|

1.

CENTRAL AND WEST AFRICA

Congo suspends log exports

Boris Ngounou, writing for Afrik21, reports that the

Republic of Congo suspended log exports as of 1 January

2023. This decision is despite guidelines from the Council

of Ministers of the Central African Economic Union

(UEAC) which decided on 28 October 2022 to postpone,

to an unspecified date, the entry into force of the log

export ban. Cameroon continues to export logs say

Ngounou.

Pointe-NoirePport officials are following instructions from

the Congolese Minister of Forest Economy, Rosalie

Matondo, who announced in a letter dated 21 October

2022 that from 1 January 2023 wood product exports from

Congo would be restricted to semi-finished or finished

products.

While not adopting a log export ban it is reported that the

government in Cameroon has significantly increased

duties and export taxes on logs which prompted some

operators to stop production as of 2 January 2023.

See:

https://www.afrik21.africa/en/congo-ban-on-export-oftimber-in-log-form-comes-into-force/

Buyers tighten demandsfor CITES documentation

Producers in other Cemac countries are seeking

clarification as there has been no official announcement on

whether the export restrictions are in place. Similarly,

producers are yet to learn of the implementation plans for

the latest CITES regulations but report that already

European authorities are asking for CITES documents

without which shipments will be detained until all papers

are cleared. It has been learned that the authorities in

Antwerp are particularly strict which has resulted in some

cargo to be redirected to Amsterdam.

The challenge of added value manufacturing

With the lifting of most covid restrictions in China

producers in the region are optimistic that demand in

China will pick up after the Chinese New Year holidays.

What has many concerned is how to contribute to the

efforts in expanding domestic processing of added value

products. There has been an increase in processing in

Congo and Cameroon and efforts are being made to

manufacture furniture, mainly for the domestic market, to

compete with imports.

Weak demand – mills cut production

It has been reported that in Gabon there are some 234

mills of which 167 are Chinese owned but due to the weak

demand in China 34 peeler mills has ceased production.

However most of the Indian mills are still operating and

production rates have increased as efforts to diversify

markets are paying off.

Demand for ovangkol, padouk, belli for the Chinese

market is holding up and buyers for the Philippines and

Middle East markets are active. However, demand for tali

for the Vietnamese market is said to be soft.

The high stock of okoume in the Gabon SEZ has not been

resolved and there are reports of additional and massive

log stocks in the forest concession areas.

Log transport is a constant issue in Gabon. Most logs are

transported by rail but log shipment take second place

after manganese shipments. Transportation delays will

continue as landslides have damaged large stretch of the

rail line and repairs will take months.

See:

https://www.lenouveaugabon.com/fr/transportslogistique/2812-19328-transport-ferroviaire-la-date-de-reprisedu-trafic-sur-le-transgabonais-toujours-pas-connue

In other news from Gabon, the local media has report the

President as announcing that retirement pension arrears

will be fully paid from January 2023. This may ease the

tensions in the Forest authority which has been plagued by

strike action in recent months.

See:

https://www.lenouveaugabon.com/fr/social/0201-19336-alibongo-promet-de-regler-integralement-les-arrieres-de-pensionsde-retraite-des-ce-mois-de-janvier

What prospects for certified tropical timber in 2023?

The 5th ATIBT ‘Think Tank’ on 7 and 8 December

addressed three themes: Carbon finance and Biodiversity,

Improving the image of tropical timber in Europe and

Exploring new markets for tropical timber. To find the

presentations see:

https://www.atibt.org/fr/resource-categories/29/atibt-think-tankn5-2022

EU timber regulation (EUDR)

The ATIBT has reported that Preferred by Nature is

organising 2 webinars on the new EU deforestation

regulation, one in French on Wednesday, 25 January from

12:00 to 13:15 CET, the other in Spanish on Thursday, 26

January from 15:00 to 16:15 CET.

Registration: contact Julie Thirsgaard Hansen

jhansen@preferredbynature.org.

See: https://www.atibt.org/en/announcements/159/preferred-bynature-

is-organizing-two-new-webinars-in-french-and-spanishon-

the-eudr

Also, the ATIBT has carried out 12 Life Cycle Impact

Assessments (LCIA) for the main certified wood products

from the Congo Basin. The results of these 12 LCIAs are

now available in English.

See: https://www.atibt.org/en/resource-categories/28/life-cycleassessment-

of-congo-basin-timber

2.

GHANA

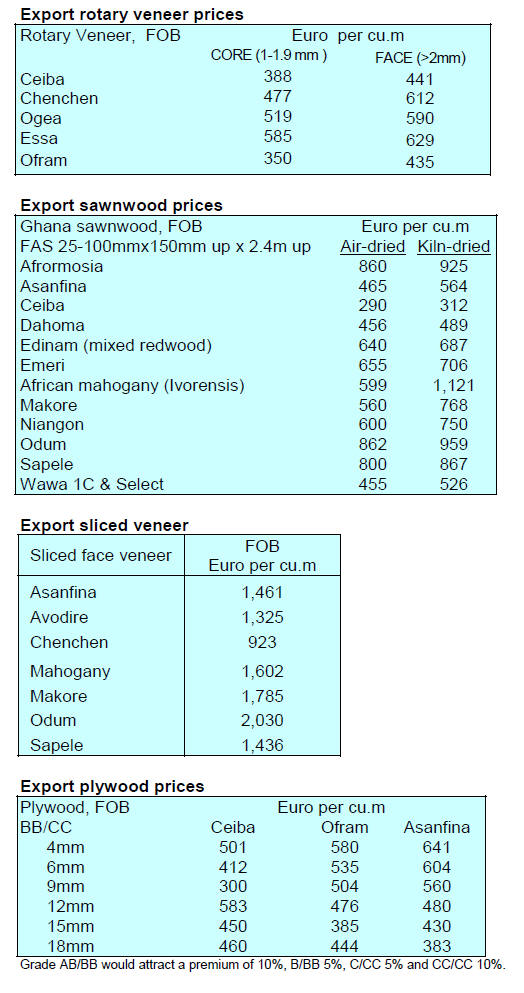

First 9-months wood exports up in volume and value

Wood product exports in the first nine months of 2022

were 267,512 cu.m with a cumulative revenue of

Eur117.14 million according to data from the Timber

Industry Development Division (TIDD) of the Forestry

Commission (FC). This is a jump of 19% in volume and

13% in value compared to the same period in 2021.

