|

Report from

Europe

UK tropical wood product imports fell

sharply in July

and August

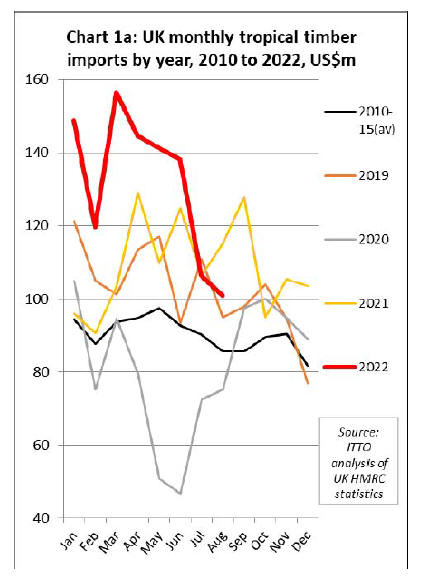

The import value of tropical wood and wood furniture into

the UK in the opening eight months of this year was

USD1.06B, 21% more than the same period last year.

Following the strongest start to the year in terms of UK

import value since before the 2008 financial crises,

imports fell sharply during July and August (Chart 1).

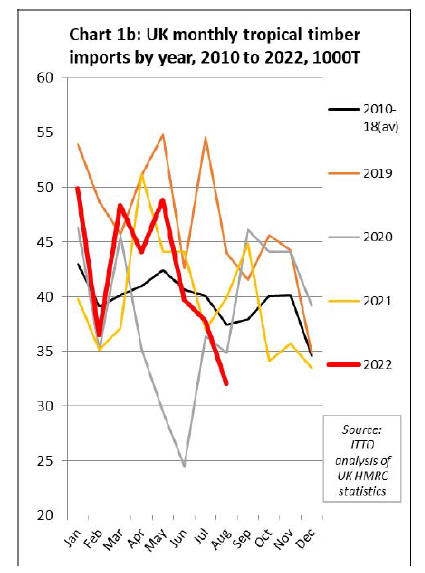

The trend looks different in quantity terms (Chart 1b).

Import quantity of tropical wood and wood furniture into

the UK in the opening eight months of this year was

337,000 tonnes, just 3% more than the same period last

year and not out of line with previous years during the last

decade.

This shows that price inflation was the major factor behind

the rise in UK import value in the first half of this year,

driven both by historically high material and freight prices

and extreme weakness of sterling against the US dollar.

The decline in UK tropical wood product imports over the

summer months was particularly dramatic in quantity

terms, with imports of only 32,000 tonnes in August being

the third lowest monthly total since August 2016. During

this six year period, monthly imports were only previously

below the August 2022 level in May and June 2020 during

the first COVID lockdown.

Dark clouds gather over UK economy

The slowdown in UK imports of tropical wood and wood

products in the summer months is unlikely to be reversed

anytime soon as market prospects have deteriorated

rapidly in the autumn months.

The latest official UK government data shows that

economic output fell 0.3 per cent in the three months to

August compared with the previous quarter during an

unprecedented period of political uncertainty and high

energy and borrowing costs.

More recent survey data shows that UK economic activity

contracted at its fastest pace in almost two years in

October, suggesting the country has fallen into a recession.

The S&P Global/Cips UK composite Purchasing

Managers Index (PMI), a measure of activity in the private

sector, dropped to a 21-month low of 47.1 in October from

49.1 in September. October’s PMI was the third

consecutive reading under 50, which indicates a majority

of businesses reporting a contraction in activity and was

below the 48.1 forecast by economists polled by Reuters.

Rishi Sunak was appointed prime minister on 25th

October following the resignation of his predecessor Liz

Truss who had been in office for only 44 days, the shortest

term of any British prime minister in history. Truss

resigned when her misfired attempt to radically reorient

the government’s economic agenda, by slashing taxes

without saying how the decision would be paid for, sent

the markets reeling.

The appointment of a new Prime Minister committed to a

tighter fiscal policy has somewhat reassured markets and

raised confidence at least of a short respite from recent

political instability. However, the sharp change of policy

also implies slower growth and higher chances of a

recession in the near-term. This means the Bank of

England is likely to be less aggressive with rate hikes.

Nevertheless, with the annual rate of inflation in excess of

10% in October, markets widely expect the BoE’s

Monetary Policy Committee to raise rates by between 75

and 100 basis points when it meets in the first week of

November. None of this is particularly positive for

Sterling which has been bumping along at close to an alltime

low of less than 1.1 to the USD since the last week of

September.

