Besides the current FMC certification for the Segaham

FMU the company has two other FMUs in the progress of

MTCC certification.

4.

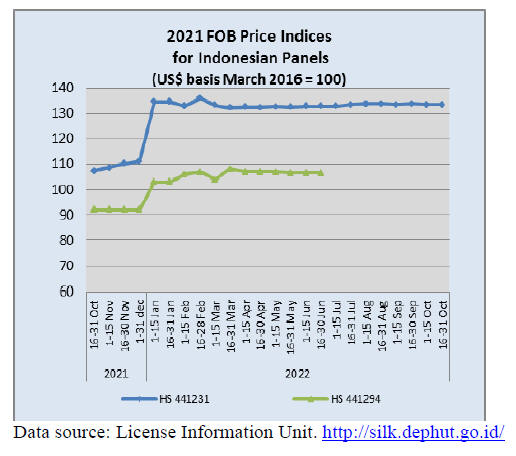

INDONESIA

Exports resilient despite sluggish Chinese demand

Indonesia's export of wood products continues to rise even

though demand in China has weakened. However, a global

recession would seriously impact export growth. Data

from the Ministry of Environment and Forestry (KLHK)

analysed by the Association of Indonesian Forest

Concession Holders (APHI) shows Indonesia's wood

product exports up to September earned US$11.07 billion,

a year on year rise of 13%.

Most growth came from an increase in exports of paper

products (US$3.15 billion), wood panels (US$2.63

billion), pulp (US$2.52 billion) and furniture (US$2.15

billion). Indonesia's timber export trade depends on four

main markets, Japan, the European Union+UK, the US

and the Republic of Korea. A market that has recently

been developed is India.

The growth in exports to India is promising and for the

year to September there was a 35% yoy expansion. As of

September exports to China were recorded at US$2.36

billion, a 21% decline from the same period in 2021.

Indonesia's wood product exports to Japan in the first three

quarters of 2022 increased 15% year on year to US$1.14

billion. Exports to the EU+UK rose 54% year on year to

US$1.3 billion and exports to the Republic of Korea

increased slightly to US$585 million.

Throughout this year export growth in the US market

increased steadily but in September there was a downturn

as wood product exports dipped 19% to US$1.77 billion.

The decline in exports to the US was because of a drop in

furniture exports which fell 40% from US$1.41 billion in

January-September 2021 to US$849.3 million in January-

September 2022.

See:

https://forestinsights.id/2022/10/14/ekspor-produk-kayumelaju-meski-pasar-china-lesu-ancaman-resesi-mestidiwaspadai/

Association welcomes approval of FSC Motion 37

The domestic media has reported that Motion 37,

discussed in the Forest Stewardship Council (FSC)

General Assembly forum held in Bali, has been approved

and will impact Indonesia’ trade in wood and on forest

products. The Secretary General of the Association of

Indonesian Forest Concession Holders (APHI), Purwadi

Soeprihanto, said this approval will provide an opportunity

for forestry companies in Indonesia to obtain FSC

certification.

He added that Motion 37 of the FSC rules will bring

significant changes in forest management in Indonesia as

well as improve relationships between industry and forest

communities.

FSC Board member, Rulita Wijayaningdyah, is reported as

saying Motion 37 can be applied in all FSC member

countries, not only for one particular country. In the

Indonesian context, motion 37 points to Industrial

Plantation Forests (HTI) and community forests which

have great potential to be certified under the FSC

scheme”.

See:

https://fsc.org/en/newscentre/motion-passed-fsc-principlesand-criteria-will-enable-the-policy-to-address-conversion

and

https://mediatataruang.com/2022/10/15/mosi-37-fsc-di-balidisahkan-ini-dampaknya/4/

Expanding exports to Ethiopia and Nigeria

Furniture entrepreneurs, members of the Indonesian

Furniture Entrepreneurs Association (Asmindo), are

targeting countries such as Ethiopia and Nigeria to expand

exports. Asmindo recently organised a Business Matching

event with the Indonesia-Africa Trade Forum (FPIA) and

the Ethiopian Embassy in order to develop cooperation

and to seek alternative non-traditional markets.

"There are several countries that are collaborating with us,

namely South Korea with 70 delegates, Saudi Arabia,

Ethiopia and Nigeria,"

When meeting the press the Deputy Secretary General of

Asmindo, Irawan, reported that wooden furniture exports

in 2021 reached US$1.99 billion up over 30% from the

previous year.