The data show that, of the 15 wood products exported, the

top five were air and kiln dried sawnwood (68%), billet

s(12%), plywood for the regional market (10%) and sliced

veneer (3%) with 10 other products accounting for the

balance.

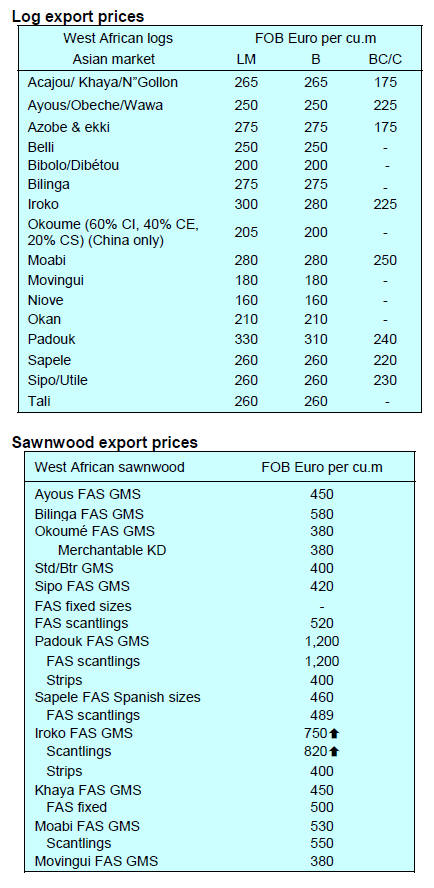

The graph below shows the wood export by product;

Leading wood product exports (Volumes, Jan-Sep 2022)

According to the TIDD report there were eighty-two

exporters in September 2022 of which the top five

exported ten different wood products from forty species to

thirty-eight countries.

The leading species in terms of volume were teak, ceiba,

wawa, denya, and black ofram. The main markets were

India, Togo, Burkina Faso, Germany and Vietnam.

Chenchen recorded the highest decline in volume in the

first three quarters of 2022 dropping by over 45%.

The average unit price of products exported for the period

January to September 2022 decreased to Eur438 per cu.m,

from the previous Eur460 per cu.m recorded in January to

September 2021.

Product exports by category

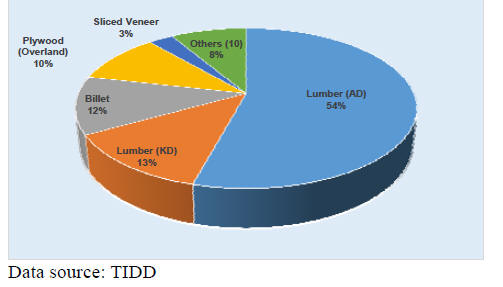

The table below shows the breakdown of the wood

products exported from Ghana as primary, secondary and

tertiary which accounted for tall shipments for the period.

Primary products, mainly billets, contributed 31,302 cu.m

(12%) and Eur10.07 million (9%) in volume and value

respectively in the first three quarters of 2022.Secondary

products being the largest group comprised of sawnwood,

boules, veneers, plywood and briquettes and contributed

229,055 cu.m (86%) and Eur101.76 million (87%) to

earnings in the period January to September 2022.

Exports of tertiary products, consisting of moulding and

dowels, contributed 7,154 cu.m and Eur5.31million in

volume and value respectively in the first three quarters of

2022. For the period under consideration the volumes of

primary and tertiary products dipped in 2022 when

compared to 2021. However, the proportion of secondary

products increased to 86% in 2022 from 80% recorded in

2021.

It is the aim of government to transform the industry away

from exports of primary to exports of value added

products and this could explain the higher volumes for

4 ITTO TTM Report: 27:1 1 - 15 Jan 2023

secondary products which account for over 80% of total

export volumes. Tertiary product exports have been lower

than expected due to the general economic operational and

technical bottlenecks affecting the manufacturing sector.

Government to support private plantation developers

Government has assured the private sector that support

and cooperation will be provided if they participate in

establishment of commercial forest plantations to create an

industrial timber resource and help restore degraded forest

landscapes.

The Minister for Lands and Natural Resources, Samuel A.

Jinapor, said this during a forum on loan scheme

awareness for private plantation developers in the Ashanti

Region of Ghana. The Forum was organised by the Ghana

Forest Investment Programme (GFIP) under the auspices

of the Ministry of Lands and Natural Resources,

Mr. Jinapor assured participants of the government’s full

backing and encouraged developers to actively get

involved.

In a related development, Ghana has obtained US$486.2

million as first payment from carbon sales.

See:

https://www.ghanaweb.com/GhanaHomePage/business/Ghanagets-486-2-million-from-carbon-sale-1680389

Ghana/UK Business Council supports bilateral trade

The Vice President, Dr. Mahamudu Bawumia, has hailed

the efforts of the UK-Ghana Business Council (UKGBC)

established to enhance trade and cooperation between the

Governments of Ghana and the United Kingdom.

Speaking at the 7th session of the Council Dr. Bawumia

said the UKGBC has helped Ghana benefit from the

funding for major infrastructure projects. He emphasised

that both the UK and Ghana continue to deepen and

increase bilateral ties on trade and investment. The UK is a

leading importer of Ghana’s wood products including

sawnwood, mouldings, veneers and briquettes.

See:

https://www.myjoyonline.com/bawumia-hails-impact-ofuk-ghana-business-council-on-ghanas-infrastructuredevelopment/