Chris Williamson, chief business economist at S&P

Global Market Intelligence, said October’s PMI data

showed “the pace of economic decline gathering

momentum” after recent political and financial market

upheaval. The economy “therefore looks certain to fall in

the fourth quarter after a likely third-quarter contraction,

meaning the UK is in recession”, he added.

The UK PMI survey, based on responses collected

between October 12 and 20, showed that new orders had

decreased at the sharpest pace since January 2021, with

panellists attributing it to the worsening economic outlook.

Manufacturers reported a particularly steep fall in new

work, with export sales falling at the fastest pace in almost

two-and-a-half years.

Business confidence also collapsed, sliding to a level

rarely seen in 25 years of survey history, with escalating

political uncertainty and rising interest rates among the

most commonly cited reasons for the downbeat sentiment.

The manufacturing sector remained in a downturn for the

third consecutive month, while the services sector reported

the first contraction in 20 months.

Williamson said that although price pressures had eased

because of the economic downturn, the weak pound and

high energy costs meant input cost inflation remained

higher than at any time in the survey’s pre-pandemic

history.

In a downbeat assessment earlier in October, analysts at

Deutsche Bank said UK GDP was due to take until 2024

to return to the level of December 2019 before the

pandemic struck.

The British Chambers of Commerce (BCC) also reported

that more than three-quarters of companies in a survey of

5,200 firms had not increased investment in the last three

months.

A rare shaft of light in all this gloom comes from the latest

S&P Global/CIPS PMI survey for the UK construction

sector. At 52.3 in September, up from 49.2 in August, the

headline construction PMI registered above the 50.0 nochange

value for the first time since June.

The latest reading was the highest for three months and

signalled a modest overall increase in construction output.

Construction survey respondents commented on a boost to

activity from work on previously delayed projects. House

building was the best-performing category in September

(index at 52.9), with growth reaching a five-month high.

Commercial work increased only marginally (51.0), while

civil engineering activity (49.6) fell for the third month in

a row.

According to S&P Global/CIPS "survey respondents often

commented on a strong pipeline of outstanding work, but

incoming new orders remained relative scarce in

September. Latest data signalled that new business

volumes were broadly unchanged overall, which

represented the worst month for new orders for almost

two-and-a-half years.

Construction firms cited slow decision making among

clients and greater risk aversion due to inflation concerns,

squeezed budgets and worries about the economic

outlook".

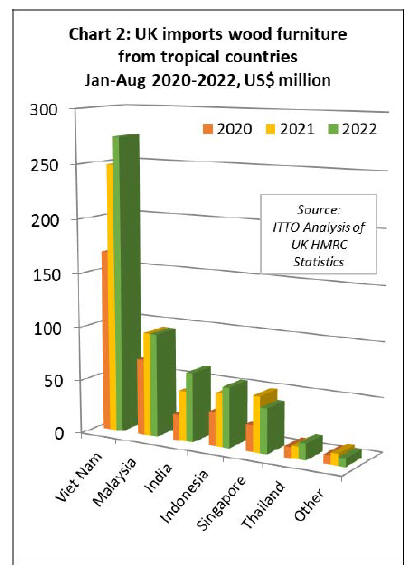

Flatlining UK imports of tropical wooden furniture

The UK imported USD555 million of tropical wood

furniture products in the first eight months of 2022, which

is 8% more than the same period in 2021. In quantity

terms, wood furniture imports were 114,000 tonnes during

the eight month period, 7% less than the same period last

year. This indicates that the rise in value was driven more

by price inflation than strong demand. Imports between

June and August this year were much lower than the same

period last year.

In the first eight months of this year compared to last year,

UK import value of wood furniture increased 10% from

Vietnam to USD274 million, 38% from India to USD64

million, 13% from Indonesia to USD56 million, and 32%

from Thailand to USD15 million.

Import value of USD96 million from Malaysia was the

same level as the previous year, while import value of

USD42 million from Singapore was 19% down compared

to 2021. (Chart 2).

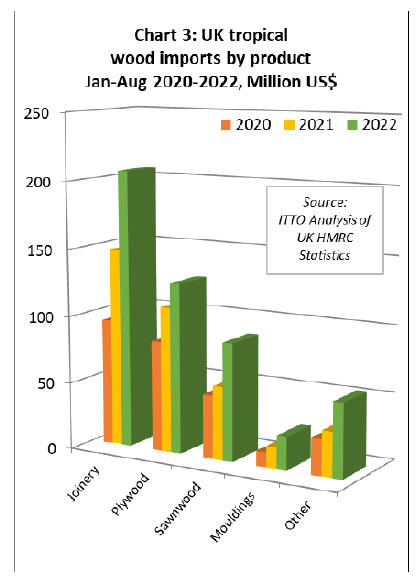

Gains in UK imports of some tropical wood products in

the first eight months of 2022

Total UK import value of all tropical wood products in

Chapter 44 of the Harmonised System (HS) of product

codes was USD501 million between January and August

this year, 39% more than the same period in 2021. In

quantity terms imports increased 8% to 223,000 tonnes

during the period.

