrease.

|