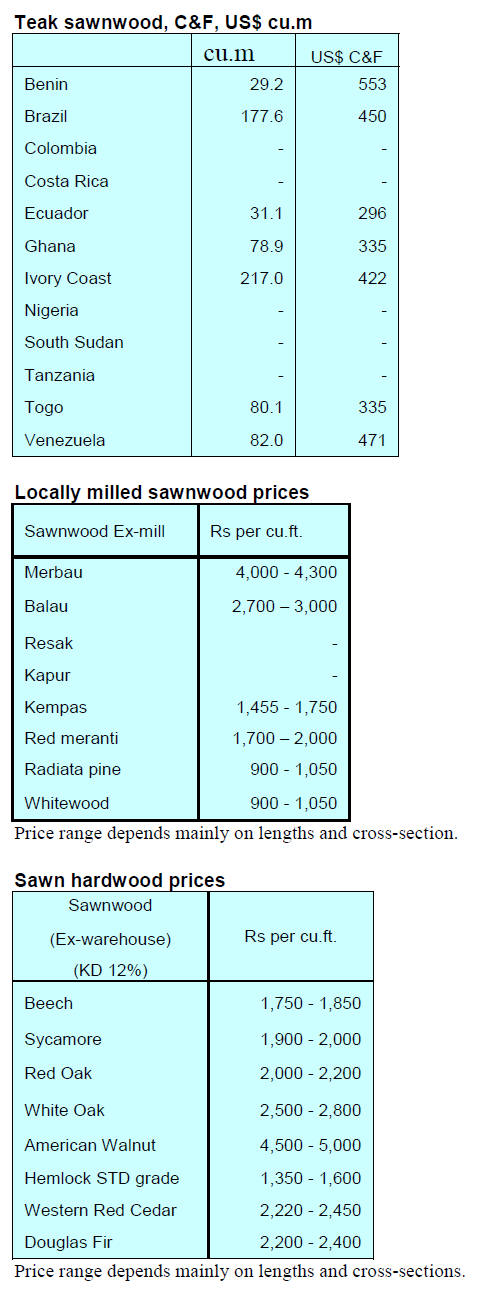

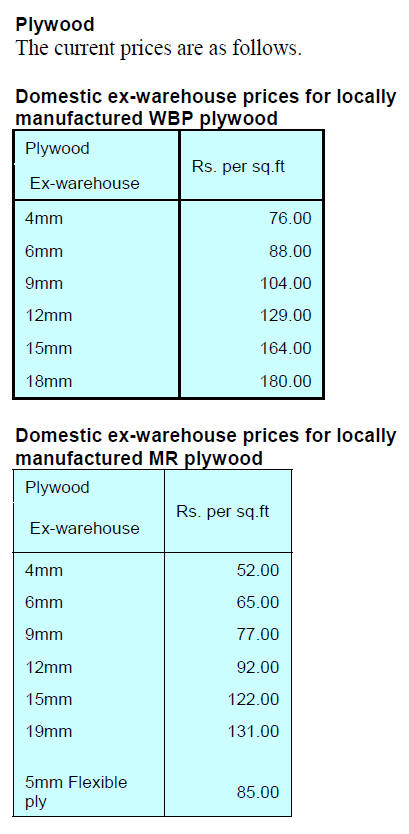

3. MALAYSIA

Moderate growth forecast

The economy is expected to grow by only 4% this year

due to the negative impact of moderating exports but could

be held up by normalisation of domestic demand and

success in taming domestic inflation. However, the impact

of higher interest rates will eventually have an impact on

consumption. It is expected that Bank Negara is unlikely

to shift from monetary tightening policies in 2023.

See:

https://www.thestar.com.my/business/businessnews/2023/01/10/moderate-growth-for-2023

Free and fair trade at risk

The Malaysian Timber Council has reported Deputy Prime

Minister, Datuk Seri Fadillah Yusof’s concerns on the

European Council’s decision on the EU Deforestation-

Free Products Regulation as this will include commodities

including palm oil, timber, cocoa and rubber.

The Deputy Prime Minister said the unilateral initiative is

detrimental to free and fair trade and could result in

adverse effects on the global supply chain.

See:

https://mtc.com.my/images/media/1350/DPM_Fadillah_states_M

alaysia---s_concern_over_new_EU_green_law_targeting_commodities___Malay_Mail.pdf

The Malaysian Prime Minister, Anwar Ibrahim, recently

met his Indonesian counterpart and discussed economic

cooperation and regional security issues. Indonesia and

Malaysia have decided to work together to defend their

exports of palm oil, a commodity included in the EUDR

(European Union Deforestation Regulation). The leaders

agreed to work to promote the commodity through the

Council of Palm Oil Producing Countries.

See: https://www.trtworld.com/magazine/why-indonesia-andmalaysia-

are-calling-out-eu-discrimination-64314

In related news, Sabah Timber Industries Association

(STIA) president Tan Peng Yuan has warned the timber

industry will be facing challenges in the coming year, one

of which is timber certification.

The STIA is concerned that the EU will be enforcing

additional requirements under the EUDR that may limit

Sabah’s products access into the market. If market access

is restricted the impetus for investment in both planting

and manufacturing could be lost, he said. According to

Tan, Sabah is well advanced with the state’s TLAS

certification system which was developed through a welldefined

Chain-of-Custody process.

See:https://www.theborneopost.com/2023/01/08/sabah-timberindustry-

to-face-certification-challenge/

Rules covering recruitment of foreign workers eased

The government has eased the rules for covering

recruitment of foreign workers. The Prime Minister (PM)

said the new ‘Plan to Facilitate the Hiring of Foreign

Workers’ (Pelan Kelonggaran Penggajian Pekerja Asing)

will allow employers to hire foreign labour without

constraints or any preconditions or quotas.

A Malaysian delegation will be organised to visit countries

to discuss matters related to the safety and wellbeing of

foreign workers in Malaysia according to the PM.

See: https://www.theborneopost.com/2023/01/10/pm-anwarputrajaya-

eases-rules-on-the-hiring-of-foreign-workers

Plantations the future for Sabah industry

The timber industry is still one of the main contributors to

Sabah’s economy. Exports generated by the timber sector

in the first half of 2022 totalled RM588 mil., an increase

of 22% in value compared to the same period in the year

2021. In terms of volume, there was a increase of over 9%.

The main products exported included plywood, sawn

timber and moulding-related products.

Sabah Deputy Chief Minister Dr. Joachim Gunsalam, said

the Sabah government has been managing the state’s

forest in a sustainable manner since the establishment of

the Sustainable Forest Management (SFM) Policy in 1997.

In addition to this, he said the timber industry in Sabah

willsee significant changes in the future with plantation

timber taking over as the primary source of raw material

for both the upstream and downstream sectors.

To achieve this transformation the State government

launched the Action Plan on Forest Plantation

Development (2022-2036) in March 2022 under which it

is planned to establish 400,000 hectares of forest

plantations by 2035 to reduce dependence on timber from

natural forest reserves.

The Forestry Department has also deemed it important to

ensure there is a reduction in the number of logging

concessions allocated. It is forecast that 400,000 hectares

of forest plantations will produce 200 cubic metres of

timber per hectare per year, a significant volume which

will attract investment in processing.