See:

https://wartakota.tribunnews.com/2022/10/21/asmindo-bidikpasar-benua-afrika-di-nigeria-dan-etiopia-lewat-businessmatching-di-south78

Perhutani pine resin gets ecolabel certificate

The Forest Stewardship Council (FSC) stated that the pine

resin resource managed by PT Perhutani received the first

ecolabel certificate in Indonesia becoming the first forest

management unit in Indonesia to obtain FSC certification

for pine resin.

FSC Indonesia Marketing and Communication Manager,

Indra Setia Dewi said Perhutani has increased the value of

its products and increased the income of local people who

depend on them as tappers for pine resin.

See:

https://www.antaranews.com/berita/3197129/fsc-getahpinus-perhutani-dapat-sertifikat-ekolabel-pertama-indonesia

Business sector invited to contribute to mangrove

restoration

The Ministry of Environment and Forestry has invited

businesses to contribute to mangrove forest restoration and

conservation in order to mitigate the impact of climate

change in Indonesia.

The Director General of Sustainable Forest Management

at the ministry, Agus Justianto, noted in a press release

that "Protecting mangroves as a carbon ecosystem does

not only to reduce emissions and increase carbon

sequestration but also to help preserve healthy mangroves

that can provide multiple benefits.

Several businesses such as the state-run oil and gas

company PT Pertamina (Persero), state-owned electricity

provider PT PLN (Persero), state-run tin mining

corporation PT Timah, as well as private-owned energy

company PT Indika Energy have actively contributed to

the preservation of mangrove ecosystems through their

corporate social responsibility (CSR) programs.

See:

https://www.republika.co.id/berita/rjlcsa330/klhk-ajak-pelakuusaha-terlibat-dalam-restorasi-ekosistem-mangrove

Indonesia/Norway emission reduction agreement

Siti Nurbaya Bakar, Minister of Environment and

Forestry, announced that Indonesia and Norway have

signed an agreement on a results-based contribution for

emission reductions. The agreement was signed as a

follow-up to a memorandum of understanding (MoU)

between Indonesia and Norway.

As part of the agreement, Norway will contribute US$56

million to support the implementation of the FoLU

(Forestry and Other Land Use) Net Sink 2030 Operational

Plan.

See:

https://en.antaranews.com/news/255681/indonesia-norwayink-emission-reduction-agreement

5.

MYANMAR

Tariff free exports

under RCEP

Beginning 1 November the Trade Department in the

Ministry of Commerce will issue Certificates of Origin

Forms (RCEP) for products that originated in Myanmar

and are designated to be exported to China so that the

authorised traders can enjoy customs tariff relief.

The Regional Comprehensive Economic Partnership-

RCEP, a free trade agreement between the ten member

states of ASEAN, Australia, China, Japan, the Republic of

Korea and New Zealand came into effect January 2022.

According to the RCEP agreement, the CO form will be

issued for the products that originated in Myanmar and

that are to be sent to China to be free from customs duty

from 1 November 2022. Myanmar, a member of RCEP

and ASEAN, will gain access to great trade opportunities.

See -

https://www.gnlm.com.mm/moc-to-issue-co-form-rcep-forfree-customs-tariff-to-china-from-1-nov/#article-title

Myanmar blacklisted

In another setback, the Financial Action Task Force

(FATF) has placed Myanmar on its blacklist for terrorism

financing alongside Iran and North Korea.

The Central Bank of Myanmar told people not to worry

since it was not a risk factor for Myanmar. However, one

timber exporter commented that this measure would be

another serious blow to timber exports.

This move is the result of concerns over Myanmar's

casinos and illicit cross-border trade. The suspected

increase in transnational criminal activities reportedly

includes the export of synthetic drugs.

Over the past year China has gradually resumed

infrastructure projects in Myanmar that were planned

before the military takeover. Chinese companies have

remained in Myanmar's energy market as others pulled out

and are said to be proceeding with work on a deep-sea port

in Kyaukphyu.

FATF was set up in 1989 by the Group of Seven advanced

economies, initially to counter money laundering. It has

since expanded its mandate to countering terrorist

financing and the proliferation of weapons of mass

destruction.

See -

https://asia.nikkei.com/Spotlight/Myanmar-Crisis/Myanmar-blacklisted-by-FATF-for-terrorism-and-crimefinance

6.