Compared to the first eight months last year, UK import

value of tropical joinery products increased 40% to

USD207 million, import value of tropical plywood was up

17% to USD127 million, import value of tropical

sawnwood increased 60% to USD88 million, and import

value of tropical mouldings/decking increased 55% to

USD25 million (Chart 3).

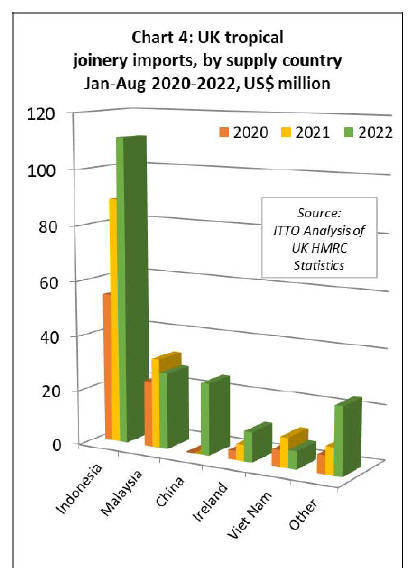

Slowing pace of UK imports of wood doors from

Indonesia

As for other tropical products, the pace of increase in UK

import value of tropical joinery products slowed between

June and August this year. Nevertheless import value from

Indonesia, by far the largest supplier of tropical joinery

products to the UK (in this case mainly doors), was at

USD111 million still up 25% year-on-year in the first

eight months of 2022 (Chart 4).

In quantity terms, UK joinery imports from Indonesia

were 35,400 tonnes in the first eight months of this year,

6% more than the same period in 2021.

UK imports of joinery products from Malaysia and

Vietnam (mainly laminated products for kitchen and

window applications) started the year slowly and

weakened further during the summer months. Import value

from Malaysia was USD28 million in the January to

August period, 15% less than the same period last year. In

quantity terms, imports from Malaysia were 8,900 tonnes,

28% less than the same period in 2021. Joinery imports

from Vietnam of 1800 tonnes valued at USD7 million

were respectively 42% and 40% less than the same period

last year.

UK imports of Chinese tropical joinery products, nearly all

comprising doors, were 10,400 tonnes with value of

USD26 million in the first eight months of 2022, up from

negligible levels in previous years. The recorded rise was

due to introduction from 1st January 2022 of new product

codes which identify wood doors and windows

manufactured using a wider range of tropical wood species

in UK and EU trade statistics. This may also explain the

apparent rise in UK imports of tropical joinery products

from Ireland which were 1,200 tonnes with value of

USD11 million in the first eight months of 2022,

respectively 56% and 85% more than the same period in

2021.

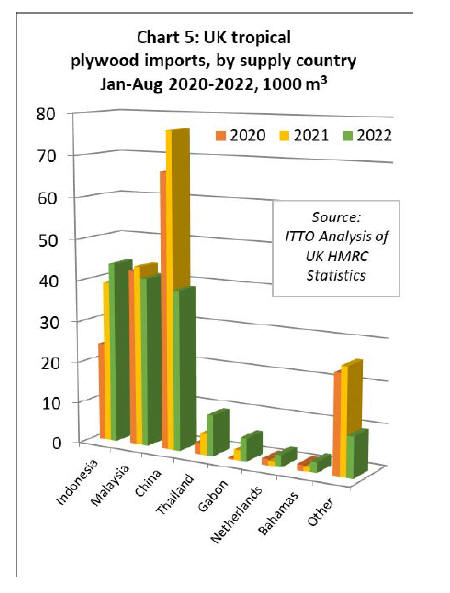

UK tropical hardwood plywood imports switch away

from China

In the first eight months of 2022, the UK imported

154,600 cu.m of tropical hardwood plywood, 21% less

than the same period last year. Tropical hardwood

plywood imports from Indonesia, Thailand and Gabon

have made gains this year, while imports from China have

fallen dramatically, and imports from Malaysia have also

lost ground (Chart 5).

The UK imported 43,900 cu.m of tropical plywood from

Indonesia in the first eight months of this year, a gain of

12% compared to the same period last year. After picking

up pace in May this year, imports from Indonesia slowed

again between June and August. The UK imported 41,000

cu.m of plywood from Malaysia in the first eight months

of this year, 6% less than the same period last year.