See: https://www.theborneopost.com/2023/01/08/timberindustry-

still-main-contributor-to-sabahs-economy/

Unconventional funding for Agarwood

Agarwood, the resinous part of the Aquilaria tree, is a

valuable commodity and has been traded for millennia for

medicine and fragrances. The global agarwood market

trade is estimated at US$32 billion. Malaysia is a leader in

the cultivation of Aquilaria.

DAdvance Agarwood Solutions is one of Malaysia’s

leading firms involved in bio-serum engineering for

agarwood inoculation and has had success in

unconventional fund raising to expand its business. It

recently raised RM1.92 million through an equity

crowdfunding (ECF) campaign. ECF is a method of

raising capital often used by start-ups

See:

https://www.freemalaysiatoday.com/category/highlight/2022/12/30/agarwood-firm-opts-for-equity-crowdfunding-to-raise-funds/

Furniture exports to the US

The furniture industry is assessing how inflation, the rising

cost of living and energy disruptions will impact

international trade.

US imports of furniture from Malaysia slowed in recent

months as US importers liquidated their over-inventoried

positions. This trend is expected to continue as a

slowdown in the US housing sector amid rising interest

rates and the higher cost of living will adversely impact

purchases of furniture.

See:

https://www.thestar.com.my/business/businessnews/2023/01/04/poh-huat-to-see-slow-furniture-demand-fromthe-united-states

Bamboo charcoal

A company in Sarawak has signed a memorandum of

understanding with the Sarawak Timber Industry

Development Corp (STIDC) to establish the bamboo

plantations for the production of charcoal.

It is planned that a technical team will be established and

efforts will be directed to collaborate with communities

for bamboo contract farming and production of bamboobased

handicrafts . Under the STIDC Bamboo Industry

Development Masterplan drawn up in 2019, Sarawak

targets to plant at least 20,000 ha of bamboo for industrial

purposes to generate RM200 mil. in export earnings by

2030, apart from creating 5,000 jobs.

See: https://www.thestar.com.my/business/businessnews/2023/01/02/pertama-ferroalloys-to-invest-in-greenbamboo-plantation

4.

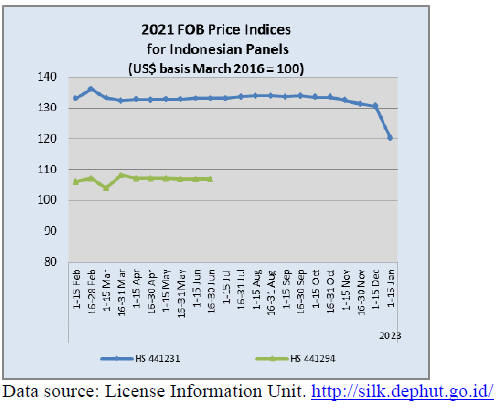

INDONESIA

Association warns of recession risk

Exports of Indonesian wood products increased in 2022

but the Ministry of Environment and Forestry (KLHK)

quoting the Association of Indonesian Forest Concession

Holders (APHI) has warned of a possible global recession.

Up to November 2022 exports of processed wood products

reached US$13.27 billion, close to the total value of export

in 2021 which was the highest on record for processed

wood products.

The 2022 performance (as of November) was supported

by paper products US$3.98 billion, up 18% (YoY)

followed by pulp products US$3.31 billion an increase of

13% (YoY). Plywood exports were US$2.67 billion, down

1.6% YoY and furniture US$2.11 billion, up 14% YoY.

Wood product exports to Japan up to November 2022

recorded an increase of 13% YoY while exports to the

Republic of Korea increased 6% YoY. Exports to the

European Union + UK increased by 10% YoY to US$1.16

billion and exports to India increased by 38% YoY to

US$471.5 million. However, demand in Indonesia's main

market, China, was weak.

In related news the KLHK revealed that the 2022 export

value of industrial forest products was good being almost

one and a half times above the target of US$10 billion.

See:

https://forestinsights.id/2022/12/23/kinerja-ekspor-kayuolahan-indonesia-dekati-rekor-tapi-resesi-mulai-membayangi/

and

https://wartaekonomi.co.id/read470381/realisasi-ekspor-produkindustri-hasil-hutan-capai-us14-milyar-klhk-kami-masih-butuhterobosan?page=2

Development of non-timber forest products

The KLHK is promoting the development of non-timber

forest product enterprises according to Agus Justianto,

Director General of Sustainable Forest Management.

Forest utilisation business permit (PBPH) holders are

being asked to optimise the utilisation of non-timber forest

products and not just focus on timber. Agus said "we have

a policy called forestry multi-business to encourage PBPH

holders to explore, even utilise non-timber forest

products".

See:

https://www.medcom.id/english/business/RkjegRWbministry-pushes-development-on-non-timber-forest-productbusinesses-in-indonesia

Social Forestry generates IDR 1.98 Trillion

The total area of community managed forests covers 5.3

million hectares spread across the entire country and

involves over than 1.2 million households.

Bambang Supriyanto, Director General of Social Forestry

and Environmental Partnerships (PSKL) in the KLHK,

said that this achievement was supported by cross-sector

collaboration adding that almost 10,000 Social Forestry

Business Groups (KUPS) have been formed. The

economic transaction value in the KUPS reached IDR

117.59 billion as of November 2022.

Bambang said "innovations in developing economic-scale

businesses and product down-streaming through Integrated

Area Development (IAD) programmes are carried out in

collaboration with many stakeholders.

See:

https://www.gatra.com/news-561696-lingkungan-klhkklaim-akses-kelola-perhutanan-sosial-capai-53-juta-hektare-di-2022.html

Towards new climate partnership

According to a newly-released joint statement by the

Governments of Indonesia and the United States reported

by the KLHK, Indonesia and the US will formulate a

framework agreement aimed at launching a new climate

partnership worth up to US$50 million.

The joint statement follows the release of a White House

Fact Sheet, titled ‘Strengthening the U.S.-Indonesia

Strategic Partnership’ related, among other things, to the

“Preserving Biodiversity” component, decided during the

G20 bilateral meeting between President Jokowi and

President Biden.

See:

https://id.usembassy.gov/id/klhk-dan-usaid-umumkankerjasama-perubahan-iklim-baru-untuk-dukung-rencanaoperasional-folu-net-sink-2030-indonesia/

Trade surpus to reach US$38.5 billion in 2023

Head of the Trade Policy Agency of the Indonesian

Ministry of Trade, Kasan, has projected a trade surplus of

US$38.3 billion to US$38.5 billion in 2023.