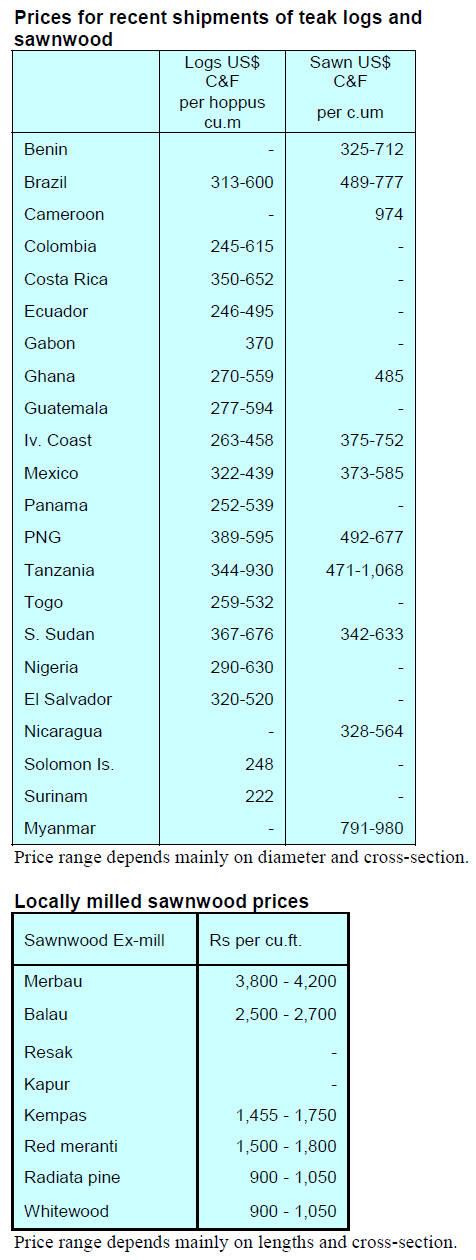

INDIA

Housing sales increase

A recent report from Anarock shows that there was a 4%

quarter on quarter in home sale in the second quarter of

2022 with almost 85,000 units were sold in the top seven

cities. The Mumbai metropole region (MMR) witnessed the

highest sales among the top seven cities followed by the

national capital region (NCR).

In terms of starts, around early 94,000 units were launched

in the third quarter 2022 against 82,150 units in the second

quarter. MMR and Hyderabad witnessed the highest level

of starts. Despite buoyant sales, the NCR considerably

restricted its new supply in comparison to other cities

including MMR, Bengaluru, Pune and Hyderabad.

With the increased supply the housing inventory rose,

however, on an annual basis inventory declined by 4% in

Q3 2022 across the top seven cities.

Residential property prices across the top cities registered

a quarterly increase in the range of one-two percent in the

third quarter. On an annual basis prices have risen

between 4-7% primarily due to an increase in input costs

and firm demand. However if inflation remains at elevated

levels forcing Reserve Bank of India (RBI) to aggressively

increase interest rates there might be some turbulence in

the market according to Anarock.

See:

https://api.anarock.com/uploads/research/Q2%202022_PAN%20India%20Residential%20Market%20Viewpoints.pdf

GST exemption on international feight charges –

traders seek extension

Exporters have sought an extension of previously granted

exemption from Goods and Services Tax (GST) on export

freight saying that a without the extension of this scheme

their liquidity will be challenged. In a letter to Minsiter of

Finance the Federation of Indian Export Organisations

(FIEO) said that international freight charges are still very

much higher than pre-Covid.

The exemption from GST on export freight ended on 30

September after being extended twice. Exporters now

have to pay 18% GST on export ocean freight. The FIEO

says global trade is entering a very challenging phase as

high inflation and the risk of a recession will affect

demand.

Good prospects for woodbased particleboard mills

In this post-pandemic period the particleboard market is

very active especially as imports are negligible and

manufacturers report good profits. Plyreporter says

recently there were more than 20 expressions of interest in

establishing woodbased particleboard mills but a problem

in securing manufacturing plant from China and licencing

issues disrupted plans for new plants during 2020 and

2021. But now prospects for new woodbased particleboard

plants in India are better.

See:

https://www.plyreporter.com/current-issue

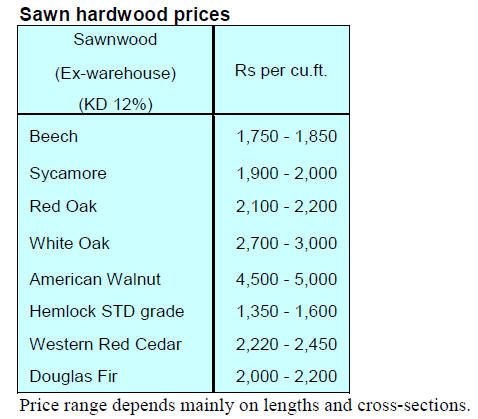

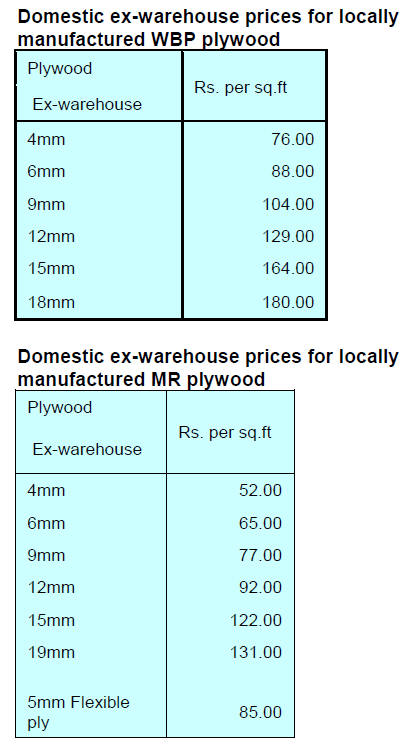

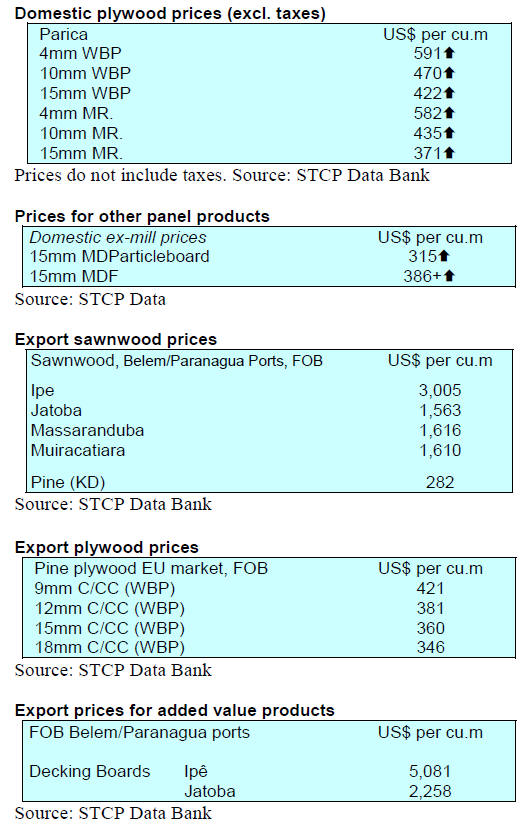

Plywood

Please note plywood prices are now shown below free of

local taxes.

7.

VIETNAM

Wood and Wood Product

(W&WP) trade highlights

W&WP exports in September 2022 reached US$1.41

billion, down 21% compared to August 2022 but up 56.5%

compared to September 2021. WP exports, in particular,

valued at US$734.8 million were down 17% compared to

August 2022 but up 71.5% compared to September 2021.

Over the first 9 months of 2022 W&WP exports amounted

to US$12.3 billion, up 10.2% over the same period in

2021. Of the total WP exports were US$8.6 billion, up

1.5% over the same period in 2021.

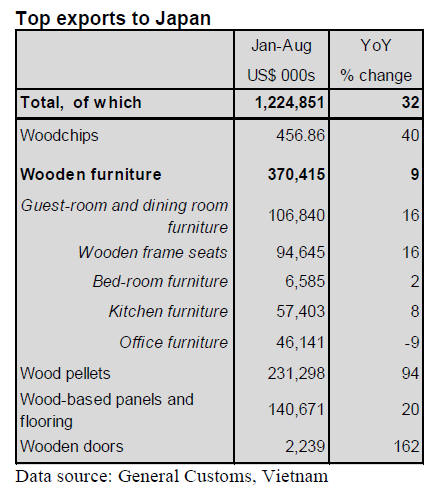

WP exports to Japan in September 2022 totaled US$159.2

million, up 55% compared to September 2021. Over the

same period W&WP exports to Japan totalled US$1.39

billion, up 34.4% year on year.

The exports of wood pellets in September 2022 were

valued at US$52 million, up 91% compared to September

2021. The accumulated exports of wood pellet over the

first 9 months of 2022 soared to US$530.7 million, a yearon-

year up of 76%.

In contrast to the slow growth of the total W&WP exports,

the exports of wood pellet have been experiencing a quite

high growth rate.