Imports from Malaysia also picked up in May to their

highest monthly level for over a year but were very slow

during the summer months.

The UK imported 38,900 cu.m of tropical hardwood

plywood from China in the first eight months of this year,

49% less than the same period in 2021. Probably the

biggest shift in the UK hardwood plywood trade in the last

two years has been a rapid decline in imports of Chinese

products faced with tropical hardwoods in favour of

Chinese products faced with temperate hardwoods.

Chinese temperate hardwood plywood has been the largest

beneficiary of UK sanctions against all trade in Russian

wood products since the start of the Ukraine conflict.

Meanwhile, Brexit is impacting on UK imports of tropical

hardwood plywood from EU countries which were just

8,600 cu.m in the opening eight months of this year

compared to over 18,000 cu.m during the same period in

the last two years.

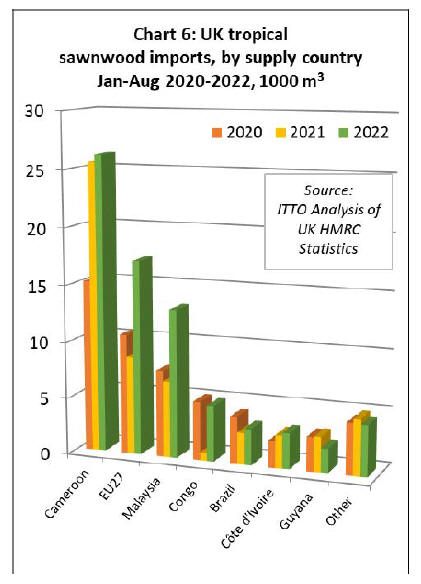

Bouyant UK imports of tropical sawnwood during 2022

Unlike tropical hardwood plywood, UK imports of

tropical sawnwood have been buoyant this year. Total UK

imports of tropical sawnwood were 74,500 cu.m in the

first eight months of 2022, 34% more than the same period

last year. In addition to making gains overall, there have

been some significant changes in the countries supplying

tropical sawnwood to the UK this year (Chart 6).

UK imports of tropical sawnwood from Cameroon were

26,200 cu.m in the first eight months of this year, 3%

more than the relatively high level in the same period last

year. UK imports of tropical sawnwood from the Republic

of Congo have recovered lost ground this year, with

imports of 4,900 cu.m in the first eight months, a 575%

gain compared to the same period last year, although still

down on the pre-pandemic level. UK imports from Côte

d'Ivoire were 3,100 cu.m in the first eight months of this

year, a 9% increase compared to the same period last year.

UK imports from Malaysia, which had fallen to little more

than a trickle in recent years, were 13,000 cu.m in the first

eight months of this year, 95% more than in the same

period last year. UK imports of tropical sawnwood from

Brazil were 3,200 cu.m in the first eight months of this

year, 14% more than the same period last year but still

down on the pre-pandemic level. Indirect UK imports of

tropical sawnwood via the EU have also recovered ground

this year despite the Brexit disruption, increasing 99% to

17,000 cu.m in the first eight months of 2022.

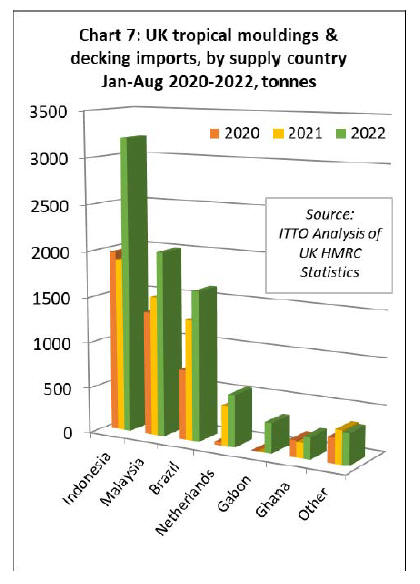

UK imports of tropical hardwood mouldings/decking were

relatively high in the first eight months of 2022, at 8,322

tonnes, 46% more than the same period last year.

This commodity group has benefited in the UK market

from shortages of non-tropical products, particularly since

the start of the war in Ukraine and sanctions on Russian

decking products that directly compete with tropical

decking.

Imports of 3,200 tonnes from Indonesia were 69% more

than the same period last year. Imports of 2,000 tonnes

from Malaysia were 32% up on the same period in 2021.

Imports from Brazil increased 24% to 1,600 tonnes during

the eight month period. (Chart 7).

|