The Ministry of Trade is targeting non-oil and gas export

growth to lie in the range of 4-5%. Meanwhile, oil and gas

exports are projected to grow 7-8%. The ministry launched

two priority programmes aimed at strengthening the

domestic market and increasing non-oil and gas exports.

See:

https://en.antaranews.com/news/266570/indonesias-tradebalance-projected-to-reach-us385-billion-in-2023

5.

MYANMAR

UNSC expresses “deep concern”

In December 2022 the United Nations Security Council

(UNSC) yesterday adopted its first resolution on Myanmar

in more than seven decades, expressing “deep concern” at

the situation that has engulfed the country since the

military take over in February 2021. The resolution was

adopted with 12 of the 15 members of the UNSC in favor,

while India, China and Russia abstained.

See:

https://press.un.org/en/2022/sc15159.doc.htm

Fading prospects for forest product exports

As a result of the ongoing international pressure and

restrictions on trade in products from Myanmar exports of

timber have been affected.

The cumulative result of the US Burma Act (recently

revised), OFAC and FATF resolutions on financial

transactions and action by the EU parliament have had a

striking impact, not only timber trade but also the entire

business sector.

In addition to external action there are also internal factors

which have slowed the timber trade. The Myanma Timber

Enterprise (MTE) is the sole and official supplier of logs

to the sector but the MTE is facing difficulties to transport

logs from the extraction sites to Yangon where many

processing mills are located because of the security threat

from the anti-government forces.

Changes to export regulations have also undermined

exports of wood products. In August 2022 an order was

issued revising the definition of type of wood products.

It was decreed that sawnwood greater than a crosssectional

area of more than 24 square Inch (for example

width 8-inch and thickness 3-inch or width 12-inch and

thickness 2-inch) shall be regarded as rough sawn and

exports are prohibited. As a result squared logs and

veneer flitches cannot be exported and this has cut into

export earnings.

Annual export earnings from timber exports have fallen to

around US$10 million over the past three years according

to data from the of Ministry of Commerce.

See:

https://myanmar-now.org/en/news/us-house-passes-burmaact-with-new-amendments,

and

https://www.en.etemaaddaily.com/world/international/fatf-addsmyanmar-to-list-of-high-risk-countries:121346#:~:text=Mon

24Oct 2022

Foreign investment flows

The Myanmar Investment Commission has reported it

approved 59 foreign investment projects from eight

countries between April and December of the current

financial year 2022-2023.

The country attracted capital of US$1.46 billion which

included expansions by existing enterprises. The sectors

that attracted most investment were agriculture,

manufacturing, power, real estate and services.

Singapore was the top source of FDI with 14 Singaporelisted

enterprises investing US$1.154 billion into

Myanmar. Hong Kong SAR was the second largest

investor with an estimated investment of around US$165

million for 12 projects. China was the third largest

investor at US$95.6 million for 27 projects.

From 1 February 2021 the Thilawa SEZ attracted capital

flows for expansions, around US$100 million and from

one new enterprise. The majority of the investments are

for cement and pharmaceutical manufacturing.

See:

https://www.gnlm.com.mm/mic-bags-59-foreign-projectsworth-1-46-bln-in-nine-months/

6.

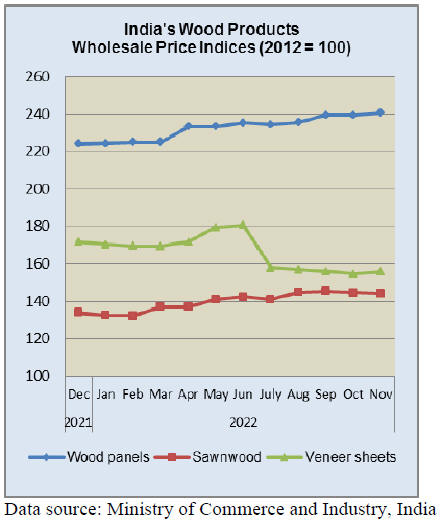

INDIA

GDP set to slow

The Indian government expects economic growth to have

slowed in the financial year ending March. GDP is

forecast to rise 7% this fiscal year compared with 8.7% the

previous year, according to the Ministry of Statistics. This

is much lower than the government's earlier forecast of

8%-8.5% but above the central bank's projection of 6.8%.

India's economy rebounded after COVID-19

restrictions were eased around mid-2022 but the Russian

invasion of Ukraine has spurred inflationary pressures

prompting the Reserve Bank of India (RBI) to reverse the

ultra-loose monetary policy it adopted during the

pandemic years.

The RBI increased interest rates by 2.25% between May

and December in an aggressive response to rising inflation

which hit a high of 7.79% in April. In other news, higher

commodity costs and a weaker rupee have caused a

deterioration of the trade balance. The rupee hit record

low last year, plunging more than 11% against the US

dollar.

See:

https://www.hurriyetdailynews.com/india-gdp-growthforecast-to-slow-to-7-percent-179954

According to the OECD, despite slower growth, India

is

set to be the second-fastest growing economy in the G20

in FY 2022-23, even with decelerating global demand and

the tightening of monetary policy to manage inflationary

pressures.

See:

https://www.oecd.org/economic-outlook/november-2022/

Welcome dip in inflation

The annual rate of inflation based on the Wholesale Price

Index was 5.85% in November 2022 compared to 8.39%

in October 2022. The decline in November inflation was

primarily contributed by fall in prices of food, basic

metals, textiles, chemicals and paper products.

The wholesale price index for manufacturing declined

in

November to 141.5. Out of the 22 NIC two-digit groups

for manufactured products, 11 groups saw an increase in

prices while 10 groups declined. The increase in price was

mainly contributed by food, fabricated metal products,

non-metallic mineral products and machinery and

equipment.

Declines were recorded for basic metals, textiles,

chemicals, paper products along with rubber and plastics

products.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Trade deficit widens

The latest trade data released by the Ministry of

Commerce and Industry show India’s exports were worth

almost US$32 billion in November 2022 while imports

were valued at almost US$56 billion. Exports grew by

0.6% over November 2021 while imports grew by 5.4%.

The rise in the value of imports could have been higher if

it was not for the rise in imports of Russian crude oil

produced in the Arctic region offered at steep discounts

after Europe stopped oil imports from Russia.