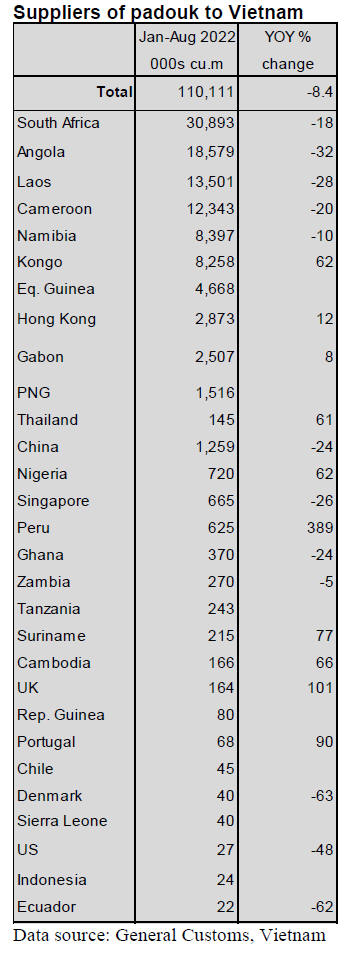

The imports of padouk in September 2022 totalled 21,300

cu.m, worth US$$8.9 million, down 8.3% in volume and

8.7% in value compared to August 2022. Compared to

September 2021 imports increased by 69% in volume and

23.5% in value.

In the first 9 months of 2022, padouk imports reached

131,400 cu.m, worth US$56.2 million, down 1.1% in

volume and 5.2% in value over the same period in 2021.

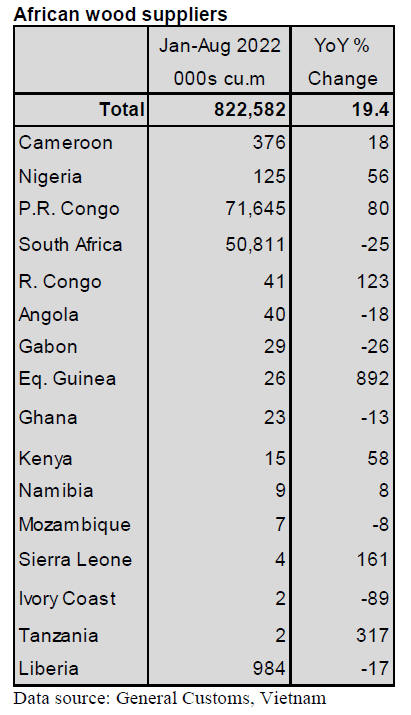

Imports of log and sawnwood from Africa in August 2022

were the highest reaching 157,000 cu.m, at a value of

US$61.28 million, up 69% in volume and 87% in value

compared to July 2022 and up 77% in volume and 86% in

value compared to August 2021.

In the first 8 months of 2022, imports of logs and

sawnwood from Africa reached 822,580 cu.m at a value of

US$307.44 million, up 19.4% in volume and 22.4% in

value over the same period in 2021.

Exports of W&WP to Japan rising

In the first 9 months of 2022 the value of W&WP exports

to Japan earned US$1.39 billion, up 34.4% over the same

period in 2021.

Most W&WPs exported to Japan increased sharply in

September 2022. Over the first 9 months of 2022, wood

chips, wood pellets, wood-based panels, floorings, wooden

doors all recorded a very high growth rates contributing to

boost export earnings from exports to the Japanese market.

Wooden furniture exports to Japan in the first 9 months of

2022 were slower however, while many top markets such

as the US and EU tended to reduce imports of wooden

furniture from Vietnam due to the impact of rising

inflation and tightened spending, exports to Japan still

recorded positive growth.

Demand in Japan, especially wood chips and wood pellets,

is expected to increase due to the transition from coal

power to clean energy, including biomass power.

In addition to wood chips and wood pellets, wooden

furniture, as a higher value-added wood product,

represents one of the important products exported from

Vietnam to the Japanese market.

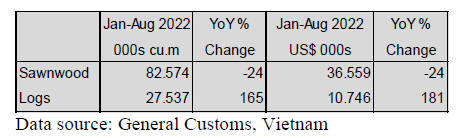

Padouk sawnwood and log imports

In the first 8 months of 2022, padouk sawnwood imports

reached 82,600 cu.m, worth US$36.6 million, year-onyear

decline of 25% in volume and 24% in value.

In contrast, imports of padouk logs were 27,500 cu.m

worth US$10.7 million, up 165% in volume and 181% in

value over the same period in 2021.

Imports from Africa at a record high

Imports from Africa in August 2022 reached the highest

level with 157,010 cu.m worth US$61.28 million, up 69%

in volume and 87% in value against July 2022 and an

increase of 77% in volume and 86. in value compared to

August 2021.

Over the first 8 months of 2022, imports of timber from

Africa weret 822,580 cu.m worth US$307.44 million, up

19.4% in volume and 22.4% in value over the same period

in 2021.

In the last months of each year demand in the domestic

market for tropical hardwood often rises. Imports of logs

and sawnwood from Africa are expected to continue to

rise.