Bio-fuel from planted degraded land

India is looking to replicate global models to

commercially grow cactus on degraded land to produce

bio-fuel, food, fodder and bio-fertliser. This has been

discussed in the Ministry of Rural

Development. Government estimates show degraded land

increased to 97.84 million hectares in 2018-19 from 96.32

million hectares in 2011-13.

The government is committed to increased farmers’

income and cultivation of cactus could significantly lift the

economies in states which have vast tracts of degraded

land. Rajasthan, Maharashtra and Gujarat are the top three

states with most degraded.

See: https://economictimes.indiatimes.com/news/india/govtmulls-

cactus-plantation-on-degraded-land-for-biofuelfood/

articleshow/96407372.cms?from=mdr

7.

VIETNAM

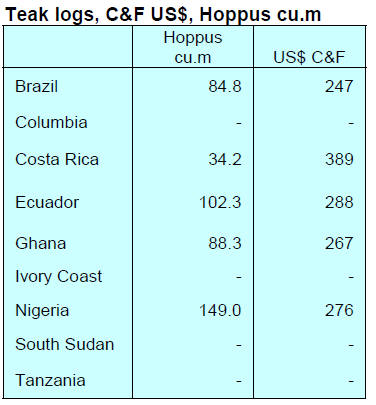

Wood and Wood Product (W&WP) Trade

Highlights

According to data provided by Vietnam General Statistics

Office, Vietnam’s W&WP exports in December 2022

reached US$1.16 billion, down 1.2% compared to

November 2022 and down 19% compared to December

2021. Of this, export of wood products (HS 94) accounted

for US$782 million, up 2.8% compared to 11/2022, but

down 27% compared to December 2021.

In 2022 the accumulated W&WP exports totalled US$15.8

billion, up 7% year-on-year. WP exports alone amounted

to US$10.9 billion, down 1.3% compared to 2021. Over

US$1 billion was contributed by exports of NTFPs. The

total export earnings from forest products is reported at

US$16.8 billion.

Vietnam's W&WP export to South Korea in December

2022 reached US$102 million, up 11% compared to

December 2021. In 2022 the W&WP exports to the

Korean market are estimated at US$1.02 billion, up 15%

compared to 2021.

Exports of woodchips in December 2022 were valued at

US$220 million, up 58% compared to December 2021. In

2022 the total export of wood chips is estimated at US$2.7

billion, up 55% compared to 2021.

W&WP imports in December 2022 totalled at US$230

million, up 4% compared to November 2022. In 2022

Vietnam spent US$3.052 billion to import W&WPs from

over 100 sources with the year-on-year growth of 4%.

With the great surplus of export over import the forestry

and wood industry has been greatly appreciated for

substantial contribution to the national economic balance

and sustainable growth.

According to Vietnam General Statistics Office in the first

11 months of 2022 the area of newly planted forests is

estimated at 26,600 hectares, up 5% over the same period

last year.

The number of scattered trees planted during the year is

reported at 96.5 million, up 5%; the volume of harvested

wood is estimated at 34.6 million cu.m, up 7%; the loss of

forests due to violations and forest-fires was reported at

1,047.6 ha, year-on-year down 58%, of which burnt forest

area was 37.9 ha, down 97%; the violated area was

1,009.7 hectares, down 2%.

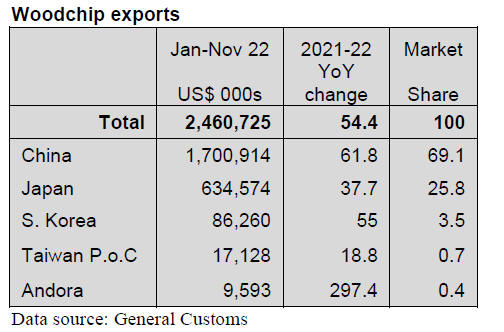

Woodchip export increase significantly

In the first 11 months of 2022 woodchip exports to China,

the top destination, were worth US$.7 billion, up 62%

over the same period in 2021 followed by the Japanese

market (US$634.6 million, up 38%), South Korea

(US$56.3 million, up 55%), Taiwan P.o.C (US$17.1

million, up 19%).

China increased imports of wood chips from Vietnam not

only for the pulp and paper industry, but also for pellet

production. In addition to Chinese market, the growth of

woodchip export to South Korea and Japan also increased

as these 2 countries continue to have the transition from

coal power to clean electricity, including biomass power.

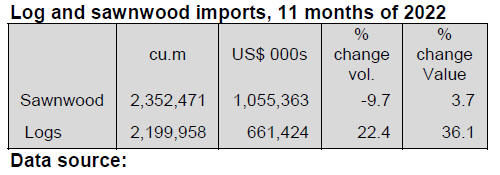

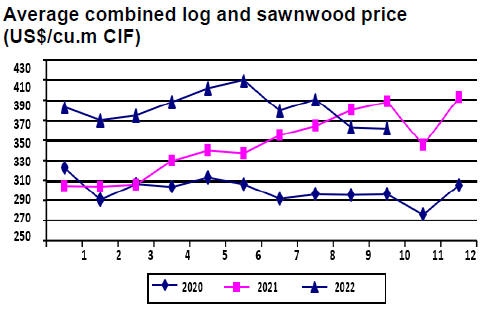

Log and sawn wood imports in 2022

In December 2022 Vietnam imported 505,700 cu.m of

logs and sawnwood, worth US$177.0 million, up 4.4% in

volume and 4% in value compared to November 2022.

Compared to December 2021 there was an increase of

35% in volume and 20% in value.

In 2022, in total, the imports of logs and sawnwood to feed

manufacturing industries are estimated at 6.04 million

cu.m, worth US$2.28 billion, down 4.5% in volume and

down 6% in value compared to 2021.

Due to the decreased demand for interior and out-door

furniture in the US and EU markets Vietnam’s imports of

non-tropical softwood and hardwood, including pine,

poplar, oak, ash, birch, beech declined. In the contrast, the

imports of tropical hardwood, such as tali, padouk, pachy,

mahogany to meet local demand increased.

Log and sawnwood imports in the first 11 months of 2022

In the first 11 months of 2022 log and sawnwood imports

amounted to 4,552 million cu.m worth US$1.72 billion.

In 11 months of 2022 the mean price of imported logs and

sawn wood was US$380.5/cu.m CIF, up 12% year-onyear.

Log and sawn wood suppliers

In the first 11 months of 2022 the volume of raw material

imported from major suppliers such as the US, China,

Thailand, Brazil, Chile and New Zealand decreased

compared to the same period in 2021. In the contrast,

imports from several sources uch as the EU, Cameroon,

Papua New Guinea, Laos, Nigeria and Congo increased.

Log and sawnwood imported from the US accounted for

12% of total imports in the first 11 months of 2022,

reaching 645,300 cu.m worth US$307.9 million, down

0.5% in volume but up 3% in value over the same period

in 2021.

Imports from China decreased by 35% in volume and 12%

in value and amounted to 613,500 cu.m, worth US$333

million equal to 11% of total imports.

In addition, imports from some other markets decreased:

from Thailand imports dropped 2%, Brazil by 32%, Chile

by 25%, New Zealand by 33% and Uruguay by 8%.

Conversely, imports from the EU increased by 1.5% in

volume and 15% in value over the same period in 2021

reaching 775,600cu.m, worth US$258 million and

accounting for 14% of total imports.

The imports of tropical hardwood from traditional

suppliers experienced significant growth with Cameroon

up by 36%, Papua New Guinea by 88%, Laos by 73%,

Nigeria by 64%, Congo by 86%, Hong Kong by 85% and

Argentina by 27%.

Positioning Vietnamese brands on the global map

Vietnamese made wooden furniture brands are still almost

"unknown" in the international market since they are

mainly traded through foreign enterprises. Changing this

can bring higher value to wood and furniture products and

contribute to the positioning of Vietnamese wood and

furniture brands on the global map.

Brands unknown to global consumers

According to the Department of Forestry more than 2,600

enterprises are exporting wood products. Of these, there

are 750 FDI units and 1,850 domestic units. Vietnamese

wood product brands are well positioned in the domestic

market but building brand image in international markets

is a challenge.

The domestic market has identifiable wooden furniture

brands such as Dong Ky Wood Village - Bac Ninh; Ho

Nai - Bien Hoa furniture craft village and the brands

owned by enterprises such as Hoang Anh Gia Lai Wood

JSC (Gia Lai); An Cuong Wood JSC (Binh Duong); Hoa

Phat Furniture JSC (Hung Yen); and Thuan An Wood JSC

(Binh Duong).

In addition to meeting domestic consumption of about

US$3-4 billion/year Vietnam's wood industry exports, on

average, generate more than US$15 billion per year

making Vietnam the 5th largest suppliers in the world, 2nd

in Asia, 1st in Southeast Asia. The export markets for

Vietnamese furniture have expanded from 60 countries

and territories in 2008 to more than 120 countries and

territories by 2022.

However, in export markets Vietnamese wood and wood

products have only won the trust of traders, wholesalers

and agents but have not yet made an impression on, or

attracted individual consumers.

According to the Department of Forestry the reason for

this situation is that a branding policy in the wood

processing industry has not been implemented.

Vietnamese wood and wood product enterprises do not

have experience and lack resources to develop overseas

sales systems which are the foundation for building a

brand image. In addition, developing overseas markets

requires large-scale production capacity but few

Vietnamese enterprises can meet this requirement.

Branding to add value

According to Nguyen Quoc Khanh, Chairman of the

Handicraft and Wood Industry Association of HCM City

(HAWA) and AA Company, Vietnamese enterprises need

to change their mindset of making money by being

diligent in production but need to build their brand.

Building a brand helps businesses develop their vision and

orientation, increase the customer base, ease access to

international markets and optimise profits.

A brand will increase a product’s commercial value

contributing to the increase in export earningsand position

the furniture industry of Vietnam on the global map.

Nguyen Van Dien, Director of the Forestry Production

Development Department - Ministry of Agriculture and

Rural Development, said that the Ministry of Agriculture

and Rural Development is assigning the Department of

Agricultural Product Processing and Market Development

to develop a decree on the branding of essential

agricultural products. "When this decree is issued

enterprise a branding process will be possible because it

can be done methodically and scientifically thereby

achieving better results," said Dien.

Additionally, to support businesses in developing their

brands, the Department of Forestry proposed the Ministry

of Foreign Affairs direct overseas trade counsellors to

support wood processing enterprises in building and

developing Vietnamese wood brands abroad.

See:https://antidumping.vn/position-vietnamese-wood-andfurniture-brands-on-the-global-map-n25277.html

8. BRAZIL

Confidence rises in the furniture sector

The Industrial Business Confidence Index (ICEI) is the

weighted average of two components: the businesses

assessment of the current and future state of their own

companies and the assessment of the current state and

future prospects for the Brazilian economy.

A total of 2,033 companies were consulted in December

2022 to prepare the index of which 803 were small-sized,

737 medium-sized and 493 large companies.

According to entrepreneurs' assessment the Brazilian

economy affected industrial confidence in December.

While four sectors made the transition from a state of

confidence to lack of confidence however enterprises in

the furniture sector made a transition from lack of

confidence to confidence.

See: http://abimovel.com/confianca-do-empresario-sobe-nosetor-

de-moveis-mas-cai-nos-demais/

Multiplier training in community forest management

Forest Management for timber production has been carried

out for over twenty years by traditional community

associations in the state of Amazonas with the support of

the Mamirauá Sustainable Development Institute (IDSM).

In November 2022, 15 professionals from different

regions of the State participated in training of multipliers

on community forest management in the municipality of

Tefé, in the Amazon Region.

Participants discussed the history of occupation of the

Mamirauá Sustainable Development Reserve; the

organisation of the riverine populations and their

involvement in management activities; forest management

techniques, environmental legislation, stock survey among other topics.

The event aimed to expand the experience with

community forest management in floodplain areas through

training multipliers who expand knowledge of

methodologies adopted by the Mamirauá Institute to other

regions of the Amazon. Mamirauá is a social organisation

backed by the Ministry of Science, Technology and

Innovation (MCTI).

See: https://www.mamiraua.org.br/noticias/instituto-mamirauarealiza-

curso-multiplicadores-manejo-florestal-comunitario-

Furniture association - prospects for 2023 are uncertain

The Bento Gonçalves Furniture Industry Union

(Sindmóveis) has warned of likely impacts from the

effects of global political and economic instability.

According to Foreign Trade Statistics the revenue

generated by the more than 300 furniture companies in the

region will end 2022 with a nominal retraction of 3.5%

compared to that of 2021. Yet, this performance is 40%

higher than registered in 2020 and 55% above 2019 (the

year before the pandemic).