African wood suppliers

In August 2022, timber imports from Africa increased

substantially due to exports from Cameroon and

Equatorial Guinea. These two suppliers contributed up to

90% of the total import growth.

In particular, in August 2022, Cameroon exported to

Vietnam 63,300 cu.m, with a value of US$27.86 million,

up 69% in volume and 87% in value compared to July

2022 and an increase of 773% in volume and 863% in

value compared to August 2021.

Over the first 8 months of 2022 Cameroon shipped

375,630 cu.m to Vietnam with a value of US$159.67

million, up 18% in volume and 19.5% in value against the

same period of 2021.

Imports of log and sawnwood from Equatorial Guinea in

August 2022 reached 19,080 cu.m valued at US$7.22

million, up 4,000+% in volume and 6,000+% in value

compared to July 2022.

Total imports from this source in the first 8 months of

2022 was reported at 25,910 cu.m valued at US$8.98

million, up 892% in volume and 494% in value over the

same period of 2021.

Imports from Equatorial Guinea were mainly logs

(accounting for 99%), of which, the 2 most imported

woody species are tali and padouk. The imports of tali and

padouk logs from Equatorial Guinea in the first 8 months

of 2022 increased significantly compared to the same

period in 2021.

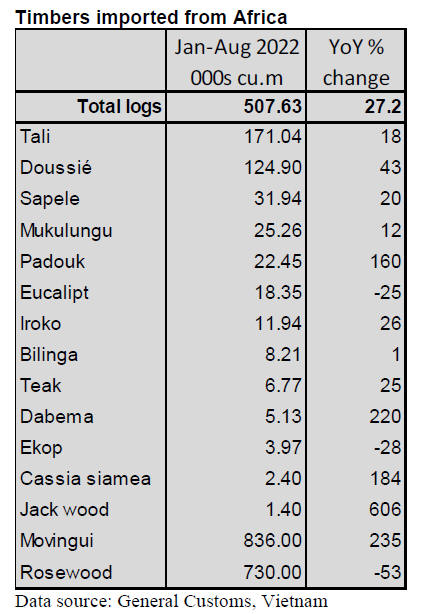

Log and sawnwood imports

Log imports from Africa in August 2022 amounted to

112,240 cu.m at a value of US$43.70 million.

The average price of imported logs in August 2022 was

US$389/cu.m, up 9.3% compared to July 2022 and up

5.6% compared to August 2021.

In the first 8 months of 2022 the average price of logs

imported from Africa to Vietnam was US$368/cu.m, up

1.2% over the same period in 2021.

In August 2022 imports of logs from Cameroon,

Equatorial Guinea, Democratic Republic of Congo,

Nigeria increased against July 2022 and August 2021.

Cameroon and Equatorial Guinea were the two biggest

suppliers of tropical hardwood for Vietnam.

Sawnwood imports from Africa to Vietnam in August

2022 reached 44,770 cu.m with a value of US$17.58

million, up 18% in volume and 33% in value compared to

July 2022 and an increase of 54.4% in volume and an

increase of 63% in value compared to August 2021.

Over the first 8 months of 2022 sawnwood imports from

Africa reached 314,770 cu.m, with a value of US$120,530,

up 9% in volume and 15% in value over the same period

in 2021. The average price of sawnwood imported from

Africa to Vietnam in August 2022 was at US$393/cu.m,

up 13% compared to July 2022 and up 5.4% compared to

August 2021.

In the first 8 months of 2022, the average price of

sawnwood from Africa was US$383/cu.m, up 5% over

the same period in 2021. Sawnwood imports increased

mainly due to imports from Cameroon, Gabon and

Angola.

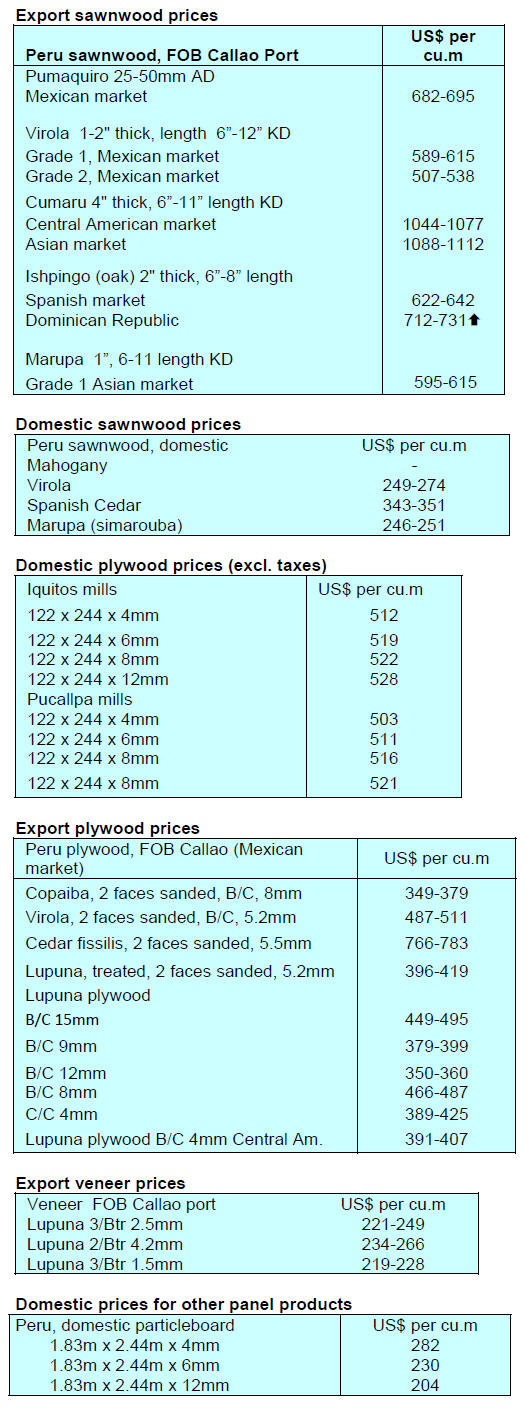

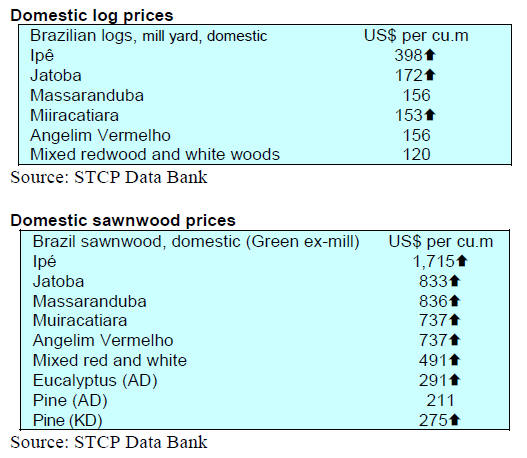

8. BRAZIL

Future of the

Brazilian furniture sector

During the first half of October 2022 the 30th MOVERGS

Congress (Furniture Industry Association of Rio Grande

do Sul) was held in Bento Gonçalves, Rio Grande do Sul,

one of the main furniture clusters in Brazil. The event

attracted more than 400 professionals from the furniture

sector. The event was held with support from the Bento

Gonçalves Furniture Industry Union (Sindmóveis),

Messem XP Investments and SEBRAE (Brazilian Support

Service to Micro and Small Businesses).

The congress opened with an overview of prospects for the

furniture sector made by a representative of the University

of Vale do Rio dos Sinos (UNISINOS) This suggested

good growth in the sector going into 2023.Information on

producer and consumer price Indices, employment,

income trends, exports and production data were provided.

See: https://forestnews.com.br/congresso-movergs-debateresultados-e-futuro-do-setor-moveleiro/(October,

2022)

Ipê survey in Acre and Mato Grosso – 40 million

commercial sized trees

In a study by Embrapa Florestas (Brazilian Agricultural

Research Corporation-PR) in forest areas under

sustainable forest management in the states of Acre and

Mato Grosso in the Amazon Region more than 40 million

commercial sized trees of the species Handroanthus

serratifolius (yellow Ipe) and Handroanthus impetiginosus

(purple Ipe) were mapped. This total number of trees did

not include seedlings or saplings.

The high incidence can be interpreted that Ipê trees are not

at risk of extinction. The results will serve as inputs for the

development of forest management regulations and

evaluation of the risk of over harvesting.

During 2020 the researchers were in the field in areas of

natural forests in the states of Acre and Mato Grosso to

survey the current situation of occurrence and growth of

the ipê. In Mato Grosso data from 2019 reported 17.6

million ha. suitable for forest management among 25

million ha of rainforest in the state.

The work also analysed the growth data of the species

through study of the growth rings of Ipê trees. With the

information on the reproductive maturity of the species it

was possible to assess that under SFM conservation of the

species is assured.

Source:https://cipem.org.br/noticias/estudo-comprova-amplaocorrencia-do-ipe-nas-florestas-do-brasil

(September, 2022)

Export update

In September 2022 Brazilian exports of wood products

(except pulp and paper) declined 11% in value compared

to September 2021, from US$382.0 million to US$341.6

million.