According to Sindmóveis the reason behind the drop in

revenue was weak international demand. Sales between

January and November 2022 fell over 25% year on year.

The Bento Gonçalves furniture cluster represents more

than 300 companies, generating 6,646 jobs and revenues

of R$2.6 billion between Jan-Oct/2022; R$3.2 billion in

2021, R$2.2 billion in 2020 and R$2.0 billion in 2019.

Prospects for 2023 are uncertain because a great deal will

depend on the measures adopted by new government

such as credit expansion, more competitive interest rates

and unemployment rate reduction which are factors that

can foster sales in the domestic market.

See:

https://www.sindmoveis.com.br/como-o-polo-moveleiro-debento-devera-encerrar-2022/

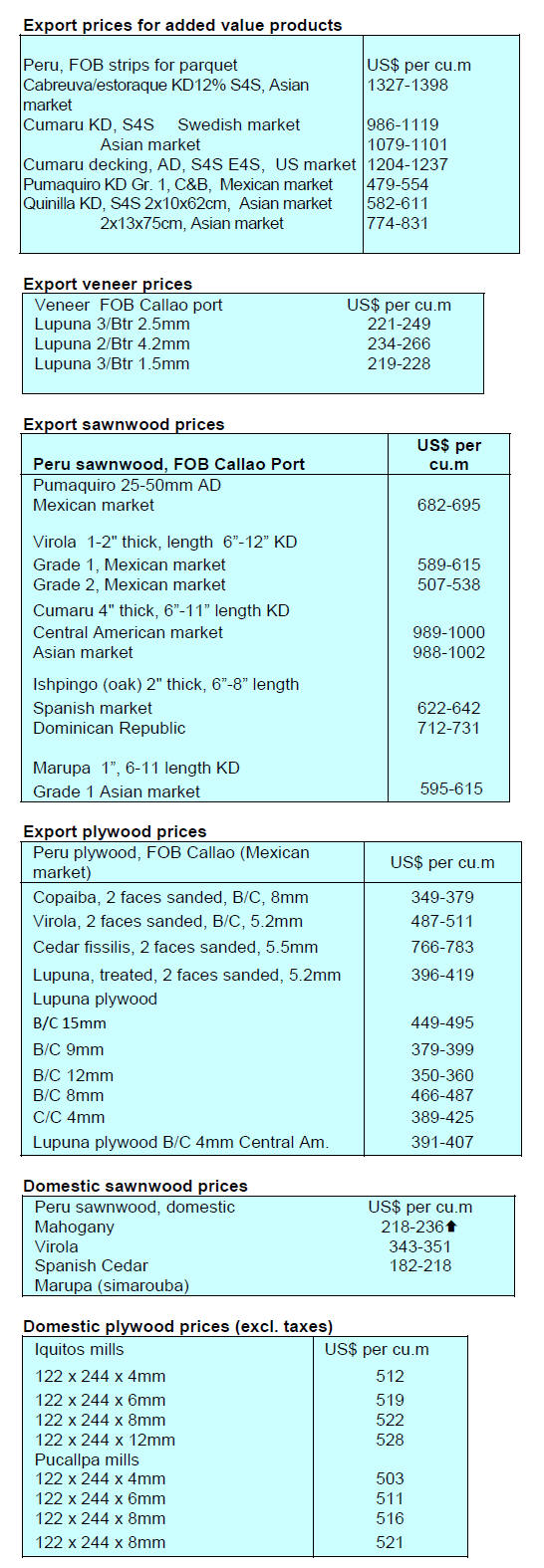

9. PERU

SERFOR promotes production for public purchases

SERFOR (National Forestry and Wildlife Service)

recently exhibited a variety of locally made wood products

such as doors and school furniture. It also provided a

series of technical specifications for wood products

acceptable for government procurement.

The technical sheets have been approved by the Central de

Compras Públicas (Perú Compras), a public body attached

to the Ministry of Economy and Finance and whose

mission is to optimise public procurement of domestically

made products.

The specifications include species that can be used.

SERFOR, through the Directorate of Promotion and

Competitiveness, is also supporting production by small

and medium-sized companies for government purchases.

OSINFOR and GERFOR Loreto exchange experiences in forest inspection

Specialists from the Forestry and Wildlife Resources

Supervision Agency (OSINFOR) and the Forestry and

Wildlife Development Management (Gerfor) recently

participated in an event to share experiences on inspection

and sanctioning in the forestry sector.

The specialists were able to share their experiences in the

activities under their jurisdiction, the execution of

complementary measures directed by OSINFOR and the

difficulties that arise in complying the various regulations.

Action Plan for the shihuahuaco and tahuari

SERFOR has published its "Action Plan” for the

implementation of CITES regulations pertaining to

shihuahuaco (Dipterix genus) and tahuari (Handroanthus

genus). At the Nineteenth meeting of the CITES

Conference of the Parties held in Panama City last

November the genera Dipteryx and Handroanthus were

added to CITES Appendix II.

The Action Plan presents four components to be

implemented by SERFOR:

--- Regulatory improvements to enable the proper

incorporation of these two species into CITES

--- Collection of information on the species for

sustainable management decision-making

--- Evaluation of the existence stocks in the forest, in

mill yards and in storage.

--- Strengthening capacity for the sustainable

management of these resources.

See:

https://www.gob.pe/institucion/serfor/informespublicaciones/3770000-propuesta-del-plan-de-accion-para-laadecuada-implementacion-de-la-inclusion-del-shihuahuaco-andtahuari-in-appendix-ii-of-the-cites-years-2023-and-2024

Communities in Ucayali learning to use drones

OSINFOR has reported that 36 leaders of native

communities in Ucayali have been trained in the use of

drones and in community forest control and surveillance in

order to strengthen the prevention of forest crimes.

OSINFOR specialists traveled to Ucayali to provide

theoretical and practical training to the communities on the

topics of Forest Crimes, Surveillance and Community

Forest Control. Community leaders were instructed on the

use of drones in order to use them for forest surveillance..

In related news, OSINFOR has conducted a course to

facilitate the identification of the main timber forest

species in the Amazon for 20 regional forest authorities in

Ucayali regions in order to contribute in the planning,

review and execution of forestry activities.

Course participants were trained by specialists to

understand the dendrological characteristics of the main

families, genera and forest species. The course

"Identification of timber forest species" had the technical

support of the German International Cooperation, GIZ,

through the ProAmbiente II programme.

|