Pine sawnwood exports dropped 15% in value compared

to September 2021 (US$82.2 million) and September 2022

(US$69.7 million).

In volume, exports also dropped but by 17% over the

same period, from 293,100 cu.m to 242,300 cu.m.

Tropical sawnwood exports declined 14% in volume, from

35,900 cu.m in September 2021 to 30,800 cu.m in

September 2022. In value, exports grew 21% from

US$12.2 million to US$14.8 million over the same period.

Pine plywood exports witnessed a 48% decrease in value

in September 2022 compared to September 2021 from

US$79.4 million to US$41.7 million. In volume, exports

also decreased but only by 28% over the same period,

from 159,100 cu.m to 114,100 cu.m.

As for tropical plywood, exports dropped in volume by a

massive 63% and in value by 56%, from 9,000 cu.m and

US$5.2 million in September 2021 to 2,300 cu.m and

US$3.3 million in September 2022.

As for wooden furniture, the exported value fell from

US$71.8 million in September 2021 to US$53.8 million in

September 2022, a 25% decline .

Markets for Brazilian furniture exports

During the early part of the second half of this year the

United States remained the main destination for Brazilian

furniture, accounting for 44% of exports. While Uruguay,

was in second place importing 7.4% of the volume

exported by the Brazilian furniture industry. In terms of

market growth exports to France were the highlight,

almost doubling, to be the third largest destination for

Brazilian furniture exports with a share of 6.4% of the

total.

So far 2022 has seen an expansion of furniture exports and

it is projected that growth will continue at a much higher

pace than even the pre-pandemic time. Furniture exports

have expanded 500% over the last five years.

See:

https://forestnews.com.br/abimovel-franca-e-terceiro-maiordestino-das-exportacoes-de-moveis/

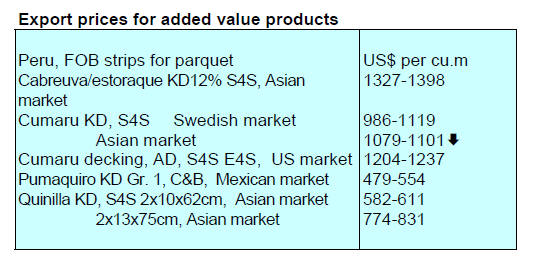

9. PERU

Exports continue to rise

but risks ahead

Between January and July 2022 exports of wood products

totalled US$84.9 million, a 26% rise year on year

according to the management of the Services and

Extractive Industries of the Association of Exporters

(ADEX).

The recovery of shipments in the first seven months

compared to last year was driven by imports by China and

France which accounted for 20% and 18% respectively.

Other markets were the Dominican Republic (up 13%) and

Vietnam (up 190%).

It is noteworthy that the most sought after products were:

HS 4409229020 (except ipe)

accounting for 23.5% of shipments (up 13%)

HS4407299000

accounting for 23% of shipments (up 120%)

HS4407990000

accounting for 9.8% of shipments (up 101%)

HS4409229090

accounting for 9% of shipments (up 300%)

Number of exporting companies rising

According to the Center for Research on Global Economy

and Business in the Association of Exporters CIENADEX,

in the first half of 2022 the number of exporting

companies was 6,231, an increase compared to the same

period in 2021.

By size, 4,035 were micro-enterprises, 1,788 were small

enterprises, 100 were medium and 308 were large

companies.

Despite the high number of SMEs they could only achieve

around 6% of the US$ FOB value earned in the first half

of the year.

Training of trainers in community forest management

The National Forestry and Wildlife Service (SERFOR),

the Regional Forestry and Wildlife Management of the

Regional Government of Ucayali (GOREU) and the NGO

Rights, Environment and Natural Resources (DAR)

announced the results of the Intercultural Program for the

Training of Trainers in Community Forest Management,

"Forest Guides".

This programme was implemented by SERFOR between

2020 and 2022. Ucayali now has 33 indigenous trainers or

Forest Guides capable of transferring knowledge on

community forest management to communities so that

they can efficiently manage forest resources.

The Forest Guides belong to communities of five

indigenous peoples: Ashaninka, Asheninka, Amawaka,

Yine and Shipibo-Konibo; and also to the technical teams

of the Regional Organization of AIDESEP (ORAU), the

Regional Union of the Indigenous Peoples of the Amazon

of the Province of Atalaya (URPIA) and the Regional

Coordinator of the Indigenous Peoples of Atalaya

(CORPIAA).

This year, the Forest Guides were able to train 274

members belonging to 17 native communities on topics

such as community forest management, wood

quantification, forest fire prevention and infractions and

sanctions, in their native languages.